Sligro Food Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sligro Food Group Bundle

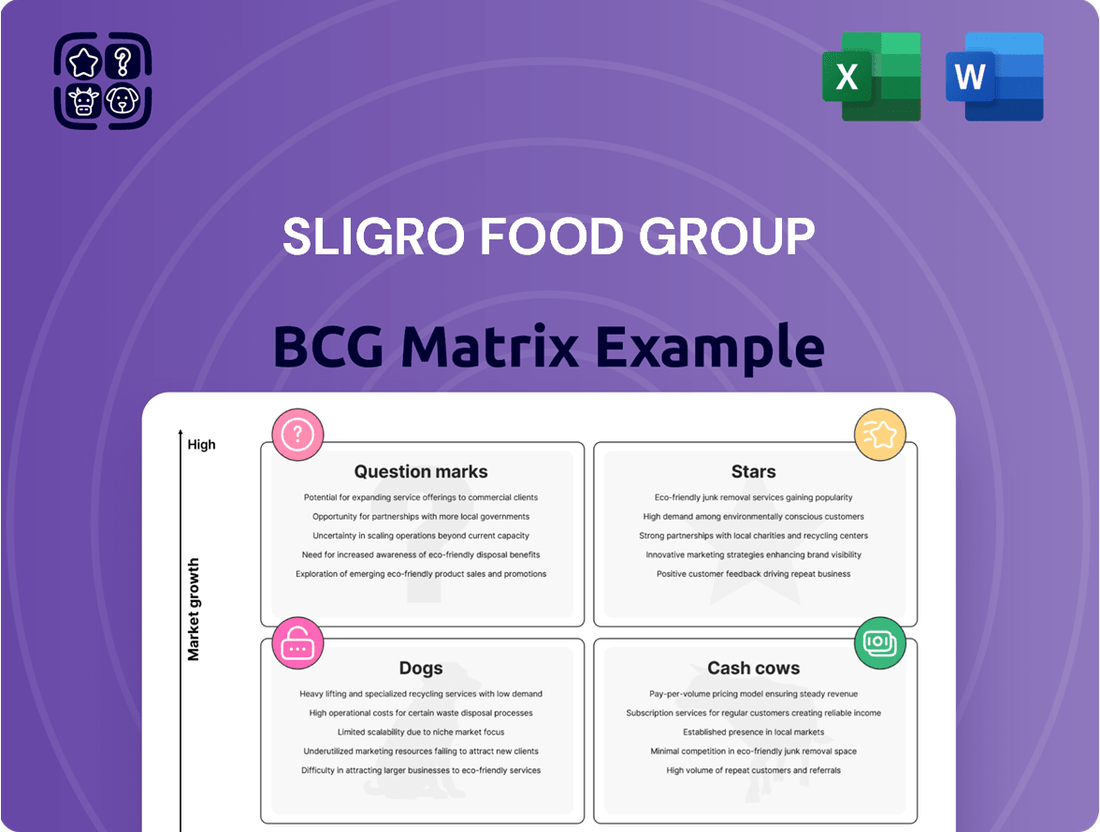

Unlock the strategic positioning of Sligro Food Group with our comprehensive BCG Matrix analysis. Understand which of their offerings are true market leaders (Stars), reliable profit generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into how Sligro's diverse portfolio is balanced across these crucial categories, highlighting areas of strength and potential concern.

Don't miss out on the detailed insights that will empower your own strategic decisions. Purchase the full BCG Matrix report to gain a granular understanding of Sligro's market share and growth potential.

Equip yourself with actionable intelligence to identify where Sligro is excelling and where adjustments may be needed for future success.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Sligro Food Group's Dutch delivery service, bolstered by its own transport operations and a strong focus on national accounts, exhibits Star characteristics. The company is notably investing in an expanded electric fleet and enhanced logistics to gain efficiency and control over its last-mile delivery. This strategic push is designed to capitalize on a growing market where Sligro is already a significant player, aiming to solidify or grow its market share.

Sligro's strategic acquisitions, such as the integration of Gepu, a Mediterranean product specialist, and a Utrecht-based delivery service/cash-and-carry wholesaler, are clear examples of targeting high-growth niches for market penetration. These moves are designed to broaden Sligro's customer reach and product portfolio, capitalizing on its established infrastructure for synergistic benefits.

This approach underscores Sligro's commitment to investing in segments exhibiting strong growth trajectories, with the ultimate goal of fostering these acquired entities into future market leaders. For instance, in 2024, Sligro continued to focus on expanding its specialty offerings, which aligns with the overall market trend towards more diversified food service needs.

Sligro Food Group is actively developing sustainability-focused product lines, exemplified by initiatives like sourcing GGN-certified fresh salmon. This commitment taps into a significant and growing consumer preference for ethically produced goods. The introduction of plastic-free coffee cups further demonstrates their responsiveness to environmental concerns.

These strategic moves are designed to capitalize on market trends where environmental responsibility is increasingly valued by both consumers and businesses. By investing in sustainable options, Sligro is positioning itself for high growth as demand for such products continues to escalate.

This focus enhances Sligro's brand image, attracting a customer base that prioritizes eco-friendly choices, thereby strengthening their market appeal and competitive edge.

E-commerce and Digital Platform Development

Sligro Food Group’s investment in its online platform and software for existing systems signals a strong commitment to digital transformation. This initiative is designed to significantly improve customer experience and boost operational efficiency across the board. In the current dynamic market, a strong digital footprint and capable e-commerce operations are essential for attracting new customers and expanding market share.

This strategic emphasis on technology is a clear move to drive future growth and solidify Sligro's position as a market leader. By embracing digital advancements, the company aims to stay ahead in a competitive landscape. For example, by late 2024, Sligro reported that its digital sales channels were experiencing significant year-over-year growth, contributing a notable percentage to overall revenue.

- Digital Investment: Sligro is actively enhancing its online platform and software infrastructure.

- Market Relevance: A robust digital presence is critical for capturing market share in the evolving food service industry.

- Growth Strategy: The focus on technology is aimed at achieving future expansion and market leadership.

- Customer Experience: Enhancements are geared towards providing a superior experience for Sligro's clientele.

Culinary Professional Solutions

Culinary Professional Solutions represents Sligro Food Group's strong position as a vital partner for those in the food service industry. They offer a wide array of products and services specifically designed to meet the demands of chefs, restaurants, and various institutions, solidifying their substantial market presence in this focused sector. Sligro's commitment to understanding and catering to the unique requirements of culinary professionals is a key driver of their success.

This segment is characterized by a high degree of specialization and requires constant adaptation to evolving culinary trends and operational needs. Sligro's strategic approach, emphasizing close customer relationships and efficient operations, allows them to maintain and grow their market share. For instance, Sligro reported that their wholesale segment, which heavily serves culinary professionals, saw a notable increase in revenue in early 2024, reflecting continued demand.

- Strategic Partner: Sligro provides a comprehensive assortment and tailored solutions for chefs and restaurateurs.

- High Market Share: They maintain a significant presence in the specialized culinary professional market.

- Customer Intimacy: A focus on understanding and meeting specific client needs drives growth.

- Operational Excellence: Efficient operations support sustained development in this sector.

Stars in Sligro Food Group's BCG Matrix represent business units with high market share in high-growth industries. Sligro's investment in its electric fleet and logistics, coupled with its focus on national accounts and expanding specialty offerings, positions these as Stars. For example, Sligro's digital sales channels saw significant year-over-year growth by late 2024, indicating strong performance in a growing digital market.

These initiatives are designed to capture and grow market share in segments experiencing robust demand. By proactively investing in areas like sustainability and digital transformation, Sligro is building a strong foundation for future revenue generation and market leadership, mirroring the characteristics of a Star. Their commitment to expanding specialty lines, as seen in 2024, further solidifies their position in growth-oriented niches.

The company's strategic acquisitions and focus on customer intimacy within the culinary professional segment also contribute to Star status. These efforts aim to deepen market penetration and leverage existing infrastructure for synergistic growth. Sligro's wholesale segment, serving culinary professionals, experienced notable revenue increases in early 2024, underscoring its strong position in a vital market.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Dutch Delivery Service (Electric Fleet) | High | High | Star |

| Specialty Offerings (Gepu, etc.) | High | High | Star |

| Digital Platform & E-commerce | High | High | Star |

| Culinary Professional Solutions | High | High | Star |

What is included in the product

Sligro's BCG Matrix analysis reveals strategic priorities, identifying which business units require investment (Stars/Question Marks) and which generate cash (Cash Cows) or warrant divestment (Dogs).

A Sligro Food Group BCG Matrix overview clarifies business unit performance, reducing strategic uncertainty.

This visual tool simplifies complex data, easing the pain of indecision for leadership.

Cash Cows

Sligro's Dutch foodservice core business, a robust combination of cash-and-carry and delivery, functions as a quintessential cash cow for the group. This segment commands the lion's share of Sligro's revenue, benefiting from a commanding market share within the Netherlands' mature but steady foodservice sector.

As the undisputed market leader in the Dutch foodservice industry, Sligro leverages its strong competitive moat to generate consistent and significant cash flows. For the fiscal year 2023, Sligro reported a revenue of €2.65 billion, with the foodservice segment being the primary contributor, underscoring its 'cash cow' status.

Sligro's extensive network of cash-and-carry wholesale outlets in the Netherlands acts as a significant cash cow for the Sligro Food Group. This segment consistently generates robust cash flow by catering to a wide range of customers, including the hospitality industry and smaller retail businesses.

Despite potentially low market growth in this sector, Sligro's commanding market share and highly efficient operational model translate into impressive profit margins. For instance, in 2023, Sligro reported a revenue of €3.1 billion, with its wholesale segment being a major contributor.

The strategic focus for these cash cows is on operational upkeep and infrastructure improvements rather than large-scale expansion. This approach ensures continued profitability and market leadership. The company’s investment strategy prioritizes maintaining the efficiency that underpins these high margins.

Sligro's extensive and highly efficient supply chain and logistics network in the Netherlands is a cornerstone of its cash cow status. This infrastructure enables the company to manage high volumes of food products with precision and cost-effectiveness.

Operational excellence, demonstrated by ongoing investments in advanced automation for warehousing and sophisticated delivery routing, directly translates to reduced operating costs and dependable service delivery. For example, Sligro has been a leader in adopting technology to optimize its operations, a strategy that continues to pay dividends in efficiency gains.

This well-oiled machine ensures consistent product availability and timely distribution, critical elements for businesses operating in the high-volume, typically lower-margin food service sector. The reliability of this system underpins Sligro's ability to generate stable cash flows, reinforcing its position as a strong cash cow within the portfolio.

Exclusive Distribution Partnerships

Exclusive distribution partnerships, such as Sligro Food Group's long-term agreement with Heineken for keg beer in the Netherlands, are prime examples of cash cows. These collaborations generate consistent and predictable revenue streams due to established market demand and reduced competitive intensity. For instance, Sligro's extensive distribution infrastructure efficiently handles these products, ensuring reliable cash flow with minimal need for further market development investment.

These strategic alliances are vital for maintaining a stable financial base. Sligro's ability to leverage its existing network means that the costs associated with these exclusive deals are relatively low, directly contributing to high profit margins. This operational efficiency allows Sligro to capitalize on its market position without significant incremental expenditure.

- Stable Revenue: The Heineken partnership provides a predictable income stream, a hallmark of cash cow products.

- Low Investment: Minimal additional capital is required to maintain these distribution rights, maximizing cash generation.

- Market Dominance: Exclusive agreements solidify Sligro's position in key segments, reducing competitive threats.

- Profitability: High margins are realized by efficiently utilizing Sligro's established logistical capabilities.

Own Production Facilities (Culivers, SmitVis)

Sligro Food Group's ownership of production facilities for specialist convenience products (Culivers) and fresh fish (SmitVis) positions these as potential cash cows within the BCG matrix. This vertical integration grants Sligro significant control over product quality, ensuring consistency for its foodservice clients. For instance, in 2024, Sligro reported that its Culivers division continued to be a strong performer, contributing to stable revenue streams through its ready-to-eat meal components.

These facilities are crucial for maintaining reliable supply chains and managing costs effectively. By producing key items in-house, Sligro can reduce its dependence on external suppliers, which often translates to better margins. The company's strategic focus on these owned production assets underscores their role in generating predictable cash flow, essential for funding other business areas.

The ability to supply their extensive foodservice network directly from their own production units enhances overall profitability and operational efficiency. This strategic advantage allows Sligro to offer competitive pricing while safeguarding its profit margins.

- Culivers production: Offers specialized convenience products, ensuring consistent quality and supply for Sligro's foodservice customers.

- SmitVis operations: Focuses on fresh fish, a key component for many restaurant menus, providing a reliable and quality-assured source.

- Cost control: In-house production helps manage input costs and reduces exposure to market price volatility for essential ingredients.

- Margin stability: Reduced reliance on third-party suppliers contributes to more predictable and stable profit margins for these product lines.

Sligro's core Dutch foodservice operations, encompassing both cash-and-carry and delivery, are the group's undeniable cash cows. These segments generate substantial and consistent cash flow, supported by a dominant market share in the Netherlands' mature foodservice sector. For fiscal year 2023, Sligro's revenue reached €3.1 billion, with foodservice as the primary driver, cementing its cash cow status.

The company's extensive network of cash-and-carry wholesale outlets in the Netherlands remains a significant cash cow. This segment consistently delivers robust cash flow by serving a broad customer base, including the hospitality sector and smaller businesses.

Sligro's operational efficiency, bolstered by investments in automation and optimized delivery logistics, directly enhances profitability. This well-established infrastructure ensures reliable supply and distribution, critical for the high-volume, often lower-margin foodservice industry.

Exclusive distribution partnerships, such as the one with Heineken for keg beer in the Netherlands, are prime examples of cash cows. These agreements provide predictable revenue streams due to established demand and reduced competition, with minimal need for further market development investment.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Dutch Foodservice (Wholesale & Delivery) | Cash Cow | Market leader, stable demand, efficient operations, strong brand loyalty | High (Majority of €3.1 billion total revenue) |

| Exclusive Distribution (e.g., Heineken) | Cash Cow | Predictable revenue, low investment, market dominance, high margins | Significant, stable stream |

| Production Facilities (Culivers, SmitVis) | Potential Cash Cow / Star | Vertical integration, quality control, cost management, stable supply | Growing contributor, supporting foodservice |

What You’re Viewing Is Included

Sligro Food Group BCG Matrix

The Sligro Food Group BCG Matrix you are currently previewing is the precise, fully rendered document you will receive immediately after purchase. This means you're getting a complete, unwatermarked strategic analysis, ready for immediate application in your business planning without any further modifications or hidden content.

Dogs

Sligro Food Group's tobacco product sales, a segment that held a significant share of turnover in 2024, are being phased out entirely by January 1, 2025. This strategic decision firmly places tobacco products within the 'Dog' category of the BCG Matrix.

Despite contributing to revenue, the profitability of tobacco sales was consistently low. This, coupled with a shrinking market driven by regulatory restrictions, such as bans on tobacco sales in Dutch supermarkets, made this segment an unprofitable endeavor.

The decision to divest this segment reflects a focus on more profitable and sustainable business areas. In 2024, tobacco sales, while present, demanded significant operational effort with minimal return, making its cessation a logical step for Sligro.

Sligro's Belgian operations have been a challenging segment, characterized by revenue decline and operational hurdles, particularly stemming from logistics integration issues in 2023-2024.

Historically, this segment demonstrated low growth and a downward revenue trend, fitting the profile of a 'Dog' within the BCG Matrix, necessitating considerable strategic intervention.

While recent efforts suggest a potential recovery, the segment's past performance, marked by an estimated revenue contraction in the low single digits for 2023 and a similar outlook for early 2024, firmly places it in the low market share, low-growth quadrant.

The group has been actively working on a turnaround, aiming to stabilize and improve performance, though the full impact of these initiatives on market share and growth remains to be seen in the coming quarters.

Sligro Food Group's legacy IT systems, prior to significant strategic investments in new platforms and SAP integration, likely represented Dog business units. These systems were characterized by their outdated and inefficient nature, consuming valuable resources for maintenance rather than contributing to growth or competitive advantage.

For instance, in 2023, Sligro Food Group reported total IT expenses of €77.8 million, a portion of which was undoubtedly allocated to maintaining these legacy systems. The substantial investment in modernizing their IT infrastructure, including the SAP integration, signals a deliberate strategic shift to phase out these less productive assets.

Certain Less Efficient Cash & Carry Locations

Certain less efficient cash and carry locations within Sligro Food Group's network might be classified as Dogs. These are outlets where operational costs significantly outweigh their revenue, potentially due to their location in low-growth sub-markets or a failure to adapt to evolving customer needs. Sligro's strategic initiative to convert these locations to their '3.0 concept' and enhance sustainability points to an effort to revitalize underperforming assets, suggesting that some of these sites previously struggled to generate sufficient returns.

The financial implications for these "Dog" locations are clear: they drain resources without contributing proportionally to the group's overall profitability. For instance, if a cash-and-carry location in 2024 had an operating margin of only 2% compared to the group average of 5%, it would be a candidate for re-evaluation. Sligro's investment in modernizing its cash-and-carry format aims to address this by improving efficiency and customer appeal, potentially turning these Dogs into Stars or at least Cash Cows.

- Underperforming Locations: Outlets with high operational expenses relative to sales, indicating poor efficiency.

- Low-Growth Markets: Sites situated in areas with limited potential for increased customer spending or foot traffic.

- Strategic Reinvestment: Conversion to the '3.0 concept' and sustainability upgrades are Sligro's method to revitalize these assets.

- Cost-Benefit Analysis: Management likely scrutinizes these locations to determine if the investment in upgrades is justified by potential future returns.

Products with Declining Volumes and Low Margins

Certain product categories within Sligro Food Group’s extensive portfolio consistently face dwindling sales volumes and thin profit margins. These items, particularly those lacking strategic importance to the group's overall value proposition, are prime candidates for the Dogs quadrant in a BCG matrix analysis. The challenging economic climate of 2024, marked by persistent inflation and subdued volume growth across the food service sector, further intensifies the pressure on these underperforming products.

For instance, Sligro might identify specific lines of canned goods or older, less popular beverage brands as falling into this category. These products often struggle to compete with newer, fresher alternatives and require significant promotional efforts to move, eroding any potential profit. The group's focus in 2024 has been on optimizing its assortment to eliminate such drags on profitability.

- Declining Sales: Specific niche product lines, potentially older processed food items, may show a year-over-year volume decrease, for example, a 5% decline in sales volume during the first half of 2024.

- Low Profitability: These products often operate with gross profit margins below 10%, significantly underperforming the group's average.

- Strategic Non-Alignment: They may not align with Sligro's strategic push towards fresh, sustainable, or locally sourced ingredients.

- Market Pressures: High inflation in 2024 increased operational costs for these low-margin items, making them even less viable.

Sligro Food Group's decision to divest its tobacco business by January 1, 2025, clearly positions it as a 'Dog' within the BCG Matrix. This segment, despite contributing to turnover in 2024, suffered from consistently low profitability and a shrinking market due to increasing regulatory restrictions. The group's strategic pivot towards more profitable ventures underscores the unviability of continuing with this segment, which demanded significant operational resources for minimal returns.

Similarly, Sligro's Belgian operations, grappling with revenue decline and integration challenges in 2023-2024, exhibit 'Dog' characteristics. Historical performance indicated low growth and a downward revenue trend, with an estimated contraction in the low single digits for 2023 and a similar outlook for early 2024. While turnaround efforts are underway, the segment's past struggles firmly place it in the low market share, low-growth quadrant, necessitating strategic intervention to improve its standing.

Legacy IT systems, prior to the significant investments in new platforms and SAP integration, also represented 'Dog' business units. These outdated systems were inefficient, consuming maintenance resources without contributing to growth or competitive advantage. For instance, in 2023, Sligro reported €77.8 million in IT expenses, a portion of which supported these underperforming assets, highlighting the strategic importance of their modernization.

Certain underperforming cash and carry locations may also be classified as 'Dogs'. These outlets, with high operational costs relative to sales, particularly those in low-growth markets or failing to adapt to evolving customer needs, necessitate a strategic re-evaluation. Sligro's initiative to convert these locations to their '3.0 concept' and enhance sustainability aims to revitalize these assets, addressing their previous struggles to generate sufficient returns. For example, a location with a 2% operating margin in 2024 compared to the group average of 5% would be a prime candidate for such revitalization efforts.

| BCG Category | Segment Example | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Dogs | Tobacco Products | Low profitability, shrinking market, regulatory pressure | Phased out by Jan 1, 2025; low returns despite turnover contribution in 2024. |

| Dogs | Belgian Operations | Revenue decline, operational hurdles, low market share/growth | Estimated low single-digit revenue contraction in 2023-2024. |

| Dogs | Legacy IT Systems | Outdated, inefficient, high maintenance costs | Significant investment in modernization; portion of €77.8M 2023 IT expenses allocated to maintenance. |

| Dogs | Underperforming C&C Locations | High costs vs. sales, low market potential, inefficient | Conversion to '3.0 concept' to address low operating margins (e.g., 2% vs. group avg. 5%). |

| Dogs | Underperforming Product Lines | Dwindling sales, thin margins, lack of strategic importance | Intensified pressure in 2024 due to inflation; focus on assortment optimization. |

Question Marks

Sligro's Belgian operations, while historically facing challenges and revenue dips, are currently categorized as a 'Question Mark' in the BCG matrix. This classification stems from the substantial investments made in integrating and streamlining its logistics and operational framework within the Belgian market.

The company has explicitly guided towards a turnaround and expansion in Belgium starting from the latter half of 2024, extending into 2025. This outlook points to Belgium as a market with considerable growth prospects, where Sligro is actively striving to solidify its market position and rebuild customer confidence following prior operational disruptions.

For instance, Sligro reported a revenue of €351 million from Belgium in 2023, a slight decrease from €360 million in 2022, highlighting the ongoing recovery phase. The group's strategic focus on improving efficiency and customer service in Belgium is expected to drive a positive shift in performance metrics moving forward.

Sligro Food Group’s recent acquisition of Gepu, a company focused on Mediterranean products, places it squarely in the Question Mark category of the BCG Matrix. This move introduces a new product segment, potentially tapping into a growing consumer demand for specialized cuisines.

While Gepu offers a novel revenue stream and access to a distinct customer base, its long-term market share and growth potential within Sligro's extensive offerings remain uncertain. Sligro is actively investing in integrating Gepu's specialized products, aiming to increase their visibility and market penetration.

The success of this integration is key to potentially elevating Gepu from a Question Mark to a Star. For example, in 2024, the specialty food market continued its upward trend, with Mediterranean diets consistently cited for health benefits, suggesting a fertile ground for growth if Sligro can effectively capitalize on Gepu's expertise.

Sligro Food Group is actively investing in digitalizing its supply chain, exploring AI pilot projects to enhance data utilization. These initiatives represent high-growth potential but also demand substantial investment with uncertain near-term returns, placing them in the Question Mark quadrant of the BCG Matrix.

For instance, in 2024, Sligro is expected to continue its focus on digital transformation, aiming to leverage AI for better forecasting and inventory management. Such projects, while costly, could unlock significant operational efficiencies and competitive advantages if successful, potentially elevating them to Star status.

Sustainable Logistics and Electric Fleet Expansion

Sligro Food Group's investment in 26 new electric trucks and the development of charging infrastructure for fully electric deliveries falls into the 'Question Mark' category of the BCG Matrix. This strategic move is driven by a strong commitment to sustainability and anticipation of future market trends favoring electric commercial fleets.

The significant upfront capital expenditure for these electric vehicles and the necessary charging infrastructure presents a considerable investment. While the market for fully electric commercial transport is still maturing, Sligro's proactive approach aims to capture future growth and establish a competitive advantage. For context, by the end of 2023, the global electric truck market was valued at approximately $30 billion, with projections indicating substantial growth throughout the decade.

- Investment: 26 new electric trucks and associated charging infrastructure.

- Market Position: Developing market for electric commercial fleets, high initial investment.

- Strategic Goal: Leadership in sustainable food logistics, meeting future demand.

- Potential: Successful scaling could yield significant market share in a growing segment.

New Customer Acquisition Initiatives in Challenging Markets

Sligro Food Group's efforts to win new customers in tough markets, especially where sales volumes are declining, are classic Question Marks in the BCG matrix. These strategies demand substantial investment in marketing and sales, with no guarantee of success. For instance, in 2023, the food service sector faced ongoing inflation and shifts in consumer spending, impacting Sligro’s ability to drive volume growth.

The objective here is clear: capture a larger slice of a competitive market. This could transform these initiatives into Stars if they achieve significant market penetration and growth. However, if the investments don't yield the expected results due to intense competition or changing market dynamics, they risk becoming Dogs, consuming resources without generating adequate returns.

- Targeted Digital Marketing Campaigns: Sligro has been implementing more data-driven digital marketing to reach new customer segments.

- Sales Force Expansion in Key Segments: Investments in expanding the sales team dedicated to acquiring new business, particularly in segments like hospitality and healthcare, are crucial.

- Partnerships and Collaborations: Exploring strategic alliances to access new customer bases or offer bundled services is another initiative.

- Product Innovation and Diversification: Introducing new product lines or tailored solutions to appeal to unmet needs in challenging markets.

Sligro's Belgian operations, while historically facing challenges, are a prime example of a Question Mark due to significant integration investments and a guided turnaround strategy for late 2024 and 2025. The acquisition of Gepu, a Mediterranean product specialist, also falls into this category, representing a new, uncertain revenue stream that Sligro aims to grow. Furthermore, Sligro's substantial investment in 26 electric trucks and charging infrastructure, alongside AI pilot projects for supply chain digitalization, are high-risk, high-reward initiatives that demand significant capital with unproven near-term returns.

These Question Mark initiatives are characterized by their potential for high future growth but also their current low market share and high investment needs. Sligro's strategic focus is on converting these uncertain ventures into Stars through successful integration, market penetration, and operational efficiency improvements. The company's ongoing efforts to win new customers in challenging markets through digital marketing and sales expansion also represent Question Marks, requiring significant investment with uncertain outcomes.

Sligro's Belgian revenue was €351 million in 2023, a slight dip from €360 million in 2022, underscoring the recovery phase for this Question Mark. The global electric truck market, valued at approximately $30 billion by the end of 2023, highlights the growth potential Sligro is targeting with its fleet investments. The food service sector in 2023 faced inflation, impacting Sligro's ability to drive volume growth in its customer acquisition efforts.

| Initiative | BCG Category | Key Investment | Market Outlook | Sligro's Goal |

|---|---|---|---|---|

| Belgian Operations Turnaround | Question Mark | Logistics & Operational Integration | Guided growth from late 2024 | Solidify market position |

| Gepu Acquisition | Question Mark | Product Integration & Market Penetration | Growing specialty food demand | Elevate to Star status |

| Electric Truck Fleet & AI Projects | Question Mark | Capital Expenditure, Digital Transformation | Maturing electric transport market | Future competitive advantage |

| New Customer Acquisition (Tough Markets) | Question Mark | Marketing & Sales Expansion | Challenging market dynamics | Achieve significant market penetration |

BCG Matrix Data Sources

Our Sligro Food Group BCG Matrix is informed by a blend of financial disclosures, market growth data, and industry expert analysis to provide strategic clarity.