Sligro Food Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sligro Food Group Bundle

Sligro Food Group operates within a dynamic food service distribution landscape, facing moderate threats from new entrants and intense rivalry among existing players. Buyer power is considerable, especially from large catering chains, while supplier power varies depending on the specific product category. The threat of substitutes, though present, is generally lower in this sector.

The complete report reveals the real forces shaping Sligro Food Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Sligro Food Group's bargaining power. If Sligro relies on a limited number of suppliers for essential food or non-food items, those suppliers gain considerable leverage. For instance, in 2024, the Dutch food service market saw consolidation among key agricultural producers, meaning Sligro had fewer sourcing options for certain fresh produce, potentially increasing supplier pricing power.

Sligro's bargaining power with its suppliers is influenced by the uniqueness and differentiation of the inputs it sources. If a supplier offers highly specialized or proprietary ingredients, Sligro faces greater difficulty in finding alternative sources, thereby increasing the supplier's leverage. For instance, if Sligro relies on a specific type of exclusive cheese or a unique spice blend from a particular producer, that producer gains more power in price negotiations.

Switching costs for Sligro Food Group are a significant factor in assessing supplier bargaining power. If Sligro faces high costs when moving from one supplier to another, such as expenses related to retooling production lines, adapting inventory systems, or retraining employees on new product specifications, then suppliers gain considerable leverage. For example, if a key ingredient supplier requires extensive testing and certification for its products, the cost and time involved in switching would be substantial, giving that supplier more power.

Conversely, if Sligro can easily find alternative suppliers for its needs without incurring significant disruption or expense, its ability to negotiate favorable terms is enhanced. This is particularly relevant for commodity items where multiple providers exist. In 2024, Sligro's diverse product portfolio means that switching costs can vary greatly depending on the specific product category and the supplier's unique offerings.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers means Sligro's suppliers might start selling directly to Sligro's customers, like restaurants and caterers. This would allow them to bypass Sligro as an intermediary, potentially cutting into Sligro's market share and profitability.

If a supplier has strong brand recognition or unique products, they could find it attractive to reach end customers directly. For instance, a specialty cheese producer with a loyal following might see an opportunity to sell directly to high-end restaurants, thereby reducing their reliance on Sligro's distribution network.

- Supplier Capability: Suppliers need the logistical infrastructure and customer relationships to manage wholesale or foodservice operations effectively.

- Market Incentives: Suppliers will consider forward integration if they believe they can capture higher margins or gain greater market control by selling directly.

- Competitive Landscape: The presence of numerous potential suppliers, especially those with strong brand equity, heightens this threat for Sligro.

Importance of Sligro to Supplier's Business

Sligro Food Group's significance as a customer directly impacts its suppliers' bargaining power. When Sligro accounts for a substantial portion of a supplier's sales, that supplier is incentivized to maintain the relationship by offering more favorable terms. This reliance can limit the supplier's ability to dictate prices or impose stringent conditions.

For many specialized food producers and distributors, Sligro represents a key channel to a broad market. For example, a niche organic vegetable supplier might find that Sligro's extensive network of hospitality clients forms a significant percentage of their overall customer base. This concentration of business with Sligro can tilt the scales in Sligro's favor during price negotiations.

- Revenue Dependence: Suppliers heavily reliant on Sligro for a large share of their revenue are less likely to exert strong bargaining power.

- Market Access: Sligro provides suppliers with access to a wide customer base, particularly within the Dutch food service sector.

- Supplier Concentration: In segments where there are fewer suppliers capable of meeting Sligro's volume and quality standards, Sligro’s importance to those specific suppliers increases.

The bargaining power of suppliers to Sligro Food Group is a critical factor in its operational costs and profitability. Factors like supplier concentration, input differentiation, and switching costs significantly shape this power dynamic. For instance, in 2024, increased demand in the European food sector led to tighter supply chains for certain raw materials, potentially strengthening supplier leverage for Sligro.

Sligro's ability to negotiate depends heavily on the availability of alternative suppliers and the costs associated with changing them. If suppliers face a low threat of forward integration and Sligro represents a small portion of their business, their power increases. Conversely, when Sligro is a major customer, its influence grows, as seen in its relationships with niche producers who rely on its extensive distribution network.

| Factor | Impact on Sligro | 2024 Context Example |

|---|---|---|

| Supplier Concentration | High concentration empowers suppliers. | Consolidation in Dutch agriculture reduced options for fresh produce. |

| Input Differentiation | Unique inputs increase supplier power. | Exclusive specialty ingredients give producers leverage. |

| Switching Costs | High costs favor suppliers. | Certification requirements for new ingredients can be substantial. |

| Sligro's Customer Importance | Sligro's significance boosts its power. | Niche suppliers dependent on Sligro for market access have less leverage. |

What is included in the product

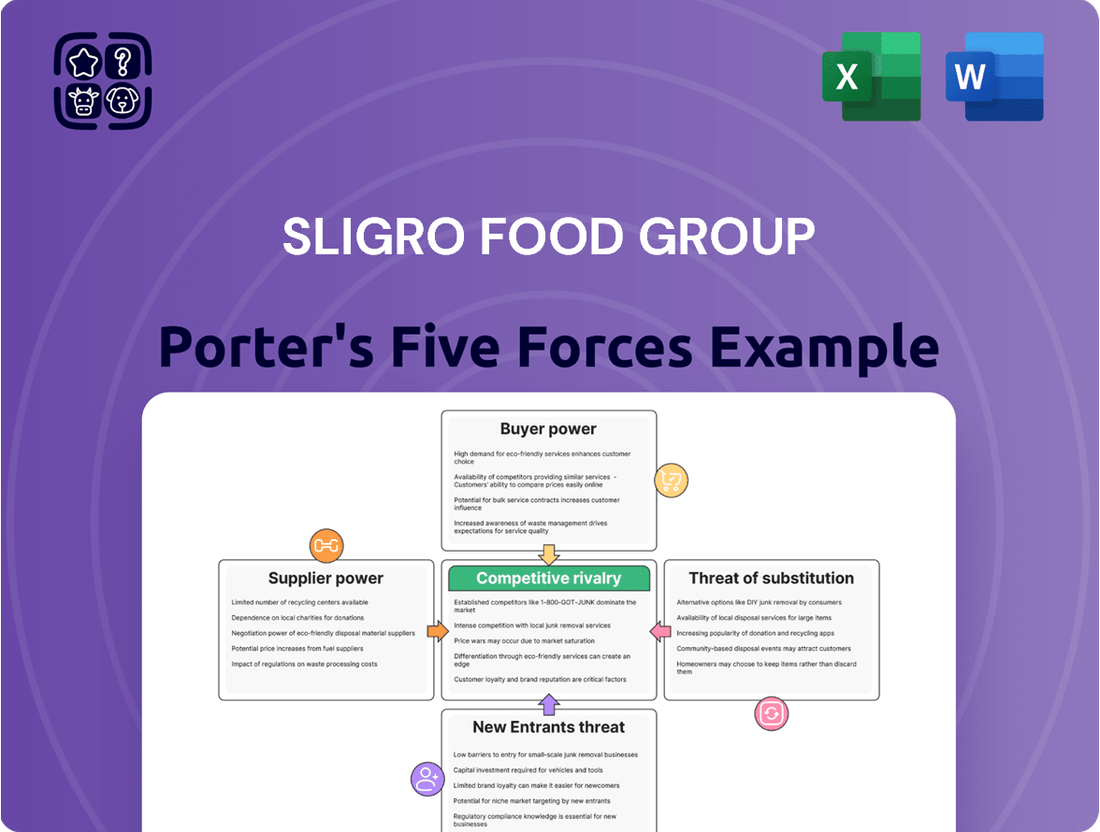

Tailored exclusively for Sligro Food Group, this analysis dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Instantly assess competitive threats and opportunities within the food service industry, empowering Sligro Food Group to strategically navigate market dynamics and alleviate pressure from intense competition.

Customers Bargaining Power

The bargaining power of customers for Sligro Food Group is significantly influenced by customer concentration and the volume of their purchases. A key factor is the presence of large professional clients, such as major hotel chains, large-scale catering operations, or extensive restaurant groups.

When a small number of these substantial customers represent a considerable percentage of Sligro's overall revenue, their ability to negotiate favorable terms increases. This leverage stems directly from their substantial purchasing power, allowing them to demand lower prices or more advantageous service agreements, thereby impacting Sligro's profitability.

Customer switching costs for Sligro Food Group are a key factor in their bargaining power. If it's easy and inexpensive for Sligro's customers, such as restaurants or caterers, to switch to a competitor, they hold more sway. This pressure compels Sligro to maintain competitive pricing and high service levels to retain its client base.

For instance, in 2024, the food service distribution market remains competitive. A customer's ability to switch suppliers might depend on factors like the cost of changing ordering systems, potential disruption to their operations during a transition, or the loss of any loyalty discounts. Sligro's efforts to build strong relationships and offer value-added services directly aim to increase these switching costs, thereby mitigating customer bargaining power.

Customer price sensitivity significantly impacts Sligro's bargaining power of customers. In the competitive foodservice and institutional sectors, businesses often operate on thin margins, making them acutely aware of every cost. This means Sligro's clients, from restaurants to caterers, will actively seek the best deals, directly influencing the prices Sligro can command.

For instance, if a competitor offers a comparable product at a lower price, Sligro's customers have a strong incentive to switch. This dynamic puts considerable downward pressure on Sligro's profit margins, particularly if their own procurement costs are high or if the market is saturated with suppliers. In 2024, the ongoing inflationary pressures across Europe have only amplified this price sensitivity among Sligro's diverse customer base, forcing greater scrutiny on all expenditures.

Threat of Backward Integration by Customers

The threat of backward integration by Sligro's customers, particularly larger ones, poses a significant challenge. If customers, such as major hotel chains or restaurant groups, develop the capability and desire to procure food and non-food items directly from manufacturers or establish their own production facilities, it directly undermines Sligro's role as an intermediary. This would reduce Sligro's value proposition and increase the bargaining power of these customers.

For instance, a large catering company might explore consolidating its purchasing power to negotiate directly with food producers, thereby cutting out the wholesaler. In 2024, the ongoing consolidation within the hospitality sector means that key Sligro customers are becoming larger and potentially more capable of undertaking such integration efforts. This trend amplifies the leverage these customers hold in their dealings with Sligro.

- Customer Consolidation: Increased mergers and acquisitions in the food service industry can create larger, more powerful buyers with greater potential for backward integration.

- Economies of Scale: Large customers may achieve economies of scale in procurement or even production that Sligro cannot match, making direct sourcing more attractive.

- Direct Sourcing Benefits: Customers integrating backward might seek cost savings, greater control over product quality, or customized product development by bypassing intermediaries.

- Sligro's Value Proposition: Sligro's ability to mitigate this threat relies on its continued provision of value through efficient logistics, a broad product assortment, and specialized services that are difficult for individual customers to replicate.

Information Availability to Customers

Customers of Sligro Food Group, particularly those in the foodservice sector, have increasing access to information. This transparency regarding product pricing, competitor offerings, and overall market conditions significantly impacts their ability to negotiate.

With readily available data, customers can easily compare Sligro’s offerings against those of other food distributors. This empowers them to demand better terms, potentially leading to price concessions or improved service levels. For instance, the growth of online comparison platforms and industry-specific market intelligence reports enhances this information asymmetry.

- Increased Price Transparency: Online platforms and industry reports make it easier for customers to benchmark Sligro’s prices against competitors.

- Availability of Alternatives: Customers can quickly identify and evaluate alternative suppliers, reducing their dependence on a single provider.

- Market Condition Awareness: Understanding broader market trends, such as commodity price fluctuations, allows customers to negotiate more effectively based on external factors.

The bargaining power of Sligro Food Group's customers is substantial, driven by several key factors. Large professional clients, like major hotel chains and restaurant groups, possess significant leverage due to their high purchase volumes, enabling them to negotiate favorable pricing and service terms. This is amplified by increasing price sensitivity in 2024 due to ongoing inflationary pressures, pushing customers to scrutinize all expenditures and seek the best deals.

Customer switching costs also play a crucial role; if it's easy and inexpensive for clients to switch to a competitor, their negotiating power increases. Sligro combats this by fostering strong relationships and offering value-added services to raise these costs. Furthermore, the threat of backward integration by large customers, such as sourcing directly from manufacturers, directly challenges Sligro's intermediary role.

The rise of online platforms and industry reports in 2024 has significantly boosted customer access to information, enhancing price transparency and awareness of alternative suppliers. This empowers customers to benchmark Sligro’s offerings and negotiate more effectively, putting downward pressure on Sligro's profit margins.

| Factor | Impact on Sligro | 2024 Context |

|---|---|---|

| Customer Concentration & Volume | High leverage for large clients | Ongoing consolidation in hospitality sector |

| Switching Costs | Low switching costs increase power | Need for strong relationships to retain clients |

| Price Sensitivity | Customers seek best deals due to thin margins | Inflationary pressures amplify price scrutiny |

| Backward Integration Threat | Potential for customers to bypass Sligro | Larger clients may gain integration capabilities |

| Information Access | Increased transparency aids negotiation | Online platforms and market reports are prevalent |

Same Document Delivered

Sligro Food Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Within this comprehensive Sligro Food Group Porter's Five Forces Analysis, you'll find a detailed examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants, the threat of substitute products, and the intensity of rivalry within the industry. Each force is thoroughly analyzed to provide actionable insights into Sligro's strategic position and potential challenges.

Rivalry Among Competitors

The Dutch and Belgian food wholesale markets are characterized by a substantial number of competitors, creating a highly competitive landscape for Sligro Food Group. This includes large, established wholesalers, numerous specialized distributors catering to specific market segments, and a multitude of smaller, local players. This intense rivalry often forces companies to engage in aggressive pricing strategies and focus heavily on service differentiation to capture market share.

Key competitors for Sligro include major retail and wholesale players like Ahold Delhaize, which operates both retail chains and wholesale operations, and JDE Peet's, a significant player in the beverage sector. The presence of such diverse and well-resourced rivals means Sligro must continually innovate and optimize its offerings to remain competitive.

The overall growth rate of the foodservice and food wholesale market in the Netherlands and Belgium presents a mixed outlook, directly impacting competitive rivalry. While the Dutch foodservice market is expected to see growth, the food and drink wholesaling revenue in the Netherlands is forecast to decline. This divergence suggests that companies like Sligro Food Group will face intensified competition, particularly in the wholesaling segment, as they vie for a shrinking revenue pool.

Sligro Food Group actively pursues product and service differentiation to stand out in a competitive landscape. By positioning itself as a strategic partner rather than just a supplier, Sligro offers a comprehensive assortment of food products alongside tailored solutions and expert advice. This approach aims to move beyond price-based competition, emphasizing value-added services that cater to specific customer needs within the foodservice sector.

The degree of differentiation directly impacts the intensity of competitive rivalry. In markets where offerings are similar, businesses often compete primarily on price, leading to margin erosion. Sligro's strategy to provide specialized services, such as customized product sourcing and logistical support, seeks to create a distinct value proposition that commands customer loyalty and supports healthier profit margins, even in 2024.

Switching Costs for Customers

Switching costs for Sligro Food Group's customers are a key factor in competitive rivalry. If it's easy for customers to switch to a competitor, perhaps due to low contract penalties or simple setup with new suppliers, then the competition becomes much tougher. This means Sligro needs to make it attractive for customers to stay. For example, if a restaurant can easily switch from Sligro to another food service distributor without much hassle or extra cost, they might do so if another supplier offers a slightly better price or service. This directly increases the pressure on Sligro to maintain its competitive edge.

Sligro actively works to increase customer loyalty by making it more difficult or less appealing to switch. A significant part of this strategy involves optimizing its logistics and supply chain. By providing reliable, timely, and efficient delivery services, Sligro aims to become an indispensable partner for its clients. For instance, in 2024, Sligro continued to invest in its distribution network to ensure product availability and reduce lead times, directly impacting customer retention. A smooth and dependable supply chain reduces the incentive for a customer to explore alternative providers, thereby raising the effective switching cost.

The ease of switching directly influences how intensely rivals compete for Sligro's customer base. Low switching costs empower customers by giving them more choices and leverage. Sligro's focus on its supply chain is not just about efficiency; it’s a strategic move to build stickiness. A customer who relies on Sligro’s integrated ordering system, consistent product quality, and timely delivery is less likely to risk disruption by switching, even for a marginal price difference. This operational excellence acts as a barrier to easy customer migration.

- Low Switching Costs: If customers can easily switch suppliers, rivalry intensifies.

- Logistics & Supply Chain: Sligro enhances customer loyalty through efficient operations.

- Customer Stickiness: Investments in logistics aim to make it harder for customers to leave.

- Competitive Pressure: Ease of switching allows competitors to poach Sligro's clients more readily.

Exit Barriers

Exit barriers are a significant factor for Sligro Food Group in the food wholesale market, as they dictate how easily competitors can leave the industry. High costs associated with exiting, such as specialized equipment that has little resale value or substantial severance packages for a large workforce, can trap even struggling companies in the market. This can lead to prolonged periods of oversupply and pressure on profit margins.

In the fragmented Dutch food service sector, smaller wholesalers might face relatively lower exit barriers. However, for a large, established player like Sligro, the costs of exiting would be considerably higher. This includes the potential write-down of significant investments in logistics, distribution centers, and potentially long-term supplier or customer contracts that are difficult to terminate without penalty.

- High Capital Investment: Sligro's extensive network of distribution centers and specialized fleet of vehicles represent substantial, illiquid assets, making it costly to divest or repurpose upon exit.

- Long-Term Contracts: Agreements with suppliers and major customers often include clauses that penalize early termination, creating financial disincentives to leave the market quickly.

- Workforce Considerations: The large number of employees across Sligro's operations would incur significant severance and retraining costs if the company were to scale back or exit operations.

- Brand Reputation: A disorderly exit could damage Sligro's brand, impacting its remaining businesses or potential future ventures.

Competitive rivalry within the Dutch and Belgian food wholesale markets is intense, driven by a crowded field of large, specialized, and local players. This environment necessitates aggressive pricing and a strong focus on service differentiation for Sligro Food Group to maintain its market position. For instance, in 2024, Sligro continued to invest in its distinct value proposition, aiming to move beyond simple price competition by offering tailored solutions and expert advice to its foodservice clients.

The overall growth trajectory of the market segments also fuels rivalry. While the Dutch foodservice sector shows promise, the broader food and drink wholesaling revenue in the Netherlands is projected to contract. This divergence intensifies competition for market share, particularly in the declining wholesaling segment, as demonstrated by ongoing strategic maneuvers from major competitors like Ahold Delhaize.

Sligro's efforts to cultivate customer loyalty by increasing switching costs, primarily through optimizing its logistics and supply chain, are crucial. Investments in its distribution network in 2024 were designed to ensure product availability and reduce lead times, thereby making it more difficult and less appealing for customers to switch to competitors.

The intensity of competition is further shaped by the relatively low exit barriers for smaller players, contrasting with the substantial exit costs for a large entity like Sligro. These high costs, stemming from significant capital investments in logistics and potential penalties on long-term contracts, can keep even struggling firms in the market, contributing to sustained competitive pressure.

SSubstitutes Threaten

The threat of substitutes for Sligro Food Group hinges significantly on the availability of direct food sourcing. Professional customers, particularly larger ones, might bypass traditional wholesale channels and procure directly from food producers, farmers, or manufacturers. This trend is amplified by advancements in logistics and emerging direct-to-business models.

For instance, the growth of online marketplaces connecting food producers directly with businesses presents a viable alternative. While specific 2024 data on this direct sourcing trend for Sligro’s customer base isn't publicly detailed, the broader e-commerce penetration in the food sector suggests a growing potential for such bypasses.

Sligro's strategic acquisition of transport operations from Simon Loos in 2024 is a key move to counter this threat. By bolstering control over the 'last mile' of delivery, Sligro aims to enhance its value proposition and make direct sourcing less attractive for its professional clientele.

The increasing popularity of meal replacement products and plant-based alternatives presents a growing threat to Sligro Food Group. While not a direct substitute for wholesale distribution, a significant consumer shift towards these options could reduce demand for Sligro's conventional food offerings.

In 2023, the market for plant-based foods in the Netherlands saw continued robust growth, with sales of meat and dairy substitutes showing a notable increase, indicating a tangible change in consumer purchasing habits within the food service industry.

This trend impacts Sligro's business model by potentially decreasing the volume of traditional ingredients they supply if restaurants and food service providers pivot their menus to cater to this evolving demand.

The growing accessibility of retail and e-commerce channels presents a significant threat of substitutes for traditional food wholesalers like Sligro. Many smaller professional clients, such as independent cafes and restaurants, are increasingly finding it convenient and cost-effective to source their supplies from large retail supermarkets or dedicated online business-to-business (B2B) platforms. These alternatives can offer competitive pricing and a broad product selection, directly challenging the wholesale model.

While the online grocery market for businesses is still developing, its upward trajectory is undeniable. For instance, in 2023, the global online grocery market was valued at approximately $1.1 trillion and is projected to reach over $2.5 trillion by 2030, indicating a substantial shift in purchasing habits that wholesalers must address. This growth means that more professional buyers will have readily available substitutes for their procurement needs.

In-house Production or Self-Sufficiency by Customers

The threat of customers opting for in-house production or self-sufficiency is a notable factor for Sligro Food Group. Large institutional clients, such as hospitals, universities, or corporate dining facilities, possess the scale and resources to manage more of their food preparation and sourcing internally. This shift directly diminishes their need for external food service wholesalers, impacting Sligro's customer base. For instance, a large hospital system might invest in expanded kitchen facilities and direct relationships with local farms, bypassing traditional wholesale channels. This trend is particularly relevant in markets where such institutions have significant purchasing power and a desire for greater control over their supply chain and food quality.

In 2024, the foodservice industry continues to see a trend towards customization and local sourcing among large institutions. While specific data on the percentage of large institutions increasing in-house production is proprietary, industry reports indicate that operational efficiency and cost control remain paramount. For example, a survey of healthcare facility managers in Europe revealed that over 40% were evaluating or implementing strategies to increase in-house food preparation to manage costs and ensure dietary compliance. This growing inclination towards self-sufficiency represents a tangible threat, as it directly erodes the addressable market for wholesale food suppliers like Sligro.

- Customer Self-Sufficiency: Large institutional buyers may develop in-house capabilities for food preparation and sourcing, reducing reliance on wholesalers.

- Resource Requirements: This threat is most pronounced for very large entities possessing the necessary infrastructure, capital, and logistical expertise.

- Market Impact: Increased in-house production by key clients directly translates to a smaller market share and revenue potential for Sligro.

- Strategic Consideration: Sligro must monitor the capabilities and strategic shifts of its major institutional clients to anticipate and mitigate this threat.

Changing Consumer Preferences impacting Foodservice Demand

Shifting consumer tastes present a significant threat of substitutes for Sligro Food Group. As more people opt for home cooking or choose convenient, ready-to-eat meals from supermarkets and convenience stores, the overall demand for traditional foodservice channels can diminish. This means Sligro's direct customers, such as restaurants and cafes, might see reduced footfall, indirectly impacting Sligro's wholesale volumes.

The Dutch foodservice industry, including Sligro's market, is already seeing this play out with evolving consumer preferences. For instance, a growing emphasis on healthy eating and sustainable sourcing can lead consumers to seek out alternatives to conventional restaurant offerings. In 2023, Dutch households spent approximately €25 billion on food away from home, a figure that could be influenced by these broader substitution trends.

- Increased Home Cooking: A notable trend in the Netherlands, particularly post-pandemic, has been a resurgence in home cooking, reducing reliance on eating out.

- Convenience Meals: Supermarkets and other non-foodservice retailers are expanding their ready-to-eat and meal-kit offerings, directly competing with restaurant meals.

- Health and Sustainability Focus: Consumer demand for plant-based, organic, and locally sourced ingredients can drive individuals towards specialized food providers or home preparation over traditional foodservice.

- Digital Food Delivery Platforms: While often facilitating foodservice, these platforms also enable consumers to easily compare a wider array of food options, including those from non-traditional caterers or meal prep services.

The threat of substitutes for Sligro Food Group is multi-faceted, encompassing direct sourcing, alternative food products, and shifting consumer habits that bypass traditional foodservice channels. Increased direct sourcing by professional customers, fueled by online marketplaces and improved logistics, presents a significant challenge.

Furthermore, the growing consumer preference for plant-based alternatives and convenient meal solutions, alongside a resurgence in home cooking, directly impacts the demand for Sligro's core offerings, potentially reducing volume for their restaurant and catering clients.

Retail and e-commerce channels also serve as potent substitutes, offering competitive pricing and accessibility for smaller professional buyers. These trends necessitate Sligro's strategic focus on enhancing its delivery capabilities and adapting its product portfolio to remain competitive.

Entrants Threaten

The threat of new entrants for Sligro Food Group is relatively low, largely due to the substantial capital requirements needed to enter the food wholesale market. Establishing a robust operation demands significant investment in warehouses, a complex logistics network, and substantial inventory. For instance, Sligro's ongoing investments in modernizing its logistics infrastructure and automation highlight the scale of capital commitment necessary to maintain operational efficiency and competitiveness.

Existing players like Sligro benefit immensely from economies of scale in both procurement and distribution. This scale allows them to negotiate better prices with suppliers and optimize delivery routes, creating a cost advantage that is challenging for newcomers to match without considerable financial backing. In 2023, Sligro reported revenues of €2.7 billion, underscoring the operational scale required to compete effectively.

New entrants face a significant hurdle in replicating Sligro Food Group's established distribution network and deep-rooted customer relationships. Building a comparable multi-channel approach, encompassing both cash-and-carry outlets and efficient delivery services, requires substantial investment and time.

Sligro's long-standing partnerships with professional customers, cultivated over years of reliable service and tailored offerings, create a strong loyalty that is difficult for new players to penetrate. For instance, Sligro's 2023 revenue reached €2.7 billion, demonstrating the scale of its operations and customer base.

The company's strategic acquisitions, such as that of Gepu in recent years, further solidify its market position by expanding its reach and capabilities. This proactive network enhancement presents a formidable barrier to entry for any aspiring competitor seeking to gain traction in the food service distribution sector.

Navigating the stringent food safety, hygiene, and business licensing regulations in the Netherlands and Belgium presents a significant hurdle for potential new entrants into the foodservice distribution market. These complex requirements, which can be both time-consuming and costly to meet, act as a substantial barrier. For instance, recent regulations concerning single-use plastics and the presence of Migration of Adulterants (MOAH) in food products add layers of compliance complexity that can deter new players from entering the market.

Brand Loyalty and Reputation

The threat of new entrants for Sligro Food Group is significantly mitigated by its strong brand loyalty and established reputation within the food wholesale sector. Sligro's long operating history, dating back to 1935, has allowed it to cultivate deep relationships and trust with a wide array of professional clients, from restaurants to caterers. New players entering the market would face a considerable challenge in replicating this level of customer allegiance, requiring substantial investment in marketing and service to even approach Sligro's standing. In 2024, Sligro continued its strategic focus on customer acquisition and retention, aiming to solidify its market position further.

Building a trusted brand in food wholesale requires consistent delivery, reliable service, and a deep understanding of customer needs. Sligro's extensive network and tailored solutions contribute to this, making it difficult for newcomers to gain immediate traction. For instance, in the competitive Dutch market, Sligro's commitment to quality and its comprehensive product offering are key differentiators.

- Established Customer Base: Sligro benefits from a loyal, long-term customer base in the professional food service industry.

- Brand Recognition: Decades of operation have cemented Sligro's brand as a trusted name in food wholesale.

- High Entry Barriers: New entrants must overcome significant investment in marketing, logistics, and service to compete with Sligro's reputation.

- Customer Retention Focus: Sligro actively works to retain its existing clients, further solidifying its market share against potential new competitors.

Supplier Access and Relationships

The threat of new entrants to the food wholesale market, specifically regarding supplier access, is relatively low for Sligro Food Group. Established wholesalers benefit from deeply entrenched, long-term relationships with a diverse array of food and non-food producers. These relationships are built on trust, volume, and consistent business, granting Sligro significant procurement power. New entrants would find it exceptionally challenging to quickly establish similar partnerships, likely facing higher input costs or a restricted product range, thus limiting their competitiveness.

Sligro's strategic partnerships, such as its recent collaboration with Greenyard for fresh produce, underscore the importance and strength of its supplier network. Such alliances are not easily replicated by newcomers. This access to a wide and reliable supply chain is a critical barrier, making it difficult for new players to gain a foothold and offer a comparable breadth of products and services.

The difficulty in securing reliable supply agreements is a significant deterrent. New entrants would need substantial capital and time to build comparable supplier relationships. For instance, Sligro's extensive network allows it to negotiate favorable terms, a feat that would be incredibly difficult for a nascent competitor to match in the short to medium term.

- Established Procurement Power: Sligro leverages its scale to secure better terms from suppliers.

- Long-Term Relationships: Decades of partnership provide stability and preferential treatment.

- Limited Access for Newcomers: New entrants face higher input costs and restricted product availability.

- Strategic Partnerships: Alliances like the one with Greenyard reinforce Sligro's supply chain advantage.

The threat of new entrants for Sligro Food Group remains low due to substantial capital requirements, established economies of scale, and strong customer loyalty. New players must overcome significant investment in logistics, supplier relationships, and regulatory compliance. Sligro's proactive network enhancements and strategic acquisitions further solidify its market position, creating formidable barriers for aspiring competitors in the food service distribution sector.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sligro Food Group leverages a comprehensive dataset including Sligro's annual reports, industry-specific market research from firms like Nielsen, and publicly available competitor financial statements to assess competitive intensity.