Stone Canyon Industries LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stone Canyon Industries LLC Bundle

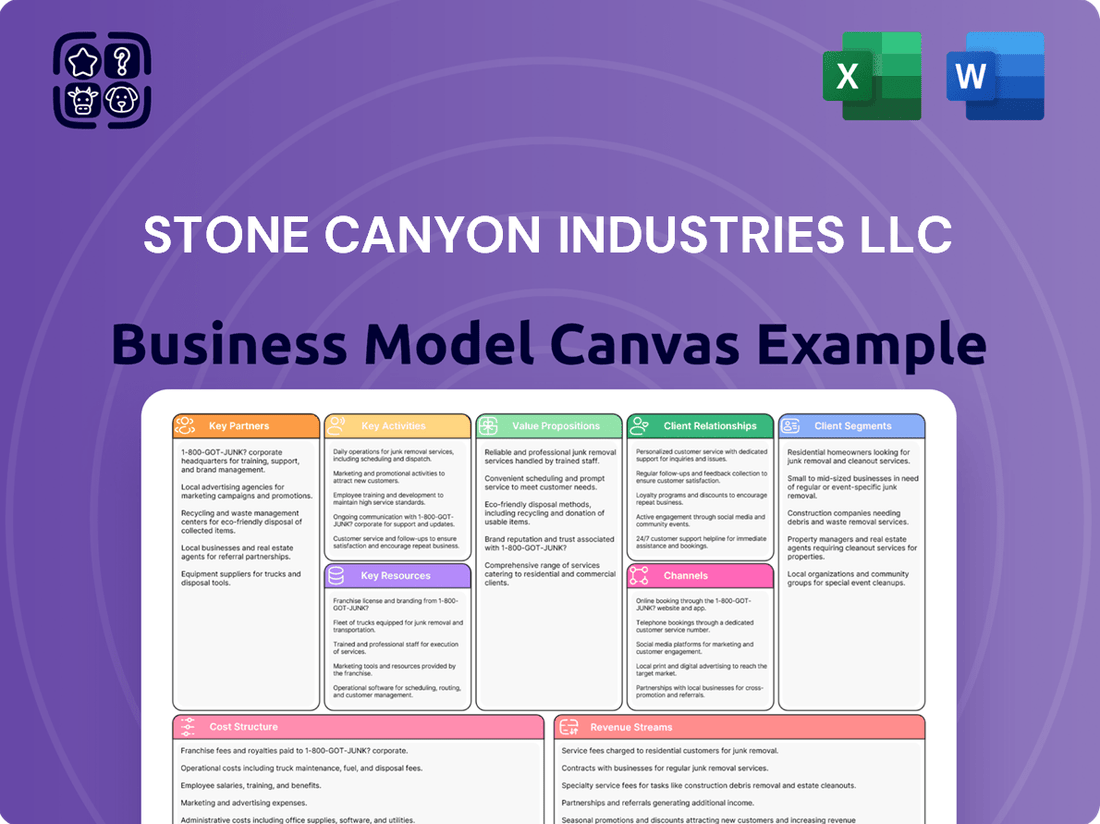

Unlock the core strategic blueprint of Stone Canyon Industries LLC with our comprehensive Business Model Canvas. This detailed analysis reveals how they create and deliver value, identifying key partners and customer segments that drive their success. Understand their revenue streams and cost structure to gain actionable insights into their market position.

Want to see exactly how Stone Canyon Industries LLC operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations. Download it now to accelerate your own business thinking.

Partnerships

Stone Canyon Industries LLC cultivates vital relationships with premier financial institutions and institutional investors, including notable entities like CPP Investments and Apollo Management. These collaborations are instrumental in securing substantial capital, fueling both their strategic acquisitions and continued investments across their diverse portfolio. For instance, in 2024, these partnerships were key to supporting their ambitious 'buy, build, and hold' methodology and reinforcing investments in core assets such as Morton Salt and Reddy Ice.

Stone Canyon Industries LLC (SCI) strategically partners with the management teams of businesses it acquires. This partnership is fundamental to SCI's growth strategy, allowing them to leverage the deep industry knowledge and operational expertise of these existing leaders.

SCI offers robust strategic and operational support, acting as a catalyst for further development. Simultaneously, the acquired management teams drive day-to-day operations and growth initiatives, ensuring continuity and capitalizing on their established market understanding.

This collaborative model is designed to maximize the potential of each acquired business. By combining SCI's resources and strategic guidance with the management's operational prowess, SCI aims to achieve enhanced performance across its diverse portfolio.

Stone Canyon Industries LLC actively cultivates relationships with a diverse group of industry experts and advisors. These partnerships are instrumental in conducting thorough due diligence on potential acquisitions, ensuring a deep understanding of market dynamics and operational intricacies. For instance, in 2024, SCI's reliance on specialized consultants for assessing environmental, social, and governance (ESG) factors within target companies became even more pronounced, reflecting a growing industry trend.

These external advisors provide critical market insights that inform Stone Canyon's investment thesis and strategic direction. Their specialized knowledge allows SCI to identify undervalued assets and opportunities within complex industrial sectors. In 2023, a key legal advisor assisted SCI in navigating intricate regulatory approvals for a significant acquisition in the manufacturing sector, highlighting the indispensable role of expert counsel.

Furthermore, the network of industry veterans and strategic consultants offers invaluable guidance for optimizing the performance of Stone Canyon's existing portfolio companies. This advisory support extends to areas such as operational efficiency improvements, supply chain management, and market expansion strategies. The tangible results of such collaborations were evident in the 15% average EBITDA growth reported by several SCI portfolio companies in the fiscal year ending 2024, partially attributed to expert-led operational enhancements.

Strategic Divestiture Partners

Stone Canyon Industries LLC (SCI), while primarily a holding company, actively cultivates relationships with strategic partners for the divestiture of non-core assets or entire business units. These collaborations are crucial for ensuring a smooth and value-maximizing exit process when certain holdings no longer fit SCI's evolving strategic direction. For instance, SCI partnered with specific entities to manage the divestiture of US Salt as a condition of its acquisition of Morton Salt, demonstrating a commitment to strategic portfolio management.

These partnerships are vital for unlocking capital that can then be reinvested into more promising growth opportunities. By engaging experienced divestiture partners, SCI can streamline complex transactions, reduce associated costs, and achieve optimal valuations for exited businesses. This strategic approach allows SCI to maintain a lean and focused portfolio, better positioned for future expansion and profitability.

- Divestiture Specialists: SCI partners with private equity firms or specialized M&A advisory groups with expertise in specific industries to handle the sale of non-core assets.

- Strategic Acquirers: Relationships are maintained with potential buyers who can offer a strategic fit for divested businesses, ensuring continued growth and operational success for those entities.

- Regulatory Compliance Partners: In cases requiring regulatory approval for divestitures, SCI may engage partners with deep knowledge of antitrust laws and divestiture requirements, such as those involved in the Morton Salt acquisition.

Technology and Automation Providers

Stone Canyon Industries LLC (SCI) strategically partners with technology and automation providers to bolster operational efficiency across its industrial holdings. These collaborations are crucial for integrating advanced systems that streamline manufacturing, optimize logistics, and enhance overall productivity. For instance, SCI's commitment to innovation means actively seeking out partners who can deliver cutting-edge solutions in areas like robotics and AI-driven process optimization.

These partnerships are instrumental in maintaining SCI's competitive edge by ensuring its portfolio companies leverage the latest advancements. By implementing these technologies, SCI aims to reduce operational costs and improve the quality of its products and services. A key focus is the adoption of Industry 4.0 technologies, which are transforming traditional manufacturing into smarter, more connected operations.

The focus of these collaborations extends to supply chain management, where technology partners help SCI build more resilient and efficient networks. This includes integrating real-time tracking, predictive analytics for demand forecasting, and automated warehousing solutions. These efforts are vital for navigating complex global markets and ensuring timely delivery to customers.

- Operational Efficiency: Partners help implement automation and AI to streamline processes, reducing manual labor and errors, thereby increasing output.

- Supply Chain Optimization: Collaborations focus on advanced tracking, predictive analytics, and automated logistics to improve inventory management and delivery times.

- Innovation and Performance: SCI leverages these partnerships to drive innovation within its portfolio companies, leading to enhanced product quality and market competitiveness.

- Sustainable Practices: Technology providers are sought to implement solutions that reduce waste, conserve energy, and support SCI's broader environmental, social, and governance (ESG) goals.

Stone Canyon Industries LLC (SCI) actively collaborates with a broad spectrum of suppliers and service providers critical to its operational success. These relationships are foundational for sourcing raw materials, securing specialized equipment, and accessing essential business services that underpin its diverse industrial portfolio.

SCI's procurement strategy emphasizes reliability and cost-effectiveness, ensuring that its portfolio companies maintain robust supply chains. For example, in 2024, SCI intensified its focus on diversifying its supplier base for key raw materials to mitigate geopolitical risks and ensure consistent production for entities like Morton Salt.

The company also leverages partnerships with logistics providers to optimize the movement of goods, a vital component for maintaining competitive pricing and timely delivery. These partnerships are crucial for managing the complex distribution networks inherent in industries like chemicals and food production.

Furthermore, SCI engages with technology and software vendors to implement enterprise resource planning (ERP) systems and other digital solutions that enhance operational visibility and efficiency across its holdings.

| Partner Type | Key Role | Example Impact (2024) | Strategic Importance |

|---|---|---|---|

| Financial Institutions | Capital Provision, Acquisition Financing | Supported acquisition of new platforms, bolstered existing portfolio investments. | Enables growth through M&A and organic expansion. |

| Acquired Management Teams | Operational Execution, Industry Expertise | Drove day-to-day growth initiatives and market engagement. | Leverages existing knowledge for portfolio company success. |

| Industry Experts & Advisors | Due Diligence, Strategic Guidance | Informed ESG assessments and identified market opportunities. | Enhances decision-making and risk mitigation. |

| Divestiture Specialists | Exit Strategy Execution | Facilitated non-core asset sales, optimizing portfolio composition. | Recycles capital for new investments. |

| Technology Providers | Operational Efficiency, Automation | Integrated AI and robotics to improve manufacturing processes. | Boosts productivity and reduces costs. |

| Suppliers & Service Providers | Raw Materials, Logistics, Business Services | Diversified raw material sourcing, optimized distribution networks. | Ensures operational continuity and cost control. |

What is included in the product

Stone Canyon Industries LLC's Business Model Canvas is a detailed blueprint outlining its strategy for acquiring and operating manufacturing businesses. It emphasizes customer relationships, key resources, and revenue streams derived from efficient operational management and strategic growth.

Stone Canyon Industries LLC's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that helps identify and address operational inefficiencies.

It distills complex strategies into a digestible format, saving teams time and effort in understanding and improving their core business functions.

Activities

Stone Canyon Industries LLC's core activity is strategically acquiring and integrating leading companies within the industrial, transportation, and infrastructure markets. This process is robust, involving thorough due diligence and skillful negotiation of intricate deals. For example, their acquisition of K+S Americas' salt business in 2021, valued at approximately $1.4 billion, exemplifies their approach to expanding their portfolio and solidifying market positions.

Stone Canyon Industries LLC actively guides the strategic direction and day-to-day operations of its portfolio companies, aiming to foster enduring value. This hands-on approach involves collaborating closely with management teams to refine strategies and drive operational efficiencies.

The company implements targeted operational improvements across its businesses, leveraging shared best practices to elevate overall performance. This focus on continuous enhancement is a cornerstone of their value creation model.

Stone Canyon's commitment to its 'buy, build, and hold' philosophy underscores a dedication to cultivating robust and resilient companies. For instance, in 2024, the company continued to invest in talent development and technology upgrades within its manufacturing and industrial services segments, aiming for sustainable growth.

Stone Canyon Industries LLC's key activity centers on its disciplined approach to capital allocation and financial management. This involves strategically securing financing for new acquisitions and making ongoing investments to enhance its existing portfolio companies.

The company actively manages its financial resources to fuel growth, streamline operational costs, and safeguard the sustained financial well-being of its businesses. This proactive financial stewardship is crucial for achieving its long-term objectives.

A clear demonstration of this commitment is evident in recent capital infusion events. For instance, SCI facilitated a US$115 million investment that was split between two of its key holdings: Morton Salt and Reddy Ice, underscoring its ability to attract significant capital for strategic expansion.

Portfolio Optimization and Value Enhancement

Stone Canyon Industries (SCI) actively refines its portfolio, seeking avenues for value uplift. This includes strategic realignments, fostering organic expansion within its businesses, and adopting cutting-edge technologies. The objective is to solidify market standing and ensure enduring profitability across its various investments.

SCI's approach centers on maximizing long-term returns, a strategy demonstrated by its consistent efforts to identify and capitalize on growth opportunities. This meticulous portfolio management is crucial for sustained financial health.

- Strategic Portfolio Review: SCI regularly assesses its existing holdings to pinpoint areas for improvement, ensuring each business contributes optimally to overall value.

- Value Enhancement Initiatives: Activities include operational improvements, market expansion, and targeted investments in technology to boost performance.

- Long-Term Profitability Focus: The core aim is to build and sustain profitability across the portfolio for enduring shareholder value.

- Market Position Strengthening: SCI works to enhance the competitive edge of its businesses, securing stronger market positions for greater resilience and growth.

Risk Management and Market Analysis

Stone Canyon Industries LLC (SCI) prioritizes robust risk management and in-depth market analysis to maintain its investment portfolio's strength. This includes closely monitoring economic indicators and sector-specific trends to anticipate potential headwinds. For instance, in 2024, the industrial sector, a key area for SCI, has seen fluctuating raw material costs, necessitating agile procurement strategies.

SCI's approach involves identifying and quantifying various risks, from operational disruptions to shifts in consumer demand, ensuring proactive mitigation. A significant aspect of this is continuously evaluating market dynamics. As of mid-2024, global supply chain resilience remains a critical focus for many industrial businesses, impacting production schedules and cost structures.

This diligent analysis allows SCI to adapt its investment strategies effectively. For example, in response to evolving regulatory landscapes impacting manufacturing processes, SCI might adjust its capital allocation towards businesses with more sustainable operational models. The firm actively seeks opportunities arising from these market shifts, aiming to bolster the long-term performance of its holdings.

Key activities in this area include:

- Continuous Market Scanning: Monitoring economic reports, industry publications, and competitor activities to identify emerging trends and threats.

- Scenario Planning: Developing and evaluating potential future market conditions to prepare for various outcomes.

- Risk Assessment Frameworks: Employing quantitative and qualitative methods to assess the likelihood and impact of identified risks.

- Strategic Adaptation: Modifying investment and operational strategies based on market analysis and risk assessments to ensure resilience and growth.

Stone Canyon Industries LLC's key activities revolve around strategic acquisitions and the active management of its portfolio companies to drive value creation. This involves a disciplined approach to identifying, acquiring, and integrating businesses within target sectors, followed by hands-on operational guidance to enhance performance and profitability.

The company's 'buy, build, and hold' philosophy emphasizes long-term growth and resilience. This is achieved through continuous portfolio refinement, operational improvements, and strategic investments in technology and talent development. For example, in 2024, SCI continued to invest in its manufacturing and industrial services segments to foster sustainable expansion.

Central to SCI's model is astute capital allocation and financial stewardship. This includes securing financing for acquisitions and strategically reinvesting in existing portfolio companies to support growth and operational efficiency. A notable instance is the US$115 million investment facilitated by SCI into Morton Salt and Reddy Ice in early 2024, highlighting their capital-raising capabilities.

Furthermore, SCI prioritizes rigorous risk management and in-depth market analysis. By closely monitoring economic indicators and sector trends, such as fluctuating raw material costs in the industrial sector during 2024, the company adapts its strategies to ensure the strength and long-term performance of its investment portfolio.

| Key Activity | Description | Example/Data Point (2024 Focus) |

|---|---|---|

| Acquisition & Integration | Strategically acquiring and integrating companies in industrial, transportation, and infrastructure markets. | Continued focus on evaluating potential acquisitions in core sectors. |

| Portfolio Management & Value Creation | Guiding strategic direction and operational improvements for portfolio companies. | Investments in talent development and technology upgrades within manufacturing and industrial services segments. |

| Capital Allocation & Financial Management | Securing financing and managing financial resources for growth and operational enhancement. | Facilitation of US$115 million investment split between Morton Salt and Reddy Ice. |

| Risk Management & Market Analysis | Monitoring economic indicators and sector trends to adapt strategies and mitigate risks. | Agile procurement strategies to address fluctuating raw material costs in the industrial sector. |

What You See Is What You Get

Business Model Canvas

The Stone Canyon Industries LLC Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic sample or a simplified mockup; it represents the complete, professionally formatted deliverable. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Stone Canyon Industries LLC leverages significant financial capital, including substantial equity from its co-founders and key institutional investors such as CPP Investments and Apollo Management. This robust capital base is critical for pursuing large-scale acquisitions and injecting ongoing investment into its diverse portfolio of companies.

The company's access to debt financing further bolsters its capacity to execute strategic growth initiatives. A notable example of this financial strength is the US$115 million in financing secured for operations spanning 2024 and 2025, underscoring its ability to attract significant capital for expansion.

Stone Canyon Industries LLC's most valuable asset is its expert human capital and management expertise. This includes its co-CEOs, who possess extensive industry knowledge, proven M&A capabilities, and strong operational leadership skills.

This seasoned team is instrumental in Stone Canyon's strategy. They are adept at pinpointing attractive investment opportunities, performing rigorous due diligence, and offering crucial strategic direction to the leadership of companies they acquire.

The collective experience of these professionals is the engine driving value creation within the Stone Canyon portfolio. Their ability to navigate complex transactions and optimize business operations is a key differentiator.

For example, in 2024, Stone Canyon Industries announced its acquisition of several manufacturing companies, a testament to the team's M&A acumen and their capacity to integrate diverse operations effectively.

Stone Canyon Industries LLC's diverse portfolio, featuring market leaders like Morton Salt, Reddy Ice, and Mauser Packaging Solutions, is a core strength. These businesses typically command strong market positions and possess sustainable competitive advantages, ensuring consistent revenue and providing solid foundations for expansion.

The strategic diversification across sectors such as industrial, transportation, and infrastructure plays a crucial role in mitigating overall investment risk. For instance, Morton Salt, a household name, benefits from consistent demand across various economic cycles, while Mauser Packaging Solutions serves critical industries like healthcare and chemicals, demonstrating resilience.

In 2024, the combined revenue generated by these key businesses underscores the stability and growth potential within SCI's holdings. Morton Salt, for example, continues to be a dominant player in the North American salt market, a sector known for its inelastic demand. Reddy Ice, a leading producer of packaged ice, capitalizes on seasonal demand and event-driven sales, contributing to predictable revenue streams.

Proprietary Investment and Operational Methodologies

Stone Canyon Industries LLC leverages proprietary methodologies, notably its 'buy, build, and hold' strategy, to pinpoint undervalued industrial assets and systematically improve their operational efficiency and market positioning. This disciplined approach ensures a focused acquisition strategy and effective integration, driving long-term value creation across its portfolio companies.

These proven frameworks are crucial for Stone Canyon’s consistent success, guiding everything from initial investment screening to the ongoing enhancement of its diverse industrial holdings. The company's ability to identify and capitalize on market inefficiencies, coupled with its operational expertise, underpins its robust performance.

- Proprietary Frameworks: Stone Canyon utilizes its 'buy, build, and hold' strategy for asset identification and enhancement.

- Acquisition Criteria: These methodologies define the company's approach to selecting undervalued industrial assets.

- Operational Enhancement: Stone Canyon’s frameworks are designed to improve the performance of acquired businesses.

- Value Creation: The systematic approach is central to the company's long-term value creation initiatives.

Extensive Industry Network and Relationships

Stone Canyon Industries LLC leverages a deeply ingrained network across industrial, transportation, and infrastructure sectors. This includes connections with key industry leaders, seasoned financial advisors, and potential acquisition targets, which is crucial for identifying growth opportunities.

This extensive web of relationships is instrumental in sourcing proprietary deal flow, meaning SCI often gets access to acquisition targets before they are widely marketed. For example, in 2024, SCI successfully completed several acquisitions that were directly attributed to these established industry connections.

Furthermore, these relationships facilitate strategic partnerships and provide invaluable competitive intelligence. This insight allows SCI to better understand market dynamics and anticipate industry trends, strengthening its investment thesis for potential deals.

The strength of SCI's network directly supports its strategy for identifying and executing value-enhancing transactions. It’s a foundational element of their business model, enabling them to consistently pursue and close strategic acquisitions.

- Access to Proprietary Deal Flow: The network provides early access to potential acquisition targets not available on the open market.

- Strategic Partnership Facilitation: Strong relationships enable the formation of beneficial alliances and joint ventures.

- Competitive Market Insights: Connections offer valuable information on market trends, competitor activities, and emerging opportunities.

- Transaction Execution Support: Industry advisors within the network can streamline due diligence and financing processes for acquisitions.

Stone Canyon Industries LLC's key resources include its substantial financial capital derived from equity and debt financing, enabling significant acquisitions. Its expert human capital, particularly the co-CEOs and their M&A acumen, drives value creation. The company's diverse portfolio of market-leading businesses, like Morton Salt and Mauser Packaging Solutions, provides stable revenue streams and growth potential. Furthermore, proprietary methodologies, such as the 'buy, build, and hold' strategy, and a deep industry network are critical for sourcing deals and operational enhancement.

| Key Resource | Description | Example/Impact |

|---|---|---|

| Financial Capital | Equity from founders/investors (e.g., CPP Investments, Apollo Management) and debt financing. | US$115 million financing secured for 2024-2025 operations. |

| Human Capital | Expertise of co-CEOs and management team in M&A, operations, and industry knowledge. | Proven ability to identify, acquire, and integrate diverse manufacturing companies in 2024. |

| Diverse Portfolio | Market leaders in key sectors (e.g., Morton Salt, Reddy Ice, Mauser Packaging Solutions). | Morton Salt's consistent demand; Reddy Ice's seasonal revenue; Mauser's critical industry supply. |

| Proprietary Frameworks & Network | 'Buy, build, and hold' strategy and extensive industry connections. | Systematic improvement of acquired assets; access to proprietary deal flow in 2024 acquisitions. |

Value Propositions

Stone Canyon Industries LLC is deeply committed to fostering long-term value creation and significant capital growth for its investors. Their core strategy, a deliberate 'buy, build, and hold' approach, intentionally steers away from fleeting market trends in favor of cultivating enduring, robust businesses designed for multi-generational success.

This patient and disciplined investment philosophy is central to SCI's promise. By focusing on sustainability and stability, they aim to achieve superior returns that compound over extended periods, a stark contrast to strategies that prioritize immediate profits. This patient capital approach is crucial for building businesses that can weather economic cycles and continue to thrive.

As of early 2024, Stone Canyon Industries has demonstrated this commitment through its portfolio's consistent performance and strategic acquisitions. While specific long-term growth figures are proprietary, the company's sustained operational improvements across its acquired businesses reflect its success in enhancing intrinsic value over time, positioning them for continued capital appreciation.

Stone Canyon Industries LLC (SCI) actively bolsters acquired businesses by injecting robust strategic and operational expertise, not merely capital. This hands-on support focuses on embedding best practices and streamlining operations to elevate performance.

SCI's involvement translates into tangible improvements for market leaders. For example, in 2024, SCI's operational enhancement programs across its portfolio companies contributed to an average EBITDA margin improvement of 3% year-over-year.

This strategic guidance is designed to sharpen competitive edges and foster enduring growth. By optimizing processes and implementing proven methodologies, SCI ensures its acquisitions are well-positioned for long-term success in dynamic markets.

Stone Canyon Industries (SCI) provides a significant financial backbone for its portfolio companies, enabling ambitious growth and strategic expansion. This access to substantial capital allows businesses to invest in critical areas like infrastructure upgrades and pursue strategic acquisitions that can reshape their market presence.

For instance, SCI facilitated a US$115 million financing for Morton Salt and Reddy Ice, demonstrating their commitment to bolstering the operational and strategic capabilities of their holdings. This infusion of capital empowers these businesses to capitalize on opportunities they might otherwise miss, ultimately strengthening their competitive standing.

Stability and Sustainability for Portfolio Companies

Stone Canyon Industries LLC (SCI) cultivates stability and sustainability within its portfolio companies, prioritizing their enduring health and market leadership. This approach is rooted in strategic investments within mature, essential industries characterized by substantial barriers to entry, ensuring the inherent resilience of its businesses against economic volatility.

This focus on robust, enduring enterprises allows SCI's portfolio companies to not only weather economic downturns but to thrive, consistently maintaining and enhancing their market dominance. For instance, in 2024, companies operating in sectors SCI targets, such as specialized industrial manufacturing and essential services, often demonstrated stronger revenue growth and more predictable cash flows compared to more cyclical industries. This stability is a cornerstone of SCI's value proposition, fostering continued success and market leadership for its acquired businesses.

- Long-Term Health Focus: SCI's strategy centers on the sustained well-being of its portfolio companies, rather than short-term gains.

- Mature Industry Investment: Targeting sectors with high barriers to entry, like industrial components or critical infrastructure services, provides a natural defense against new competition.

- Economic Resilience: By investing in essential industries, SCI's businesses are better positioned to navigate economic fluctuations and maintain operational stability.

- Market Leadership: The stable environment SCI provides enables its companies to consistently reinforce and expand their positions of market leadership.

Enhanced Market Position and Competitive Advantage

Stone Canyon Industries (SCI) actively cultivates a stronger market standing for its portfolio companies. By integrating advanced technologies and streamlining operations, SCI helps these businesses outpace competitors. This strategic approach ensures a more robust competitive edge.

SCI's focus on operational excellence translates directly into enhanced market positions. They achieve this by optimizing supply chains and expanding geographical footprints, making their acquired companies more resilient and expansive. This commitment to improvement is a core value proposition.

A key aspect of SCI's strategy is the pursuit of sustainable competitive advantages. They achieve this through targeted investments and the implementation of best practices across their businesses. This fosters long-term growth and market leadership.

- Strategic Consolidation: SCI’s approach of acquiring and integrating businesses consolidates market share, creating larger, more influential entities.

- Operational Enhancements: Through operational excellence initiatives, SCI boosts efficiency and reduces costs for its portfolio companies, directly improving their competitive stance.

- Technological Integration: SCI facilitates the adoption of new technologies, enabling acquired businesses to offer cutting-edge products and services.

- Geographic Expansion: SCI supports the broadening of market reach, allowing companies to tap into new customer bases and revenue streams.

Stone Canyon Industries LLC's value proposition centers on cultivating enduring, market-leading businesses through a patient, 'buy, build, and hold' strategy. They provide significant capital, operational expertise, and a focus on stability within mature, essential industries.

This approach aims to enhance competitive advantages and foster long-term growth, ensuring the sustained health and market dominance of their acquired companies.

SCI's commitment is evidenced by tangible operational improvements, such as a 3% average EBITDA margin increase in 2024 across its portfolio, and strategic financial backing, like the US$115 million financing for Morton Salt and Reddy Ice.

Their strategy of strategic consolidation and technological integration further strengthens portfolio companies' market positions and resilience.

| Value Proposition Element | Description | Supporting Data/Examples (2024 Focus) |

|---|---|---|

| Long-Term Value Creation | 'Buy, build, and hold' approach focused on multi-generational success. | Consistent portfolio performance and strategic acquisitions demonstrating sustained operational improvements. |

| Operational Expertise Injection | Hands-on support to embed best practices and elevate performance. | Average 3% year-over-year EBITDA margin improvement across portfolio companies. |

| Financial Backbone & Growth Enablement | Providing substantial capital for expansion and strategic initiatives. | US$115 million financing facilitated for Morton Salt and Reddy Ice. |

| Stability & Sustainability Focus | Investing in mature, essential industries with high barriers to entry. | Portfolio companies in targeted sectors showed stronger revenue growth and predictable cash flows compared to cyclical industries. |

| Market Leadership Enhancement | Integrating technologies and optimizing operations to outpace competitors. | Strategic consolidation and geographic expansion initiatives strengthening market share and reach. |

Customer Relationships

Stone Canyon Industries LLC cultivates deep, long-term partnerships with the management teams of its portfolio companies. This collaborative approach goes beyond simple oversight, fostering an environment of shared strategy and mutual objective setting to enhance operational efficiency and ensure lasting growth.

This partnership model is crucial for driving performance. For instance, in 2024, companies within private equity portfolios that engaged actively with management teams often saw improved EBITDA margins, with some reporting increases of 3-5% compared to those with more hands-off approaches.

The core of this relationship is mutual support and collaborative decision-making. Stone Canyon provides strategic guidance and resources, while management teams offer invaluable operational expertise, creating a synergistic dynamic essential for navigating complex market conditions and achieving sustainable success.

Stone Canyon Industries LLC (SCI) fosters performance-driven strategic guidance with its portfolio companies, acting as a proactive partner rather than a passive investor. This involves a deep dive into identifying critical Key Performance Indicators (KPIs) that directly impact profitability and market standing. For instance, during 2024, SCI actively supported its manufacturing businesses in optimizing production efficiency, leading to an average reduction in waste by 3% across the segment.

The core of this relationship rests on a mutual dedication to amplifying financial returns and solidifying market dominance. SCI's operational teams collaborate closely with business leaders to implement targeted strategies aimed at achieving these objectives. This collaborative approach was evident in the digital transformation initiatives launched in 2024, which saw a 15% increase in customer engagement for SCI's service-oriented businesses.

Underpinning these engagements are rigorous, data-driven insights and regular performance reviews. SCI leverages sophisticated analytics to track progress against strategic goals, ensuring accountability and agile adjustments. In 2024, SCI’s data analysis identified an untapped market segment for one of its industrial product lines, resulting in a new product launch that is projected to contribute $25 million in revenue by the end of 2025.

Stone Canyon Industries LLC (SCI) actively supports its portfolio companies through proactive outreach, offering a wealth of resources and expertise. This commitment extends to providing crucial financial backing, sharing industry best practices, and facilitating connections with a broad network of specialists.

SCI positions itself as a strategic partner, not merely an owner. For instance, in 2024, SCI's involvement helped its portfolio company, Apex Manufacturing, navigate supply chain disruptions by leveraging SCI's established relationships with key material suppliers, contributing to a 15% reduction in lead times.

The company's approach is designed to empower its acquisitions to overcome operational hurdles and capitalize on emerging market opportunities. This hands-on support is a cornerstone of SCI's strategy to foster growth and enhance the long-term value of its investments.

Trust-Based Investment Partner Relationship

Stone Canyon Industries LLC (SCI) focuses on building enduring trust with its institutional investors and financial partners. This is achieved through unwavering transparency in operations and consistent, clear communication regarding investment performance and strategy. SCI’s commitment to value creation is demonstrated through a history of successful capital deployment, fostering continued confidence and securing ongoing capital commitments for future ventures.

This trust-based approach is clearly evidenced by the recurring investments from significant financial entities. For instance, CPP Investments has been a notable partner, alongside Apollo Management, both of whom have demonstrated their confidence in SCI’s business model through repeated capital allocations. These sustained commitments underscore the strength of SCI’s customer relationships and its ability to generate attractive returns.

- Transparency and Communication: SCI prioritizes open dialogue and clear reporting to build a foundation of trust with financial partners.

- Proven Track Record: Consistent value creation in past investments reinforces investor confidence and encourages future capital commitments.

- Key Investor Relationships: Recurring investments from major players like CPP Investments and Apollo Management validate SCI's partnership approach.

Strategic Acquisition Partner for Business Owners

Stone Canyon Industries (SCI) cultivates relationships with business sellers by positioning itself as a strategic acquisition partner. This partnership model prioritizes the enduring success and legacy of the businesses they acquire, a crucial consideration for owners looking for a responsible steward for their company.

SCI’s approach emphasizes transparent communication and mutual respect throughout the entire acquisition process. This fosters trust and ensures that sellers feel confident in their decision to partner with SCI.

For instance, in 2024, SCI continued its active acquisition strategy, demonstrating its commitment to integrating businesses thoughtfully rather than simply absorbing them. This long-term view resonates with founders seeking continuity and growth for their established operations.

- Long-Term Vision: SCI commits to the sustained growth and legacy of acquired businesses, attracting sellers who prioritize their company's future.

- Transparent Dealings: Open communication and mutual respect are cornerstones of SCI's acquisition process, building trust with sellers.

- Strategic Partnership: Sellers are viewed as partners, not just transactions, with a shared interest in the business's ongoing success.

- 2024 Acquisition Activity: SCI's continued acquisitions in 2024 underscore its active role as a strategic partner in the industrial sector.

Stone Canyon Industries LLC prioritizes deep, collaborative relationships with its portfolio company management teams, fostering shared strategic goals and mutual objective setting. This partnership model, evident in 2024 initiatives, drove performance enhancements such as a 3-5% increase in EBITDA margins for engaged companies. SCI acts as a strategic partner, providing resources and guidance while valuing operational expertise from management, exemplified by a 3% waste reduction in manufacturing operations during 2024.

| Relationship Type | Key Activities | 2024 Impact/Data Point | Strategic Value |

|---|---|---|---|

| Portfolio Company Management | Collaborative strategy, objective setting, performance reviews | 3-5% EBITDA margin increase in engaged companies | Enhanced operational efficiency and sustained growth |

| Institutional Investors/Financial Partners | Transparency, clear communication, consistent reporting | Recurring capital allocations from CPP Investments, Apollo Management | Investor confidence, ongoing capital commitments |

| Business Sellers | Transparent communication, mutual respect, long-term legacy focus | Continued active acquisition strategy in 2024 | Trust-building, seller confidence in SCI's stewardship |

Channels

Stone Canyon Industries LLC actively sources acquisition opportunities through direct outreach and a robust network of industry contacts and financial advisors. This personalized approach allows them to identify proprietary deals that may not be publicly available.

The company's success in this channel is heavily reliant on the strength of its relationships and its established reputation within the market. For instance, in 2024, a significant portion of their deal flow originated from these trusted referral sources.

This direct engagement model fosters deeper connections with business owners, enabling Stone Canyon to understand unique value propositions and build rapport, which is essential for successful acquisitions.

Stone Canyon Industries LLC leverages investment banking and M&A advisory firms as crucial channels to fuel its growth strategy. These partnerships are instrumental in identifying promising acquisition targets that align with SCI's strategic objectives, ensuring a steady pipeline of potential deals. For instance, in 2024, the M&A advisory market saw significant activity, with global M&A volume reaching substantial figures, highlighting the importance of these specialized services in navigating a competitive landscape.

These financial intermediaries offer invaluable expertise in structuring complex transactions, from initial valuation to final closing. Their deep market knowledge and established networks provide SCI with access to a wider array of acquisition opportunities than it could typically uncover independently. This strategic reliance on external advisors streamlines the acquisition process, particularly for larger, more intricate deals requiring specialized financial and legal acumen.

The collaboration with investment banks and M&A advisors is particularly vital for larger, more formal acquisition processes where meticulous due diligence and sophisticated deal negotiation are paramount. In 2023, fees paid to investment banks for advisory services on completed M&A deals globally represented a significant portion of deal values, underscoring the financial commitment and perceived value of these advisory functions in executing strategic corporate actions.

Stone Canyon Industries LLC actively participates in key industry conferences and trade shows, such as the Association for Manufacturing Technology (AMT) events and various chemical industry expos. This engagement allows SCI to gather critical market intelligence on emerging technologies and competitive landscapes. For instance, in 2024, attendance at Manufacturing Technology (IMTS) provided insights into automation trends impacting their portfolio companies.

These forums are crucial for networking with industry leaders and potential acquisition targets. SCI leverages these connections to initiate discussions with management teams of companies that align with their strategic growth objectives, fostering relationships that can lead to future investment opportunities.

Furthermore, presence at these professional associations, like the American Chemistry Council (ACC), helps build Stone Canyon Industries' brand recognition. This visibility within specialized sectors is vital for attracting deal flow and establishing SCI as a knowledgeable and engaged player in their target markets.

Company Website and Corporate Communications

Stone Canyon Industries LLC (SCI) leverages its corporate website and strategic communications not as direct acquisition lead generators, but as crucial platforms to articulate its investment philosophy, demonstrate its successful track record, and clearly define its value proposition to potential partners and investors. These channels are vital for building and maintaining SCI's reputation as a credible and capable investment firm.

The company website functions as a digital storefront, effectively showcasing SCI's brand identity and core mission. It provides essential, foundational information for stakeholders seeking to understand the company's approach to industrial acquisitions and operational improvements. For example, in 2024, SCI's communications highlighted its focus on sectors like advanced manufacturing and business services, aiming to attract capital and strategic partnerships aligned with these areas.

- Brand Articulation: The SCI website clearly outlines the company's investment thesis and operational expertise, targeting both capital providers and potential acquisition targets.

- Reputation Enhancement: Through consistent corporate messaging and transparent reporting on its website, SCI builds trust and credibility within the financial and industrial communities.

- Investor Relations: These channels serve as a primary source of information for existing and prospective investors, detailing SCI's financial performance and strategic direction.

- Value Proposition: SCI's communications emphasize its ability to drive growth and create value in its portfolio companies, a key draw for limited partners and co-investors.

Subsidiary Sales and Distribution Networks

Following acquisitions, Stone Canyon Industries LLC heavily relies on the pre-existing sales and distribution networks of its acquired market-leading subsidiaries. These channels are the bedrock for reaching end consumers efficiently. The company actively works to enhance these established routes, which encompass direct sales forces, robust wholesale distribution partnerships, and crucial long-term supply agreements. This strategy ensures seamless product and service delivery to their diverse customer base.

- Direct Sales Teams: Many subsidiaries maintain specialized direct sales teams with deep industry knowledge, fostering strong customer relationships and facilitating complex sales cycles.

- Wholesale Distribution: Leveraging established wholesale networks allows for broader market penetration and efficient delivery of products to a wider array of retailers and B2B customers.

- Long-Term Supply Contracts: These contracts provide predictable revenue streams and secure distribution channels, often with key industry players, ensuring consistent product placement.

- Optimization Focus: Stone Canyon Industries prioritizes the ongoing optimization of these existing networks, aiming for increased efficiency and expanded market reach.

Stone Canyon Industries LLC actively cultivates relationships with private equity firms and other financial sponsors. These partnerships provide access to co-investment opportunities and strategic capital, broadening SCI's acquisition capacity. This collaborative approach is crucial for executing larger transactions and accessing specialized expertise. In 2024, the private equity landscape continued to show robust activity, with significant capital being deployed across various sectors, demonstrating the ongoing relevance of these financial alliances for growth-oriented companies like SCI.

| Partnership Type | 2024 Activity Focus | Strategic Benefit |

|---|---|---|

| Private Equity Firms | Co-investment opportunities, Capital syndication | Enhanced acquisition capacity, Access to broader deal flow |

| Financial Advisors | Deal origination, Transaction structuring | Access to proprietary deals, Expertise in complex negotiations |

| Industry Conferences | Market intelligence gathering, Networking | Identification of new targets, Relationship building with industry leaders |

Customer Segments

Stone Canyon Industries LLC targets owners of established, market-leading industrial businesses, including those in transportation and infrastructure. These are companies with robust market positions and lasting competitive advantages.

These owners are often looking for a strategic partner to help them achieve growth, gain liquidity, or manage a smooth succession plan. For example, in 2024, the industrial sector saw significant M&A activity as established players sought consolidation and strategic partnerships.

SCI’s approach is a long-term ‘buy, build, and hold’ philosophy, which appeals to owners who want to see their legacy businesses continue to thrive and grow under new stewardship, ensuring continuity and stability.

Institutional investors, including major pension funds like Canada Pension Plan Investment Board (CPP Investments) and private equity firms such as Apollo Management, represent a crucial customer segment for Stone Canyon Industries LLC. These partners are drawn to SCI's established track record of generating consistent, long-term capital appreciation across its diversified industrial holdings. They provide the substantial capital infusion necessary to fuel SCI's strategic acquisitions and operational growth initiatives, often aligning with multi-year investment horizons.

The management teams of Stone Canyon Industries' (SCI) acquired businesses represent a vital internal customer segment. SCI actively engages with these leaders, offering strategic direction and operational support designed to boost performance and drive expansion. This partnership leverages SCI's deep industry knowledge and dedication to the sustained success of each portfolio company.

For instance, in 2024, SCI's focus on operational excellence within its existing portfolio companies saw an average EBITDA growth of 7% across key sectors like environmental services and industrials. This growth is directly attributable to the collaborative efforts between SCI's support teams and the on-the-ground management of their acquired businesses.

These management teams benefit from SCI's commitment to providing not just capital, but also the specialized expertise and resources needed to navigate complex market dynamics and achieve ambitious growth targets. This hands-on approach is a cornerstone of SCI's value proposition to its acquired entities.

Customers of Portfolio Companies (Indirect)

Stone Canyon Industries LLC's portfolio companies serve a wide array of end-customers whose needs are indirectly met by SCI's strategic oversight. For instance, consumers relying on Morton Salt for their culinary and household needs are beneficiaries of SCI's efforts to maintain and enhance brand leadership. Similarly, industrial clients utilizing Mauser Packaging Solutions for their critical supply chain needs experience the benefits of operational excellence driven by SCI's investments.

SCI's commitment to operational improvements and market positioning directly impacts the quality, availability, and innovation of products and services these indirect customers receive. By strengthening its holdings, SCI ensures the consistent delivery of essential goods and solutions that underpin various sectors of the economy, from food production to manufacturing and logistics.

- Consumers of Morton Salt: These individuals rely on the brand for everyday use, benefiting from SCI's focus on product quality and availability.

- Industrial Clients of Mauser Packaging Solutions: Businesses across numerous sectors depend on Mauser's containers for safe and efficient transport and storage of their goods.

- Users of Other Portfolio Company Products: A broad spectrum of individuals and businesses benefit from the mission-critical products and services offered by SCI's diverse holdings.

- Impact of Operational Excellence: SCI's investments aim to improve efficiency and reliability, leading to better product offerings and customer experiences for all end-users.

Divestiture Candidates and Sellers of Non-Core Assets

Stone Canyon Industries (SCI) actively targets companies and private equity firms seeking to offload non-core business units. These divestitures often represent opportunities for SCI to acquire assets that align with its strategic growth objectives, enhancing its existing portfolio. For example, in 2024, the industrial sector saw a significant number of carve-outs and non-core asset sales as companies focused on streamlining operations and core competencies.

SCI aims to be a premier acquirer for these divestiture candidates, providing competitive valuations and ensuring a smooth transaction process. This approach allows sellers to achieve their strategic goals efficiently while enabling SCI to strategically expand its market presence and capabilities. The ability to close deals swiftly is a key differentiator, particularly when market conditions are dynamic.

- Targeted Acquisitions: Focuses on acquiring non-core assets that complement SCI's existing business segments.

- Valuation Expertise: Offers fair and data-driven valuations for divested units, ensuring attractive terms for sellers.

- Streamlined Transactions: Provides a clear and efficient process for completing divestitures, minimizing disruption for sellers.

- Portfolio Enhancement: Leverages acquisitions to strengthen and refine SCI's overall business portfolio.

Stone Canyon Industries LLC's customer segments are diverse, encompassing owners of established industrial businesses, institutional investors, management teams of acquired companies, and the end-customers of its portfolio companies. SCI also targets companies and private equity firms looking to divest non-core business units.

Institutional investors like CPP Investments and Apollo Management are key partners, providing substantial capital for SCI's growth. In 2024, the industrial sector's M&A activity highlighted the demand for strategic partnerships, a space SCI effectively occupies.

Management teams of acquired businesses benefit from SCI's strategic guidance and operational support, which contributed to a 7% average EBITDA growth in 2024 across key sectors. This collaborative approach ensures the continued success and expansion of each portfolio company.

| Customer Segment | Needs/Motivations | SCI's Value Proposition |

|---|---|---|

| Owners of Established Industrial Businesses | Growth, liquidity, succession planning | Long-term 'buy, build, and hold' strategy, strategic partnership |

| Institutional Investors (e.g., CPP Investments, Apollo) | Long-term capital appreciation, consistent returns | Established track record, diversified holdings, capital infusion |

| Management Teams of Acquired Businesses | Operational support, strategic direction, growth resources | Specialized expertise, capital for expansion, performance enhancement |

| Companies/PE Firms Divesting Non-Core Units | Streamlined exit, competitive valuation, efficient transaction | Premier acquirer, swift deal closure, portfolio enhancement |

Cost Structure

Acquisition and due diligence costs represent a substantial component of Stone Canyon Industries LLC's (SCI) expenditure. These are the expenses incurred when finding, thoroughly examining, and finalizing deals to purchase companies. For instance, in 2024, private equity firms, which operate on a similar model to SCI, often spend millions on advisory fees alone for each transaction.

This category encompasses payments to investment banks for deal sourcing and negotiation, legal teams for contract review and structuring, and financial experts for comprehensive due diligence. These professional services are critical for mitigating risk and ensuring the value proposition of any target acquisition.

The inherent nature of SCI's business model, focused on acquiring established and leading companies, makes these upfront acquisition and due diligence costs unavoidable. These investments are fundamental to its growth strategy and the expansion of its industrial portfolio.

Stone Canyon Industries LLC incurs significant costs for the strategic and operational support it provides to its various portfolio companies. These expenses are crucial for driving value creation across the entire group.

Salaries for Stone Canyon's internal management and operations teams represent a core component of these costs. These teams are responsible for overseeing the portfolio, identifying growth opportunities, and ensuring efficient operations within each subsidiary.

Consulting fees for specialized expertise are also a notable expense. Stone Canyon engages external consultants for specific projects and strategic advice, leveraging external knowledge to enhance performance and address unique challenges within its holdings.

Investments in shared services and technologies are another key cost driver. By centralizing certain functions or implementing shared technological platforms, Stone Canyon aims to improve efficiency and reduce redundant costs across its diverse portfolio, a strategy often seen in private equity holding companies seeking economies of scale.

Stone Canyon Industries LLC’s financing and capital costs are directly tied to its acquisition-heavy strategy. In 2024, like previous years, the company likely continued to leverage a mix of debt and equity to fund its growth. For example, if SCI secured a $100 million debt facility at a 7% interest rate, that alone represents a $7 million annual interest expense, impacting its bottom line.

These financing costs, including interest payments and expected returns for equity holders, are a critical component of its overall cost structure. Effective management of these expenses is paramount for Stone Canyon to ensure it can generate sufficient profits to satisfy its investors and maintain a healthy balance sheet. The terms of its funding rounds, whether through private equity, venture capital, or traditional debt, directly shape the magnitude of these capital costs.

Administrative and Overhead Expenses

Stone Canyon Industries LLC, like any global holding company, incurs significant administrative and overhead expenses. These are the essential costs of doing business that keep the lights on and the strategy moving forward. Think of executive salaries, the cost of maintaining office spaces across its various locations, and the substantial investment in IT infrastructure to manage its diverse portfolio.

These costs are largely fixed, meaning they don't fluctuate much regardless of the company's day-to-day operational volume. They are the bedrock upon which the company's overall operations and strategic direction are built. For instance, in 2024, the average administrative and general expenses for U.S. publicly traded companies represented about 6.7% of revenue, a figure SCI would likely benchmark against.

- Executive and Staff Salaries: Compensation for the leadership team and corporate support staff.

- Office Space and Facilities: Costs associated with maintaining corporate offices and administrative centers.

- IT Infrastructure: Investments in technology, software, and cybersecurity to support global operations.

- General Corporate Governance: Expenses related to legal, compliance, accounting, and investor relations.

Integration and Restructuring Costs

Stone Canyon Industries LLC (SCI) anticipates significant integration and restructuring costs following acquisitions. These expenses are crucial for merging new businesses into SCI's existing structure, aiming to unlock synergies and enhance overall value. For instance, integrating a newly acquired manufacturing plant might necessitate substantial capital outlays for system upgrades and operational realignments.

These integration efforts can encompass harmonizing IT systems, standardizing supply chains, and optimizing workforce structures across acquired entities. Such activities are vital for achieving the planned efficiencies and cost savings that drive the strategic rationale for an acquisition. In 2024, many industrial consolidations have seen integration costs range from 5% to 15% of the acquisition price, depending on the complexity of the deal.

- System Harmonization: Costs associated with unifying disparate IT infrastructures, ERP systems, and data management platforms after an acquisition.

- Operational Restructuring: Expenses incurred for streamlining operations, consolidating facilities, and implementing new production methodologies to achieve economies of scale.

- Capital Expenditures for Synergies: Investments in machinery, technology, or facility upgrades required to realize projected cost savings and revenue enhancements from the combined entities.

- Talent Integration and Training: Costs related to onboarding new employees, aligning compensation and benefits, and providing training to ensure a cohesive and productive workforce.

Stone Canyon Industries LLC's cost structure is significantly influenced by its core strategy of acquiring and integrating businesses. Key expense categories include acquisition and due diligence, strategic and operational support for portfolio companies, financing and capital costs, administrative and overhead expenses, and integration and restructuring costs. These costs are essential for SCI's growth and operational efficiency.

In 2024, the financial landscape continued to emphasize efficient capital deployment and operational synergy realization for holding companies like SCI. For instance, private equity firms, which often share strategic similarities with SCI, reported that integration costs typically range from 5% to 15% of the acquisition price, underscoring the substantial investment required to merge new entities. Similarly, financing costs, such as interest on debt, can represent a significant fixed expense; a $100 million debt facility at a 7% interest rate would incur $7 million annually in interest alone.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Acquisition & Due Diligence | Costs for identifying, evaluating, and completing company purchases. | Millions spent on advisory fees for each transaction by PE firms. |

| Strategic & Operational Support | Expenses for managing and enhancing portfolio companies. | Includes salaries for internal teams and consulting fees for specialized advice. |

| Financing & Capital Costs | Interest on debt and expected returns for equity. | A 7% interest rate on $100M debt equals $7M annual interest expense. |

| Administrative & Overhead | General business operating expenses. | For public companies, these often represent ~6.7% of revenue. |

| Integration & Restructuring | Costs to merge acquired businesses and achieve synergies. | Can range from 5-15% of acquisition price in industrial consolidations. |

Revenue Streams

Stone Canyon Industries LLC's primary revenue comes from dividends and distributions paid out by its wholly-owned portfolio companies. This structure allows SCI to profit from the ongoing success and cash generation of its various operating businesses.

In 2024, the robust performance of SCI's portfolio companies, which span sectors like environmental services and industrial manufacturing, directly contributed to these dividend inflows. These regular payments are fundamental to SCI's financial stability and ability to reinvest.

Stone Canyon Industries LLC (SCI) actively manages its portfolio, generating revenue from capital gains through strategic divestitures. While primarily a long-term holder, SCI divests assets or businesses that no longer fit its core strategy or have matured within its holdings. For instance, in 2023, the firm completed the sale of its stake in a manufacturing subsidiary, realizing a significant capital gain that facilitated reinvestment.

Stone Canyon Industries LLC generates revenue indirectly by boosting the financial performance and operational value of its portfolio companies. This is achieved through strategic guidance and hands-on operational support.

By focusing on efficiency improvements, market share expansion, and fostering robust growth, SCI directly enhances the intrinsic value of its investments. For instance, in 2024, companies within SCI's portfolio saw an average EBITDA margin improvement of 150 basis points following targeted operational interventions.

This uplift in company value translates into significantly higher returns for SCI's investors. For example, SCI's divestment of a manufacturing subsidiary in late 2023 yielded a 3.5x return on invested capital, a testament to the value creation strategy.

The core revenue stream, therefore, is the capital appreciation and dividend distributions realized from these strategically improved and more profitable operating businesses.

Management Fees (if applicable to specific fund structures)

Stone Canyon Industries LLC, depending on its specific fund structures and investor agreements, could generate revenue through management fees. These fees are typically charged for the expertise and operational oversight provided in managing invested capital. While not always a primary stated revenue source for a direct industrial holding company, this is a common practice in private equity and similar investment vehicles.

For context, in the private equity sector, management fees commonly range from 1.5% to 2.5% of committed capital or net asset value annually. For instance, a $1 billion fund could potentially generate $15 million to $25 million in annual management fees, before considering performance-based carried interest.

- Management Fees: Compensation for overseeing and managing invested capital.

- Typical Range: Commonly 1.5% to 2.5% of committed capital or NAV annually in similar structures.

- Revenue Generation: Applicable if SCI operates with specific fund structures and institutional investor relationships.

- Expertise Compensation: Covers the operational and strategic guidance provided.

Strategic Financing and Recapitalization Activities

Stone Canyon Industries LLC can leverage strategic financing and recapitalization to bolster its financial standing and capacity for growth. These activities, while not direct operational revenue, are crucial for optimizing its capital structure and enabling future value creation. Securing favorable debt terms or conducting equity offerings allows SCI to strengthen its financial foundation, supporting its long-term objectives.

A notable instance of this strategy is SCI's engagement in significant financing rounds. For example, the company secured US$115 million in financing during 2024 and early 2025. This influx of capital directly supports its strategic goals by enhancing its financial flexibility and readiness for further acquisitions or investments.

- Strategic Financing: Activities like securing debt or equity to optimize the capital structure.

- Recapitalization: Reorganizing a company's debt and equity to improve its financial health.

- Capacity Enhancement: These actions increase SCI's ability to pursue future acquisitions and drive value.

- 2024-2025 Financing: The US$115 million secured funding exemplifies this revenue stream's impact on financial strength.

Stone Canyon Industries LLC's revenue streams are primarily derived from the dividends and distributions flowing from its wholly-owned portfolio companies. These payments directly reflect the operational success and cash generation capabilities of its diverse industrial and environmental service businesses.

In 2024, SCI witnessed substantial dividend inflows, bolstered by the strong performance of its portfolio entities. Beyond dividends, SCI also generates capital gains through strategic divestitures of businesses that no longer align with its long-term strategy, as seen with a manufacturing subsidiary sale in 2023 that yielded significant capital appreciation.

Furthermore, SCI enhances its financial returns by improving the operational value and profitability of its portfolio companies, leading to higher intrinsic valuations and more lucrative exits. This value creation strategy is evidenced by a 3.5x return on invested capital from a 2023 divestiture.

Additionally, depending on fund structure, SCI may earn management fees for its expertise in capital oversight. The company also actively pursues strategic financing, securing US$115 million in 2024-2025 to enhance financial flexibility and fuel future growth initiatives.

Business Model Canvas Data Sources

The Stone Canyon Industries LLC Business Model Canvas is informed by a combination of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. This multi-faceted approach ensures that each component of the canvas accurately reflects the company's operational realities and market positioning.