Symbotic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symbotic Bundle

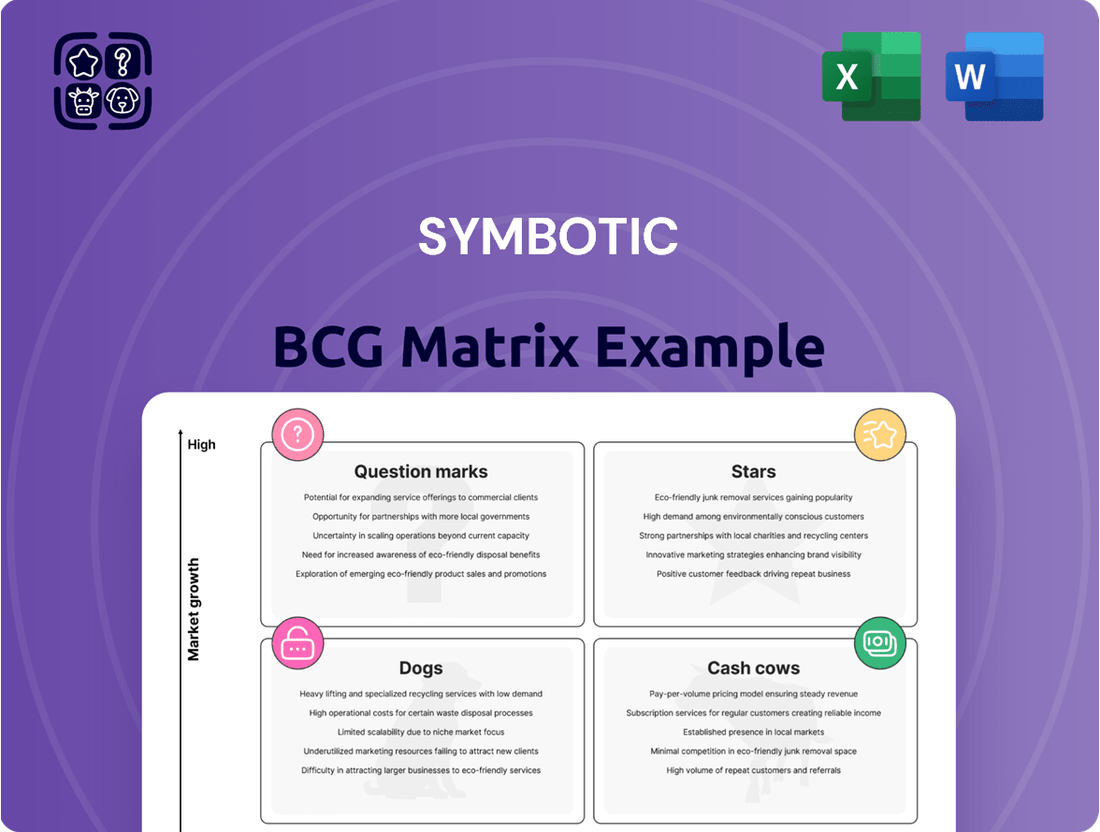

Curious about which of this company's products are poised for growth and which might be holding it back? Our Symbiotic BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars and Cash Cows. Understanding these dynamics is crucial for informed strategic decisions and capital allocation.

Don't let this limited view hold you back from unlocking the full potential of your portfolio. Purchase the complete Symbiotic BCG Matrix to gain a comprehensive understanding of each product's standing across all four quadrants: Stars, Cash Cows, Question Marks, and Dogs. This detailed analysis provides the actionable insights you need to optimize your investments and drive future success.

Stars

Symbotic's core AI-powered robotic fulfillment system is a quintessential Star in the BCG matrix. This advanced automated warehouse solution, built on proprietary AI and robotics, excels at high-density storage and retrieval, positioning it at the vanguard of the expanding warehouse automation industry.

Securing substantial contracts with industry giants such as Walmart underscores its significant market share within this high-growth sector. For instance, Symbotic announced a significant expansion of its agreement with Walmart in 2024, aiming to deploy its systems across an additional 50 facilities.

The ongoing rollout of new systems and continuous upgrades fuels substantial revenue expansion, solidifying Symbotic's leadership. This relentless innovation and market penetration are key indicators of its Star status, promising continued growth and market dominance.

Symbotic's expansion within Walmart's network is a prime example of a Star in the BCG matrix. The company is actively deploying its advanced automation systems across multiple Walmart distribution centers, a move that underscores the technology's proven effectiveness and scalability. This ongoing partnership is not just about initial installations; it represents a deepening commitment to integrate Symbotic's solutions further into Walmart's operational fabric.

This strategic growth with a major player like Walmart, which operates hundreds of distribution centers, indicates a substantial and expanding market share in a critical sector. The automation of a significant portion of Walmart's logistics is a testament to Symbotic's ability to deliver high-impact solutions that drive efficiency and value, positioning it for continued strong performance.

Symbotic's Proprietary Symbotic Operating System (SOS) is a clear Star in the BCG matrix. This advanced software platform is the brain behind Symbotic's automated warehouse solutions, orchestrating complex hardware movements with remarkable efficiency and accuracy. Its ability to deliver high throughput is a significant competitive advantage.

SOS is a core differentiator, enabling unmatched performance in automated warehouses. For instance, Symbotic's systems have demonstrated throughputs significantly exceeding traditional methods, directly attributable to SOS's intelligent orchestration. This software is constantly evolving, integrating with new hardware to maintain its leading position in the dynamic supply chain automation market.

Strategic Acquisition of Veo Robotics

Symbotic's strategic acquisition of Veo Robotics in August 2024 significantly bolsters its position as a Star in the BCG matrix. This move is designed to integrate cutting-edge robotics technology, enhancing operational efficiency and safety within Symbotic's automation solutions. By incorporating Veo's advanced capabilities, Symbotic aims to drive unparalleled innovation in warehouse automation. This acquisition positions Symbotic to capitalize further on the rapidly expanding market for intelligent automation systems, a sector projected to see substantial growth through 2025 and beyond.

- Enhanced Market Position: The Veo Robotics acquisition solidifies Symbotic's standing in the high-growth warehouse automation market, reinforcing its Star status.

- Technological Integration: This move allows for the seamless integration of Veo's advanced AI-powered robotics, improving operational efficiency and safety for Symbotic's clients.

- Innovation Acceleration: The combined expertise is set to accelerate the development of next-generation automation solutions, offering a significant competitive advantage.

- Future Growth Potential: By acquiring a company with strong technological underpinnings, Symbotic is well-positioned to capture a larger share of the expanding automation market, expected to reach hundreds of billions globally by 2025.

New Client Acquisitions and International Expansion

Symbotic's recent client wins, such as the significant agreement with Walmex in Mexico, firmly place it in the Star category of the BCG Matrix. This expansion beyond its initial anchor customer highlights its growing market presence and ability to secure new, high-profile clients.

These new deployments and strategic international expansions are crucial for Symbotic's growth, allowing it to diversify its customer base and capture market share in new, high-growth geographies. This reduces its reliance on any single major client, strengthening its overall market position.

The Walmex deal, announced in October 2024, is a prime example of Symbotic tapping into the global demand for advanced warehouse automation. This international venture is a key indicator of its potential for sustained rapid growth.

Symbotic's ability to win contracts like the one with Walmex demonstrates its competitive edge in the warehouse automation sector. This success is a testament to its innovative technology and its strategic approach to global market penetration.

- Star Classification: Symbotic's acquisition of clients like Walmex beyond its anchor customer positions it as a Star.

- International Expansion: The Walmex agreement in Mexico is a concrete example of Symbotic tapping into global demand for warehouse automation.

- Market Diversification: These new clients and international ventures reduce Symbotic's dependence on a single major customer.

- Growth Potential: Capturing market share in new high-growth geographies signifies substantial future revenue potential.

Symbotic's AI-powered robotic fulfillment systems are definitive Stars due to their high market share in the rapidly expanding warehouse automation sector. The company's substantial contracts, including significant expansions with Walmart in 2024, highlight its market leadership and robust revenue growth fueled by ongoing innovation and system rollouts.

Symbotic's proprietary Symbotic Operating System (SOS) is a critical Star component, enabling superior performance and high throughput in automated warehouses. This software is a key differentiator, constantly evolving and integrating with new hardware to maintain its leading edge in the competitive supply chain automation market.

The acquisition of Veo Robotics in August 2024 further solidifies Symbotic's Star status by integrating advanced AI robotics and enhancing operational efficiency and safety. This strategic move accelerates innovation in a sector projected for significant global growth, positioning Symbotic to capture a larger market share.

Recent wins like the Walmex agreement in Mexico demonstrate Symbotic's ability to secure new, high-profile clients beyond its anchor customers, signaling international expansion and market diversification. This success in capturing global demand for advanced automation underscores its competitive edge and substantial future revenue potential.

| Key Symbotic Offerings | BCG Matrix Classification | Supporting Rationale |

| AI-Powered Robotic Fulfillment System | Star | High market share in growing warehouse automation; significant Walmart expansion in 2024. |

| Symbotic Operating System (SOS) | Star | Core differentiator for high throughput; continuous software evolution and hardware integration. |

| Veo Robotics Acquisition (Aug 2024) | Star | Enhances AI robotics integration; accelerates innovation in a high-growth market. |

| Walmex Agreement (Oct 2024) | Star | International expansion; market diversification beyond anchor customers; taps into global demand. |

What is included in the product

Strategic assessment of Symbiotic's product portfolio across BCG Matrix quadrants, guiding investment decisions.

Symbotic's BCG Matrix offers a clear, one-page overview, instantly highlighting business unit performance to alleviate strategic planning confusion.

Cash Cows

Symbotic's long-term service and maintenance contracts are true cash cows for the company. These agreements, covering its installed robotic systems, offer a consistent and predictable revenue stream. Think of them as a steady income source that requires minimal extra spending after the initial system deployment.

These contracts are incredibly valuable because they utilize Symbotic's existing infrastructure and strong client relationships. As more Symbotic systems are put into operation, the revenue from these service agreements grows, directly boosting the company's cash flow and overall profitability. For example, in the first quarter of 2024, Symbotic reported a significant increase in its recurring revenue from these services, underscoring their importance to the company's financial health.

Established Software Licensing Fees are Symbotic's cash cows. The recurring fees from its Symbotic Operating System (SOS) and other software components in mature deployments provide a steady and predictable revenue stream. This predictable income, generated with minimal variable costs after initial deployment, underpins Symbotic's financial stability.

For instance, in 2024, Symbotic continued to benefit from the high margins associated with its established software licensing model. This reliable income allows the company to confidently invest in further innovation and cover ongoing operational expenses.

Fully deployed operational systems are Symbotic's cash cows. By the third quarter of 2024, Symbotic had completed 21 such systems. These mature assets consistently deliver value to clients, translating into stable revenue streams for Symbotic from system sales and ongoing services.

The predictable returns from these operational systems contribute significantly to Symbotic's improved gross margins. This established performance solidifies their role as reliable revenue generators within the company's portfolio.

Revenue from Long-Standing Walmart Partnership

The enduring commercial agreement with Walmart, a cornerstone client since 2017, is a definitive Cash Cow for Symbotic. This established relationship, distinct from new growth initiatives, generates a substantial and dependable revenue stream. Walmart's ongoing investment in automating its distribution network guarantees consistent business, bolstering Symbotic's financial resilience.

This long-term partnership provides a predictable revenue base, crucial for Symbotic's operational stability. While new Walmart projects are classified as Stars due to their growth potential, the existing revenue from this foundational agreement represents a mature and highly profitable segment. This consistent income supports Symbotic's overall financial health and allows for continued investment in innovation.

- Established Revenue Base: The Walmart partnership provides a predictable and significant income stream.

- Financial Stability: This reliable revenue underpins Symbotic's financial stability and operational capacity.

- Support for Growth: The cash flow from this Cash Cow enables investment in developing new Stars.

Standardized Hardware Modules in Mature Systems

Standardized and proven hardware modules within Symbotic's fully deployed systems function as cash cows. These components, honed over years of implementation, necessitate reduced research and development investment, thereby generating steady revenue streams from ongoing system sales. Their well-established manufacturing processes enhance gross margins as deployment efficiency escalates.

For instance, Symbotic’s focus on modularity and standardization in its warehouse automation solutions allows for efficient scaling. By leveraging these mature hardware modules, the company can capitalize on its existing technological base. This operational efficiency directly translates to improved profitability on each system deployed.

- Mature Product Lifecycle: Standardized hardware modules are in the mature phase of their product lifecycle, demanding minimal R&D.

- Consistent Revenue Generation: These modules contribute to predictable revenue through continued system sales and potential upgrades.

- Improved Profit Margins: Established production processes and economies of scale lead to higher gross margins for these components.

- Reduced Operational Risk: The proven nature of these modules minimizes technical and implementation risks, ensuring reliable performance.

Symbotic's long-term service and maintenance contracts are true cash cows, providing a consistent and predictable revenue stream with minimal additional spending after initial deployment. These agreements leverage existing infrastructure and client relationships, growing revenue as more systems are installed. For example, Symbotic saw a significant increase in recurring service revenue in Q1 2024, highlighting their financial importance.

Established software licensing fees from the Symbotic Operating System (SOS) in mature deployments also act as cash cows, offering a steady, predictable income with low variable costs. This reliable income in 2024 supported Symbotic's financial stability and allowed for investment in innovation.

Fully deployed operational systems, like the 21 completed by Q3 2024, are cash cows generating stable revenue from sales and ongoing services, contributing to improved gross margins due to their predictable returns.

The enduring commercial agreement with Walmart, a key client since 2017, is a definitive cash cow, providing a substantial and dependable revenue stream that bolsters Symbotic's financial resilience and supports investment in new growth areas.

| Revenue Source | Type | 2024 Impact |

|---|---|---|

| Service & Maintenance Contracts | Cash Cow | Significant increase in recurring revenue |

| Software Licensing (SOS) | Cash Cow | High margins, supports innovation investment |

| Fully Deployed Systems | Cash Cow | Stable revenue, improved gross margins |

| Walmart Agreement (Existing) | Cash Cow | Dependable revenue, financial resilience |

What You’re Viewing Is Included

Symbotic BCG Matrix

The Symbiotic BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed, analysis-ready report ready for your strategic planning. You're getting the exact same file, crafted for clarity and professional use, which you can instantly download and integrate into your business operations. This ensures you have a complete and actionable tool for evaluating your product portfolio without any hidden surprises or need for further editing.

Dogs

Underperforming early-stage R&D ventures represent a critical category within the BCG framework, often categorized as Dogs. These are projects that have consumed substantial investment in research and development but have yet to demonstrate a path to commercial success or significant market penetration. For example, in 2024, many biotechnology firms reported that a notable percentage of their early-stage drug discovery pipelines failed to advance due to efficacy or safety concerns.

These initiatives, while born from a desire for innovation, drain financial resources without generating commensurate returns or strengthening the company's strategic market position. A recent analysis of venture capital funding in 2024 revealed that a significant portion of early-stage tech startups focused on emerging AI applications struggled to find product-market fit, leading to high failure rates.

The reality is that not all innovative ideas translate into profitable products. Companies must be prepared to identify and either divest or deprioritize these underperforming R&D efforts to reallocate capital to more promising ventures. This strategic pruning is essential for maintaining financial health and fostering a more efficient innovation ecosystem.

Highly customized, non-repeatable solutions for early clients might be categorized as Dogs in Symbotic's BCG matrix. These one-off projects, while potentially serving initial customer needs, often lack the scalability and broader market appeal necessary for significant future growth. For instance, if Symbotic dedicated substantial engineering resources to a unique client integration in 2024 that cannot be replicated for other customers, it represents a drain on resources without a clear path to recurring revenue.

Older generations of Symbotic's hardware, particularly those predating their latest advancements in AI-driven automation, could be classified as Dogs in the BCG Matrix. These systems, while once cutting-edge, now struggle to match the speed, efficiency, and adaptability of their newer counterparts. Their declining market relevance means they generate lower revenue and may even require significant ongoing support costs.

For instance, Symbotic's focus on integrated software and hardware solutions means that older, less connected hardware versions are inherently less valuable. The cost of maintaining legacy systems, including specialized parts and technical support, can outweigh the revenue they generate, especially as newer, more capable systems gain market share. This situation necessitates strategic decisions regarding their future, such as phased retirement or targeted upgrades.

Niche Market Explorations with Limited Adoption

Symbotic's endeavors into niche markets with limited customer adoption, often characterized by low growth potential, could be categorized as Question Marks or potentially Dogs within a BCG Matrix framework. These specialized segments may not have garnered significant traction, leading to a low market share. For instance, if Symbotic invested heavily in developing a highly specialized robotic solution for a micro-manufacturing niche that ultimately saw minimal uptake, this would represent a strategic misstep in terms of market penetration. Such initiatives often fail to generate sufficient demand to recoup investments in sales, marketing, and product customization, leaving Symbotic with a weak position in an unpromising market.

The financial implications of such ventures are substantial. Consider a scenario where Symbotic allocated $20 million to develop and market a solution for a niche industry with an estimated total addressable market of only $50 million. If adoption remains below 10% after several years, the return on investment would be severely hampered.

- Low Market Share: Efforts to penetrate highly specialized, small niche markets that have not resulted in significant customer adoption or growth.

- Low Growth Segments: These ventures operate in markets with limited expansion prospects, hindering overall revenue generation.

- Investment Justification: The investment in sales, marketing, and product adaptation may not generate enough demand to justify the expenditure.

- Divestment Consideration: Such underperforming ventures should be evaluated for divestment to reallocate resources to more promising opportunities.

Pilot Programs Failing to Convert to Full Deployments

Pilot programs that consume resources for initial setup and demonstration but consistently fail to convert into full-scale system deployments or significant follow-on business with new clients can be viewed as Dogs in the BCG Matrix. These situations indicate a potential lack of product-market fit or a competitive disadvantage in those specific instances, tying up valuable capital without yielding the desired returns.

For Symbotic, a persistent pattern of pilot programs not progressing to full deployments suggests underlying issues. This could mean the technology, while promising in a controlled environment, isn't meeting the rigorous demands or cost-effectiveness required for widespread adoption by warehouse operators. For example, if a pilot with a major retailer in 2023 showed initial promise but did not lead to a contract for their entire network by mid-2024, it would be flagged.

- Resource Drain: Pilots consume upfront capital for customization, installation, and training, which are lost if the project doesn't scale.

- Market Fit Questions: Failure to convert suggests the solution might not fully address client needs or offer a compelling ROI compared to alternatives.

- Competitive Landscape: Competitors offering more mature or cost-effective solutions could be hindering Symbotic's conversion rates.

- Scalability Hurdles: Technical or operational challenges in scaling the pilot solution to a client's entire operation can lead to abandonment.

Dogs represent business units or products with low market share in low-growth industries. These ventures typically generate minimal profits or even losses, consuming resources without significant potential for future growth. Companies often consider divesting or phasing out these offerings to reallocate capital to more promising areas.

For instance, in 2024, many established tech companies found themselves managing legacy software products with declining user bases and limited market expansion opportunities. These products, while still generating some revenue, required ongoing maintenance costs that outweighed their growth potential, fitting the description of Dogs.

The strategic implication is clear: such units hinder overall company performance. A 2024 analysis by a leading financial consultancy found that companies with a higher proportion of "Dog" units in their portfolio exhibited slower revenue growth compared to peers focused on high-potential areas.

Consider Symbotic's older automation hardware. While these systems once represented the forefront of warehouse technology, by 2024, their limited integration capabilities and slower processing speeds compared to newer AI-driven solutions placed them firmly in the Dog category. Their market share in new installations is negligible, and continued support costs for existing units can strain resources.

| Product/Service Category | Market Share (Estimated 2024) | Market Growth Rate (Estimated 2024) | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy Automation Hardware | <2% | <1% | Low/Negative | Phased Retirement/Divestment |

| Early-Stage R&D (Unsuccessful Pipelines) | N/A | N/A | Loss | Deprioritize/Terminate |

| Niche Market Solutions (Low Adoption) | <5% | <3% | Low/Break-even | Evaluate for Divestment |

Question Marks

The joint venture GreenBox Systems LLC, a collaboration with SoftBank, positions Symbotic's warehouse-as-a-service offering squarely in the Question Mark quadrant of the BCG Matrix. This strategic move diversifies Symbotic's revenue streams, shifting from direct sales of automation systems to a recurring service model. This has the potential for significant growth by serving multiple clients within shared warehouse infrastructure.

While the warehouse-as-a-service concept taps into a high-growth market driven by e-commerce and supply chain optimization, GreenBox's market share and profitability are still in their nascent stages. As of early 2024, the full financial impact and market penetration of this venture are yet to be definitively established, necessitating continued investment to demonstrate its long-term success and scalability.

The January 2025 acquisition of Walmart's Advanced Systems and Robotics (ASR) unit for micro-fulfillment positions Symbotic squarely in a high-growth, albeit nascent, market. This move signals Symbotic's ambition to capture a significant share of the expanding e-commerce and last-mile delivery sectors. The integration of ASR technology is expected to bolster Symbotic's offerings, moving beyond its traditional warehouse automation.

This strategic expansion into micro-fulfillment is a classic Question Mark on the BCG matrix for Symbotic. While the potential for rapid growth is substantial, the segment represents a new frontier for the company. Significant capital will be needed to refine and scale these micro-fulfillment solutions, demonstrating their efficacy and economic viability across a broader customer base beyond the initial Walmart integration.

The success of this venture hinges on Symbotic's ability to prove the scalability and profitability of its micro-fulfillment technology. Achieving market dominance in this competitive space will require not just technological innovation but also efficient operational execution and strong customer adoption. The investment required to establish this market presence could be substantial, presenting both an opportunity and a challenge.

Symbotic's recent expansion into Mexico via its partnership with Walmex positions it as a Question Mark within the BCG framework for geographic diversification. This venture, while promising, demands considerable capital for establishing robust infrastructure and forging crucial local alliances.

The company must also tailor its advanced automation solutions to meet the specific demands and regulatory landscapes of the Mexican market. As of early 2024, Symbotic's market share in Mexico is still developing, yet the potential for rapid growth and substantial market penetration is significant, mirroring the inherent characteristics of a Question Mark.

Development of New Robotic Capabilities

Symbotic's development of new robotic capabilities, such as their 'minibot' and advanced sensor arrays, positions them firmly in the question mark category of the BCG matrix. These innovations are designed to unlock new applications and operational environments for their automation solutions. The potential for high growth is evident, but the commercial viability and widespread market acceptance of these nascent technologies remain to be fully realized, necessitating ongoing research and development investment.

- Minibot Development: Symbotic is actively developing smaller, more agile robotic units designed for intricate tasks and tighter spaces, expanding potential use cases beyond traditional warehouse operations.

- Enhanced Sensor Arrays: The integration of next-generation sensors aims to improve object recognition, navigation, and data collection, enabling robots to operate more intelligently and adaptively in dynamic environments.

- High Growth Potential: These advancements target emerging markets and applications where current automation solutions may not be optimal, promising significant future revenue streams if successful.

- Unproven Market Adoption: Despite the technological promise, the commercial success of these new robotic forms and advanced sensor capabilities is still subject to market demand and competitive responses, requiring substantial R&D expenditure to validate.

Advanced AI/ML Features for Broader Supply Chain Optimization

The expansion of Symbotic's AI/ML capabilities beyond its established warehouse automation into broader supply chain optimization represents a significant growth opportunity, placing it squarely in the Stars category of the BCG Matrix. This strategic evolution promises to unlock new value propositions, potentially expanding Symbotic's addressable market considerably.

These advanced AI/ML features aim to optimize operations across the entire supply chain, from demand forecasting and inventory management to transportation and logistics. For instance, by leveraging predictive analytics, Symbotic can help clients anticipate disruptions and proactively adjust their supply chain strategies. In 2024, companies across various sectors are increasingly investing in AI-powered supply chain solutions to enhance resilience and efficiency, with the global AI in supply chain market projected to reach tens of billions of dollars by the end of the decade.

- Enhanced Demand Forecasting: AI algorithms can analyze vast datasets, including historical sales, market trends, and even weather patterns, to predict demand with greater accuracy, reducing stockouts and overstocking.

- Optimized Inventory Management: Machine learning models can dynamically adjust inventory levels across multiple locations based on real-time demand signals and lead times, minimizing holding costs and improving service levels.

- Intelligent Transportation & Logistics: AI can optimize routing, load balancing, and carrier selection, leading to reduced transportation costs and faster delivery times.

- Predictive Maintenance for Fleet: ML can predict potential equipment failures in logistics fleets, allowing for proactive maintenance and minimizing costly downtime.

However, the market acceptance and effective monetization of these more advanced, broader supply chain optimization features are still in their nascent stages. Symbotic will need to invest substantially in research and development, alongside dedicated market development efforts, to fully realize the potential of these capabilities. As of early 2025, while interest is high, the widespread adoption of fully integrated AI across entire supply chains is still a developing trend.

The GreenBox Systems LLC joint venture, in collaboration with SoftBank, firmly places Symbotic's warehouse-as-a-service offering within the Question Mark quadrant of the BCG Matrix. This strategic diversification moves Symbotic from direct automation system sales to a recurring service model, potentially capturing significant growth by serving multiple clients within shared warehouse infrastructure.

The January 2025 acquisition of Walmart's Advanced Systems and Robotics (ASR) unit for micro-fulfillment also positions Symbotic as a Question Mark. While this taps into a high-growth e-commerce and last-mile delivery sector, the market share and profitability of these nascent micro-fulfillment solutions require substantial investment to prove scalability and economic viability beyond the initial Walmart integration.

Similarly, Symbotic's expansion into Mexico via its Walmex partnership represents a Question Mark for geographic diversification. This venture, though promising significant growth potential, necessitates considerable capital for infrastructure and local alliances, with market share still developing as of early 2024.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, including sales figures, customer acquisition costs, and competitive landscape analysis to provide actionable strategic insights.