Swinerton Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swinerton Bundle

Swinerton's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants. Understanding these dynamics is crucial for strategic advantage.

We've explored the bargaining power of Swinerton's suppliers and buyers, revealing key leverage points within their operational ecosystem. This analysis highlights critical dependencies.

Furthermore, the threat of substitute products looms large, pushing Swinerton to innovate and differentiate its offerings continuously. Identifying these alternatives is paramount.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Swinerton’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Swinerton's bargaining power with suppliers can be significantly influenced by supplier concentration and specialization. If Swinerton relies on a limited number of suppliers for critical, specialized components such as advanced mass timber elements or cutting-edge renewable energy systems, these suppliers can wield considerable power.

The company's strategic move to expand Timberlab, which includes acquiring glulam timber manufacturing facilities, directly addresses this potential vulnerability. By bringing these capabilities in-house, Swinerton aims to strengthen its supply chain and lessen its dependence on external, specialized suppliers for key materials.

High switching costs can significantly empower suppliers. For a company like Swinerton, these costs might involve retraining staff for new equipment or rebuilding relationships with different subcontractors. These hurdles make it more difficult and expensive to change suppliers, giving existing suppliers more leverage in negotiations.

However, Swinerton’s in-house capabilities, like their concrete services through SAK Builders, act as a powerful countermeasure. By self-performing certain crucial tasks, Swinerton reduces its reliance on external subcontractors for those specific services. This internal capacity directly lowers the switching costs associated with finding and integrating new providers for those trades, thereby diminishing supplier bargaining power in those areas.

Suppliers providing specialized components for LEED-certified or net-zero carbon buildings can exert significant bargaining power over Swinerton, as these materials directly influence project quality and differentiation. For instance, in 2024, the demand for advanced sustainable building materials saw a notable increase, with companies specializing in recycled content and low-VOC products experiencing robust growth.

Swinerton's commitment to green services amplifies the leverage of suppliers offering innovative, environmentally friendly materials. This is particularly evident as the construction industry increasingly prioritizes sustainability; a 2023 report indicated that over 60% of construction firms planned to increase their use of green building materials in upcoming projects.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into construction services significantly amplifies their bargaining power. While less prevalent in broad construction, specialized component manufacturers could directly offer integrated solutions to clients, effectively cutting out general contractors. This capability allows them to capture more value from the project, potentially increasing their leverage in price negotiations.

For instance, a prefabrication specialist supplying complex modular units for a large infrastructure project might also possess the expertise and capital to manage the on-site assembly and installation. This dual capability transforms them from a mere component provider to a potential competitor for the main contractor, especially if they can demonstrate cost or efficiency advantages. In 2024, the trend towards off-site construction and modular building is gaining momentum, potentially empowering such suppliers.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms more effectively.

- Niche Specialization: This threat is most pronounced for suppliers of highly specialized or proprietary components.

- Market Dynamics: The growing adoption of modular construction in 2024 could foster more supplier forward integration.

- Value Chain Capture: Suppliers can aim to capture a larger portion of the project's total value.

Availability of Substitute Inputs

The availability of substitute inputs significantly curbs supplier power. For Swinerton, this means that if a particular material or service has readily available alternatives, such as different construction techniques or a diverse labor market, suppliers of a specific input cannot exert excessive leverage. This is a crucial consideration in the construction sector, where material and labor sourcing can be complex.

Swinerton’s strategic embrace of innovative building systems like mass timber is a prime example of mitigating supplier power through substitution. By integrating new methods, the company can forge relationships with a wider array of suppliers, thereby diminishing its dependence on traditional, potentially concentrated sources for materials like steel or concrete. For instance, the global mass timber market was valued at approximately USD 8.5 billion in 2023 and is projected to grow substantially, indicating an expanding supplier base for this alternative material.

- Reduced Reliance: Access to alternative construction methods, like modular building or advanced prefabrication, provides Swinerton with options beyond traditional supply chains.

- Expanded Supplier Network: The adoption of materials such as cross-laminated timber (CLT) opens doors to new suppliers, fostering competition and potentially lowering input costs.

- Innovation as a Lever: Swinerton's investment in R&D for new building technologies can create internal capabilities or partnerships that reduce the need for specialized, single-source suppliers.

- Market Dynamics: In 2024, the construction industry is seeing increased demand for sustainable materials, driving innovation and the emergence of new suppliers for products like engineered wood, further diluting the power of established material providers.

Swinerton's exposure to supplier bargaining power is heightened when suppliers are concentrated, specialized, or have high switching costs associated with changing them. Conversely, the availability of substitute inputs and Swinerton’s own backward integration or development of in-house capabilities can significantly diminish this power. The trend towards sustainability and modular construction in 2024 is reshaping supplier dynamics, potentially empowering those offering specialized green materials or integrated off-site solutions.

| Factor Influencing Supplier Bargaining Power | Swinerton's Vulnerability/Mitigation | 2024 Industry Trend Relevance |

|---|---|---|

| Supplier Concentration & Specialization | High for specialized components; mitigated by Timberlab expansion. | Growing demand for sustainable, specialized materials. |

| Switching Costs | High for specialized equipment/training; reduced by in-house SAK Builders concrete services. | Industry focus on efficiency and supply chain resilience. |

| Importance of Supplier's Input | High for LEED/net-zero materials; supplier power increases. | Over 60% of firms planned increased green material use in projects post-2023. |

| Threat of Forward Integration | Potential for prefab specialists to offer integrated solutions, increasing leverage. | Momentum in modular construction favors suppliers with assembly capabilities. |

| Availability of Substitutes | Lowers supplier power; mass timber adoption expands options beyond steel/concrete. | Mass timber market valued at $8.5 billion in 2023, indicating growing supplier base. |

What is included in the product

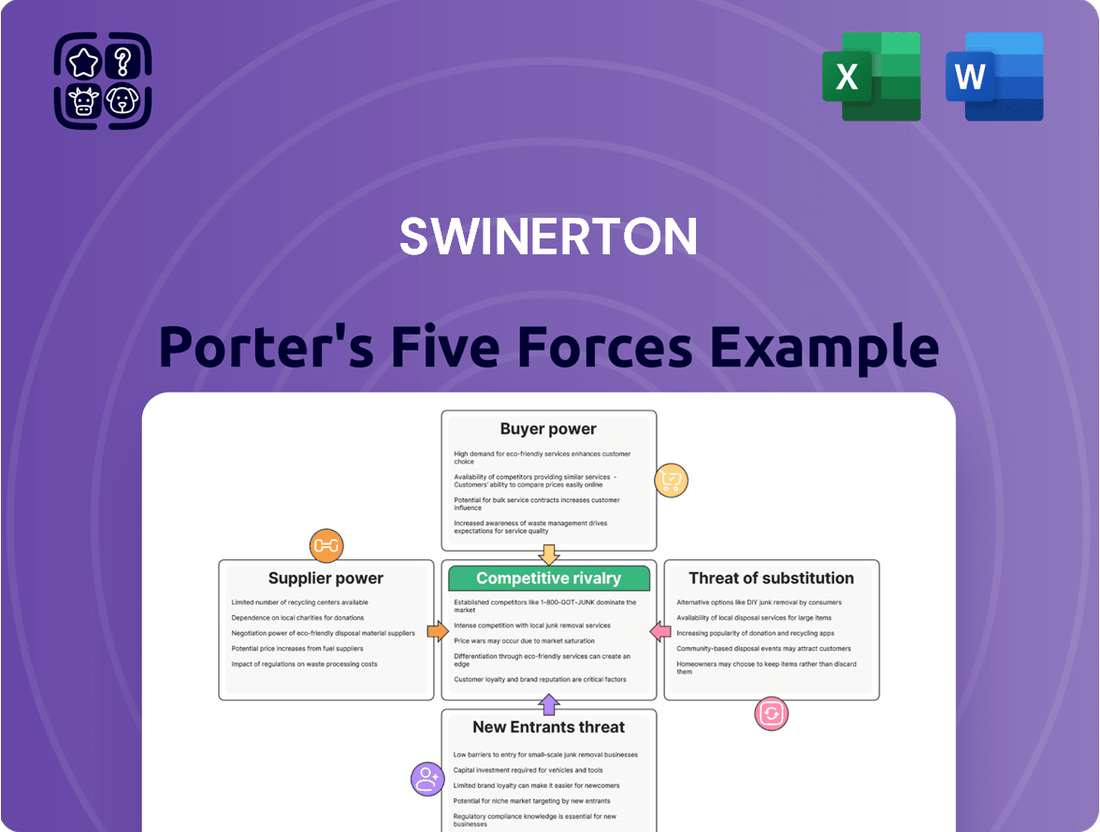

Unpacks the five competitive forces—rivalry, new entrants, buyer power, supplier power, and substitutes—to reveal Swinerton's strategic position and profitability drivers.

Swinerton Porter's Five Forces Analysis provides a structured framework to identify and address competitive pressures, transforming complex market dynamics into actionable insights for strategic advantage.

Customers Bargaining Power

Customer concentration is a key factor in assessing the bargaining power of customers. Swinerton's broad client diversification, with over 500 clients across various sectors like commercial, residential, industrial, and renewable energy in 2024, significantly mitigates this risk. This wide spread means no single client represents a dominant portion of revenue, thereby diminishing any individual customer's leverage.

Customers in the construction industry, particularly for significant commercial and public works, are frequently very sensitive to price. This is because these projects often operate under strict budgetary constraints, making cost a primary decision-making factor.

Swinerton's strength in self-performing various construction tasks allows them to maintain tighter control over costs and quality. This capability directly addresses customer price sensitivity by enabling the company to offer more competitive pricing without compromising on the final product.

For instance, in 2024, the construction sector experienced ongoing pressure from rising material costs, averaging a 5% increase year-over-year for key commodities. Companies like Swinerton that can absorb some of these increases through efficient self-perform operations are better positioned to manage customer price expectations.

The ability to deliver value, not just the lowest bid, becomes crucial. Swinerton's focus on integrated project delivery models, which often lead to cost savings through early collaboration and risk mitigation, also plays a significant role in appeasing price-sensitive clients by demonstrating long-term cost-effectiveness.

Customers wield considerable bargaining power primarily because the construction market offers a wide array of general contractors. From large, national companies to more focused, regional firms, clients have ample choices. This availability means that even a highly-ranked contractor like Swinerton, which is recognized among the nation's top construction companies, must still contend with clients who can readily explore alternatives. For instance, in 2023, the U.S. construction industry saw thousands of new general contracting firms established, further increasing client options.

Threat of Backward Integration by Customers

For major commercial and industrial construction projects, clients typically lack the expertise and resources to manage the building process themselves. This means they generally can't easily "backward integrate" by taking construction in-house.

This inability of customers to build projects on their own significantly reduces their bargaining power. They must rely on specialized contractors like Swinerton for their technical skills and project management capabilities.

In 2024, the construction industry continued to see a high degree of specialization, with clients outsourcing complex execution. For example, while some large corporations might have internal facilities management, the actual construction of a new skyscraper or a large manufacturing plant remains firmly in the domain of experienced general contractors.

- Limited In-House Capability: Clients typically do not possess the specialized labor, equipment, and management expertise required for large-scale construction.

- Focus on Core Competencies: Customers prefer to concentrate on their primary business operations rather than diverting resources to construction management.

- Risk Mitigation: Outsourcing construction to experienced firms transfers significant project risks, such as delays, cost overruns, and quality control, away from the client.

- Contractor Specialization: The complexity and regulatory environment of modern construction demand specialized knowledge that clients usually do not maintain.

Project Size and Importance to Customer

For very large or critical projects, a customer’s bargaining power can significantly increase. This is directly tied to the sheer scale of the contract and its strategic importance to the customer's own business operations. Swinerton, by specializing in comprehensive services and adeptly managing large-scale projects, is well-positioned to secure these substantial contracts.

However, these significant engagements naturally come with elevated customer expectations and a greater likelihood of intense negotiation. For instance, in 2024, major infrastructure projects, often valued in the hundreds of millions or even billions of dollars, represent a substantial portion of a general contractor's annual revenue. A single client awarding such a project holds considerable sway, potentially influencing pricing, timelines, and contractual terms.

- Project Scale: Larger contracts inherently grant customers more leverage.

- Strategic Importance: Projects critical to a customer's success amplify their bargaining power.

- Swinerton's Position: Expertise in large projects attracts significant clients but also increases customer expectations.

- Negotiation Intensity: High-stakes projects often lead to more rigorous contract discussions.

The bargaining power of customers in the construction industry is a significant factor, largely driven by the availability of numerous contractors. Swinerton's broad client base, exceeding 500 clients in 2024 across diverse sectors, helps mitigate the impact of any single customer's leverage. This diversification means that the loss of one client, while impactful, does not disproportionately affect overall revenue, thus tempering individual customer power. The industry's inherent price sensitivity, especially for large projects, means customers can exert pressure by seeking competitive bids, a reality Swinerton manages through efficient self-performance and value-driven delivery models.

| Factor | Impact on Customer Bargaining Power | Swinerton's Mitigation Strategy (2024 Data) |

|---|---|---|

| Client Concentration | High potential power if clients are few and large | Over 500 clients across multiple sectors, reducing reliance on any single entity. |

| Price Sensitivity | High for large projects due to budget constraints | Self-performance capabilities allow for cost control and competitive pricing. |

| Availability of Alternatives | High due to a competitive contractor landscape | Focus on integrated project delivery and value beyond just price. |

| Customer's In-House Capability | Low, as clients typically lack construction expertise | Clients outsource complex execution due to specialized needs and risk transfer. |

What You See Is What You Get

Swinerton Porter's Five Forces Analysis

This preview shows the exact Swinerton Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Swinerton, covering buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This detailed document is ready for your immediate use, offering valuable strategic insights.

Rivalry Among Competitors

The commercial construction sector is intensely competitive, featuring many large national general contractors such as Clark and Mortenson, alongside a multitude of regional and specialized companies. Swinerton, a significant player, ranked 30th among top contractors by revenue in 2024, underscores the fragmented nature of this market with its numerous participants.

The U.S. construction market anticipates continued expansion through 2025, yet growth will not be uniform across all sectors. This uneven growth can intensify competition as firms chase opportunities in higher-performing segments.

Swinerton's strategic advantage lies in its broad market presence, encompassing commercial, residential, industrial, and renewable energy projects. This diversification allows the company to navigate the inherent cyclicality of different construction markets, mitigating the impact of slowdowns in any single sector.

For instance, while the overall U.S. construction spending was projected to reach approximately $2.0 trillion in 2024 according to some industry forecasts, the residential sector might experience more moderate growth compared to the robust expansion anticipated in infrastructure and renewable energy projects.

Swinerton's competitive edge lies in its broad service spectrum, encompassing construction management, design-build, and general contracting, which allows it to manage projects from inception to completion. This end-to-end capability reduces reliance on subcontractors and offers clients a single point of accountability.

The company's deep expertise across diverse project phases, from pre-construction planning to post-construction support, further distinguishes it. This holistic approach ensures quality and efficiency, minimizing potential disruptions and enhancing client satisfaction, thereby lessening the intensity of price-based competition.

Furthermore, Swinerton's specialized divisions, such as Swinerton Renewable Energy and Timberlab, cater to burgeoning market segments with tailored solutions. For instance, Swinerton Renewable Energy has been a significant player in solar projects, with the company's involvement in numerous utility-scale solar farms contributing to its strong reputation in this growing sector.

This strategic diversification into niche markets, supported by dedicated expertise, allows Swinerton to command premium pricing and build strong customer loyalty, effectively dampening direct rivalry with less specialized competitors.

Exit Barriers

High exit barriers, like specialized assets, long-term contracts, and employee ownership, can really crank up the competitive rivalry. When it's tough for companies to leave a market, they tend to fight harder for every project, which can lead to more aggressive pricing and strategies. For instance, a construction firm with a large fleet of specialized equipment and ongoing multi-year projects might find it extremely difficult and costly to simply shut down operations.

Swinerton, with its substantial investments across various construction sectors and its employee-owned structure, likely faces significant exit barriers. This means Swinerton and its competitors are more likely to remain committed to the market, even during downturns, potentially intensifying competition for new work. Consider that in 2023, the U.S. construction industry saw significant investment in new equipment and technology, with spending on construction machinery alone reaching hundreds of billions of dollars, a commitment that makes exiting difficult.

- Specialized Assets: Investments in unique equipment or facilities make leaving costly.

- Long-Term Contracts: Obligations to clients can tie a company to the market for years.

- Employee Ownership: Structures like ESOPs (Employee Stock Ownership Plans) can create a strong incentive for continued operation and may involve complex buy-back provisions upon exit.

- Sunk Costs: Previous investments that cannot be recovered if operations cease.

Market Share Concentration

While Swinerton holds a commanding presence, notably ranking as the No. 1 Top Contractor in California for eight consecutive years, the broader construction market exhibits a low degree of market share concentration. This means that no single company, including Swinerton, dominates the entire industry landscape. The absence of a clear market leader intensifies competitive pressures as numerous firms actively compete for every project opportunity.

This competitive environment is further highlighted by the fact that in 2023, the top 10 construction firms globally accounted for only a fraction of the total market revenue, indicating a highly fragmented sector. For instance, the market share of even the largest players often remains in the single digits when considering the vastness of global construction spending.

- Low Market Concentration: The construction industry, despite the success of individual firms like Swinerton, is characterized by a fragmented market structure.

- Intense Rivalry: This lack of dominance fuels aggressive competition among companies striving to capture market share and secure new contracts.

- Swinerton's Strong Position: Swinerton's consistent leadership in California underscores its operational strength within a specific regional market.

- Fragmented Industry Landscape: Globally, the market share distribution among top contractors remains relatively dispersed, preventing any single entity from establishing overwhelming control.

The commercial construction sector is highly competitive, with numerous large national firms and many regional and specialized companies vying for projects. Swinerton, a significant player, ranked 30th among top contractors by revenue in 2024, highlighting the market's fragmented nature. High exit barriers, such as specialized assets and employee ownership, encourage firms to remain committed, intensifying rivalry. This means companies like Swinerton often fight aggressively for every project, influencing pricing and strategies.

| Industry Aspect | Description | Swinerton's Position/Impact |

|---|---|---|

| Number of Competitors | Many large national, regional, and specialized firms | Swinerton is one of many, though a significant player (30th in 2024 revenue). |

| Market Concentration | Low, highly fragmented | No single company dominates; intensifies competition for projects. |

| Exit Barriers | High (specialized assets, long-term contracts, employee ownership) | Encourages continued market participation, leading to sustained rivalry. |

| Strategic Differentiation | Broad service spectrum, specialized divisions (Renewable Energy, Timberlab) | Helps mitigate direct price-based competition and builds loyalty. |

SSubstitutes Threaten

The threat of substitutes in construction is significant, with alternative methods like modular construction, prefabrication, and 3D printing offering potential advantages in speed and cost. For instance, the global modular construction market was valued at approximately $107.6 billion in 2023 and is projected to grow, presenting a direct challenge to traditional building approaches.

Swinerton actively addresses this threat by embracing innovation, including its involvement in mass timber construction. This approach integrates advanced techniques, allowing Swinerton to offer competitive solutions that can rival the efficiency and cost-effectiveness of some substitute methods.

By investing in and utilizing these forward-thinking construction technologies, Swinerton aims to stay ahead of market shifts and maintain its competitive edge against emerging alternatives. This proactive stance is crucial in an industry constantly seeking more efficient and sustainable building practices.

For many large-scale commercial and industrial projects, clients typically lack the specialized in-house expertise and extensive resources needed to manage construction independently. This significantly limits the threat of clients performing construction tasks themselves.

However, the threat from client in-house capabilities can emerge for less complex undertakings. Smaller projects or routine maintenance activities might be handled internally by client teams or outsourced to niche service providers, thereby bypassing general contractors.

In 2024, the construction industry saw a continued trend of clients seeking external expertise for complex builds, with over 80% of major infrastructure projects relying on specialized general contractors. This reliance underscores the limited threat from client in-house capabilities in this segment.

Nevertheless, for simpler tasks, some organizations are building internal maintenance divisions. Reports from 2023 indicated a 15% increase in companies establishing or expanding their in-house facility management teams, suggesting a growing, albeit niche, threat in specific service areas.

A significant shift in client preferences toward novel building types or technologies outside Swinerton's current offerings represents a potent threat of substitutes. For instance, a surge in demand for modular construction using entirely new composite materials could bypass traditional building methods. Swinerton's 2024 Sustainability Report details significant investments in digital modeling and green building technologies, aiming to preempt such shifts by aligning with growing client desires for sustainable and technologically advanced structures.

Outsourcing to Design-Only Firms

Clients might opt to engage with specialized design-only firms and then separately procure construction services. This approach bypasses Swinerton’s integrated design-build model, potentially limiting the company’s involvement to just the construction phase on such projects.

This separation allows clients to source the best design expertise independently, and then competitively bid construction, which could lead to cost savings or access to niche construction expertise. For instance, if a client prioritizes a highly specific architectural vision, they might work with a renowned design firm before bringing in a builder.

- Reduced Scope: Swinerton's services could be narrowed to construction management or general contracting, excluding the lucrative design component.

- Competitive Pressure: Design-only firms can focus solely on design quality and client relationships, creating a distinct competitive set.

- Client Choice: This option empowers clients with greater flexibility in selecting their design and construction partners, potentially impacting Swinerton’s market share in integrated projects.

Non-Construction Solutions to Client Needs

Clients' needs can sometimes be met by solutions outside of traditional construction. For instance, the rise of remote and hybrid work models has significantly reduced the demand for new office buildings, with companies prioritizing the optimization of existing spaces rather than new construction projects. This trend directly impacts the revenue streams for construction firms like Swinerton.

Swinerton's broad diversification across sectors like healthcare, industrial, and infrastructure provides a crucial buffer. For example, while office construction might see a slowdown, a robust infrastructure pipeline or increased demand for data centers can offset these challenges. In 2024, the infrastructure sector, particularly in the US, saw substantial investment driven by government initiatives, potentially mitigating some of the impact from other sectors. Swinerton's presence in these diverse markets allows them to capitalize on growth areas, even as others face headwinds.

- Remote work adoption: Studies in 2024 indicated that a significant percentage of the workforce continued to work remotely at least part-time, impacting commercial real estate needs.

- Facility optimization: Companies are increasingly investing in retrofitting and upgrading existing facilities to improve efficiency and accommodate new work styles, rather than undertaking greenfield construction.

- Sectoral diversification: Swinerton's presence in sectors like transportation and energy infrastructure provides resilience against downturns in the commercial or residential building markets.

- Government investment: In 2024, the Bipartisan Infrastructure Law continued to fuel significant spending in areas like bridges, transit, and renewable energy, benefiting diversified construction companies.

The threat of substitutes in construction remains a critical factor, with evolving technologies like modular construction and 3D printing offering faster and potentially more cost-effective alternatives to traditional methods.

These substitutes challenge established practices by providing novel solutions that can appeal to clients seeking efficiency and innovation. For example, the global prefabricated construction market was valued at over $130 billion in 2023, indicating a substantial and growing substitute option.

Swinerton's strategic focus on integrating advanced building techniques, such as mass timber and digital prefabrication, directly counters this threat by offering competitive, forward-thinking solutions.

The company's proactive investment in these innovative construction technologies is essential for maintaining its market position against a landscape of increasingly sophisticated alternatives.

Entrants Threaten

Entering the commercial construction sector, particularly for substantial projects similar to those Swinerton Porter engages in, demands significant financial resources. This includes substantial investment in heavy machinery, securing robust bonding capacity, and maintaining adequate working capital to manage project lifecycles.

These considerable upfront financial commitments act as a formidable barrier, effectively deterring a large influx of new competitors. For instance, the average cost of heavy construction equipment alone can run into millions of dollars, a sum many emerging firms simply cannot muster.

The need for substantial bonding capacity, often millions of dollars for larger contracts, further restricts entry. Companies must demonstrate financial stability and reliability to secure these bonds, a hurdle that smaller or newer entities find particularly challenging to overcome.

Consequently, the threat of new entrants is somewhat mitigated by these high capital requirements, as only well-capitalized firms can realistically compete for the larger, more lucrative projects that define the commercial construction landscape.

Swinerton, a company with a legacy stretching back to 1888, boasts a powerful advantage through its established client relationships and a sterling reputation. As a 100% employee-owned entity, this fosters a unique commitment to quality and client satisfaction that new competitors find incredibly difficult to match. In 2024, the construction industry continues to value reliability and a proven track record, especially for large-scale projects.

The construction sector grapples with persistent skilled labor shortages, a significant barrier for new entrants. In 2024, the Associated General Contractors of America reported that 70% of construction firms struggled to find enough qualified craft workers, a trend that continued from previous years.

Established companies like Swinerton have cultivated deep relationships with skilled craft professionals over decades, creating a loyal and experienced workforce. This extensive talent pool is not easily replicated by newcomers, giving Swinerton a distinct advantage in project execution.

Furthermore, securing reliable supply chains for materials and equipment is crucial. New entrants would face considerable hurdles in establishing comparable networks and negotiating favorable terms with suppliers, especially given the ongoing global supply chain disruptions that impacted the industry throughout 2023 and into 2024.

Regulatory Hurdles and Licensing

The construction sector faces substantial regulatory scrutiny, demanding a complex web of licenses, permits, and strict adherence to building codes and safety regulations. For instance, in 2024, the average time to obtain a building permit in major US cities continued to be a significant factor, with some areas experiencing delays of over six months for complex projects. This intricate regulatory landscape acts as a considerable barrier to entry for new companies, especially those aiming for large-scale, multi-state operations.

New entrants must invest heavily in understanding and complying with diverse state and local regulations, including environmental impact assessments and labor laws. Failure to navigate these requirements can lead to project delays, fines, and reputational damage. In 2024, construction firms faced increased scrutiny regarding material sourcing and waste management, adding another layer of compliance complexity. The sheer capital and expertise required to manage these regulatory demands effectively can deter potential competitors.

- Licensing and Permitting Costs: New construction firms often face substantial upfront costs associated with obtaining necessary licenses and permits, which can run into tens of thousands of dollars depending on the jurisdiction and project scope.

- Adherence to Building Codes: Compliance with evolving building codes, such as those related to energy efficiency or seismic resilience, requires ongoing investment in training and technology, presenting a challenge for new entrants.

- Safety Standards: Meeting rigorous Occupational Safety and Health Administration (OSHA) standards and state-specific safety regulations demands significant investment in safety training, equipment, and compliance personnel.

- Environmental Regulations: Navigating environmental protection regulations, including those related to stormwater management and hazardous material disposal, adds another layer of complexity and cost for new construction companies.

Economies of Scale and Experience Curve

Established giants like Swinerton leverage significant economies of scale, particularly in bulk purchasing of materials and equipment, which allows them to negotiate lower costs than newcomers. This procurement advantage directly translates into more competitive bidding on projects.

Furthermore, Swinerton’s deep well of experience enables them to navigate the learning curve more effectively. This means they have refined processes for project execution, risk management, and quality control, leading to greater efficiency and fewer costly errors, which are common pitfalls for new entrants.

- Economies of Scale: Swinerton’s large-scale operations reduce per-unit costs in procurement and project management.

- Experience Curve Benefits: Decades of project execution have optimized Swinerton's processes, improving efficiency and reducing waste.

- Competitive Pricing: These efficiencies allow Swinerton to offer more attractive pricing, a significant barrier for new firms.

- Quality Assurance: Proven track records and established quality control measures provide a competitive edge over inexperienced entrants.

The threat of new entrants in the commercial construction sector is generally low, primarily due to the substantial capital investment required for equipment, bonding, and operational capacity. These high barriers to entry, coupled with established reputations and skilled labor advantages held by firms like Swinerton, make it difficult for newcomers to compete effectively on larger projects. Regulatory complexities also add significant hurdles.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, leveraging industry reports, financial statements, and market research databases. This comprehensive approach ensures a thorough understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.