Swinerton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swinerton Bundle

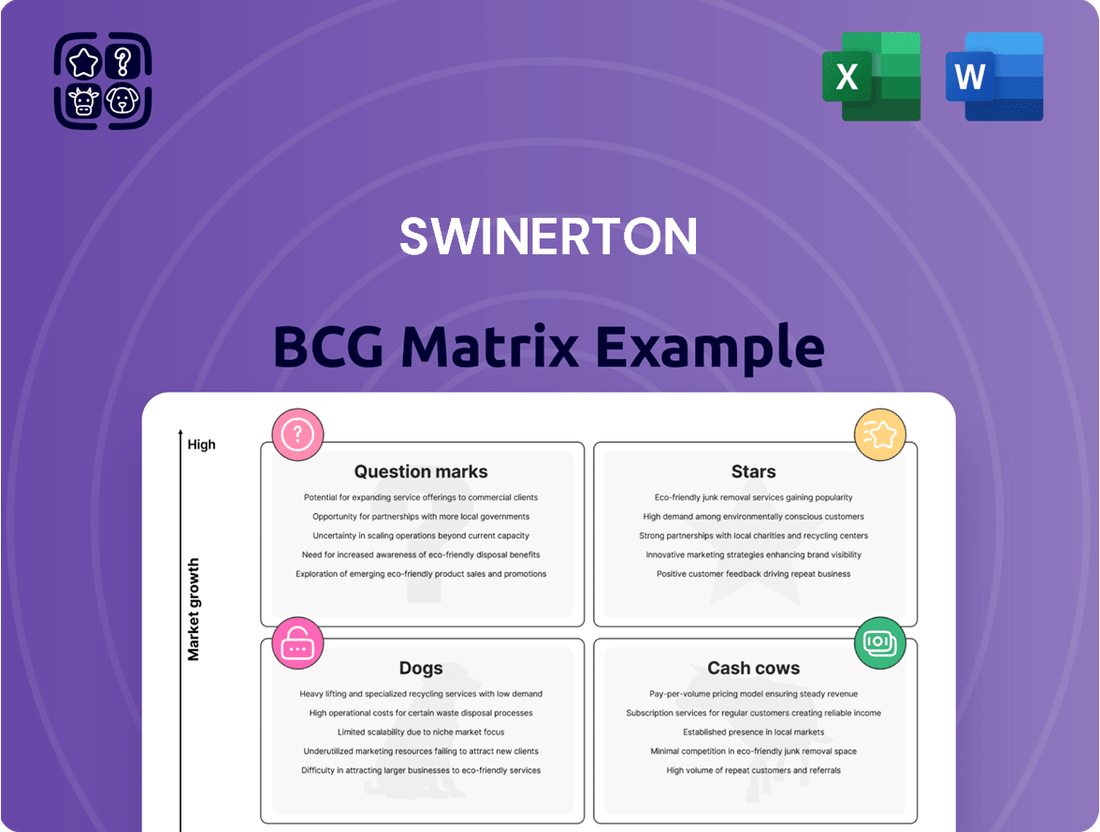

Curious about Swinerton's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas like potential Stars and established Cash Cows, offering a foundational understanding of their market positioning.

However, to truly grasp the nuances of Swinerton's competitive landscape and unlock actionable growth strategies, a deeper dive is essential. Understanding the precise placement of each product within the Stars, Cash Cows, Dogs, and Question Marks quadrants is crucial for informed decision-making.

Imagine having a clear roadmap to optimize resource allocation and identify lucrative investment opportunities. The full Swinerton BCG Matrix provides just that, offering detailed insights and data-backed recommendations tailored to their specific market dynamics.

Don't be left guessing about where Swinerton's future growth lies or which products might be underperforming. Purchase the full BCG Matrix today to gain a comprehensive, strategic advantage and drive your business forward with confidence.

Stars

Swinerton Energy, a vital part of Swinerton, is a major player in the booming renewable energy market, focusing on large-scale solar and renewable natural gas projects. This sector is experiencing substantial growth, and Swinerton's strong presence is evident, having completed 315 projects in 20 states.

This segment is a star in the Swinerton BCG matrix due to its high market growth and Swinerton's significant market share. Their consistent success in securing new projects, like the recent award for a 200 MW solar farm in Nevada, highlights their innovative approach and solidifies their position as a key growth engine for the company.

Swinerton's affiliate, Timberlab, is aggressively pursuing the burgeoning mass timber construction market. This segment is experiencing rapid growth, fueled by increasing demand for sustainable building solutions. Timberlab's efforts position Swinerton to capture significant market share in this innovative and environmentally conscious sector.

Swinerton's commitment is evident through substantial investments, including the acquisition of manufacturing facilities and the development of landmark projects such as 'Workbench' in Austin. These actions underscore a strategic imperative to lead in mass timber, a construction method gaining considerable traction for its environmental benefits and aesthetic appeal. By 2024, the mass timber market was projected to reach over $30 billion globally, highlighting its rapid expansion.

Swinerton's strategic push into East Coast markets, including the Carolinas, Atlanta, and New York Metro, has been a resounding success. These new divisions have demonstrated remarkable revenue growth, with some experiencing an astonishing 16,000% increase. This aggressive geographical diversification highlights a commitment to capturing substantial market share beyond their established California base.

Healthcare Construction

The healthcare construction sector is a strong performer, showing significant growth. Swinerton is investing heavily in this area, expanding its teams, particularly in markets like Atlanta and Charlotte, to capitalize on this demand.

Swinerton's extensive experience, exceeding $5 billion in healthcare construction projects, positions it as a leader. Projections indicate billions in healthcare construction spending from 2024 through 2026, underscoring the sector's robust expansion.

- Market Growth: Healthcare construction is experiencing a substantial upswing in demand.

- Swinerton's Investment: The company is actively growing its healthcare construction team and expertise.

- Geographic Focus: Key expansion areas include Atlanta and Charlotte.

- Experience and Projections: Swinerton boasts over $5 billion in healthcare construction experience, with billions more expected in spending from 2024-2026.

Public and Civic Projects / Public-Private Partnerships

Swinerton's strategic shift towards public and civic projects, including public-private partnerships (PPPs), marks a significant growth opportunity. This pivot is particularly astute given the current challenges and delays often encountered by the private sector.

The company's success in securing contracts for innovative projects like all-electric firehouses and net-zero carbon police stations highlights its expanding footprint. These achievements underscore a growing market share within a sector characterized by stability and consistent expansion.

Key indicators of this trend include:

- Increased government infrastructure spending: By 2024, the U.S. infrastructure market is projected to reach substantial figures, with a significant portion allocated to public works and sustainable development initiatives.

- Growth in PPPs: Public-private partnerships are becoming a more common funding and delivery model for public infrastructure, offering Swinerton a robust pipeline of diverse projects.

- Demand for sustainable construction: The emphasis on net-zero and all-electric facilities aligns with Swinerton's capabilities and the increasing regulatory and societal demand for environmentally conscious building.

- Swinerton's project wins: Securing contracts for public facilities demonstrates a proven ability to navigate the complexities of public sector procurement and deliver specialized, high-value projects.

The mass timber construction sector is a prime example of a Star within Swinerton's BCG matrix. Timberlab's aggressive pursuit of this rapidly growing market, driven by sustainability demands, positions Swinerton for significant share capture. Investments in manufacturing and landmark projects like 'Workbench' underscore this commitment.

By 2024, the global mass timber market was projected to exceed $30 billion, illustrating the substantial growth potential Swinerton is targeting.

| Segment | Market Growth | Swinerton's Share | BCG Category |

| Mass Timber Construction | High (Global market projected >$30B by 2024) | Growing rapidly through Timberlab's strategic investments and project wins. | Star |

What is included in the product

The Swinerton BCG Matrix provides a strategic framework for evaluating a company's business units based on market growth and relative market share.

It offers insights into which units to invest in, hold, or divest for optimal resource allocation.

Swinerton's BCG Matrix provides a clean, distraction-free view optimized for C-level presentation, simplifying complex portfolio analysis.

Cash Cows

Swinerton's traditional commercial general contracting services are firmly positioned as a Cash Cow within the BCG matrix. Established in 1888, this core business operates in a mature market where Swinerton has cultivated a dominant market share. The company's 2024 revenues reached $4.8 billion, complemented by a robust $5.2 billion backlog, underscoring the consistent and substantial cash generation from these established services.

Swinerton's subsidiary, SAK Builders, operates as a self-perform concrete services provider. This capability is crucial, as concrete work is a foundational element in the vast majority of construction projects.

By handling concrete in-house, Swinerton gains significant advantages in efficiency and quality control. This direct management allows for greater certainty over project costs and timelines, contributing to a reliable and consistently profitable revenue stream within the stable construction market.

In 2024, the construction industry continued to see robust demand for concrete services. SAK Builders' self-perform model positions them to capitalize on this, with industry analysts projecting the global concrete market to reach over $1.2 trillion by 2025, reflecting sustained demand for these essential services.

California operations, particularly in established sectors like commercial and industrial construction, represent Swinerton's core cash cow. This segment consistently delivers robust profits due to Swinerton's dominant market position, holding the No. 1 Top Contractor ranking in the state for eight consecutive years. The deep-rooted client relationships and extensive project history in California ensure a stable, high market share.

Multi-family Residential Construction (Established Markets)

Swinerton's extensive history in multi-family residential construction, especially in vibrant markets like metro Atlanta, positions this sector as a significant cash cow. They have a proven ability to deliver large-scale projects, having completed approximately 1,000 units in Atlanta alone, with hundreds more currently in development.

This consistent delivery in a mature, high-demand market segment, characterized by stable demand and predictable revenue streams, solidifies its status as a reliable generator of cash flow for Swinerton. The focus on established urban and suburban areas ensures a strong market position.

- Market Share: High in established multi-family residential markets.

- Growth Rate: Mature, stable growth, not high but consistent.

- Cash Flow Contribution: Significant and reliable positive cash flow.

- Strategic Importance: Core business segment providing foundational stability.

Aviation and Hospitality Construction

Swinerton's significant involvement in aviation and hospitality construction, with over $10 billion in completed projects, firmly places these sectors as Cash Cows within its portfolio. These are established markets where Swinerton has demonstrated deep expertise in managing complex, large-scale developments.

The consistent, substantial contract values in aviation and hospitality, though not characterized by rapid expansion, generate predictable and stable cash flows. This stability is a hallmark of a Cash Cow, providing a reliable foundation for Swinerton's overall financial health.

- Market Dominance: Over $10 billion in aviation and hospitality projects signifies a commanding presence in these sectors.

- Stable Revenue: These mature industries offer consistent, large-scale contracts that drive reliable cash generation.

- Expertise Leverage: Swinerton's established experience allows for efficient project execution and profitability.

- Financial Backbone: The predictable earnings from these sectors support investment in other areas of the business.

Swinerton's traditional commercial general contracting, SAK Builders' self-perform concrete services, and its substantial aviation and hospitality projects are all strong cash cows. These segments operate in mature markets with high market share, generating consistent and significant positive cash flow.

| Business Segment | Market Share | Growth Rate | Cash Flow Contribution | Strategic Importance |

| Commercial General Contracting | High (No. 1 in CA for 8 years) | Mature, Stable | Significant Positive | Core Business, Foundational Stability |

| SAK Builders (Concrete Services) | High (Essential service) | Mature, Stable (Global market >$1.2T by 2025) | Significant Positive | Efficiency, Quality Control, Profitability |

| Aviation & Hospitality | High (>$10B completed projects) | Mature, Stable | Significant Positive | Predictable Earnings, Financial Backbone |

What You See Is What You Get

Swinerton BCG Matrix

The Swinerton BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This strategically designed report, which outlines product portfolio analysis, is ready for immediate integration into your business planning and competitive strategy. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file that will be yours to edit, print, or present without any further modifications.

Dogs

Swinerton, like many forward-thinking construction firms, likely steers clear of niche, outdated methods that offer little in terms of market growth or share. These could include traditional techniques that have been surpassed by more efficient and cost-effective modern practices. For instance, reliance on manual labor for tasks now automated, or the use of materials with inferior performance characteristics compared to current standards, would fall into this category.

Engaging in such outdated methods would typically result in break-even scenarios or even losses, tying up valuable company resources without generating substantial returns. In 2024, the construction industry continues to see a drive towards prefabrication, modular construction, and advanced building information modeling (BIM) technologies, which offer significant advantages in speed, cost, and quality over older approaches. A firm focusing on these modern solutions would naturally deprioritize outdated techniques.

Small-scale, non-strategic renovations, particularly in saturated local markets, represent a challenging segment for a large contractor like Swinerton. In these scenarios, the company’s significant national scale and specialized expertise, which are key competitive advantages, are simply not leveraged effectively. This leads to projects where Swinerton operates on a more level playing field with smaller, local competitors.

The financial realities of these types of projects are often characterized by low profit margins. For instance, in 2024, the average profit margin for small-scale renovation projects in highly competitive local markets often hovered around 5-8%, a stark contrast to the 15-20% or higher seen in larger, more specialized projects. Limited opportunities for market share expansion further diminish their strategic appeal.

These engagements are less desirable because they drain resources without contributing significantly to Swinerton’s overall growth or market dominance. The company’s infrastructure and overhead are not efficiently utilized, making it difficult to achieve economies of scale. Consequently, such projects are typically viewed as necessary evils rather than strategic growth drivers.

Regions where Swinerton has a minimal operational footprint and no current strategic plans for substantial market penetration are classified as Dogs. These areas typically lack a competitive advantage for Swinerton, and without significant investment, projects there would find it difficult to capture market share, especially in slow-growing local economies.

Legacy, Low-Tech Service Offerings

Legacy, low-tech service offerings in construction, such as basic general contracting for smaller, repetitive projects or routine maintenance services, might fall into the dog category for a company like Swinerton, which emphasizes innovation and complex projects. These services often have low profit margins and minimal growth potential, especially as more advanced, tech-enabled solutions become prevalent. For instance, while the overall construction market is projected to grow, segments heavily reliant on manual labor and older methods may see stagnant or declining demand.

These offerings typically lack significant technological integration, making them less attractive to clients seeking cutting-edge solutions. Their commoditized nature means competition is fierce, often based solely on price, which further erodes profitability. Swinerton’s strategic direction, focusing on areas like prefabrication, advanced building technologies, and large-scale, intricate developments, naturally sidelines these less dynamic services.

The market share for such services is likely to be small within Swinerton's broader portfolio, given the company's specialization. In 2024, the construction industry saw a significant push towards digital transformation, with companies investing heavily in BIM, AI, and robotics. Services that don't align with this trend will increasingly struggle to compete.

- Low Differentiation: Traditional services offer little unique value compared to competitors.

- Minimal Growth: Market segments focused on older methods exhibit slow or no expansion.

- Declining Demand: Clients increasingly prefer technologically advanced construction solutions.

- Eroding Margins: Price-based competition in commoditized services limits profitability.

Projects in Stagnant Sub-Markets with High Hurdles

Projects situated in stagnant sub-markets, especially those grappling with substantial barriers to entry or expansion, often fall into the ‘Dogs’ category of the BCG matrix. These environments, characterized by slow or negative growth, make it inherently challenging to generate significant returns. For instance, construction ventures in regions experiencing prolonged economic downturns, perhaps due to the decline of a major local industry, would fit this description.

The persistent difficulties in these markets amplify the dog status. Imagine construction projects facing severe skilled labor shortages, a reality that has been a growing concern in the US construction sector. In 2024, the Associated General Contractors of America reported that a significant percentage of construction firms struggled to find qualified workers, driving up labor costs and delaying projects. Similarly, unresolved supply chain disruptions, which saw material costs fluctuate wildly in recent years, add another layer of complexity, making it tough to forecast budgets and timelines accurately, further hindering profitability.

- Stagnant Market Conditions: Projects in areas with little to no economic growth, leading to reduced demand for new construction.

- High Barriers to Entry/Exit: Significant obstacles like regulatory hurdles or high capital requirements that prevent new competitors or make it difficult to divest existing projects.

- Persistent Operational Challenges: Ongoing issues such as chronic skilled labor deficits, impacting project timelines and costs.

- Supply Chain Volatility: Unpredictable material availability and pricing that erode profit margins and increase project risk.

Swinerton's 'Dogs' likely encompass outdated construction methods, such as those heavily reliant on manual labor for tasks now efficiently automated. These segments offer little market growth or share, and in 2024, the industry's focus on prefabrication and BIM makes such practices increasingly unattractive.

Small-scale renovations in saturated local markets also fall into this category. Swinerton's national scale and specialized expertise are not leveraged effectively here, resulting in low profit margins, often around 5-8% in 2024 for such projects, with limited expansion potential.

Legacy, low-tech services like basic general contracting for smaller, repetitive projects represent another 'Dog'. These have minimal growth potential and low profit margins, especially as tech-enabled solutions gain traction, with demand for manual labor-heavy segments potentially declining.

Projects in stagnant sub-markets with high barriers to entry, such as those in economically depressed regions or facing chronic skilled labor shortages, are also 'Dogs'. In 2024, the US construction sector continued to grapple with these shortages, impacting timelines and costs.

Question Marks

Swinerton is significantly investing in and testing cutting-edge digital tools like AI, Building Information Modeling (BIM), and drone technology to boost their internal operations. These advancements are crucial for enhancing project management, safety, and overall productivity within the construction sector.

While the construction industry's adoption of these technologies is accelerating, Swinerton's primary focus appears to be on leveraging them for internal efficiency rather than developing and selling these technological solutions as standalone products. This positions them as a question mark in the BCG matrix, indicating high potential but uncertain market share in the direct technology development space.

The global construction technology market is projected to reach substantial figures, with some estimates suggesting it could exceed $100 billion by 2027, highlighting the vast growth opportunity in this area. For instance, the BIM market alone was valued at over $7 billion in 2023 and is expected to grow considerably.

Swinerton's strategic investment in these digital tools, even for internal use, suggests a forward-thinking approach. However, their current market share in the commercialization of AI and advanced digital solutions as distinct offerings is likely minimal, placing them in a category that requires further strategic development to capitalize on the high-growth potential.

Swinerton is actively investigating innovative materials beyond mass timber, such as mycelium-based composites and recycled plastic lumber, recognizing their significant growth potential in the green construction sector. These emerging materials, while still in early adoption phases, align with the company's commitment to sustainability and could capture substantial market share as regulations and demand evolve. For instance, the global market for sustainable building materials is projected to reach $467.4 billion by 2028, indicating a fertile ground for these newer alternatives.

The company is also focusing on highly specialized green building certifications, such as the Living Building Challenge or WELL Building Standard, which cater to a niche but growing segment of environmentally conscious clients. While these certifications represent a smaller portion of the overall market compared to LEED, they offer premium value and can command higher project fees, positioning Swinerton in a high-growth, high-margin segment. In 2023, over 2,000 projects globally pursued WELL certification, a testament to the increasing demand for health and wellness in built environments.

Swinerton's Atlanta division is seeing a significant uptick in office-to-multifamily conversions, a key indicator of urban redevelopment's evolving landscape. This niche within adaptive reuse is experiencing robust growth, fueled by shifting tenant needs and the persistent demand for housing in urban centers.

While this segment presents a high-growth opportunity, Swinerton's market share here is likely still developing compared to their established presence in traditional new construction projects. For instance, in 2024, the U.S. saw a substantial increase in office conversions, with projects like the conversion of a vacant downtown office building into apartments in a major city, demonstrating the trend's momentum.

Pilot Programs for Innovative Construction Integration

Swinerton is actively engaging in pilot programs for novel construction technologies, like the Modular Grid Platform (MGP) panels designed for efficient above-ceiling integration within the South Landing energy ecosystem. These initiatives place Swinerton at the forefront of high-potential, emerging sectors.

- Early Adoption: Swinerton's involvement in pilot programs signifies a strategic move to explore and integrate cutting-edge construction methods.

- High Growth Potential: Technologies like MGP panels represent areas with significant future market expansion possibilities in specialized construction niches.

- Low Current Market Share: While an early adopter, Swinerton's current market share within these nascent sub-segments remains minimal, reflecting the exploratory nature of these ventures.

- Innovation Focus: These pilot programs align with a broader strategy to drive innovation and efficiency in construction practices, particularly in areas like integrated energy systems.

New Geographic Market Entries (Initial Phase)

While Swinerton's East Coast operations are a clear Star in their portfolio, the company is likely in the earliest stages of exploring entirely new geographic markets. These are areas with significant future growth potential, but where Swinerton currently holds a negligible market share.

This phase demands substantial investment to gauge market receptiveness and establish a foothold. The goal here is to identify potential future Stars or Cash Cows before competitors dominate these nascent territories.

Considerations for these initial phases include:

- Market Attractiveness: Evaluating macroeconomic factors, construction industry growth rates, and regulatory environments in potential new regions. For instance, looking at projected GDP growth in emerging economies could signal opportunity.

- Competitive Landscape: Understanding the existing players, their market share, and their strategies within these new territories. A fragmented market might offer easier entry than one dominated by established giants.

- Resource Allocation: Determining the necessary capital and human resources for initial market research, business development, and potential pilot projects. This could involve dedicating a specific budget for new market exploration in 2024.

- Risk Assessment: Identifying and quantifying the potential risks associated with entering unfamiliar markets, such as political instability, currency fluctuations, or unforeseen operational challenges.

Swinerton's exploration of advanced digital tools like AI and BIM places them in a "Question Mark" category. While these technologies offer high growth potential in construction, Swinerton's current market share in developing and selling these as standalone products is minimal.

This strategic focus on internal efficiency rather than external productization means they are investing in high-potential areas without yet having established a significant market presence in the technology sector itself. The global construction technology market is substantial, projected to exceed $100 billion by 2027, indicating the vast opportunity Swinerton is exploring.

The company's investment in novel materials and specialized green building certifications also falls into the Question Mark quadrant. These represent high-growth, niche markets with significant future potential, but Swinerton's current market share in these specific segments is still developing. For example, the WELL Building Standard, while niche, saw over 2,000 projects globally pursue certification in 2023.

Swinerton's involvement in pilot programs for new technologies, such as Modular Grid Platform panels, further illustrates their position as a Question Mark. They are early adopters in high-potential emerging sectors, but their market share in these nascent areas is currently low, requiring further development and investment to mature into Stars or Cash Cows.

BCG Matrix Data Sources

Our Swinerton BCG Matrix is informed by robust data, including financial disclosures, project performance metrics, market trend analysis, and industry expert insights to ensure strategic accuracy.