Sumitomo Riko PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Riko Bundle

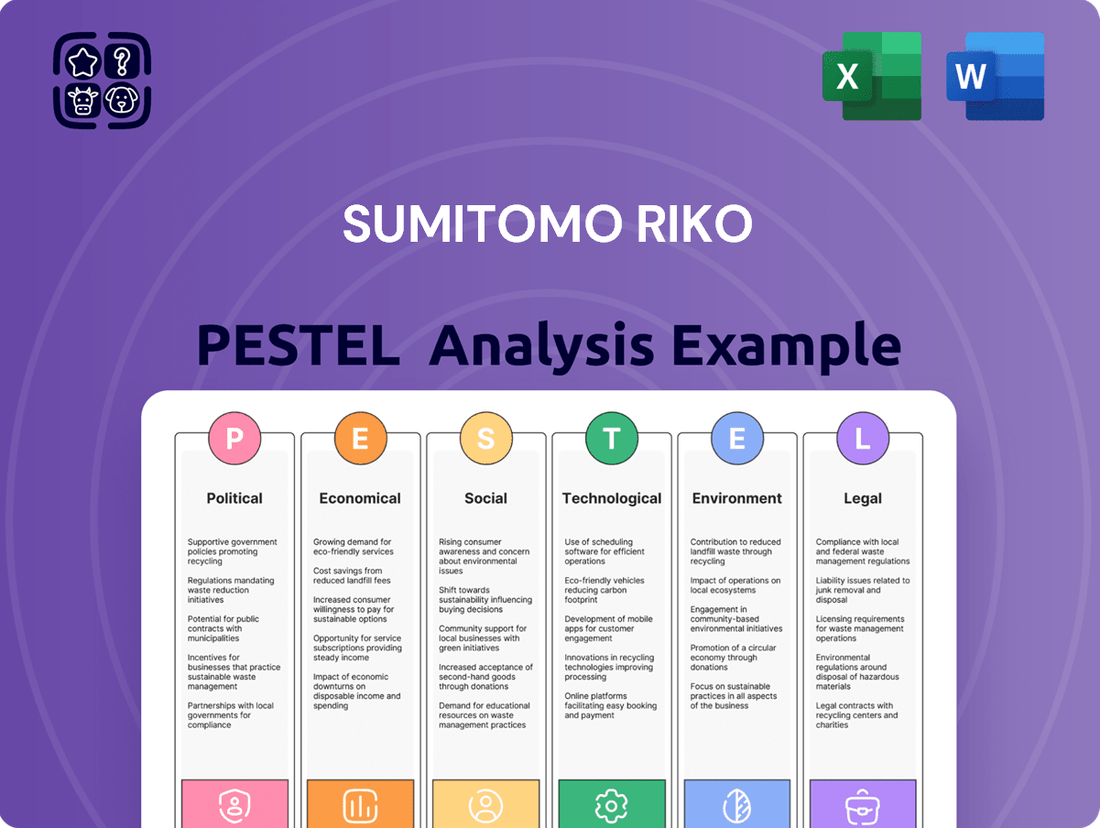

Sumitomo Riko's future is intricately linked to global political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for navigating the competitive landscape and identifying growth opportunities. Our PESTLE analysis dives deep into these critical factors, offering actionable intelligence.

From technological advancements impacting manufacturing to stringent environmental regulations shaping production, a comprehensive PESTLE framework is essential. This analysis provides a clear picture of the external environment influencing Sumitomo Riko's strategic decisions and operational effectiveness.

Gain a significant advantage by leveraging our expertly crafted PESTLE analysis for Sumitomo Riko. Uncover the political, economic, social, technological, legal, and environmental factors that are shaping the company's trajectory. Download the full version now to equip yourself with the insights needed to make informed strategic choices.

Political factors

Uncertainty surrounding international trade policies and the imposition of tariffs significantly impacts Sumitomo Riko's global operations. As a major automotive supplier, tariffs on imported raw materials or exported finished goods, such as potential 2025 EU tariffs on certain Asian components, could increase production costs by an estimated 2-4%. Ongoing trade disputes between major economic blocs like the US, EU, and China create a volatile environment, complicating supply chain management and long-term investment planning for the fiscal year 2024-2025. This unpredictability demands agile strategic adjustments to maintain pricing competitiveness and market share in key regions.

Global political tensions, such as ongoing conflicts impacting the Red Sea shipping routes in early 2025, severely disrupt supply chains and elevate raw material costs for companies like Sumitomo Riko. Its extensive global manufacturing footprint, including operations across Asia, Europe, and North America, directly exposes it to risks from regional instability. These geopolitical events can significantly increase operational expenses, with freight costs potentially rising by 15-20% in affected corridors, challenging the company's ability to maintain consistent production schedules. Therefore, Sumitomo Riko must continuously monitor the dynamic geopolitical landscape to mitigate disruptions to its global manufacturing and distribution networks effectively.

Governments globally are enforcing more stringent automotive regulations, particularly concerning safety and emissions, impacting Sumitomo Riko's component development. The EU's ongoing shift towards stricter Euro 7 emission standards, even with revised timelines, mandates significant investment in advanced anti-vibration rubber and hose technologies. Compliance with diverse global standards, like the US EPA's 2025-2026 fuel efficiency targets, necessitates continuous R&D. This regulatory landscape compels Sumitomo Riko to innovate, ensuring its products meet evolving environmental and safety benchmarks worldwide.

Incentives for Electric and Hydrogen Vehicles

Government support for green technologies, including subsidies and tax credits for electric and fuel cell vehicles, presents a significant opportunity. For instance, the US Inflation Reduction Act continues to offer up to $7,500 tax credits for qualifying EVs through 2032. Sumitomo Riko's development of components for next-generation vehicles, such as specialized parts for fuel cell trucks, aligns with this political trend. The market demand for these innovative products is directly influenced by the extent and longevity of these government incentives, which are projected to drive global EV sales above 17 million units in 2024.

- Global EV sales are projected to exceed 17 million units in 2024, driven by policy support.

- US IRA provides up to $7,500 tax credits for new EVs, influencing market adoption through 2032.

- European Union targets 55% CO2 emissions reduction by 2030, boosting demand for green vehicle components.

- Japan continues to offer subsidies for FCV purchases, supporting hydrogen infrastructure and vehicle development.

Local Content Requirements

Local content requirements, mandating a percentage of product value from domestic production, significantly influence Sumitomo Riko's global operational strategy. For instance, countries like India continue to push for increased localization in automotive components, impacting supply chain configuration for manufacturers. To comply with these evolving regulations, Sumitomo Riko may need to expand or establish new manufacturing facilities in specific markets, directly affecting its capital expenditure and regional footprint through 2025. This is a critical consideration for a company with a broad international automotive and industrial parts presence.

- India's "Make in India" initiative targets higher local value addition in automotive components, affecting import strategies.

- Brazil's Inovar-Auto program, though evolving, historically incentivized local production, influencing plant investment decisions.

- Mexico's USMCA rules of origin for automotive require 75% North American content by 2025, impacting supply chain reconfigurations.

Volatile international trade policies, including potential 2025 EU tariffs, could raise Sumitomo Riko's production costs by 2-4%. Geopolitical tensions, such as Red Sea disruptions in early 2025, elevate freight costs by 15-20%, impacting global supply chains. Stricter automotive regulations, like EU Euro 7 and US EPA 2025-2026 targets, mandate continuous R&D for compliance. Government support for green tech, including US IRA tax credits, drives demand for EV components, with global EV sales projected to exceed 17 million units in 2024.

| Factor Type | Specific Political Factor | Impact on Sumitomo Riko |

|---|---|---|

| Trade Policy | Potential 2025 EU Tariffs | 2-4% increase in production costs |

| Geopolitics | Red Sea Shipping Disruptions (2025) | 15-20% rise in freight costs |

| Regulation | EU Euro 7 / US EPA 2025-2026 | Mandates R&D for compliance |

| Incentives | US IRA Tax Credits | Drives EV component demand (17M+ global EV sales 2024) |

What is included in the product

This Sumitomo Riko PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal forces on the company's operations and strategy.

It provides a comprehensive overview of external factors, highlighting potential risks and opportunities for Sumitomo Riko in the global marketplace.

Sumitomo Riko's PESTLE analysis offers a clear and simple language version, making complex external factors accessible for all stakeholders and relieving the pain point of jargon-heavy reports.

This analysis provides a concise, easily shareable summary format ideal for quick alignment across teams or departments, relieving the pain point of time-consuming information dissemination.

Economic factors

The overall health of the global economy directly influences demand for automotive and industrial products, which are core to Sumitomo Riko's operations.

Forecasts for 2025 indicate a projected global economic growth of around 3.2%, as per the IMF's April 2024 World Economic Outlook, suggesting a modest expansion.

However, this growth is anticipated to be uneven, with certain regions experiencing slowdowns, necessitating agile management of production and sales forecasts.

For instance, while the OECD's May 2024 Economic Outlook projects global GDP growth at 3.2% for 2025, it also highlights ongoing geopolitical tensions affecting regional stability.

This economic landscape requires Sumitomo Riko to precisely adjust its supply chain and market strategies to navigate varying regional demands effectively.

Sumitomo Riko's profitability is significantly impacted by fluctuations in raw material prices, especially for natural and synthetic rubber. Global natural rubber prices, influenced by factors like the 2024 El Niño weather patterns affecting Southeast Asian supply, directly increase manufacturing costs. Synthetic rubber prices also remain volatile, tied to crude oil market dynamics through mid-2025. The company must implement strategic sourcing and robust hedging mechanisms to mitigate these ongoing price pressures on its financial performance.

As a global entity, Sumitomo Riko faces significant currency exchange rate volatility given its vast international operations and sales. Fluctuations between the Japanese Yen and major currencies like the US Dollar and Euro directly impact its reported revenue and cost structures. For instance, a strengthening Yen against the USD (e.g., JPY 150 to JPY 140) can reduce the yen-denominated value of overseas earnings, influencing projected operating profit margins for fiscal year 2025. Effective financial hedging strategies are crucial to mitigate these risks and maintain stable profitability.

Slower Adoption of Battery Electric Vehicles (BEVs)

While the long-term trend leans towards electrification, recent 2024 analyses indicate a potential slowing in consumer BEV adoption rates in key markets, shifting interest towards hybrid vehicles. This trend impacts the product mix and demand for specific components supplied by Sumitomo Riko, as seen with some automakers adjusting their 2025 production forecasts. The company must maintain agile production to cater to BEV, hybrid, and traditional internal combustion engine (ICE) vehicle markets. For instance, hybrid vehicle sales increased by over 20% in the US in Q1 2024, while BEV growth slowed to below 5% in some European segments.

- Global BEV sales growth is projected to decelerate to around 20-25% in 2024, down from 60% in 2022.

- Hybrid electric vehicle (HEV) sales are forecast to grow by 30-40% in 2024 across major markets.

- Sumitomo Riko's component demand shifts based on this evolving market, impacting their material and production planning.

- Diversification across vehicle types is crucial for maintaining stable revenue streams through 2025.

Inflation and Interest Rates

Global inflationary pressures, with consumer price inflation forecasted at 3.9% for 2024 by the IMF, directly elevate Sumitomo Riko's operational costs and influence consumer demand. Higher interest rates, such as the Federal Reserve maintaining rates above 5.25% in early 2025, can significantly dampen consumer spending on large purchases like new vehicles. For Sumitomo Riko, inflation specifically increases the cost of labor, energy, and raw materials, exemplified by a 5% average rise in global energy costs anticipated for 2025, necessitating stringent cost management. This economic climate impacts profitability and strategic investment decisions.

- IMF forecasts global CPI inflation at 3.9% for 2024.

- Federal Reserve maintains interest rates above 5.25% into early 2025.

- Global energy costs projected to rise 5% on average in 2025.

Global economic growth, projected at 3.2% for 2025, remains uneven, impacting Sumitomo Riko's diverse market demands.

Fluctuating raw material prices, particularly for rubber, and currency volatility directly affect profitability.

Shifting automotive trends towards hybrids and away from rapid BEV adoption alter component demand.

Persistent inflation and higher interest rates elevate operational costs and temper consumer spending on vehicles.

| Economic Factor | 2025 Outlook | Impact on Sumitomo Riko |

|---|---|---|

| Global GDP Growth | 3.2% (IMF, OECD) | Influences overall demand for products. |

| Raw Material Prices | Volatile (rubber, oil) | Increases manufacturing costs. |

| Inflation/Interest Rates | CPI 3.9% (IMF), US Fed >5.25% | Elevates operating costs, dampens demand. |

Same Document Delivered

Sumitomo Riko PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Sumitomo Riko PESTLE analysis provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and innovation opportunities. Understand the strategic environment Sumitomo Riko operates within.

Sociological factors

A notable shift in consumer behavior, particularly among younger demographics, favors mobility-as-a-service (MaaS) over traditional car ownership. Global MaaS subscriptions are projected to grow by 15% annually through 2025, reflecting this preference. This trend could reduce new vehicle demand by 2-3% in major urban markets by 2026. Sumitomo Riko must adapt its automotive component supply strategy to align with evolving fleet and shared vehicle needs, moving beyond solely individual car sales.

Consumers are increasingly prioritizing sustainability, with a 2024 survey indicating that over 60% of global consumers consider environmental impact in their purchasing decisions, a trend extending significantly into the automotive sector. This fuels a growing interest in vehicles incorporating recycled and eco-friendly materials, presenting a key opportunity for Sumitomo Riko. By innovating with sustainable rubber and plastic components, the company can align with this market demand. This strategic pivot allows Sumitomo Riko to market its products based on strong environmental credentials, tapping into a market segment projected to influence over $300 billion in automotive sales by 2025.

Japan's rapidly aging population, with over 29% of its citizens aged 65 or older by early 2024, significantly reshapes the automotive market. This demographic shift drives demand for vehicles with enhanced safety features and accessibility, influencing Sumitomo Riko's product development towards more comfortable and secure components. Concurrently, the shrinking working-age population, projected to decline further by 2025, presents challenges for workforce recruitment and retention in manufacturing. Sumitomo Riko must adapt its talent acquisition strategies and potentially invest in automation to maintain operational efficiency.

Urbanization and Changing Lifestyles

Continued urbanization globally is reshaping transportation needs, directly influencing Sumitomo Riko's automotive component designs. By 2025, over 58% of the world's population is projected to reside in urban areas, intensifying demand for efficient and sustainable mobility solutions. This trend emphasizes smaller, lighter vehicles and robust public transportation systems, impacting material and product specifications for noise and vibration control. The shift necessitates innovative solutions for compact electric vehicles and shared mobility platforms.

- Global urban population growth is projected to reach approximately 58.5% by mid-2025.

- Demand for compact EVs, ideal for urban settings, is accelerating, with global sales forecast to surpass 18 million units in 2025.

- Increased focus on lightweight materials and advanced vibration control for smaller vehicles and public transport.

- Investment in sustainable urban mobility infrastructure continues to rise across major economies.

Declining Brand Loyalty Among Car Buyers

Recent studies from early 2024 indicate a significant decline in vehicle brand loyalty, with some market analyses showing defection rates exceeding 50% for certain segments. This trend compels automakers to intensely innovate across quality, technology, and pricing to retain customers. For Sumitomo Riko, a key supplier, this means its components must consistently meet stringent performance standards to secure integration into diverse, highly competitive vehicle platforms globally. The shift emphasizes adaptability and superior product offerings.

- In Q1 2024, industry reports highlighted increasing consumer willingness to switch vehicle brands.

- Automakers are prioritizing advanced features and cost-effectiveness.

- Supplier components must support broad platform compatibility.

Consumer preferences are shifting towards mobility-as-a-service, with global subscriptions growing 15% annually through 2025, impacting new vehicle demand. Sustainability is a key driver, as over 60% of consumers consider environmental impact, influencing $300 billion in automotive sales by 2025. Japan's aging population, exceeding 29% aged 65+ in 2024, reshapes vehicle demand and workforce availability. Urbanization, with 58% global population in urban areas by 2025, emphasizes compact, sustainable transport.

| Factor | Trend (2024/2025) | Impact for Sumitomo Riko |

|---|---|---|

| MaaS Adoption | 15% annual growth in subscriptions | Shift to fleet/shared vehicle components |

| Sustainability Focus | $300B influenced sales | Demand for eco-friendly materials |

| Aging Demographics | 29%+ Japan aged 65+ | Demand for safety features; labor challenges |

Technological factors

Innovation in materials science is crucial for Sumitomo Riko, particularly advancements in rubber and polymer compounds. The development of self-healing elastomers and advanced rubber nanocomposites offers opportunities for more durable and lightweight automotive components. For instance, the global market for advanced polymers is projected to reach nearly $900 billion by 2025, highlighting this growth area. Staying at the forefront of these technological shifts is essential for Sumitomo Riko to maintain its competitive edge and meet evolving industry demands.

The automotive sector is rapidly shifting towards software-defined vehicles, where software dictates core functionalities, influencing nearly 90% of future vehicle innovations. While Sumitomo Riko specializes in rubber and resin products, their components must now integrate with advanced electronic and software architectures. The global software-defined vehicle market is projected to reach approximately $60 billion by 2025, demanding that traditional suppliers like Sumitomo Riko embed smart capabilities, such as sensors or data-enabled materials, directly into their automotive parts. This requires strategic R&D to ensure their products remain essential within this evolving digital vehicle ecosystem.

The adoption of Industry 4.0 technologies, including IoT, AI, and robotics, is rapidly transforming manufacturing processes globally. For Sumitomo Riko, embracing these innovations is essential for optimizing operations and reducing costs, with projections indicating a global smart manufacturing market size reaching over $500 billion by 2025. These technologies can significantly increase efficiency, potentially leading to a 10-20% reduction in production costs through automation and predictive maintenance. Furthermore, improved quality control mechanisms enabled by AI-driven analytics can minimize defects, enhancing product reliability. Flexible production systems, facilitated by advanced robotics, allow for quicker adaptation to market demands, crucial as the automotive and industrial sectors evolve.

Development of Hydrogen Fuel Cell Technology

Sumitomo Riko is deeply engaged in the hydrogen fuel cell vehicle sector, actively developing and producing essential components like specialized anti-vibration rubber and hoses for fuel cell trucks. This positions the advancement and commercial viability of hydrogen fuel cell technology as a significant growth avenue for the company, especially with global efforts pushing for decarbonization. Continued investment in research and development for these high-performance products is crucial for Sumitomo Riko to capitalize on this emerging market, aligning with projected growth in FCV adoption through 2025 and beyond.

- Sumitomo Riko supplies parts for hydrogen fuel cell trucks, tapping into the expanding FCV market.

- Global FCV sales are projected to reach over 100,000 units annually by 2025, offering substantial growth potential.

- Strategic R&D in specialized components ensures the company's competitive edge in sustainable mobility.

3D Printing and Additive Manufacturing

Additive manufacturing, commonly known as 3D printing, is revolutionizing rapid prototyping and the creation of intricate, customized components from rubber and polymer materials. This technology significantly shortens product development cycles, allowing for innovative designs, especially in automotive parts. Sumitomo Riko can leverage 3D printing to enhance its research and development capabilities, potentially streamlining the creation of new vibration control or hose products. The global polymer additive manufacturing market is projected to exceed $1.5 billion by 2025, highlighting its growing industrial adoption. This enables specialized, low-volume production that can meet bespoke client demands efficiently.

- 3D printing facilitates rapid prototyping, cutting development time by up to 50% for complex polymer components.

- The technology supports customized, low-volume production, crucial for niche automotive or industrial applications.

- It enhances R&D, allowing for quick iteration and testing of new material compositions and designs.

- Market growth in polymer additive manufacturing offers new avenues for Sumitomo Riko's material expertise.

Sumitomo Riko's technological advancements focus on materials science, particularly advanced polymers, with the market reaching $900 billion by 2025. Embracing Industry 4.0 technologies, like AI and robotics, is crucial for efficiency, as the smart manufacturing market exceeds $500 billion by 2025. The company also leverages additive manufacturing and develops components for hydrogen fuel cell vehicles, with global FCV sales projected over 100,000 units annually by 2025. Integrating with software-defined vehicle architectures, a $60 billion market by 2025, ensures product relevance in evolving automotive trends.

| Technological Area | 2025 Market Projection | Sumitomo Riko Impact |

|---|---|---|

| Advanced Polymers | ~$900 Billion | Enhanced material durability and lightweighting |

| Smart Manufacturing (Industry 4.0) | >$500 Billion | Optimized operations, 10-20% cost reduction |

| Hydrogen Fuel Cell Vehicles (FCV) | >100,000 Units (sales) | Growth in specialized component supply |

| Software-Defined Vehicles (SDV) | ~$60 Billion | Integration of smart capabilities into components |

| Polymer Additive Manufacturing | >$1.5 Billion | Faster prototyping, customized product development |

Legal factors

Governments, particularly in the EU, are enforcing increasingly strict CO2 emission standards for new vehicles, targeting a 55% reduction by 2030 from 2021 levels. Non-compliance can lead to substantial fines for automakers, driving a critical need for innovation. Upcoming Euro 7 standards, effective from 2025 for new models, expand regulations to include non-exhaust emissions from brakes and tires. This legal framework directly boosts demand for lightweight and efficient components from suppliers like Sumitomo Riko to help automakers meet these stringent environmental targets.

The automotive industry enforces stringent product safety and recall regulations globally, directly impacting component suppliers like Sumitomo Riko. Ensuring their critical components meet the highest quality and safety benchmarks is paramount to mitigate significant liability risks and preserve brand reputation. For instance, the 2024 projected increase in global automotive recall costs, estimated to exceed $30 billion, underscores the financial imperative for robust compliance. Adherence to diverse legal frameworks, such as the UN ECE R155 cybersecurity regulations for vehicles, which became mandatory in 2024 for new vehicle types, is fundamental to Sumitomo Riko's operational integrity across all jurisdictions.

Protecting innovations through robust patent portfolios is vital for Sumitomo Riko, especially in the highly competitive automotive and industrial products sectors. The company must skillfully navigate complex international patent laws to safeguard its intellectual property, particularly for cutting-edge materials and advanced product designs. This legal framework directly enables Sumitomo Riko to capitalize on its substantial research and development investments, which reached ¥16.4 billion in fiscal year 2023. Effective IP protection ensures continued market leadership and revenue generation from its proprietary technologies.

Labor and Employment Laws

Sumitomo Riko, as a global manufacturer with operations in over 20 countries, faces a complex landscape of labor and employment laws. These regulations, evolving significantly into 2024 and 2025, dictate working conditions, minimum wages, and employee rights, including new mandates on remote work and digital labor platforms in some regions. Compliance is critical for fostering positive employee relations and avoiding costly legal disputes, especially given the global push for enhanced labor protections and fair wages. For instance, the company must navigate diverse minimum wage increases projected for 2025 across key markets like the EU and parts of Asia.

- Global workforce exceeding 25,000 employees requires adherence to varied national labor codes.

- Compliance with 2024/2025 wage transparency laws in regions like Europe and California.

- Addressing new regulations on employee data privacy and remote work policies globally.

Waste and Recycling Regulations

Environmental laws concerning waste management and recycling are increasingly stringent globally, impacting Sumitomo Riko's operations. Regulations in Japan and other key markets are accelerating the shift towards a circular economy, directly influencing how the company manages manufacturing byproducts and end-of-life products. Sumitomo Riko actively collaborates on developing advanced recycling technologies, particularly for materials like tires and resins, aligning with its 2030 target to increase resource circulation.

- Sumitomo Riko aims for a 95% waste recycling rate across its global operations by fiscal year 2025.

- The company is investing in advanced pyrolysis and chemical recycling methods for rubber and plastic waste.

- Japan's revised Circular Economy Promotion Act (expected 2025) will likely impose stricter producer responsibility.

- Collaborations include joint development of tire-to-oil recycling technology, targeting industrial application by 2026.

Sumitomo Riko navigates a complex legal landscape, with stringent EU CO2 emission targets and Euro 7 standards (2025) driving innovation for lightweight components. Adherence to global product safety, including UN ECE R155 cybersecurity (2024), and robust IP protection for its ¥16.4 billion FY2023 R&D are critical. Evolving labor laws, like 2025 minimum wage increases, and environmental regulations targeting 95% waste recycling by FY2025, also significantly shape operations.

| Legal Factor | Key Regulation/Impact | 2024/2025 Data Point |

|---|---|---|

| Environmental Emissions | EU CO2 Reduction Target | 55% by 2030 (vs. 2021) |

| Product Safety | UN ECE R155 Cybersecurity | Mandatory for new vehicle types from 2024 |

| Intellectual Property | R&D Investment | ¥16.4 Billion (FY2023) |

| Labor & Employment | Global Minimum Wages | Projected increases for 2025 |

| Waste Management | Waste Recycling Target | 95% by FY2025 |

Environmental factors

A significant governmental and societal push in Japan emphasizes a circular economy, aiming for resource efficiency and waste reduction by designing products for reuse and recycling. Sumitomo Riko is actively contributing to this shift, focusing on advanced recycling solutions for materials such as used tires and resins. For instance, collaborative efforts are underway to process over 100,000 tons of end-of-life tires annually by 2025 into new rubber products. This aligns with Japan's target to achieve a 60% resource productivity rate by 2030, driving innovative material recovery strategies.

Sumitomo Riko actively addresses climate change through its environmental vision, targeting carbon neutrality by 2050, aligning with global efforts. This includes expanding renewable energy adoption, with solar power installations increasing across its global facilities, contributing to a projected 15% reduction in CO2 emissions by fiscal year 2025 compared to 2018 levels. These initiatives are driven by evolving regulatory pressures, such as stricter European Union emission standards, and a robust commitment to corporate social responsibility.

As a major manufacturer of rubber and resin products, Sumitomo Riko actively manages a diverse array of chemical substances. The company faces increasingly stringent global regulations, such as those under REACH and TSCA, necessitating robust internal control systems to prevent environmental pollution and ensure worker safety, a critical focus for 2024 and 2025. Compliance efforts involve significant investment in chemical inventory management and risk assessment technologies. This proactive approach helps mitigate potential liabilities, which for large chemical handlers can exceed tens of millions in fines for non-compliance, while also bolstering their ESG profile.

Water Risk Management

Water is a critical resource for Sumitomo Riko's global manufacturing operations, and responsible management is paramount. The company actively implements initiatives to mitigate water risks, addressing concerns like regional water scarcity and maintaining water quality in its operational areas. Sustainable water management forms a core pillar of its broader environmental strategy, aiming for resource efficiency. For instance, Sumitomo Riko aims to reduce water consumption per unit of sales by 30% by fiscal year 2030 compared to 2018 levels.

- Sumitomo Riko reported a 2% reduction in water usage across its global sites in fiscal year 2023, reflecting ongoing efforts.

- The company prioritizes water recycling technologies, with some facilities achieving over 70% water recirculation rates.

- Investments in advanced filtration systems mitigate discharge risks, ensuring compliance with evolving environmental regulations into 2025.

Development of Environmentally Friendly Products

The increasing global demand and stringent regulatory incentives are driving the development of environmentally friendly products across their lifecycle. Sumitomo Riko is strategically focusing on creating components that significantly contribute to improved fuel efficiency in traditional vehicles, addressing immediate environmental concerns. Furthermore, the company is heavily invested in developing advanced components for next-generation green vehicles, including electric vehicles (EVs) and fuel cell vehicles (FCVs), aligning with the automotive industry's shift towards electrification, which is projected to accelerate through 2025. This commitment to sustainable product innovation is a core element of its business strategy.

- Market demand for eco-friendly auto parts is robust, driven by global sustainability goals.

- Sumitomo Riko enhances fuel efficiency in ICE vehicles, crucial for 2024-2025 emissions targets.

- The company is expanding its portfolio for EVs and FCVs, anticipating strong growth in these segments.

- Product development aligns with stricter environmental regulations like Euro 7 and regional ZEV mandates.

Sumitomo Riko targets carbon neutrality by 2050, aiming for a 15% CO2 reduction by fiscal year 2025 while expanding renewable energy adoption. The company actively contributes to a circular economy, projecting to process over 100,000 tons of end-of-life tires annually by 2025. Water management is critical, with a 2% reduction in usage in fiscal year 2023, and product development focuses on eco-friendly components for both traditional and next-generation vehicles, aligning with 2024/2025 market shifts.

| Metric | Target/Achievement | Timeline/Context |

|---|---|---|

| CO2 Emissions Reduction | 15% reduction (vs 2018) | By Fiscal Year 2025 |

| End-of-Life Tires Processed | >100,000 tons annually | By 2025 |

| Water Usage Reduction | 2% reduction | Fiscal Year 2023 (achieved) |

PESTLE Analysis Data Sources

Our Sumitomo Riko PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, international economic reports, and leading industry analysis firms. This ensures comprehensive insights into political, economic, social, technological, legal, and environmental factors impacting the company.