Sligro Food Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sligro Food Group Bundle

Uncover the critical external factors shaping Sligro Food Group's trajectory through a thorough PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks present both challenges and opportunities for this major player in the food service sector. This analysis provides a strategic roadmap for navigating the complex external landscape. Download the full version now to gain an unparalleled understanding of Sligro's operating environment and bolster your own market foresight.

Political factors

Sligro Food Group operates within a stringent regulatory environment concerning food safety and hygiene. These government mandates, covering everything from sourcing to delivery, necessitate significant investment in quality control and traceability systems. Meeting these standards across Sligro's extensive multi-channel distribution network is paramount.

Compliance with these food safety regulations incurs substantial operational costs for Sligro, including investments in training, technology, and rigorous testing protocols. Non-compliance can lead to hefty fines, reputational damage, and potential disruptions to business. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets a high bar for traceability, requiring businesses to track food products at every stage of production, processing, and distribution.

Sligro's reliance on international sourcing for a portion of its food and non-food products makes it susceptible to shifts in trade policies and tariffs. For instance, changes to the European Union's common agricultural policy or new import duties on specific goods could directly impact Sligro's procurement costs. The group’s 2023 annual report noted that while a significant portion of its products are sourced domestically, international sourcing remains crucial for certain categories, exposing it to global trade dynamics.

Fluctuations in import/export duties can ripple through Sligro's supply chain, potentially increasing the cost of goods sold. This, in turn, may necessitate adjustments to pricing strategies for its foodservice and institutional clients. Maintaining supply chain stability is paramount, and unpredictable trade policy changes, such as those experienced in recent years with various global trade disputes, can create significant volatility and require agile inventory management and supplier diversification.

Sligro Food Group, like any major employer in the Netherlands, operates under a stringent framework of national labor laws. These laws dictate minimum wage levels, regulate working hours, and govern aspects of employee contracts and termination. For instance, the minimum wage in the Netherlands for those 21 and older was €13.27 per hour as of January 1, 2024, a figure that directly impacts Sligro's operational costs for its numerous staff across its cash-and-carry locations and delivery fleets.

Changes in employment regulations, such as potential adjustments to working hour limits or new rules around flexible work arrangements, can significantly influence Sligro's staffing strategies. These regulations directly affect how many employees are needed for peak operational periods in both its wholesale cash-and-carry outlets and its extensive delivery network. Adherence to these laws is crucial for maintaining operational efficiency and managing labor expenses, which are a substantial part of the company's cost structure.

Collective bargaining agreements, often negotiated between unions and employer organizations, also play a vital role. These agreements can set terms for wages, benefits, and working conditions that may exceed statutory minimums, further impacting Sligro's human resources strategy and overall operational costs. The dynamic nature of labor laws and their interpretation requires Sligro to maintain robust compliance mechanisms and adapt its HR policies accordingly to ensure fair labor practices and operational continuity.

Fiscal Policies and Taxation

Sligro's profitability is directly impacted by government fiscal policies. Changes in corporate income tax rates, such as the Dutch corporate income tax rate which stood at 25.5% for profits up to €200,000 and 25.5% for profits above that threshold in 2024, can significantly alter net earnings. Value Added Tax (VAT) also plays a crucial role; the standard VAT rate in the Netherlands is 21%, affecting the final price of goods and influencing consumer demand.

Specific industry taxes or levies could also affect Sligro's operating costs. For instance, any environmental taxes related to food distribution or packaging would add to expenses. Anticipated shifts in tax legislation, such as potential adjustments to corporate tax or the introduction of new industry-specific charges, require Sligro to engage in robust financial planning and adapt its capital allocation strategies to maintain competitive pricing and investment capacity.

- Corporate Income Tax: The Dutch corporate income tax rate impacts Sligro's retained earnings and reinvestment capabilities.

- VAT: Fluctuations in the 21% VAT rate affect Sligro's pricing strategy and sales volume.

- Industry-Specific Taxes: Potential new levies on logistics or food waste could increase operational expenditures.

- Tax Law Changes: Anticipated alterations in tax legislation necessitate proactive financial forecasting and strategic adjustments for Sligro.

Political Stability and Public Policy

Political stability in the Netherlands, Sligro's primary market, remains a key consideration. The Dutch government's focus on economic growth and sustainable practices can create opportunities for food wholesalers embracing innovation and eco-friendly solutions. For instance, ongoing investments in infrastructure, totaling billions of euros annually, benefit logistics and supply chain efficiency for companies like Sligro.

Shifts in government priorities directly impact the food wholesale sector. Increased public spending on healthcare, a trend observed across Europe in response to demographic changes, can bolster demand from institutional markets such as hospitals and care homes, a segment Sligro serves. Conversely, changes in food safety regulations or tax policies, like potential adjustments to VAT on food products, could introduce risks or alter operating costs.

- Netherlands' Political Landscape: Generally stable, with coalition governments often requiring consensus, leading to predictable policy environments.

- EU Policy Impact: Sligro, operating across Europe, is subject to EU-wide regulations on food safety, trade, and sustainability, influencing market access and operational standards.

- Public Spending Trends: Growing emphasis on public health and sustainable food systems in European nations may favor food service providers prioritizing quality and ethical sourcing.

- Consumer Sentiment: Evolving political discourse around food security and affordability can shape consumer purchasing habits, indirectly affecting demand patterns for wholesale food suppliers.

Government regulations heavily influence Sligro's operations, particularly regarding food safety and labor laws. The Dutch minimum wage for those 21 and older was €13.27 per hour as of January 1, 2024, impacting labor costs. Furthermore, EU directives on food traceability, like Regulation (EC) No 178/2002, mandate rigorous tracking systems, adding to operational expenses.

Fiscal policies, including corporate income tax and VAT, directly affect Sligro's profitability. The Dutch corporate income tax rate was 25.5% in 2024, and the standard VAT rate is 21%. Changes in these rates or the introduction of industry-specific taxes, such as environmental levies on logistics, require careful financial planning and strategic adaptation to maintain competitive pricing.

Political stability in the Netherlands and the broader EU provides a generally predictable operating environment, though policy shifts can introduce risks. For instance, government spending on healthcare can boost demand from institutional clients. Conversely, evolving regulations on sustainability or food waste could necessitate further investment in Sligro's supply chain and operational practices.

What is included in the product

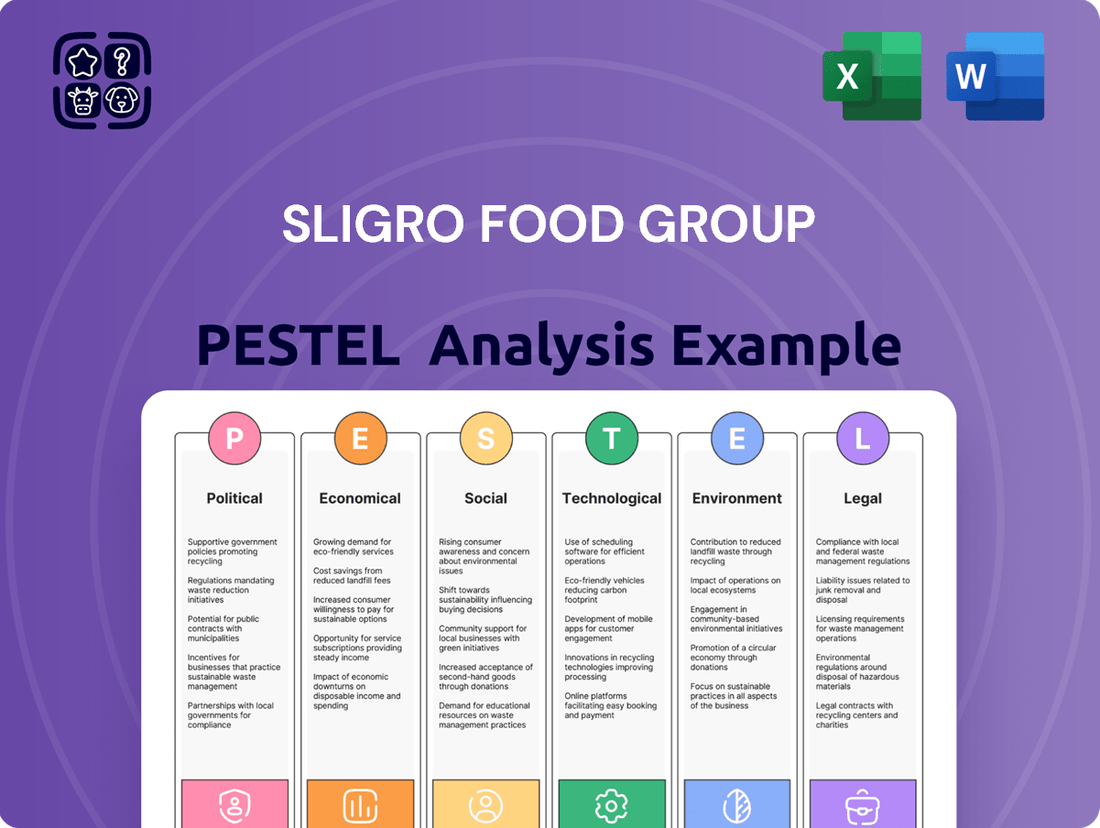

This Sligro Food Group PESTLE analysis examines how external macro-environmental factors, including political stability, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks, influence the company's strategic landscape.

This Sligro Food Group PESTLE analysis acts as a pain point reliever by offering a concise, easily shareable summary format ideal for quick alignment across teams or departments when navigating complex external factors.

Economic factors

Rising inflation in 2024 and early 2025 directly pressures Sligro's cost of goods sold and operational expenses, particularly for fuel and energy, which are critical for its distribution network. For instance, the Eurozone experienced an inflation rate of 2.4% in April 2024, a slight uptick from previous months, indicating persistent cost pressures. This economic environment erodes the purchasing power of Sligro's professional customers, such as restaurants and hospitality businesses, forcing them to manage tighter budgets.

Consequently, Sligro must carefully calibrate its pricing strategies to offset increased input costs without alienating its customer base. The company's ability to pass on these higher costs will significantly influence customer demand and overall profit margins. A delicate balance is needed to maintain competitiveness while ensuring profitability amidst these challenging economic conditions.

Sligro Food Group's performance is intrinsically linked to the health of the broader economy, especially the hospitality and foodservice industries. When these sectors are robust, Sligro benefits directly from increased demand for its extensive range of food and beverage products. For instance, in 2023, the Dutch foodservice market saw a notable recovery, with revenues approaching pre-pandemic levels, translating into stronger sales for Sligro.

A flourishing restaurant, hotel, and catering landscape means more business for Sligro's wholesale operations. Higher consumer spending on dining out and events directly fuels the need for the ingredients and supplies Sligro provides. As of early 2024, projections indicated continued growth in Dutch tourism and leisure spending, a positive signal for Sligro's sales pipeline.

Conversely, economic downturns or contractions in consumer spending present substantial headwinds for Sligro. A slowdown in the hospitality sector, characterized by reduced dining out and event cancellations, directly impacts Sligro's order volumes and profitability. For example, during periods of high inflation and economic uncertainty, consumers often cut back on discretionary spending, which can lead to a decrease in demand for Sligro's offerings.

Data from 2024 suggests that while inflation has moderated, consumer confidence in the Netherlands remains a key variable. Sligro's ability to navigate economic fluctuations is therefore dependent on the resilience and recovery of its primary customer base within the foodservice and hospitality sectors.

Prevailing interest rates significantly impact Sligro Food Group's borrowing costs. For instance, if interest rates rise, Sligro's expenses for financing new distribution centers or upgrading its IT systems will increase. This directly affects their ability to fund strategic growth initiatives and manage day-to-day operations efficiently.

Higher interest rates can also constrain Sligro's access to capital, making expansion projects more expensive and potentially delaying them. Furthermore, it impacts the availability and cost of credit for Sligro's diverse customer base, ranging from restaurants to hotels, which could affect their purchasing power and demand for Sligro's products.

For example, in early 2024, central banks in Europe, including the ECB which influences Dutch rates, maintained relatively high policy rates to combat inflation. While specific Sligro financing rates vary, a benchmark rate increase like a 0.25% hike by the ECB typically translates to higher borrowing costs across the economy, directly impacting companies like Sligro.

Supply Chain Costs and Commodity Prices

Sligro Food Group's profitability is significantly influenced by global commodity prices for food items and the cost of energy, which directly impacts its extensive logistics operations. Fluctuations in these areas can create substantial cost pressures, demanding a highly adaptable approach to sourcing and stock management. For instance, the average global food commodity prices saw an increase in early 2024, continuing trends from previous years, which would directly affect Sligro's cost of goods sold.

These rising expenses necessitate agile procurement strategies to mitigate the impact on margins. Efficient inventory management is crucial to avoid holding excess stock bought at higher prices or facing shortages. The company's sensitivity to these factors is evident in its reliance on a robust supply chain, where even minor shifts in transportation fuel costs or the price of core ingredients can have a noticeable effect on the bottom line.

- Sensitivity to Food Commodities: Sligro's business model is directly tied to the cost of raw food materials, such as grains, dairy, and meat.

- Energy Cost Impact: Logistics are a core component, making the group vulnerable to volatility in oil and gas prices, affecting delivery costs.

- Profitability Squeeze: Increased supply chain expenses can directly reduce gross profit margins if not passed on to customers effectively.

- Agile Procurement Needs: The group must maintain flexible sourcing agreements and monitor markets closely to optimize purchasing.

Consumer Spending Patterns and Discretionary Income

Consumer spending patterns significantly influence Sligro's business, as shifts in discretionary income directly impact its foodservice clients. When consumers have more disposable income, they tend to dine out more frequently, boosting demand for the food and beverages Sligro supplies to restaurants, hotels, and catering services. For instance, in early 2024, a growing consumer confidence in many European economies, coupled with moderating inflation, suggested a potential uptick in discretionary spending on dining experiences. Conversely, economic uncertainty or a squeeze on household budgets can lead consumers to cut back on eating out, which then reduces the volume of orders Sligro receives from its B2B customers.

Changes in dining preferences also create ripples through Sligro's supply chain. If consumers increasingly favor specific cuisines or dietary options, such as plant-based meals or locally sourced ingredients, Sligro must adapt its product offerings to meet these evolving demands from its B2B clients. This adaptability is crucial for maintaining strong relationships and market share. For example, a surge in demand for sustainable seafood in the foodservice sector in 2024 would necessitate Sligro sourcing and distributing these products efficiently to its restaurant partners.

- Disposable Income Impact: Higher disposable income generally translates to increased dining out, benefiting Sligro's B2B clients and, by extension, Sligro itself.

- Consumer Confidence: Fluctuations in consumer confidence directly correlate with willingness to spend on non-essential services like dining out.

- Dining Frequency Shifts: A decrease in dining out frequency by consumers directly reduces order volumes for Sligro's customers.

- Preference Evolution: Changes in consumer taste, such as a move towards healthy or sustainable options, require Sligro to adjust its product sourcing and availability.

Economic factors significantly shape Sligro Food Group's operating environment, with inflation and interest rates being key concerns. Rising inflation in 2024 and early 2025 directly impacts Sligro's costs, particularly for energy and fuel, which are vital for its distribution. Higher interest rates also increase borrowing costs, affecting the company's ability to finance growth and potentially limiting credit for its customers.

Sligro's fortunes are closely tied to the health of the hospitality and foodservice sectors. A robust economy with strong consumer spending on dining out fuels demand for Sligro's products. Conversely, economic downturns or reduced consumer confidence can lead to decreased order volumes from its business clients.

Global commodity prices for food and energy also exert considerable influence. Fluctuations in these prices directly affect Sligro's cost of goods sold and logistics expenses, necessitating agile procurement and inventory management to maintain profitability. For instance, global food commodity prices saw an increase in early 2024.

| Factor | Impact on Sligro | Data Point (2024/2025) |

| Inflation | Increased operational and COGS | Eurozone inflation 2.4% (April 2024) |

| Interest Rates | Higher borrowing costs, impacts customer credit | ECB policy rates remained relatively high in early 2024 |

| Economic Growth | Drives demand in foodservice sector | Dutch foodservice market revenues approaching pre-pandemic levels (2023) |

| Commodity Prices | Affects cost of goods sold and logistics | Global food commodity prices increased in early 2024 |

Preview the Actual Deliverable

Sligro Food Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Sligro Food Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a detailed examination of the external forces shaping Sligro's strategic landscape. You'll gain valuable insights into market trends, competitive pressures, and regulatory considerations. This is the actual file you’ll be working with.

Sociological factors

Consumers are increasingly seeking out plant-based, organic, and healthier food options, with a notable rise in demand for locally sourced products. This shift directly influences Sligro Food Group's product assortment, necessitating a broader range of sustainable and ethically produced goods to cater to these evolving preferences.

For instance, the plant-based food market in Europe experienced significant growth, with projections indicating continued expansion through 2028, driven by health and environmental consciousness. Sligro must therefore adapt its offerings to ensure culinary professionals, Sligro's primary customers, can readily access these in-demand ingredients to serve their end-consumers.

This adaptation involves not only expanding the variety of plant-based alternatives but also ensuring the quality and traceability of organic and local produce. Failing to align with these dietary trends could lead to a disconnect with the market and a missed opportunity for Sligro to maintain its competitive edge.

Demographic shifts significantly impact Sligro's professional clientele. An aging population in many European countries, including the Netherlands, means a growing demand for convenient, nutritious, and easily digestible meals in institutional settings like healthcare facilities and retirement homes. This trend, observed across Sligro's core markets, necessitates product development focusing on health benefits and ease of preparation for their foodservice customers. For instance, the increasing number of single-person households also alters demand, pushing for smaller portion sizes and ready-to-eat options that cater to individual needs rather than larger family units.

Societal shifts are significantly impacting Sligro's access to a ready workforce. Labor shortages are a persistent challenge in the food wholesale and hospitality industries, exacerbated by changing worker expectations around flexibility and work-life balance. This means Sligro must actively adapt its recruitment and retention strategies to attract and keep talent.

The need for specialized skills, from supply chain management to digital customer interaction, further complicates the labor landscape. For instance, in 2024, the Dutch hospitality sector reported persistent staff shortages, with many businesses struggling to fill vacancies, directly affecting operational efficiency. Sligro's ability to provide robust training programs to upskill existing staff and attract new employees with the necessary expertise is therefore crucial for maintaining its competitive edge and meeting customer demands.

Health Consciousness and Food Trends

Societal emphasis on health, wellness, and transparent food sourcing continues to grow. Consumers are increasingly demanding clear nutritional labeling, detailed allergen information, and evidence of sustainable practices throughout the food supply chain. This shift directly impacts Sligro's clientele, who are then compelled to seek out products that meet these evolving preferences.

In response, Sligro is enhancing its product data management and supply chain traceability. For instance, data from 2024 indicates a significant consumer preference for plant-based options, with the global plant-based food market projected to reach over $74.02 billion by 2027. This growing demand necessitates Sligro offering a wider variety of healthy and ethically sourced ingredients.

Key influences on Sligro's business include:

- Rising consumer demand for organic and natural food products.

- Increased scrutiny of food ingredients and production methods.

- Growing popularity of flexitarian, vegetarian, and vegan diets.

- Consumer desire for locally sourced and traceable food items.

Cultural Shifts in Dining and Food Service

Cultural shifts are profoundly reshaping how people dine and interact with food services, directly impacting Sligro's clientele. The surge in food delivery services, for instance, necessitates a focus on convenient, easily transportable meal solutions and ingredients suitable for third-party logistics. Experiential dining, where the atmosphere and unique culinary journey are paramount, requires Sligro to offer specialty ingredients and innovative product concepts that enable their customers to create these memorable experiences.

The blurring lines between home and out-of-home eating, driven by factors like increased remote work and a desire for home-cooked meals with restaurant-quality ingredients, also influence demand. Sligro must adapt by providing a wider array of high-quality, convenient meal kits, premium ready-to-cook items, and ingredients that empower home cooks to replicate restaurant dishes. For example, in 2023, the Dutch food delivery market continued its growth trajectory, with platforms reporting significant order volumes, underscoring the sustained consumer preference for convenient food solutions.

To support these evolving culinary landscapes, Sligro needs to refine its service offerings and product range. This includes expanding its portfolio of plant-based and sustainable food options, catering to a growing consumer consciousness around health and environmental impact. Sligro's investment in digital platforms to streamline ordering and inventory management for its customers also reflects an adaptation to the increasing reliance on technology across the food service sector.

- Rise of Food Delivery: Consumers increasingly opt for convenience, driving demand for delivery-ready products and packaging solutions.

- Experiential Dining: A growing segment seeks unique dining experiences, pushing for premium ingredients and innovative culinary concepts.

- Home-to-Out-of-Home Blur: Consumers desire restaurant-quality meals at home, increasing demand for meal kits and high-quality ingredients.

- Sustainability and Health: Preferences are shifting towards plant-based and ethically sourced food products.

Societal values are increasingly prioritizing health, wellness, and transparent food sourcing, influencing demand for products with clear nutritional labeling and evidence of sustainable practices. This trend necessitates Sligro offering a wider variety of healthy and ethically sourced ingredients, aligning with a growing consumer consciousness around environmental impact.

The persistent challenge of labor shortages within the food wholesale and hospitality sectors, exacerbated by evolving worker expectations for flexibility, requires Sligro to adapt its recruitment and retention strategies. Specialized skills are in demand, making robust training programs crucial for maintaining operational efficiency and meeting customer needs.

Demographic shifts, such as an aging population and an increase in single-person households, are altering demand patterns for Sligro's professional clientele. This necessitates product development focused on convenience, nutritional value, and easily digestible options for institutional settings and individual consumer needs.

| Societal Factor | Impact on Sligro | Example/Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for plant-based, organic, and traceable products. | Global plant-based food market projected to exceed $74 billion by 2027. |

| Labor Shortages | Need for enhanced recruitment, retention, and training. | Dutch hospitality sector reported persistent staff shortages in 2024. |

| Demographic Shifts | Demand for convenient, nutritious, and smaller portioned meals. | Growing demand for easy-to-digest meals in Dutch healthcare facilities. |

Technological factors

Sligro Food Group's multi-channel approach heavily relies on sophisticated e-commerce and digital ordering platforms. These systems are fundamental to their strategy, ensuring seamless integration across various customer touchpoints. The company's commitment to these digital tools directly impacts its ability to serve a diverse clientele efficiently.

Continuous investment in user-friendly online interfaces and mobile applications is key. Sligro's focus here enhances customer convenience, whether for cash-and-carry or delivery services. Personalized ordering experiences further boost engagement and streamline operations, a crucial element in today's competitive food service market.

By upgrading these digital platforms, Sligro aims to improve operational efficiency, which is vital for managing inventory and logistics. For instance, in 2024, Sligro reported a significant portion of its sales being generated through its digital channels, highlighting the critical role these platforms play in their revenue streams and customer satisfaction.

Sligro Food Group is leveraging advanced technologies to significantly streamline its logistics and supply chain operations. AI-driven route optimization is a key area, promising to cut down on fuel consumption and delivery times, which is crucial for a company with a vast distribution network. For instance, similar technologies in the logistics sector have shown potential to reduce delivery costs by up to 15%.

Warehouse automation, including robotics and automated sorting systems, is another critical technological factor. These innovations boost efficiency within Sligro's distribution centers, leading to faster order fulfillment and reduced labor costs. Companies implementing such systems often report a 20% increase in throughput capacity.

Real-time inventory tracking, powered by IoT sensors and advanced software, allows Sligro to maintain precise control over its stock levels. This not only prevents stockouts and reduces waste but also ensures product freshness by optimizing stock rotation, a vital concern in the food service industry. Accurate inventory management can lead to a reduction in spoilage by as much as 10%.

Sligro Food Group actively employs data analytics to understand its professional clients better. By analyzing purchasing habits, they can forecast demand more accurately, ensuring they have the right products available. This allows for personalized offerings, making it easier for their business customers to find what they need.

The company utilizes this data to streamline operations, such as optimizing inventory levels to reduce waste and ensure product freshness. Identifying emerging market trends through data analysis also helps Sligro stay ahead of the curve. For instance, their investment in data capabilities is a key part of their strategy to enhance overall business intelligence, a crucial element in the competitive food service sector.

Food Processing and Preservation Innovations

Technological advancements in food processing and preservation are significantly shaping Sligro Food Group's product offerings and quality standards. Innovations in areas like modified atmosphere packaging and advanced chilling techniques are enabling Sligro to maintain product integrity for longer periods, directly impacting the freshness and variety of items available to its customers.

The continuous improvement in cold chain management is crucial for Sligro. For instance, the adoption of smart sensors and real-time temperature monitoring systems ensures that perishable goods, from fresh produce to specialized dairy products, reach their destination in optimal condition. This technological integration supports Sligro's strategy of delivering a consistently high-quality, diverse assortment to a broad customer base, including restaurants and catering services.

Sligro benefits from technologies that extend shelf life, allowing for more efficient inventory management and reduced waste. This translates to a wider selection of seasonal and imported products being accessible year-round.

- Extended Shelf Life: Technologies like high-pressure processing (HPP) are becoming more prevalent, increasing the shelf life of products such as juices and ready-to-eat meals by up to 30% without compromising nutritional value.

- Smart Packaging: Innovations in active and intelligent packaging can signal product spoilage, further enhancing Sligro's ability to guarantee freshness and safety.

- Cold Chain Efficiency: Investments in advanced refrigeration and logistics tracking systems ensure temperature-sensitive products maintain their quality throughout the supply chain, critical for Sligro's diverse food service clients.

- Food Safety Innovations: Technologies like blockchain are being explored for enhanced traceability, providing greater assurance of food safety from farm to fork, a key concern for Sligro's B2B customers.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Sligro Food Group, given its handling of extensive customer information and financial transactions. The company must invest in advanced IT infrastructure to safeguard against increasingly sophisticated cyber threats, ensuring the integrity of its operations and sensitive data. Staying ahead of evolving data privacy regulations, such as GDPR, is crucial for maintaining customer trust and avoiding potential penalties.

Disruptions caused by cyberattacks can significantly impact Sligro's supply chain and customer service. For instance, a major data breach could lead to operational downtime, reputational damage, and substantial financial losses. In 2023, businesses globally reported an average cost of a data breach at $4.45 million USD, highlighting the financial imperative for robust security measures.

- Investment in secure IT infrastructure is essential to protect customer data and financial transactions.

- Compliance with evolving data protection regulations is critical for maintaining trust and avoiding penalties.

- Cyber threats pose a significant risk to operational integrity and can cause costly disruptions.

- Protecting sensitive information is paramount to Sligro's reputation and long-term business sustainability.

Sligro Food Group's technological strategy centers on enhancing customer experience and operational efficiency through advanced digital platforms. Their e-commerce and mobile ordering systems are crucial for seamless integration across all client touchpoints, supporting both cash-and-carry and delivery services. In 2024, Sligro saw a substantial increase in digital sales, underscoring the effectiveness of these investments in driving revenue and customer satisfaction.

Legal factors

Sligro Food Group operates under stringent legal frameworks governing food labeling and allergen declarations across its diverse product portfolio. These regulations mandate precise nutritional information, ingredient lists, and clear allergen warnings to protect consumer health. For instance, in the EU, Regulation (EU) No 1169/2011 dictates comprehensive labeling requirements, including the mandatory declaration of 14 major allergens.

Failure to comply with these food labeling laws can result in severe penalties, including hefty fines and product recalls, significantly impacting Sligro's reputation and financial standing. In 2023, the Dutch Food and Consumer Product Safety Authority (NVWA) reported an increase in enforcement actions related to mislabeling, underscoring the critical need for meticulous data management systems to track ingredients and allergens accurately throughout the supply chain.

These regulations directly influence Sligro's product sourcing strategies, requiring close collaboration with suppliers to ensure compliance. Furthermore, clear and accurate labeling is paramount for effective customer communication, building trust and enabling consumers, especially those with allergies, to make informed purchasing decisions, a key aspect of Sligro's commitment to food safety and transparency.

Competition law in the Netherlands, where Sligro operates, mandates adherence to regulations preventing anti-competitive practices. This includes scrutiny of pricing strategies to ensure they do not harm fair market competition, particularly concerning potential price fixing or abuse of dominant positions. For instance, the Netherlands Authority for Consumers and Markets (ACM) actively monitors sectors for such violations.

Anti-trust regulations are crucial for maintaining a level playing field in the food wholesale sector, preventing any single entity from unfairly dominating the market. This framework ensures that smaller players can still compete effectively, fostering innovation and consumer choice. Sligro, like its peers, must navigate these rules when considering any mergers or acquisitions to ensure they do not unduly restrict competition.

In 2023, the ACM reported investigating numerous cases across various sectors for potential breaches of competition law, highlighting the active enforcement environment. While specific Sligro-related enforcement actions are not publicly detailed, the general regulatory climate necessitates careful compliance with Dutch and EU competition legislation regarding market share and potential monopolistic behavior.

Data privacy regulations like the General Data Protection Regulation (GDPR) significantly impact Sligro Food Group's operations. These laws dictate how Sligro must collect, store, and process customer and employee data, requiring explicit consent for data usage. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Sligro must maintain robust data governance policies to ensure adherence to these stringent requirements, covering data minimization, purpose limitation, and security measures. This includes implementing clear procedures for data access, rectification, and erasure requests from individuals. The ongoing evolution of data privacy laws necessitates continuous review and updates to Sligro's data handling practices.

Contract Law and Supplier Agreements

Sligro's operations are heavily reliant on the legal framework governing its contracts with a diverse range of partners. This includes agreements with suppliers for food products, customers for distribution services, and logistics providers for efficient delivery. These contracts are the bedrock of their business, ensuring clarity and accountability across the supply chain.

Robust legal agreements are paramount for Sligro to maintain seamless business continuity. These contracts meticulously outline critical aspects such as product quality standards, precise delivery schedules, agreed-upon payment terms, and clear mechanisms for dispute resolution. Such diligence minimizes operational disruptions and safeguards Sligro's reputation.

For instance, Sligro's supplier agreements would detail specifications for fresh produce, ensuring adherence to food safety regulations and quality benchmarks. Similarly, customer contracts would define service level agreements for timely order fulfillment and payment cycles. In 2024, Sligro continued to focus on strengthening these contractual relationships, with a significant portion of their procurement and sales volume being governed by formal agreements, although specific figures on the percentage of contractually bound transactions are proprietary.

- Supplier Contracts: Ensuring adherence to quality, safety, and delivery terms for all food and beverage inputs.

- Customer Agreements: Defining service levels, pricing structures, and payment terms for wholesale and retail clients.

- Logistics Partnerships: Establishing clear responsibilities for transportation, warehousing, and last-mile delivery.

- Dispute Resolution: Implementing legally sound processes to manage and resolve any contractual disagreements efficiently.

Health and Safety Regulations in Operations

Sligro Food Group operates under stringent health and safety regulations across all its facilities, including extensive requirements for its warehouses, cash-and-carry markets, and its delivery fleet. These legal frameworks are designed to ensure the well-being of its workforce and the integrity of the food products handled. For instance, in the Netherlands, the Working Conditions Act (Arbowet) mandates employers to provide a safe and healthy working environment, which translates into detailed protocols for manual handling, equipment operation, and hazard identification within Sligro's operations.

The company's legal obligations extend to the meticulous safe handling of food products, covering everything from temperature control during storage and transport to preventing cross-contamination. This necessitates regular internal and external audits to verify compliance with food safety standards, such as HACCP (Hazard Analysis and Critical Control Points). Furthermore, ongoing compliance training for employees is a legal imperative, ensuring that all staff are equipped with the knowledge to adhere to safety procedures and legal requirements. In 2023, Dutch food businesses faced an average of €1,500 in fines for non-compliance with food safety regulations, highlighting the financial risks associated with lapses in health and safety protocols.

- Employee Safety: Adherence to Dutch Arbowet for safe working conditions in warehouses and markets.

- Food Handling: Compliance with HACCP principles for safe storage, transport, and preparation of food items.

- Fleet Safety: Meeting regulations for vehicle maintenance and driver safety for the delivery fleet.

- Training Mandates: Requirement for continuous training on health, safety, and food handling protocols.

Sligro Food Group must adhere to strict food safety and labeling laws across its markets, including EU regulations like Regulation (EU) No 1169/2011, which mandates clear allergen declarations and nutritional information to protect consumers. Non-compliance can lead to significant penalties, such as fines and product recalls, as evidenced by the Dutch Food and Consumer Product Safety Authority's increased enforcement actions in 2023.

Competition law, enforced by bodies like the Netherlands Authority for Consumers and Markets (ACM), requires Sligro to avoid anti-competitive practices such as price fixing or abusing dominant market positions, ensuring a fair playing field. The ACM's active monitoring in 2023 across various sectors underscores the importance of Sligro's compliance with these antitrust regulations.

Data privacy laws, notably GDPR, impose strict rules on how Sligro handles customer and employee data, with potential fines reaching up to 4% of global annual turnover. Maintaining robust data governance is essential, with continuous adaptation to evolving privacy legislation a key operational focus.

Environmental factors

Sligro Food Group faces growing pressure from governments and society to curb its environmental impact, especially concerning carbon emissions. This means stricter rules on how much energy they use, how clean their delivery vehicles are, and their overall sustainability efforts.

In response, Sligro has set ambitious goals. For instance, the company aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 40% by 2030 compared to a 2019 baseline. This directly affects their fleet management and energy sourcing strategies.

The company is actively investing in more sustainable logistics, including electric vehicles. By the end of 2023, Sligro reported that 12% of its delivery fleet was already electric, a significant step towards meeting its emission reduction targets for its extensive distribution network.

Furthermore, Sligro is working to improve energy efficiency in its distribution centers and is exploring renewable energy sources. These initiatives are crucial for complying with evolving environmental regulations and meeting the increasing demand for eco-conscious business practices from customers and stakeholders.

Sligro Food Group faces stringent legal and ethical mandates for waste management, particularly concerning food waste and packaging. Recent EU directives, effective through 2024 and beyond, push for significant reductions in food waste, impacting Sligro’s supply chain and distribution. The company must also adhere to evolving packaging recycling regulations, aiming for higher recycled content and improved recyclability.

In response, Sligro is actively investing in initiatives to curb waste and embrace circular economy models. For instance, their 2023 sustainability report highlighted a 5% reduction in food waste across their operations compared to 2022, achieved through optimized inventory management and partnerships for surplus food redistribution. They are also piloting new reusable packaging solutions, aiming to divert 10% of their single-use plastic packaging from landfill by the end of 2025.

Consumers increasingly demand products sourced responsibly, pushing companies like Sligro to prioritize sustainability. This trend is amplified by stricter regulations aimed at ensuring ethical labor practices and environmental stewardship throughout the supply chain. For instance, by 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) requires many companies to disclose detailed information on their environmental and social impacts, directly affecting businesses like Sligro and their suppliers.

Sligro actively incorporates environmental impact, social responsibility, and animal welfare into its supplier selection and management. This means they look beyond just price and quality, assessing how suppliers operate in terms of their carbon footprint, waste management, and fair labor practices. Their commitment is reflected in initiatives designed to improve conditions for all involved, from farmers to the final product. For example, Sligro has set targets to increase the proportion of sustainably certified products it offers, aiming for a significant uplift by 2025.

Climate Change Impact on Agricultural Supply

Climate change poses a significant long-term risk to agricultural yields and the availability of key food products Sligro distributes. For instance, in 2024, persistent droughts in parts of Europe impacted grain harvests, a staple for many food service clients. The increasing frequency of extreme weather events, such as floods and heatwaves, disrupts traditional growing seasons and can lead to sudden price volatility for produce and proteins.

Sligro must proactively address these environmental shifts by diversifying its sourcing regions and strengthening the resilience of its supply chains. Building robust relationships with a wider range of suppliers, including those in regions less affected by specific climate impacts, will be crucial. Adapting to potential disruptions requires investing in logistics and storage solutions that can mitigate the effects of unforeseen weather-related shortages, ensuring consistent product availability for customers.

- Diversification of Sourcing: Exploring suppliers in regions with different climate patterns to reduce reliance on single-source vulnerabilities.

- Supply Chain Resilience: Investing in temperature-controlled logistics and diversified warehousing to buffer against weather-induced disruptions.

- Adaptation Strategies: Partnering with farmers to adopt climate-smart agricultural practices that enhance yield stability.

- Product Portfolio Adjustment: Monitoring climate impacts on specific food categories and potentially adjusting offerings to include more climate-resilient products.

Consumer and Stakeholder Pressure for Eco-Friendly Practices

Consumers and Sligro's professional clients, like restaurants and caterers, are increasingly demanding environmentally responsible options. This heightened awareness translates directly into purchasing decisions. For instance, a significant portion of food service businesses are actively seeking suppliers who can demonstrate strong sustainability credentials, influencing their choice of partners.

This pressure compels Sligro to integrate more eco-friendly practices throughout its operations. This includes sourcing sustainable ingredients, reducing food waste, and optimizing logistics to lower carbon emissions. By doing so, Sligro aims to meet the evolving expectations of its diverse customer base and secure long-term loyalty.

Sligro's commitment to sustainability is also crucial for maintaining and enhancing its brand reputation. Transparent communication about its environmental initiatives, such as waste reduction targets or the proportion of sustainably sourced products, helps build trust. In 2024, for example, many food businesses reported that sustainability was a key factor in their supplier selection process, sometimes outweighing price alone.

The company is actively expanding its portfolio of sustainable product lines. This caters to the growing demand for ethically produced and environmentally conscious food choices. This strategic move not only addresses consumer and stakeholder pressure but also positions Sligro for future growth in a market increasingly shaped by environmental concerns.

- Growing demand for sustainably sourced ingredients: Research indicates a substantial increase in consumer willingness to pay a premium for products with clear sustainability labels.

- Focus on waste reduction: Food service businesses are setting ambitious targets to cut food waste, driving demand for suppliers with similar commitments. Sligro's efforts in this area are therefore critical.

- Transparent reporting: Stakeholders expect clear and verifiable data on environmental performance, making Sligro's communication of its eco-friendly practices vital for maintaining trust and brand image.

- Eco-friendly packaging solutions: The push for reduced plastic and more recyclable or compostable packaging is a significant factor influencing purchasing decisions within the food supply chain.

Sligro faces increasing regulatory and societal pressure to minimize its environmental footprint, particularly regarding carbon emissions and waste. The company has set a target to reduce its Scope 1 and 2 greenhouse gas emissions by 40% by 2030 from a 2019 baseline. By the end of 2023, 12% of its fleet was electric, supporting its sustainability goals.

The demand for sustainably sourced products is rising, with a notable portion of food service businesses prioritizing suppliers with strong environmental credentials. Sligro is expanding its sustainable product lines and improving waste management, aiming to reduce food waste by 5% in 2023 compared to 2022 and piloting reusable packaging solutions to cut single-use plastics by 10% by the end of 2025.

Climate change poses risks to agricultural yields, impacting product availability and prices. Sligro is addressing this by diversifying sourcing and enhancing supply chain resilience. The EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates detailed disclosure of environmental and social impacts, influencing business practices and supplier relationships.

| Metric | Target/Status | Year | Baseline |

| Scope 1 & 2 GHG Emission Reduction | 40% reduction | 2030 | 2019 |

| Electric Delivery Vehicles | 12% of fleet | End of 2023 | N/A |

| Food Waste Reduction | 5% reduction | 2023 | 2022 |

| Single-Use Plastic Packaging Reduction | 10% reduction | End of 2025 | N/A |

PESTLE Analysis Data Sources

Our Sligro Food Group PESTLE Analysis is built on a foundation of comprehensive data, drawing from official government publications, reputable market research firms like Statista, and key industry reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and credible.