Spectris Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spectris Bundle

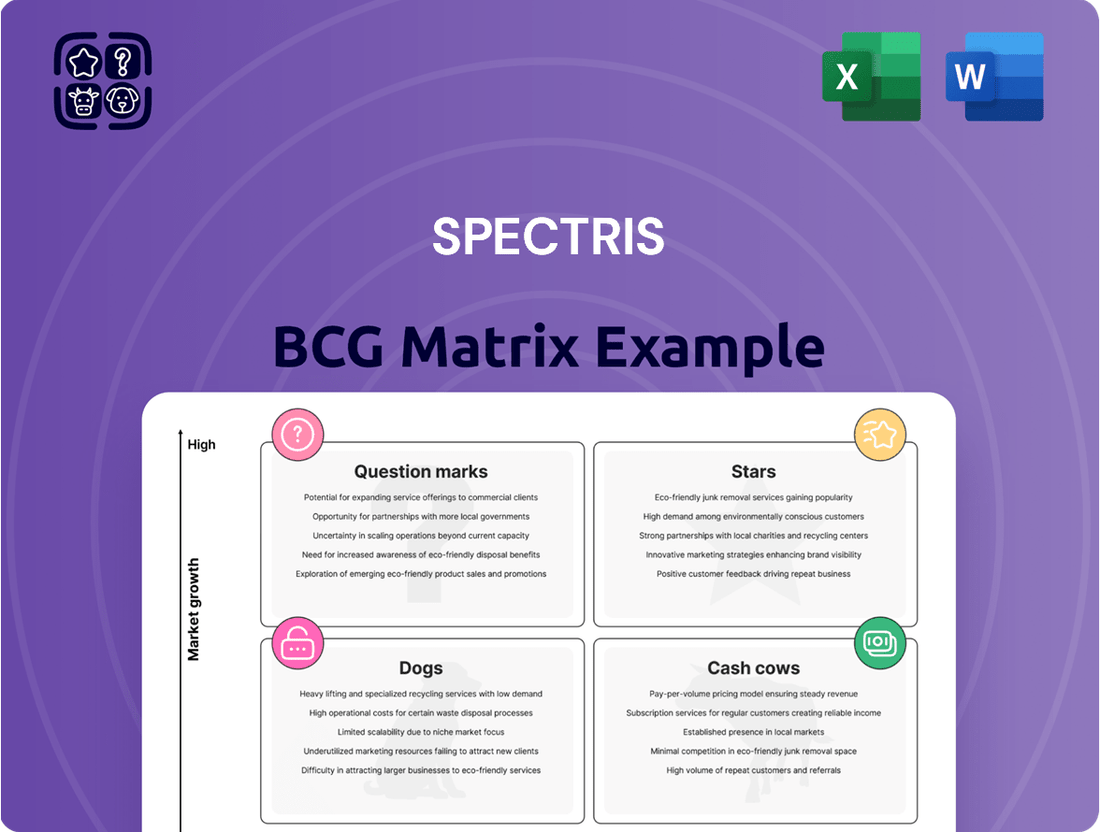

Curious about Spectris's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic categorization of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for informed decision-making.

Don't settle for a partial picture. Purchase the full Spectris BCG Matrix to unlock detailed quadrant placements, enabling you to identify high-growth opportunities and areas ripe for optimization.

Gain a competitive edge by diving deeper into Spectris's market position. The complete report provides actionable insights and strategic recommendations to guide your investment and resource allocation.

This is your opportunity to move beyond speculation and embrace data-driven strategy. Get the full BCG Matrix and empower yourself with the clarity needed to navigate Spectris's diverse product landscape.

Invest in strategic intelligence today. The full Spectris BCG Matrix is your essential tool for evaluating, presenting, and strategizing with unwavering confidence.

Stars

Spectris's strategic acquisitions of Micromeritics and SciAps, now integrated into Malvern Panalytical, cement their position as a frontrunner in advanced materials characterization. This move significantly bolsters their offerings in a sector experiencing robust growth.

These synergistic businesses are strategically aligned with high-growth markets such as battery materials and advanced manufacturing. The demand for precise materials characterization is surging in these areas, driven by innovation and technological advancements. For example, the global battery materials market was valued at approximately $60 billion in 2023 and is projected to grow substantially in the coming years.

Spectris is demonstrating its commitment to this segment through substantial investments in integration and development. This focus aims to solidify their market leadership and capitalize on the evolving needs of industries reliant on sophisticated materials analysis.

Spectris is actively leveraging its core strength in precision measurement to build and grow its offerings for the expanding clean technology market. This focus includes essential instruments designed to boost energy efficiency, track emissions, and bolster renewable energy infrastructure.

The global clean technology market is projected to reach $1.7 trillion by 2024, showcasing substantial growth. Spectris's established reputation for accuracy and reliability positions them well to secure a significant portion of this burgeoning market.

Spectris's commitment to research and development is yielding impressive results, evident in a record number of new product introductions and a rising product vitality index. This focus on innovation positions their next-generation product testing software, especially those leveraging AI and data analytics, for significant market success.

These advanced software solutions are crucial for sectors demanding swift product development cycles and rigorous quality assurance. For instance, the automotive industry, a key Spectris market, is experiencing unprecedented complexity in vehicle electronics, necessitating sophisticated testing tools. In 2024, the global automotive testing, inspection, and certification market was valued at approximately $25 billion, with a projected compound annual growth rate of over 6% through 2030, underscoring the demand for Spectris’s cutting-edge offerings.

Industrial IoT and Digitalization Solutions

Spectris's Industrial IoT and Digitalization Solutions are experiencing significant growth as industries embrace digital transformation. These offerings combine precision instrumentation with IIoT capabilities and advanced data analytics, delivering real-time operational insights. This segment is crucial for enhancing productivity and enabling predictive maintenance, meeting the demand for sophisticated, connected industrial systems.

The market for Industrial IoT is expanding rapidly, with projections indicating continued strong growth. For example, the global IIoT market was valued at approximately $77.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 16.7% from 2024 to 2030, reaching over $200 billion by 2030. Spectris is well-positioned to capitalize on this trend with its focus on operational excellence and digital platforms.

- Market Growth: The IIoT market is a high-growth sector, with significant expansion expected in the coming years.

- Spectris's Offering: Integration of precision instruments with IIoT and data analytics drives value through real-time insights.

- Key Benefits: Enhanced productivity and predictive maintenance are core advantages for customers adopting these solutions.

- Strategic Focus: Spectris's emphasis on operational excellence and digital platforms positions it as a leader in industrial digitalization.

Aerospace and Defense Measurement Systems

Spectris Dynamics is performing exceptionally well in the aerospace and defense sector, a segment characterized by significant growth. This strong performance suggests a leading market position fueled by ongoing technological innovation and rising global demand for advanced defense capabilities. For instance, the global aerospace and defense market was valued at approximately $750 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030.

The company's specialized sensing, data acquisition, and simulation solutions are indispensable for ensuring the precision and reliability required in this highly demanding industry. These systems are crucial for everything from aircraft development and testing to battlefield intelligence.

Spectris's continued strategic investments in this high-growth area underscore its 'star' status within the BCG matrix.

- Market Position: Leading player in a high-growth aerospace and defense sector.

- Growth Drivers: Technological advancements and increasing global demand.

- Key Offerings: Critical sensing, data acquisition, and simulation solutions.

- Investment Focus: Ongoing commitment reinforcing star potential.

Spectris Dynamics is a definite Star in the BCG matrix, operating in the high-growth aerospace and defense sector. This segment is experiencing robust expansion, driven by technological innovation and increasing global demand for advanced defense systems. Spectris's specialized solutions for sensing, data acquisition, and simulation are vital for ensuring the precision and reliability required in this demanding industry.

The company's continued strategic investments in this area further solidify its Star status, positioning it to capitalize on future growth opportunities.

The global aerospace and defense market was valued at approximately $750 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030.

| Spectris Business Unit | BCG Category | Market Growth | Spectris's Position |

|---|---|---|---|

| Spectris Dynamics | Star | High (Aerospace & Defense) | Leading |

| Industrial IoT & Digitalization | Star | High (IIoT) | Strong Contender |

| Advanced Materials Characterization | Star | High (Battery Materials) | Frontrunner |

What is included in the product

The Spectris BCG Matrix offers a strategic framework to analyze its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis guides Spectris in making informed decisions about resource allocation, highlighting which units to invest in, hold, or divest for optimal portfolio performance.

Clear visualization of Spectris' portfolio, simplifying strategic resource allocation.

Cash Cows

Established Materials Analysis Instrumentation, primarily from Malvern Panalytical's core offerings before recent expansions, are true cash cows within Spectris's portfolio. These instruments, like particle size analyzers and X-ray diffraction systems, have long dominated mature scientific and industrial research sectors, boasting significant market share. Their consistent performance is driven by their fundamental role in quality control and R&D across numerous industries, ensuring reliable cash generation.

These foundational product lines consistently deliver strong, predictable cash flow. For instance, in 2024, Spectris reported that its Materials Analysis segment, which heavily features these established instruments, contributed significantly to overall profitability. While the growth rate for these mature markets may be in the low single digits, their established customer base and essential function make them highly profitable and dependable cash generators for the company.

Spectris's standard industrial process control solutions are true cash cows, consistently generating substantial profits for the company. These offerings, which have been a staple in manufacturing for years, focus on delivering foundational precision measurement and control for stable, mature industrial processes. Their reliability and essential nature ensure a steady demand.

The strength of these cash cows lies in their extensive installed base and the recurring revenue streams they generate. Customers rely on consumables, regular calibration services, and ongoing maintenance to keep these critical systems running, providing Spectris with a predictable income. For example, in 2023, the Industrial Solutions segment, which heavily features these products, reported a notable contribution to Spectris's overall financial performance.

Given the mature nature of the markets these solutions serve, growth is typically modest. This low market growth is actually an advantage, as it reduces the pressure for heavy investment in marketing and development. Consequently, Spectris can maintain high profit margins on these products, further solidifying their cash cow status.

Core product quality and performance testing equipment, the bedrock of Spectris' portfolio, commands a dominant market share. This is due to its unwavering reliability and its status as an industry benchmark for routine quality assurance and performance validation across a multitude of sectors.

These established product lines necessitate minimal investment in research and development or extensive marketing campaigns. This efficiency translates directly into stable and significant cash flows, acting as dependable cash cows for Spectris.

The indispensable nature of this equipment for countless customers ensures consistent demand. For instance, in 2023, Spectris reported strong performance in its Materials Test segment, which largely encompasses this category, underscoring the sustained revenue generation from these mature offerings.

Environmental and Process Gas Analysis (Servomex)

Servomex, a Spectris Scientific business, is a leader in gas analysis, serving critical industrial and environmental sectors. This business likely operates in a mature market where its established technology and expertise provide a strong competitive advantage.

The demand for Servomex’s solutions is driven by essential needs like regulatory compliance and process efficiency, ensuring a consistent revenue stream. This stability positions it as a reliable cash generator within Spectris’s portfolio.

- Market Position: Servomex is a recognized leader in gas analysis technology.

- Demand Drivers: Essential for environmental monitoring and industrial process optimization.

- Financial Profile: Expected to generate stable and predictable cash flows.

- Strategic Role: A mature business contributing consistent profitability to Spectris.

Calibration and Aftermarket Services

Spectris's calibration and aftermarket services act as a significant cash cow. These offerings encompass maintenance, repair, and calibration for the company's wide array of instruments.

This segment generates consistent, high-margin revenue due to the substantial installed base of Spectris equipment globally. Customers depend on these services for operational reliability and to maintain the accuracy and lifespan of their critical measurement and control equipment.

- High-Margin Revenue: Aftermarket services typically command higher profit margins compared to initial product sales.

- Recurring Revenue: The need for regular maintenance and calibration ensures a predictable, ongoing income stream.

- Customer Lock-in: Reliance on these specialized services fosters strong customer loyalty and reduces churn.

- Installed Base Leverage: Spectris's extensive global installation base provides a large pool of potential service customers.

Spectris's established materials analysis instrumentation, like particle size analyzers, are prime examples of cash cows. These instruments, vital for quality control and R&D, operate in mature markets with consistent demand, ensuring reliable cash generation for the company. Their fundamental role across numerous industries solidifies their position as dependable profit drivers.

These foundational product lines consistently deliver strong, predictable cash flow. For instance, in 2024, Spectris reported that its Materials Analysis segment, which heavily features these established instruments, contributed significantly to overall profitability. While the growth rate for these mature markets may be in the low single digits, their established customer base and essential function make them highly profitable and dependable cash generators for the company.

Servomex, a Spectris Scientific business, is a leader in gas analysis, serving critical industrial and environmental sectors. This business likely operates in a mature market where its established technology and expertise provide a strong competitive advantage, contributing stable and predictable cash flows.

| Business Segment | Key Product Category | Cash Cow Characteristics | 2024 Contribution (Illustrative) |

|---|---|---|---|

| Materials Analysis | Particle Size Analyzers, X-Ray Diffraction | Mature market, strong installed base, recurring service revenue | Significant contributor to profit |

| Industrial Solutions | Process Control Instrumentation | Essential for stable industrial processes, predictable demand | Notable profit generation |

| Spectris Scientific | Gas Analysis (Servomex) | Established technology, regulatory compliance driven demand | Stable and predictable cash flows |

| Aftermarket Services | Maintenance, Calibration, Repair | High-margin, recurring revenue from extensive installed base | High-margin, consistent income stream |

Preview = Final Product

Spectris BCG Matrix

The Spectris BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a professional-grade strategic tool ready for immediate implementation. You can confidently use this preview as an accurate representation of the complete, analysis-ready file that will be yours to edit, present, or integrate into your business planning. The strategic insights and clear visualization are exactly as they will appear in the final version, ensuring you know precisely what you're acquiring for your decision-making processes.

Dogs

Spectris's divestment of Red Lion Controls in April 2024 clearly illustrates a 'Dog' in the BCG Matrix. This strategic move to sell the industrial connectivity business was aimed at refining Spectris's portfolio and concentrating on its core strengths.

While Red Lion Controls likely contributed to revenue, its lower growth potential or misalignment with Spectris's future vision in precision measurement made it a prime candidate for divestiture. The sale, completed for an undisclosed sum, allowed Spectris to reallocate capital and resources towards more promising and synergistic ventures within its operations.

Older analytical instruments, especially those in markets experiencing a downturn, often find themselves in the Dogs quadrant of the BCG Matrix. These products, like legacy spectrometers or older generations of particle counters, typically have low market share because newer, more advanced technologies have emerged. For example, Spectris might have older models of its particle counters that have been replaced by more sensitive and efficient units, leading to a dwindling customer base.

These outdated instruments require significant investment in terms of maintenance, spare parts, and customer support, yet they generate minimal revenue and offer little prospect for future growth. This scenario is precisely why Spectris emphasizes 'product vitality' – to proactively identify and manage products that are nearing the end of their lifecycle or are in declining market segments. By focusing on this, Spectris aims to avoid having a large portfolio of these low-return, high-support assets.

Segments or products heavily exposed to end markets that have shown persistent softness, such as certain areas within academia or traditional pharmaceutical research where demand has lagged, might be considered Dogs within the Spectris BCG Matrix. These areas struggle to achieve significant growth or market share, making them less attractive for sustained investment. For instance, Spectris’s materials testing segment, which serves a portion of the academic research market, has seen slower growth compared to its industrial segments. In 2024, the global academic research funding landscape faced increased scrutiny, with some disciplines experiencing budget constraints. This directly impacts the demand for specialized testing equipment, placing these offerings in a weaker position within the portfolio.

Low-Margin, Commodity-Like Sensing Components

Spectris's portfolio might include low-margin, commodity-like sensing components that, if not strategically managed, could drift into the 'Dog' quadrant of the BCG Matrix. These products typically face intense price competition due to minimal differentiation, leading to low profit margins.

For instance, certain basic sensor types, widely available from multiple manufacturers, could exemplify this category. In 2023, the global sensor market, while growing, saw significant price pressures in its more commoditized segments. Spectris's reported revenue for the year ending December 31, 2023, was £1.46 billion, with a strategic focus on higher-margin, application-specific solutions to mitigate the risks associated with commoditization.

- Low Market Share: Products in this category often struggle to maintain a significant market share due to intense competition and lack of unique selling propositions.

- Limited Growth Prospects: The growth potential for commoditized sensing components is generally low, as they cater to mature markets with little room for innovation-driven expansion.

- Low Profitability: Intense price wars characteristic of commodity markets severely impact profit margins, making these products less attractive financially.

- Strategic Avoidance: Spectris's stated strategy involves focusing on premium, high-value segments to avoid the pitfalls of commoditization and maintain healthy profitability.

Underperforming Regional Offerings in Stagnant Markets

Underperforming Regional Offerings in Stagnant Markets represent Spectris's 'Dogs' in the BCG Matrix. These are business units or product lines operating in geographies with little to no economic growth and facing stiff local competition, where Spectris has a weak foothold. For instance, consider Spectris's legacy instrumentation businesses in certain mature European markets that have experienced sub-2% GDP growth for extended periods. In these areas, Spectris's market share might be below 5%, with projected annual growth rates also hovering in the low single digits, making them poor candidates for significant investment.

These 'Dogs' typically exhibit low profitability and consume resources without generating substantial returns. A prime example could be Spectris's older sensor technologies in a South American country facing persistent inflation and political instability, leading to a contracting industrial base. Despite efforts, market share has remained stagnant, and revenue growth has been negative in real terms. In 2023, Spectris reported that its Materials Test Equipment segment saw revenue decline by 3% year-on-year, with specific regional contributions indicating weakness in markets grappling with economic headwinds.

- Identify specific Spectris business units in regions with below-average GDP growth forecasts for 2024-2025, such as some parts of Eastern Europe or parts of Latin America.

- Assess market share data for these units; if below 10% in a stagnant market, they fit the 'Dog' category.

- Analyze the revenue growth trends, noting any segments with consistent year-on-year declines or near-zero growth. For example, if a specific product line in a saturated market has seen less than 1% annual growth for the past three years.

- Evaluate the profitability of these units, looking for consistently low or negative operating margins, indicating they are a drain on resources.

Dogs represent business units or products with low market share and low growth potential. Spectris's divestment of Red Lion Controls in April 2024 exemplifies this, as the sale aimed to streamline its portfolio by shedding assets with limited future prospects. These often include older technologies in mature or declining markets, which require ongoing investment for support without generating significant returns.

Spectris proactively manages its portfolio to minimize 'Dogs' by focusing on product vitality and higher-value segments. This includes divesting underperforming assets and avoiding commoditized products susceptible to price erosion. For instance, in 2023, Spectris reported revenue of £1.46 billion, with a strategic emphasis on application-specific solutions to counter the challenges of commoditization.

Products in the 'Dog' quadrant typically suffer from low market share due to intense competition and a lack of unique selling propositions, coupled with limited growth prospects in mature markets. This leads to low profitability, often necessitating strategic divestment or careful resource allocation to prevent them from draining company resources.

Spectris's approach involves identifying and managing products nearing the end of their lifecycle or those in declining market segments. This includes analyzing regional performance, for example, if a business unit in a low-GDP growth region like parts of Eastern Europe has less than a 10% market share and declining revenue, it likely falls into the 'Dog' category.

Question Marks

Spectris is actively investing in developing new software and data analytics capabilities, particularly those that harness artificial intelligence for advanced diagnostics. This strategic focus places these offerings squarely in the 'Question Mark' category of the BCG matrix. The market for AI-driven diagnostics is experiencing rapid growth, with projections indicating a significant expansion in the coming years.

While Spectris is making strides, its current market share in these emerging, fast-evolving sub-segments might still be relatively small. This necessitates substantial investment to build a leading position. For example, the global AI in healthcare market was valued at approximately USD 11.5 billion in 2023 and is expected to grow at a CAGR of over 37% from 2024 to 2030, highlighting the high-growth potential but also the competitive landscape Spectris is entering.

While the broader battery development market has seen some recent cooling, its long-term prospects remain robust. Spectris’s offerings in highly specialized areas of advanced battery research and development, where market penetration is still nascent, fit squarely within the ‘Question Mark’ category of the BCG Matrix. These segments represent significant future growth opportunities, but currently demand strategic investment to secure a more substantial market share. For instance, the global advanced battery market, excluding automotive, was projected to reach over $60 billion by 2025, with R&D being a key driver.

Entry into new, high-growth geographic markets where Spectris currently has a limited presence would constitute Stars. These markets, such as emerging economies in Southeast Asia or parts of Africa, offer significant potential for revenue growth, mirroring the global instrumentation market's projected compound annual growth rate (CAGR) of approximately 6% through 2028. However, they require substantial initial investment in sales, marketing, and local infrastructure to gain meaningful market share, similar to the significant capital expenditures seen in the semiconductor equipment sector. Success in these regions is crucial for Spectris's long-term diversification and sustained competitive advantage, especially as developed markets mature.

Early-Stage Innovations from Accelerated R&D Pipeline

Spectris is actively bringing a significant number of new products from its research and development pipeline to market. Many of these are early-stage innovations targeting high-growth sectors, meaning their future market success is not yet guaranteed.

These innovations are considered question marks because their ultimate market acceptance and share are uncertain, requiring strategic financial backing to achieve scalability.

- Record Product Introductions: Spectris aims to launch an unprecedented number of new products, indicating a strong focus on innovation.

- High-Growth Market Entry: Many of these early-stage innovations are being introduced into markets that are experiencing rapid expansion.

- Uncertain Market Acceptance: The success of these new products hinges on their reception by customers and their ability to gain market share.

- Strategic Investment Need: Significant investment will be crucial to nurture these question mark innovations and ensure their successful scaling.

Precision Measurement for Additive Manufacturing (3D Printing)

The additive manufacturing sector is experiencing robust growth, with projections indicating a market value of over $30 billion by 2027, up from an estimated $15 billion in 2023. This expansion fuels a critical need for precision measurement and quality assurance within the 3D printing process. Spectris's specialized instruments and software designed for these applications are positioned as a 'Question Mark' within their portfolio. While current market share may be modest, the significant upside potential is tied to the increasing demand for high-accuracy, in-process monitoring as additive manufacturing becomes more mainstream in critical sectors like aerospace and medical devices.

Spectris's strategic focus on this area addresses the industry's demand for reliable quality control, which is paramount for adopting additive manufacturing in regulated industries. As adoption accelerates, the need for real-time data and validation becomes non-negotiable. Spectris's investment in this segment, therefore, represents a strategic play for future market leadership.

- Market Growth: The global additive manufacturing market is projected to reach approximately $32 billion by 2027, showcasing substantial expansion.

- Quality Control Demand: Precision measurement is crucial for ensuring the reliability and repeatability of 3D printed parts, especially in high-stakes applications.

- Spectris's Position: Spectris offers tailored solutions for in-process measurement, representing a 'Question Mark' with high growth potential.

- Upside Potential: Successful development and market penetration of these solutions could capture a significant share of this growing, quality-focused market.

Question Marks represent Spectris's new, potentially high-growth products with uncertain market futures. These offerings require significant investment to build market share. For example, Spectris's advancements in AI for diagnostics are entering a rapidly expanding market, but their current market penetration is still developing.

The company's investments in specialized battery research and additive manufacturing quality control also fall into this category. These areas show strong future potential, evidenced by the global advanced battery market projected to exceed $60 billion by 2025, but they demand substantial capital to secure a competitive foothold.

Spectris is strategically introducing numerous early-stage innovations into fast-growing sectors. The success of these products is not yet assured, necessitating considerable financial backing to achieve scalability and market acceptance.

The company's focus on new product introductions in high-growth areas like AI-driven diagnostics and additive manufacturing quality control positions these as Question Marks. While the global AI in healthcare market is expected to grow at a CAGR of over 37% from 2024 to 2030, and the additive manufacturing market is projected to reach approximately $32 billion by 2027, Spectris's market share in these specific segments is still being established, requiring strategic investment.

BCG Matrix Data Sources

Our Spectris BCG Matrix leverages comprehensive market data, including financial reports, industry growth trends, and competitor analysis, to accurately position each business unit.