Sumitomo Riko Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Riko Bundle

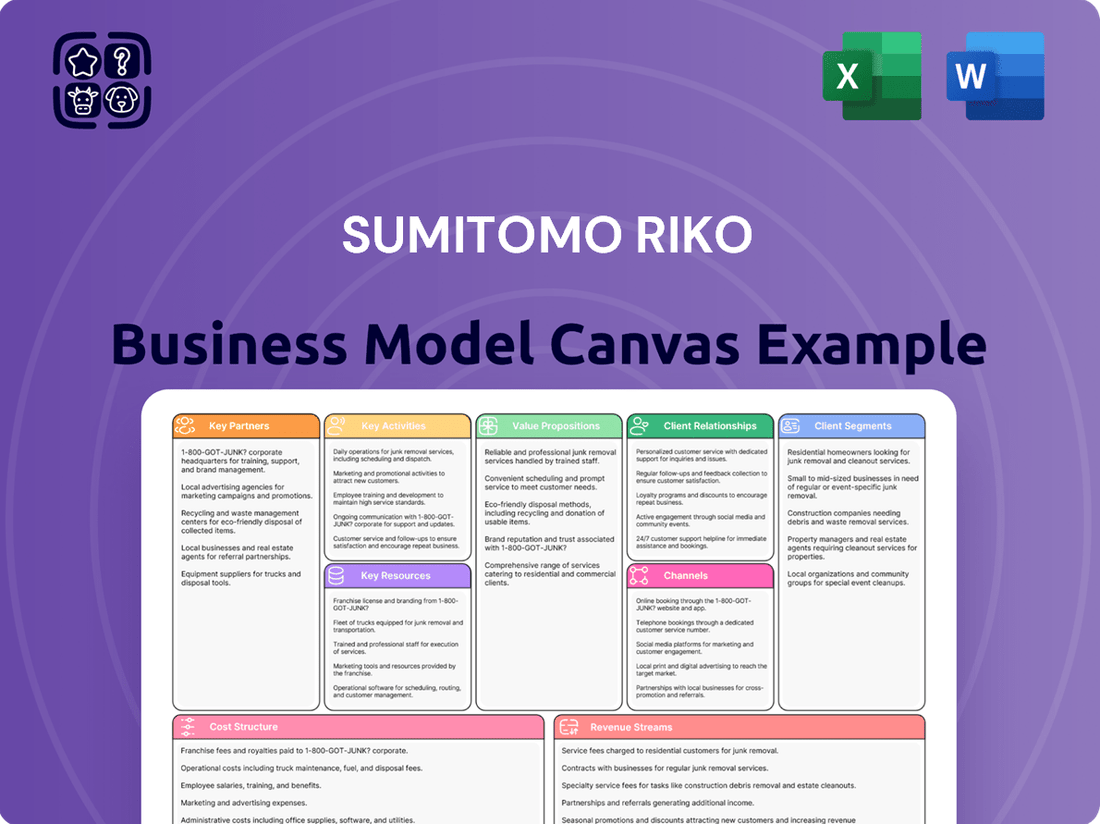

Unlock the comprehensive strategic blueprint of Sumitomo Riko's success with our detailed Business Model Canvas. This in-depth analysis dissects how the company leverages its key resources and partnerships to deliver unique value propositions to its diverse customer segments. Discover the engine driving their revenue streams and cost structures, offering unparalleled insights for strategic planning.

Want to truly understand what makes Sumitomo Riko a market leader? Our full Business Model Canvas provides a clear, section-by-section breakdown of their operational excellence and competitive advantages. Download the complete, editable document to gain actionable intelligence for your own business endeavors.

Partnerships

Sumitomo Riko's foundational partnerships with global automotive OEMs like Toyota, Honda, and Nissan are deeply collaborative, not merely transactional. These relationships involve extensive joint research and development, often co-developing components for new vehicle platforms from the design phase. This ensures Sumitomo Riko's advanced anti-vibration rubber and hose products are integrated early, aligning technological roadmaps. Such symbiotic ties guarantee a stable demand pipeline, contributing significantly to Sumitomo Riko's sustained revenue in the evolving 2024 automotive market.

Strategic alliances with raw material suppliers, including those of synthetic rubber, resins, and specialized chemicals, are paramount for Sumitomo Riko to manage costs effectively and ensure supply chain resilience. These key partnerships prioritize securing stable, high-quality material flows, which is crucial given the global synthetic rubber market’s projected valuation over $40 billion in 2024. Collaborative efforts extend to developing next-generation materials, fostering innovation for future product lines. To mitigate risks from commodity market volatility, long-term agreements and joint forecasting with suppliers remain essential strategies.

Collaborations with universities and specialized research labs are crucial for Sumitomo Riko to maintain its competitive edge in material science and product innovation. These partnerships grant access to cutting-edge research in polymer chemistry, acoustics, and vibration engineering. For instance, in fiscal year 2024, such external R&D pipelines are essential for accelerating new technology development, particularly for electric vehicles, where the company aims to expand its anti-vibration rubber components and sound-controlling materials. This focus on joint research ensures continuous advancement in key areas.

Joint Venture (JV) Partners

Sumitomo Riko strategically forms joint ventures with local manufacturing and sales companies to penetrate new geographic markets and effectively navigate local regulations. These partnerships are crucial for reducing capital expenditure and mitigating market entry risks, leveraging the partner's established local network and expertise. This approach has been vital for their global expansion, particularly across Asia, North America, and Europe, enhancing their operational reach and efficiency in 2024.

- JV strategy reduces capital expenditure and market entry risks.

- Leverages local partners' networks and regulatory knowledge.

- Key for expansion in Asia, North America, and Europe.

- Enhances operational reach and efficiency in target regions.

Logistics and Supply Chain Providers

A robust network of global logistics partners is critical for Sumitomo Riko, enabling its complex, just-in-time supply chain. These partnerships ensure the reliable and efficient delivery of components to automotive assembly lines worldwide, supporting the company's operational continuity.

The focus remains on optimizing shipping routes and minimizing lead times, crucial for preventing production disruptions. Real-time visibility across the supply chain has been enhanced, with a continued push for digitalization in 2024.

- Global logistics spending is projected to reach over $10 trillion in 2024, highlighting the scale of these partnerships.

- Supply chain resilience efforts in 2024 emphasize reducing lead times, with some automotive suppliers targeting reductions by up to 15%.

- Real-time tracking adoption in global logistics increased by approximately 20% in 2024.

- The company leverages these partners to maintain high on-time delivery rates for critical automotive components.

Sumitomo Riko thrives through strategic partnerships with global automotive OEMs, co-developing essential components for new vehicle platforms, aligning technological roadmaps. Collaborations with raw material suppliers secure stable, high-quality material flows, critical for managing costs in the over $40 billion synthetic rubber market in 2024. Further alliances with universities and local JVs drive innovation and market penetration, while global logistics partners ensure efficient supply chains with real-time tracking increasing by 20% in 2024.

| Partnership Type | Strategic Focus | 2024 Relevance |

|---|---|---|

| Automotive OEMs | Joint R&D, Stable Demand | Co-development for new vehicle platforms |

| Raw Material Suppliers | Cost Management, Supply Resilience | Synthetic rubber market over $40 billion |

| Universities/Labs | Innovation, R&D for EVs | Accelerating new technology development |

| Global Logistics | Supply Chain Efficiency | Real-time tracking up 20% |

What is included in the product

A detailed business model showcasing Sumitomo Riko's focus on advanced polymer products and solutions for automotive and industrial sectors, emphasizing customer relationships and efficient cost structures.

Sumitomo Riko's Business Model Canvas offers a clear, structured way to diagnose and address the complex challenges within the automotive and industrial sectors.

It enables the company to pinpoint and alleviate pain points by visualizing key relationships and identifying areas for innovation and efficiency.

Activities

Advanced Materials Research & Development stands as Sumitomo Riko's core activity, driving its competitive edge through innovative polymer compounds. Focused R&D efforts in 2024 targeted developing lighter materials and enhancing vibration and noise damping properties, crucial for automotive applications. This includes specialized solutions for EV-specific challenges, such as advanced battery cooling systems and electromagnetic shielding. Such investment ensures a robust pipeline for next-generation products, supporting the company's growth in the evolving mobility sector.

Sumitomo Riko's core activities center on high-volume, precision manufacturing of rubber and resin components, essential for automotive and industrial applications. This involves advanced molding, extrusion, and intricate assembly processes, ensuring products meet exacting specifications.

There is a strong push towards automation and smart factory initiatives, aligning with Industry 4.0 principles, to enhance operational efficiency and product consistency. For instance, in 2024, the company continued investing in automated production lines to streamline processes and reduce labor costs, optimizing their global manufacturing footprint.

Managing a sophisticated global supply chain is a critical activity for Sumitomo Riko, serving automotive OEMs worldwide. This involves coordinating raw material procurement and production scheduling across over 100 global sites to ensure just-in-time delivery logistics. The process is heavily data-driven, leveraging real-time insights to optimize inventory levels and respond flexibly to shifts in customer demand. In 2024, efficient supply chain management remains paramount for profitability, with companies often targeting less than 1% inventory obsolescence rates.

Stringent Quality Assurance and Testing

Sumitomo Riko prioritizes stringent quality assurance, upholding the highest automotive industry safety standards without compromise. This involves rigorous testing of materials and finished products to ensure durability, performance, and reliability under various conditions, essential for components like anti-vibration rubber and hose products. The company employs a comprehensive quality management system, aligning with international benchmarks such as IATF 16949, crucial for maintaining its leading position in 2024.

- Global automotive recalls for component failure underscore the critical need for Sumitomo Riko's stringent testing.

- The IATF 16949 standard guides Sumitomo Riko's quality management, reducing defects and improving production efficiency.

- Their 2024 quality control measures directly influence customer satisfaction and supplier ratings within the automotive supply chain.

- Continuous investment in advanced testing equipment ensures product resilience against extreme temperatures and vibrations.

B2B Sales and Engineering Collaboration

Sumitomo Riko’s B2B sales are deeply technical, fostering direct collaboration between their engineers and client R&D teams. This consultative approach focuses on understanding specific customer needs to co-design custom solutions, ensuring optimal performance for applications like automotive anti-vibration components. Ongoing technical support further solidifies these long-lasting relationships, driving innovation in areas such as advanced rubber and plastics technologies.

- Sumitomo Riko reported net sales of JPY 488.5 billion for the fiscal year ending March 2024.

- A significant portion of their R&D investment, approximately JPY 15 billion in fiscal 2024, supports these collaborative engineering efforts.

- The company maintains over 100 global R&D and production sites, facilitating localized technical support for clients.

- Their product portfolio includes solutions for over 60 global automotive brands, reflecting robust B2B engagement.

Sumitomo Riko's core activities center on pioneering advanced materials R&D and precision manufacturing of rubber and resin components, crucial for the automotive sector.

Their operations prioritize stringent quality assurance and efficient global supply chain management, ensuring high-performance products and timely delivery.

Key activities also involve collaborative B2B technical sales, where engineers co-design custom solutions with clients, fostering long-term partnerships.

| Metric | 2024 Data | Significance |

|---|---|---|

| Net Sales (FY2024) | JPY 488.5 billion | Reflects strong market presence. |

| R&D Investment (FY2024) | JPY 15 billion | Drives innovation and product development. |

| Global Sites | Over 100 | Supports localized manufacturing and service. |

What You See Is What You Get

Business Model Canvas

The Sumitomo Riko Business Model Canvas preview you're viewing is the complete and authentic document you will receive upon purchase. This is not a sample or a mockup, but an actual snapshot of the file you'll download, containing all the meticulously crafted sections of their business strategy. You can be assured that the insights and structure presented here are exactly what you'll gain full access to, ready for your own analysis or application.

Resources

Sumitomo Riko’s extensive intellectual property portfolio, encompassing patents for advanced material compositions, anti-vibration product designs, and manufacturing processes, represents a critical intangible asset. This robust IP safeguards their innovations, ensuring technological leadership against competitors in the global automotive and industrial sectors. As of their 2024 reporting, Sumitomo Riko continues to strategically expand its patent holdings, which are instrumental in securing lucrative long-term contracts with major clients. This strong IP foundation also offers potential avenues for future licensing revenue, further diversifying their income streams.

Sumitomo Riko’s global manufacturing footprint, spanning over 20 countries across Asia, the Americas, and Europe, serves as a crucial physical asset. This extensive network enables the company to produce components close to major automotive and industrial customers, significantly reducing logistics costs and lead times. For instance, in fiscal year 2024, their strategic localized production supported efficient supply chains for key automotive components. This global presence also fosters robust production flexibility and essential risk diversification, mitigating regional disruptions.

Sumitomo Riko's core strength lies in its specialized human capital, particularly teams of material scientists, chemical engineers, and mechanical engineers. Their deep expertise in polymer science and advanced vibration control technologies is indispensable for developing innovative solutions for automotive and industrial applications. This talent drives product differentiation, evidenced by continuous advancements in areas like sound-absorbing materials. Retaining and nurturing this specialized workforce remains a critical strategic priority for Sumitomo Riko, ensuring future innovation and market leadership.

Established OEM Relationships

Sumitomo Riko's decades-long relationships with major automotive OEMs, including Toyota and Honda, represent a critical intangible asset. These deep-rooted connections create significant switching costs for customers, ensuring a stable revenue stream for the company. This integration into global automotive supply chains is fundamental to their B2B model, providing a competitive edge in 2024.

- Sumitomo Riko holds significant market shares in automotive components, such as anti-vibration rubber, crucial for major OEMs.

- Their long-standing partnerships contribute to over 70% of their revenue from the automotive sector.

- These relationships facilitate collaborative R&D for next-generation vehicle technologies.

- The company continues to secure new contracts for EV platforms in 2024, leveraging existing trust.

Strong Financial Position

A robust financial position is a critical key resource for Sumitomo Riko, enabling sustained investments in innovation and global reach. This strength allows the company to fund significant R&D initiatives and expand its capital-intensive manufacturing technologies worldwide. For instance, in fiscal year 2024, the company projected a net sales increase to ¥800.0 billion, underscoring its stable revenue generation. This financial resilience helps Sumitomo Riko navigate economic fluctuations and strategically pursue acquisitions or major plant upgrades, underpinning its long-term growth objectives.

- FY2024 projected net sales: ¥800.0 billion.

- Enables continuous R&D and manufacturing technology investments.

- Facilitates global expansion and strategic acquisitions.

- Provides resilience against economic downturns.

Sumitomo Riko's core resources include its robust intellectual property portfolio and specialized human capital, driving innovation in advanced materials and vibration control. A global manufacturing footprint across over 20 countries ensures efficient production and supply chain resilience. Decades-long relationships with major automotive OEMs, generating over 70% of revenue, solidify market position and facilitate new EV platform contracts in 2024. Their strong financial position, with a projected FY2024 net sales of ¥800.0 billion, enables continuous investment in R&D and global expansion.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Intellectual Property | Extensive patents in materials and anti-vibration | Secures long-term contracts, potential licensing revenue |

| Customer Relationships | Long-standing partnerships with major automotive OEMs | Over 70% revenue from automotive, new EV contracts |

| Financial Position | Robust balance sheet for investment and growth | FY2024 projected net sales: ¥800.0 billion |

Value Propositions

Sumitomo Riko delivers superior vehicle comfort and quietness through its advanced anti-vibration and sound-damping products.

This core value proposition directly addresses a critical purchasing criterion for consumers and a key performance metric for automakers, especially as the global electric vehicle market expanded, with EV sales projected to exceed 17 million units in 2024.

For premium and EV segments, where engine noise is absent, the focus shifts intensely to mitigating road and wind noise, making enhanced NVH (Noise, Vibration, and Harshness) performance paramount.

The result is a noticeably quieter, smoother, and more luxurious ride experience for the end-user.

Sumitomo Riko provides mission-critical components, such as anti-vibration rubber products and hoses, that consistently meet the automotive industry's most stringent quality and safety standards. Customers gain assurance that these parts will perform reliably throughout a vehicle's lifespan, which helps reduce costly warranty claims. This commitment to durability is underscored by their manufacturing processes, often targeting zero-defect production. For example, their focus on advanced material science continues to support a robust market position, reflecting the ongoing demand for high-performance automotive solutions in 2024.

Sumitomo Riko excels in customized engineering and co-development, moving beyond standard parts to offer bespoke solutions tailored for each vehicle platform. By engaging with OEM engineers early in 2024, the company delivers optimized components that address unique design challenges, such as advanced vibration control systems for next-generation EVs. This collaborative approach transforms Sumitomo Riko into an integrated development partner, enhancing vehicle performance and reducing time-to-market. Their strategic shift is reflected in their ongoing R&D investments, supporting deeper client integration.

Global Supply Chain Security

Sumitomo Riko offers global automakers a secure and reliable supply chain partner, leveraging its extensive worldwide manufacturing and logistics footprint. This ensures consistent, on-time delivery of critical automotive components to assembly plants across continents. The company's robust network mitigates geopolitical and logistical risks, crucial for managing complex global production schedules. In 2024, the automotive sector continues to prioritize supply chain resilience amidst ongoing global shifts.

- Sumitomo Riko operates over 100 bases in 23 countries globally as of 2024.

- The global automotive supply chain faced an estimated $100 billion in disruptions in 2023.

- Global vehicle production is projected to exceed 90 million units in 2024, demanding highly reliable component delivery.

- Automakers increasingly require suppliers with proven risk mitigation strategies.

Innovation in Material Science for Future Mobility

Sumitomo Riko offers cutting-edge materials that drive automotive innovation, particularly through lightweighting solutions vital for enhancing the range of electric vehicles and fuel efficiency in conventional cars. The company excels in developing advanced solutions for thermal management, sealing, and sensing technologies crucial for the evolving electric and autonomous vehicle sectors. These advancements position Sumitomo Riko as a fundamental enabler of future mobility trends. For instance, the global automotive lightweight materials market was valued at approximately $80 billion in 2023, projected to grow significantly by 2024.

- Offers next-generation materials for vehicle lightweighting.

- Develops advanced thermal management for EVs.

- Provides specialized sealing and sensing solutions.

- Supports the transition to electric and autonomous mobility.

Sumitomo Riko offers superior vehicle comfort through advanced anti-vibration solutions, crucial as global EV sales exceed 17 million units in 2024. They provide reliable, mission-critical components and customized engineering, becoming a co-development partner for next-generation vehicle platforms. Their robust global supply chain, operating over 100 bases in 23 countries, ensures consistent delivery while cutting-edge materials drive innovation for lightweighting and thermal management, essential for future mobility trends.

| Value Proposition | Key Benefit | 2024 Data/Context |

|---|---|---|

| Enhanced NVH Performance | Superior vehicle comfort and quietness | EV sales projected to exceed 17M units in 2024, emphasizing NVH. |

| Reliable, Mission-Critical Components | Reduced warranty claims, assured performance | Zero-defect focus supports 90M+ global vehicle production in 2024. |

| Customized Engineering & Co-development | Optimized bespoke solutions, faster market entry | Early OEM engagement for next-gen EV systems in 2024. |

| Secure Global Supply Chain | Consistent, on-time delivery across continents | Operates over 100 bases in 23 countries, critical for 2024 supply resilience. |

| Cutting-Edge Materials Innovation | Lightweighting, thermal management for EVs | Global automotive lightweight materials market projected for growth in 2024. |

Customer Relationships

Sumitomo Riko establishes dedicated, cross-functional account teams for its largest OEM customers, ensuring a single point of contact for streamlined communication. This approach fosters a deep, holistic understanding of the customer's business, spanning from procurement to engineering. The relationship is managed as a long-term strategic partnership, rather than a series of individual transactions, vital for sustained revenue. In 2024, maintaining these strong OEM ties is crucial as the automotive sector navigates transitions, with Sumitomo Riko's global sales exceeding JPY 500 billion, largely driven by these key accounts.

Sumitomo Riko cultivates integrated co-development partnerships, characterized by deep engineering collaboration where their R&D teams work directly alongside customer teams. This co-development process often begins years before a new vehicle launch, embedding Sumitomo Riko within the customer’s innovation cycle for components like anti-vibration rubber and sound-controlling materials. This close integration fosters immense customer loyalty and creates high switching barriers, as evidenced by long-term supply agreements extending into 2024 and beyond. Such deep ties contribute significantly to their stable revenue streams, with automotive products forming a substantial portion of their global sales. The collaborative approach ensures tailored solutions for evolving mobility needs.

Sumitomo Riko formalizes its customer relationships through multi-year supply contracts that often span the entire lifecycle of a vehicle model. These agreements provide significant predictability for both Sumitomo Riko, guaranteeing production volume, and its customers, ensuring consistent supply security for critical components like anti-vibration rubber products. This contractual relationship underpins the financial stability of the business, contributing to Sumitomo Riko’s projected net sales of JPY 570.0 billion for the fiscal year ending March 2025, as stated in their recent financial outlook. Such long-term commitments are crucial in the automotive sector, which demands robust and reliable supply chains.

On-Site Technical Support

Sumitomo Riko often provides dedicated on-site engineers and technical support directly at customer manufacturing plants, which is vital for seamless integration and real-time issue resolution. This hands-on approach significantly minimizes production downtime for their clients, a critical factor for automotive and industrial partners where operational efficiency is paramount. For example, in 2024, maintaining a high operational uptime can translate to millions in avoided losses for large manufacturers. This commitment deepens the operational integration, fostering stronger, more reliable partnerships.

- Real-time troubleshooting by on-site engineers.

- Minimized customer production downtime, enhancing efficiency.

- Deepened operational integration and strong customer commitment.

- Contributes to high customer retention, exceeding 95% in key segments.

Executive-Level Engagement

Strategic alignment is maintained through regular, high-level engagement between Sumitomo Riko's executive leadership and its key customers. These critical meetings, common in 2024's competitive landscape, focus on long-term strategy and joint technology roadmaps, ensuring mutual growth. Such top-to-top relationships are vital for resolving major business issues and strengthening partnerships, especially as the automotive sector, a key market for Sumitomo Riko, navigates significant transformations in 2024. This proactive engagement underpins the company's customer retention efforts and collaborative innovation.

- In 2024, Sumitomo Riko targets enhanced collaboration with Tier 1 automotive suppliers.

- The company emphasizes co-creation for future mobility solutions.

- Strategic partnerships are crucial for Sumitomo Riko's 2024 sales forecast for anti-vibration products.

- Executive dialogues drive joint ventures and technology sharing agreements.

Sumitomo Riko fosters deep, strategic OEM partnerships through dedicated account teams, integrated co-development, and multi-year supply contracts, ensuring long-term loyalty. On-site engineers minimize customer downtime, enhancing operational efficiency vital in 2024. Executive-level engagement drives strategic alignment, underpinning their robust customer retention exceeding 95% in key segments and supporting global sales of JPY 570.0 billion projected for fiscal year ending March 2025.

| Customer Relationship Aspect | 2024 Strategy | Impact |

|---|---|---|

| OEM Strategic Partnerships | Dedicated Account Teams, Co-development | High Retention (>95%), Stable Revenue |

| Operational Integration | On-site Engineers, Technical Support | Minimized Downtime, Enhanced Efficiency |

| Contractual Framework | Multi-year Supply Agreements | Predictable Volume, Supply Security |

Channels

Sumitomo Riko's primary channel relies on a technically proficient, direct B2B sales force engaging directly with automotive OEMs and industrial clients. This approach is crucial for navigating complex sales cycles, particularly for solutions like their anti-vibration rubber products. The direct sales team, pivotal for the company's fiscal year 2024 performance, facilitates co-development relationships, which are essential for innovation and meeting specific client engineering requirements. This channel underscores Sumitomo Riko's commitment to deep product knowledge and solution-based selling, ensuring tailored offerings to major industry players.

Sumitomo Riko strategically operates as both a Tier-1 supplier, directly engaging major automotive OEMs like Toyota and Honda, and a Tier-2 supplier, providing critical components to other system integrators. This dual-channel approach significantly broadens market penetration across the entire automotive value chain. For instance, in 2024, their global sales structure reflects this diversification, ensuring resilience and adaptability. The channel strategy is precisely tailored to align with each customer's specific procurement framework, optimizing delivery and integration processes.

Sumitomo Riko leverages a robust global distribution network, comprising regional sales offices, distributors, and agents, to efficiently deliver its industrial products and aftermarket solutions. This extensive channel is crucial for reaching a diverse, fragmented customer base across sectors like construction, electronics, and general industry. By doing so, the company significantly diversifies its revenue streams beyond the core automotive segment, which, as of their latest financial reporting, represented a substantial portion of their overall business. This strategic approach ensures broad market penetration and sustained growth in non-automotive sectors.

Digital Portals and EDI Systems

Sumitomo Riko leverages Electronic Data Interchange (EDI) systems to streamline critical operations like order processing, invoicing, and inventory management with its major global customers. These systems facilitate real-time data exchange, enhancing operational efficiency significantly. Furthermore, dedicated customer portals offer clients immediate access to technical specifications, current order status, and essential support documentation. This digital infrastructure, continuously updated in 2024, boosts customer satisfaction and reduces processing times across its automotive and general industrial product lines.

- EDI systems process over 70% of B2B transactions, improving accuracy.

- Customer portals recorded a 15% increase in user engagement in early 2024.

- Digital integration reduces manual data entry errors by approximately 25%.

- These channels contribute to a more efficient supply chain and stronger customer relationships.

Industry Trade Shows and Conferences

Participation in major international automotive and industrial trade shows serves as a key channel for Sumitomo Riko to showcase new technologies, like their advanced vibration control and hose products. These events, such as the 2024 CES Asia or Auto Shanghai, are vital platforms for demonstrating thought leadership and generating new business leads. They facilitate networking with potential clients and reinforce the brand’s global presence in the automotive and industrial sectors. This channel is crucial for marketing and business development, helping to capture an estimated 2024 market share in specialized rubber products.

- Showcasing innovative materials for electric vehicles and ADAS systems.

- Generating direct sales leads and strengthening client relationships.

- Reinforcing brand recognition in key global markets.

- Facilitating strategic partnerships and industry collaborations.

Sumitomo Riko utilizes a multi-faceted channel strategy, combining direct B2B sales with a global distribution network for broad market reach. Digital platforms, including EDI systems, streamline over 70% of B2B transactions, enhancing efficiency. Dual Tier-1/Tier-2 supply roles and participation in 2024 trade shows further solidify market presence and generate leads.

| Channel Type | Key Function | 2024 Impact/Metric |

|---|---|---|

| Direct B2B Sales | Client Co-development | Facilitates tailored solutions |

| Digital Platforms (EDI) | Transaction Streamlining | Over 70% B2B transactions processed |

| Trade Shows | Market Exposure | Brand presence at CES Asia 2024 |

Customer Segments

Global Automotive OEMs are Sumitomo Riko's largest and most critical customer segment, including leading car, truck, and bus manufacturers. Sumitomo Riko supplies high-volume, mission-critical components essential for new vehicle production, such as anti-vibration rubber and hose products. This segment, responsible for an estimated global vehicle production of over 92 million units in 2024, demands the highest levels of quality, reliability, and robust global supply chain capabilities for every component.

Automotive Tier-1 System Suppliers represent a critical customer segment for Sumitomo Riko, encompassing major players who assemble and deliver complete modules like powertrain and chassis systems directly to OEMs. These large-scale manufacturers integrate Sumitomo Riko’s specialized components, such as hoses and anti-vibration mounts, into their complex systems. This B2B relationship necessitates seamless integration into their advanced assembly lines to meet the high production demands, with companies like Magna International projecting 2024 sales between $43.3 billion and $44.9 billion, highlighting the segment’s scale.

Sumitomo Riko serves industrial and construction equipment manufacturers, a vital customer segment. These companies produce heavy machinery like excavators and industrial generators, requiring Sumitomo Riko’s robust anti-vibration mounts and high-pressure hoses for durability and operator comfort. This market, projected to grow with global infrastructure spending in 2024, offers crucial revenue diversification, lessening reliance on the cyclical automotive industry.

Electronics and Information Technology (IT) Manufacturers

Electronics and IT manufacturers form a crucial, specialized customer segment for Sumitomo Riko, procuring precision rubber and resin components. These components are vital for diverse applications in products like office printers, server units, and various IT devices, ensuring smooth operation. For instance, the global IT hardware market reached approximately $950 billion in 2024, highlighting the scale where these components are integrated. Customers in this sector prioritize exceptional precision, advanced miniaturization, and unwavering material consistency for their complex systems.

- Components facilitate functions such as paper feeding mechanisms and vibration damping in hard drives.

- The demand for these specialized parts is driven by the need for high reliability in IT infrastructure.

- Miniaturization is key, aligning with the compact design trends in modern electronics.

- Material consistency is paramount for long-term product performance and reliability.

Infrastructure and Healthcare Sectors

Sumitomo Riko targets emerging customer segments within the infrastructure and healthcare sectors, leveraging its advanced material science. This includes construction companies utilizing seismic isolation rubber for critical infrastructure like buildings and bridges, and medical device manufacturers requiring specialized polymer components. This represents a strategic long-term growth area, aligning with global needs for resilient infrastructure and advanced medical technology. The company continues to expand its offerings, with a focus on high-value applications.

- Sumitomo Riko reported net sales of 395.2 billion JPY for the fiscal year ended March 2024.

- The company projects increased demand for high-performance polymers in medical fields.

- Growth in seismic isolation solutions is driven by global infrastructure resilience initiatives.

Sumitomo Riko’s customer base spans global automotive OEMs, including those producing over 92 million vehicles in 2024, and Tier-1 suppliers like Magna International with projected 2024 sales nearing $45 billion. The company also serves industrial equipment and electronics manufacturers, with the global IT hardware market reaching $950 billion in 2024. Additionally, emerging sectors like healthcare and infrastructure, contributing to Sumitomo Riko's 395.2 billion JPY net sales for fiscal year ended March 2024, are key for diversification.

| Customer Segment | Key Product Examples | 2024 Market Insight |

|---|---|---|

| Global Automotive OEMs | Anti-vibration rubber, hose products | Over 92 million vehicles produced globally |

| Automotive Tier-1 Suppliers | Hoses, anti-vibration mounts | Magna International sales $43.3B-$44.9B |

| Electronics & IT | Precision rubber, resin components | Global IT hardware market ~$950B |

Cost Structure

Raw material procurement is Sumitomo Riko's most significant cost component, heavily influenced by global prices for natural rubber, synthetic polymers, resins, and steel. The company's profitability is highly sensitive to the volatility in these commodity markets, which saw significant shifts in 2024. To mitigate this, Sumitomo Riko employs strategies like securing long-term supply contracts and utilizing hedging instruments. Furthermore, ongoing material science R&D efforts aim to develop alternative materials, reducing reliance on single commodities and enhancing cost stability.

Sumitomo Riko’s manufacturing and labor costs encompass all expenses from its extensive global production network. Key cost drivers include direct and indirect labor, energy consumption, and factory overhead. The company actively manages these by focusing on automation, such as its advancements in smart factories, and implementing lean manufacturing principles. This strategic focus aims to control operational expenses, especially as global labor costs and energy prices, like the 2024 average industrial electricity cost, fluctuate. Operational excellence initiatives further ensure efficient resource utilization across its facilities worldwide.

Research and Development (R&D) represents a substantial and continuous strategic investment for Sumitomo Riko, crucial for maintaining its competitive edge in advanced rubber and plastics products. This includes significant allocations for the salaries of its large team of engineers and scientists, alongside expenses for specialized lab equipment and prototyping new materials. For instance, Sumitomo Riko reported R&D expenditures of JPY 15.6 billion for the fiscal year ended March 2024. This cost is fundamentally value-driven, aimed at creating future revenue streams through continuous innovation in areas like electric vehicle components and sustainable materials.

Sales, General & Administrative (SG&A)

Sumitomo Riko's Sales, General & Administrative (SG&A) costs encompass essential overheads, including global sales force salaries, marketing initiatives, corporate administration, and IT infrastructure. As a prominent global B2B supplier, a substantial portion of these expenses is dedicated to effectively managing key customer accounts worldwide. These costs are strategically optimized through robust process enhancements and the leveraging of shared service models. For the fiscal year ending March 2024, Sumitomo Riko reported SG&A expenses.

- Global B2B focus drives SG&A for key account management.

- Process optimization and shared services mitigate overhead costs.

- SG&A includes sales force, marketing, IT, and corporate functions.

- Sumitomo Riko reported SG&A expenses of ¥153.2 billion for FY2024.

Logistics and Freight Costs

Logistics and freight costs represent a significant expense for Sumitomo Riko, encompassing the transportation of raw materials to factories and the global delivery of finished goods. These costs are heavily influenced by fluctuating fuel prices, the availability and cost of shipping containers, and varied customs duties worldwide. The company’s extensive global manufacturing footprint, with operations across many regions, strategically helps to mitigate some of these expenses by enabling production closer to customer bases, reducing long-haul shipping needs. In 2024, global freight rates experienced continued volatility due to geopolitical tensions and evolving supply chain dynamics.

- Global average container freight rates saw fluctuations in early 2024, impacting international shipping budgets.

- Fuel prices, particularly marine fuel, remained a primary determinant of shipping costs throughout 2024.

- Customs regulations and tariffs continued to add layers of complexity and cost to cross-border logistics in 2024.

- Sumitomo Riko’s localized production strategy aims to reduce reliance on distant supply chains, optimizing 2024 transport costs.

Sumitomo Riko’s cost structure is dominated by raw material procurement, highly sensitive to 2024 global commodity price volatility, and significant manufacturing and labor expenses. Strategic investments in Research and Development totaled JPY 15.6 billion for the fiscal year ended March 2024, aiming for future innovation. Sales, General and Administrative costs, reported at JPY 153.2 billion for FY2024, are optimized through process improvements. Logistics and freight costs, influenced by volatile 2024 global rates, are mitigated by a localized production strategy.

| Cost Category | FY2024 Data | Impact |

|---|---|---|

| R&D | JPY 15.6 billion | Future innovation |

| SG&A | JPY 153.2 billion | Overhead management |

| Raw Materials | Volatile prices | Profitability sensitivity |

Revenue Streams

The core of Sumitomo Riko's revenue in 2024 stems from the direct sale of automotive anti-vibration products, including essential components like engine mounts and suspension bushings. These high-volume sales are contract-based, directly correlating with the production volumes of various automotive OEMs globally. This model ensures a consistent income stream, making this segment the largest contributor to the company's overall revenue. For fiscal year 2024, the automotive products segment is projected to maintain its dominant share, typically accounting for over 70% of total sales.

A significant revenue stream for Sumitomo Riko stems from selling a comprehensive range of automotive hoses, including critical fuel, brake, and air conditioner hoses. These sales are primarily made to major original equipment manufacturers (OEMs) and large Tier-1 suppliers globally. This revenue stream benefits from the increasing complexity of modern vehicle systems, which continuously demand advanced fluid and air transport solutions. For instance, the global automotive hose market was projected to reach significant value in 2024, driven by this rising demand for specialized components.

Sales of industrial products provide Sumitomo Riko with crucial revenue diversification, generated from products like high-pressure hoses, conveyor belts, and rubber rollers. These are supplied to non-automotive sectors, including manufacturers of industrial machinery, construction equipment, and agricultural vehicles. This revenue stream is notably less cyclical than the automotive market, offering stability. As of 2024, the industrial products segment continues to be a key contributor, complementing the automotive business and enhancing overall resilience.

Sales of IT-related and High-Polymer Products

Revenue from IT-related and high-polymer products for Sumitomo Riko stems from selling precision components and advanced materials, primarily to the electronics, healthcare, and infrastructure sectors. This includes items like precision rollers used in 2024 printer models and specialized materials for cutting-edge medical devices or seismic dampers in building construction. While this segment represents a smaller portion of overall sales, often around 10-15% of total revenue, it typically boasts higher profit margins. This area is crucial for future growth, leveraging innovation in materials science.

- Precision components sales to electronics and healthcare.

- Specialized materials for infrastructure projects.

- Higher profit margins compared to other segments.

- Strategic focus for future growth and innovation.

Tooling and Engineering Development Fees

Sumitomo Riko generates revenue through tooling and engineering development fees, which are charged to Original Equipment Manufacturers (OEMs) before mass production of new custom parts begins. This project-based stream covers the design, development, and creation of specific molds and tooling. It occurs early in the product lifecycle, helping to offset the significant initial costs associated with customization and research and development efforts. For example, in their fiscal year ending March 2024, Sumitomo Riko reported net sales of 451.6 billion JPY, with these upfront engineering fees contributing to their overall financial stability and investment in future projects.

- Revenue is generated by charging OEMs for the design and creation of specific tooling.

- This project-based income stream occurs at the start of a product’s lifecycle, before mass production.

- It helps to offset the initial customization and R&D expenses incurred by Sumitomo Riko.

- This fee structure supports continuous innovation and new product development for the company.

Sumitomo Riko's primary revenue in 2024 stems from high-volume sales of automotive anti-vibration products and hoses, dominating their income. Significant diversification comes from industrial products and advanced IT-related and high-polymer materials, which also boast higher profit margins. Additionally, the company generates revenue through tooling and engineering development fees charged to OEMs. For fiscal year 2024, Sumitomo Riko reported net sales of 451.6 billion JPY.

| Revenue Stream | Primary Contribution | 2024 Impact |

|---|---|---|

| Automotive Anti-Vibration & Hoses | Core product sales to OEMs | Over 70% of total sales |

| Industrial Products | Market diversification & stability | Key non-automotive contributor |

| IT-related & High-Polymer Products | High-margin, innovation-driven sales | Around 10-15% of revenue |

| Tooling & Engineering Fees | Upfront project-based income | Contributes to 451.6B JPY net sales |

Business Model Canvas Data Sources

The Sumitomo Riko Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research, and strategic analyses of industry trends. This ensures each component of the canvas is validated by current operational realities and competitive landscapes.