Starwood Property Trust Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Starwood Property Trust Bundle

Starwood Property Trust navigates a dynamic real estate landscape, facing pressures from various market forces. Understanding the intensity of buyer bargaining power and the threat of substitute products is crucial for their strategic positioning.

The competitive rivalry within the commercial real estate sector significantly impacts Starwood's profitability and growth potential. Similarly, the bargaining power of suppliers, including lenders and service providers, requires careful management.

The threat of new entrants, while potentially lower in established markets, can still disrupt existing dynamics. Porter's Five Forces provides a structured framework to assess these critical external influences.

The complete report reveals the real forces shaping Starwood Property Trust’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers for Starwood Property Trust are its capital providers, including institutional investors, banks, and the public markets. The bargaining power of these suppliers is moderate to high, as the availability and cost of capital are vital for STWD's operations and growth. For instance, as of early 2024, access to diverse funding sources, such as their over $16 billion in total financing arrangements, is crucial. Maintaining competitive rates, influenced by current market conditions, is essential for originating new loans and making strategic investments.

Investment banks and other financial institutions that structure and underwrite Starwood Property Trust’s debt and equity offerings possess some bargaining power. These entities can influence the terms and costs of capital, which is crucial for a real estate finance company. However, Starwood's substantial scale, with its market capitalization around $5.5 billion in early 2024, and established reputation significantly mitigate this power. Its consistent access to diverse capital markets reduces its dependency on any single financial institution. This strong market standing allows Starwood to negotiate more favorable terms.

Starwood Property Trust relies heavily on experienced real estate and finance professionals for critical functions like deal sourcing and asset management. The specialized skills of this workforce are a crucial input, creating a degree of bargaining power for these key employees. Competition for top talent in the real estate finance sector remains intense, with average compensation for senior real estate investment professionals reaching well into six figures in 2024. This market demand necessitates competitive compensation and benefits packages for STWD to attract and retain the expertise essential for its complex investment strategies.

Property Sellers and Developers

When Starwood Property Trust invests directly in commercial real estate, the sellers and developers of those properties function as key suppliers. In a highly competitive property market, especially for sought-after asset classes, sellers of high-quality properties can exert significant bargaining power. This dynamic directly impacts Starwood’s ability to acquire desirable properties at attractive prices, thereby influencing its investment returns. For instance, strong demand for industrial and multifamily assets continued through early 2024, maintaining seller leverage in those segments.

- Commercial real estate transaction volumes in Q1 2024 showed continued competition for prime assets.

- Sellers of high-occupancy multifamily and industrial properties often command premium pricing.

- Starwood's investment strategy must account for prevailing cap rates and asset valuations.

- Market supply constraints in specific urban cores can further empower property developers.

Service Providers

Starwood Property Trust relies on various third-party service providers, including legal firms, valuation experts, and property managers. While these services are essential for operations, the bargaining power of any single provider is generally limited due to the wide availability of multiple qualified firms in the market. This broad selection allows Starwood to negotiate favorable terms and maintain competitive pricing for these crucial services.

The cost and quality of these external services directly influence Starwood's operational efficiency and overall profitability. For instance, in Q1 2024, Starwood reported general and administrative expenses of $39.5 million, which includes a portion of these service fees. The ability to choose among many providers helps manage these costs effectively.

- Starwood Property Trust benefits from a competitive market for legal, valuation, and property management services.

- The ample supply of service providers limits the bargaining power of individual firms.

- Effective negotiation helps manage operational expenses, impacting STWD's profitability.

- General and administrative expenses, which include service fees, were $39.5 million in Q1 2024.

Capital providers and specialized real estate talent exert moderate to high bargaining power, essential for Starwood Property Trust's operations and growth. Property sellers also hold significant leverage, especially for high-demand assets like industrial and multifamily. However, STWD's substantial scale and diverse funding sources mitigate some supplier influence, while third-party service providers face limited power due to market competition.

| Supplier Type | Bargaining Power | 2024 Data Point |

|---|---|---|

| Capital Providers | Moderate to High | Over $16B in total financing arrangements |

| Specialized Talent | High | High compensation for senior real estate roles |

| Property Sellers | Significant | Strong demand for industrial/multifamily assets Q1 2024 |

| Service Providers | Limited | Q1 2024 G&A expenses $39.5M |

What is included in the product

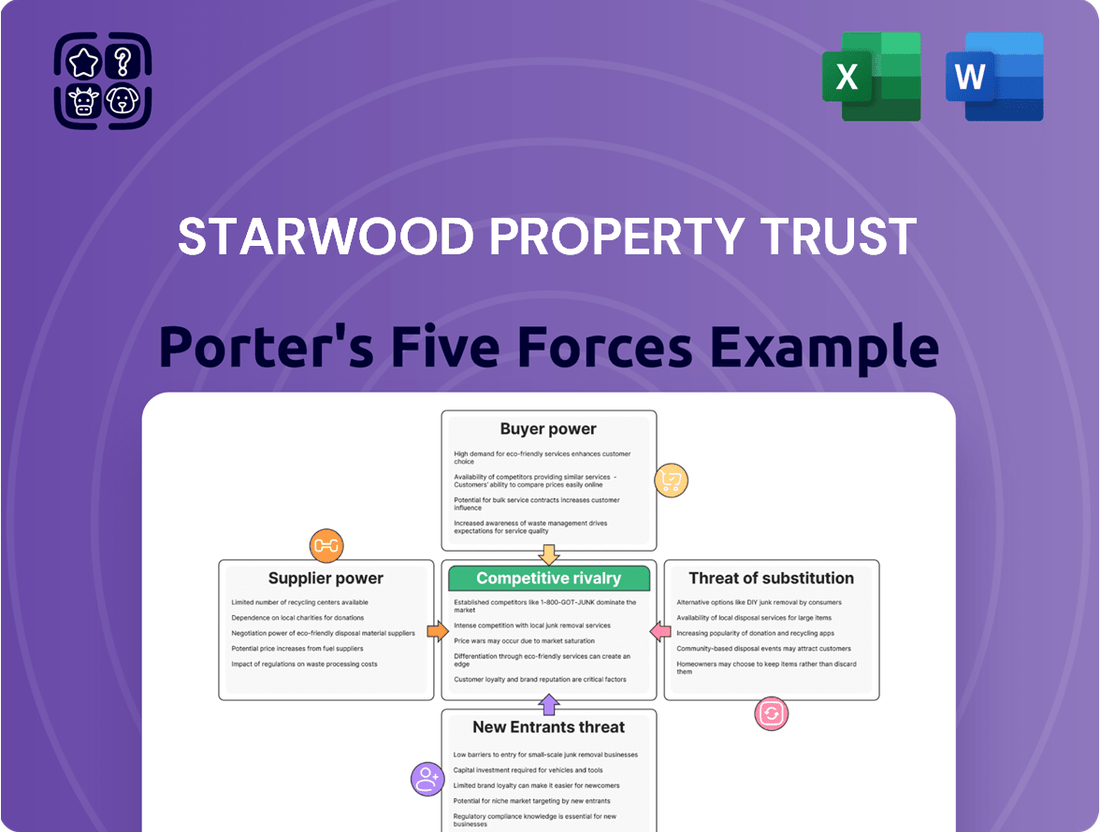

This Porter's Five Forces analysis of Starwood Property Trust examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the commercial real estate investment landscape.

Starwood Property Trust's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making.

This analysis allows for customized pressure level assessment based on new data or evolving market trends, offering instant strategic insight.

Customers Bargaining Power

Starwood Property Trust's customers are commercial real estate owners and developers seeking financing. The bargaining power of these borrowers varies greatly with the overall health of the real estate market and credit availability. For example, in early 2024, with higher interest rates and tighter lending standards observed across the commercial real estate sector, borrowers generally faced reduced negotiating leverage. However, a competitive lending environment or strong borrower financials could still enable them to secure more favorable loan terms. This fluidity directly influences Starwood's deal flow and profit margins.

Large, well-capitalized borrowers, particularly those with strong track records and high-quality assets, possess significant bargaining power. These sophisticated clients often maintain relationships with multiple lenders, allowing them to negotiate for better pricing and more flexible financing terms. For instance, in the commercial real estate market during 2024, institutional borrowers managing portfolios valued in the hundreds of millions could leverage their scale. Starwood Property Trust counters this by offering highly customized and complex financing solutions, which helps attract and retain these valuable, high-volume clients, ensuring a stable deal flow.

The size and complexity of a requested loan significantly influence a borrower's negotiating power. For exceptionally large or intricate commercial real estate transactions, the pool of lenders capable of providing such financing shrinks considerably. This reduced competition directly diminishes the borrower's leverage, as fewer institutions possess the capacity and specialized expertise. Starwood Property Trust, with its robust balance sheet and deep experience in complex originations, including over $8.5 billion in new debt investments in 2023, gains a distinct advantage in these situations.

Access to Alternative Financing

Borrowers seeking financing from Starwood Property Trust have strong bargaining power due to numerous alternative options, including traditional banks and other commercial mortgage REITs. For instance, in 2024, many large banks continue to offer competitive rates for prime real estate loans. However, Starwood's agility and capacity to close deals quickly, often within 30-60 days compared to traditional banks taking 90+ days, differentiate its offerings. This speed can be crucial for time-sensitive real estate transactions, enhancing Starwood's appeal despite the broader availability of capital.

- Traditional banks held over $17 trillion in assets as of Q1 2024, providing vast lending capacity.

- Other commercial mortgage REITs, like BXMT and ARI, offer similar financing products, increasing competition.

Economic Conditions

Broader economic conditions, particularly interest rate trends, significantly influence the bargaining power of Starwood Property Trust's borrowers. In a rising rate environment, like the period leading into 2024 where the Federal Funds Rate peaked above 5%, the increased cost of borrowing can reduce demand for new loans, granting well-capitalized borrowers more leverage to negotiate terms. Conversely, as the Federal Reserve contemplates potential rate cuts in late 2024 or 2025, a lower rate environment could intensify competition among lenders, thereby increasing borrower power. This dynamic directly impacts the profitability and risk profile of new real estate debt originations for Starwood Property Trust.

- Federal Funds Rate: Maintained above 5% through mid-2024, increasing borrowing costs.

- Loan Demand: Higher rates can suppress demand for new commercial real estate loans.

- Lender Competition: Anticipated rate cuts could intensify competition for quality borrowers.

- Borrower Leverage: Strong projects gain negotiation power in tighter credit markets.

Starwood Property Trust's customers, commercial real estate borrowers, face fluctuating bargaining power influenced by market conditions and loan complexity. In 2024, higher interest rates generally reduced borrower leverage, yet large, sophisticated clients still command favorable terms. Alternatives like traditional banks, holding over $17 trillion in Q1 2024 assets, increase competition. Starwood mitigates this with speed and tailored solutions, maintaining its competitive edge.

| Factor | 2024 Impact | Borrower Leverage |

|---|---|---|

| Interest Rates | Above 5% | Reduced |

| Alternative Lenders | Many options (Banks, REITs) | High |

| Loan Complexity | Large, intricate deals | Low |

Same Document Delivered

Starwood Property Trust Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Starwood Property Trust, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate investment trust sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain insights into the strategic positioning of Starwood Property Trust and the competitive landscape it navigates. This analysis provides a deep dive into the external factors shaping the industry, offering actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The commercial real estate finance market is highly competitive, with Starwood Property Trust facing rivalry from numerous players. This includes other commercial mortgage REITs like Blackstone Mortgage Trust (BXMT) and KKR Real Estate Finance Trust (KREF), which also actively originate and acquire loans. Traditional banks, insurance companies, and private debt funds further intensify this competition, with private debt AUM projected to exceed $2 trillion by 2027, indicating robust growth in alternative lending. In 2024, the landscape remains crowded, pressuring lending margins and requiring agility from all participants.

While the commercial real estate finance market is competitive, many players differentiate themselves by focusing on specific property types or geographic regions. Starwood Property Trust's diversified business model, encompassing lending, property ownership, and servicing, provides a significant competitive advantage. This broad approach, reflected in their 2024 portfolio, allows them to navigate various market segments. Furthermore, the company's unique ability to originate large, complex loans, often exceeding what smaller competitors can handle, distinctly sets it apart.

Competition over interest rates and origination fees significantly impacts the commercial real estate lending market. Lenders, including Starwood Property Trust, must offer attractive terms to secure deals, which can pressure profit margins. Starwood's substantial scale, with a $13.2 billion loan portfolio as of Q1 2024, and its efficient access to capital, including $4.3 billion in available liquidity, enable it to compete effectively on price while sustaining profitability. This allows them to maintain a competitive edge in a crowded market.

Reputation and Relationships

Reputation and relationships are paramount in the competitive real estate finance sector. Lenders with a proven track record for reliable execution consistently attract repeat business and superior deal flow. Starwood Property Trust, leveraging its extensive history and strong affiliation with Starwood Capital Group, significantly enhances its brand equity and fosters crucial industry relationships.

- Starwood Property Trust's loan portfolio totaled approximately $17.5 billion as of Q1 2024.

- Its established reputation helps secure high-quality originations, evidenced by a low default rate across its diversified book.

- Affiliation with Starwood Capital Group, managing over $130 billion in assets as of 2024, provides a significant competitive advantage in deal sourcing.

- Strong relationships contribute to a stable client base and preferred access to complex, larger transactions.

Market Cycles and Risk Appetite

Competitive dynamics in real estate lending significantly shift with market cycles. During periods of economic expansion, numerous lenders may enter the market, intensifying competition for deals. Conversely, economic downturns or periods of credit tightening, like the higher interest rate environment observed in 2023-2024, cause many lenders, particularly regional banks, to pull back. This creates strategic opportunities for well-capitalized and experienced players such as Starwood Property Trust to gain market share and acquire attractive assets as others retreat.

- In Q1 2024, Starwood Property Trust maintained a robust liquidity position, enabling opportunistic investments.

- The commercial real estate transaction volume saw a decline in early 2024, indicating market caution.

- Non-bank lenders like STWD have increased their market share as traditional banks reduce CRE exposure.

- STWD's diversified portfolio, including real estate debt and equity, provides resilience across cycles.

Starwood Property Trust navigates a highly competitive commercial real estate finance market, facing rivalry from diverse lenders including other mortgage REITs and traditional banks, with private debt AUM projected to exceed $2 trillion by 2027. Its diversified business model, substantial scale with a $13.2 billion loan portfolio as of Q1 2024, and strong affiliation with Starwood Capital Group provide distinct advantages. This enables STWD to compete effectively on price and capitalize on market shifts, such as regional banks pulling back in the 2024 higher interest rate environment, leveraging its robust liquidity of $4.3 billion to gain market share.

SSubstitutes Threaten

Traditional bank loans represent the most significant substitute for financing provided by Starwood Property Trust and other commercial mortgage REITs. Banks are major sources of commercial real estate debt, though they typically impose stricter underwriting criteria and offer less flexibility than alternative lenders. The competitiveness of bank lending fluctuates with regulatory changes and economic cycles. For instance, in early 2024, tighter lending standards observed among banks could make alternative financing more attractive for certain borrowers, impacting STWD's market position.

Large real estate companies can bypass traditional mortgage lenders like Starwood Property Trust by tapping into public bond markets or securing private debt. For instance, in 2024, highly rated real estate investment trusts successfully issued billions in unsecured notes, offering a direct alternative for financing large, stable portfolios. However, this robust financing path remains largely exclusive to the most creditworthy borrowers, limiting its widespread threat to STWD's broad lending portfolio.

Property owners can opt for equity financing instead of debt, bringing in partners or selling property stakes. This directly substitutes debt, though it means diluting ownership. The choice hinges on the cost of capital; with the Federal Funds Rate holding steady at 5.25%-5.50% through early 2024, the cost of debt remained elevated, making equity a more appealing alternative for some. This strategic decision impacts Starwood Property Trust by influencing the demand for its debt products.

Seller Financing

Seller financing presents a substitute threat as property sellers may offer direct funding to buyers, bypassing traditional lenders like Starwood Property Trust. While convenient in specific transactions, its availability is not guaranteed, and terms are often less favorable than institutional options. For instance, seller-financed deals in 2024 might feature higher interest rates or shorter amortization periods compared to Starwood's structured commercial mortgages, which averaged around 7-9% for new originations in Q1 2024.

- Limited availability for large-scale commercial deals.

- Terms often less competitive than dedicated lenders.

- Primarily observed in smaller or niche property transactions.

- Higher perceived risk for sellers often translates to higher costs.

Crowdfunding and Fintech Platforms

The rise of real estate crowdfunding and financial technology platforms introduces alternative, albeit smaller-scale, funding avenues. These platforms serve as capital sources for more modest projects, often in the residential or smaller commercial sectors. For instance, the global real estate crowdfunding market was valued at around $10 billion in 2023, projected to grow, yet Starwood Property Trust primarily deals in large-scale commercial real estate loans, with average loan sizes often exceeding $50 million in 2024. Therefore, these platforms do not yet pose a significant competitive threat to established lenders like STWD in the institutional-grade large-loan market.

- Real estate crowdfunding platforms typically target smaller projects.

- Starwood Property Trust focuses on large, institutional commercial loans.

- The scale of capital deployed by Fintech platforms remains limited compared to STWD's portfolio.

- Direct competition in STWD's core market segment is minimal.

Starwood Property Trust faces substitution threats from traditional bank lending and, for highly creditworthy borrowers, public bond markets. Equity financing remains an alternative, especially with elevated debt costs like the 5.25%-5.50% Federal Funds Rate in early 2024. While seller financing and crowdfunding exist, they generally lack the scale and competitive terms of STWD's institutional offerings, which saw new loan originations average 7-9% in Q1 2024.

| Substitute Type | Prevalence | STWD Impact (2024) |

|---|---|---|

| Traditional Bank Loans | High | Tighter bank standards create opportunities. |

| Public/Private Debt | Low (for STWD's market) | Limited to large, highly-rated entities. |

| Equity Financing | Moderate | Cost of debt influences attractiveness. |

| Seller Financing | Low | Less competitive terms, limited availability. |

| Crowdfunding/Fintech | Low | Primarily smaller projects; global market ~$10B (2023). |

Entrants Threaten

The commercial real estate lending business presents high barriers to entry, primarily due to the substantial capital necessary to originate and maintain a diversified loan portfolio. A new entrant would need to raise significant funds, potentially billions, to effectively compete with established players like Starwood Property Trust, which reported total assets of approximately $29.1 billion as of Q1 2024. This extensive capital requirement makes the threat of new, large-scale competitors relatively low in this sector. For instance, launching a new real estate investment trust (REIT) or private credit fund requires initial capital commitments often exceeding hundreds of millions just to gain market traction and secure institutional backing. This financial hurdle significantly deters most potential new entrants.

The financial services sector, particularly real estate finance, is heavily regulated, posing significant hurdles for new entrants. New firms aiming to compete with Starwood Property Trust would face a complex web of federal and state licensing and compliance requirements. This process is both time-consuming and costly, with substantial legal and operational expenses involved in meeting standards like those from the SEC or state banking departments. As of 2024, the compliance burden continues to intensify, acting as a robust barrier to market entry.

Success in commercial real estate lending, a cornerstone for Starwood Property Trust, demands profound industry expertise and robust underwriting capabilities. New entrants would need to build a seasoned team with the necessary experience and establish a proven track record. This process takes significant time, as evidenced by STWD managing a diverse portfolio that exceeded $28 billion as of Q1 2024. Replicating such an extensive and well-performing portfolio is a substantial barrier.

Established Relationships

The real estate business fundamentally relies on established relationships. Starwood Property Trust, with its extensive history, benefits from long-standing connections with borrowers, brokers, and various market participants, ensuring a consistent flow of deal opportunities. This deep network, cultivated over years, presents a formidable barrier for new entrants who would need to build similar trust and access from the ground up, a significant and time-consuming challenge in 2024. Starwood's established position helps it maintain strong deal origination capabilities.

- Starwood Property Trust leverages decades of industry connections.

- These relationships secure a consistent pipeline of lending and investment opportunities.

- New entrants face a substantial hurdle in replicating such extensive networks.

- Established trust reduces risk and enhances deal flow for incumbents.

Brand Recognition and Reputation

Starwood Property Trust possesses a formidable brand and a leading reputation within the commercial real estate finance sector. This established recognition significantly aids in attracting both high-quality borrowers and a diverse investor base, solidifying its market position. For a new entrant, replicating this deep-seated trust and brand equity presents a substantial barrier. Without comparable reputational leverage, competing for new business becomes exceedingly difficult, as evidenced by STWD's over $100 billion in originations since inception.

- STWD's market capitalization reached approximately $5.4 billion in early 2024, reflecting investor confidence.

- Its extensive portfolio, valued at over $27 billion as of Q1 2024, showcases its scale and reach.

- New entrants face significant capital and relationship hurdles without a comparable track record.

New entrants face significant hurdles in commercial real estate lending, primarily due to the immense capital required and stringent regulatory compliance. Established players like Starwood Property Trust leverage deep industry expertise, long-standing relationships, and a formidable brand, making market entry exceptionally challenging. The high barriers to entry, including building trust and a proven track record, keep the threat of new competitors low.

| Barrier Type | Starwood Property Trust Data (2024) | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Total Assets: ~$29.1 Billion (Q1 2024) | Requires billions to compete |

| Market Presence | Market Cap: ~$5.4 Billion (early 2024) | Difficult to replicate scale |

| Industry Expertise | Portfolio Value: >$28 Billion (Q1 2024) | Years to build comparable track record |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Starwood Property Trust leverages data from SEC filings, annual reports, and investor presentations to understand financial health and strategic positioning. We supplement this with industry research reports and market data from reputable sources to gauge competitive intensity and market dynamics.