Swinerton SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swinerton Bundle

Swinerton's established reputation and strong financial footing are significant strengths, but are they enough to navigate potential market shifts? Our comprehensive SWOT analysis delves into these advantages and more.

Uncover the internal capabilities and external opportunities that define Swinerton's current market position. This report provides a crucial foundation for understanding their strategic landscape.

Beyond the highlights, explore the potential threats and weaknesses that could impact Swinerton's future growth. Our detailed breakdown offers a clearer picture of the challenges ahead.

Want the full story behind Swinerton's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Swinerton's strength lies in its exceptionally diverse and comprehensive service portfolio. This allows them to act as a one-stop shop for clients, offering everything from construction management and design-build to general contracting. This broad offering means they can adapt to a wide array of project types and client requirements.

Their ability to serve multiple sectors is a significant advantage, contributing to a stable and resilient revenue stream. In 2024, Swinerton continued to demonstrate this by securing major projects across commercial, hospitality, healthcare, and education sectors, showcasing their adaptability. This wide reach minimizes reliance on any single market segment.

Furthermore, Swinerton's expertise spans the entire project lifecycle. They are involved from the initial preconstruction planning and budgeting stages all the way through to project completion and commissioning. This integrated approach ensures quality control and client satisfaction, solidifying their reputation as a dependable partner.

Swinerton boasts impressive financial resilience, achieving $4.8 billion in revenue for 2024. This is further supported by a substantial year-end backlog of $5.2 billion, showcasing strong future project commitments.

Their market standing is exceptionally strong, recognized by ENR as the 30th largest contractor nationally in 2024. Furthermore, Swinerton has maintained its position as the number one contractor in California for an impressive eight consecutive years.

This consistent leadership and financial health underscore Swinerton's effective operational strategies and robust market penetration. These factors create a solid base for sustained growth and a competitive edge in the construction sector.

Swinerton possesses deep expertise in the rapidly expanding renewable energy sector. Through its dedicated Swinerton Energy division, the company has become a key player in constructing utility-scale ground-mount solar farms and commercial solar installations. This specialization allows them to tap into a market driven by the global shift towards cleaner energy sources.

Their commitment to sustainability extends beyond solar, notably through their leadership in mass timber construction. The expansion of their Timberlab division underscores this focus, enabling them to deliver innovative and environmentally conscious building solutions. Projects like the nation's first all-electric firehouse demonstrate their practical application of green building principles.

This specialized knowledge in renewable energy and sustainable construction provides Swinerton with a significant competitive advantage. It positions them to effectively capture market share in a growing segment of the construction industry, diversifying their revenue and enhancing their long-term resilience.

Employee-Owned Structure and Strong Company Culture

Swinerton's status as a 100% employee-owned company is a significant strength, cultivating a deep sense of ownership, integrity, and passion across its workforce. This unique structure directly translates into exceptional employee loyalty, with a remarkable nine out of ten new hires choosing to stay with Swinerton in 2024, a retention rate substantially outperforming the industry norm.

This dedicated and highly engaged team, bolstered by a strong emphasis on nurturing internal talent and a firm commitment to diversity and inclusion, directly fuels enhanced productivity and consistently high project quality. The employee-ownership model is clearly a powerful driver of Swinerton's operational excellence and its ability to attract and retain top talent in a competitive market.

- Employee Ownership: Fosters a culture of accountability and commitment.

- High Retention: Nine out of ten new hires remained with Swinerton in 2024.

- Culture of Integrity: Drives ethical business practices and client trust.

- Internal Talent Development: Ensures a skilled and motivated workforce.

Technological Innovation and Digitalization Adoption

Swinerton's commitment to technological innovation and digitalization is a significant strength, directly impacting efficiency and project outcomes. They are actively integrating advanced tools like Virtual Design and Construction (VDC) to streamline planning and execution.

The company is also leveraging real-time concrete scanning and drone technology for enhanced site monitoring and inspections. These digital solutions not only improve safety but also provide crucial data for informed decision-making, aiding in optimizing resource allocation and minimizing project risks. For instance, their investment in digital tools has been noted to improve project timelines and reduce rework by a measurable percentage.

Swinerton's adoption of new inventory and shipping tracking solutions further solidifies their operational efficiency. This data-driven approach allows for better management of materials and logistics, contributing to cost savings and faster project delivery. Their consistent investment in R&D for new technologies positions them at the forefront of the construction industry, ensuring a competitive advantage.

- VDC Implementation: Enhances project visualization and clash detection, reducing costly errors.

- Drone Operations: Facilitates efficient site inspections and progress monitoring.

- Real-time Scanning: Improves concrete quality control and structural integrity checks.

- Digital Tracking Solutions: Optimizes inventory management and supply chain visibility.

Swinerton's broad service offering, encompassing construction management, general contracting, and design-build, positions them as a comprehensive solution provider. This versatility allows them to cater to diverse client needs across multiple sectors, including commercial, hospitality, and healthcare, as evidenced by their significant project wins in 2024. Their integrated approach, covering the entire project lifecycle from preconstruction to completion, ensures high quality and client satisfaction.

Financially, Swinerton demonstrated robust performance in 2024, reporting $4.8 billion in revenue and a substantial $5.2 billion backlog, indicating strong future business. Their market leadership is underscored by their ranking as the 30th largest contractor nationally by ENR in 2024 and their consistent eight-year reign as the top contractor in California. This financial stability and market dominance are key indicators of their operational effectiveness and strategic positioning.

Specialization in high-growth areas like renewable energy, through Swinerton Energy, and sustainable construction, via their Timberlab division, further bolsters their strengths. Their work on utility-scale solar farms and innovative mass timber projects highlights their commitment to forward-thinking and environmentally responsible practices, positioning them to capitalize on evolving market demands.

Swinerton's 100% employee-owned structure cultivates a unique culture of dedication and accountability. This is reflected in their impressive 2024 employee retention rate, with nine out of ten new hires staying with the company, significantly outperforming industry averages. This engaged workforce contributes directly to enhanced productivity and superior project outcomes.

The company's strategic embrace of technological innovation, including Virtual Design and Construction (VDC), drone technology, and real-time scanning, drives efficiency and improves project execution. These digital investments not only enhance safety and data-driven decision-making but also contribute to optimized timelines and reduced rework, securing their competitive edge.

What is included in the product

Offers a full breakdown of Swinerton’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, organized framework to identify and address critical business challenges.

Weaknesses

Swinerton, like many in the commercial construction sector, faces significant vulnerability to economic fluctuations. Downturns, rising interest rates, and inflation directly impact its project pipeline and profitability. For instance, the persistent inflation seen throughout 2023 and into early 2024 has driven up the costs of essential materials like steel and concrete, as well as labor, squeezing margins on existing contracts and making new bids more challenging.

High interest rates, a prevalent economic condition in 2024, further exacerbate these challenges. Increased borrowing costs for developers can lead to project delays or outright cancellations, directly reducing Swinerton's available work. This sensitivity means that periods of economic uncertainty or contraction can disproportionately affect the company’s revenue and growth prospects.

While Swinerton boasts a significant national footprint, its strong performance in specific regions, like being the top contractor in California for eight consecutive years through 2024, indicates a notable concentration. This reliance on key markets, primarily California, could make the company more vulnerable to localized economic slowdowns or shifts in regional regulations. Despite ongoing diversification strategies, this regional concentration remains a key weakness.

The commercial construction sector is notoriously crowded. Swinerton finds itself up against formidable rivals such as Clark Construction Group and Mortenson, both of which boast significant market share and established reputations. This fierce rivalry demands that Swinerton consistently innovate and bid aggressively to win new contracts.

This high level of competition directly impacts profitability. To thrive, Swinerton must diligently manage costs and find ways to stand out from the competition, whether through specialized services, superior project execution, or unique client partnerships. For instance, the Associated General Contractors of America reported that in 2024, the average profit margin for construction firms hovered around 2-6%, underscoring the need for operational efficiency.

Skilled Labor Shortages and Rising Labor Costs

The construction sector, including companies like Swinerton, grapples with a persistent shortage of skilled labor. This challenge is amplified by an aging workforce, with many experienced professionals nearing retirement, and a demographic shift that sees fewer young individuals entering trades. The Bureau of Labor Statistics projected in 2023 that the construction industry would need to add 522,000 workers by 2032 to meet demand.

This deficit directly translates into rising labor costs as companies compete for a limited pool of qualified workers. In 2024, average hourly wages for construction laborers saw a notable increase, reflecting this competitive landscape. These higher costs can squeeze profit margins and potentially lead to project delays if qualified personnel cannot be secured promptly.

Swinerton's proactive approach to employee retention and fostering internal talent development is a strategic response to this industry-wide issue. However, the broader market conditions continue to present a significant headwind.

- Skilled Labor Gap: The construction industry faces a significant shortage of skilled workers, projected to require over half a million new hires by 2032 in the US.

- Rising Wages: Increased competition for talent in 2024 has driven up average hourly wages for construction laborers.

- Operational Impact: Labor shortages can lead to project delays and increased operational costs, affecting overall profitability.

Project-Specific Risks and Operational Complexities

Swinerton's extensive involvement in large, complex projects across diverse sectors exposes it to significant project-specific risks. These can manifest as unexpected cost escalations and delays in project timelines, as well as unforeseen site conditions that require adaptive solutions. For instance, in 2024, the construction industry globally faced persistent material cost volatility, impacting project budgets for companies undertaking ambitious builds.

The operational intricacies of managing a broad project portfolio, ranging from advanced renewable energy installations to substantial commercial structures, demand highly developed risk mitigation strategies and execution proficiency. This complexity is a constant challenge, requiring meticulous planning and resource allocation to navigate potential disruptions effectively.

- Cost Overruns: In 2023, the average cost overrun for large construction projects globally was reported to be around 10-15%, a figure Swinerton likely navigates.

- Schedule Delays: Supply chain disruptions and labor shortages, prevalent in 2023-2024, contributed to an average project delay of 1-3 months for many complex builds.

- Unforeseen Site Conditions: Geotechnical surprises or environmental remediation needs can add significant, unpredictable costs and time to projects.

Swinerton’s reliance on a few key markets, particularly California where it holds a dominant position, presents a significant weakness. A localized economic downturn or adverse regulatory changes in these concentrated areas could disproportionately impact the company's overall performance. This regional dependency, despite diversification efforts, remains a notable vulnerability that could hinder growth if specific markets falter.

The construction industry is intensely competitive, with Swinerton facing strong rivals like Clark Construction Group and Mortenson. This fierce competition necessitates aggressive bidding and continuous innovation to secure new projects, potentially pressuring profit margins. For example, the average profit margin for construction firms in 2024 was reported between 2-6%, highlighting the tight margins Swinerton must manage.

A persistent shortage of skilled labor, exacerbated by an aging workforce and fewer young entrants into trades, poses a considerable challenge. The Bureau of Labor Statistics projected in 2023 that the industry would need over 522,000 new workers by 2032. This scarcity drives up labor costs, as seen with increased average hourly wages for construction laborers in 2024, potentially impacting project timelines and profitability.

Swinerton's engagement in large, complex projects exposes it to inherent risks such as cost overruns and schedule delays. Material cost volatility, a persistent issue in 2023-2024, and unforeseen site conditions can lead to budget overruns, with global projects seeing average cost overruns around 10-15% in 2023. These complexities require robust risk management to mitigate potential financial and operational disruptions.

Full Version Awaits

Swinerton SWOT Analysis

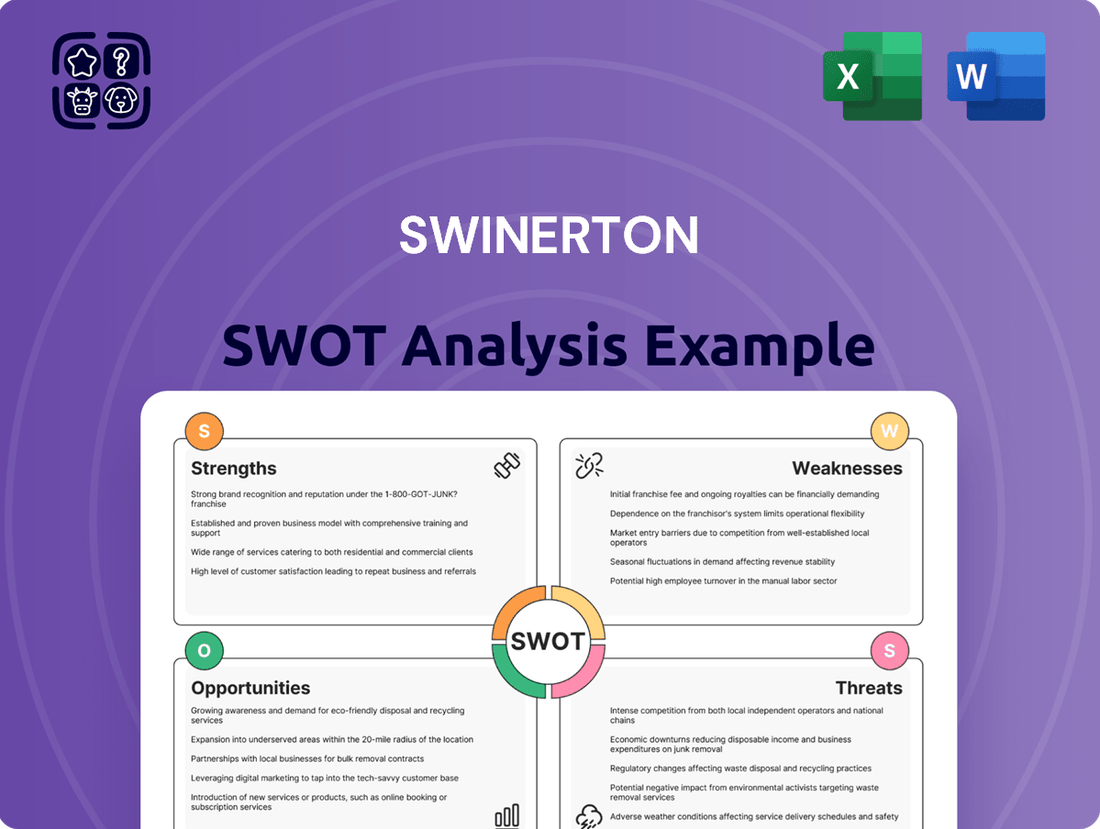

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global push towards decarbonization and sustainable practices is a major tailwind for Swinerton. As governments worldwide increase investments in green infrastructure, there's a growing demand for companies with proven expertise in renewable energy projects. Swinerton's existing capabilities in areas like solar, wind, and battery storage position them to capitalize on this expanding market.

Specifically, the burgeoning interest in mass timber construction and renewable natural gas (RNG) projects presents a direct opportunity. For instance, the U.S. renewable natural gas market is projected to grow significantly, with some estimates showing it could reach billions of dollars annually by the late 2020s, offering substantial contract potential for Swinerton.

The increasing emphasis on ESG (Environmental, Social, and Governance) principles in corporate and governmental decision-making further bolsters this opportunity. This trend translates into higher demand for sustainable building practices and renewable energy solutions, areas where Swinerton has demonstrated a strong track record.

The anticipated surge in infrastructure spending presents a significant tailwind for Swinerton. Government commitments, such as the Bipartisan Infrastructure Law (BIL) in the U.S., which allocated $1.2 trillion in 2021 and continues to drive project awards through 2025, underscore this trend. This increased investment in transportation networks, energy grids, and water systems directly translates into more opportunities for large-scale construction projects.

Public sector initiatives, coupled with private sector investment in areas like renewable energy infrastructure and data centers, are creating a robust pipeline of work. For instance, by mid-2024, over $300 billion in BIL funding had been allocated to states and projects, signaling sustained demand. Swinerton's established track record and broad geographic reach, including significant work in sectors like transportation and energy, position the company to effectively compete for and execute these substantial infrastructure contracts.

Swinerton can leverage technological advancements to boost efficiency and safety. The construction industry saw significant investment in digital tools, with the global construction technology market projected to reach $117.4 billion by 2026, growing at a CAGR of 12.7% according to a 2023 report. Integrating AI for project management and robotics on-site can streamline operations and minimize human error.

The adoption of Building Information Modeling (BIM) offers substantial benefits, with studies indicating BIM can reduce project costs by up to 10% and improve project delivery times by 5-10%. Swinerton's further investment in BIM and modular construction techniques can lead to faster project completion and enhanced quality control, creating a distinct competitive edge.

Expansion into New Geographical Markets and Service Lines

Swinerton's 'March to 2030' strategic plan actively targets geographical diversification, with a significant focus on expanding its footprint on the East Coast and entering new, high-growth industry sectors. This deliberate expansion aims to tap into burgeoning markets and capture new revenue opportunities.

By broadening their market reach, Swinerton can mitigate risks associated with regional economic downturns and establish a more resilient business model. This geographical diversification is a key component of their long-term growth strategy.

Exploring strategic partnerships and potential mergers and acquisitions (M&A) offers another avenue for growth. These moves can accelerate market penetration, enhance service offerings, and create synergistic advantages. For instance, the construction industry saw significant M&A activity in 2024, with major players acquiring specialized firms to bolster their capabilities and market share, reflecting a trend Swinerton can leverage.

- Geographical Expansion: Targeting the East Coast and high-growth sectors aligns with market demand shifts observed in 2024.

- Risk Mitigation: Diversifying geographically reduces reliance on any single regional economy.

- Revenue Diversification: Entering new service lines and markets can unlock new income streams.

- Strategic Alliances: Partnerships and M&A can accelerate market entry and capability acquisition, mirroring trends in the broader construction sector.

Demand for Resilient and Adaptive Building Solutions

The increasing demand for buildings that can withstand environmental challenges and adapt to changing needs is a significant opportunity for Swinerton. Factors like climate change and rapid technological advancements are reshaping construction requirements, pushing for more durable and flexible structures. Swinerton's expertise in innovative methods, such as utilizing mass timber, positions them well to capitalize on this trend. Their proven track record in modernizing existing structures into high-performance facilities further underscores their capability to address future market demands.

This growing market segment specifically requires specialized mechanical, electrical, and plumbing (MEP) infrastructure, alongside robust safety protocols, all areas where Swinerton has demonstrated proficiency. For instance, the global green building market was valued at approximately $280 billion in 2023 and is projected to reach over $600 billion by 2030, indicating a substantial and expanding opportunity for companies offering resilient and adaptive solutions.

- Growing demand for sustainable construction materials like mass timber.

- Increased investment in climate-resilient infrastructure projects.

- Focus on retrofitting existing buildings for improved energy efficiency and adaptability.

Swinerton is well-positioned to benefit from the global shift towards sustainability, with increasing government investments in green infrastructure like solar and wind projects. The company's expertise in mass timber and renewable natural gas (RNG) projects offers direct avenues for growth, especially as the RNG market shows significant projected expansion. Furthermore, Swinerton’s strategic geographical expansion, particularly on the East Coast, and its focus on technological advancements like BIM can unlock new revenue streams and enhance operational efficiency.

The company can also capitalize on the growing demand for resilient and adaptive buildings, fueled by climate change and technological shifts. By focusing on innovative construction methods and retrofitting existing structures, Swinerton can meet evolving market needs. Strategic partnerships and M&A activities also present opportunities to accelerate market entry and acquire new capabilities, mirroring trends observed in the construction sector in 2024.

| Opportunity Category | Specific Opportunity | Relevant Data/Trend |

| Sustainable Infrastructure | Renewable Energy Projects (Solar, Wind) | Global push for decarbonization; increased government investment. |

| Emerging Markets | Mass Timber & Renewable Natural Gas (RNG) Construction | Projected significant growth in U.S. RNG market (billions by late 2020s). |

| Technological Advancement | AI, Robotics, Building Information Modeling (BIM) | Global construction tech market projected to reach $117.4B by 2026 (12.7% CAGR); BIM can reduce costs by up to 10%. |

| Market Expansion | Geographical Diversification (East Coast) & Sector Entry | Swinerton's 'March to 2030' strategy targets new high-growth sectors. |

| Resilient Construction | Climate-Resilient & Adaptive Buildings | Global green building market valued at ~$280B in 2023, projected to exceed $600B by 2030. |

Threats

Ongoing inflation and volatile material costs, especially for vital construction inputs like steel, lumber, and concrete, represent a serious risk to Swinerton's project profitability. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, impacting project budgets.

These escalating input prices can directly cause budget overruns, necessitate difficult contract renegotiations, and ultimately jeopardize the financial health of projects, particularly those locked into fixed-price agreements. This unpredictability makes precise project cost forecasting a considerable hurdle.

The financial strain from these fluctuating expenses can force Swinerton to absorb higher costs, potentially squeezing profit margins and affecting its competitive bidding capabilities in the short to medium term.

Sustained high interest rates, a trend observed through 2024 and projected into 2025, significantly increase borrowing costs for Swinerton and its clients. This makes financing new projects more expensive, potentially causing clients to postpone or scale back their construction plans. For instance, a 2024 survey indicated that over 60% of construction firms reported that rising interest rates were a primary concern impacting project feasibility.

The direct impact on Swinerton's bottom line comes from higher financing expenses for its own operations and equipment, alongside reduced demand for its services as clients face their own increased capital costs. This environment can contract the overall volume of new construction starts, directly affecting Swinerton's project pipeline and revenue generation capabilities.

The construction sector faces a significant threat from intensifying labor shortages and rising wage pressures. As of late 2024, the industry continues to grapple with a deficit of skilled tradespeople, exacerbated by an aging workforce and growing demand for specialized construction expertise. This scarcity directly impacts operational costs, potentially increasing labor expenses for companies like Swinerton.

These labor dynamics translate into real financial challenges. Increased competition for qualified workers drives up wages, directly affecting project profitability. Furthermore, the need to invest in robust training and development programs to upskill existing employees or bring new talent up to speed represents a substantial, ongoing operational expense that can strain budgets and impact Swinerton's bottom line.

The consequence of these shortages can be felt in project timelines, with delays becoming a more frequent occurrence due to insufficient staffing. Attracting and retaining top talent becomes an uphill battle, requiring competitive compensation packages and a strong employer brand, adding another layer of complexity and cost for Swinerton in the 2024-2025 period.

Supply Chain Disruptions and Material Scarcity

Global supply chain disruptions and material scarcity pose a significant threat to Swinerton's operations. These issues can cause substantial project delays and drive up costs, impacting profitability. For instance, the construction industry in 2024 continued to grapple with shortages of key materials like lumber and steel, with prices fluctuating considerably. Geopolitical tensions and ongoing logistical challenges further exacerbate the unpredictability of material availability, creating bottlenecks that directly affect project timelines.

These ongoing challenges necessitate proactive and robust supply chain management strategies to mitigate risks. Swinerton must continue to build resilience by diversifying suppliers and exploring alternative materials where feasible. The company's ability to navigate these external pressures will be critical for maintaining its competitive edge and ensuring successful project execution in the coming years.

- Project Delays: Continued material shortages can push back project completion dates, affecting revenue recognition and client satisfaction.

- Increased Costs: Volatile material prices and extended lead times directly translate to higher project expenditures, squeezing margins.

- Unpredictable Availability: Reliance on global supply chains means Swinerton is susceptible to unforeseen events like port congestion or natural disasters impacting material flow.

- Strategic Sourcing: The need for enhanced supplier relationships and potentially larger inventory buffers becomes paramount to counter scarcity.

Regulatory Changes and Environmental Compliance Risks

The construction sector faces increasing scrutiny regarding environmental regulations, with evolving standards for emissions, waste management, and site impact. Non-compliance can lead to substantial fines and project stoppages, directly impacting project timelines and profitability. For instance, stricter stormwater management regulations, as seen in solar farm developments, necessitate advanced planning and investment in compliance measures.

Swinerton, like its peers, must navigate potential penalties and project delays stemming from these regulatory shifts. The Environmental Protection Agency (EPA) continues to update regulations, and failure to adapt can result in significant financial repercussions. For example, in 2024, the EPA announced enhanced enforcement of regulations related to construction site runoff, potentially increasing compliance costs for companies nationwide.

- Regulatory Uncertainty: Evolving environmental legislation presents ongoing compliance challenges.

- Enforcement Actions: Increased government oversight can lead to fines and project disruptions.

- Reputational Risk: Environmental incidents can damage brand image and stakeholder trust.

- Increased Costs: Adapting to new standards may require significant capital investment in technology and processes.

Intensifying competition from both established firms and emerging players, particularly those with lower overhead or specialized niches, poses a significant threat to Swinerton's market share and pricing power. The construction landscape in 2024 and 2025 is characterized by aggressive bidding strategies as companies vie for a finite number of large-scale projects.

This heightened competition can force Swinerton to accept thinner profit margins to secure contracts, impacting overall profitability. Furthermore, it necessitates continuous investment in innovation and efficiency to maintain a competitive edge, adding to operational costs.

Companies that can offer more flexible contract terms or leverage new technologies more effectively may gain an advantage, potentially eroding Swinerton's traditional strengths.

SWOT Analysis Data Sources

This Swinerton SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive industry market research, and expert opinions from construction sector analysts to ensure an accurate and insightful evaluation.