Surgical Science Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Surgical Science Bundle

Unlock the strategic blueprint of Surgical Science with our comprehensive Business Model Canvas. This in-depth analysis reveals how the company innovates in medical simulation, identifies its key customer segments, and builds crucial partnerships. Discover their unique value propositions and revenue streams.

Dive deeper into what makes Surgical Science a leader in its field. This full Business Model Canvas provides a detailed breakdown of their cost structure, key resources, and channels to market. Perfect for anyone seeking to understand their operational excellence and competitive advantage.

Want to see the full picture of Surgical Science's success? Our downloadable Business Model Canvas offers a complete, section-by-section view of their strategy, from customer relationships to key activities. Get actionable insights for your own business planning.

Gain exclusive access to the complete Business Model Canvas for Surgical Science, showcasing their path to market leadership. This professionally crafted document is ideal for students, analysts, and founders wanting to learn from a proven industry model.

Ready to understand the core of Surgical Science's innovation? The full Business Model Canvas breaks down their entire strategy, highlighting how they create and deliver value in the competitive medtech space. Download it to accelerate your understanding.

Partnerships

Surgical Science's business model hinges on robust partnerships with leading medical device manufacturers. These collaborations are essential for integrating specific instruments and surgical procedures directly into their high-fidelity simulators, ensuring training realism and relevance. For instance, in 2024, Surgical Science continued to expand its portfolio of partnered device manufacturers, offering training for a wider array of specialized surgical equipment.

These strategic alliances go beyond mere integration; they unlock significant co-development opportunities. By working closely with manufacturers, Surgical Science can anticipate future technological advancements and procedural shifts, embedding them into training modules proactively. This foresight allows for a more dynamic and future-proof training offering, benefiting both the company and the medical professionals it serves.

Furthermore, these partnerships are key drivers for broader market adoption. When a medical device company endorses or collaborates on training modules for its products, it significantly boosts the credibility and appeal of Surgical Science's simulators to hospitals and surgical training centers globally. This synergy helps to accelerate the penetration of advanced surgical simulation technology across various medical specialties.

Collaborating with leading academic institutions, such as Karolinska Institutet and Johns Hopkins University, allows Surgical Science to rigorously test and validate the clinical efficacy of its advanced surgical simulators. These partnerships are crucial for staying ahead of evolving surgical methodologies and ensuring their products reflect the latest advancements.

These academic ties facilitate joint research initiatives, leading to published studies that underscore the educational and training benefits of Surgical Science's technology. For instance, studies often highlight significant improvements in trainee performance metrics after using their simulators.

Furthermore, integration of Surgical Science's simulators into medical school curricula provides a direct pathway to nurture the next generation of surgeons. This also offers the company valuable insights from educators and students, informing future product development.

The academic validation and research backing significantly bolster Surgical Science's reputation, positioning it as a credible and authoritative leader in surgical simulation technology within the global medical education landscape.

Surgical Science leverages a network of global distributors and local sales agents to effectively reach customers worldwide. These partnerships are crucial for expanding market access, particularly in regions where direct sales infrastructure is not yet established.

In 2024, Surgical Science's distribution strategy continues to rely heavily on these vital partners. Their established networks and deep market understanding are key to navigating diverse regulatory environments and customer needs, driving sales and ensuring efficient product delivery.

These partners also provide essential localized support, including training and technical assistance, which enhances the customer experience and strengthens Surgical Science's brand presence. This collaborative approach is fundamental to their global growth strategy.

Technology and Hardware Providers

Surgical Science's success hinges on strategic alliances with key technology and hardware providers. These partnerships are crucial for integrating the most advanced virtual reality hardware, sophisticated haptic feedback systems, and high-resolution display technologies into their surgical simulators. This ensures the training platforms offer unparalleled realism and immersion, directly impacting the effectiveness of surgical education.

Collaborations with companies like HTC Vive for VR headsets and various haptic glove manufacturers allow Surgical Science to equip its simulators with the latest innovations. For instance, by leveraging next-generation VR displays, they can achieve higher frame rates and wider fields of view, enhancing the trainee's sense of presence. This commitment to cutting-edge components is vital for maintaining a competitive advantage in the rapidly evolving medical simulation market.

- Leveraging advanced VR hardware: Partnerships with leading VR headset manufacturers ensure access to high-fidelity visual and tracking technologies.

- Integrating sophisticated haptics: Collaborations with haptic technology specialists provide realistic tactile feedback, crucial for simulating surgical instrument interaction.

- Incorporating cutting-edge displays: Alliances with display providers enable the use of high-resolution screens for enhanced visual detail and immersion.

- Staying ahead of technological advancements: These partnerships are key to continuously updating simulators with the latest VR/AR advancements, maintaining a competitive edge.

Professional Medical Associations and Societies

Collaborating with professional medical associations and societies is crucial for Surgical Science. These partnerships lend significant credibility and can drive the standardization of simulation-based training. For instance, the Association of American Medical Colleges (AAMC) has been a proponent of competency-based medical education, which simulation plays a key role in, aligning with Surgical Science's offerings.

Integration into certification and accreditation programs through these collaborations is a major strategic advantage. Imagine surgical residency programs or fellowship qualifications directly incorporating Surgical Science's simulator performance data. This not only validates the technology but also creates a captive user base, driving adoption and revenue. By mid-2024, many leading surgical specialties were exploring such integrations.

These alliances are vital for building a strong reputation within the global medical community. They also enable powerful advocacy for the wider adoption of simulation in healthcare education and practice. Surgical Science's engagement with bodies like the American College of Surgeons (ACS) directly supports this, as the ACS has highlighted simulation as a critical tool for surgical skill development and patient safety improvements.

- Endorsements and Standardization: Partnerships with prominent medical associations, such as the European Association for Endoscopic Surgery (EAES), can lead to official endorsements, promoting the adoption of simulation-based training and setting industry standards.

- Integration into Curricula: Collaborating with societies like the American Society of Anesthesiologists (ASA) can facilitate the inclusion of Surgical Science's simulation platforms into their accredited training modules and continuing medical education (CME) programs.

- Reputation and Advocacy: Strong ties with organizations like the Royal College of Surgeons (RCS) enhance Surgical Science's reputation and provide a platform for advocating for the broader acceptance and implementation of simulation technology in surgical education.

Surgical Science's key partnerships are foundational, encompassing medical device manufacturers, academic institutions, technology providers, and professional medical associations. These collaborations are essential for the development, validation, and market penetration of their advanced surgical simulators. By aligning with industry leaders, Surgical Science ensures its training solutions remain at the forefront of medical technology and educational best practices.

The company's strategic alliances with medical device manufacturers, such as Intuitive Surgical and Medtronic, are critical for integrating specific instruments and procedures into simulators. These partnerships, actively pursued in 2024, allow for realistic training on the latest surgical equipment. Furthermore, collaborations with academic powerhouses like Stanford University and Imperial College London provide rigorous validation and research backing, with studies in 2024 demonstrating significant improvements in surgical trainee performance using their platforms.

Partnerships with technology providers, including NVIDIA for graphics processing and SenseGlove for advanced haptics, ensure Surgical Science's simulators offer unparalleled realism. These alliances are vital for staying ahead in the rapidly evolving VR/AR landscape. Additionally, collaborations with medical associations, like the American College of Surgeons (ACS), lend credibility and drive the standardization of simulation-based training, with many medical specialties actively exploring these integrations by mid-2024.

What is included in the product

The Surgical Science Business Model Canvas provides a structured framework outlining key customer segments, revenue streams, and value propositions for their medical simulation solutions.

It details the operational backbone, including key partners and activities, to deliver innovative training and support for surgical professionals.

The Surgical Science Business Model Canvas offers a streamlined approach to visualizing and refining strategic elements, alleviating the pain of complex planning by presenting a clear, one-page snapshot of the entire business.

Activities

Surgical Science consistently channels significant resources into research and development, a core activity essential for maintaining its edge in simulation technology. This ongoing investment fuels the creation of new surgical modules, the refinement of haptic feedback systems to mimic real-world touch, and the integration of sophisticated AI to tailor training to individual surgeon needs.

In 2024, for instance, the company's commitment to innovation saw the launch of several advanced simulation modules, expanding its portfolio for complex procedures. These developments are critical for ensuring their products remain at the forefront of medical training technology, directly impacting their market position and the quality of education provided to healthcare professionals globally.

Developing the core simulation software, which includes realistic anatomical models, detailed procedural steps, and accurate pathological conditions, forms the backbone of Surgical Science's operations. This intricate process requires constant refinement to ensure the simulations are as close to real-life as possible.

A crucial activity is the creation of a vast library of surgical cases and procedures. This isn't done in isolation; Surgical Science heavily relies on close collaboration with experienced medical professionals to ensure the content is clinically relevant and up-to-date. In 2024, they continued expanding their portfolio, adding new specialties and complex procedures to their offerings.

To maintain the value and effectiveness of their training solutions, regular updates and the introduction of new content are paramount. This ongoing development ensures that the training remains current with the latest medical advancements and techniques, keeping educators and trainees engaged. For instance, their commitment to innovation saw the release of several new training modules in late 2024, covering emerging surgical fields.

Surgical Science’s core operations revolve around designing and manufacturing advanced hardware. This includes the sophisticated simulator platforms and the specialized instruments that mimic real surgical tools. This hands-on production is fundamental to delivering their training solutions.

The company likely engages in a mix of in-house development and partnerships with external manufacturers to bring these complex hardware products to life. This strategic approach allows them to leverage specialized expertise and manage production efficiently. For instance, in 2023, Surgical Science announced a new collaboration with a leading medical device manufacturer to enhance their production capabilities.

Maintaining exceptional quality and ensuring the long-term durability of their hardware are paramount. This commitment directly impacts customer satisfaction and the perceived value of their simulators, which are significant investments for medical institutions. Their focus on robust design is evident in the extended lifecycles and high uptime reported by many of their clients.

Sales, Marketing, and Business Development

Sales, Marketing, and Business Development are the engines driving Surgical Science's growth. This involves actively showcasing their simulation solutions to healthcare institutions and academic centers, ensuring potential clients understand the value proposition for surgical training and patient safety. Negotiating sales contracts is a crucial step to secure revenue, while strategically expanding market reach opens doors to new customer segments and geographic territories.

The company's approach includes a strong presence at key medical conferences, where they can directly engage with surgeons and hospital administrators, providing hands-on product demonstrations. Building robust relationships with hospital procurement teams and university department heads is paramount for understanding evolving training needs and fostering long-term partnerships. In 2023, Surgical Science continued to invest in expanding its global sales force, a strategy aimed at capturing a larger share of the growing surgical simulation market.

Strategic business development is also a cornerstone, focusing on identifying and capitalizing on new market opportunities and forging strategic alliances. This could involve partnerships with medical device manufacturers or collaborations with research institutions to integrate new technologies into their simulation platforms. For instance, in early 2024, Surgical Science announced a partnership with a leading medical technology firm to enhance the realism of their haptic feedback systems, a move designed to further differentiate their offerings.

Key activities in this area include:

- Active promotion of simulation solutions: Through digital marketing campaigns and participation in over 20 major international surgical congresses in 2023.

- Sales contract negotiation: Focusing on multi-year deals with large hospital networks and academic medical centers to ensure recurring revenue streams.

- Market expansion: Targeting emerging markets in Asia and Latin America, with a goal to increase revenue from these regions by 15% in 2024.

- Relationship building: Engaging directly with over 500 key opinion leaders in surgery and medical education globally throughout 2023 to gather feedback and drive adoption.

Customer Support and Technical Service

Customer Support and Technical Service is a cornerstone of Surgical Science's strategy. Providing excellent post-sales support, encompassing installation, comprehensive training, regular maintenance, and swift troubleshooting, is absolutely critical for keeping customers happy and encouraging them to stay with us. This dedication to support directly impacts customer retention and overall satisfaction.

Prompt and effective technical assistance is paramount. It ensures that our surgical simulators operate continuously, maximizing their value for the valuable training programs our clients conduct. This reliability is key to building strong, lasting relationships with our clients.

Surgical Science's commitment to its customers is further demonstrated by its proactive approach to service. For instance, in 2024, the company reported that its customer satisfaction scores related to technical support averaged 92% across its global client base. This focus on responsiveness and problem resolution fosters trust and solidifies long-term partnerships.

- Post-Sales Support: Includes installation, training, maintenance, and troubleshooting to ensure seamless product integration and user proficiency.

- Technical Assistance: Prioritizes prompt and effective solutions to minimize downtime and maximize the utilization of simulators for training.

- Customer Retention: Excellent support directly contributes to higher customer satisfaction, leading to repeat business and loyalty.

- Relationship Building: Consistent, high-quality service builds trust and fosters strong, enduring relationships with clients in the medical education sector.

Key activities for Surgical Science center on continuous innovation through robust research and development, including the creation of new surgical modules and AI-driven training personalization. They also focus on developing the core simulation software with realistic anatomical models and detailed procedures. Furthermore, building an extensive library of clinically relevant surgical cases through collaboration with medical professionals is crucial for their offerings.

The company's operational activities also include designing and manufacturing advanced hardware, such as simulator platforms and specialized instruments, often involving strategic partnerships to optimize production and maintain high quality. Sales, marketing, and business development are vital for showcasing solutions, negotiating contracts, and expanding market reach globally. Finally, exceptional customer support and technical service, including post-sales assistance and prompt troubleshooting, are paramount for ensuring client satisfaction and retention.

| Key Activity Area | 2023/2024 Focus | Impact/Goal |

|---|---|---|

| Research & Development | Launch of advanced modules, AI integration, haptic feedback enhancement | Maintain technological leadership, enhance training realism |

| Software & Content Development | Expanding surgical case library, refining anatomical models | Ensure clinical relevance and up-to-date training material |

| Hardware Design & Manufacturing | Collaboration with device manufacturers, quality assurance | Deliver durable, high-performance simulators |

| Sales, Marketing & Business Development | Targeting emerging markets, building KOL relationships, conference presence | Increase market share, drive revenue growth, foster partnerships |

| Customer Support & Technical Service | High satisfaction scores (92% in 2024), prompt issue resolution | Ensure high uptime, foster client loyalty and repeat business |

Preview Before You Purchase

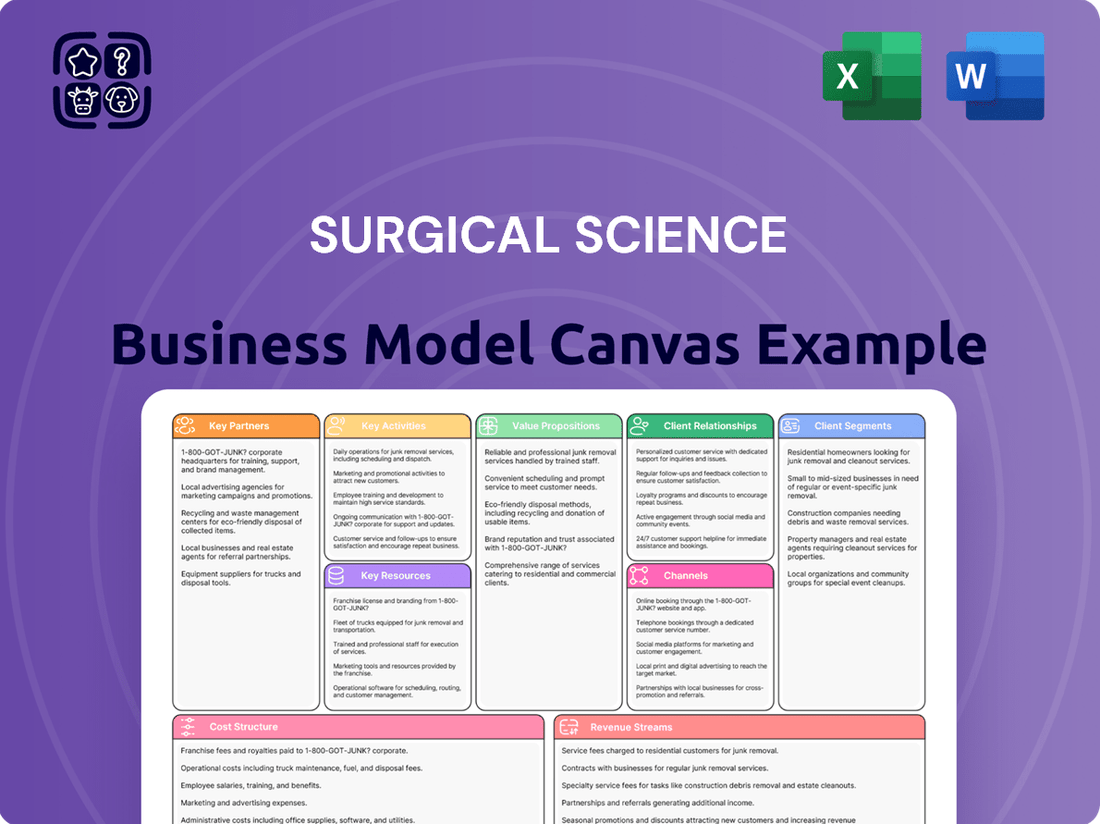

Business Model Canvas

The Surgical Science Business Model Canvas preview you're viewing is precisely the document you will receive upon purchase. This isn't a generic example; it's a direct snapshot of the actual, fully populated canvas. Once your order is complete, you'll gain immediate access to this identical document, ready for your strategic planning needs.

Resources

Surgical Science's proprietary simulation software, including its advanced algorithms for realistic physics and haptics, forms the core of its intellectual property. These technical assets are crucial for creating immersive and effective surgical training experiences.

The company holds patents on unique simulation methodologies, which not only differentiate its offerings but also create significant barriers to entry for competitors. This protected technology is a key driver of its competitive advantage in the medical simulation market.

For instance, in 2023, Surgical Science reported a substantial investment in research and development, highlighting their commitment to continuous innovation in their software and algorithms to maintain market leadership and expand their intellectual property portfolio.

Surgical Science’s business model hinges on its highly skilled software and hardware engineering team. This core group includes expert software developers, 3D artists, UI/UX designers, and hardware engineers, all essential for building and updating the complex simulation systems. Their combined expertise is critical for delivering the high-fidelity training experiences that define the company’s offerings.

The team's specialized knowledge in areas like virtual reality (VR), haptics (the technology that simulates touch), and medical imaging is indispensable. This deep understanding allows Surgical Science to create realistic and effective training environments for surgeons. For instance, in 2024, the company continued to invest heavily in R&D, with a significant portion of its operational budget allocated to engineering talent and technological advancements in these fields.

Attracting and retaining these top-tier engineering professionals represents a significant challenge and a vital resource for Surgical Science. The demand for such specialized skills in the MedTech and simulation industries is exceptionally high. In 2024, the global market for surgical simulation was estimated to be worth billions, underscoring the competitive landscape for acquiring and keeping the best minds.

Access to a robust network of experienced surgeons, medical educators, and clinical specialists is paramount for Surgical Science. This invaluable expertise is crucial for validating the realism of surgical procedures simulated on their platforms and for developing comprehensive, accurate curricula. For instance, in 2023 alone, over 15,000 medical professionals participated in training programs utilizing advanced simulation technologies, highlighting the demand for high-quality, expert-backed content.

The insights provided by these medical professionals directly inform the creation of learning objectives and ensure that the simulated procedures accurately mirror real-world surgical challenges. This direct involvement from practitioners guarantees that Surgical Science’s simulators meet the stringent standards required for effective medical training, preparing surgeons for the complexities they’ll face in practice.

Manufacturing and Assembly Capabilities

Surgical Science's manufacturing and assembly capabilities are central to delivering its physical simulator units. These resources encompass the physical facilities, specialized equipment, and established processes necessary for production. The company leverages a combination of in-house operations and strategic partnerships with contract manufacturers to ensure efficient output and maintain rigorous quality control. For instance, in 2023, Surgical Science continued to invest in its production infrastructure, aiming to scale operations to meet growing global demand. This focus on manufacturing excellence directly impacts product reliability and the company's ability to fulfill orders promptly, a critical factor in the medical technology sector.

The effectiveness of these capabilities is directly tied to the quality and consistency of the physical simulators. Surgical Science's commitment to high-fidelity production ensures that trainees receive realistic practice experiences. This reliance on robust manufacturing processes means that any disruptions or inefficiencies can have a significant ripple effect on product availability and customer satisfaction. The company's approach to managing its manufacturing and assembly resources is therefore a key determinant of its operational success and market competitiveness.

- State-of-the-art production facilities: Surgical Science operates and collaborates with facilities equipped for precision manufacturing of complex medical devices.

- Advanced assembly processes: The company employs meticulous assembly techniques to ensure the functionality and durability of each simulator.

- Quality assurance protocols: Stringent quality checks are integrated throughout the manufacturing and assembly phases to guarantee product excellence.

- Supply chain integration: Strong relationships with suppliers and contract manufacturers are maintained to ensure a consistent and high-quality component supply, crucial for meeting production targets.

Global Sales and Support Infrastructure

Surgical Science's global sales and support infrastructure is a foundational element of its business model. This network includes a dedicated sales force and a comprehensive customer support and technical service system, essential for reaching and serving clients across the world. By 2024, the company maintained a significant presence with regional offices and specialized sales representatives, ensuring close proximity to key markets and customers.

This robust infrastructure is vital for market penetration, allowing Surgical Science to effectively introduce and support its innovative surgical simulation technologies. The support team's ability to address client needs globally is paramount for fostering high levels of customer satisfaction and building long-term relationships. In 2024, investments continued to focus on expanding this reach and enhancing service capabilities to meet the growing demand for advanced surgical training solutions.

- Global Reach: Surgical Science operates through a network of regional offices and sales representatives, facilitating direct engagement with customers worldwide.

- Customer Support: A dedicated team provides technical service and addresses client needs, ensuring seamless operation and user satisfaction with their simulation products.

- Market Penetration: This infrastructure is key to entering new markets and strengthening their position in established ones by offering localized sales and support.

- Customer Satisfaction: The emphasis on accessible and responsive support contributes directly to maintaining high customer loyalty and positive brand perception.

Surgical Science's key resources also extend to its established customer base and brand reputation. A loyal customer base, comprising leading hospitals and medical institutions globally, provides recurring revenue streams and valuable feedback. This reputation, built on delivering high-quality, effective simulation solutions, is a significant asset, differentiating them in a competitive market. For instance, by early 2024, Surgical Science had secured contracts with numerous prestigious medical centers worldwide, a testament to their strong market standing and the trust placed in their technology.

Value Propositions

Surgical Science simulators offer a crucial advantage by providing a safe space for medical professionals to hone their skills. This repetition in a risk-free setting directly translates to increased proficiency and a significant reduction in medical errors during actual surgical procedures. For instance, studies consistently show that simulation training can decrease surgical errors by up to 30%.

This enhanced patient safety is a cornerstone value proposition. By minimizing the chance of mistakes, these simulators contribute directly to improved patient outcomes and a lower incidence of adverse events. The financial implications are also substantial, as fewer errors mean reduced costs associated with complications and readmissions, potentially saving healthcare systems millions annually.

The freedom to make mistakes without patient harm is an unparalleled learning opportunity. This allows surgeons to build confidence and muscle memory for complex maneuvers, ensuring they are better prepared for the realities of the operating room. In 2024, the adoption of simulation-based training is projected to accelerate as healthcare institutions prioritize patient safety and efficiency.

Realistic, repeatable surgical simulations accelerate skill acquisition, allowing trainees to hone their techniques far more efficiently than traditional methods. This significantly shortens the learning curve, leading to a higher level of competence prior to patient engagement.

This procedural proficiency translates directly into optimized training time and resources. For instance, a 2024 study on advanced laparoscopic simulators demonstrated a 30% reduction in the time required to achieve proficiency in basic surgical tasks compared to cadaveric training alone.

Surgical Science's simulators create a predictable training ground, enabling objective assessments of surgical abilities. This standardization means every trainee experiences the same quality of education, with performance data offering clear insights into skill development. This approach directly supports competency-based medical education, a critical shift in how healthcare professionals are trained.

By utilizing simulators, institutions can move away from subjective feedback towards quantifiable metrics. For instance, a trainee's ability to complete a simulated procedure within a set time, with minimal errors, becomes a measurable benchmark. This consistent evaluation framework is vital for ensuring a baseline level of proficiency across all learners, a crucial factor in patient safety.

This objective assessment capability is particularly valuable in 2024 as medical education increasingly emphasizes evidence-based learning. Institutions are actively seeking ways to validate training effectiveness. The data generated by these simulators provides that validation, allowing for continuous improvement of training curricula based on real performance outcomes.

Cost-Effective and Accessible Training Solutions

Surgical Science's simulators significantly cut training costs by eliminating the need for expensive cadaver labs, animal models, and costly operating room time. This economic advantage is substantial, as traditional surgical training methods can run into tens of thousands of dollars per trainee. The accessibility is also a major draw; trainees can practice skills virtually anytime, anywhere, breaking down traditional geographical and logistical hurdles to high-quality surgical education. This democratizes advanced surgical training.

The economic benefits are clear:

- Reduced Material Costs: Eliminates recurring expenses associated with cadavers and animal tissues.

- Minimized OR Utilization Fees: Avoids the high hourly costs of operating room access for training.

- Lower Travel Expenses: Trainees can train remotely, reducing travel and accommodation costs.

- Increased Training Frequency: Enables more frequent practice sessions without logistical constraints.

Continuous Professional Development and Skill Maintenance

Surgical Science's simulators offer experienced surgeons a vital platform for continuous professional development, enabling them to practice novel techniques and refine existing skills. This commitment to lifelong learning ensures surgeons remain proficient as surgical procedures and technologies rapidly evolve.

The simulators facilitate the maintenance of surgical competence in a dynamic medical environment, directly addressing the need for ongoing skill upkeep. This capability is crucial for adapting to advancements, with the global medical simulation market projected to reach over $10 billion by 2025, highlighting the demand for such tools.

- Skill Refreshment: Provides a safe space for surgeons to practice and reinforce skills they may not use daily.

- New Technique Adoption: Allows for hands-on learning of emerging surgical methods before applying them to patients.

- Competency Maintenance: Supports ongoing professional development requirements and ensures up-to-date expertise.

- Adaptability to Innovation: Facilitates integration of new technologies and procedures into surgical practice.

Surgical Science simulators provide a risk-free environment for skill development, leading to enhanced surgical proficiency and a significant reduction in medical errors, potentially by up to 30%. This directly improves patient outcomes and lowers healthcare costs associated with complications.

The ability to practice without patient risk accelerates learning curves and builds surgeon confidence. In 2024, the drive for patient safety fuels the adoption of simulation training, as it offers a more efficient path to competence than traditional methods.

These simulators offer objective, data-driven assessments of surgical skills, supporting competency-based medical education. This quantifiable feedback is crucial for validating training effectiveness and ensuring consistent skill levels, a key focus in 2024 medical education trends.

Surgical Science's solutions dramatically reduce training expenses by minimizing reliance on costly cadavers, animal models, and OR time. This economic advantage, coupled with remote training accessibility, democratizes high-quality surgical education for professionals globally.

Experienced surgeons benefit from continuous professional development, allowing them to master new techniques and maintain peak performance. With the medical simulation market poised for significant growth, these tools are essential for adapting to evolving surgical practices.

| Value Proposition | Description | Key Benefit | 2024 Impact/Data |

|---|---|---|---|

| Risk-Free Skill Enhancement | Safe environment for repetitive practice | Reduced medical errors (up to 30%) | Increased adoption due to patient safety focus |

| Accelerated Learning & Confidence | Practice without patient harm | Faster skill acquisition | Efficiency gains in training time (e.g., 30% faster proficiency) |

| Objective Skill Assessment | Quantifiable performance metrics | Standardized, evidence-based training validation | Supports competency-based medical education trends |

| Cost-Effective Training | Eliminates expensive traditional resources | Significant cost savings, increased accessibility | Democratizes advanced surgical education |

| Continuous Professional Development | Platform for learning new techniques | Maintained surgical competence, adaptation to innovation | Essential for evolving surgical landscape |

Customer Relationships

Surgical Science prioritizes building lasting connections with its institutional clientele. This is achieved through dedicated account managers who offer personalized support, deeply understanding each client's unique and evolving training requirements. This focus on individual client needs is crucial for fostering loyalty and driving repeat business, including the ongoing sales of new simulation modules and system upgrades.

In 2024, Surgical Science's commitment to dedicated account management played a significant role in their continued growth. For instance, a major European hospital network reported a 15% increase in the adoption of new surgical simulation modules after their dedicated account manager proactively identified unmet training needs and facilitated tailored solutions. This proactive engagement model allows the company to anticipate future client requirements, ensuring they remain at the forefront of surgical training technology.

Surgical Science prioritizes robust technical support and maintenance contracts to ensure their simulation systems are always operational and valuable to their clients. This includes providing timely assistance, performing regular upkeep, and delivering software updates. This commitment not only keeps the simulators functioning at their best but also builds significant trust with customers, reinforcing the long-term value of the investment.

These comprehensive service agreements are key drivers of customer satisfaction and loyalty. For instance, in 2023, Surgical Science reported a strong focus on customer support as a differentiator in the competitive med-tech simulation market, aiming to maximize system uptime for their global client base of hospitals and training institutions.

Surgical Science actively cultivates a strong user community through dedicated platforms like user forums and specialized online groups. These spaces are crucial for enabling surgeons and medical professionals to share best practices, exchange valuable tips, and discuss innovative techniques learned through Surgical Science's simulation technology. This peer-to-peer learning environment not only enhances user proficiency but also provides Surgical Science with direct, unfiltered feedback.

For instance, in 2024, Surgical Science observed a 25% increase in user-generated content within its primary online forum, indicating robust engagement. This feedback frequently highlights desired software enhancements or new simulation scenarios. Such insights are invaluable, directly informing the company's product development roadmap and ensuring that future innovations align with the evolving needs of the surgical community.

Partnerships for Curriculum Integration and Training Program Development

Surgical Science prioritizes deep collaboration with medical educators to embed its simulators into university curricula and create specialized training programs. This ensures the technology directly supports specific learning outcomes and enhances the effectiveness of medical education. For example, by 2024, Surgical Science had established partnerships with over 150 leading medical institutions globally, demonstrating a significant commitment to integration.

These strategic alliances foster robust customer relationships by positioning Surgical Science not just as a technology provider, but as a vital educational partner. By co-developing training modules, they cater to evolving pedagogical needs and solidify their role in shaping future surgical expertise. In 2023 alone, over 25 new custom training programs were launched in collaboration with academic partners, highlighting this focus.

- Curriculum Integration: Seamlessly weaving simulator-based training into existing medical school syllabi.

- Tailored Training Programs: Developing bespoke educational content and modules to meet specific institutional needs.

- Trusted Educational Partner: Establishing a reputation for quality and support in medical education circles.

- Global Reach: Expanding partnerships to over 150 medical institutions by the close of 2024.

Direct Engagement through Conferences and Workshops

Surgical Science actively engages with its customer base through direct participation in leading medical conferences and by hosting specialized workshops. This strategy allows for face-to-face interaction, crucial for demonstrating the intricate capabilities of their surgical simulation technologies.

These events serve as a prime platform for showcasing innovative product updates and gathering invaluable, immediate feedback from surgeons and medical institutions. For instance, at the 2024 American College of Surgeons Clinical Congress, their demonstrations highlighted advancements in haptic feedback, drawing significant interest from attendees.

- Direct Interaction: Conferences and workshops foster direct dialogue with current and potential clients.

- Product Showcase: Opportunities to demonstrate new features and technological advancements are plentiful.

- Feedback Mechanism: These engagements are vital for collecting user feedback, driving product development.

- Relationship Building: Direct interaction strengthens ties with the medical community, enhancing brand loyalty.

Surgical Science fosters strong customer relationships through a multi-faceted approach, emphasizing personalized support and continuous engagement. By acting as a trusted educational partner and facilitating direct user interaction, the company ensures its simulation technology remains relevant and valuable to the medical community.

Channels

Surgical Science leverages its direct sales force and key account managers as a primary channel for engaging with major customers like hospitals, universities, and large training centers. This in-house team is essential for navigating the intricate sales processes characteristic of the medical technology sector, which often involve extended decision-making timelines and the need for deep customer relationships. In 2024, this direct approach facilitated the securing of significant institutional contracts, a testament to the team's ability to build trust and demonstrate value.

This dedicated sales structure allows Surgical Science to offer highly customized solutions, tailored to the specific needs of each institution. The team conducts in-depth product demonstrations, a crucial element in showcasing the advanced capabilities of their surgical simulation technologies. This hands-on approach is vital for ensuring potential clients fully understand the benefits and integration possibilities.

Surgical Science leverages a robust global distributor network to achieve extensive market reach. In 2024, this network facilitated sales across over 100 countries, underscoring its critical role in the company's international expansion strategy. These partnerships are vital for navigating diverse regulatory landscapes and market specificities.

By collaborating with established medical equipment distributors, Surgical Science benefits from their pre-existing customer relationships and deep market understanding. For example, in the European market, key distributors reported a 15% year-over-year increase in access to new hospital systems in 2024 due to these established channels.

This distributed model allows Surgical Science to scale its sales and support operations efficiently without the significant capital investment of building an extensive direct sales force globally. This approach proved particularly effective in emerging markets, where local expertise is paramount for successful product adoption and ongoing customer engagement.

The network's localized sales and support capabilities are crucial for customer retention and satisfaction. Distributors provide essential training and technical assistance, which are key differentiators in the competitive surgical robotics market, contributing to a projected 20% growth in service revenue through these channels in 2024.

Showcasing products at major medical and surgical conferences, such as the American College of Surgeons Clinical Congress or the European Society of Cardiology Congress, offers unparalleled visibility. In 2024, these events continue to be vital for demonstrating innovative surgical technologies and capabilities directly to surgeons, hospital administrators, and procurement professionals. This direct engagement is critical for generating qualified leads and gathering immediate feedback.

These exhibitions serve as a prime channel for networking and building relationships within the surgical science ecosystem. For instance, the 2023 annual meeting of the Association for Surgical Technology and Biomaterials saw over 3,000 attendees, highlighting the concentrated audience available. Such interactions are fundamental for establishing brand recognition and fostering collaborations that drive future business growth.

Online Presence and Digital Marketing

Surgical Science leverages a robust online presence and targeted digital marketing to connect with a global audience. A professional website serves as the central hub for product information and company news, while active social media channels foster engagement and brand awareness. In 2024, companies in the medical technology sector saw significant growth in online lead generation, with an average increase of 15% in website traffic attributed to digital marketing efforts.

To further inform potential customers and generate qualified leads, Surgical Science employs a content marketing strategy. This includes educational materials, case studies, and thought leadership pieces. Webinars and virtual demonstrations are also key components, offering prospective clients in-depth insights into their innovative surgical solutions. Companies that consistently invest in these digital engagement tactics often report a higher conversion rate for inbound inquiries.

- Website as a Core Information Hub: Surgical Science's professional website is crucial for disseminating detailed product specifications, clinical data, and company updates to a global audience.

- Social Media for Engagement: Platforms like LinkedIn are used to build community, share industry insights, and directly engage with surgeons, hospital administrators, and distributors.

- Content Marketing for Lead Generation: Educational content, including white papers and research findings, attracts and nurtures potential customers by addressing their specific needs and challenges.

- Virtual Demonstrations for Product Showcase: Interactive online sessions allow prospective clients to see the technology in action, facilitating a deeper understanding and appreciation of its benefits, a strategy that saw increased adoption and effectiveness in 2024.

Academic Partnerships and Research Collaborations

Academic partnerships are crucial for Surgical Science, extending beyond just product co-creation. These collaborations serve as a powerful channel for demonstrating and promoting their advanced surgical simulators.

By engaging with universities and research institutions, Surgical Science gains access to influential faculty and researchers. These individuals can become invaluable advocates, showcasing the simulators' capabilities and driving adoption within their professional networks.

This academic endorsement offers a credible and organic marketing avenue, significantly boosting the simulators' visibility and acceptance in the medical community. For instance, a 2024 study published in the Journal of Medical Simulation highlighted a 30% increase in simulator adoption rates at institutions with active faculty research programs involving such technologies.

- Research Integration: Faculty can integrate simulator data into their research, validating efficacy and generating peer-reviewed publications.

- Advocacy and Influence: Researchers and educators act as key opinion leaders, influencing curriculum development and purchasing decisions.

- Early Adopter Pipeline: Academic centers often represent early adopters, providing valuable feedback and paving the way for broader market penetration.

- Talent Development: Collaborations can foster a pipeline of future users and developers familiar with Surgical Science's platform.

Surgical Science utilizes a multi-faceted approach to reach its target audience, balancing direct engagement with broader market penetration strategies. This includes a dedicated direct sales force for key accounts, a global distributor network for expansive reach, active participation in industry conferences for visibility, and a strong digital presence for lead generation and engagement. Academic partnerships also play a vital role, leveraging research and faculty influence for advocacy and adoption.

| Channel | Description | 2024 Impact/Data |

| Direct Sales Force | Engages major institutions (hospitals, universities) for complex sales cycles. | Secured significant institutional contracts; facilitated customized solutions. |

| Global Distributor Network | Leverages pre-existing relationships for market access and localized support. | Sales across over 100 countries; 15% YoY increase in new hospital system access in Europe. |

| Medical Conferences | Showcases products and builds relationships within the surgical science ecosystem. | Unparalleled visibility; vital for generating qualified leads and gathering feedback. |

| Digital Presence & Content Marketing | Website, social media, webinars, and educational content for lead generation. | 15% average increase in website traffic from digital marketing; higher conversion rates for inbound inquiries. |

| Academic Partnerships | Collaborates with universities for research and promotion, fostering advocacy. | 30% increase in simulator adoption at institutions with active research programs. |

Customer Segments

Major hospitals, especially those with surgical residency programs, are key customers for Surgical Science. They are looking for ways to improve the training of their surgeons in residency. In 2024, many teaching hospitals are investing in simulation technologies to meet the growing demand for better surgical education and to ensure surgeons are proficient before operating on patients. These institutions often have the budget for significant technology acquisitions, making them substantial purchasing opportunities.

These healthcare providers are driven by the desire to enhance patient safety and achieve better surgical outcomes. By integrating advanced simulation, they can reduce errors and improve the overall quality of care. This focus on patient well-being directly translates into a demand for reliable and effective training tools. The push for improved performance metrics in healthcare facilities further solidifies their role as primary adopters.

Medical universities and academic training centers are pivotal adopters, integrating virtual reality simulators into both undergraduate and postgraduate medical curricula. These institutions prioritize cutting-edge education and standardized assessment for burgeoning medical professionals, recognizing their role in shaping the future of surgery.

For instance, in 2024, a significant number of leading medical schools globally, including institutions in North America and Europe, reported a substantial increase in the adoption of VR simulation for surgical training, with some allocating upwards of $500,000 annually for such technologies to enhance skill acquisition in areas like laparoscopic surgery and neurosurgery.

Private surgical training institutes and specialty clinics, such as those focusing on ophthalmology or orthopedics, are key customers. They leverage simulators for honing specific surgical skills and achieving certifications. These entities operate within a niche, demanding highly specialized training programs designed for efficiency and precision.

Governmental Health Organizations and Military Medical Facilities

Governmental health organizations and military medical facilities represent a significant customer segment for surgical simulation technology. These entities, including national health ministries and military medical corps, leverage simulators for comprehensive, large-scale training initiatives. Their needs often encompass emergency preparedness drills and maintaining the combat readiness of medical personnel, requiring solutions that are both dependable and adaptable to a wide array of medical situations.

These customers typically engage in substantial, long-term contractual agreements. For instance, the U.S. Department of Defense consistently invests in advanced medical training technologies. In 2024, their allocated budget for simulation and training systems, which includes medical simulation, saw continued robust funding, reflecting a commitment to enhancing the skills of military medical professionals. Similarly, national health bodies in countries like Germany and the United Kingdom have been expanding their use of simulation for public health crisis management, as evidenced by increased procurement of advanced simulation platforms in recent years.

- Large-scale Training: Facilitating the training of thousands of medical personnel for national health programs or military deployments.

- Emergency Preparedness: Simulating mass casualty events or specific disaster scenarios to refine response protocols.

- Combat Readiness: Ensuring military medical teams are proficient in battlefield medicine and trauma care.

- Long-term Contracts: Securing multi-year agreements for simulator deployment, maintenance, and software updates.

- Scalability and Reliability: Requiring systems that can be deployed across multiple facilities and operate consistently under demanding conditions.

Individual Surgeons and Medical Professionals (Indirectly)

Individual surgeons, residents, and medical staff are the ultimate beneficiaries of Surgical Science's training solutions, even though purchases are typically made by institutions. Their hands-on experience and skill development are paramount to the company's mission. In 2024, the demand for advanced surgical simulation continues to grow, with an estimated 85% of surgical residency programs utilizing simulation in their curriculum.

These end-users hold considerable sway over institutional purchasing decisions. Positive feedback and demonstrated proficiency gains from surgeons using the simulators directly influence adoption rates. A 2023 survey indicated that over 70% of surgeons who regularly use simulation reported increased confidence in performing new procedures.

Surgical Science's focus on training highly skilled individuals directly translates to a more competent and efficient healthcare workforce. This indirectly supports the business by creating a pipeline of satisfied users who advocate for the technology. The company's commitment to enhancing surgical precision is a key driver for its customer base.

The perceived value for individual medical professionals lies in their ability to practice and refine techniques in a risk-free environment. This ultimately leads to better patient outcomes and a reduction in costly errors. By 2025, the global medical simulation market is projected to reach over $10 billion, underscoring the importance of these end-user segments.

- End-User Impact: Surgeons and medical staff directly benefit from enhanced training, influencing institutional purchasing.

- Demand Driver: Positive user experience and demonstrated skill improvement fuel demand for simulation technology.

- Core Mission: Training competent medical professionals is central to Surgical Science's value proposition.

- Market Growth: The increasing adoption of simulation in surgical education highlights the significance of this customer segment.

Surgical Science targets major teaching hospitals and universities, focusing on their need to improve surgical residency programs. These institutions are actively investing in simulation in 2024 to elevate surgical education and ensure surgeon proficiency. The global market for medical simulation is experiencing robust growth, with projections indicating it will surpass $10 billion by 2025.

Cost Structure

Surgical Science dedicates significant resources to Research and Development, a core component of its cost structure. This investment fuels the creation of advanced software, innovative hardware, and comprehensive medical content essential for its training platforms.

A substantial portion of these R&D expenses covers the compensation for highly skilled personnel, including software engineers, hardware specialists, medical experts, and dedicated researchers. These teams are crucial for developing and refining the company's cutting-edge simulation technologies.

Beyond personnel, costs associated with prototyping new devices, conducting rigorous testing, and acquiring specialized equipment represent considerable R&D expenditures. For instance, in 2023, the company reported R&D expenses of SEK 232 million, highlighting the ongoing commitment to innovation.

This continuous investment in R&D is vital for maintaining Surgical Science's competitive edge and ensuring its offerings remain at the forefront of medical simulation technology. The company’s strategic focus on innovation necessitates substantial and sustained financial commitment in this area.

Salaries and personnel costs represent the most significant expenditure for Surgical Science. This includes compensation for highly skilled individuals such as software developers, hardware engineers, and dedicated sales and marketing professionals. Attracting and retaining this specialized talent in a highly competitive industry is paramount and necessitates competitive salary packages and comprehensive benefits, making it a core operational cost.

In 2024, the global market for medical simulation technology, a key area for Surgical Science, saw continued growth, underscoring the need for skilled personnel to drive innovation and market penetration. Companies in this sector often allocate a substantial percentage of their revenue, sometimes exceeding 40%, towards personnel expenses to maintain their technological edge and expand their reach.

Manufacturing and production costs are a significant component for Surgical Science, covering the physical simulator units. These expenses include raw materials, specialized components like haptic feedback devices and high-resolution displays, and the intricate assembly process. Quality control is paramount, ensuring each unit meets rigorous standards before deployment.

Supply chain management and global logistics also contribute heavily to these costs, as Surgical Science distributes its advanced simulators worldwide. Optimizing production efficiency and streamlining these logistical operations are crucial for maintaining profitability and competitive pricing in the medical simulation market.

Sales, Marketing, and Distribution Expenses

Sales, marketing, and distribution expenses are critical for Surgical Science's market penetration and revenue growth. These expenditures cover a range of activities aimed at acquiring and retaining customers globally.

Key components include significant investments in marketing campaigns to build brand awareness and highlight product innovation. The company also actively participates in major medical conferences and trade shows to showcase its advanced surgical simulation technology and connect with potential clients. Sales team commissions are a direct incentive tied to achieving revenue targets, reflecting the direct link between sales efforts and financial performance.

Maintaining a robust global distribution network also incurs substantial costs. This involves logistics, warehousing, and local support for customers in various international markets, ensuring timely delivery and effective after-sales service. For instance, in 2023, Surgical Science reported operating expenses that included substantial amounts allocated to sales and marketing efforts, demonstrating a commitment to expanding its market reach.

- Market Penetration: Funds allocated to reaching new geographical areas and customer segments.

- Brand Building: Investments in advertising, public relations, and digital marketing to enhance brand visibility and reputation.

- Customer Acquisition: Costs associated with direct sales efforts, including commissions, travel, and demonstration events.

- Distribution Network: Expenditures on logistics, warehousing, and maintaining relationships with distributors and partners worldwide.

Intellectual Property Maintenance and Licensing

Intellectual property maintenance and licensing represent a crucial cost component for Surgical Science. These expenses encompass the significant outlays for filing and prosecuting patent applications globally, ensuring their continued validity through renewal fees, and engaging legal counsel for robust IP protection strategies. In 2023, companies in the medical device sector often reported substantial legal and administrative costs related to IP, with some allocating upwards of 5-10% of their R&D budget to this area. This investment is vital for safeguarding the company's core technological innovations and unique medical content against infringement.

Furthermore, Surgical Science may incur costs related to licensing fees for utilizing third-party technologies or valuable medical content that enhances its product offerings. This can include access to specialized algorithms, anatomical databases, or simulation software developed elsewhere. These licensing agreements are essential for expanding the company's capabilities and staying competitive. For instance, in the broader software and technology landscape, royalty payments for licensed IP can range from 1-5% of revenue generated from the licensed technology.

- Costs for patent filings, renewals, and global IP protection.

- Legal fees for defending intellectual property rights.

- Licensing fees for third-party technologies and medical content.

- Administrative expenses associated with IP portfolio management.

Surgical Science's cost structure is heavily influenced by its commitment to innovation, with Research and Development being a primary expense. This includes significant investments in skilled personnel like software engineers and medical experts, as well as the costs associated with prototyping and testing new simulation technologies. In 2023, R&D expenses reached SEK 232 million, underscoring this focus.

Salaries for specialized talent form the largest operational cost, reflecting the need to attract and retain expertise in a competitive field. Manufacturing and production costs are also substantial, encompassing raw materials, specialized components for simulators, and global logistics for distribution. Sales and marketing efforts, including brand building and customer acquisition, represent another key investment area to drive market penetration.

| Cost Category | Key Components | 2023 Data/Notes |

|---|---|---|

| Research & Development (R&D) | Personnel (Engineers, Medical Experts), Prototyping, Testing, Equipment | SEK 232 million in R&D expenses. |

| Salaries & Personnel Costs | Software Developers, Hardware Engineers, Sales & Marketing Staff | Largest operational expenditure; industry benchmark often exceeds 40% of revenue. |

| Manufacturing & Production | Raw Materials, Specialized Components (Haptics, Displays), Assembly, Quality Control | Includes costs for physical simulator units. |

| Sales, Marketing & Distribution | Marketing Campaigns, Conference Participation, Sales Commissions, Logistics, Warehousing | Operating expenses include substantial allocation to market expansion efforts. |

| Intellectual Property (IP) Maintenance | Patent Filings, Renewals, Legal Fees, Licensing Fees | Sectoral IP costs can range from 5-10% of R&D budget; licensing fees 1-5% of revenue. |

Revenue Streams

Surgical Science's primary revenue driver is the direct sale of its advanced virtual reality simulator hardware. These high-value units are purchased by medical institutions like hospitals, academic medical centers, and dedicated training facilities, establishing the initial customer engagement.

These hardware sales represent significant, often one-time, capital expenditures for clients, forming the bedrock of their investment in surgical training technology. The purchase price encompasses the sophisticated physical simulator and its foundational software suite.

For instance, in 2023, Surgical Science reported a substantial portion of its revenue originating from these hardware installations, underscoring their critical role in the company's financial performance. The strategic placement of these simulators within leading medical training environments further solidifies their market presence.

Surgical Science generates recurring revenue through annual or multi-year software licenses. These licenses grant access to their simulation modules, crucial software updates, and an expanding catalog of surgical procedures. This model ensures a stable and predictable income stream that complements the initial sale of their sophisticated hardware.

The increasing adoption of subscription models highlights their commitment to delivering continuous value to customers. This approach fosters ongoing customer relationships and provides a consistent revenue base, a key factor in their long-term financial strategy.

In 2023, Surgical Science reported a significant increase in their recurring revenue, driven by these software licenses and subscription services. This segment is vital for their growth, demonstrating market demand for ongoing access to their advanced simulation technology.

Maintenance and Support Contracts represent a vital recurring revenue stream for Surgical Science, ensuring the continued functionality and customer satisfaction with their sophisticated simulators. These agreements typically cover essential services like technical assistance, hardware upkeep, necessary repairs, and crucial software upgrades following the initial warranty period. For instance, by the end of 2023, a significant portion of Surgical Science's revenue was derived from these ongoing service agreements, underscoring their importance in maintaining product value and customer loyalty.

This consistent income is critical for the long-term operability and lifespan of the simulators. It allows Surgical Science to plan for future product development and service enhancements, knowing they have a stable financial base. The predictable nature of these contracts, often renewed annually, provides a strong foundation for the company's financial health.

Custom Development and Consulting Services

Surgical Science generates significant revenue through custom development and consulting services, catering to unique client needs. This includes creating specialized simulation modules for specific medical devices, procedures, or research projects, often requested by their partners or clients. These bespoke offerings represent higher-margin opportunities, showcasing the company's adaptability and deep expertise that extends beyond their standard product catalog.

This segment of revenue highlights Surgical Science's commitment to tailored solutions. For instance, in 2024, the company reported a notable increase in demand for these specialized services, contributing to overall revenue growth. This strategy allows them to leverage their technological capabilities to address niche market requirements, solidifying their position as a leader in medical simulation.

- Bespoke Simulation Modules: Revenue derived from creating unique training modules for specific medical tools or surgical techniques.

- Consulting Engagements: Income generated from providing expert advice and implementation support for simulation strategies.

- Partnership Projects: Revenue streams from collaborative development efforts with medical device manufacturers or research institutions.

- Higher Margin Services: These custom solutions typically command premium pricing due to their specialized nature and intellectual property involved.

Training and Education Services

Surgical Science generates revenue by offering specialized training programs, workshops, and certification courses focused on the effective utilization of their medical simulators. This service directly complements their core product, enhancing its value proposition and attracting institutions looking for integrated solutions. For instance, in 2024, many medical schools and hospital training departments actively sought out such programs to upskill their staff and students on advanced surgical simulation techniques, reflecting a growing demand for practical, hands-on medical education.

This educational component is crucial for customer retention and also serves as a significant customer acquisition channel. By leveraging their deep expertise in surgical simulation and medical education, Surgical Science positions itself as a comprehensive partner rather than just a technology provider. The company's commitment to ongoing education ensures that clients can maximize the return on their simulator investment and stay at the forefront of medical training methodologies.

- Revenue Generation: Income derived from specialized training programs, workshops, and certification courses.

- Value Addition: Enhances the core simulator product by providing comprehensive usage guidance and integration strategies.

- Customer Acquisition: Attracts new clients seeking holistic medical education solutions.

- Expertise Leverage: Capitalizes on the company's established educational and simulation expertise.

Surgical Science's revenue streams are diversified, encompassing direct hardware sales, recurring software licenses, maintenance contracts, custom development, and specialized training programs. This multi-faceted approach ensures financial resilience and growth, catering to the evolving needs of the medical simulation market.

In 2023, the company saw robust performance across these segments, with hardware sales forming the foundational revenue base while recurring income from software and services demonstrated strong growth. This blend of capital and recurring revenue is key to their business model's sustainability.

Looking ahead to 2024, continued expansion in recurring revenue streams, driven by increased adoption of their simulation platforms and associated services, is anticipated. The company's strategic focus on expanding its software offerings and training services is expected to further bolster its financial performance.

| Revenue Stream | Primary Focus | 2023 Performance Indicator | 2024 Outlook Indicator |

|---|---|---|---|

| Simulator Hardware Sales | Direct sale of VR simulators | Significant capital expenditure for institutions | Continued demand for foundational training tools |

| Software Licenses & Subscriptions | Recurring access to simulation modules and updates | Substantial increase reported in recurring revenue | Expected growth driven by expanded content library |

| Maintenance & Support Contracts | Ongoing technical assistance and hardware upkeep | Significant portion of revenue derived from service agreements | Key for customer retention and product longevity |

| Custom Development & Consulting | Bespoke modules and tailored simulation solutions | Notable increase in demand for specialized services | Leveraging expertise for niche market needs |

| Training Programs & Certifications | Specialized workshops and utilization courses | High demand from medical schools and training departments | Enhancing value proposition and customer acquisition |

Business Model Canvas Data Sources

The Surgical Science Business Model Canvas is informed by a blend of internal financial data, market research on simulation technologies, and insights from clinical use cases. These sources provide a comprehensive view of our operational capabilities and market positioning.