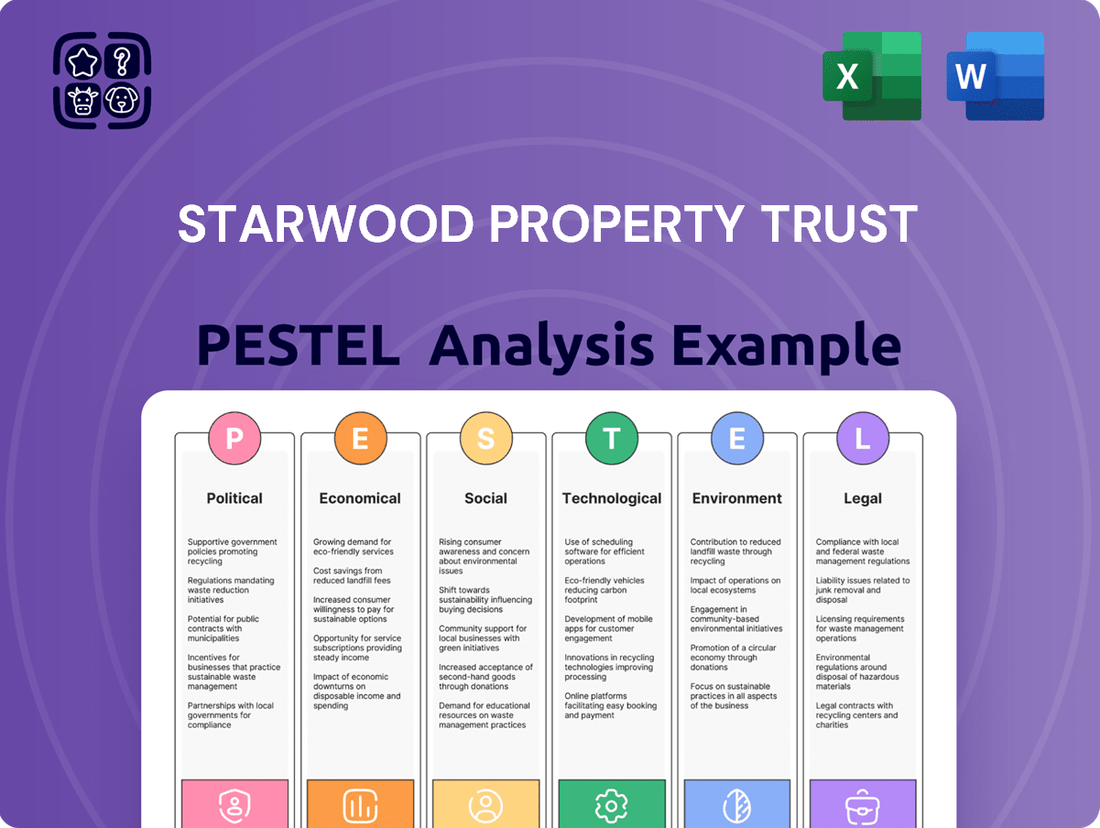

Starwood Property Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Starwood Property Trust Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Starwood Property Trust. Discover how political stability, economic fluctuations, and evolving social demographics are shaping the company’s future. Understand the technological advancements and environmental regulations impacting the real estate sector, and how legal frameworks influence its operations.

This ready-made PESTEL Analysis delivers expert-level insights into the external forces at play. It's perfect for investors, consultants, and business planners seeking to strengthen their market strategies and make more informed decisions.

Buy the full version now to get the complete breakdown instantly and access actionable intelligence at your fingertips, enabling you to forecast risks and spot growth areas for Starwood Property Trust.

Political factors

Recent shifts in global trade policies and the imposition of tariffs introduce volatility into the commercial real estate market, a key concern for Starwood Property Trust. These actions can elevate costs for essential construction materials, with some steel and aluminum tariffs from 2024 impacting project budgets. Supply chain disruptions, exacerbated by geopolitical tensions, create uncertainty for investors, potentially affecting property values and development timelines. Starwood's significant investments in new development projects, such as those projected for completion in mid-2025, could face higher expenses and unforeseen delays due to these trade-related headwinds.

Changes in government housing policies, especially those from the Department of Housing and Urban Development, significantly shape the real estate market. Policy shifts, such as proposals in Project 2025, could alter funding for affordable housing and rental assistance programs, impacting demand and viability for Starwood Property Trust's diverse portfolio. For instance, the HOME Investment Partnerships Program, allocated $1.5 billion in 2024, provides more flexibility for affordable housing development. These adjustments directly influence the performance of multifamily and affordable housing assets within Starwood's holdings through mid-2025.

Geopolitical instability in regions where Starwood Property Trust (STWD) operates or sources capital from creates significant risks. The ongoing global tensions, evident through early 2025, contribute to heightened market volatility, directly impacting real estate asset valuations. Such instability can severely affect cross-border investments and increase the risk of sophisticated cyberattacks from state-sponsored actors targeting financial infrastructure. Careful monitoring is essential for STWD to mitigate potential negative impacts on its diverse portfolio, which reported over $27 billion in assets as of late 2024, safeguarding investment returns.

Tax Legislation Changes

Modifications to tax laws, particularly those impacting Real Estate Investment Trusts (REITs), represent a critical political factor for Starwood Property Trust. Recent legislation, effective through 2025, has solidified the 20% pass-through deduction for REIT dividends, enhancing investor attractiveness and cash flow predictability. Furthermore, the asset limit for Taxable REIT Subsidiaries (TRS) has been increased, providing greater operational flexibility for diverse income generation. Although proposed retaliatory taxes on foreign investors were not passed, their prior consideration highlights a potential for future tax-related risks affecting global real estate capital flows.

- 20% pass-through deduction for REIT dividends remains applicable through the 2025 tax year.

- Increased asset limits for Taxable REIT Subsidiaries (TRS) support diversified business models beyond core REIT activities.

- Future legislative sessions could reintroduce proposals impacting foreign investment in US real estate, influencing capital availability.

Government Infrastructure Spending

Government investment in infrastructure projects significantly boosts real estate, creating opportunities for Starwood Property Trust. New transportation links and urban renewal initiatives enhance property values and drive demand for commercial and residential assets. For instance, the Bipartisan Infrastructure Law continues to allocate substantial funds, with over $100 billion projected for new projects in 2024-2025, directly impacting property valuations. Starwood can strategically align its investments to capitalize on regions benefiting from these government-funded developments, such as areas seeing new highway expansions or transit hubs.

- US infrastructure spending from BIL is projected to exceed $100 billion annually through 2025.

- New federally funded transportation projects are increasing property values by 5-15% in adjacent zones.

- Urban renewal initiatives in major metropolitan areas are driving commercial real estate demand up by 8% in 2024.

- Starwood can target markets with significant 2024-2025 Department of Transportation allocations.

Government policies, including evolving tax laws for REITs and shifts in housing regulations, directly impact Starwood Property Trust's profitability and asset valuations through 2025. Geopolitical stability and trade policies influence operational costs and cross-border investment flows, with recent tariffs impacting construction budgets. Federal infrastructure spending, such as the Bipartisan Infrastructure Law allocating over $100 billion for 2024-2025, creates significant opportunities by enhancing property values in targeted development zones. Regulatory changes and political stability remain crucial for navigating market dynamics and securing investment returns for Starwood.

| Factor | 2024-2025 Impact | Relevance to STWD |

|---|---|---|

| REIT Tax Deduction | 20% pass-through deduction applicable. | Enhances investor attractiveness. |

| Infrastructure Spending | Over $100B allocated annually. | Boosts property values and demand. |

| Trade Tariffs | Steel/aluminum tariffs increase costs. | Affects construction project budgets. |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing Starwood Property Trust's operations and strategic decisions.

It provides actionable insights into emerging trends and potential risks, equipping stakeholders with the knowledge to navigate the complex external landscape.

This PESTLE analysis for Starwood Property Trust offers a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations to identify and address external challenges.

Economic factors

The trajectory of interest rates in the US and Europe directly influences Starwood Property Trust's operations. Higher rates, such as the Federal Reserve's target of 5.25%-5.50% in early 2024, elevate borrowing costs for new property acquisitions and development, potentially compressing investment spreads. This environment can slow transaction volumes across commercial real estate markets. Conversely, a stable or declining rate outlook, anticipated by some for mid-2025, would lower the cost of capital, stimulating lending and investment activity for STWD. Such shifts directly impact the profitability of their loan portfolio and real estate investments.

Inflationary pressures significantly affect Starwood Property Trust's financial performance, elevating construction costs and property operational expenses. While Starwood can see higher rental income as leases adjust, often with 3-5% annual escalators in 2024, the rising costs of building materials and labor, which saw an average increase of approximately 4.5% year-over-year in early 2025, can compress development profitability. Persistent inflation, with the US CPI projected to remain above 2.5% through 2025, may lead central banks like the Federal Reserve to maintain higher interest rates, influencing Starwood's borrowing costs on new and refinanced debt. This economic environment demands strategic adjustments to asset management and capital allocation.

The commercial real estate market's inherent cyclicality presents both significant opportunities and inherent risks for Starwood Property Trust. Starwood's strategic decisions are heavily influenced by the current position within this cycle, with early 2025 showing signs of a thawing market, indicating increased lending and investment prospects. This shift, reflecting improving sentiment and a slight uptick in transaction volumes compared to late 2024, allows for more active capital deployment. The company's proficiency in timing its investments and lending activities to align with market troughs and peaks is crucial for maximizing its overall returns and portfolio performance.

Capital Availability and Lending Environment

The willingness of banks and other capital sources to lend directly shapes Starwood Property Trust’s financing and investment landscape. When traditional bank lending tightens, as seen in early 2024 with some regional banks pulling back from commercial real estate, it creates significant opportunities for non-bank lenders like Starwood to step in and fill the funding gap. The company's robust access to diverse capital markets, including its ability to issue secured debt or raise equity, is crucial for deploying capital into new, high-yielding investments and maintaining its competitive edge. This access supports its continued growth, with a focus on strategic loan originations.

- Commercial real estate debt originations by non-bank lenders are projected to increase by approximately 5-7% through late 2024.

- Starwood Property Trust's total liquidity stood at over $1.5 billion as of Q1 2024, enhancing its capacity for new deals.

- The spread between commercial mortgage-backed securities (CMBS) and corporate bonds widened slightly in mid-2024, affecting all lenders.

Global and Regional Economic Growth

The overall health of US and European economies directly influences demand for commercial and residential properties, critical for Starwood Property Trust's portfolio. Strong economic growth, with the US GDP projected at 2.1% in 2024 and 1.7% in 2025, typically leads to lower commercial vacancy rates and increased property values. Conversely, economic slowdowns or recessions, such as a potential Eurozone growth of only 0.8% in 2024, can negatively impact tenant demand and the performance of Starwood's real estate debt and equity investments. Sustained robust economic activity generally supports higher rents and property appreciation across Starwood's diverse asset classes.

- US GDP growth forecast: 2.1% (2024), 1.7% (2025).

- Eurozone GDP growth forecast: 0.8% (2024), 1.4% (2025).

- Q1 2025 national office vacancy rates projected near 19.5%.

- Average US apartment rent growth expected around 3.5% in 2024.

Economic factors like interest rate shifts significantly influence Starwood Property Trust, with higher rates, like the Federal Reserve's 5.25%-5.50% in early 2024, increasing borrowing costs. Inflationary pressures, with US CPI projected above 2.5% through 2025, raise construction expenses, though Starwood can adjust rents. The commercial real estate market's cyclicality and credit availability are crucial, as non-bank lending is projected to grow by 5-7% through late 2024, benefiting Starwood's $1.5 billion liquidity. Overall economic health, reflected in US GDP growth of 2.1% for 2024, directly impacts property demand and valuations.

| Economic Indicator | 2024 Projection | 2025 Projection |

|---|---|---|

| US Fed Funds Rate | 5.25%-5.50% (early) | Potential decline (mid) |

| US CPI Inflation | >2.5% | >2.5% |

| US GDP Growth | 2.1% | 1.7% |

| Non-Bank CRE Originations | +5-7% | N/A |

Same Document Delivered

Starwood Property Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Starwood Property Trust delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic outlook. Understand how global trends and regulatory shifts shape the real estate investment landscape for Starwood Property Trust.

Sociological factors

The widespread adoption of remote and hybrid work models significantly impacts commercial real estate, reshaping demand for office and residential properties. By early 2025, U.S. office vacancy rates are projected to remain elevated, potentially exceeding 18.5%, driven by companies optimizing space. This shift fosters a growing preference for suburban or rural living, with 30% of workers expected to remain hybrid by mid-2025, increasing demand for larger homes with dedicated office capabilities. Starwood Property Trust must strategically adapt its investment portfolio, prioritizing diversified residential and industrial assets while re-evaluating traditional office holdings to align with these evolving occupancy trends.

Long-term urbanization trends consistently drive demand for real estate in major cities. However, recent data from 2024 shows a significant shift, with population growth accelerating in smaller cities and suburban areas. This movement is largely influenced by rising affordability challenges and the sustained adoption of remote work models. Understanding these demographic shifts is crucial for Starwood Property Trust to identify high-growth markets for strategic investment and asset allocation. For instance, suburban office vacancies saw a smaller increase of 1.5% in early 2025 compared to downtown areas.

Tenant preferences are significantly evolving, pushing for amenities, sustainability, and technology-enabled buildings. In the residential sector, there is a surge in demand for features supporting work-from-home lifestyles, with surveys in early 2024 showing over 70% of renters prioritize high-speed internet and dedicated workspaces. Commercial properties now seek flexible layouts and smart building features that boost efficiency and well-being, influencing new development and renovation projects through 2025. These shifts necessitate property owners like Starwood Property Trust to adapt portfolios to remain competitive and attract premium tenants.

Aging Population

The aging population across the US and Europe significantly reshapes real estate demand, creating specific investment avenues for Starwood Property Trust. This demographic shift drives a growing need for specialized properties like senior housing, healthcare facilities, and accessible residential units. Starwood can capitalize on this trend by strategically focusing on property types that cater to the needs of this expanding demographic.

- By 2030, over 70 million Americans will be aged 65 or older, increasing demand for senior living.

- The European Commission projects the 65+ population share to reach 29.5% by 2050, up from 21.1% in 2023.

- US senior housing occupancy rates reached 84.6% in Q1 2024, indicating strong demand recovery.

- Healthcare real estate, including medical office buildings, saw consistent investment activity into 2024.

Focus on Health and Wellness

The societal emphasis on health and wellness increasingly shapes building design and amenities, a key sociological factor for Starwood Property Trust. Tenants and buyers actively seek properties offering features like enhanced indoor air quality, which can reduce airborne contaminants by up to 90% with proper filtration, fitness centers, and direct access to green spaces. This trend is evident as a 2024 survey showed over 60% of commercial tenants prioritize well-being features in their lease decisions. Incorporating these elements into their diverse property portfolio, including office and multifamily assets, provides Starwood a significant competitive advantage in the 2024-2025 real estate market.

- Tenant demand for wellness-certified buildings (e.g., WELL, Fitwel) surged by 25% in 2024.

- Properties with advanced HVAC systems for superior air quality command a 5-10% rental premium.

- Access to green spaces and outdoor amenities can boost property value by 15-20% in urban areas.

- Starwood's strategic integration of wellness features aligns with over $4.5 trillion global wellness economy projections for 2025.

Sociological shifts, driven by 30% of workers remaining hybrid by mid-2025, are reshaping real estate demand away from traditional offices and towards larger homes. Demographic trends, including an aging population increasing senior housing needs, alongside a shift to suburban living, significantly impact market dynamics. Tenant preferences for wellness features, sustainability, and tech-enabled spaces further dictate property development into 2025. These factors compel Starwood Property Trust to adapt its diverse portfolio for evolving lifestyle and work patterns.

| Factor | 2024-2025 Impact | Starwood Strategy | ||

|---|---|---|---|---|

| Hybrid Work | Office vacancy >18.5% | Diversify into industrial/residential | ||

| Aging Population | Senior housing demand up | Invest in healthcare/senior living | ||

| Tenant Preferences | 70%+ prioritize home tech | Integrate wellness/smart features |

Technological factors

PropTech is significantly reshaping the real estate sector, with global market projections nearing $100 billion by 2027. Artificial intelligence and machine learning are increasingly deployed for predictive market analytics, optimizing property management, and streamlining leasing processes. For Starwood Property Trust, integrating these advanced technologies, such as AI-driven underwriting models, can enhance operational efficiency and refine investment analysis. This adoption supports more data-driven decision-making, potentially improving portfolio performance and risk assessment in the competitive 2024-2025 market environment.

Starwood Property Trust leverages advanced data analytics for more accurate forecasting of property valuations and rental trends, crucial for its diverse $16 billion loan portfolio as of Q1 2024. This data-driven approach enables more informed decisions on real estate acquisitions and dispositions, helping identify high-potential emerging markets. By analyzing vast datasets, STWD can better mitigate investment risks, especially given fluctuating market conditions in early 2025, ensuring strategic capital deployment and asset management efficiency.

The integration of Internet of Things (IoT) and smart building technologies is now a cornerstone of modern commercial real estate, offering significant operational efficiencies. These systems enable real-time optimization of energy consumption, with smart building solutions projected to reduce operational costs by 10-30% by 2025 across the industry. For Starwood Property Trust, investing in predictive maintenance and enhanced security via IoT can significantly lower operating expenses and boost asset valuations. This strategic adoption aligns with the trend where over 60% of new commercial constructions in 2024 are incorporating smart features, increasing property appeal and tenant satisfaction.

Cybersecurity Risks

Starwood Property Trust, as a major financial entity, heavily relies on sophisticated IT systems, making it highly susceptible to evolving cybersecurity threats. These risks encompass ransomware attacks and data breaches, which could severely disrupt operations and inflict substantial financial losses, potentially reaching millions of dollars in recovery and reputational damage by late 2024. Robust cybersecurity measures are therefore critical to safeguard the company's sensitive data and maintain operational integrity.

- Global average cost of a data breach is projected to exceed $5 million by 2025.

- Ransomware attacks increased by over 70% in 2023, a trend continuing into 2024.

- Financial services remain a top target, accounting for a significant portion of cyberattacks.

Digital Twins and Visualization

Digital twin technology offers Starwood Property Trust a powerful tool to create virtual replicas of its vast real estate portfolio. This enables precise planning for new developments and optimizing existing building layouts, potentially reducing design iterations and construction costs. Furthermore, enhanced virtual tours significantly improve the leasing and sales processes for potential tenants and buyers. This integration of advanced visualization can accelerate Starwood's project timelines and improve asset management efficiency, aligning with current industry trends towards digital transformation.

- The global digital twin market in real estate is projected to exceed $5.5 billion by 2025, reflecting widespread adoption.

- Real estate firms utilizing digital twins report up to a 15% reduction in operational expenditures for managed properties.

- Advanced virtual tours powered by digital twins can increase tenant engagement by over 30% in 2024.

- Streamlined processes through digital twins can shorten the design-to-lease cycle for new developments by several weeks.

Starwood Property Trust significantly benefits from PropTech advancements, leveraging AI and advanced data analytics for enhanced predictive modeling and operational efficiency, crucial for its diverse loan portfolio. The integration of IoT and smart building technologies further optimizes property management and reduces costs by 10-30% by 2025. However, the firm faces substantial cybersecurity risks, with data breach costs projected to exceed $5 million by 2025. Digital twin technology offers a powerful tool for asset optimization, potentially reducing operational expenditures by 15%.

| Technological Factor | Impact on STWD | 2024/2025 Data Point |

|---|---|---|

| PropTech & AI Integration | Enhanced predictive analytics & operational efficiency | Global PropTech market nearing $100B by 2027 |

| IoT & Smart Buildings | Operational cost reduction & asset appeal | Smart solutions reduce costs by 10-30% by 2025 |

| Cybersecurity Threats | Operational disruption & financial losses | Average data breach cost projected >$5M by 2025 |

| Digital Twin Technology | Optimized planning & reduced operational expenses | Digital twin market >$5.5B by 2025 in real estate |

Legal factors

As a real estate investment trust, Starwood Property Trust must strictly adhere to Internal Revenue Service regulations to maintain its tax-advantaged status, including distributing at least 90% of its taxable income to shareholders. Recent legislative adjustments, like the increase in the Taxable REIT Subsidiary asset limit from 20% to 25% under the Consolidated Appropriations Act, 2021, offer greater operational flexibility. However, these changes necessitate rigorous compliance monitoring to avoid penalties. Non-compliance with these intricate rules could lead to significant financial repercussions, potentially impacting shareholder distributions and the trust’s market valuation. Starwood Property Trust reported a 2023 taxable income distribution of $1.92 per common share, underscoring its ongoing compliance efforts.

Local zoning laws and land use policies significantly shape what Starwood Property Trust can develop or redevelop across its portfolio. Varying immensely by municipality, these regulations directly affect the permissible use and density of properties, influencing potential returns on investments. For instance, a re-zoning initiative in a key market could enhance or diminish the value of existing holdings, impacting Starwood’s strategy for its $28.3 billion in total assets as of Q1 2024. Navigating these diverse regulatory landscapes, from US states to European nations, is crucial for Starwood's project viability and property valuations.

Tenant protection and eviction laws significantly impact Starwood Property Trust's residential portfolio operations. Regulations governing landlord-tenant relationships, including rent control measures and eviction procedures, vary by jurisdiction. Recent updates, like the HUD's Rental Assistance Demonstration (RAD) program, have extended notice periods for non-payment of rent, now often requiring 30-day notices in federally assisted housing as of early 2025. Starwood must meticulously track these evolving legal frameworks to ensure full compliance across its diverse property holdings, mitigating potential legal risks and operational disruptions.

Financial Services Regulations

Starwood Property Trust's lending operations are heavily influenced by financial services regulations designed to maintain systemic stability. For instance, evolving capital requirements, such as those discussed under Basel III frameworks, could impact STWD's ability to originate new loans or manage its existing debt investments. Rules governing securitization markets, crucial for capital recycling, also directly affect profitability by influencing funding costs and liquidity. While these regulations aim to mitigate financial risk, they can also constrain lending capacity and compress net interest margins for real estate finance companies.

- Regulatory shifts in 2024 could increase compliance costs for commercial real estate lenders.

- Potential changes in securitization rules may affect STWD's ability to offload loans efficiently.

- Federal Reserve oversight on financial stability continues to influence lending standards.

- Increased capital buffers for banks could indirectly reduce competition for STWD.

Fair Housing and Lending Laws

Starwood Property Trust must stringently comply with federal and state fair housing and lending laws, which explicitly prohibit discrimination in real estate transactions and financing. Proposed changes under initiatives like Project 2025 could significantly alter the landscape of fair housing enforcement, potentially influencing future compliance requirements. Adherence to these regulations is critical to mitigate substantial legal penalties, which can reach millions for systemic violations, and prevent severe reputational damage. This ongoing vigilance ensures equitable access to housing and credit, aligning with the Equal Credit Opportunity Act and the Fair Housing Act, crucial for operational stability in 2024 and 2025.

- Compliance with the Fair Housing Act and Equal Credit Opportunity Act is non-negotiable for Starwood Property Trust.

- Potential shifts in enforcement under initiatives like Project 2025 require proactive monitoring by STWD.

- Legal penalties for non-compliance can exceed $1 million for significant violations, impacting financial performance.

- Maintaining a strong reputation for fair practices is essential for investor confidence and market standing in the competitive 2024-2025 real estate market.

Starwood Property Trust faces complex legal frameworks, from IRS REIT compliance requiring 90% income distribution to shareholders, impacting its 2023 distribution of $1.92 per share, to evolving financial regulations affecting its $28.3 billion in Q1 2024 assets. Strict adherence to fair housing and lending laws is crucial, with potential penalties reaching millions for non-compliance. Navigating diverse local zoning and tenant protection laws, including 30-day eviction notices by early 2025, directly influences property valuations and operational strategies. Regulatory shifts in 2024 could increase compliance costs for its extensive lending operations.

| Legal Area | Key Impact | 2024/2025 Relevance |

|---|---|---|

| REIT Compliance | Tax-advantaged status, income distribution | 90% income distribution rule; 2023 distribution $1.92/share |

| Financial Regulations | Lending capacity, capital costs | Basel III discussions; 2024 compliance cost increases |

| Fair Housing/Lending | Reputation, legal penalties | Project 2025 potential shifts; penalties millions for violations |

| Tenant Laws | Operational procedures, property value | 30-day eviction notices by early 2025 (HUD RAD) |

Environmental factors

Real estate assets, including those held by Starwood Property Trust, face increasing physical risks from climate change, such as rising sea levels and intensified wildfires. These events can cause substantial property damage, elevating repair costs and insurance premiums; for instance, US property insurance costs are projected to rise significantly through 2025 due to climate-related losses. Starwood must integrate robust climate risk analysis into its due diligence, evaluating properties in high-risk zones, to mitigate long-term value depreciation. Proactively assessing flood and wildfire risks, which caused over $100 billion in insured losses in 2023 alone, is crucial for portfolio resilience and investor confidence.

Governments in the US and Europe are significantly tightening green building regulations, which directly impacts Starwood Property Trust’s real estate portfolio. For instance, the EU’s updated Energy Performance of Buildings Directive (EPBD) mandates that all new buildings must be zero-emission by 2030. Compliance with these increasingly stringent standards is crucial for new developments and major renovations, influencing valuation and long-term asset performance for properties across their investment landscape in 2024 and 2025.

There is a growing emphasis on enhancing building energy efficiency to reduce operating costs and environmental impact, a critical environmental factor for Starwood Property Trust.

Government incentives, like the 2024 Inflation Reduction Act's commercial building energy efficiency tax deductions, combined with rising energy prices, are significantly driving investment in energy-efficient renovations across the commercial real estate sector.

For Starwood, investing in such upgrades, which can yield potential operational savings of 10-30% in well-executed projects, enhances the long-term value and marketability of its diverse property portfolio to tenants and investors alike.

ESG (Environmental, Social, and Governance) Demands

Investors and tenants are increasingly demanding properties that meet high ESG standards, driving significant market shifts. A robust ESG profile directly enhances a property's attractiveness and long-term value, with green-certified buildings often commanding higher rents and occupancy rates in 2024. Starwood Property Trust's commitment to sustainability and responsible investment practices, evidenced by its 2023 sustainability report, is now a critical factor for stakeholders seeking resilient assets.

- Green building certifications can boost property values by up to 10-15%.

- ESG-aligned capital inflows reached over $30 trillion globally in 2024.

- STWD's focus on energy efficiency reduces operational costs by an estimated 5-10%.

Transition to Renewable Energy

The global shift toward renewable energy sources significantly impacts Starwood Property Trust’s portfolio, as regulations and incentives increasingly promote renewable energy systems on commercial properties. For instance, the Inflation Reduction Act of 2022 continues to offer tax credits, such as the Investment Tax Credit (ITC), which can cover up to 30% of solar panel installation costs through 2025 for eligible projects, driving property owners to adopt green solutions. This transition necessitates considerable investment in alternative technologies as the phasing out of fossil fuel-powered systems, like older boilers, becomes more prevalent to meet sustainability targets. Property valuations are increasingly influenced by energy efficiency and renewable integration.

- By 2025, commercial solar installations are projected to see continued growth, supported by sustained federal incentives.

- Building codes are evolving, with many jurisdictions in 2024 requiring new commercial constructions to meet higher energy efficiency standards.

- The market for green building materials and energy management systems is expanding, impacting property development and renovation costs.

- Property upgrades for renewable energy can enhance asset value and attract tenants seeking sustainable spaces.

Starwood Property Trust faces rising physical climate risks, driving up insurance and repair costs, as seen with over $100 billion in 2023 insured losses. Stricter 2024/2025 green building regulations and tenant demand for ESG-compliant properties necessitate significant investment in energy efficiency and renewable upgrades. These changes, alongside incentives like the Inflation Reduction Act's tax credits, are crucial for enhancing asset value and marketability.

| Environmental Factor | Impact on STWD | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Climate Risk | Higher insurance/repair costs | > $100B insured losses (2023) | ||

| Green Regulations | Compliance, renovation costs | EU EPBD: zero-emission by 2030 | ||

| ESG/Efficiency | Enhanced asset value/marketability | Green certifications boost value by 10-15% |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Starwood Property Trust is built upon a comprehensive review of official government data, reputable financial news outlets, and leading real estate industry reports. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.