Surgical Science Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Surgical Science Bundle

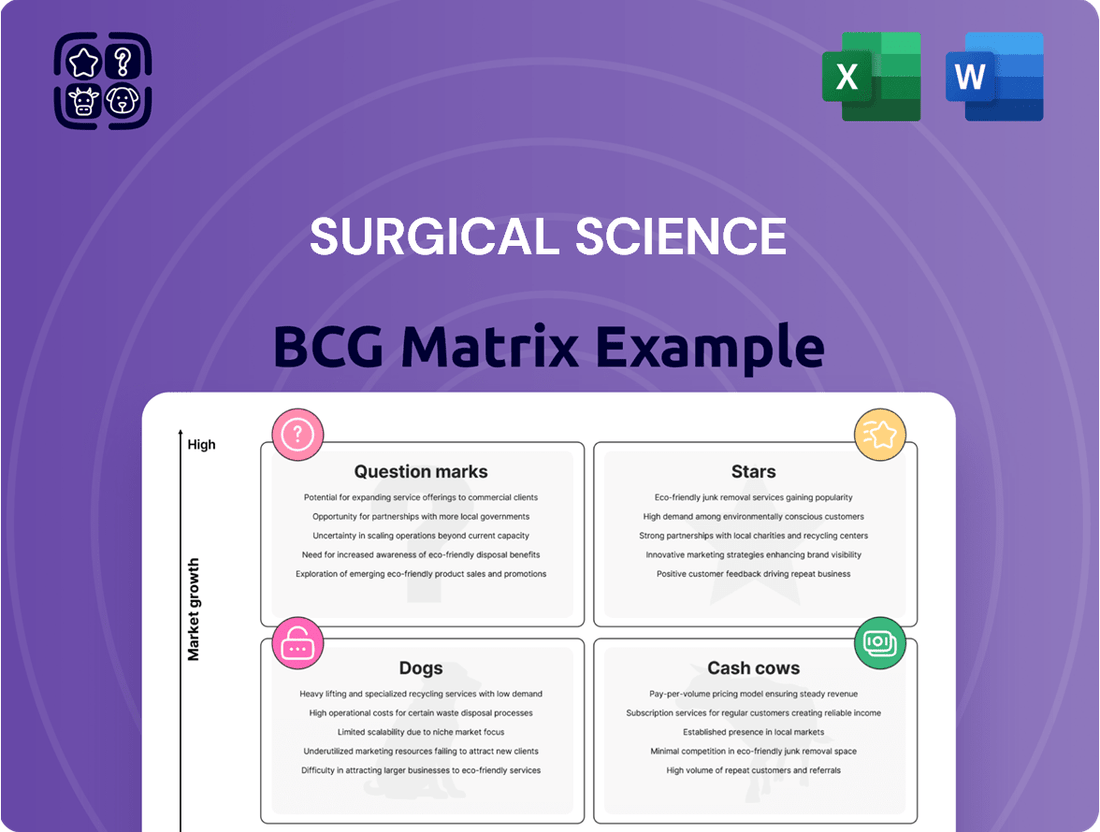

Unlock the strategic power of Surgical Science's product portfolio with our expert BCG Matrix analysis. Understand which innovations are poised for rapid growth (Stars), which consistently generate reliable revenue (Cash Cows), which are underperforming and need attention (Dogs), and which hold future promise but require more investment (Question Marks). This preview offers a glimpse into how these crucial categories shape Surgical Science's market position.

Ready to move beyond a superficial understanding? Purchase the full Surgical Science BCG Matrix to gain a comprehensive, data-driven assessment of each product's market share and growth potential. You'll receive detailed quadrant placements and actionable insights to inform your investment and resource allocation decisions, ensuring you capitalize on opportunities and mitigate risks effectively.

Stars

Surgical Science's strategic partnership with Intuitive Surgical, integrating its simulation software into all da Vinci 5 systems, firmly places Robotic Surgery Simulation Platforms in the Star quadrant. This move is projected to drive significant market penetration within the burgeoning surgical training sector, transitioning to a subscription-based revenue model starting January 2025.

The market for robotic-assisted surgery continues its upward trajectory, and Surgical Science's established leadership in simulation solutions for medical device manufacturers reinforces its Star status. This segment benefits from high growth potential and a dominant market player.

The market for virtual reality surgical training is experiencing significant growth, with projections indicating a compound annual growth rate of nearly 20% between 2024 and 2030. This expansion is fueled by the increasing need for sophisticated, high-fidelity simulation tools to adequately prepare surgeons for complex procedures.

Surgical Science is strategically positioned within this expanding market, particularly with its advanced simulators designed for intricate interventional procedures. This segment is characterized by a critical demand for high skill proficiency, making it a prime area for high growth and increased market share.

These cutting-edge simulators are not just enhancing medical education; they are actively addressing the dynamic needs of the healthcare workforce and responding to stringent regulatory requirements. The focus on advanced interventional procedures highlights a commitment to providing realistic and effective training solutions.

Surgical Science's OEM/Industry Simulation Solutions segment experienced robust expansion in 2024, reporting a significant 21% surge in sales. This area focuses on crafting bespoke simulation tools for medical device manufacturers, a testament to the company's capability in adapting to evolving industry needs.

The growth is driven by the development of highly specific simulations for novel instruments and surgical procedures, positioning Surgical Science at the forefront of a dynamic and expanding market. Their expertise in proprietary software and hardware is a key differentiator, ensuring a competitive edge.

This strategic emphasis on device-specific training solutions not only solidifies Surgical Science's market leadership but also fuels ongoing revenue expansion. By providing essential training platforms for new technologies, they are integral to the success of medical device innovation.

Integrated Simulation Ecosystems

Surgical Science's strategy to merge its acquired technologies, including Simbionix, Mimic Technologies, SenseGraphics, and Intelligent Ultrasound, into unified simulation ecosystems is a key driver of its market dominance. This consolidation creates a more comprehensive and integrated training solution, catering to a wider array of medical disciplines and strengthening its hold on the expanding market for comprehensive simulation platforms.

The company's ability to present a complete, cohesive platform significantly boosts its competitive edge and market penetration. This integrated approach allows Surgical Science to address diverse training requirements more effectively, solidifying its position as a leader in the medical simulation sector.

- Market Share Growth: Surgical Science aims to capture a larger portion of the medical simulation market by offering integrated solutions.

- Acquisition Synergies: The combination of Simbionix, Mimic Technologies, SenseGraphics, and Intelligent Ultrasound creates a powerful, unified product offering.

- Competitive Advantage: A holistic simulation platform enhances customer value and differentiates Surgical Science from competitors.

- Industry Trends: The market for integrated training solutions is expanding, aligning with Surgical Science's strategic direction.

Subscription-Based Software Licenses (for new systems)

Surgical Science's move to subscription-based software licenses for new systems, exemplified by their partnership with Intuitive Surgical for the da Vinci 5, positions these offerings as Stars in the BCG Matrix. This strategy guarantees predictable, recurring revenue, fostering deep customer integration and strengthening market leadership for their simulation software. The subscription model is designed to leverage the growing number of new surgical systems entering the market, ensuring continuous engagement and revenue generation.

- Recurring Revenue: The subscription model provides a stable and predictable revenue stream, crucial for long-term financial planning and investment.

- Market Dominance: Deep integration into customer ecosystems through these subscriptions solidifies Surgical Science's market share and creates high switching costs for competitors.

- Growth Potential: Capitalizing on the expanding installed base of new surgical systems, such as the da Vinci 5, offers significant growth opportunities.

- Customer Lock-in: The subscription approach fosters strong, long-term relationships with key partners, enhancing customer loyalty and reducing churn.

Surgical Science's robotic surgery simulation platforms are firmly in the Star quadrant due to their high market share in a rapidly growing sector. The strategic integration with Intuitive Surgical's da Vinci 5 systems, coupled with a shift to a subscription-based revenue model from January 2025, underscores this position. This move is expected to significantly boost market penetration in surgical training, a market projected to grow at a CAGR of nearly 20% from 2024 to 2030.

The company's OEM/Industry Simulation Solutions segment saw a robust 21% sales surge in 2024, driven by tailored simulators for new instruments and procedures. This segment benefits from high growth and dominance, a hallmark of Stars. The consolidation of acquired technologies like Simbionix and Mimic Technologies into unified ecosystems further strengthens their competitive advantage and market hold.

The subscription model for new systems, particularly with Intuitive Surgical, ensures predictable recurring revenue and deep customer integration, reinforcing market leadership. This strategy capitalizes on the expanding installed base of new surgical systems, creating significant growth opportunities and customer loyalty.

| Segment | Market Growth | Market Share | Strategic Importance | BCG Classification |

| Robotic Surgery Simulation Platforms | High (20% CAGR 2024-2030) | High (Dominant Player) | Key for future revenue, customer integration | Star |

| OEM/Industry Simulation Solutions | High | High | Drives innovation, bespoke solutions | Star |

What is included in the product

Surgical Science's BCG Matrix analyzes its product portfolio by market growth and share.

It identifies Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

Visualize your product portfolio's strategic positioning with the Surgical Science BCG Matrix, offering clarity and direction.

Cash Cows

Surgical Science's established general laparoscopic simulators, like LapSim, have been a cornerstone of their business since their launch in 2001. This long market presence has cultivated a substantial installed base, with over 8,000 systems distributed globally, underscoring their maturity and market leadership in this training segment.

These simulators represent true cash cows for Surgical Science, consistently generating robust cash flow. This income stream is bolstered by both initial system sales and recurring revenue from service agreements and software licenses, requiring little additional investment for continued market presence.

The extensive validation, with more than 400 studies supporting their efficacy, further solidifies these simulators' position in a mature market. Their established reputation and proven track record allow them to command a significant market share with minimal need for aggressive promotional spending.

Surgical Science's basic endoscopy and bronchoscopy simulators are firmly positioned as cash cows within their BCG matrix. These simulators have achieved widespread adoption across medical universities and training institutions worldwide, becoming a staple for foundational procedural training. Their strength lies in providing reliable, repetitive practice, a critical element for skill development in these areas.

The consistent demand for these simulators stems from their integration into standard medical curricula, ensuring a predictable revenue stream. While innovation in these specific basic models might be slower, their established market presence and essential function in medical education guarantee stable cash generation for Surgical Science. This reliability makes them a cornerstone of the company's product portfolio.

Surgical Science's legacy simulator maintenance and service contracts are a prime example of a Cash Cow. These agreements generate a predictable and substantial portion of the company's revenue, thanks to a large installed base of simulators. This recurring income stream boasts high profit margins because the initial development costs are already covered, requiring minimal incremental investment to service existing customers.

In 2024, Surgical Science continued to leverage these contracts for consistent cash flow. For instance, the company reported that its service and maintenance revenue remained a robust contributor to overall financial performance, underscoring the stability of this business segment. This strategy of maximizing returns from established products is a hallmark of a successful Cash Cow, providing a solid financial foundation.

Educational Products Business Area (Core)

Surgical Science's Educational Products business area, a core segment, operates within a mature market where it holds a significant share. While 2024 presented macroeconomic challenges, this segment continues to function as a cash cow, generating consistent revenue from its installed base of teaching hospitals and clinics. The company's proprietary simulators are a key driver of this stable cash flow, underscoring its position as a reliable profit contributor.

The educational products are central to Surgical Science's ability to fund other ventures. For instance, in 2023, the company reported total revenue of SEK 1.44 billion, with a substantial portion attributable to its established training solutions. This consistent performance allows for reinvestment and strategic growth initiatives across the broader organization.

- High Market Share: Surgical Science maintains a leading position in the mature market for surgical simulation education.

- Steady Revenue Stream: The segment reliably generates income from existing customers, primarily teaching hospitals and clinics.

- Profitability Contributor: Educational Products are a significant source of profit and cash generation for the company.

- 2023 Performance: The company's overall revenue reached SEK 1.44 billion in 2023, highlighting the importance of its core segments.

Older Generation Simulator Hardware Platforms

Older generation simulator hardware platforms from Surgical Science, while not seeing explosive growth, maintain a strong market position. This is largely due to their established presence and the significant number of institutions that have already integrated these systems into their training programs.

These established platforms remain valuable revenue generators for Surgical Science. Institutions that previously invested in this hardware continue to utilize it, contributing to a steady income stream through ongoing usage fees, necessary upgrades, and the purchase of related software licenses. This creates a predictable cash flow with minimal need for substantial new research and development investments.

For example, in 2024, Surgical Science reported that its established simulator platforms continued to contribute a significant portion of its recurring revenue, driven by a loyal customer base and the ongoing demand for simulation training. This demonstrates the enduring value of these "cash cows."

- High Market Share: Secured through early adoption and widespread integration.

- Steady Revenue Streams: Generated from continued usage, upgrades, and software licenses.

- Limited R&D Costs: Reduced investment needed compared to newer, emerging technologies.

- Predictable Cash Flow: Offers a reliable income source for the company.

Surgical Science's established laparoscopic simulators are prime examples of cash cows. These products benefit from a substantial installed base, with over 8,000 systems globally, and generate consistent cash flow through initial sales and recurring service/software revenue. Their market leadership is further solidified by over 400 validation studies, minimizing the need for extensive marketing spend.

The company's basic endoscopy and bronchoscopy simulators also function as cash cows, deeply embedded in medical curricula worldwide. Their consistent demand ensures a predictable revenue stream, with their essential role in foundational training negating the need for rapid innovation. This reliability makes them a stable profit contributor.

Legacy simulator hardware platforms contribute significantly to Surgical Science's recurring revenue. Driven by a loyal customer base and ongoing demand for simulation, these established systems require minimal new R&D investment. This predictable cash flow from continued usage, upgrades, and software licenses underscores their cash cow status.

| Product Category | BCG Status | Key Characteristics | 2024 Relevance |

| General Laparoscopic Simulators | Cash Cow | Large installed base (>8,000 systems), recurring revenue from service/software, strong market leadership. | Continued stable cash generation, minimal investment required. |

| Basic Endoscopy/Bronchoscopy Simulators | Cash Cow | Integrated into medical curricula, predictable demand, essential foundational training tools. | Reliable revenue stream, cornerstone of product portfolio. |

| Legacy Simulator Hardware | Cash Cow | Established presence, continued usage fees, upgrades, and software licenses. | Significant contributor to recurring revenue, loyal customer base. |

Full Transparency, Always

Surgical Science BCG Matrix

The Surgical Science BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get a complete, analysis-ready strategic tool without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Discontinued or obsolete simulator modules from Surgical Science, such as older versions of their LapSim or GI Bronchoscopy simulators that no longer receive significant updates, would be categorized as Dogs in the BCG Matrix. These products, while perhaps having an initial market presence, now represent a low market share in a declining or stagnant market segment. For instance, if a specific module, like an early iteration of their ultrasound simulator, saw a significant drop in sales from, say, 50 units in 2022 to just 10 units in 2024 due to newer, more advanced models, it would fit this description.

Underperforming niche training simulators represent the 'Dogs' in the BCG Matrix for companies like Surgical Science. These are products that, despite initial investment, haven't captured significant market share. For instance, a specialized simulator for a very rare surgical procedure might fall into this category.

Surgical Science's 2024 financial reports might highlight specific simulator lines that are showing minimal revenue growth. These products often operate in low-growth segments of the medical simulation market, meaning the overall demand is not expanding.

The challenge with these 'Dog' products is that they consume resources without generating substantial profits. They might be breaking even at best, or more likely, incurring losses due to ongoing maintenance, support, and marketing costs.

By the end of 2024, Surgical Science would likely be reassessing its portfolio, considering whether to divest or significantly reduce investment in these underperforming niche simulators to reallocate capital to more promising areas.

Geographical markets with insignificant presence and high overhead represent areas where Surgical Science has a limited footprint, faces stiff competition, or experiences substantial operational costs without generating proportional revenue. These markets are characterized by low market share and limited growth potential, making them candidates for divestment or reduced investment. For example, while specific figures for 2024 are still emerging, historical analysis often points to emerging markets with underdeveloped healthcare infrastructure as potential examples where initial entry costs and regulatory hurdles can be high, leading to a low return on investment.

Non-Strategic, Low-Demand Custom Development Projects

Non-strategic, low-demand custom development projects, in the context of Surgical Science's potential BCG Matrix, would likely fall into the 'Dogs' category. These are custom simulation development projects tailored for specific clients, which do not foster the creation of broader, scalable product lines or generate significant intellectual property. Their limited future demand means they are unlikely to contribute to substantial, recurring revenue or enhance market share.

These types of projects can be a drain on valuable R&D resources. For instance, if a company like Surgical Science invests $500,000 in a custom project that yields only $300,000 in revenue and has no follow-on potential, it represents a net loss. Such initiatives might consume developer hours that could otherwise be allocated to developing more innovative, market-leading products, thereby impacting overall growth and profitability.

- Limited Scalability: Custom solutions rarely translate into mass-market products, restricting revenue growth potential.

- Resource Drain: Development time and capital are tied up in projects with low future return on investment.

- Low ROI: These projects often yield minimal financial returns compared to the investment made in their development.

- Opportunity Cost: Resources spent here could be invested in 'Stars' or 'Question Marks' with higher growth potential.

Outdated Haptic Feedback Systems

Outdated haptic feedback systems in surgical science often fall into the question mark category of the BCG matrix. While haptics remain vital for realistic surgical simulation, older systems may struggle to compete with advancements in force feedback and tactile rendering. These legacy technologies could be experiencing declining market demand as newer, more sophisticated alternatives emerge, leading to a low market share.

The economic viability of these outdated systems is further challenged by their maintenance and potential upgrade costs. When the diminishing utility and market demand for older haptic technology are weighed against the expenses of keeping them operational or bringing them up to modern standards, they often represent a weak investment. For instance, a system that cost $50,000 in 2020 might now require $10,000 annually for maintenance, but its perceived value has dropped significantly due to competitors offering similar or better experiences for a comparable initial outlay.

- Low Market Share: Older haptic systems may possess less than 10% of the current market share for surgical simulation hardware.

- Declining Demand: Consumer preference has shifted towards systems offering higher fidelity tactile and force feedback.

- High Maintenance Costs: Annual upkeep for legacy systems can exceed 15% of their original purchase price.

- Limited Upgrade Potential: The architecture of outdated haptic feedback technology often makes significant upgrades prohibitively expensive or technically infeasible.

Dogs in Surgical Science's BCG Matrix represent products with low market share in slow-growing or declining markets. These are typically older, less competitive simulator modules or specialized custom projects that no longer attract significant demand. For example, a 2024 analysis might reveal that a legacy ultrasound simulator module, which once sold 50 units annually, now only sells 10 units due to newer, more advanced alternatives. These products consume resources without generating substantial profits, often resulting in a negative return on investment and requiring strategic decisions regarding divestment or reduced support.

Question Marks

Surgical Science's early 2025 acquisition of Intelligent Ultrasound places its ultrasound simulation products squarely in the Question Mark category of the BCG Matrix. This move significantly boosts Surgical Science's presence in a high-growth market, aiming to establish them as a leader. However, as a newer addition to their broader portfolio, these products will likely demand considerable investment to capture substantial market share and achieve seamless integration.

The immediate financial outlook for these newly acquired ultrasound simulation products suggests a potential dip in Surgical Science's overall profit margin in the short term. This is a common characteristic of Question Marks, as the initial investment in market penetration, product development, and operational synergy often outweighs early revenue contributions.

AI-driven adaptive learning modules in surgical training simulators are a burgeoning area, fueled by the demand for customized education and instant performance analysis. Surgical Science’s exploration into this advanced AI sub-segment positions it as a Question Mark within the BCG framework. This category signifies high potential growth but currently a nascent or unestablished market position for the company itself within this niche.

Augmented Reality (AR) surgical training solutions represent a significant growth area for Surgical Science. While the company has a strong position in Virtual Reality (VR), the AR segment is anticipated to experience the most rapid compound annual growth rate (CAGR) between 2025 and 2032, with projections indicating a CAGR exceeding 30% during this period. This suggests a substantial market opportunity for Surgical Science to expand its offerings and capture market share in this evolving technology.

If Surgical Science is actively investing in AR solutions, it would likely be categorized as a question mark within the BCG Matrix. This means the AR segment possesses high market growth potential but currently represents a relatively low market share for Surgical Science. Such investments typically require significant cash expenditure for research and development, with the returns on these investments being uncertain in the short to medium term.

Entry into New International Markets (e.g., emerging economies)

Entry into new international markets, particularly emerging economies, would typically position Surgical Science's ventures as Stars or Question Marks within a BCG Matrix framework. These markets, while offering substantial long-term growth potential as healthcare infrastructure matures, present initial challenges. Surgical Science would likely hold a low market share in these regions, necessitating considerable investment for market penetration and brand building.

For instance, consider the projected growth of the medical simulation market in Southeast Asia. Analysts forecast this region to see a compound annual growth rate (CAGR) of over 15% in the coming years, driven by increasing healthcare expenditure and a rising demand for advanced medical training. Surgical Science's expansion into countries like Vietnam or Indonesia, where simulation technology is still in its early adoption phase, would require substantial capital for sales, distribution, and localized training support. This aligns with the characteristics of a Question Mark, demanding careful strategic evaluation and significant resource allocation to determine if it can capture a meaningful market share and evolve into a future Star.

- High Growth Potential: Emerging economies often exhibit rapid economic development, leading to increased healthcare spending and a greater demand for sophisticated medical technologies like surgical simulators.

- Nascent Market Adoption: In many of these regions, medical simulation is a relatively new concept, meaning Surgical Science would be entering a market with limited existing competition but also a lower initial customer base.

- Significant Investment Required: Establishing a presence in these markets involves costs related to market research, regulatory compliance, building distribution networks, and educating potential clients about the benefits of simulation technology.

- Low Initial Market Share: As a first-mover or early entrant, Surgical Science would naturally start with a small percentage of the market, requiring aggressive strategies to gain traction and build brand recognition.

Early-Stage Robotic Surgery Simulator Development for Emerging OEMs

Developing early-stage robotic surgery simulators for emerging Original Equipment Manufacturers (OEMs) places Surgical Science in a classic question mark position within the BCG matrix. While Surgical Science is a recognized leader in established robotic surgery simulation markets, these new ventures are characterized by high investment in research and development, particularly for OEMs navigating complex regulatory approval processes. The market share for these specific simulators is currently low, reflecting the nascent stage of the OEM's product lifecycle.

The potential for these question mark initiatives is significant. If an emerging OEM successfully achieves regulatory clearance and gains market traction, Surgical Science's early investment in tailored simulation technology could yield substantial returns and establish a dominant position in a new segment. For instance, in 2024, the global surgical robotics market was valued at approximately $8.2 billion, with significant growth projected in emerging technologies and smaller, specialized systems.

- High R&D Investment: Developing simulators for OEMs in regulatory stages requires significant upfront capital for customization and validation.

- Low Current Market Share: These simulators serve markets not yet established or widely adopted.

- High Growth Potential: Successful OEM adoption can lead to significant future market share gains.

- Uncertainty of Return: The success of the OEM directly impacts the return on investment for the simulator development.

Surgical Science's expansion into augmented reality (AR) surgical training solutions places these offerings within the Question Mark category of the BCG Matrix. The AR segment is poised for substantial growth, with projections indicating a compound annual growth rate exceeding 30% between 2025 and 2032. However, Surgical Science likely holds a relatively low market share in this nascent area, necessitating considerable investment in research and development to capture market share.

These AR solutions represent high-growth potential but currently a low market share for Surgical Science. This means significant cash expenditure is required for R&D, with uncertain short to medium-term returns.

The company's entry into emerging international markets, such as Southeast Asia, also positions its ventures as Question Marks. These regions offer substantial long-term growth, with the medical simulation market in Southeast Asia expected to grow at over 15% CAGR. Surgical Science's expansion requires significant capital for market penetration and brand building, starting with a low initial market share.

Developing early-stage robotic surgery simulators for emerging OEMs also falls into the Question Mark category. This involves high R&D investment and currently low market share for these specific simulators. However, successful OEM adoption could lead to significant future market share gains, capitalizing on the global surgical robotics market, valued at approximately $8.2 billion in 2024.

BCG Matrix Data Sources

Our Surgical Science BCG Matrix leverages comprehensive data, including financial reports, market share analysis, and R&D investment figures. This ensures a robust understanding of each product's position.