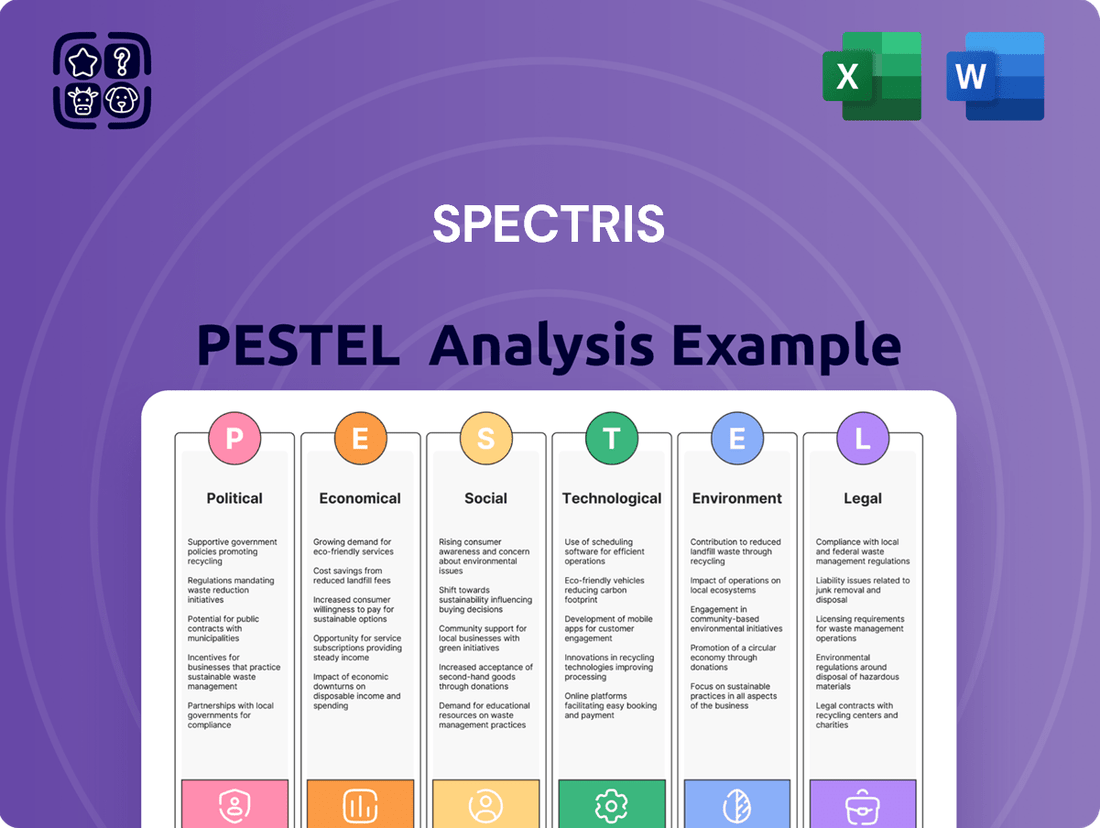

Spectris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spectris Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Spectris's trajectory. Our meticulously researched PESTLE analysis provides the deep insights you need to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full version for an actionable roadmap to success.

Political factors

Government R&D funding and incentives play a crucial role in shaping Spectris's operational landscape. For instance, in the UK, the government has committed to increasing R&D tax relief, a move that directly benefits companies investing in innovation. In 2024, the UK's R&D tax credit scheme saw a significant overhaul, aiming to simplify claims and encourage more businesses to invest in research. This creates a more favorable environment for Spectris to develop its advanced instrumentation and control technologies.

Spectris's operations are significantly influenced by global trade policies and tariffs. Changes in these policies can directly impact the cost of sourcing components and the accessibility of key markets for Spectris's precision instrumentation and control solutions. For instance, increased tariffs on semiconductors, critical for many of their products, could inflate manufacturing expenses and potentially affect pricing strategies.

Fluctuations in international trade relations, particularly those affecting the automotive and semiconductor industries which are significant end markets for Spectris, can lead to either heightened operational costs or a noticeable dip in demand across various geographical regions. The company actively monitors these dynamics to mitigate potential disruptions.

Spectris acknowledges the current uncertain macroeconomic climate and the potential for indirect impacts of tariffs. These can manifest as reduced consumer spending or business investment in their key markets, ultimately influencing the demand for their advanced measurement and testing equipment. For example, a downturn in global automotive production, exacerbated by trade disputes, could directly reduce the need for Spectris's engine testing and emissions monitoring systems.

The company's strategy includes building resilience within its supply chain and diversifying its market presence to buffer against the effects of evolving trade landscapes. This proactive approach aims to maintain cost competitiveness and ensure continued market access, even amidst shifting international trade agreements and potential new tariff implementations.

Geopolitical instability, including ongoing regional conflicts, presents a significant risk to Spectris's global operations and its customers' industrial activities. For instance, the continued tensions in Eastern Europe and the Middle East can disrupt critical supply routes, affecting the timely delivery of components and finished goods. This instability directly impacts Spectris's ability to maintain smooth supply chains, a vital aspect for its diverse customer base operating in sectors like industrial manufacturing and healthcare.

The repercussions of such disruptions are substantial. In 2024, global supply chain disruptions, often exacerbated by geopolitical events, led to increased logistics costs and lead times for many industries. Spectris, like its peers, must navigate these challenges by actively diversifying its supplier base and investing in more resilient infrastructure. This proactive approach is essential to ensure continued product availability and minimize operational interruptions for its clients.

Industrial policy and manufacturing support

Governments globally are increasingly implementing industrial policies to bolster manufacturing sectors and encourage the adoption of advanced technologies. These initiatives, such as tax incentives for R&D or subsidies for automation, directly benefit companies like Spectris, whose high-precision instruments and software are crucial for modern manufacturing. For instance, the European Union's focus on Industry 5.0, which emphasizes human-centric, sustainable, and resilient manufacturing, creates a strong demand for Spectris's solutions aimed at enhancing productivity and environmental performance.

These government strategies often translate into increased investment in domestic production capabilities and a drive for greater industrial efficiency. For example, the United States' CHIPS and Science Act, dedicating billions to semiconductor manufacturing, indirectly supports the need for advanced metrology and testing equipment that Spectris provides. Such policies foster an environment where businesses are incentivized to upgrade their operations, thereby boosting the market for Spectris's sophisticated measurement and control technologies.

- Government investment in advanced manufacturing: Many nations are channeling funds into sectors like semiconductors and electric vehicles, driving demand for precision measurement tools.

- Support for automation and digitalization: Industrial policies often promote the adoption of smart factory technologies, aligning with Spectris's offerings in data acquisition and analytics.

- Focus on sustainability targets: Environmental regulations and green manufacturing initiatives encourage the use of technologies that optimize resource efficiency, a key area for Spectris.

Data privacy and cybersecurity regulations

The evolving landscape of data privacy and cybersecurity regulations presents a significant political factor for Spectris. As industrial software and connected instruments become more central to their offerings, compliance with these laws is paramount. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks globally impose strict rules on how customer data is collected, processed, and stored. Spectris must navigate these complex requirements to maintain customer trust and avoid substantial financial penalties, which can include fines of up to 4% of global annual turnover or €20 million, whichever is greater, under GDPR.

Spectris's integration of more Internet of Things (IoT) and cloud-based solutions amplifies the importance of robust cybersecurity measures. Regulatory bodies worldwide are increasingly scrutinizing the security of connected devices and the data they generate. Failure to comply could lead to reputational damage and loss of market access. For example, in 2023, cybersecurity incidents led to billions in financial losses for businesses globally, highlighting the tangible risks of non-compliance.

Ensuring their systems and software adhere to stringent data protection standards across various jurisdictions is a continuous challenge. This necessitates ongoing investment in compliance programs and security infrastructure. The increasing focus on data localization requirements in some regions further complicates matters, requiring Spectris to potentially manage data storage and processing within specific national borders.

Key considerations for Spectris include:

- Adherence to global data privacy laws: Ensuring compliance with regulations like GDPR, CCPA (California Consumer Privacy Act), and emerging national data protection laws.

- Cybersecurity for connected products: Implementing robust security protocols for all IoT devices and cloud platforms to prevent data breaches and unauthorized access.

- Data localization compliance: Adapting to varying data residency requirements in different operating markets.

- Regular security audits and updates: Proactively identifying and mitigating vulnerabilities in software and hardware to meet evolving threat landscapes and regulatory expectations.

Government support for advanced manufacturing and R&D significantly impacts Spectris. For example, the UK's increased R&D tax relief in 2024 aims to boost innovation, directly benefiting companies like Spectris. Furthermore, policies promoting automation and sustainability, such as the EU's Industry 5.0 focus, create demand for Spectris's precision measurement and control technologies.

Trade policies and geopolitical stability also pose challenges. Tariffs on key components like semiconductors can increase Spectris's manufacturing costs, while international tensions can disrupt supply chains, as seen with increased logistics costs in 2024 due to global disruptions.

Data privacy regulations, like GDPR, are critical for Spectris's software and connected instruments. Compliance requires ongoing investment, with potential fines for non-adherence. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million.

What is included in the product

This Spectris PESTLE analysis comprehensively examines the impact of external macro-environmental forces on the company, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting emerging threats and opportunities within Spectris's operating landscape.

The Spectris PESTLE Analysis offers a structured framework that simplifies complex external factors, enabling teams to identify potential threats and opportunities with greater clarity and speed.

Economic factors

The global economic outlook significantly shapes demand for Spectris's specialized testing and measurement instruments. A healthy global economy, marked by robust industrial production, directly translates into higher capital expenditure by Spectris's key customer sectors, such as automotive and semiconductors. For instance, if global GDP growth moderates in 2025, it could temper investment in new manufacturing capabilities, impacting Spectris's order pipeline.

Trends in industrial production are critical indicators. A surge in manufacturing output, particularly in advanced economies, typically signals increased adoption of new technologies and a greater need for precision measurement tools. Conversely, a contraction in industrial output, as potentially seen in certain European manufacturing hubs during late 2024, could lead to a more cautious spending environment for Spectris's clients.

Spectris's performance is closely tied to the capital expenditure cycles of its major end markets. For example, the semiconductor industry's investment in new fabrication plants directly drives demand for Spectris’s metrology and inspection equipment. If semiconductor capital expenditure forecasts for 2025 are revised downwards due to geopolitical tensions or supply chain disruptions, Spectris may experience a slowdown in this segment.

Rising inflationary pressures are a significant concern for Spectris, directly impacting the cost of raw materials and overall operational expenses. This can put a squeeze on the company's profit margins.

In response, Spectris has implemented a profit improvement program designed to achieve substantial cost savings and better manage these escalating expenses. For instance, the company targeted £20 million in savings from its profit improvement program in 2023.

While these cost-saving initiatives are crucial, persistent inflation throughout 2024 and into 2025 could still present ongoing challenges to maintaining robust profitability. For example, the UK saw inflation at 2.3% in April 2024, a slight decrease but still a factor for businesses.

Currency exchange rate fluctuations present a significant economic factor for Spectris, impacting its international sales and the cost of goods procured globally. For instance, the company's Q1 2025 report highlighted that a weaker US dollar positively influenced its cash generation.

This volatility directly affects Spectris's reported profits when earnings from foreign subsidiaries are translated back into its reporting currency. Managing these currency risks through effective hedging strategies is therefore essential for maintaining predictable and stable financial performance across its diverse international markets.

Interest rates and customer investment cycles

Interest rates significantly shape how customers approach investment decisions, directly impacting Spectris's sales cycles. When interest rates rise, the cost of borrowing increases, making it more expensive for businesses to finance large capital expenditures, such as new industrial equipment. This can lead to a slowdown in orders for Spectris's precision instruments and control technologies, as companies postpone or scale back expansion plans. For instance, a hike in the Bank of England base rate, which stood at 5.25% in early 2024, can make a significant difference in the cost of financing a multi-million-pound technology upgrade for a manufacturing firm.

Conversely, a period of falling interest rates can act as a catalyst for investment. As borrowing becomes cheaper, businesses are more inclined to take on debt to fund new projects and upgrade their operational capabilities. This trend is particularly relevant for Spectris, as many of its customers operate in sectors that are increasingly investing in digital transformation and automation. The potential for interest rates to decline in 2025, perhaps mirroring the expectations of some economists for a pivot by central banks, could spur a wave of investment in advanced manufacturing technologies, benefiting Spectris.

- Impact of Interest Rate Hikes: Higher borrowing costs deter capital expenditure, potentially delaying or reducing orders for Spectris's precision equipment.

- 2024 Interest Rate Environment: Central bank policies, such as the Bank of England's base rate at 5.25% in early 2024, influence the cost of capital for Spectris's clients.

- Potential for 2025 Investment: Anticipated falling interest rates in 2025 could accelerate customer investment in digital technologies and automation, boosting demand for Spectris's solutions.

Customer industry specific investment cycles

Spectris operates across a variety of industries, and each of these has its own unique rhythm when it comes to investment. Think about sectors like automotive, aerospace, and pharmaceuticals; they don't all ramp up spending at the same time. This means Spectris needs to be nimble, understanding that demand from one customer group might be strong while another is experiencing a slowdown.

This cyclical nature can have a direct effect on Spectris's performance. For instance, a downturn in key markets like clean tech or automotive, as observed in Spectris's Q1 2025 performance where revenue in these segments experienced pressure, directly translates to softer demand for the company's products and services. This highlights the importance of diversification, but also the need for deep insight into each industry's specific economic cycle.

To maintain steady growth, Spectris must effectively anticipate and respond to these varied investment cycles. Successfully navigating these fluctuations requires robust market intelligence and a flexible operational strategy.

- Automotive Sector: Investment cycles here are often tied to new model launches and regulatory changes, impacting demand for testing and measurement equipment.

- Aerospace Industry: This sector's investment is influenced by new aircraft development and maintenance cycles, which can be long-term and capital-intensive.

- Pharmaceuticals and Life Sciences: Investment in this area is driven by R&D spending, new drug pipelines, and regulatory compliance, creating distinct demand patterns.

- Impact of Sectoral Weakness: Spectris noted in its Q1 2025 update that challenges in areas like clean tech and automotive led to reduced order intake in those segments, underscoring the direct link between industry-specific cycles and Spectris's revenue.

Global economic growth is a primary driver for Spectris, directly influencing capital expenditure in its key customer industries like semiconductors and automotive. For example, if global GDP growth slows in 2025, it could lead to reduced investment in new manufacturing, impacting Spectris's order pipeline.

Industrial production trends are vital; a strong manufacturing output typically means greater adoption of new technologies and increased demand for precision measurement tools. Conversely, any contraction in industrial output, such as that seen in some European manufacturing hubs in late 2024, could signal a more cautious spending environment for Spectris's clients.

Spectris's performance is intrinsically linked to the capital expenditure cycles of its core markets, with the semiconductor industry's investment in new fabrication plants being a prime example that drives demand for Spectris’s metrology and inspection equipment. A downward revision of semiconductor capital expenditure forecasts for 2025, potentially due to geopolitical issues or supply chain disruptions, could result in a slowdown for Spectris in this critical segment.

| Economic Factor | Spectris Impact | 2024/2025 Data/Outlook |

|---|---|---|

| Global GDP Growth | Demand for capital equipment | Moderating growth expected in 2025, potentially impacting investment |

| Industrial Production | Adoption of new technologies | Mixed signals, with some European hubs showing contraction in late 2024 |

| Capital Expenditure (Semiconductors) | Demand for metrology/inspection | Forecasts for 2025 subject to geopolitical and supply chain risks |

Full Version Awaits

Spectris PESTLE Analysis

The Spectris PESTLE analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Spectris. It's designed to provide actionable insights for strategic decision-making. What you're previewing here is the actual file, offering a detailed examination of these critical external influences.

Sociological factors

The availability of a skilled workforce, especially in STEM fields like advanced manufacturing and data science, is paramount for Spectris's continued success. Reports from 2024 indicate a persistent shortage of qualified engineers in these sectors across many developed economies, potentially impacting Spectris's ability to innovate and scale operations efficiently.

A significant skills gap can directly impede Spectris's operational efficiency and new product development cycles. For instance, the demand for software developers with expertise in AI and machine learning, crucial for Spectris's intelligent solutions, outstripped supply by an estimated 15% globally in late 2024, necessitating proactive talent acquisition strategies.

To address these challenges, Spectris must consider robust investment in internal training programs and explore international recruitment to secure specialized talent. The increasing automation trend, projected to grow by 20% in industrial applications by 2025, also means Spectris needs to adapt its workforce's skill sets to manage and develop these advanced systems.

Societal and customer demand for sustainability is a significant driver for Spectris. Consumers and businesses alike are increasingly prioritizing products and services that are ethically sourced and have a minimal environmental impact. This shift directly influences Spectris's approach to innovation and how it operates day-to-day.

Customers are actively seeking solutions that not only perform well but also contribute to better environmental outcomes, such as reducing resource consumption. For instance, the demand for energy-efficient manufacturing processes, a key area for Spectris's precision measurement tools, has been on the rise. Surveys in late 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions for industrial equipment.

Spectris itself emphasizes its commitment to this trend, positioning its precision measurement solutions as enablers of progress for a more sustainable world. Their technologies help industries optimize processes, leading to reduced waste and energy usage, aligning directly with these evolving customer expectations.

Societies worldwide are increasingly prioritizing automation and efficiency, a trend that directly fuels demand for sophisticated instrumentation and data acquisition solutions. This societal shift means businesses are actively seeking ways to streamline operations, minimize errors, and boost productivity through technological adoption.

Spectris, with its portfolio of precision measurement and control equipment, is well-positioned to capitalize on this demand. For instance, the global industrial automation market was valued at approximately $177.9 billion in 2023 and is projected to reach $333.7 billion by 2030, growing at a compound annual growth rate of 9.2%. This growth underscores the significant opportunity for Spectris as companies invest in smart factory initiatives and advanced manufacturing processes.

The drive for efficiency extends across numerous sectors, from advanced manufacturing and materials testing to healthcare and energy. Businesses are investing in Spectris's offerings to gain deeper insights into their processes, enabling faster decision-making and higher quality outputs. This societal emphasis on operational excellence translates into a robust market for Spectris's productivity-enhancing technologies.

Aging infrastructure modernization

The global imperative to modernize aging industrial and public infrastructure offers a substantial growth avenue for Spectris. As nations grapple with outdated systems, the demand for advanced measurement, testing, and control solutions escalates to guarantee safety, operational efficiency, and adherence to contemporary regulations. This societal shift directly plays into Spectris's core competencies in precision instrumentation and quality assurance technologies.

For instance, the United States alone faces an estimated infrastructure funding gap of $2.59 trillion by 2029, according to the American Society of Civil Engineers. This necessitates widespread upgrades, from transportation networks to utilities, all of which rely on sophisticated monitoring and testing equipment. Spectris’s product portfolio, including vibration analysis tools and materials testing equipment, is well-positioned to support these critical modernization efforts.

- Increased Demand for Precision: Modern infrastructure projects require higher levels of precision and quality control, directly benefiting Spectris's metrology and testing solutions.

- Safety and Compliance Drivers: Aging infrastructure poses safety risks, driving government and private investment in upgrades that mandate advanced inspection and monitoring technologies.

- Efficiency Gains: Upgrading infrastructure aims for greater efficiency, which Spectris's equipment can help achieve through optimized performance monitoring and process control.

- Global Investment Trends: Major economies are earmarking significant capital for infrastructure renewal; for example, the European Union's NextGenerationEU recovery plan includes substantial funding for green and digital transitions, often involving infrastructure modernization.

Societal push for improved product quality and safety

Consumers and regulators are increasingly demanding higher standards for product quality, reliability, and safety. This societal push directly fuels demand for Spectris’s precision measurement and testing instruments, as companies must rigorously verify their products meet stringent requirements. For instance, in the automotive sector, recalls due to safety defects can cost millions; in 2023, global automotive recalls cost manufacturers an estimated $15 billion, underscoring the financial imperative for robust quality control.

Spectris's offerings are vital for businesses aiming to build consumer trust and avoid costly recalls or regulatory penalties. The growing emphasis on sustainability also plays a role, with consumers expecting products to be durable and safe for long-term use, further solidifying the need for advanced testing solutions. A 2024 survey indicated that 78% of consumers consider product safety a primary purchasing factor.

- Heightened Consumer Expectations: A growing segment of the global consumer base prioritizes durability and safety, influencing purchasing decisions across electronics, automotive, and consumer goods sectors.

- Regulatory Scrutiny: Governments worldwide are enacting stricter product safety regulations, compelling manufacturers to invest in advanced testing and measurement technologies to ensure compliance.

- Brand Reputation Management: Product failures can severely damage brand image. Companies are investing in quality assurance to protect their reputation, with the global brand reputation management market projected to reach $6.5 billion by 2025.

- Industry-Specific Demands: Sectors like aerospace and medical devices, already subject to high safety standards, are seeing even tighter controls, creating a sustained need for Spectris's high-precision solutions.

Societal focus on sustainability and ethical consumption is increasingly shaping market demands. Consumers and businesses alike are prioritizing environmentally friendly products and processes, directly impacting Spectris's product development and operational strategies.

The global demand for automation and efficiency continues to rise, creating significant opportunities for Spectris's precision measurement and data acquisition solutions. As industries strive for enhanced productivity and reduced errors, the adoption of advanced technologies, including Spectris's offerings, is accelerating.

There's a growing societal emphasis on modernizing infrastructure, leading to increased demand for sophisticated testing, monitoring, and control equipment. Spectris's portfolio is well-suited to support these upgrades, ensuring safety, efficiency, and compliance with new standards.

Heightened consumer expectations for product quality, reliability, and safety are driving demand for rigorous testing and measurement. Spectris's solutions play a crucial role in helping manufacturers meet these stringent requirements, build consumer trust, and avoid costly recalls.

| Societal Trend | Impact on Spectris | Supporting Data (2024/2025) |

|---|---|---|

| Sustainability & Ethical Consumption | Drives demand for eco-friendly solutions; influences Spectris's innovation | 70% of consumers consider sustainability in industrial equipment purchases (late 2024 survey) |

| Automation & Efficiency | Increases demand for precision instrumentation and data acquisition | Global industrial automation market projected to reach $333.7 billion by 2030 (from $177.9 billion in 2023) |

| Infrastructure Modernization | Boosts need for advanced testing and monitoring equipment | US infrastructure funding gap estimated at $2.59 trillion by 2029 |

| Product Quality & Safety Expectations | Elevates demand for rigorous quality control and verification tools | Global automotive recalls cost manufacturers an estimated $15 billion in 2023; 78% of consumers prioritize safety (2024) |

Technological factors

Technological advancements, particularly in AI, machine learning, and data analytics, are fundamentally reshaping industrial operations. These powerful tools allow for sophisticated predictive maintenance, significantly reducing downtime, and enable highly accurate advanced quality control measures. Furthermore, they are instrumental in optimizing complex manufacturing processes, leading to greater efficiency and cost savings.

Spectris is well-positioned to capitalize on these trends, as these technologies directly align with enhancing its software and instrument offerings. The company's Q1 2025 performance highlights a strategic emphasis on operational efficiencies, a goal directly supported by the integration of AI and advanced analytics into its product development and customer solutions. For instance, Spectris’s Precision and Test & Measurement segments are already seeing benefits from data-driven insights that improve product performance and customer service.

The constant innovation in material science, with new composites and alloys emerging, directly fuels demand for advanced testing equipment. For instance, the aerospace sector, a key market for Spectris, is increasingly adopting lightweight, high-strength materials that require rigorous validation. This technological push means Spectris must continually upgrade its metrology and testing solutions to accurately characterize these novel substances, ensuring their performance and safety in critical applications.

The convergence of the Internet of Things (IoT) and cloud computing within industrial instruments is a significant technological driver. This integration facilitates the seamless collection of real-time data, enabling remote diagnostics and continuous performance monitoring for Spectris' diverse product lines.

By leveraging cloud platforms, Spectris can provide customers with enhanced data accessibility and sophisticated analytical capabilities, moving beyond traditional instrument functionalities to offer integrated, intelligent solutions. This shift is crucial for improving operational efficiencies and unlocking deeper insights from manufacturing processes.

Market projections from IoT Analytics indicate robust expansion in cloud infrastructure and services specifically for the manufacturing sector, with substantial growth anticipated through 2025. This trend directly supports Spectris' strategy to embed advanced connectivity and data processing into its offerings, aligning with industry demand for smarter, more connected equipment.

Miniaturization and increased precision

The relentless pursuit of miniaturization and enhanced precision is a significant technological driver for Spectris. Industries like semiconductor manufacturing and advanced healthcare demand measurement tools capable of operating at increasingly smaller scales and with greater accuracy. This constant need pushes Spectris to innovate, ensuring its products meet the evolving requirements for finer tolerances and higher resolution. For instance, in the semiconductor sector, the drive towards smaller chip nodes, such as those moving from 3nm to 2nm in 2024/2025, necessitates metrology equipment with unprecedented precision to ensure yield and performance.

Spectris's core strength lies in its ability to deliver these advanced measurement solutions. As a result, the company is well-positioned to capitalize on this trend. The market for precision measurement equipment is projected to grow, with various segments showing robust expansion. For example, the global semiconductor test equipment market was valued at approximately $7.4 billion in 2023 and is expected to see continued growth driven by technological advancements and demand for more sophisticated chips.

- Semiconductor Metrology: Continued demand for smaller feature sizes on integrated circuits requires highly precise measurement tools, impacting Spectris's market for wafer inspection and characterization equipment.

- Advanced Materials: The development of new materials with specific properties requires sophisticated characterization techniques, boosting demand for Spectris's analytical instruments.

- Medical Devices: Miniaturization in medical devices, such as implantable sensors and diagnostic tools, demands ultra-precise manufacturing and quality control, areas where Spectris's technologies are crucial.

- Automotive: The increasing complexity of automotive components, including sensors for autonomous driving, drives the need for high-precision manufacturing and testing solutions.

Cybersecurity threats to industrial systems

Cybersecurity threats to industrial systems are a growing concern for Spectris. The increasing connectivity of its software and instruments means robust security is essential to safeguard data and operations for both Spectris and its clients. In 2024, reports indicated a significant rise in attacks targeting Operational Technology (OT) networks, with some analysts predicting a 50% increase in the frequency of such incidents compared to previous years.

Protecting industrial control systems (ICS) and OT networks is crucial as Spectris's products become more integrated into manufacturing processes. Failure to do so could lead to costly operational disruptions and data breaches. For instance, a major cybersecurity incident in the manufacturing sector in late 2023 resulted in an estimated $2.5 billion in damages and downtime.

Manufacturers are increasingly adopting advanced security measures to counter these evolving threats. This includes implementing strategies like zero-trust architecture, which assumes no implicit trust is granted to devices or users, and leveraging AI-driven threat detection to identify and respond to anomalies in real-time. By 2025, it's projected that over 70% of critical infrastructure organizations will have adopted some form of AI for cybersecurity monitoring.

The implications for Spectris are clear: continued investment in cybersecurity is not just a protective measure but a competitive necessity. This involves ensuring their own systems are secure and providing customers with the tools and assurance that their connected solutions are resilient against sophisticated cyberattacks.

The rapid evolution of artificial intelligence, machine learning, and data analytics is fundamentally altering industrial operations, offering enhanced predictive maintenance and more precise quality control. These technologies are key to optimizing manufacturing processes, leading to significant efficiency gains and cost reductions.

Spectris is strategically positioned to leverage these technological advancements, with its Q1 2025 performance indicating a focus on integrating AI and advanced analytics into its product development. The company's Precision and Test & Measurement segments are already benefiting from data-driven insights that improve product performance and customer service, reflecting a clear alignment with industry trends.

Legal factors

Spectris operates in a landscape where product liability and safety standards are paramount. For instance, in 2024, the European Union continued to enforce rigorous CE marking requirements for electronic equipment, necessitating thorough safety testing and documentation for Spectris's precision instruments sold within the bloc. Failure to comply can result in significant fines and product recalls, directly impacting revenue and market access.

These global regulations demand that Spectris's advanced measurement tools not only perform accurately but also demonstrably meet stringent safety benchmarks. Consider the automotive sector, a key market for Spectris, where evolving safety standards, such as those for advanced driver-assistance systems (ADAS) being refined in 2025, directly influence the required precision and reliability of testing equipment. This necessitates continuous investment in R&D to ensure products align with these ever-increasing demands.

Spectris places significant emphasis on safeguarding its intellectual property rights and patents, which are fundamental to its high-tech and proprietary product offerings. Strong legal frameworks are vital for protecting its innovations, ensuring a sustained competitive edge. This involves actively defending against patent infringements and strategically managing its extensive patent portfolio.

In 2023, Spectris continued to invest in research and development, a key driver for its intellectual property. While specific R&D spend figures for the full 2024 year are not yet fully reported across all segments, the company's historical commitment suggests ongoing substantial investment. Protecting these innovations is paramount, as evidenced by their participation in industry dialogues on intellectual property law and enforcement.

Spectris, as a global entity, must meticulously adhere to a complex web of international trade laws and stringent export controls. Fluctuations in these regulations, particularly concerning dual-use technologies or sanctions against specific nations, can significantly disrupt its market access and operational capabilities. For instance, the ongoing geopolitical tensions in 2024 continue to reshape trade landscapes, demanding constant vigilance and adaptation from companies like Spectris.

The company's proactive stance in preparing to mitigate the direct impact of tariffs is crucial. In 2023, global trade disputes led to an estimated $1.9 trillion in tariffs imposed worldwide, affecting various sectors. Spectris’s strategy to absorb or pass on these costs demonstrates a forward-thinking approach to maintaining its competitive edge amidst evolving trade policies.

Environmental regulations and emissions standards

Spectris must navigate a complex web of environmental regulations, particularly concerning emissions and hazardous materials in its manufacturing operations. These rules directly impact how Spectris designs its products and conducts its business, driving a focus on sustainability. For instance, tighter emissions standards in key markets like the European Union, with the EU Green Deal aiming for climate neutrality by 2050, necessitate investments in cleaner production technologies.

The company's commitment to transparency is evident in its sustainability disclosures, which detail progress on emissions reduction and energy efficiency targets. In 2023, Spectris reported a reduction in Scope 1 and 2 greenhouse gas emissions, aligning with its science-based targets. This focus on accurate reporting is crucial for maintaining stakeholder trust and meeting regulatory expectations.

- Regulatory Compliance: Spectris faces increasing scrutiny regarding hazardous materials, emissions, and waste management, requiring adherence to stringent environmental standards globally.

- Product Design Impact: Environmental regulations influence product development, pushing Spectris towards more sustainable materials and energy-efficient designs to meet future market demands and compliance.

- Sustainability Reporting: Spectris actively discloses its environmental performance, including data on emissions and energy usage, to demonstrate commitment and meet stakeholder expectations for transparency.

- Emissions Reduction Efforts: The company is focused on reducing its operational carbon footprint, with ongoing initiatives to improve energy efficiency across its manufacturing sites.

Labor laws and employment regulations

Spectris navigates a complex global landscape, operating in over 30 countries, each with its own distinct labor laws and employment regulations. This necessitates a robust compliance framework to manage hiring practices, termination procedures, working conditions, and the fundamental rights of employees across its diverse workforce. For instance, in 2024, the company's ongoing portfolio adjustments, including potential acquisitions or divestments, underscore the critical need for agile management of labor compliance to avoid legal repercussions and ensure smooth transitions.

Adherence to varied employment standards is paramount. These regulations often dictate minimum wage requirements, working hours, health and safety protocols, and employee benefits, all of which can significantly impact operational costs and human resource strategies. Spectris's global presence means it must stay abreast of evolving legislation, such as new data privacy laws affecting employee information or changes in union representation rights in key markets.

- Global Compliance Burden: Spectris must comply with over 30 different sets of national labor laws, each with unique requirements for hiring, compensation, and termination.

- Employee Rights Protection: Regulations often mandate specific employee rights regarding working conditions, anti-discrimination, and collective bargaining, requiring careful adherence.

- Acquisition/Divestiture Impact: Fluctuations in employee numbers due to strategic portfolio changes in 2024 and 2025 demand meticulous management of labor law compliance during integration or separation processes.

- Evolving Regulatory Landscape: Staying updated on changes in global labor legislation, such as those concerning remote work or gig economy workers, is crucial for ongoing compliance.

Spectris must navigate stringent product liability laws and evolving safety standards across its global markets. For example, in 2024, the company faced continued enforcement of CE marking requirements in the EU for its precision instruments, with non-compliance risking significant fines. Furthermore, anticipated updates to automotive safety regulations in 2025, particularly for ADAS testing equipment, necessitate ongoing investment in product development to meet these heightened demands for accuracy and reliability.

Environmental factors

Manufacturers, including Spectris, face growing demands to implement eco-friendly operations, focusing on reducing resource use, energy consumption, and waste across their product's life. This shift impacts supply chains and product design significantly.

Spectris actively contributes to a more sustainable future by offering precision measurement solutions that help its customers optimize processes, improve efficiency, and lower environmental impact. For instance, advanced metrology tools can reduce material scrap in manufacturing, a key area for sustainability gains.

The company's own sustainability targets are also driving internal changes, aiming for a reduced carbon footprint and more responsible resource management. This aligns with global trends; for example, the European Union's Green Deal initiatives are pushing industries towards circular economy principles, directly influencing manufacturing standards.

Stricter environmental regulations globally, particularly concerning industrial emissions and waste management, directly influence Spectris's business model and its clientele. These evolving rules necessitate sophisticated monitoring and control technologies, areas where Spectris excels by offering advanced instrumentation and software solutions to help companies comply and improve their environmental performance.

The increasing emphasis on sustainability reporting means businesses are actively tracking key metrics such as energy consumption, greenhouse gas emissions, and waste generation. For example, the European Union's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for large companies, mandates detailed reporting on environmental impact, driving demand for Spectris's data acquisition and analysis capabilities.

Customers are increasingly seeking out products and services that minimize environmental impact. This growing demand for eco-friendly solutions directly influences Spectris's approach to product development and innovation, pushing them to prioritize energy efficiency and sustainable materials. For example, in 2024, a significant portion of new product development within Spectris's divisions, such as their Materials testing equipment, focused on features that enable customers to reduce their carbon footprint.

This trend acts as a catalyst for Spectris, driving the need for technologies that empower their clients to meet their own sustainability targets. Spectris's commitment to environmental performance is clearly articulated in their sustainability disclosures, which often detail investments in R&D aimed at creating greener alternatives and more resource-efficient equipment.

Impact of climate change on supply chain resilience

The escalating effects of climate change, marked by an increase in extreme weather occurrences, present significant challenges to the robustness of global supply chains, potentially impacting Spectris's operations. Businesses are increasingly advised to diversify their supplier base and bolster infrastructure to better withstand climate-induced disruptions. Given Spectris's extensive international presence, integrating these climate-related risks into its strategic operational planning is crucial for maintaining continuity and mitigating potential financial losses.

The financial implications are substantial; for instance, a 2024 report by the World Economic Forum highlighted that supply chain disruptions, often exacerbated by climate events, cost the global economy billions annually. Spectris, operating in sectors like test and measurement, relies on intricate global supply networks for its components and manufacturing. Failure to adapt could lead to increased costs, delayed production, and damage to its reputation.

- Increased frequency of extreme weather events: Hurricanes, floods, and droughts directly threaten transportation routes and manufacturing facilities.

- Supply chain diversification necessity: Reducing reliance on single-source suppliers in climate-vulnerable regions is paramount.

- Infrastructure investment needs: Strengthening warehouses, logistics hubs, and transportation networks against climate impacts is essential.

- Regulatory and investor pressure: Growing demand for climate-resilient business practices from governments and shareholders.

Circular economy principles and resource efficiency

The global push for circular economy models, focusing on resource efficiency, recycling, and reuse, is generating significant demand for advanced material analysis and testing technologies. Spectris's core competencies in materials characterization are vital for industries navigating this transition, enabling them to effectively evaluate and repurpose materials for new applications. This strategic alignment of economic viability and environmental responsibility is becoming increasingly important for long-term business success.

For instance, the European Union's circular economy action plan aims to boost sustainable product design and encourage new business models. By 2030, it targets significant reductions in waste generation and increased recycling rates for key materials. Spectris's solutions directly support these goals by providing the precision needed to verify the quality and composition of recycled materials, ensuring they meet the rigorous standards required for reuse in manufacturing. This capability is critical for sectors like electronics and automotive, where material recovery and remanufacturing are paramount.

- Increased Demand for Material Testing: The shift to circularity necessitates robust testing to ensure recycled materials meet performance specifications.

- Spectris's Role in Repurposing: Spectris's technologies aid in assessing the suitability of used materials for remanufacturing and upcycling.

- Economic and Environmental Synergy: Circular economy principles allow businesses to achieve profitability while minimizing environmental footprints.

- Regulatory Drivers: Policies promoting waste reduction and recycling, like those in the EU, are accelerating the adoption of circular practices and related technologies.

Spectris is directly impacted by environmental factors as businesses globally prioritize sustainability. Stricter regulations on emissions and waste management, such as the EU's Green Deal, are driving demand for Spectris's precision measurement and monitoring solutions. For example, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for large companies, requires detailed environmental impact reporting, increasing the need for Spectris's data acquisition capabilities. This push for eco-friendly operations also influences customer purchasing decisions, with a growing preference for products that minimize environmental impact, directly affecting Spectris's product development focus. The company itself is implementing internal targets to reduce its carbon footprint and manage resources more responsibly.

PESTLE Analysis Data Sources

Our Spectris PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the industries Spectris serves.