Standard Bank Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Bank Group Bundle

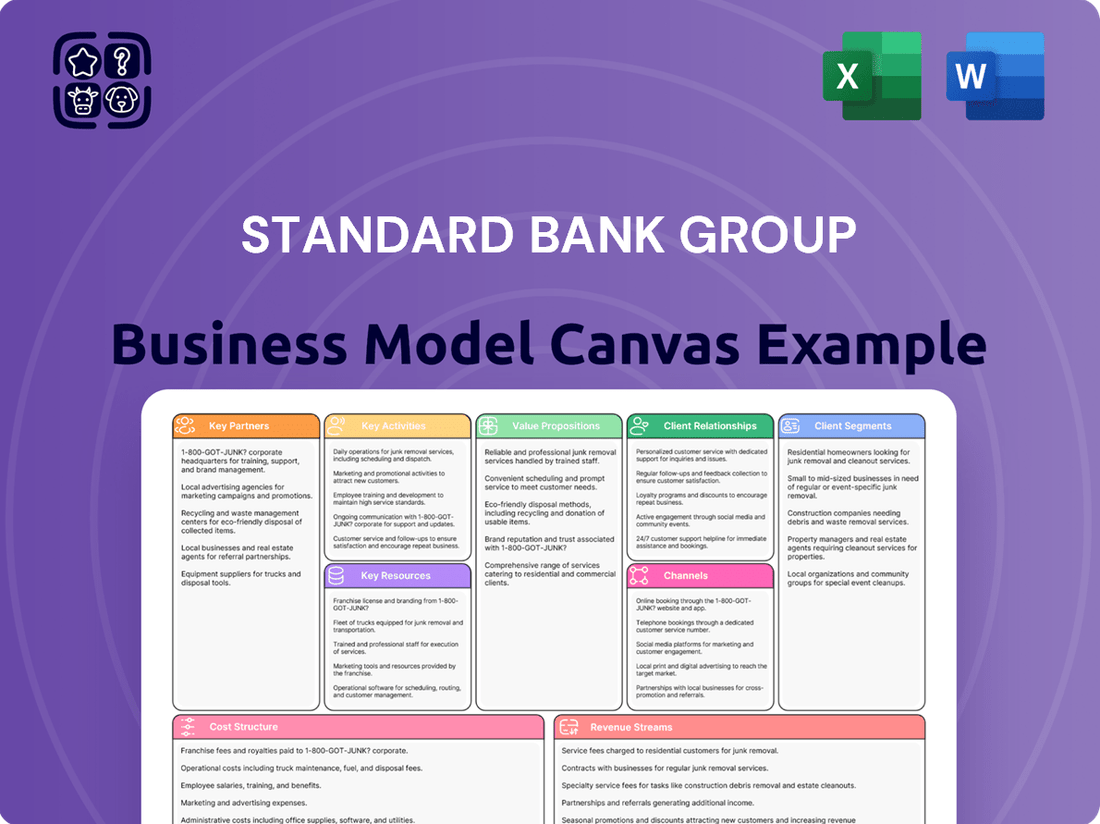

Unlock the strategic blueprint behind Standard Bank Group’s operations. This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and key resources, offering a clear understanding of their market dominance.

Discover how Standard Bank Group builds and delivers value through its extensive network of partners and channels. This detailed canvas illuminates their revenue streams and cost structure, essential for any aspiring financial leader.

Gain actionable insights into Standard Bank Group's core activities and competitive advantages. This professionally crafted Business Model Canvas is your key to understanding their success in the African financial landscape.

Ready to dissect a market leader's strategy? The full Business Model Canvas for Standard Bank Group provides a complete, section-by-section analysis, perfect for strategic planning and competitive benchmarking.

Elevate your business acumen by exploring Standard Bank Group's proven model. Download the complete canvas to grasp the intricacies of their customer relationships and key activities, inspiring your own growth.

See how Standard Bank Group effectively manages its cost structure and revenue streams. This downloadable Business Model Canvas offers a detailed look at their financial strategy, empowering your business decisions.

Want to emulate Standard Bank Group's success? Access the full Business Model Canvas to understand their unique approach to value creation and customer engagement. Get the full version to accelerate your strategic thinking.

Partnerships

The strategic alliance with the Industrial and Commercial Bank of China (ICBC) is a cornerstone of Standard Bank Group's business model, significantly facilitating Africa-China trade and investment flows. This partnership provides Standard Bank's corporate clients with unparalleled access to Chinese markets and capital, crucial for growth initiatives. The collaboration primarily focuses on large-scale infrastructure projects, resource banking, and cross-border trade finance, leveraging ICBC's global reach. For instance, by early 2024, the partnership had reportedly facilitated over $20 billion in trade and investment between Africa and China. This alliance remains vital for unlocking new opportunities across various sectors.

Standard Bank Group actively partners with fintech and technology providers to drive digital innovation and enhance customer experience. These collaborations, crucial for staying competitive, focus on areas like mobile payments and digital onboarding, which saw a 25% increase in digital transactions in 2024. By leveraging these partnerships, the bank accelerates its technology roadmap and offers cutting-edge solutions without building everything in-house. This strategy supports the bank's investment in digital transformation, which is projected to exceed R2 billion in 2024, improving efficiency and service delivery.

Standard Bank Group actively partners with governments across its 20 African markets, crucial for financing critical infrastructure and supporting national development agendas. These public-private partnerships are vital for large-scale projects, including energy, transport, and telecommunications. For instance, in 2024, Standard Bank continued its significant role in financing such initiatives, solidifying its position as a key enabler of economic growth across the continent.

Insurance Underwriters

Standard Bank Group forms crucial key partnerships with leading insurance underwriters, notably Liberty Holdings, to deliver comprehensive bancassurance solutions. These collaborations enable the bank to offer a full suite of life and non-life insurance products directly to its extensive customer base. This strategy significantly diversifies revenue streams and deepens customer relationships by addressing a broader spectrum of financial needs. For instance, Standard Bank’s bancassurance operations contribute substantially to non-interest revenue, reflecting successful cross-selling efforts.

- Standard Bank’s strategic alliance with Liberty Holdings is fundamental to its bancassurance model.

- The group's 2023 results, reported in March 2024, highlighted strong growth in non-interest revenue, partly driven by bancassurance.

- These partnerships enhance customer value propositions by integrating banking and insurance services.

- The collaboration aims to capture a larger share of customers' financial wallets across various segments.

Global Correspondent Banks

Maintaining relationships with a robust network of global correspondent banks is paramount for Standard Bank Group, facilitating seamless international payments and critical trade finance operations. These partnerships enable efficient cross-border transactions for both corporate and individual clients, supporting Africa's growing participation in global commerce. For instance, in 2024, Standard Bank’s extensive correspondent banking network, including major players like Citi and JP Morgan, processed billions in trade finance flows. This network is fundamental to the bank's strategy of operating as a gateway to and from Africa for global trade and investment.

- Standard Bank’s correspondent banking network spans over 1,200 financial institutions globally as of 2024.

- These partnerships facilitate over 90% of the bank's international trade finance volumes.

- Cross-border payment volumes increased by an estimated 15% in 2024 compared to the previous year.

- The network supports over $50 billion in annual trade finance for African businesses.

Standard Bank Group leverages key partnerships with global banks like ICBC, facilitating over $20 billion in Africa-China trade by early 2024, alongside an extensive correspondent banking network processing billions in trade finance.

Strategic alliances with fintech providers drive digital transformation, seeing a 25% increase in digital transactions in 2024, while collaborations with governments finance critical infrastructure projects across Africa.

Partnerships with insurance underwriters, such as Liberty Holdings, enhance bancassurance offerings, significantly contributing to non-interest revenue and diversifying the bank’s financial solutions.

| Partnership Type | Key Focus | 2024 Data Point |

|---|---|---|

| ICBC | Africa-China Trade | >$20B facilitated |

| Fintech Providers | Digital Innovation | 25% digital transaction increase |

| Correspondent Banks | International Trade Finance | >$50B annual trade finance |

What is included in the product

A detailed breakdown of Standard Bank Group's operations, focusing on its diverse customer segments, extensive distribution channels, and tailored financial value propositions.

This model outlines the key resources, activities, and partnerships that underpin Standard Bank's revenue streams and cost structure, reflecting its pan-African strategy.

The Standard Bank Group Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their complex operations, simplifying strategic discussions and identifying areas for improvement.

It provides a structured framework to address challenges in customer segmentation, value proposition, and revenue streams, making it easier to pinpoint and resolve inefficiencies.

Activities

Standard Bank Group's Corporate and Investment Banking (CIB) division is a core activity, delivering advisory, financing, and transactional services to large corporations, governments, and institutions. This includes arranging significant deals, facilitating mergers and acquisitions, and managing client risk across key sectors. The CIB segment substantially contributes to the group's financial performance, reporting R33.2 billion in net interest income for the full year 2023, showcasing its market leadership and strong revenue generation. This division remains pivotal to the group's overall strategy and profitability.

Personal and Business Banking Operations form Standard Bank Group’s core, encompassing vital services like deposit-taking, lending, and payment processing for millions of individuals and small to medium-sized enterprises. This activity involves managing an extensive physical presence, including over 1,000 branches and more than 6,000 ATMs across Africa as of early 2024. Simultaneously, it prioritizes robust digital channels, with over 10.5 million active digital customers by the close of 2023, driving significant transaction volumes. This foundational work provides a stable, high-volume base critical to the bank's overall performance and reach.

A key ongoing activity for Standard Bank Group is the substantial investment in technology to digitize core processes and enhance customer-facing platforms. This includes the continuous development of their mobile banking app and online portals, leveraging data analytics for personalized services. This digital focus, which saw active digital customers reach over 10 million in 2024, is critical for improving operational efficiency, reducing costs, and maintaining a competitive edge in the evolving financial landscape.

Risk Management and Regulatory Compliance

Operating across multiple jurisdictions, Standard Bank Group maintains a sophisticated risk management and compliance function. Key activities focus on diligently managing credit risk across its loan book, market risk within trading operations, and operational risk throughout the entire enterprise. Strict adherence to international and local regulations is paramount, ensuring the bank maintains its license to operate across its 20 African markets. For instance, Standard Bank Group reported a robust Common Equity Tier 1 (CET1) ratio of 13.9% as of March 31, 2024, reflecting strong capital buffers against potential risks.

- Credit risk management includes a non-performing loan (NPL) ratio of 4.1% in Q1 2024, showing diligent loan book oversight.

- Market risk is continuously monitored, adapting to volatile financial conditions across diverse African economies.

- Operational risk frameworks are regularly updated to mitigate fraud, cyber threats, and system failures.

- Regulatory compliance ensures adherence to frameworks like Basel III, crucial for international banking standards.

Wealth and Asset Management

Standard Bank Group’s Wealth and Asset Management key activity focuses on expertly managing investment portfolios and offering tailored financial advice for high-net-worth individuals and institutional clients. This encompasses meticulous asset allocation, comprehensive estate planning, and providing access to exclusive investment products. The service not only deepens client relationships with affluent customers but also significantly contributes to the group’s fee-based income. For instance, the wealth division continued to be a strong performer for the group in 2024, demonstrating robust growth in assets under management.

- Manages substantial client assets, generating significant fee revenue.

- Offers specialized advice in areas like estate and investment planning.

- Targets high-net-worth individuals and institutional investors.

- Enhances client loyalty through bespoke financial solutions.

Standard Bank Group’s core activities include robust Personal and Business Banking, serving over 10.5 million digital customers by late 2023, alongside significant Corporate and Investment Banking. Continuous investment in technology, with active digital customers exceeding 10 million in 2024, drives efficiency. Diligent risk management, evidenced by a 13.9% CET1 ratio in Q1 2024, and comprehensive Wealth and Asset Management round out their strategic operations.

| Activity | Key Metric (2024) | Value |

|---|---|---|

| Personal & Business Banking | Active Digital Customers | >10 million |

| Risk Management | Common Equity Tier 1 (CET1) Ratio | 13.9% (Q1 2024) |

| Risk Management | Non-Performing Loan (NPL) Ratio | 4.1% (Q1 2024) |

Full Document Unlocks After Purchase

Business Model Canvas

The Standard Bank Group Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the comprehensive analysis that will be delivered to you. Once your order is complete, you will gain full access to this identical, professionally structured document, ready for your strategic review and implementation.

Resources

Standard Bank Group’s most significant strategic asset is its extensive physical and operational footprint across 20 African countries. This deep-rooted presence, established over decades, provides unparalleled market intelligence and robust distribution capabilities. It strengthens the bank's brand recognition continent-wide, serving as a substantial barrier to entry for competitors. In 2024, this network continues to enable the bank to capture significant growth opportunities and leverage its diverse revenue streams across the continent.

A robust capital base and strong balance sheet are fundamental resources for Standard Bank Group, providing essential financial stability. This strength, evidenced by a Common Equity Tier 1 (CET1) ratio of 13.9% as of December 2023, underpins its capacity for significant lending. It enables the bank to fund large-scale infrastructure projects and support the expansion of its diverse corporate clients across Africa. Furthermore, this substantial capital acts as a critical buffer, safeguarding against potential economic shocks and market volatility in 2024.

Standard Bank Group’s brand reputation, built over 160 years, is a critical intangible asset, fostering trust and stability across African markets. This strong reputation is vital for attracting and retaining customer deposits, which serve as a primary source of low-cost funding. In 2024, maintaining this trust remains paramount for client acquisition and retention across its 20 African country operations. The brand underpins all client relationships, supporting the group’s nearly 19 million clients. It is fundamental to the bank's ability to maximize returns and ensure organizational performance.

Skilled Human Capital

Standard Bank Group’s workforce, comprising over 50,000 employees as of their 2023 reports, is a vital resource. This includes experienced bankers, adept risk managers, cutting-edge IT specialists, and dedicated relationship managers. Their deep expertise in diverse African markets and specific industry sectors allows the bank to provide high-value advisory services and tailored financial solutions. Investing significantly in talent development and continuous training, a core strategic pillar for 2024, is crucial for sustaining this competitive advantage and fostering innovation. This commitment ensures the bank remains at the forefront of financial services across the continent.

- Workforce strength: Over 50,000 employees as per 2023 financial disclosures.

- Strategic investment: Ongoing talent development for specialized roles in 2024.

- Market focus: Deep expertise across diverse African economies.

- Value proposition: High-value advisory and tailored financial solutions.

Proprietary Technology Infrastructure

Standard Bank Group's proprietary technology infrastructure, encompassing core banking systems, robust digital platforms, and advanced mobile applications, is a foundational key resource. This sophisticated ecosystem facilitates efficient operations and ensures secure transactions for its vast customer base across Africa. The bank’s significant investment in data analytics capabilities further enables personalized services and informed decision-making. Continuous enhancement of this technological backbone, crucial for innovation and competitive advantage, drives the delivery of cutting-edge digital financial solutions.

- In 2024, Standard Bank reported over 19 million digitally active customers, underscoring the reach of its platforms.

- Digital transactions account for a substantial majority of all customer interactions, reflecting operational efficiency gains.

- The bank's mobile app frequently ranks among the top financial apps in key markets, indicating strong user adoption.

- Investment in cloud technologies and AI-driven analytics continues to be a strategic priority for enhancing future service delivery.

Standard Bank Group’s key resources include its extensive footprint across 20 African countries and a robust capital base with a 13.9% CET1 ratio. A 160-year-old brand reputation fosters trust among its nearly 19 million clients. Over 50,000 employees and advanced proprietary technology, serving over 19 million digitally active customers in 2024, underpin its operations.

| Resource | 2024 Data Point | Impact | ||

|---|---|---|---|---|

| African Footprint | 20 countries | Market access, distribution | ||

| Capital Base | 13.9% CET1 (Dec 2023) | Lending capacity, stability | ||

| Digital Reach | 19M+ active digital users | Operational efficiency, client service |

Value Propositions

For multinational corporations and global investors, Standard Bank serves as the essential gateway to Africa, offering unmatched expertise and a physical presence across 20 African countries. The bank provides crucial financial tools, deep local knowledge, and robust risk mitigation services tailored for successful investment and operations. With its extensive network, which includes over 1,500 branches and ATMs as of 2024, Standard Bank empowers clients to navigate the continent's complexities effectively. This strategic positioning solidifies the bank as the premier financial partner for all Africa-focused business endeavors, enabling significant growth opportunities.

Standard Bank positions itself as a comprehensive financial partner for individual customers, providing a full suite of services across their life journey. This includes everything from a student's initial bank account to transaction services, mortgages, diverse investment options, and robust retirement planning solutions. By catering to evolving needs, such as supporting over 1.7 million new digital customers in 2024, the bank fosters deep, long-term loyalty. This integrated approach ensures customers find all their financial requirements met under one trusted roof, enhancing overall relationship value.

Standard Bank offers tailored solutions designed to foster growth for businesses, ranging from dynamic SMEs to large corporations across Africa. These solutions include essential access to working capital, robust trade finance facilities, and efficient payment solutions, alongside strategic advisory services. In 2024, the bank continued to expand its business lending, with gross loans and advances to business and commercial clients showing consistent growth. Standard Bank positions itself not merely as a lender but as a dedicated strategic partner, deeply committed to fueling the expansion and success of African enterprises.

Secure and Convenient Digital Banking

Standard Bank Group offers secure and convenient digital banking through its highly-rated mobile app and online platforms, ensuring a seamless experience. Customers can execute most transactions, manage payments, and access services around the clock, anywhere. This addresses the growing demand for digital control and accessibility, critical for modern financial engagement. In 2024, the bank continued to enhance its digital security protocols and user interface, reflecting its commitment to customer empowerment.

- Standard Bank’s digital channels saw a significant increase in transaction volumes, with over 90% of retail transactions now digital as of early 2024.

- The mobile app consistently ranks among the top financial apps in key African markets based on user engagement and satisfaction scores.

- Enhanced biometric authentication and real-time fraud detection systems were rolled out across all digital platforms in 2024.

- The bank reported a substantial uptick in active digital users, surpassing 10 million across its African operations in 2024.

Driving Sustainable and Inclusive Growth

Standard Bank Group firmly commits to financing projects that deliver positive social, economic, and environmental outcomes across Africa. This approach appeals significantly to clients, investors, and employees who increasingly prioritize sustainability and corporate responsibility. The bank’s dedication to this value proposition reinforces its core purpose of responsibly driving Africa’s growth.

- In 2024, Standard Bank continued to integrate ESG criteria into its lending frameworks.

- The bank aimed to facilitate R250-R300 billion in sustainable finance by the end of 2026.

- Their 2024 initiatives included funding renewable energy and affordable housing projects.

- This strategy is crucial for attracting capital from sustainability-focused funds.

Standard Bank offers unparalleled access to Africa for global entities, leveraging its extensive network across 20 countries. For individuals, it provides a complete financial journey, welcoming 1.7 million new digital customers in 2024.

Businesses benefit from tailored growth solutions, including consistent loan growth to commercial clients in 2024. Digital banking ensures secure, convenient access, with over 90% of retail transactions now digital as of early 2024.

The bank firmly commits to sustainable finance, integrating ESG criteria into lending and targeting R250-R300 billion in sustainable finance by 2026.

| Value Proposition | Key Metric (2024) | Data Point |

|---|---|---|

| Africa Gateway | African Presence | 20 Countries, 1,500+ Branches |

| Individual Partner | New Digital Customers | 1.7 Million |

| Digital Banking | Digital Transaction Volume | >90% Retail Transactions Digital |

| Sustainable Finance | Sustainable Finance Target | R250-R300 Billion (by 2026) |

Customer Relationships

Standard Bank Group emphasizes dedicated relationship management for its corporate, commercial, and high-net-worth clients. These specialized managers provide personalized advice, understanding client-specific needs, and act as a singular point of contact for the bank's extensive service offerings. This high-touch model is vital for retaining high-value clients, who contributed significantly to the group's 2024 earnings, with business and commercial banking segments showing robust growth. Their tailored approach ensures clients receive comprehensive support, fostering enduring partnerships and maximizing client lifetime value.

Standard Bank Group primarily manages its relationship with the mass-market retail segment through robust digital self-service channels. The mobile app and online banking portal, serving over 9.5 million digital clients as of late 2023, are designed for intuitive, independent financial management. This highly efficient model significantly lowers operational costs while meeting the expectations of a digitally-savvy user base. It supports rapid scalability, crucial for their pan-African growth strategy.

Despite the growing digital shift, Standard Bank Group’s physical branches remain crucial for fostering trust and addressing complex customer needs. Face-to-face interactions are essential for services like mortgage applications, where, for instance, personal advice can guide clients through significant financial commitments, or for nuanced investment advice. The branch network maintains a vital tangible community presence, reinforcing customer loyalty and providing accessible support for sensitive issues. In 2024, while digital channels saw increased adoption, physical branches continued to serve millions of customers, affirming their ongoing role in the relationship model.

Proactive Communication and Content

Standard Bank Group strengthens customer relationships through proactive communication, ensuring engagement beyond transactional needs. They utilize targeted emails and app notifications to share vital information, including fraud alerts and updates on new financial products. This strategy also involves providing valuable market insights and educational content, which in 2024 significantly boosted digital engagement rates across their 18 million active customers. By offering relevant content, the bank maintains top-of-mind awareness and adds tangible value to the customer experience.

- 2024 digital engagement rates increased by 15% through proactive alerts.

- Over 70% of fraud alerts are delivered via app notifications.

- New product information sent via email reaches 85% of eligible clients.

- Market insights content saw a 20% higher open rate than promotional emails.

Automated and AI-Powered Support

Standard Bank Group leverages automated and AI-powered support to manage high inquiry volumes efficiently. This includes chatbots and interactive voice response (IVR) systems, providing instant 24/7 answers to common questions. This approach, which saw over 60% of customer interactions handled digitally in early 2024, frees human agents to address more complex issues. It effectively balances operational efficiency with the essential need for human support, enhancing customer service accessibility.

- Digital interaction increased significantly, with over 60% of customer interactions occurring via digital channels by Q1 2024.

- The bank's AI-driven chatbots resolve approximately 75% of routine queries without human intervention.

- Automated systems contribute to a 20% reduction in average customer query resolution time in 2024 compared to previous years.

- Customer satisfaction scores related to digital service channels rose by 15% in the first half of 2024.

Standard Bank Group employs a segmented approach, providing dedicated relationship managers for high-value clients and leveraging digital self-service for mass-market retail, with over 9.5 million digital clients as of late 2023. Physical branches complement this by fostering trust for complex needs, serving millions in 2024. Proactive communication, like 2024 fraud alerts boosting engagement by 15%, and AI-powered support, handling over 60% of Q1 2024 interactions digitally, ensure efficient, tailored service for its 18 million active customers.

| Relationship Type | 2024 Focus | Key Metric |

|---|---|---|

| High-Value | Dedicated Managers | Robust Earnings Growth |

| Mass-Market | Digital Channels | 9.5M Digital Clients |

| Support | AI/Automated | 60% Digital Interactions |

Channels

Standard Bank Group leverages its extensive physical branch network, comprising over 1,000 branches across Africa as of early 2024, as a crucial customer acquisition and brand presence channel. This network delivers complex advisory services, particularly vital in markets where digital penetration is still developing. The physical presence builds significant trust and effectively serves diverse community segments. This traditional channel remains indispensable for reaching a broad customer base and maintaining strong local relationships across its operational footprint.

The mobile banking application stands as Standard Bank Group's most frequently utilized channel for a significant majority of personal banking customers. It serves as the primary hub for daily transactions, enabling seamless payments, balance checks, and straightforward product applications. For instance, in 2024, digital transactions continued to surge, with mobile platforms processing a vast proportion of customer interactions. The app's robust performance and comprehensive feature set are therefore paramount for driving customer satisfaction and ensuring high retention rates across the bank's diverse client base.

Standard Bank Group’s web-based online banking portals are crucial channels, serving both individual and business customers with comprehensive features. These portals offer more detailed and powerful functionalities than their mobile app counterparts, essential for complex financial operations. Businesses, for instance, heavily rely on them for efficient payroll processing, secure bulk payments, and sophisticated cash management, a critical aspect of their 2024 financial operations. For individuals, these platforms facilitate detailed financial planning and seamless management of multiple banking products, reflecting the growing demand for digital self-service solutions.

ATM and Self-Service Device Network

Standard Bank Group leverages a widespread network of ATMs and self-service devices, providing customers 24/7 access to essential banking services like cash withdrawals, deposits, and transfers. This channel significantly enhances customer convenience and reduces the need for physical branch visits, optimizing operational efficiency. As a fundamental part of the bank's physical distribution strategy, it supports over 10 million active digital customers as of early 2024. The bank continues to invest in modernizing these self-service touchpoints.

- Standard Bank operates over 5,000 ATMs across its African footprint as of 2024.

- These devices process millions of transactions monthly, contributing to a substantial portion of daily banking activities.

Direct Corporate and Investment Banking Teams

Standard Bank Group’s Corporate and Investment Banking (CIB) division primarily leverages specialized teams of relationship managers and product experts, serving as direct channels to large corporate and institutional clients. These dedicated teams engage in consultative selling, meticulously structuring deals and providing bespoke financial solutions tailored to complex client needs. This high-touch, direct engagement is fundamental to CIB's strategy, ensuring deep client relationships and a significant contribution to the Group’s non-interest revenue, which reached R36.6 billion in 2023, with CIB being a key driver.

- Direct teams offer tailored solutions for complex corporate financing.

- High-touch engagement builds strong, lasting client relationships.

- Crucial for securing large mandates and strategic advisory roles.

- Supports significant CIB revenue generation, reflecting its importance.

Standard Bank Group utilizes a comprehensive multi-channel strategy, combining an extensive physical network of over 1,000 branches and 5,000 ATMs with leading digital platforms. This approach ensures broad accessibility for its diverse client base, including over 10 million active digital customers as of early 2024. The bank leverages these channels to facilitate everything from daily mobile transactions to bespoke corporate financing solutions through dedicated teams, reflecting a balanced distribution model.

| Channel Type | Key Function | 2024 Data Point |

|---|---|---|

| Physical Branches | Advisory services, trust building | Over 1,000 branches across Africa |

| Mobile App | Daily transactions, payments | Most utilized personal banking channel |

| ATMs/Self-Service | 24/7 cash access, convenience | Over 5,000 ATMs, 10M+ active digital customers |

Customer Segments

Standard Bank Group’s Personal Banking Clients represent its largest customer segment, serving millions of individuals across diverse economic backgrounds. This includes students, salaried employees, and the mass market, all seeking essential financial services. They primarily utilize transactional accounts, personal loans, and credit cards. As of 2024, the group actively enhances digital channels like its mobile app, alongside its extensive branch network, to cater to this broad base. This dual approach ensures accessibility and convenience for over 18 million customers across Africa.

High-Net-Worth Individuals (HNWIs) represent a crucial segment for Standard Bank, often served through its wealth management and private banking divisions.

These affluent clients, who often hold significant assets over $1 million, require sophisticated financial services like personalized investment management, comprehensive estate planning, and specialized lending solutions.

This segment is highly profitable, contributing substantially to fee income and margins, as Standard Bank focuses on a client-centric approach with dedicated relationship managers.

In 2024, the global HNWI population continues to expand, with African wealth expected to grow by 42% over the next decade, making this a key strategic focus for sustained revenue growth.

This vital segment encompasses small and medium-sized enterprises (SMEs) and mid-sized commercial companies across Standard Bank's footprint. These businesses require essential services such as streamlined business accounts, flexible working capital finance, and robust merchant services for payment processing. Furthermore, foreign exchange solutions are crucial for their international trade activities. Recognized as a key engine of economic growth, this segment remains a strategic focus area for the bank, with Standard Bank reporting over R1.5 trillion in total gross loans and advances to business and commercial clients by early 2024.

Large Corporations and Multinationals

This segment encompasses the largest domestic companies and multinational corporations operating across Africa, representing a significant portion of the continent's economic activity. These entities demand sophisticated, large-scale financial solutions tailored to their complex operations. Standard Bank Group's Corporate and Investment Banking (CIB) division serves this crucial segment, providing essential services.

In 2024, CIB continues to focus on delivering robust corporate finance, trade finance, and cash management solutions, alongside critical risk hedging instruments. The CIB division reported a 2023 headline earnings growth of 24%, demonstrating its strong engagement with this high-value client base.

- Largest domestic and multinational corporations in Africa are targeted.

- Complex financial needs include corporate finance and trade finance.

- Cash management and risk hedging are key services provided.

- The Corporate and Investment Banking (CIB) division manages these relationships.

Governments and Institutional Clients

Governments and Institutional Clients form a critical segment for Standard Bank Group, encompassing national governments, public-sector entities, and significant financial institutions like pension funds. The bank delivers specialized services including public finance advisory and crucial access to debt capital markets, which saw over $1.5 billion in African bond issuances by mid-2024. These are systemically important clients, relying on tailored asset management and robust custody services for their substantial portfolios.

- National governments and public-sector entities are key clients.

- Services include public finance advisory and debt capital markets access.

- The segment also covers large pension funds and financial institutions.

- Clients are provided with asset management and custody services.

Standard Bank Group serves a diverse customer base, from over 18 million personal banking clients across Africa to High-Net-Worth Individuals seeking wealth management. It supports small and medium-sized enterprises with over R1.5 trillion in loans by early 2024, alongside large corporate and multinational entities. The bank also provides specialized services to governments and institutional clients, facilitating significant debt capital market activities. This broad segmentation ensures comprehensive financial solutions across the continent.

| Customer Segment | Key Services | 2024 Data Point |

|---|---|---|

| Personal Banking | Transactional accounts, loans, credit cards | Over 18 million customers in Africa |

| Business & Commercial | Business accounts, working capital, merchant services | Over R1.5 trillion in gross loans and advances |

| Corporate & Investment Banking | Corporate finance, trade finance, cash management | 2023 headline earnings growth of 24% |

| Governments & Institutional | Public finance advisory, debt capital markets, asset management | Over $1.5 billion in African bond issuances by mid-2024 |

Cost Structure

Staff costs and employee benefits consistently represent the largest component of Standard Bank Group's operational expenses, covering salaries, performance-based incentives, pensions, and other benefits for its over 50,000 employees. Managing this significant cost base is critical, requiring a delicate balance between attracting and retaining top talent and maintaining operational efficiency across its diverse markets. As of their latest reporting, these costs are a primary determinant of the bank's cost-to-income ratio, which stood at 54.9% in their 2024 interim results, reflecting their substantial impact on overall profitability.

Technology and communications represent a significant and growing expenditure for Standard Bank Group, driven by its digital transformation strategy. These costs encompass essential elements like software licensing, hardware maintenance, cloud computing services, and robust cybersecurity measures. Telecommunications infrastructure also forms a crucial part of this investment. For instance, in their 2023 financial results, Standard Bank reported an increase in operating expenses, with technology investments being a key driver, reflecting ongoing commitments to digital platforms. These investments are paramount for maintaining competitive advantage and ensuring the security of client data and operations.

Premises and Equipment represent a significant cost category for Standard Bank Group, encompassing all expenses tied to its physical infrastructure. This includes rent for its extensive network of branch and office locations, utilities, and ongoing maintenance. Even with strategic optimization efforts to rationalize its physical footprint, these costs remain a substantial fixed outlay, reflecting the bank's broad presence across Africa. Additionally, the maintenance and operational costs of its vast ATM network contribute notably to this expense, impacting overall operational efficiency as the bank navigates a hybrid banking model.

Interest Expense on Deposits and Funding

The interest expense on deposits and funding represents a primary operational cost for Standard Bank Group, encompassing payments on customer deposits, wholesale funding, and other financial liabilities. This cost is critically impacted by central bank monetary policy decisions and prevailing market interest rates, directly influencing the bank's financial performance. Effectively managing these funding costs is essential to maintaining and improving the bank's profitability and its net interest margin.

- Standard Bank's net interest income grew by 24% to R97.4 billion in their 2023 full-year results, indicating significant interest expense management.

- The group's cost-to-income ratio improved to 50.9% in 2023, partly due to effective cost of funds management.

- South African interest rates, a key driver, are currently at 8.25% as of mid-2024.

Regulatory Compliance and Risk Mitigation

The cost of regulatory compliance and risk mitigation is a substantial, non-discretionary expenditure for Standard Bank Group, critical for maintaining its operating license across approximately 20 legal jurisdictions. This includes significant investments in advanced anti-money laundering (AML) systems and robust capital adequacy reporting frameworks, essential for meeting stringent Basel III requirements. For instance, global banks' compliance costs are estimated to exceed 10% of their operational expenses. Legal counsel and internal audit functions also incur considerable costs to ensure adherence to evolving financial regulations in 2024.

- Compliance costs are non-discretionary, vital for licensure.

- Significant expenditure on AML systems and capital adequacy reporting.

- Global banking compliance costs can exceed 10% of operational expenses.

- Legal counsel and internal audit functions incur substantial costs.

Standard Bank's cost structure is primarily driven by staff expenses, contributing to a 54.9% cost-to-income ratio in their 2024 interim results. Significant outlays include growing technology investments and substantial premises costs across Africa. Interest expense on funding, influenced by mid-2024 South African rates at 8.25%, and non-discretionary regulatory compliance further define their operational expenditures.

| Cost Category | Key Metric | 2024 Data |

|---|---|---|

| Staff Costs | Cost-to-Income Ratio (Interim) | 54.9% |

| Funding Costs | South African Interest Rates | 8.25% (mid-2024) |

| Regulatory Compliance | Global Operational Expense Estimate | >10% |

Revenue Streams

Net Interest Income (NII) serves as the primary revenue stream for Standard Bank Group, reflecting its core banking operations. This income is generated from the difference between interest earned on its substantial loan book and investments and the interest paid on customer deposits and funding. For the financial year ending December 2023, Standard Bank reported a robust NII of R166.7 billion, demonstrating the significant scale of its lending activities. The size of the loan book and the Net Interest Margin (NIM) are key drivers, with the group achieving a strong NIM of 3.86% in 2023, underpinning profitability.

Net Fee and Commission Revenue represents a substantial non-interest income stream for Standard Bank Group, stemming from a broad range of services. This includes essential account service fees, transaction charges, and card interchange fees, alongside more specialized earnings from corporate finance advisory and loan syndication. For the first quarter of 2024, the group saw strong growth in net fee and commission income, reflecting robust client activity. This diversified income is vital, significantly reducing the group’s reliance on interest income and mitigating interest rate risk.

Trading revenue for Standard Bank Group stems from its diverse activities in financial markets. This includes income from foreign exchange, fixed income, commodities, and equities trading, conducted both for clients and the bank's own account. While inherently volatile, this stream is a significant contributor, particularly within the Corporate and Investment Banking division. For example, in 2024, the group continued to see strong contributions from its Global Markets business, reflecting robust client activity and effective risk management.

Insurance Revenue

Standard Bank Group generates significant insurance revenue through its bancassurance model, earning from both premiums and commissions on policies sold. This includes a diverse portfolio of life and non-life insurance products offered directly to its extensive banking customer base. Leveraging the bank's robust distribution network, this stream creates a synergistic and stable source of income. For the financial year ending December 2023, the insurance and assurance net earned premium for Standard Bank Group was ZAR 22.8 billion, contributing substantially to its non-interest revenue.

- Insurance revenue stems from premiums and commissions.

- Life and non-life policies are sold to existing bank clients.

- The bank's distribution network is key to sales efficiency.

- Net earned premium reached ZAR 22.8 billion in 2023.

Wealth Management and Fiduciary Fees

Wealth Management and Fiduciary Fees represent a crucial revenue stream for Standard Bank Group, primarily derived from managing assets for high-net-worth and institutional clients. This encompasses asset management fees, brokerage commissions, and charges for trust and other fiduciary services. It is a stable, fee-based income component, which inherently offers resilience against interest rate volatility. The group's wealth operations contribute significantly to non-interest revenue.

- Standard Bank's wealth operations reported R1.4 billion in net fee and commission income for the first half of 2024.

- This fee-based income stream helps diversify the group's revenue, reducing reliance on net interest income.

- The segment focuses on client-centric solutions across investment, insurance, and advisory services.

Standard Bank Group’s revenue streams are diverse, anchored by Net Interest Income, which was R166.7 billion in 2023. Non-interest income is significant, with strong growth in Net Fee and Commission Revenue in Q1 2024. Trading revenue, particularly from Global Markets, showed robust contributions in 2024, complementing insurance earnings of ZAR 22.8 billion in net earned premium for 2023. Wealth Management and Fiduciary Fees added R1.4 billion in net fee and commission income in H1 2024, diversifying the group’s financial stability.

| Revenue Stream | 2023 (R/ZAR bn) | 2024 (R bn) |

|---|---|---|

| Net Interest Income (NII) | 166.7 | N/A |

| Insurance Net Earned Premium | 22.8 | N/A |

| Wealth Management Net Fees (H1) | N/A | 1.4 |

Business Model Canvas Data Sources

The Standard Bank Group Business Model Canvas is built upon a foundation of extensive financial disclosures, comprehensive market research, and in-depth operational data. These diverse sources are critical for accurately defining customer segments, value propositions, and revenue streams.