Sumitomo Riko Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Riko Bundle

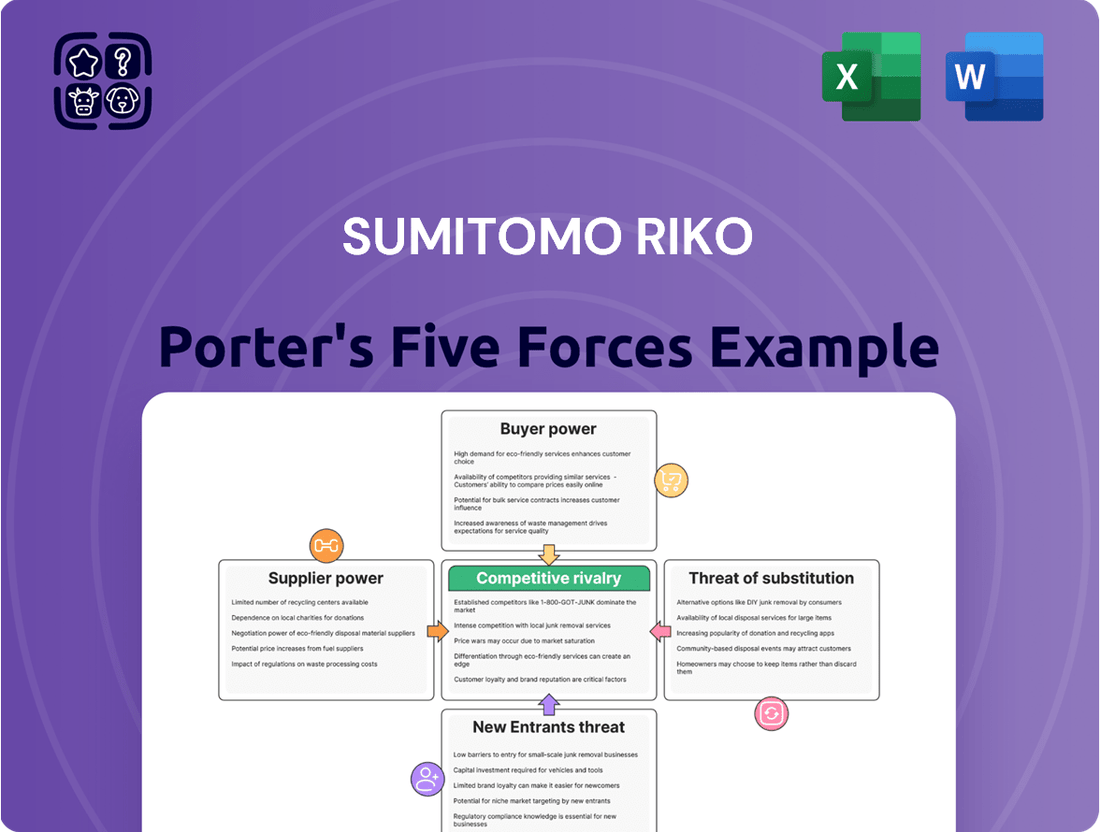

Sumitomo Riko navigates a landscape shaped by powerful competitive forces, from the bargaining power of its customers to the threat of new entrants. Understanding these dynamics is crucial for any stakeholder seeking to grasp the company's strategic positioning.

The intensity of rivalry within its industry significantly impacts Sumitomo Riko's pricing power and profitability. Analyzing this aspect reveals the core competitive battles the company faces daily.

Furthermore, the availability of substitute products presents a constant challenge, forcing Sumitomo Riko to innovate and differentiate its offerings. This threat is a key consideration for long-term viability.

The bargaining power of suppliers can also exert considerable pressure, influencing raw material costs and supply chain stability for Sumitomo Riko.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Sumitomo Riko’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Sumitomo Riko relies heavily on specialized raw materials like natural and synthetic rubbers, alongside unique resins. Suppliers of these critical inputs, particularly if offering proprietary formulations or operating in concentrated markets, wield considerable influence. In 2024, global supply chain volatility and rising energy costs continued to impact the pricing of these specialized materials. This strong supplier bargaining power can significantly affect Sumitomo Riko's production costs and timely delivery schedules. Managing these dependencies is crucial for operational stability.

The market for critical raw materials like natural rubber and various steel grades, essential for Sumitomo Riko, often features high supplier concentration. For instance, major natural rubber producers like Sri Trang Agro-Industry PCL and Halcyon Agri control significant market shares, giving them considerable pricing power. If these dominant suppliers also engage in forward integration, manufacturing components or sub-assemblies themselves, their leverage against Sumitomo Riko intensifies. This vertical integration could reduce Sumitomo Riko's sourcing options and increase material costs, impacting profitability in 2024. Such a scenario demands strategic long-term contracts and diversification of the supply base.

Developing new suppliers for the automotive sector, especially for components crucial to safety and performance, is a protracted and expensive undertaking, often necessitating adherence to rigorous standards like IATF 16949. Sumitomo Riko's strategy of cultivating enduring partnerships, while fostering stability, simultaneously elevates the costs and complexities associated with changing suppliers. This deep integration means that the financial outlay for re-qualification and supply chain disruption could easily run into millions for a major component change, significantly bolstering the bargaining power of established suppliers. Such high switching costs solidify supplier influence over pricing and terms. This dynamic is a constant consideration in 2024 supply chain negotiations.

Volatility in Raw Material Prices

The prices of crucial raw materials, such as natural rubber and oil-based synthetic rubbers, exhibit significant market volatility. This fluctuation, often driven by geopolitical events and global demand, empowers suppliers, especially given Sumitomo Riko's expectation of soaring raw material prices. For instance, natural rubber prices saw considerable shifts in 2024, impacting manufacturing costs. This volatility means suppliers gain leverage during periods of scarcity or high demand, directly affecting Sumitomo Riko's profitability and operational planning.

- Natural rubber prices averaged around 160 JPY/kg in early 2024, showing fluctuations due to supply chain dynamics.

- The company projected a 10-15% increase in raw material costs for the fiscal year ending March 2025.

- Crude oil prices, influencing synthetic rubber, saw WTI ranging from $70-$85/barrel in early 2024, adding to cost uncertainty.

Supplier Importance to Business

Key suppliers providing critical components or unique chemical formulations are indispensable to Sumitomo Riko's innovation and product quality, especially for automotive vibration control and sound insulation products. Suppliers who engage in joint design and development processes hold significant bargaining power, as their specialized expertise becomes deeply embedded in the final product's performance and intellectual property. This interdependence is crucial for maintaining Sumitomo Riko's competitive edge in advanced material solutions.

- Sumitomo Riko relies on a concentrated base of specialized suppliers for roughly 70% of its core raw materials, including specific rubber polymers and chemical additives as of 2024.

- Collaborative development projects with suppliers have increased by 15% in 2023-2024, integrating their R&D insights directly into new product lines.

- The automotive sector's shift towards electric vehicles further elevates the importance of suppliers providing advanced lightweight and noise-reducing materials.

Sumitomo Riko faces strong supplier power due to reliance on specialized raw materials like natural rubber, which averaged around 160 JPY/kg in early 2024. Market concentration and high switching costs, stemming from rigorous automotive standards, further empower key suppliers. The company projects a 10-15% increase in raw material costs for the fiscal year ending March 2025, reflecting this leverage. Collaborative development with a concentrated base of specialized suppliers (70% of core materials in 2024) also solidifies their influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Raw Material Costs | High volatility, price hikes | Natural Rubber: ~160 JPY/kg (early 2024) |

| Supplier Concentration | Limited sourcing options | 70% core materials from specialized suppliers |

| Switching Costs | Expensive supplier changes | Millions for major component re-qualification |

What is included in the product

This analysis unpacks the competitive landscape for Sumitomo Riko, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and how these forces shape the company's strategic options.

Visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex market dynamics for Sumitomo Riko.

Easily identify and address strategic vulnerabilities by simulating the impact of each Porter's Five Force on Sumitomo Riko's profitability.

Customers Bargaining Power

Sumitomo Riko primarily serves a concentrated group of global automotive original equipment manufacturers. These powerful buyers, such as Toyota or Honda, command significant purchasing volumes, enabling them to exert substantial pressure on pricing and contract terms. For instance, the automotive industry's top 10 OEMs represented over 60% of global vehicle production in 2024, highlighting this concentrated demand. This high customer concentration significantly elevates the bargaining power of Sumitomo Riko's clientele.

The automotive industry maintains intense competition, compelling Original Equipment Manufacturers (OEMs) to relentlessly pursue cost reductions from their suppliers. This significant price pressure directly impacts component manufacturers like Sumitomo Riko, constraining their profit margins. For instance, in 2024, global automotive production forecasts continue to emphasize efficiency, leading OEMs to demand more competitive pricing. This persistent push for lower costs directly limits the profitability of suppliers within the vehicle supply chain.

For standardized components like hoses or anti-vibration rubber parts, automotive OEMs face relatively low switching costs when considering alternative suppliers. This ease of transition empowers customers, granting them significant leverage in price and quality negotiations. Major automakers, who often procure in high volumes, can readily shift orders to secure better terms. This competitive pressure compels companies like Sumitomo Riko to consistently offer competitive pricing and maintain stringent quality standards to retain key clients in 2024.

OEMs' Own Bargaining Power

Large automakers, as key customers, possess substantial bargaining power against suppliers like Sumitomo Riko. Their sophisticated procurement strategies often involve dual-sourcing critical components, a practice that inherently mitigates supply chain risks and intensely fosters price competition among suppliers. This dynamic significantly weakens the negotiation position of individual suppliers, compelling them to adhere to stringent pricing and delivery terms. For instance, major OEMs continued to leverage their scale in 2024, influencing component pricing across the automotive supply chain.

- Automakers' purchasing volumes provide immense leverage.

- Dual-sourcing strategies reduce reliance on any single supplier.

- OEMs demand competitive pricing and high-quality standards.

- The ability to switch suppliers limits price increases from Sumitomo Riko.

Demand for Customization and Value

Original Equipment Manufacturers (OEMs) exert significant pressure on suppliers like Sumitomo Riko. While demanding competitive pricing, OEMs also require high levels of innovation, quality, and highly customized solutions, especially for rapidly evolving electric vehicle (EV) platforms. This dual demand forces suppliers to invest heavily in research and development (R&D) to meet future vehicle specifications while simultaneously maintaining cost efficiency. The automotive industry's shift towards electrification, with global EV sales projected to exceed 17 million units in 2024, intensifies the need for specialized components and new material solutions.

- OEMs demand tailored solutions for new EV models, which often feature unique battery packaging and thermal management requirements.

- Suppliers face immense R&D costs; for instance, the average R&D intensity in automotive parts manufacturing often exceeds 4% of revenue.

- The push for lightweighting and advanced noise-vibration-harshness (NVH) solutions in EVs necessitates continuous material science breakthroughs.

- Customers seek long-term partnerships with suppliers capable of co-developing next-generation automotive technologies.

Sumitomo Riko navigates strong customer bargaining power given its concentrated OEM base, with the top 10 OEMs controlling over 60% of 2024 global vehicle production. Low switching costs and dual-sourcing enable these powerful buyers to enforce competitive pricing and demand continuous innovation. OEMs also compel significant R&D for evolving EV technologies, as global EV sales are projected to exceed 17 million units in 2024.

| Factor | Impact on Sumitomo Riko | 2024 Data Point |

|---|---|---|

| Customer Concentration | High leverage for OEMs | Top 10 OEMs > 60% global vehicle production |

| Switching Costs | Low for standardized parts | OEMs easily shift suppliers |

| Innovation Demand | Increased R&D investment | Global EV sales > 17 million units |

Full Version Awaits

Sumitomo Riko Porter's Five Forces Analysis

This preview showcases the comprehensive Sumitomo Riko Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering no surprises or placeholder content. You're looking at the actual, fully editable analysis, providing actionable insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. Once your purchase is complete, you’ll gain instant access to this precise document, ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The automotive anti-vibration and hose product market features strong global competition, significantly influencing Sumitomo Riko. Major established players like Continental AG, Hutchinson SA, Trelleborg AB, and Vibracoustic GmbH dominate, creating a moderately consolidated yet highly competitive landscape. In 2024, these firms continue to invest heavily in R&D, maintaining intense rivalry through product innovation and pricing strategies. This environment necessitates continuous efficiency improvements and technological advancements from Sumitomo Riko to maintain market share.

The automotive components sector faces intense rivalry, with companies like Sumitomo Riko competing fiercely on price, technology, quality, and service. Original Equipment Manufacturers (OEMs) exert significant pressure for continuous cost reduction, often demanding annual price cuts of 2-3%, alongside stringent quality standards and innovation. This drives suppliers to invest heavily in R&D, as seen with over $100 billion in global automotive R&D spending projected for 2024, to offer advanced solutions and maintain market share. The need to meet evolving vehicle electrification and safety requirements further elevates this competitive landscape.

The global automotive anti-vibration mounting market is experiencing steady yet moderate growth, with projections indicating a compound annual growth rate (CAGR) around 4.5% in 2024. This environment of moderate expansion typically intensifies competitive rivalry, as companies like Sumitomo Riko vie more aggressively for existing market share rather than relying on rapid market expansion. Such conditions can lead to increased price competition and innovation pressures among key players. Given this, firms must strategically differentiate their offerings to maintain profitability and market position.

Product Differentiation and Innovation

To gain a competitive edge, Sumitomo Riko heavily invests in research and development, focusing on innovative products like lightweight materials and advanced solutions for electric vehicles. This strategic push helps them differentiate their offerings in a crowded market. They face robust competition from global chemical giants such as BASF, Dow, and 3M, especially within the automotive noise, vibration, and harshness (NVH) materials sector. In 2024, the demand for sustainable and high-performance automotive components continues to drive this innovation race.

- Sumitomo Riko's R&D focuses on lightweight materials and EV solutions.

- Key competitors include BASF, Dow, and 3M in automotive NVH.

- Innovation is crucial for market differentiation.

- The 2024 automotive market emphasizes sustainable and high-performance components.

Global Market Dynamics

The competitive landscape for Sumitomo Riko is significantly shaped by evolving global market dynamics, particularly the increasing prominence of Chinese suppliers.

These companies have aggressively gained market share and improved profitability in the automotive components sector, intensifying pressure on established Japanese and Western manufacturers like Sumitomo Riko.

For instance, in 2024, Chinese automotive parts manufacturers continued their expansion, with some reporting revenue growth exceeding 15% year-over-year.

This shift necessitates strategic adaptation for companies aiming to maintain competitiveness and profitability.

- Chinese suppliers reported significant market share gains in the automotive rubber and plastic parts segment in 2024.

- Their cost structures often allow for more aggressive pricing, challenging traditional players.

- Sumitomo Riko faces direct competition in key Asian and European markets.

- Profitability margins for some established firms are under pressure due to this rivalry.

The intensifying competitive rivalry, particularly from Chinese automotive component suppliers, significantly pressures Sumitomo Riko. These firms, often benefiting from lower production costs, have aggressively expanded their global footprint, challenging established players. In 2024, their market share gains in segments like anti-vibration rubber components continue to drive price competition and innovation. This dynamic forces companies like Sumitomo Riko to enhance operational efficiencies and innovate to sustain profitability.

| Key Competitor | Primary Focus | 2024 Revenue Growth (Est.) |

|---|---|---|

| Continental AG | Anti-vibration, Automotive Hoses | 4-6% |

| Hutchinson SA | Fluid Transfer, Vibration Control | 3-5% |

| Vibracoustic GmbH | NVH Solutions | 5-7% |

SSubstitutes Threaten

Ongoing research into advanced materials poses a significant threat to Sumitomo Riko's traditional rubber and resin components. Lightweight alternatives such as carbon fiber-reinforced composites, advanced polymers, and high-strength steel alloys are increasingly favored to enhance vehicle fuel efficiency and performance. For instance, the global automotive lightweight materials market was valued at over $85 billion in 2024, continuing its robust expansion. This shift is driven by stricter emission regulations and consumer demand for lighter, more durable vehicles, pressuring manufacturers to adopt these innovative substitutes.

The rapid rise of electric vehicles significantly alters the landscape for vibration and noise damping products. While EVs reduce powertrain vibrations, they introduce new NVH challenges, such as tire and road noise, opening the door for alternative materials and solutions. Projections for 2024 indicate global EV sales could reach over 17 million units, increasing demand for specific lightweight and acoustic damping materials. This shift could see traditional rubber-based components substituted by advanced composites or smart materials, impacting companies like Sumitomo Riko. New suppliers offering these specialized EV-centric solutions pose a direct threat of substitution.

Innovations like advanced 3D printing with specialized additive materials pose a growing threat to traditional manufacturing for Sumitomo Riko. These new methods enable the production of components using novel materials or integrated designs, potentially replacing complex multi-part assemblies from existing suppliers. For instance, the global 3D printing market is projected to reach over $25 billion in 2024, reflecting its expanding capability to produce functional end-use parts. This shift could empower customers to produce components in-house or source from a broader, non-traditional base.

Bio-Based and Sustainable Alternatives

Growing environmental concerns are significantly driving the development of bio-based synthetic rubbers and biodegradable polymers, posing a threat to traditional materials. Companies like Kuraray are actively developing novel components for electric vehicle tires and alternatives to conventional resins, which could serve as substitutes for Sumitomo Riko's offerings. The global bio-based chemicals market is projected to reach USD 115 billion by 2024, reflecting substantial investment and growth in these sustainable alternatives. This shift underscores a clear market trend towards eco-friendly solutions.

- Global bio-based chemicals market projected at USD 115 billion by 2024.

- Increased R&D into sustainable EV tire components.

- Rising consumer and regulatory demand for eco-friendly materials.

- Developments by competitors like Kuraray in bio-based resins.

Integration of Functions

The integration of functions in advanced vehicle designs presents a notable threat of substitution for Sumitomo Riko. For instance, innovative structural battery packs, a growing trend in 2024 electric vehicle architectures, are designed to not only store energy but also contribute to chassis stiffness and vibration damping. This multi-functional approach could significantly diminish the need for Sumitomo Riko's conventional anti-vibration components, impacting future demand. As the automotive industry shifts towards more consolidated and efficient designs, the market for standalone damping solutions may face contraction.

- Global EV market share, projected to exceed 18% in 2024, drives this integration trend.

- OEMs prioritize cost and weight reduction, favoring multi-functional components.

- Sumitomo Riko's reliance on traditional anti-vibration parts faces long-term pressure.

- The shift towards platform-based EV production accelerates component consolidation.

Sumitomo Riko faces significant threats from substitute materials and technologies. Advanced lightweight composites, bio-based polymers, and innovative 3D printed components are increasingly replacing traditional rubber and resin parts, driven by demands for sustainability and performance. The automotive industry's shift towards electric vehicles also favors new multi-functional designs, reducing reliance on conventional anti-vibration solutions. These trends compel Sumitomo Riko to adapt or risk market share.

| Substitute Category | 2024 Market Data | Impact on Sumitomo Riko |

|---|---|---|

| Automotive Lightweight Materials | Over $85 billion | Replaces traditional rubber for weight/efficiency. |

| Global EV Sales | Over 17 million units | Shifts demand to EV-specific damping solutions. |

| Global 3D Printing Market | Over $25 billion | Enables new material use and in-house production. |

| Global Bio-based Chemicals | $115 billion | Drives shift to sustainable material alternatives. |

| Integrated EV Designs | EV market share over 18% | Reduces need for standalone damping components. |

Entrants Threaten

Entering the automotive components manufacturing market requires substantial capital investment, acting as a formidable barrier for new entrants. Establishing state-of-the-art production plants and acquiring specialized machinery demands significant upfront financing. For instance, a new competitor would need to invest heavily in advanced R&D facilities to meet evolving industry standards, a cost often exceeding hundreds of millions of dollars in 2024. This high initial outlay limits the pool of potential newcomers, protecting established players like Sumitomo Riko.

The automotive industry demands exceptionally high standards for quality, safety, and reliability in its components. New players face significant hurdles, needing mandatory certifications such as IATF 16949, which ensures robust quality management systems. Achieving these stringent benchmarks requires deep technical expertise and a long, proven track record. For instance, the cost of compliance and R&D in automotive components can be substantial, often exceeding tens of millions of dollars for new product development and certification processes. This makes it incredibly challenging for new entrants to gain trust and market share against established players like Sumitomo Riko in 2024.

Incumbent suppliers such as Sumitomo Riko maintain deep, integrated relationships with major automotive OEMs, often spanning decades. These long-standing ties, built on trust and proven quality, create a formidable barrier for new entrants. For example, Sumitomo Riko’s global presence, with over 100 bases worldwide, strengthens its position within established supply chains, making it challenging for newcomers to secure significant contracts. Winning the confidence of top automakers like Toyota or Honda requires extensive validation processes and a track record of consistent performance. New players in 2024 face immense hurdles in dislodging these entrenched partnerships and penetrating a market where reliability and established partnerships are paramount.

Economies of Scale

Large, established manufacturers like Sumitomo Riko benefit immensely from economies of scale in purchasing and production, allowing them to achieve a superior cost structure. For instance, their global network, which included 107 bases in 24 countries as of early 2024, enables bulk procurement of materials like rubber and plastics at lower per-unit costs. New entrants would struggle significantly to match these established supply chain efficiencies and production volumes.

- Established players can leverage existing manufacturing facilities for optimized output.

- Bulk purchasing power reduces raw material costs for major companies.

- R&D investments are spread across higher production volumes, lowering per-unit innovation costs.

- New companies face higher initial capital expenditures and operational costs without scale.

Technological Expertise and Patents

New entrants face a significant hurdle in the specialized rubber and resin market due to the deep technological expertise required. Sumitomo Riko, for instance, invests heavily in research and development for its anti-vibration and sound control products.

Developing these advanced materials and applications involves complex processes and often proprietary, patented technologies, which are costly and time-consuming to replicate. This intellectual property acts as a robust barrier, deterring new companies from easily entering the market and competing effectively in areas like automotive components.

- Sumitomo Riko holds over 3,000 global patents.

- Their 2024 R&D investment supports innovation in materials.

- Specialized rubber compounds require years of expertise.

- Anti-vibration technology demands precise engineering.

New entrants into the automotive components market face formidable barriers, primarily due to the immense capital investment needed for advanced facilities and R&D. The industry's stringent quality standards and the deeply entrenched relationships between established players like Sumitomo Riko and major OEMs further deter new competition. Sumitomo Riko's significant economies of scale and extensive patent portfolio make it incredibly challenging for newcomers to compete effectively.

| Barrier Type | Sumitomo Riko Data (2024) | New Entrant Impact |

|---|---|---|

| Capital Investment | R&D costs often exceed hundreds of millions of dollars | High initial outlay, difficulty securing financing |

| Quality & Compliance | Mandatory IATF 16949 certification, tens of millions for R&D | Requires deep expertise, long validation processes |

| Economies of Scale | 107 global bases, bulk procurement efficiencies | Struggle to match cost structure and production volumes |

| Technological Expertise | Over 3,000 global patents, significant R&D investment | Difficult to replicate proprietary technologies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sumitomo Riko leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from trade publications and financial news outlets to understand competitive dynamics.