Stone Canyon Industries LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stone Canyon Industries LLC Bundle

Gain a strategic advantage by understanding the external forces impacting Stone Canyon Industries LLC. Our PESTLE analysis meticulously dissects political, economic, social, technological, legal, and environmental factors, revealing critical opportunities and potential threats. Equip yourself with actionable intelligence to navigate the complexities of the market and refine your strategy. Don't let external shifts catch you off guard; download the full PESTLE analysis now and unlock a deeper understanding of Stone Canyon Industries LLC's operating landscape.

Political factors

Government policies directly shape the landscape for companies like Stone Canyon Industries LLC, especially those involved in industrial, transportation, and infrastructure. The US Bipartisan Infrastructure Investment and Jobs Act (IIJA), enacted to revitalize the nation's infrastructure, is a prime example. This legislation is expected to stimulate significant economic activity, with projections indicating it could add 800,000 jobs by 2025.

The IIJA allocates substantial funding, estimated in the hundreds of billions of dollars, towards critical areas such as road and bridge repair, public transit expansion, broadband deployment, and the development of clean energy infrastructure. These large-scale government initiatives translate into tangible opportunities for Stone Canyon Industries' diverse portfolio companies that operate within these vital sectors, potentially boosting demand for their products and services.

Shifting global trade policies and the imposition of tariffs directly influence Stone Canyon Industries LLC's operational costs and supply chain stability. For instance, in 2024, the World Trade Organization (WTO) reported an increase in trade-restrictive measures globally, impacting sectors reliant on international sourcing.

Geopolitical friction and a rise in protectionist stances, including tariffs on imported components, create significant price volatility and uncertainty for industrial manufacturers like Stone Canyon. This can disrupt the flow of essential raw materials, leading to higher production expenses.

To navigate this, continuous vigilance over evolving regulatory landscapes and tax structures is crucial for Stone Canyon. Adapting production schedules and supply chain strategies in response to these changes is key to maintaining competitiveness and mitigating risks.

Political stability within Stone Canyon Industries LLC's operational regions is paramount, especially considering geopolitical complexities are a significant hurdle for the industrial manufacturing sector. For instance, the U.S. manufacturing sector, a key area for many industrial firms, faced ongoing supply chain disruptions in 2024, partly driven by international tensions. This instability can force companies to be less agile in managing their supply chains and sourcing strategies, potentially increasing costs and lead times.

Furthermore, the aftermath of major elections in 2024 and anticipated elections in 2025 presents a critical consideration. Policy shifts following these electoral events can dramatically influence supply chain operations, alter market demand for manufactured goods, and impact long-term capital investment decisions for companies like Stone Canyon Industries LLC. For example, changes in trade tariffs or environmental regulations stemming from new administrations can quickly reshape the competitive landscape.

Regulatory Environment and Compliance

Stone Canyon Industries LLC operates within a complex and often fragmented global regulatory landscape. This presents a significant challenge, especially concerning Environmental, Social, and Governance (ESG) factors. For instance, the European Union has been actively strengthening its ESG regulations, with initiatives like the Corporate Sustainability Reporting Directive (CSRD) demanding more detailed disclosures from companies. In contrast, the United States has seen periods of both increased and decreased regulatory focus on environmental and social issues, creating an unpredictable operating environment.

Navigating these diverging regulatory approaches is paramount for Stone Canyon Industries. The company must meticulously track and adapt to evolving ESG standards to ensure compliance across its diverse portfolio. Failure to do so could lead to penalties, reputational damage, and operational disruptions. By 2024, the global ESG reporting market was estimated to be worth billions, highlighting the increasing importance of robust compliance frameworks.

- Divergent ESG Legislation: The EU's stringent ESG rules contrast with potentially more relaxed approaches in other major economies, requiring tailored compliance strategies.

- Evolving Standards: Continuous monitoring of new regulations and industry best practices is essential for maintaining compliance and mitigating risk.

- Impact on Operations: Regulatory changes can directly affect manufacturing processes, supply chain management, and product development, necessitating proactive adaptation.

- Investor Expectations: Increasingly, investors are scrutinizing companies' ESG performance, making regulatory compliance a key factor in capital allocation decisions.

Industrial Policy and Reshoring Initiatives

Government industrial policies, particularly those encouraging reshoring and nearshoring, present a dynamic landscape for companies like Stone Canyon Industries LLC. These initiatives, aimed at strengthening domestic manufacturing capabilities, can offer tangible benefits such as tax credits or subsidies for bringing production back home. For instance, the US CHIPS and Science Act of 2022 allocated $52.7 billion to boost domestic semiconductor manufacturing, a sector relevant to many industrial supply chains. However, the success of such policies hinges on the availability of local supply chains for critical components, which can still be a bottleneck.

Stone Canyon Industries LLC, operating across various industrial sectors, must remain agile to navigate these evolving global manufacturing footprints. The drive towards localized production, while beneficial for domestic job creation and supply chain security, can also introduce complexities. Challenges may arise in sourcing specialized raw materials or intermediate goods that are not yet readily available domestically, potentially increasing production costs or lead times in the short to medium term. Adapting to these shifts requires strategic planning around procurement and production strategies.

- Government Incentives: Policies like the Inflation Reduction Act of 2022 offer significant tax credits for clean energy manufacturing in the US, potentially benefiting Stone Canyon’s portfolio if it includes relevant operations.

- Supply Chain Dependencies: Despite reshoring efforts, reliance on specific imported components, especially in advanced manufacturing, remains a persistent challenge for many industries.

- Geopolitical Influences: Trade tensions and national security concerns continue to drive government policies that favor domestic or allied-nation production, impacting global sourcing decisions.

- Economic Impact: Reshoring initiatives can lead to job growth in manufacturing sectors but may also necessitate investments in workforce training and infrastructure development to support increased domestic capacity.

Government policies, particularly infrastructure spending and trade regulations, significantly impact Stone Canyon Industries LLC. The US Bipartisan Infrastructure Investment and Jobs Act, a multi-hundred-billion-dollar initiative, is a key driver for sectors Stone Canyon operates in, potentially boosting demand for its products and services through 2025.

Global trade policies and rising protectionism, including tariffs, create cost volatility and supply chain uncertainty for industrial manufacturers like Stone Canyon. The WTO’s 2024 report indicated an increase in trade-restrictive measures, directly affecting companies reliant on international sourcing.

Political stability and evolving ESG regulations are crucial. Geopolitical tensions in 2024 impacted US manufacturing supply chains, and differing ESG compliance standards, like the EU's CSRD, require careful navigation for Stone Canyon's diverse operations.

Government incentives for reshoring, such as those in the US CHIPS Act, offer opportunities but also highlight ongoing dependencies on specific imported components, requiring agile strategic planning for Stone Canyon Industries LLC.

What is included in the product

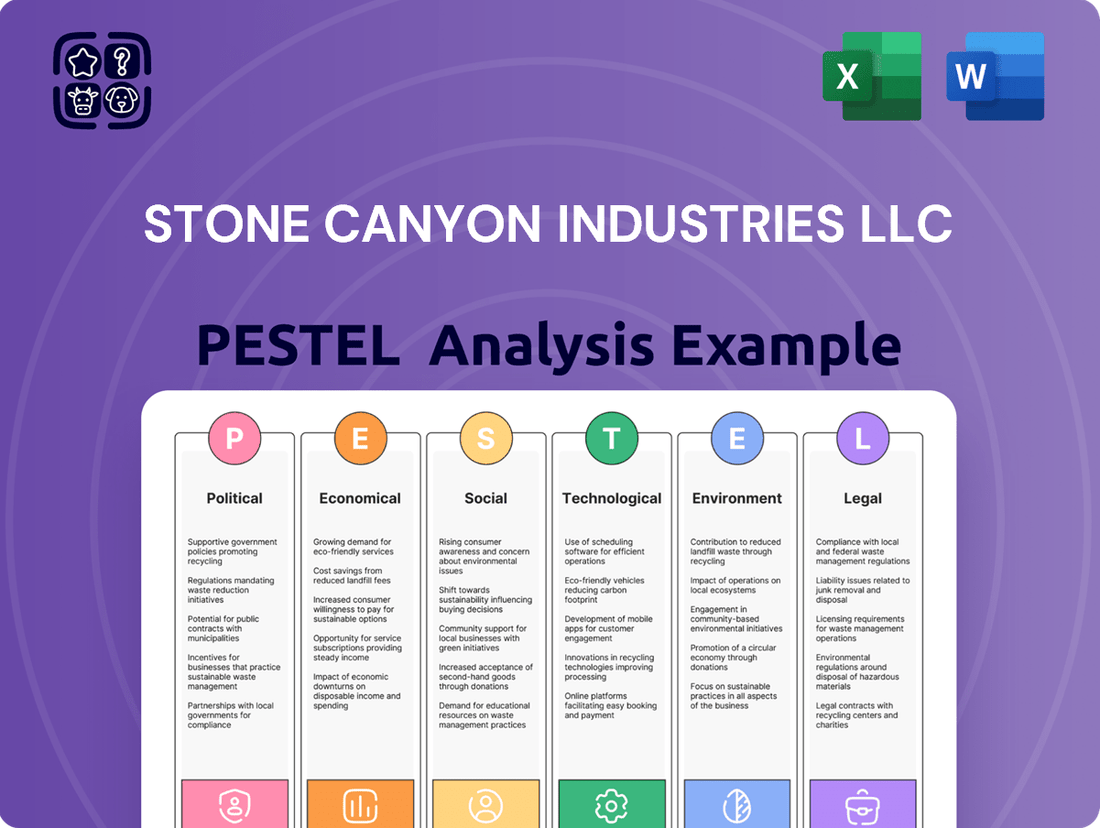

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Stone Canyon Industries LLC across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into potential threats and opportunities, enabling strategic decision-making and proactive adaptation to market shifts.

This PESTLE analysis for Stone Canyon Industries LLC provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, helping to relieve the pain point of information overload.

Visually segmented by PESTEL categories, it allows for quick interpretation at a glance, simplifying complex external factors and supporting strategic decision-making.

Economic factors

The health of the global economy is a crucial driver for Stone Canyon Industries LLC, as its portfolio companies operate in sectors like industrial, transportation, and infrastructure, which are highly sensitive to economic cycles. For instance, while manufacturing PMIs showed some expansion in early 2024, a noticeable dip back into contraction by July 2024 signals a potential slowdown in industrial demand.

A broader global economic slowdown, if it materializes more significantly than anticipated, could directly impact travel demand and general consumer spending. This would likely dampen the need for transportation infrastructure projects and related services, directly affecting Stone Canyon's businesses.

Inflation remains a significant consideration, with the producer price index for input materials and components showing stabilization but still at elevated levels. Concurrently, total compensation costs continue their upward trend, impacting operational expenses.

Higher interest rates, a persistent feature of the economic landscape in 2024 and projected into 2025, present substantial headwinds for near-term industrial expansion. This challenging interest rate environment directly affects the cost of capital and investment decisions.

For infrastructure projects, a slower-than-anticipated reduction in interest rates could exacerbate interest cost burdens. For instance, if benchmark rates remain elevated longer than forecasted, the financing costs for long-term capital investments will be higher, potentially delaying or scaling back project timelines.

Global economic uncertainties and ongoing supply chain disruptions continued to present significant challenges for Stone Canyon Industries LLC through 2024. While improvements have been noted since the peak of the pandemic in 2020-2022, supply chains have not fully reverted to their pre-pandemic efficiency levels. This persistent strain impacts operational costs and timelines, a trend expected to continue as the International Monetary Fund (IMF) projected global growth to moderate in 2024.

The absence of standardized supply chain practices across industries is a key factor contributing to elevated costs. These inefficiencies directly affect Stone Canyon's operational expenses, potentially hindering productivity gains and increasing the environmental footprint of its logistics. For instance, the continued reliance on less predictable shipping routes and the need for larger buffer stocks add to overall expenditure, a concern echoed by reports indicating a 5% increase in global logistics costs year-over-year in early 2024.

Investment and Capital Markets

Stone Canyon Industries LLC's investment strategy, focused on a 'buy, build, and hold' model, aims for sustained long-term value. The company secured significant financing in both 2024 and 2025, bolstering its capacity to invest further in core assets such as Morton Salt and Reddy Ice. This strategic financial maneuvering underscores a commitment to growth and operational enhancement within its portfolio companies.

The capital markets environment in 2024 and into 2025 shows continued robustness for platforms aligning with modular infrastructure and automation-driven logistics. This sustained investor appetite provides a fertile ground for Stone Canyon's acquisition strategies and effective capital deployment. Such favorable conditions enable the company to pursue opportunities that align with its long-term vision.

- Financing secured in 2024 and 2025: This indicates active capital raising to support growth initiatives.

- Focus on modular infrastructure and automation: These sectors are attracting significant institutional interest, reflecting market trends.

- Strategic acquisitions: The favorable market conditions support Stone Canyon's approach to expanding its holdings.

- Long-term value creation: The 'buy, build, and hold' strategy emphasizes patient capital and operational improvements.

Sector-Specific Economic Trends

Stone Canyon Industries LLC operates across diverse sectors, each influenced by unique economic currents. The global transportation market is a significant area, with projections indicating it will reach $11.1 trillion by 2030, a substantial increase from its current valuation. This expansion directly impacts SCI's involvement in transportation-related manufacturing and services.

Furthermore, the transportation infrastructure construction market is also set for robust growth, estimated to be worth $172.59 billion in 2025. This presents opportunities for SCI’s industrial segment, particularly in supplying materials or equipment for these vital projects.

The demand for skilled labor in light industrial roles is another key economic trend. Through 2025, this demand is expected to climb, fueled by increased automation and technological adoption within manufacturing and logistics.

- Global Transportation Market Growth: Projected to reach $11.1 trillion by 2030.

- Transportation Infrastructure Construction: Valued at $172.59 billion in 2025.

- Skilled Labor Demand: Rising for light industrial roles through 2025, driven by automation.

Economic headwinds persist, with manufacturing PMIs dipping into contraction by July 2024, signaling potential demand slowdowns. Elevated inflation, particularly in input materials and compensation costs, continues to pressure operational expenses. Higher interest rates throughout 2024 and projected into 2025 significantly increase the cost of capital, potentially delaying industrial expansion and infrastructure projects.

| Economic Indicator | Value/Trend | Implication for Stone Canyon |

|---|---|---|

| Manufacturing PMI | Contracted by July 2024 | Reduced demand for industrial products |

| Inflation (Input Materials) | Stabilized but elevated | Increased operational costs |

| Compensation Costs | Upward trend | Higher labor expenses |

| Interest Rates | Elevated (2024-2025) | Increased cost of capital, potential project delays |

| Global Logistics Costs | +5% YoY (early 2024) | Impacts supply chain efficiency and expenditure |

What You See Is What You Get

Stone Canyon Industries LLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Stone Canyon Industries LLC delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides critical insights for strategic planning and risk assessment. You'll gain a thorough understanding of the external forces shaping Stone Canyon Industries' operations and future prospects.

Sociological factors

The manufacturing and light industrial sectors are grappling with a critical need for skilled workers, with an estimated shortfall of 1.9 million by 2033 if current trends persist. This talent gap is exacerbated by an aging workforce and a general decline in labor participation rates across the economy, even as average annual earnings remain competitive.

To counter these labor shortages, companies like Stone Canyon Industries must implement robust strategies focusing on upskilling existing employees, developing comprehensive training programs for new hires, and actively working to attract a broader talent pool to the industry.

Workforce trends leading into 2025 underscore a strong demand for continuous learning and the widespread adoption of hybrid work models. Employees are actively seeking flexible work arrangements, making them a key factor in talent acquisition and retention strategies.

Companies prioritizing investment in comprehensive learning and development programs are better positioned to attract and keep skilled employees. This focus is crucial as artificial intelligence and automation continue to transform job landscapes, necessitating new skill sets.

For instance, a 2024 report indicated that over 60% of workers would prefer hybrid arrangements. Furthermore, the demand for upskilling and reskilling programs is projected to grow significantly as businesses adapt to technological advancements, with an estimated 70% of companies planning to increase L&D budgets by 2025.

Growing consumer and stakeholder demands for higher sustainability standards and corporate social responsibility significantly impact Stone Canyon Industries LLC. Surveys in 2024 indicate that over 60% of consumers consider a company's environmental impact when making purchasing decisions, a figure expected to rise.

This trend is compelling businesses like Stone Canyon Industries LLC to go beyond minimum regulatory requirements and actively adopt greener operational practices. Demonstrating strong Environmental, Social, and Governance (ESG) performance is becoming a key differentiator.

Companies are increasingly investing in renewable energy sources and waste reduction programs. For instance, by the end of 2025, it's projected that 30% of industrial energy consumption will be met by renewables, influencing supply chain expectations for Stone Canyon Industries LLC.

Public Perception and Brand Reputation

Public perception significantly shapes Stone Canyon Industries LLC's brand reputation. A strong commitment to sustainability and ethical practices, demonstrated through transparent reporting and verifiable actions, can attract environmentally and socially conscious investors. For instance, in 2024, a significant portion of new investment capital flowed into ESG-focused funds, highlighting this trend.

Conversely, instances of 'greenwashing' or misleading sustainability claims can result in severe reputational damage and potential legal repercussions. Companies are increasingly held accountable for their environmental and social impact claims. In 2024, regulatory bodies worldwide intensified scrutiny on corporate environmental disclosures, leading to increased compliance costs for businesses.

- Brand Reputation: Public trust is a valuable asset, directly impacting customer loyalty and investor confidence.

- ESG Investment Trends: The market for Environmental, Social, and Governance (ESG) investments continued its robust growth through 2024, with global ESG assets projected to surpass $50 trillion.

- Greenwashing Penalties: Companies face growing risks of fines and reputational damage from misleading environmental claims, with several high-profile cases in 2024 resulting in multi-million dollar penalties.

- Transparency: Verifiable proof of environmental and social initiatives is crucial for maintaining a positive public image and attracting responsible stakeholders.

Health and Safety Standards

Employee safety and health are paramount in manufacturing, and Stone Canyon Industries LLC must continually adapt. Prioritizing a safe working environment involves integrating new technologies and processes to mitigate risks. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, nonfatal workplace injuries and illnesses in manufacturing occurred at a rate of 2.8 cases per 100 full-time equivalent workers, underscoring the persistent need for vigilance.

Maintaining stringent safety compliance is not merely a legal obligation but a strategic imperative for attracting and retaining talent, particularly within industrial settings. A strong safety record can significantly boost employee morale and reduce operational disruptions. In 2024, companies with exemplary safety programs often see lower insurance premiums and reduced costs associated with accidents and downtime.

Key considerations for Stone Canyon Industries LLC include:

- Investment in safety training programs: Ensuring all employees are well-versed in current safety protocols and the use of new equipment is critical.

- Ergonomic assessments: Regularly evaluating workstations and processes to prevent musculoskeletal injuries, a common issue in manufacturing.

- Adoption of advanced safety technology: Implementing AI-powered monitoring systems or automated safety features can proactively identify and address hazards.

- Compliance with evolving OSHA standards: Staying ahead of regulatory changes ensures continued adherence and avoids penalties.

Societal attitudes towards manufacturing are evolving, with a growing emphasis on ethical labor practices and community impact. Consumers and employees alike increasingly expect transparency regarding fair wages and working conditions. This societal shift influences brand perception and can affect Stone Canyon Industries LLC's ability to attract both customers and talent.

The demand for skilled labor remains a significant societal challenge, with projections indicating continued shortages in the manufacturing sector. Stone Canyon Industries LLC must actively invest in training and development to bridge this gap. Furthermore, the increasing adoption of hybrid work models by employees necessitates flexible approaches to talent management and retention.

Public discourse increasingly centers on corporate social responsibility and sustainability. Over 60% of consumers in 2024 considered environmental impact in purchasing decisions, a trend expected to grow. Stone Canyon Industries LLC must demonstrate genuine commitment to ESG principles to maintain positive public perception and investor confidence.

Employee safety and well-being are paramount societal expectations within industrial settings. In 2023, manufacturing saw 2.8 non-fatal workplace injuries per 100 full-time workers, highlighting the ongoing need for robust safety protocols. Companies prioritizing safety experience improved morale, reduced operational disruptions, and lower insurance costs.

Technological factors

Automation and AI are rapidly reshaping advanced manufacturing. By 2025, the global AI in manufacturing market is projected to reach $15.7 billion, up from an estimated $6.2 billion in 2022, showcasing significant growth. This trend will drive workforce evolution and operational efficiencies, allowing companies like those within Stone Canyon Industries LLC's portfolio to implement AI for predictive maintenance, intelligent routing, and advanced capacity planning.

The integration of AI and emerging technologies like augmented and virtual reality (AR/VR) is accelerating the development of fully automated 'dark factories'. These facilities, requiring minimal human intervention, saw investment surge in 2023 with over $10 billion poured into robotics and automation startups. This technological shift enhances customer service through AI-powered chatbots and personalized experiences, further optimizing Stone Canyon's operational capabilities.

The industrial product manufacturing sector is heavily influenced by digital transformation and Industry 4.0. Key trends include the increasing digitalization of supply chains and the widespread adoption of advanced analytics and robust data management systems. These advancements are crucial for manufacturers aiming to optimize operations and stay competitive.

Stone Canyon Industries LLC's strategic emphasis on operational enhancements and the integration of new technologies directly mirrors the core tenets of Industry 4.0. This includes leveraging sophisticated machine learning capabilities and developing seamlessly integrated systems designed for real-time data analysis, which is vital for driving process improvements and fostering efficient collaboration across all levels of the organization.

By 2024, the global market for Industrial Internet of Things (IIoT) solutions, a cornerstone of Industry 4.0, was projected to reach over $77 billion, highlighting the significant investment in these digital technologies. This trend is expected to continue its upward trajectory, with projections indicating further substantial growth through 2025, underscoring the strategic importance of these technological shifts for companies like Stone Canyon Industries LLC.

Technological advancements in materials science and additive manufacturing, particularly 3D printing, are transforming industrial capabilities. These innovations are yielding materials that are not only more precise and adaptable but also increasingly affordable, making them accessible for a wider range of applications.

Stone Canyon Industries LLC (SCI) can leverage these developments for rapid prototyping, enabling quicker design iterations and product development cycles. The ability to create highly customized parts also opens doors for tailored solutions that precisely meet specific operational needs, enhancing efficiency and performance across SCI's diverse portfolio.

Furthermore, the on-demand printing of replacement parts through additive manufacturing offers a significant advantage in maintenance and repair operations. This capability drastically reduces lead times for critical components, thereby minimizing equipment downtime and optimizing overall productivity within SCI's industrial sectors. For instance, in 2024, the global 3D printing market was valued at approximately $20 billion, with projections indicating substantial growth driven by these industrial applications.

Sustainable Technologies and Clean Energy Adoption

The growing global emphasis on sustainable technologies is reshaping industrial and transportation sectors, a trend directly impacting companies like Stone Canyon Industries LLC. Mauser Packaging Solutions, a key subsidiary, is at the forefront of this shift, concentrating on sustainable packaging materials and advanced manufacturing processes designed to minimize environmental impact.

This commitment translates into tangible investments. For instance, the broader industrial sector saw a significant surge in renewable energy capacity additions in 2023, with global capacity increasing by an estimated 50% compared to 2022, according to the International Energy Agency. Stone Canyon's strategic focus on electric vehicles for its logistics operations and the implementation of energy-efficient warehouse solutions directly align with this macro trend, aiming to reduce carbon footprints and achieve ambitious sustainability targets. These initiatives are not just about environmental responsibility; they are becoming critical for operational efficiency and long-term market competitiveness.

- Renewable Energy Growth: Global renewable energy capacity additions in 2023 were approximately 50% higher than in 2022, indicating a robust market shift.

- EV Adoption in Logistics: Investments in electric vehicles for transportation fleets are increasing, driven by cost savings and emissions reduction mandates.

- Sustainable Packaging Innovation: Companies like Mauser Packaging Solutions are investing in R&D for biodegradable and recyclable packaging materials.

- Energy Efficiency in Operations: Warehouse and manufacturing energy consumption is being targeted for reduction through smart technologies and process optimization.

Cybersecurity in Manufacturing

As manufacturing operations increasingly rely on digital systems, the importance of cybersecurity cannot be overstated. The interconnectedness of operational technology (OT) and information technology (IT) creates vulnerabilities that malicious actors can exploit, threatening everything from production lines to intellectual property.

Protecting these systems is paramount for maintaining operational continuity and safeguarding sensitive data. In 2025, industrial companies are prioritizing robust cybersecurity measures as a core strategic imperative. Reports indicate that the manufacturing sector experienced a significant rise in cyberattacks, with some estimates suggesting a 70% increase in the past two years alone.

- Increased Sophistication of Threats: Cyber attackers are developing more advanced methods targeting industrial control systems (ICS).

- Data Breach Costs: The average cost of a data breach in the manufacturing sector reached $5.1 million in 2024, highlighting the financial impact.

- Regulatory Compliance: Growing regulations around data protection and operational security are driving investment in cybersecurity solutions.

- Supply Chain Vulnerabilities: Weaknesses in one part of the manufacturing supply chain can have cascading effects, making end-to-end security crucial.

Technological advancements are driving significant shifts in industrial manufacturing, with automation and AI at the forefront. The global AI in manufacturing market is expected to grow substantially, reaching $15.7 billion by 2025, up from $6.2 billion in 2022. This growth fuels the development of "dark factories" and enhances operational efficiencies through predictive maintenance and advanced planning.

Industry 4.0 principles, including digitalization and advanced analytics, are central to modern manufacturing. The Industrial Internet of Things (IIoT) market, a key component of Industry 4.0, was projected to exceed $77 billion in 2024. Furthermore, innovations in materials science and 3D printing, with a global market valued around $20 billion in 2024, enable rapid prototyping and customized part production, reducing lead times and downtime.

| Technology Trend | Market Projection (2025) | Impact on Stone Canyon Industries LLC |

|---|---|---|

| AI in Manufacturing | $15.7 billion | Enhanced predictive maintenance, intelligent routing, capacity planning |

| Industrial IoT (IIoT) | Projected growth beyond $77 billion (2024) | Optimized operations, real-time data analysis, improved collaboration |

| 3D Printing (Additive Manufacturing) | Approx. $20 billion market (2024) | Rapid prototyping, customized parts, reduced maintenance lead times |

Legal factors

Environmental, Social, and Governance (ESG) regulations are significantly reshaping corporate compliance worldwide. The European Union's Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) are prime examples, mandating extensive sustainability reporting and supply chain oversight. These directives, fully applicable to large EU companies starting in 2024 and extending to others in subsequent years, place a substantial burden on businesses to meticulously track and disclose their environmental and social impact.

In the United States, states like California are also stepping up with climate disclosure laws, such as Senate Bill 261, which requires companies doing business in California to report their climate-related financial risks. This legislation, effective from January 1, 2025, for some companies, compels a broader range of businesses to enhance their ESG reporting practices, aligning with increasing investor and consumer demands for transparency.

Stone Canyon Industries LLC's strategy of acquiring and consolidating businesses, particularly in mature sectors like the salt industry with its notable acquisitions of Kissner Group Holdings and Morton Salt, requires strict attention to antitrust and competition laws. These regulations are designed to prevent market monopolization and ensure a level playing field for all businesses, directly influencing SCI's merger and acquisition plans and its pursuit of market dominance.

Regulatory bodies, such as the Federal Trade Commission (FTC) in the United States, actively scrutinize large-scale M&A deals to assess their potential impact on competition. For instance, in 2023, the FTC continued to challenge several significant mergers across various industries, emphasizing its commitment to upholding antitrust principles.

SCI's expansion in the salt market, where it now holds a substantial share following its acquisitions, could attract increased scrutiny. If its market share approaches thresholds that suggest a potential lessening of competition, regulatory reviews could impose conditions on future acquisitions or even block them outright, impacting its growth trajectory.

The evolving landscape of competition law, including increased enforcement against "killer acquisitions" where large firms buy smaller rivals to stifle innovation, means SCI must proactively ensure its M&A activities do not raise antitrust concerns. This requires thorough legal due diligence and strategic planning to demonstrate that its consolidations do not harm consumer welfare or market dynamism.

Labor laws significantly impact Stone Canyon Industries, affecting everything from minimum wages to workplace safety standards. For instance, the Fair Labor Standards Act (FLSA) in the US mandates overtime pay for non-exempt employees working over 40 hours a week, a critical consideration for manufacturing operations. As of 2024, many states are also reviewing or increasing their minimum wage, directly impacting payroll costs.

Attracting and retaining a skilled workforce is a major hurdle, with the manufacturing sector facing persistent labor shortages. In 2023, the U.S. manufacturing sector had over 800,000 job openings, highlighting the competitive landscape for talent. Companies like Stone Canyon must adapt to evolving workforce expectations, including offering flexible work arrangements and focusing on skills-based hiring to fill critical roles.

Diversity and inclusion regulations are also paramount. Legislation promoting equal employment opportunities and prohibiting discrimination based on race, gender, age, or disability requires careful adherence. Compliance with these laws is not only a legal necessity but also crucial for fostering a positive company culture and attracting a broader talent pool, which is increasingly important in the current labor market.

Product Safety and Liability Laws

Stone Canyon Industries LLC and its portfolio companies must navigate a complex web of product safety and liability laws globally. These regulations are designed to protect consumers and end-users from harm, requiring rigorous adherence to manufacturing standards and clear labeling. For example, in the United States, the Consumer Product Safety Commission (CPSC) sets standards for many consumer goods, and non-compliance can lead to significant fines and recalls. The potential for liability, especially concerning product defects or foreseeable misuse, necessitates robust quality control and risk management strategies across all business units.

In 2024, industries continue to see increased scrutiny on product safety, particularly with the integration of advanced technologies. The U.S. Food and Drug Administration (FDA), for instance, actively encourages the adoption of advanced manufacturing technologies, such as continuous manufacturing, which can inherently improve product consistency and quality, thereby reducing the risk of defects. For a company like Stone Canyon, this means investing in technologies that not only enhance efficiency but also demonstrably bolster product safety. The financial implications of failing to meet these standards can be substantial, encompassing legal settlements, recall costs, and damage to brand reputation.

- Regulatory Landscape: Compliance with international product safety standards (e.g., CE marking in Europe, UL certification in North America) is critical for market access and avoiding penalties.

- Liability Exposure: Potential liabilities stem from product defects, design flaws, inadequate warnings, and improper marketing, with significant financial consequences for breaches.

- Technological Integration: The FDA's encouragement of advanced manufacturing aims to improve product quality and safety, a trend Stone Canyon must embrace to mitigate risks.

- Market Impact: Stringent safety laws directly influence product design, production processes, and marketing, impacting R&D investments and overall operational costs.

Data Privacy and Cybersecurity Regulations

The increasing reliance on digital technologies and artificial intelligence across industries, including manufacturing, elevates the importance of data privacy and cybersecurity regulations. Stone Canyon Industries LLC, like its peers, must navigate a complex web of global and regional laws dictating how personal and sensitive data is collected, stored, processed, and protected. Failure to comply can result in significant financial penalties and reputational damage, especially as manufacturing environments become more interconnected and data-intensive.

For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high standard for data protection, impacting any company processing data of EU residents. In the United States, a patchwork of state-level laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), impose further obligations. As of early 2025, several other states are expected to enact similar comprehensive privacy legislation, requiring ongoing vigilance and adaptation from companies like Stone Canyon Industries.

The cybersecurity landscape is also evolving rapidly, with new threats emerging constantly. Regulations often mandate specific security measures and breach notification protocols. For a company like Stone Canyon Industries, with potentially interconnected operational technology (OT) and information technology (IT) systems, robust cybersecurity frameworks are not just a legal requirement but a critical operational necessity. Reports from 2024 highlighted a significant rise in ransomware attacks targeting industrial control systems, underscoring the heightened risk in the manufacturing sector.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA/CPRA Enforcement: The California Privacy Protection Agency (CPPA) is actively enforcing CPRA, with potential fines of up to $7,500 per violation for intentional non-compliance.

- Cybersecurity Investment: Global spending on cybersecurity is projected to exceed $200 billion in 2025, reflecting the growing imperative for robust data protection measures.

- Manufacturing Sector Risk: A 2024 IBM Security X-Force report indicated that the manufacturing sector faced an average cost of $4.11 million per data breach.

Stone Canyon Industries LLC's acquisition strategy is heavily influenced by antitrust and competition laws, requiring careful navigation to avoid market monopolization. Regulatory bodies like the FTC actively scrutinize large mergers, a trend expected to continue into 2024-2025, potentially impacting SCI's growth plans in consolidated markets like salt.

Labor laws, including minimum wage and workplace safety, directly affect operational costs and talent acquisition. As of 2024, many U.S. states are increasing minimum wages, adding to payroll expenses. Additionally, evolving workforce expectations and persistent labor shortages in manufacturing, with over 800,000 job openings in 2023, necessitate adaptive HR strategies.

Product safety and liability laws are critical for consumer protection and market access. Regulations from bodies like the CPSC and evolving standards encouraged by the FDA for advanced manufacturing, as seen in 2024, demand investment in quality control. Non-compliance can lead to substantial financial penalties and reputational damage.

Data privacy and cybersecurity regulations, like GDPR and CCPA/CPRA, are increasingly stringent, with new state laws anticipated in 2025. The manufacturing sector faces significant cybersecurity risks, with the average cost of a data breach reported at $4.11 million in 2024, underscoring the need for robust data protection measures.

Environmental factors

Global and regional climate change policies, like the European Union's goal to reduce CO2 emissions by 55% by 2030 compared to 1990 levels, directly impact Stone Canyon Industries LLC's operations, particularly in sectors like industrial manufacturing and transportation.

The growing expectation for companies to achieve net-zero commitments is a significant driver for operational changes. This is prompting shifts in logistics, transportation fleets, and warehousing strategies to actively reduce carbon footprints.

For instance, the increasing adoption of electric vehicles in commercial fleets, a trend expected to accelerate through 2025, necessitates investments in charging infrastructure and potentially impacts fuel costs and supply chain reliability.

Moreover, carbon pricing mechanisms, such as emissions trading schemes, are becoming more widespread, adding a direct financial cost to carbon-intensive activities and encouraging the adoption of greener technologies across the industry.

Growing global concerns over resource scarcity are accelerating the adoption of circular economy principles, emphasizing waste reduction through reuse, refurbishment, and recycling. This trend directly impacts industries reliant on raw materials, pushing for innovative supply chain models. For instance, the global waste management market was valued at approximately USD 1.07 trillion in 2023 and is projected to reach USD 1.47 trillion by 2028, indicating a significant market shift towards sustainability.

Stone Canyon Industries LLC's packaging division, Mauser Packaging Solutions, is strategically positioned to capitalize on this shift. Their focus on sustainable packaging solutions, including the reuse and recycling of industrial containers, directly addresses the demand for reduced environmental impact. Mauser's commitment to eco-friendly materials and designs aligns with the growing consumer and regulatory pressure for businesses to minimize waste and adopt a more circular approach to product lifecycles.

Environmental regulations are increasingly stringent, mandating robust waste management and pollution control for companies like Stone Canyon Industries LLC. This means focusing on reducing landfill waste, properly handling hazardous materials, and actively monitoring air and water emissions. For instance, in 2024, the EPA continued its focus on stricter enforcement of the Clean Air Act and Clean Water Act, with penalties for violations escalating significantly. Companies failing to meet these standards, including those in the industrial manufacturing sector where Stone Canyon operates, face substantial fines and reputational damage.

These environmental factors directly impact operational costs and strategic planning. Investment in advanced waste treatment technologies and cleaner production processes is becoming not just a compliance issue, but a competitive necessity. By 2025, many industry analyses project increased capital expenditure requirements for environmental compliance, particularly in areas like carbon capture and advanced wastewater treatment. Stone Canyon's approach to these challenges will be a key determinant of its long-term sustainability and profitability.

Water Management and Conservation

Stone Canyon Industries LLC, as an industrial entity, faces significant environmental risks tied to water management and conservation. Stricter water management laws and stringent water quality sample collection requirements pose considerable regulatory hurdles, especially for water-intensive operations. Companies must actively demonstrate responsible water usage, adhering to regulations concerning water discharge and conservation efforts, which directly impacts environmental stewardship.

Compliance with these evolving regulations is paramount. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize the importance of clean water, with ongoing initiatives to update regulations on wastewater discharge permits. Companies like Stone Canyon must invest in advanced water treatment technologies and monitoring systems to meet these standards. Failure to comply can result in substantial fines and reputational damage, underscoring the financial implications of poor water management.

- Regulatory Compliance: Adherence to water discharge permits and conservation mandates is critical.

- Operational Costs: Investments in water treatment and efficient usage can increase operational expenditures.

- Environmental Impact: Responsible water management is key to minimizing ecological footprints.

- Reputational Risk: Non-compliance can lead to negative public perception and brand damage.

ESG Pressures and Sustainable Practices Integration

Beyond regulatory mandates, Stone Canyon Industries LLC faces increasing pressure from investors, consumers, and other stakeholders to embed sustainability throughout its operations. This translates into tangible actions like investing in renewable energy sources to power facilities and optimizing logistics for greater fuel efficiency. For instance, the global renewable energy market is projected to reach $1.977 trillion by 2030, indicating significant investor interest in this sector.

The company is also focused on adopting eco-friendly packaging solutions and enhancing the overall sustainability of its supply chain. These efforts are crucial for meeting evolving stakeholder expectations and maintaining a competitive edge. Companies that prioritize ESG factors are often rewarded with lower costs of capital; a 2023 study showed companies with high ESG scores had a 15% lower cost of equity compared to their peers.

- Investor Demand: A significant majority of institutional investors now incorporate ESG criteria into their investment decisions.

- Consumer Preference: Consumers increasingly favor brands demonstrating environmental and social responsibility.

- Operational Efficiency: Sustainable practices, such as energy optimization, can lead to substantial cost savings.

- Supply Chain Resilience: Building sustainable supply chains can mitigate risks associated with climate change and resource scarcity.

Environmental regulations continue to tighten globally, impacting industrial operations. Stone Canyon Industries LLC must navigate stricter emissions standards, waste management protocols, and pollution control measures to avoid penalties. For example, the EPA's ongoing enforcement of the Clean Air Act and Clean Water Act in 2024 has led to escalating fines for non-compliance, directly affecting companies in manufacturing sectors.

The push for sustainability is reshaping consumer and investor expectations, driving demand for greener products and operations. Stone Canyon's packaging division, Mauser Packaging Solutions, is well-positioned to benefit from this trend by focusing on reusable and recyclable industrial containers, aligning with the growing circular economy movement. The global waste management market, valued at approximately USD 1.07 trillion in 2023, underscores this significant market shift.

Water management and conservation are critical environmental concerns, with evolving regulations on water usage and discharge. Stone Canyon must invest in advanced water treatment technologies and monitoring systems to comply with standards, as exemplified by the EPA's continued focus on wastewater discharge permits in 2024. Failure to meet these requirements can lead to substantial financial and reputational damage.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Stone Canyon Industries LLC is informed by a robust dataset including official government publications, economic indicators from reputable financial institutions, and market research reports from leading industry analysts. This comprehensive approach ensures all political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.