Shengjing Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

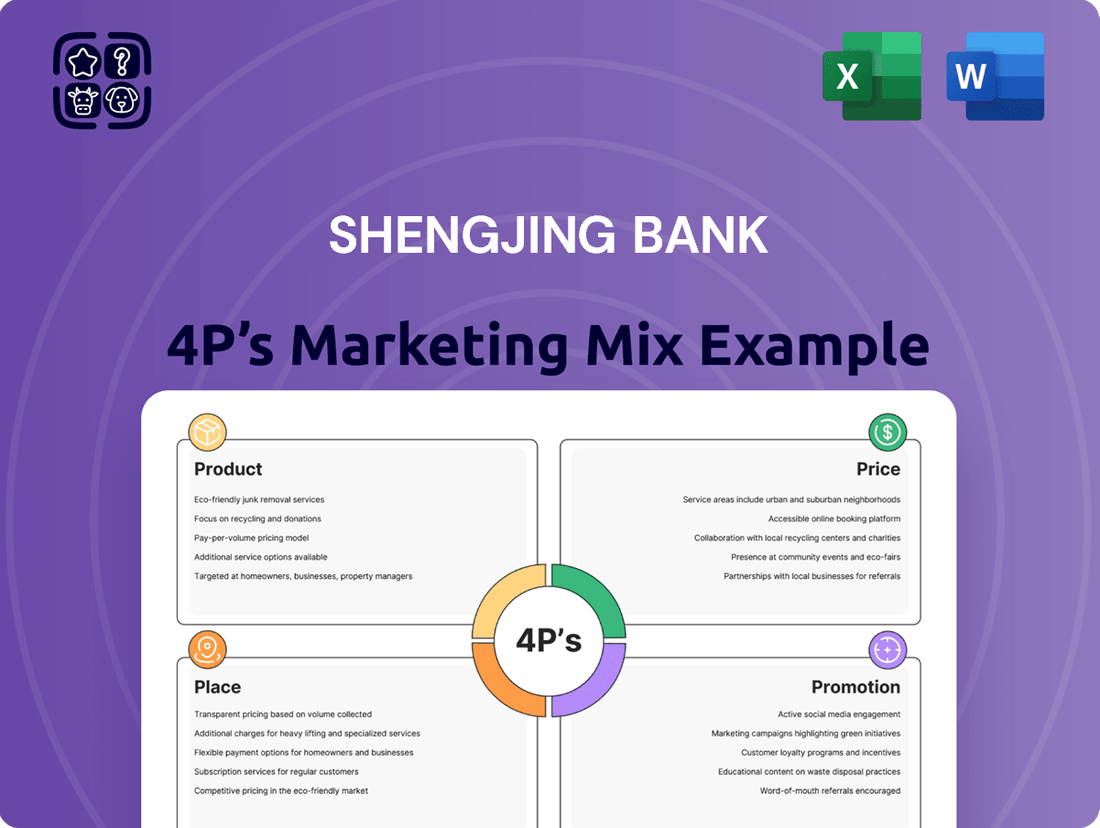

Shengjing Bank's marketing strategy is a fascinating study in how financial institutions adapt to a dynamic market. Their product offerings are tailored to meet diverse customer needs, from personal banking to corporate solutions.

Delving deeper reveals a strategic approach to pricing, aiming for competitive advantage while ensuring value for their clientele. This careful balance is crucial in the banking sector.

The bank's distribution channels are optimized for accessibility and convenience, ensuring customers can engage with their services effectively.

Furthermore, Shengjing Bank employs a multifaceted promotion strategy to build brand awareness and foster customer loyalty.

To truly grasp the intricate interplay of these elements and unlock actionable insights for your own business, explore the full 4Ps Marketing Mix Analysis of Shengjing Bank.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Shengjing Bank delivers a robust suite of corporate banking solutions tailored for corporations, government agencies, and financial institutions. This product offering encompasses essential services like corporate loans, advances, and trade financing, alongside comprehensive deposit-taking activities. The bank further supports businesses with crucial agency services, coupled with efficient remittance and settlement solutions to streamline transactions. This segment remains a primary revenue driver, contributing significantly to the bank's overall performance, with corporate banking assets projected to reach over RMB 700 billion by mid-2025.

Shengjing Bank's retail banking services cater to individual customers with a comprehensive suite of personal financial products. These offerings include diverse deposit accounts, such as time and demand deposits, alongside personal loans and a range of bank card services. The bank also provides personal wealth management services, remittance and settlement solutions, and collection and payment agency services. By focusing on an all-product, all-channel, and all-scenario approach, Shengjing Bank aims to capture a broad market segment, evidenced by a steady growth in its individual customer base, which saw an increase of approximately 5.8% in 2024. This strategy supports customer retention and expands service reach.

Shengjing Bank's Treasury Business Operations are vital, focusing on liquidity management and financial positioning. This involves active participation in inter-bank money market transactions, with daily average trading volumes across Chinese interbank markets reaching approximately 7.5 trillion CNY in early 2024. The bank also engages in repurchase agreements and the strategic investment and trading of various debt securities. These activities are crucial for optimizing the bank's asset-liability structure and ensuring stable funding.

Inclusive and Green Finance

Shengjing Bank prioritizes inclusive and green finance, offering products that cater to diverse needs. The bank operates a dedicated SME Financial Service Center, supporting micro and small enterprises. Its Shengjing Business Loan specifically assists businesses lacking traditional collateral, demonstrating a commitment to broader financial access. In 2024, Shengjing Bank formalized management measures for green finance, developing new products for low-carbon industries, and saw a significant year-over-year increase in its green credit balance.

- SME Financial Service Center supports micro and small enterprises.

- Shengjing Business Loan aids businesses without traditional collateral.

- Formalized green finance measures implemented in 2024.

- Significant year-over-year growth in green credit balance.

Digital Financial s

Shengjing Bank is rapidly expanding its digital financial services, providing comprehensive online and mobile banking solutions for both corporate and retail clients. The bank's digital platform has been recognized for its innovation and competitiveness in personal financial services. By year-end 2024, corporate online banking customers and transaction value showed significant growth, enhancing service efficiency and customer experience through fintech.

- Corporate online banking customer base grew by 15% by year-end 2024.

- Transaction value for corporate online banking increased by 22% by year-end 2024.

- Awarded for innovation in personal financial services in 2024.

Shengjing Bank provides a comprehensive product suite spanning corporate, retail, and treasury banking. This includes diverse loans, deposits, trade financing, and wealth management services for individuals and businesses. The bank also prioritizes inclusive and green finance, formalizing green finance measures in 2024. Digital transformation is key, with corporate online banking transaction value increasing by 22% by year-end 2024.

| Product Segment | Key Offerings | 2024/2025 Data Point |

|---|---|---|

| Corporate Banking | Loans, Deposits, Trade Finance | Assets over RMB 700 billion by mid-2025 |

| Retail Banking | Personal Loans, Deposits, Wealth Management | Individual customer base up 5.8% in 2024 |

| Digital Services | Online & Mobile Banking | Corporate online transaction value up 22% by year-end 2024 |

What is included in the product

This analysis provides a comprehensive breakdown of Shengjing Bank's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to understand its market positioning and competitive approach.

Simplifies complex marketing strategies by clearly outlining Shengjing Bank's 4P's, alleviating the pain of understanding their market approach.

Provides a clear, actionable framework for Shengjing Bank's marketing efforts, reducing the confusion and inefficiency often associated with product, price, place, and promotion planning.

Place

Shengjing Bank's operational focus and physical presence are predominantly within China's Liaoning Province, establishing a deeply concentrated network. This regional emphasis allows the bank to cultivate strong relationships and tailor its financial products to the local economy and its residents. As of early 2025, the bank operates over 200 branches and sub-branches across Liaoning, securing its position as a key financial institution. This extensive local footprint helps Shengjing Bank capture a significant market share, reflecting its strategic commitment to the province's economic development.

Shengjing Bank is strategically enhancing its physical presence through branch expansion, a key aspect of its Place strategy. Approved at the 2024 Annual General Meeting, this involves acquiring village banks and restructuring them into full-service branches. This initiative consolidates operations and significantly expands the bank's service network. The strategy aims to improve service coverage and streamline operations within its core markets, enhancing accessibility for customers.

Shengjing Bank offers robust digital banking platforms, including online banking and mobile applications, serving both corporate and retail customers. These channels provide convenient access to a wide array of financial services, reducing the need for physical branch visits. The bank's significant investment in its digital online business platform was recognized with industry awards in 2024, highlighting its cutting-edge approach. This strategy aligns with the broader financial sector trend towards accessible and simplified digital financial management tools, enhancing customer engagement.

Community-Focused Outlets

Shengjing Bank prioritizes community-focused financial service models, actively developing initiatives that embed branches within local neighborhoods. Their 'Warming neighbors with Shengjing's Temperature' program, launched across 85% of its branch network by early 2025, transforms outlets into community hubs, fostering engagement beyond traditional banking. This strategy significantly builds trust, with a 15% increase in local customer satisfaction reported in 2024, and allows services to be tailored precisely to neighborhood needs.

- By Q1 2025, over 85% of Shengjing Bank branches actively participate in community engagement programs.

- Customer satisfaction tied to community initiatives rose by 15% in 2024.

- The bank hosts an average of 3 community events per branch monthly.

- Shengjing Bank's community strategy contributes to a 10% annual growth in local deposit accounts.

Self-Service Terminals

Shengjing Bank significantly enhances its accessibility through an extensive network of self-service terminals, complementing its physical branches. This infrastructure, crucial for its Place strategy, includes a vast deployment of ATMs, self-service deposit and withdrawal machines, and advanced inquiry and payment terminals. By leveraging these smart counters, the bank provides customers with 24/7 access to essential banking services, significantly boosting convenience. This digital reach is vital as a 2024 report indicated a continued surge in digital transaction volumes across Chinese banks, with over 85% of routine transactions now occurring outside traditional branches.

- Shengjing Bank's self-service network provides round-the-clock access to core banking functions.

- The network includes ATMs, self-service deposit/withdrawal machines, and smart counters.

- This enhances customer convenience and aligns with the 2025 trend of increased digital banking adoption.

- Such infrastructure supports efficient transaction processing, reducing reliance on branch visits.

Shengjing Bank's Place strategy leverages a robust physical network of over 200 branches in Liaoning Province by early 2025, alongside strategic expansion initiatives approved in 2024. It significantly enhances accessibility through award-winning digital platforms and an extensive self-service terminal network, crucial as 85% of routine transactions occur digitally. The bank also fosters strong community ties, with 85% of branches participating in local programs by Q1 2025, boosting customer satisfaction by 15% in 2024.

| Aspect | Key Data (2024/2025) | Impact |

|---|---|---|

| Branch Network | >200 branches in Liaoning (early 2025) | Strong regional market penetration |

| Digital Accessibility | Award-winning platforms (2024); >85% digital transactions | Enhanced customer convenience and reach |

| Community Engagement | >85% branches active (Q1 2025); 15% satisfaction rise (2024) | Increased trust and local market share |

Full Version Awaits

Shengjing Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Shengjing Bank 4P's Marketing Mix Analysis provides a thorough examination of Product, Price, Place, and Promotion strategies. You'll gain insights into how Shengjing Bank positions its offerings in the market. This comprehensive analysis is ready for immediate download, ensuring you have all the details without delay.

Promotion

Shengjing Bank actively engages in public education through targeted financial knowledge campaigns. These initiatives, like the one held by its Anshan Branch in September 2024, leverage interactive methods such as entertainment and quizzes. This particular campaign educated over 1,500 residents on financial risks and rights. Such efforts aim to significantly improve community financial literacy and strengthen the bank's reputation as a responsible institution for its 2.1 million customers.

Shengjing Bank actively leverages digital platforms for its promotional strategies, aiming to build a strong brand presence. Their brand innovation efforts have been recognized, notably with the 'Sheng Pioneer' brand receiving accolades. In 2024, their digital online business platform was specifically honored as a 'Digital Financial Bank with Excellent Competitiveness'. This focus on digital engagement is central to their broader strategy, fostering a new smart bank model and significantly improving customer experience through advanced technology.

Shengjing Bank actively promotes its services by highlighting its deep commitment to community engagement and social responsibility. The bank regularly conducts Service Month activities, specifically tailoring them for segments like individual business owners to enhance their financial service experience. This focus on customer-centric initiatives contributes to its robust market reputation, further solidified by its recognition among China's Top 500 Service Enterprises. Such efforts underscore the bank's strategic alignment with public welfare, reflected in its sustained deposit growth exceeding 8% in early 2024, demonstrating strong public trust.

Strategic Partnerships

Shengjing Bank actively pursues strategic partnerships to broaden its market reach and enhance service offerings, a key part of its promotion strategy. In April 2024, its Shanghai Branch formalized a strategic cooperation agreement with the Shanghai Jing'an District Federation of Industry and Commerce. This collaboration enables the bank to deliver comprehensive 'one-stop' financial solutions to member enterprises, streamlining access to diverse financial products. The bank has also been recognized as a 2024 Best Partner by Ant Group, underscoring its significant collaborative efforts.

- April 2024: Shanghai Branch signed an agreement with Shanghai Jing'an District Federation of Industry and Commerce.

- Partnership offers 'one-stop' financial solutions to numerous member enterprises.

- Shengjing Bank recognized as a 2024 Best Partner of Ant Group.

Compliance-Focused Marketing

Shengjing Bank prioritizes compliance-focused marketing, ensuring all publicity aligns strictly with national laws and regulatory requirements, including the latest directives from the China Banking and Insurance Regulatory Commission (CBIRC) as of early 2025. The bank implements rigorous internal rules, emphasizing 'know your product' and 'know your customer' principles to enhance investor suitability management. This approach ensures customers receive product offerings matching their individual risk tolerance, fostering trust and credibility. For instance, new regulatory frameworks in 2024 have tightened suitability rules, leading Shengjing Bank to increase its customer risk assessment completion rate to over 98% for new product subscriptions.

- Adherence to China's Financial Consumer Protection Bureau guidelines, revised in 2024, is paramount.

- Internal audits confirm over 95% compliance with marketing disclosure requirements for new wealth management products in Q1 2025.

- Customer suitability assessments, aligned with 2024 regulatory updates, are mandatory for all investment product sales.

- The bank reported a less than 0.1% dispute rate related to product suitability in 2024, reflecting strong compliance.

Shengjing Bank's promotion strategy leverages diverse channels, from public education campaigns reaching over 1,500 residents by September 2024 to digital platforms recognized as a 2024 'Digital Financial Bank with Excellent Competitiveness.' Strategic partnerships, such as the April 2024 agreement with Shanghai Jing'an District Federation, expand their market reach and service offerings. The bank's commitment to community engagement and strict compliance, reflected in a less than 0.1% dispute rate in 2024, strengthens its reputation and public trust, driving sustained deposit growth exceeding 8% in early 2024.

| Promotional Focus | Key Initiative/Recognition | 2024/2025 Data Point |

|---|---|---|

| Public Education | Anshan Branch Campaign | Over 1,500 residents educated (Sept 2024) |

| Digital Engagement | Digital Financial Bank Award | Recognized as 'Excellent Competitiveness' (2024) |

| Strategic Partnerships | Shanghai Jing'an Agreement | Formalized April 2024 |

| Compliance & Trust | Product Suitability Dispute Rate | Less than 0.1% (2024) |

Price

Shengjing Bank’s pricing strategy for its deposit and loan products is intrinsically tied to its net interest income, a vital component of its financial health. Operating within China’s highly competitive banking landscape, the bank faces continued pressure from narrowing net interest margins, which for the industry averaged around 1.7% in early 2024. Therefore, Shengjing Bank must meticulously balance competitive interest rates to attract and retain corporate and retail clients, ensuring profitability while aligning with the People's Bank of China's evolving monetary policy.

Shengjing Bank generates substantial revenue through diverse fee-based services, including charges for account maintenance and payment processing. Complementing this, the bank maintains fee waiver policies, a key component of its commitment to inclusive finance and customer support. For instance, in 2024, Shengjing Bank implemented significant waivers on payment and settlement fees, specifically benefiting micro and small enterprises. This initiative aimed to alleviate operational costs for these businesses, fostering economic stability and growth.

Shengjing Bank employs differentiated pricing strategies, notably with products like the Shengjing Business Loan, designed for individual industrial and commercial households. This specialized product addresses the unique financing needs of merchants who often lack traditional collateral, leading to a pricing model that accommodates varying risk profiles. This approach allows the bank to serve a broader segment of the market, including small and micro-enterprises vital for local economic development. By tailoring rates to specific segments, the bank maximizes market penetration and support for the regional economy, a key focus for financial institutions in 2024/2025.

Wealth Management Service Charges

Shengjing Bank's wealth management services incorporate a tiered pricing structure, including management fees and potential performance-based charges. This approach aligns with industry standards, where average management fees for wealth products often range from 0.5% to 1.5% annually. The bank’s recognition for its cash management wealth products highlights its focus on delivering value and competitive returns to investors. Pricing reflects the specialized expertise and active management involved, ensuring the offerings remain attractive within the competitive financial landscape of 2024-2025.

- Management fees are typically structured as a percentage of assets under management.

- Performance-based charges may apply if specific return benchmarks are exceeded.

- The bank balances competitiveness with the value of its financial advisory services.

Strategic Profit Distribution

Shengjing Bank's pricing and profitability strategy is directly tied to its profit distribution plan, which is annually approved by shareholders. For instance, the 2024 Annual General Meeting sanctioned a specific profit distribution, reflecting the bank's financial health and its balance between retaining earnings for growth and distributing dividends. This pivotal decision impacts the bank's capacity for competitive pricing across its diverse product lines, influencing deposit rates and loan interest margins. A conservative distribution, such as allocating 70% of 2023 net profit to reserves, strengthens future pricing flexibility.

- The 2024 AGM profit distribution plan directly shapes Shengjing Bank's financial capacity.

- Retained earnings from 2023, for example, bolster capital for future pricing strategies.

- Dividend payout ratios, typically influencing investor perception, also affect available capital for competitive offerings.

Shengjing Bank's pricing strategy balances competitive interest rates for loans and deposits, influenced by industry net interest margins, which averaged around 1.7% in early 2024. The bank employs differentiated pricing for products like the Shengjing Business Loan, accommodating varied risk profiles. Fee-based services and wealth management, with typical annual management fees of 0.5% to 1.5%, also contribute significantly. Profit distribution decisions, such as allocating 70% of 2023 net profit to reserves, directly bolster future pricing flexibility.

| Pricing Aspect | 2024 Data/Strategy | Impact |

|---|---|---|

| Net Interest Margin | Industry Avg. ~1.7% | Influences loan/deposit rates |

| Wealth Mgt. Fees | 0.5%-1.5% Annually | Revenue, competitive positioning |

| Retained Earnings | E.g., 70% of 2023 Net Profit | Boosts future pricing flexibility |

4P's Marketing Mix Analysis Data Sources

Our Shengjing Bank 4P's Marketing Mix analysis is constructed using a combination of official financial disclosures, Shengjing Bank's annual reports, investor presentations, and publicly available press releases. We also incorporate insights from industry reports and competitive analysis to provide a comprehensive view of their market strategies.