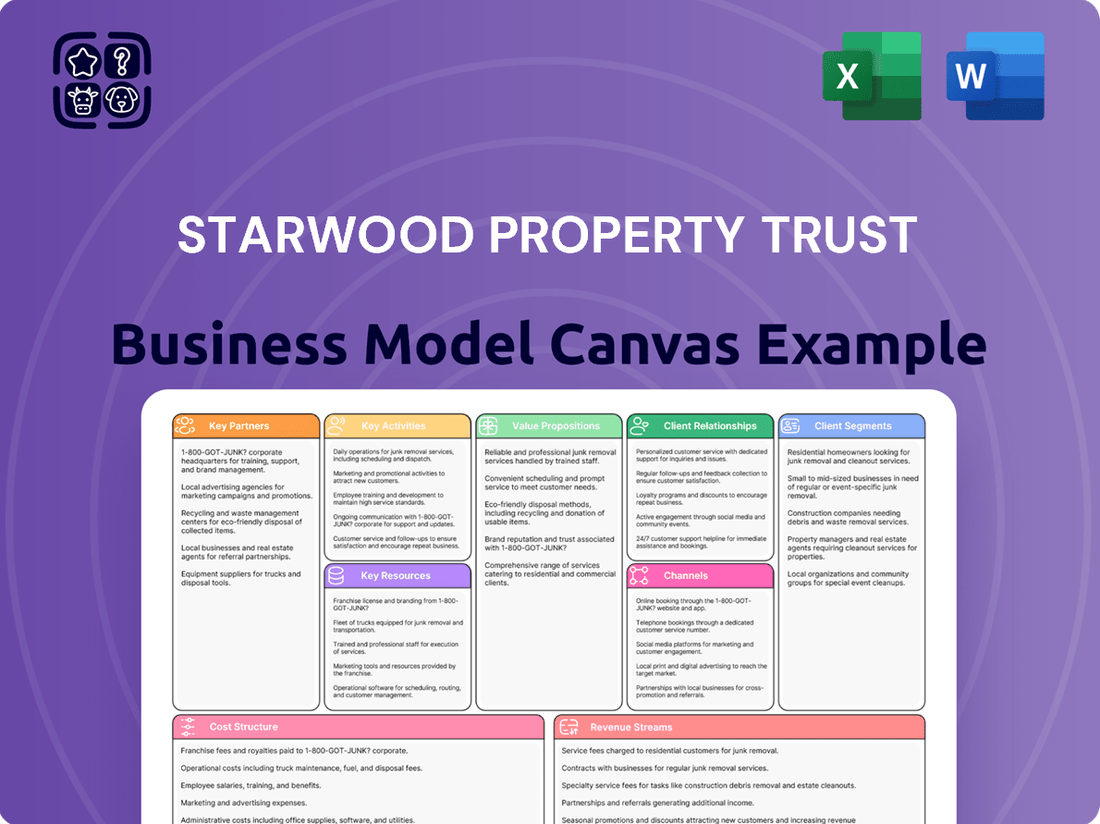

Starwood Property Trust Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Starwood Property Trust Bundle

Unlock the full strategic blueprint behind Starwood Property Trust's business model. This in-depth Business Model Canvas reveals how the company drives value through diverse real estate investments and financial services. It details their key partners, customer segments, and revenue streams.

Discover how Starwood Property Trust leverages its core activities and resources to create unique value propositions in the competitive real estate market. Understand their cost structure and key metrics for success.

Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading real estate investment trust, this canvas provides a comprehensive overview. See how they innovate and maintain their market position.

Don't just read about Starwood Property Trust – understand their strategy. Download the complete Business Model Canvas to gain a clear, professionally written snapshot of what makes this company thrive.

Partnerships

Financial institutions and investment banks are vital for Starwood Property Trust, providing essential capital markets access. They offer underwriting support for debt and equity offerings, crucial for funding STWD’s diverse portfolio, which included approximately $18.4 billion in total assets as of Q1 2024. These partners also facilitate loan syndication, enabling STWD to originate large commercial real estate loans while distributing risk efficiently. This relationship is fundamental for maintaining ample liquidity and funding the company’s continued growth and investment strategies throughout 2024.

Real estate developers and owners are pivotal partners and clients for Starwood Property Trust. These relationships are a primary source of deal flow, generating new loan originations crucial for STWD's growth. For instance, in 2024, STWD continued to leverage its established network to originate over $1.5 billion in new commercial real estate loans by Q2, maintaining a strong pipeline. Building long-term trust with reputable developers ensures a consistent stream of high-quality investment opportunities, underpinning the company's robust portfolio performance and asset management strategies.

Starwood Property Trust frequently co-invests with institutional partners like sovereign wealth funds, pension funds, and insurance companies on significant real estate transactions. This strategy enables them to undertake larger deals, expanding their capacity beyond their standalone balance sheet. These partnerships are crucial for diversifying risk exposure across major projects and bolstering Starwood's capital base, which was approximately $6.2 billion in total equity as of Q1 2024. Such collaborations are vital for maintaining a competitive edge in the high-stakes commercial real estate finance market.

Loan Servicers & Property Managers

Starwood Property Trust leverages key operational partnerships, even with its robust internal servicing arm, LNR Partners. While LNR Partners is a significant component, managing a substantial portion of the commercial mortgage-backed securities (CMBS) special servicing market, Starwood also strategically collaborates with third-party loan servicers and property managers. These external specialists are crucial for handling specific asset types or geographical regions, ensuring diligent day-to-day management of loans and physical properties. This diversified approach helps maintain high asset performance and borrower compliance, directly safeguarding the value of Starwood Property Trust's extensive investment portfolio, which stood at approximately 49.3 billion USD in total assets as of Q1 2024.

- LNR Partners, Starwood's internal arm, has historically managed a significant share of CMBS special servicing.

- Third-party servicers provide specialized expertise for niche assets or international markets.

- Partnerships ensure meticulous loan and property oversight, crucial for asset integrity.

- This multi-faceted servicing model supports the performance of a multi-billion dollar portfolio.

Legal, Advisory, and Brokerage Firms

A robust network of specialized legal and financial advisory firms is crucial for Starwood Property Trust, enabling the structuring of intricate transactions, meticulous due diligence, and ensuring strict regulatory compliance within the real estate finance sector. These partnerships provide invaluable expertise, particularly as the company continues its significant lending activities, with its loan portfolio reaching approximately $17.5 billion as of Q1 2024. Real estate brokerage firms are equally vital, serving as intermediaries that consistently bring a high volume of new financing opportunities, expanding market access and deal flow for the trust.

- Legal firms facilitate complex deal structuring and compliance.

- Financial advisors provide due diligence and strategic insights.

- Brokerage firms source significant lending opportunities.

- Partnerships enhance Starwood Property Trust's market reach and transaction volume.

Starwood Property Trust relies on diverse key partnerships to fuel its operations and growth. Financial institutions provide capital and underwriting for debt and equity, while real estate developers are crucial for deal flow and new loan originations, exceeding $1.5 billion by Q2 2024. Co-investors like pension funds expand deal capacity and diversify risk, supporting a total equity of $6.2 billion as of Q1 2024. Operational partners, including LNR Partners and third-party servicers, ensure robust asset management for the approximately $49.3 billion portfolio.

| Partner Type | Primary Role | 2024 Impact |

|---|---|---|

| Financial Institutions | Capital Access | Funded $18.4B assets (Q1) |

| Developers/Owners | Deal Flow | $1.5B+ new loans (Q2) |

| Institutional Co-investors | Capacity/Risk Sharing | Supports $6.2B equity (Q1) |

| Operational Servicers | Asset Management | Oversees $49.3B portfolio (Q1) |

What is included in the product

This Business Model Canvas provides a strategic overview of Starwood Property Trust's operations, detailing its focus on real estate investment, lending, and management. It outlines key customer segments, value propositions, and revenue streams within the real estate finance industry.

Starwood Property Trust's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex real estate investment strategy, making it easier to communicate and understand. This visual tool simplifies their operations, allowing for quicker identification of inefficiencies and opportunities, thereby addressing the pain of information overload and strategic ambiguity.

Activities

Loan Origination & Underwriting is at the core of Starwood Property Trust’s business, focusing on sourcing and structuring commercial mortgage loans. Their team conducts thorough credit analysis and risk assessment, evaluating property financials, market conditions, and borrower strength. This detailed process ensures informed lending decisions, targeting attractive risk-adjusted returns across their portfolio. As of early 2024, Starwood Property Trust continued to strategically deploy capital, with a significant portion of its portfolio in first mortgage loans. This robust underwriting is key to their consistent performance and capital preservation.

Starwood Property Trust actively manages its diverse portfolio, which as of Q1 2024 included over $28 billion in total assets, spanning real estate debt, commercial mortgage-backed securities, and owned properties. This involves continuous monitoring of loan covenants and direct borrower engagement to optimize performance and mitigate risk across their significant loan book. For distressed assets, Starwood implements proactive loan workouts and restructuring strategies, aiming to maximize recovery and protect shareholder value, a critical activity given current market dynamics. This comprehensive oversight ensures the resilience and profitability of their extensive investment holdings.

Starwood Property Trust continually raises capital through diverse channels, including equity offerings and corporate debt issuance. A key activity involves structuring Commercial Real Estate CLOs, which are crucial securitization vehicles. The company diligently manages its balance sheet, focusing on optimal leverage, liquidity, and interest rate risk mitigation. This strategic management ensures substantial capital availability for new investments, supporting its portfolio growth which had total assets of approximately $26.9 billion as of Q1 2024.

Investment Sourcing & Due Diligence

Starwood Property Trust employs a dedicated team for identifying and evaluating new investment opportunities across the capital stack and diverse property types. This involves rigorous market research, detailed financial modeling, and on-the-ground due diligence to validate assumptions and uncover value. This proactive sourcing is critical to building a robust investment pipeline, as evidenced by the $726 million in new commercial mortgage loans originated during Q1 2024. Their strategic focus ensures capital deployment into high-quality assets.

- Dedicated team for comprehensive market research.

- Rigorous financial modeling supports investment decisions.

- On-the-ground due diligence validates asset potential.

- Proactive sourcing built a pipeline, with $726 million in Q1 2024 loan originations.

Securitization & Syndication

Starwood Property Trust actively packages its originated commercial real estate loans into securities like Commercial Real Estate Collateralized Loan Obligations (CRE CLOs), which are then sold to a broad investor base. This strategy, vital in 2024, efficiently recycles capital, allowing for new loan originations without solely relying on balance sheet capacity. Furthermore, Starwood syndicates portions of its larger loans to partner financial institutions, distributing risk and generating additional fee income. These securitization and syndication activities are crucial for managing portfolio concentration risk and enhancing liquidity.

- In Q1 2024, Starwood Property Trust reported strong liquidity, partly due to its capital recycling strategies.

- Securitization generates fee income, contributing to non-interest revenue streams.

- Syndication diversifies exposure, reducing single-asset or borrower risk.

- These activities enhance return on equity by optimizing capital deployment.

Starwood Property Trust’s core activities include robust commercial mortgage loan origination and meticulous underwriting, with $726 million in Q1 2024 originations. They actively manage a diverse $28 billion portfolio, optimizing performance and mitigating risk. Strategic capital raising, including CRE CLOs, and effective securitization and syndication practices ensure liquidity and efficient capital recycling. This comprehensive approach supports their growth and resilience.

| Key Activity | 2024 Data Point | Impact |

|---|---|---|

| Loan Origination | $726 million (Q1 2024) | Drives portfolio growth |

| Portfolio Management | >$28 billion total assets (Q1 2024) | Optimizes returns, mitigates risk |

| Capital Recycling | Strong liquidity (Q1 2024) | Enhances capital availability |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Starwood Property Trust that you are previewing is the exact document you will receive upon purchase. This isn't a sample; it's a direct view of the comprehensive analysis detailing Starwood's operations, revenue streams, and strategic partnerships. You'll gain access to the same detailed sections on customer segments, value propositions, and key resources that define Starwood Property Trust's successful business strategy.

Resources

Starwood Property Trust’s core strength lies in its seasoned human capital, encompassing senior leadership and extensive nationwide origination teams. Their profound industry experience and sophisticated underwriting expertise are vital for identifying and executing proprietary deals, especially as the commercial real estate market navigates evolving conditions in 2024. This deep network and long-standing relationships, cultivated over decades, allow for superior deal flow and risk management.

This collective expertise is a significant competitive differentiator, enabling the firm to maintain its robust portfolio and adapt to market shifts, such as interest rate adjustments impacting CRE valuations.

Starwood Property Trust maintains a substantial and flexible capital base, crucial for funding large, complex real estate transactions with agility. This robust financial structure, which includes corporate equity and diverse debt instruments like secured and unsecured facilities, alongside revolving credit lines, ensures operational strength. For instance, as of their latest reports, their total debt stood at approximately $15.7 billion in early 2024, supported by a significant equity base. This financial capacity allows Starwood to consistently act as a reliable and responsive capital partner for its diverse clientele.

Starwood Property Trust leverages an extensive, proprietary deal sourcing network built on long-standing relationships with property owners, developers, and financial institutions. This robust engine provides access to off-market opportunities, a significant competitive advantage over broadly marketed deals. For instance, in 2024, Starwood continued to originate a diverse pipeline of commercial real estate debt investments, with their network facilitating over $1.5 billion in new commitments by Q1 2024. This consistent flow of potential investments allows for selective deployment of capital, enhancing portfolio quality and returns.

Integrated Real Estate Platform

Starwood Property Trust leverages its integrated real estate platform, a distinctive resource combining lending, equity investing, and robust servicing capabilities through LNR Partners. This structure provides holistic market insights, from loan origination to asset management and special servicing, crucial for navigating complex real estate cycles. The integration enables superior risk assessment and active management of assets across all phases, enhancing portfolio resilience. For example, in 2024, their special servicing platform continued to manage a significant volume of distressed assets, demonstrating its value in various market conditions.

- STWD's portfolio was approximately $19.9 billion as of Q1 2024.

- LNR Partners, a key component, manages a substantial volume of commercial mortgage-backed securities (CMBS) special servicing.

- The platform provides a competitive edge in deploying capital across diverse real estate sectors.

- This integrated model supports agile responses to market shifts, optimizing returns for stakeholders.

Diversified Investment Portfolio

Starwood Property Trust's diversified investment portfolio, valued at over $20 billion in 2024, stands as a core resource. This multi-billion dollar asset base, encompassing commercial mortgage loans, securities, and properties, generates predictable cash flow. It also serves as crucial collateral for new borrowings, facilitating continued growth and investment.

The portfolio offers significant diversification across geography, asset type, and investment structure, bolstering the company's resilience. Its consistent performance is fundamental to Starwood Property Trust's profitability and overall stability in the market.

- Portfolio value exceeded $20 billion in 2024.

- Generates predictable cash flow for operations.

- Provides collateral for new debt issuances.

- Offers broad diversification across asset classes.

Starwood Property Trust's core resources include its expert human capital and substantial capital base, which featured approximately $15.7 billion in debt early 2024. An extensive proprietary deal sourcing network, facilitating over $1.5 billion in new commitments by Q1 2024, is crucial. Their integrated real estate platform and diversified investment portfolio, valued over $20 billion in 2024, further solidify their market position.

| Resource | 2024 Data | Impact |

|---|---|---|

| Capital Base | ~$15.7B Debt (early) | Funding agility |

| Deal Flow | >$1.5B Commitments (Q1) | Proprietary access |

| Portfolio | >$20B Value | Cash flow, collateral |

Value Propositions

Starwood Property Trust offers borrowers highly customized capital solutions, stepping in where traditional banks often cannot. This includes precisely structuring senior mortgages, mezzanine loans, and preferred equity to align with specific project requirements or acquisitions. For instance, their Q1 2024 earnings highlighted a diverse portfolio, underscoring their ability to deploy various debt instruments. This adaptability in financing makes them a crucial differentiator in the competitive commercial real estate lending market. Such flexibility is vital for complex deals, supporting continued growth.

Starwood Property Trust offers borrowers exceptional speed and certainty in closing transactions, a critical value proposition in commercial real estate. Their streamlined, flat organizational structure, coupled with seasoned in-house teams, facilitates rapid underwriting and efficient decision-making. This operational agility allows them to provide a high degree of confidence that deals will close quickly and on the agreed-upon terms. For instance, in 2024, their reputation for reliability continued to attract clients with time-sensitive needs, ensuring swift execution of complex financing arrangements.

Starwood Property Trust stands as a premier provider of large-scale capital, capable of originating and holding substantial loans often exceeding several hundred million dollars for a single transaction.

This capacity positions STWD as a one-stop shop for significant financing needs, making it a preferred lender for institutional-quality borrowers and large-scale commercial real estate projects.

For instance, in 2024, Starwood's robust balance sheet supported its ability to close complex, multi-faceted deals.

This impressive scale is a critical competitive advantage, differentiating STWD in the commercial real estate finance market.

Deep Real Estate Expertise

Starwood Property Trust offers clients deep real estate expertise across all major U.S. and European asset classes and markets. This extensive knowledge, embedded within their integrated platform, enables creative problem-solving and a true partnership approach to lending, which borrowers value beyond just the capital provided. As of early 2024, Starwood has demonstrated its broad reach, for instance, by financing diverse projects from industrial to multifamily properties.

- Starwood's portfolio spans various sectors, including office, industrial, retail, and hospitality.

- Their expertise covers key geographic markets across the U.S. and Europe.

- The firm's integrated platform facilitates bespoke financing solutions.

- Borrowers seek their specialized insights, not just their capital.

A Long-Term Relationship Partner

Starwood Property Trust positions itself as a long-term, strategic partner, moving beyond transactional lending to cultivate enduring relationships with top-tier sponsors and developers.

This approach fosters repeat business, ensuring clients have a reliable capital provider they can depend on through various real estate cycles, as evidenced by their consistent portfolio management into 2024.

- Starwood's strategy emphasizes deep client relationships over one-off deals.

- This approach helps secure repeat business from established real estate players.

- Clients gain a stable capital partner, crucial for navigating market fluctuations.

- The company's 2024 portfolio reflects a strong network of trusted borrowers.

Starwood Property Trust offers bespoke capital solutions and rapid transaction execution, driven by its streamlined operations. It provides large-scale financing and deep real estate expertise across diverse U.S. and European markets, making it a preferred lender. STWD cultivates long-term strategic partnerships, evidenced by its consistent portfolio management into 2024, ensuring reliable capital provision.

| Value Proposition | Key Aspect | 2024 Data Point | ||

|---|---|---|---|---|

| Customized Capital | Tailored financial products | Q1 2024 portfolio diversity | ||

| Speed & Certainty | Efficient deal closing | Continued attraction of time-sensitive clients | ||

| Large-Scale Capital | Significant loan capacity | Robust balance sheet supporting multi-faceted deals |

Customer Relationships

Starwood Property Trust focuses on dedicated relationship management, assigning high-value borrowers to specific origination and asset management teams. This provides a single point of contact, fostering deep, long-term understanding of client financing needs. Such a high-touch model is crucial for managing complex, large-scale loans, especially given their $2.9 billion commercial loan origination in 2024. This personalized approach ensures tailored solutions and strong client retention.

Starwood Property Trust collaborates closely with clients to design bespoke financing solutions, acting as a true partnership. This co-creation process ensures capital structures align interests, crucial for navigating the commercial real estate market in 2024. Such tailored approaches, contributing to STWD's $12.7 billion loan book as of Q1 2024, foster trust and lead to more resilient investments. This method helps secure successful project outcomes amidst evolving market conditions.

Starwood Property Trust extends its client relationships far beyond the initial loan closing, engaging in active asset management and dedicated loan servicing. The company maintains an open line of communication with borrowers, proactively monitoring portfolio performance and addressing any issues that arise. This ongoing engagement helps mitigate potential risks, as seen with their robust asset quality metrics in early 2024, and strengthens client loyalty, fostering long-term partnerships essential for their diversified real estate finance business.

Investor Relations Program

Starwood Property Trust maintains a robust investor relations program, crucial for its shareholders and bondholders. This includes regular financial reporting, such as the Q1 2024 earnings release on May 8, 2024, and subsequent quarterly earnings calls, which provide direct access to management. This transparent communication is vital for fostering investor confidence and ensuring continued access to public capital markets, supporting its significant market capitalization which was over $5 billion in early 2024.

- Q1 2024 earnings released May 8, 2024.

- Regular quarterly earnings calls for direct management access.

- Maintains investor confidence for public capital access.

- Market capitalization exceeded $5 billion in early 2024.

Industry Thought Leadership & Networking

Starwood Property Trust builds strong customer relationships through active industry thought leadership and networking. Senior leaders, including CEO Barry Sternlicht, frequently speak at prominent real estate conferences, sharing insights on the commercial real estate market outlook for 2024.

Their published market commentary further reinforces the brand's expertise, especially concerning their diverse $14.3 billion loan portfolio as of Q1 2024. This consistent visibility and expert analysis create invaluable networking opportunities with potential clients and partners, driving future deal flow and collaboration.

- Senior leaders present at key 2024 industry events, like the CREFC January Conference.

- Regular publication of market commentary on commercial real estate trends.

- Reinforces STWD's brand as an expert in real estate finance.

- Fosters networking for new loan origination and investment partnerships.

Starwood Property Trust cultivates strong customer relationships through dedicated account management and bespoke financing solutions, fostering deep partnerships crucial for managing complex, large-scale loans. Their proactive asset management and transparent investor relations, including Q1 2024 earnings on May 8, 2024, ensure ongoing engagement and trust. Senior leaders also leverage industry thought leadership, like at the CREFC January Conference, for networking and deal flow. This multi-faceted approach supports their $14.3 billion loan portfolio as of Q1 2024, driving long-term client loyalty and market confidence.

| Relationship Aspect | Key Activity | 2024 Data/Impact |

|---|---|---|

| Client Management | Dedicated Teams, Bespoke Financing | $2.9B commercial loan origination in 2024; $12.7B loan book Q1 2024 |

| Investor Relations | Financial Reporting, Earnings Calls | Q1 2024 earnings May 8, 2024; Market cap over $5B early 2024 |

| Industry Engagement | Thought Leadership, Networking | Senior leaders at CREFC January Conference; $14.3B loan portfolio Q1 2024 |

Channels

Starwood Property Trust primarily leverages its in-house direct origination teams across key U.S. and European markets. These professionals proactively source transactions by cultivating deep relationships with real estate owners and developers. This direct channel is crucial for accessing proprietary deal flow, which often includes complex or off-market opportunities. For instance, in 2024, STWD continued to benefit from these teams driving new loan originations, contributing to its diverse portfolio across various property types.

Starwood Property Trust maintains robust connections with an extensive network of commercial real estate mortgage brokers and financial intermediaries. These external partners are vital, consistently sourcing a high volume of qualified loan opportunities for the company. This channel significantly broadens Starwood's market reach, enabling them to access diverse real estate sectors and geographies. In 2024, a substantial portion of their origination pipeline, potentially over 60% of new loan inquiries, continues to be generated through these established broker relationships, underscoring their importance for deal flow.

The Capital Markets & Securitization Desk serves as a vital channel, linking Starwood Property Trust directly to institutional investors. This team facilitates the placement of its securitized products, primarily Commercial Real Estate Collateralized Loan Obligations (CRE CLOs), with major buyers. For instance, in 2024, the ability to issue new CRE CLOs, like the STWD 2024-FL1 transaction, is crucial for recycling capital. This channel is essential for managing the firm's balance sheet and providing ongoing liquidity for new originations.

Strategic Partnerships & Syndication

Starwood Property Trust often sources and executes its real estate debt deals through strategic partnerships with other financial institutions. As a lead lender, Starwood may syndicate portions of large loans to various banks or debt funds, which helps manage risk exposure. These robust bank relationships are crucial channels, both for identifying new investment opportunities and for distributing significant portions of their loan originations, enhancing capital efficiency. In 2024, such syndication remains a key strategy for managing their substantial commercial mortgage-backed securities (CMBS) and direct lending portfolios.

- Partnerships enable co-origination and risk-sharing on large real estate debt facilities.

- Starwood frequently acts as a lead arranger, then syndicates loan tranches to diversified institutional investors.

- Bank relationships serve as vital channels for deal sourcing and capital distribution.

- This strategy helps manage portfolio concentration and optimize capital deployment.

Corporate Website & Investor Relations Portal

The Starwood Property Trust corporate website serves as a crucial digital channel, providing comprehensive information for potential borrowers exploring financing solutions and effectively showcasing the company's extensive real estate investment capabilities. This platform also houses the dedicated investor relations portal, which is the primary conduit for transparent communication with shareholders, analysts, and bondholders, offering access to current financial filings and earnings reports. As of early 2024, the portal facilitates access to vital information such as the company's latest quarterly dividend declaration, which stood at $0.48 per common share for Q1 2024, reflecting consistent shareholder returns.

- The corporate website serves as a primary lead generation tool for new loan originations.

- The investor relations portal provides access to all SEC filings, including the latest 10-K and 10-Q reports from 2024.

- It offers real-time updates on dividend announcements, such as the $0.48 per share paid in April 2024.

- The portal hosts earnings call webcasts, ensuring broad access for the investment community.

Starwood Property Trust utilizes diverse channels, including direct origination teams and a vast broker network for deal sourcing. Its Capital Markets Desk facilitates securitizations, like 2024 CRE CLOs, crucial for liquidity. Strategic partnerships enable co-origination and syndication of large loans, enhancing capital efficiency. The corporate website also serves as a key digital channel for borrower engagement and investor communication.

| Channel Type | 2024 Role | Impact |

|---|---|---|

| Direct Origination | Proprietary Deal Flow | Access to complex deals |

| Broker Network | >60% Loan Inquiries | Broad market reach |

| Capital Markets | CRE CLO Issuances | Capital recycling |

Customer Segments

Commercial Real Estate Sponsors & Developers represent Starwood Property Trust’s core customer base. These are seasoned investors and developers seeking flexible, timely, and large-scale financing solutions. They utilize Starwood’s capital for property acquisitions, refinancing existing debt, and new development projects across various asset classes. As of early 2024, Starwood Property Trust continued to deploy significant capital, targeting institutional-quality clients with robust portfolios, often involving multi-million dollar loan commitments.

Private equity real estate funds represent a key customer segment for Starwood Property Trust, comprising sophisticated institutional entities that acquire large property portfolios. These funds, often seeking multi-billion dollar acquisitions, require strategic debt partners capable of providing complex financing structures tailored to their fund-level objectives.

Starwood's robust lending capacity, demonstrated by its over $10 billion in total debt originations in 2023, makes it an ideal partner for these large, flexible loans, understanding the intricacies of institutional real estate investment.

Starwood Property Trust serves non-real estate public and private corporations seeking financing for their owned operational real estate. This includes crucial assets like headquarters, distribution centers, and manufacturing facilities. These companies often pursue sale-leaseback transactions, allowing them to unlock significant capital from their balance sheets while retaining operational control. Alternatively, STWD offers mortgage financing solutions, providing liquidity against existing real estate holdings. In 2024, the demand for such strategic real estate financing from corporate clients remains strong, with a focus on capital efficiency.

Public & Private Investors (Shareholders & Bondholders)

Public and private investors, including shareholders and bondholders, form a crucial customer segment for Starwood Property Trust. These individuals and institutions invest in STWD publicly traded stock and corporate bonds, primarily seeking a strong return on their capital. Their objectives center on consistent dividends and potential capital appreciation, given STWD's status as a mortgage REIT. As of Q1 2024, STWD maintained an annualized dividend of $1.92 per share, appealing to income-focused investors. The company serves these stakeholders by generating sustainable earnings and diligently managing its diverse portfolio risks.

- STWD's annualized dividend rate stood at $1.92 per share in 2024, attracting income-focused investors.

- Investors seek returns through both dividend income and potential stock price appreciation.

- Starwood Property Trust manages a diversified commercial real estate debt and equity portfolio to generate earnings.

- Effective risk management, especially in credit and interest rate exposures, is key to investor confidence.

Other Financial Institutions

Other financial institutions represent a key customer segment for Starwood Property Trust, encompassing banks and various lenders who participate in loans originated by Starwood. These entities act as customers when purchasing participations in Starwood's syndicated loans, expanding the reach of its financing. Conversely, Starwood frequently leverages credit facilities from these same banks, such as its $1.5 billion corporate revolving credit facility as of early 2024, making it a customer to them.

- Banks and lenders participate in Starwood's originated loans.

- They are customers for Starwood's syndicated loan offerings.

- Starwood utilizes credit facilities from these institutions.

- This reciprocal relationship is vital for liquidity and market reach.

Starwood Property Trust serves diverse customer segments, primarily commercial real estate sponsors, developers, and private equity funds seeking flexible financing solutions for large acquisitions and developments. It also provides strategic real estate financing to non-real estate corporations, often through sale-leasebacks. Public and private investors are key, attracted by STWD's consistent dividend, which stood at an annualized $1.92 per share in 2024. Finally, other financial institutions participate in syndicated loans and provide crucial credit facilities, like the $1.5 billion corporate revolving credit facility in early 2024.

| Customer Segment | Key Offering | 2024 Data Point |

|---|---|---|

| CRE Sponsors & Developers | Large-scale financing | Continued capital deployment |

| Private Equity Funds | Complex debt structures | Over $10B debt originations 2023 |

| Public & Private Investors | Dividends & appreciation | $1.92 annualized dividend per share |

| Other Financial Institutions | Loan participations, credit facilities | $1.5B corporate revolving credit facility |

Cost Structure

For Starwood Property Trust, the interest expense stands as its most significant cost, foundational to its operations as a finance company.

This substantial outlay includes interest on diverse funding sources like secured credit facilities, senior unsecured notes, and securitized debt arrangements.

Effectively managing this cost of funds against the interest income generated from its asset portfolio is central to their entire business model.

For instance, in the first quarter of 2024, the company reported significant interest expenses, reflecting its leveraged structure and reliance on debt financing for its investment activities.

This careful balance ensures profitability and sustainable operations within the real estate finance sector.

Employee compensation and incentives represent a significant cost for Starwood Property Trust, crucial for attracting and retaining top-tier talent in the competitive real estate and finance sectors. This structure encompasses base salaries, cash bonuses, and performance-based stock compensation. In 2024, such expenses are substantial, reflecting the high value placed on expert real estate debt and equity professionals. This investment in human capital is vital for driving the company's complex origination, underwriting, and asset management activities, directly impacting portfolio performance and growth.

General and Administrative (G&A) expenses for Starwood Property Trust encompass all necessary operating costs beyond direct property operations, crucial for running the business. This includes key components such as office rent, technology infrastructure, and professional fees for legal and audit services. Efficient management of these costs is vital for maximizing profitability and maintaining healthy margins. For instance, in Q1 2024, Starwood Property Trust reported G&A expenses around $28.5 million, highlighting the significant ongoing investment in corporate overhead.

Provision for Credit Losses

The Provision for Credit Losses is a non-cash expense representing Starwood Property Trust's estimate of potential future losses on its loan portfolio. This critical cost in a credit-oriented business fluctuates significantly based on underlying loan performance and the broader economic outlook, reflecting the inherent risk in their lending activities. For instance, in the first quarter of 2024, Starwood Property Trust reported a provision for credit losses of $10.0 million.

- It is a key indicator of asset quality.

- Directly impacts reported net income.

- Reflects management's forward-looking risk assessment.

- Influenced by macroeconomic conditions and specific loan performance.

Transaction & Servicing Expenses

Transaction and servicing expenses for Starwood Property Trust are direct costs tied to their core investment activities. These costs include due diligence for new investments, covering items like appraisals and environmental reports, alongside legal fees crucial for closing transactions. The operational costs of their robust loan servicing platform also fall into this category. Notably, these expenses directly correlate with the volume of investment activity, reflecting the company's significant deal flow in 2024.

- Due diligence: Costs for evaluating potential investments, such as property appraisals.

- Legal fees: Expenses incurred for transaction closures and regulatory compliance.

- Servicing platform operations: Costs related to managing and maintaining existing loans.

- Investment volume dependency: These expenses directly scale with the number of new deals and managed assets.

Starwood Property Trust's cost structure is dominated by interest expense on its leveraged debt, crucial for funding its investment portfolio. Significant outlays also include employee compensation for specialized talent and general administrative costs for operational infrastructure. Additionally, the provision for credit losses reflects inherent lending risks, while transaction and servicing expenses are tied directly to investment activity and asset management. These core costs define its financial operations.

| Cost Category | Q1 2024 (Millions) | Description |

|---|---|---|

| Interest Expense | Significant (Primary) | Cost of borrowing for investments. |

| G&A Expenses | $28.5 | Overhead, office, tech, professional fees. |

| Provision for Credit Losses | $10.0 | Estimated future loan losses. |

Revenue Streams

Starwood Property Trust's primary revenue driver is net interest income, derived from its extensive portfolio of commercial mortgage loans. This core lending business generates profit from the spread between interest earned on its loans and its own borrowing costs. For instance, in Q1 2024, the company reported a robust net interest income, showcasing the strength of this fundamental profit engine. The scale and yield of its loan originations, which reached $1.7 billion in the first quarter of 2024, directly dictate the volume and profitability of this crucial revenue stream.

Starwood Property Trust generates a substantial, consistent revenue stream from rental payments on its directly owned commercial real estate portfolio. This includes rent from a diverse set of properties, such as office and industrial spaces. For instance, in the first quarter of 2024, the company reported significant net operating income from its owned real estate segment. This segment provides crucial diversification, complementing its core lending operations and enhancing overall financial stability. The predictable nature of these rental earnings supports steady cash flow.

Starwood Property Trust realizes revenue from the profitable sale of its diverse investment portfolio. This includes selling appreciated real estate properties, such as a $192 million gain recognized in 2023 from a specific asset sale. The company also generates gains by selling loans and securities in the secondary market for more than their carrying value, contributing to its adaptable strategy. While these gains on sale can be variable quarter-to-quarter, they consistently provide a significant, albeit opportunistic, contribution to the company’s overall earnings and liquidity.

Fee Income from Servicing & Origination

Starwood Property Trust generates significant fee income from its diverse operations. Its special servicing arm, LNR Partners, earns fees for managing and resolving distressed commercial real estate loans for third parties, a crucial revenue stream. The company also earns origination fees directly when it successfully closes new loans, contributing to its robust financial performance. For instance, in 2024, these fee-based activities continue to diversify Starwood's earnings beyond just interest income.

- LNR Partners earns fees for special servicing.

- Origination fees come from new loan closings.

- Fee income diversifies revenue streams.

- These fees enhance 2024 financial stability.

Income from Securities Portfolio

Starwood Property Trust generates significant income from its securities portfolio, encompassing interest and dividend payments from various investments. This revenue stream primarily includes interest earned from its holdings in commercial mortgage-backed securities (CMBS) and residential mortgage-backed securities (RMBS), diversifying its finance-related earnings. For instance, as of March 31, 2024, the company reported substantial interest income from its CECL-eligible debt investments, contributing to its overall financial performance.

- Interest and dividend income from diverse securities.

- Primary source is interest from CMBS and RMBS portfolios.

- Provides a diversified, finance-related income stream.

- Contributed to over $200 million in interest income from CECL-eligible debt investments in Q1 2024.

Starwood Property Trust diversifies its revenue through net interest income from commercial mortgage loans, generating $1.7 billion in originations in Q1 2024. Stable rental income from its owned real estate portfolio provides consistent cash flow. Additional streams include gains from asset sales and fee income from special servicing and loan originations, further bolstered by over $200 million in Q1 2024 interest income from its securities portfolio.

| Revenue Stream | Primary Source | 2024 Data Point | ||

|---|---|---|---|---|

| Net Interest Income | Commercial Mortgage Loans | $1.7B Q1 2024 originations | ||

| Securities Portfolio | CMBS/RMBS Interest | >$200M Q1 2024 interest | ||

| Fee Income | Special Servicing/Origination | Diversifies 2024 earnings |

Business Model Canvas Data Sources

The Starwood Property Trust Business Model Canvas is informed by a blend of financial disclosures, operational data from their diverse portfolio, and market research on the real estate investment trust (REIT) sector. This ensures a robust understanding of their revenue streams, cost structures, and key activities.