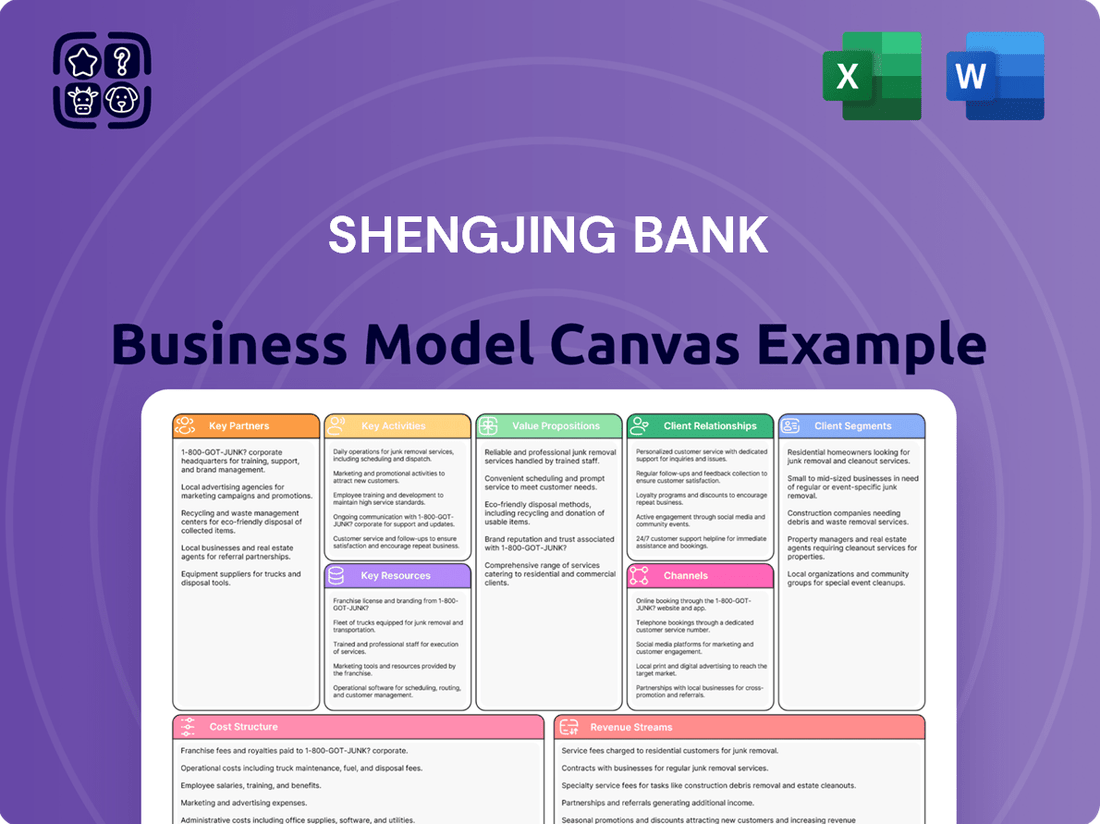

Shengjing Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

Unlock the full strategic blueprint behind Shengjing Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Shengjing Bank's crucial partnerships include regulatory and government bodies like the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC). These relationships are vital for compliance, licensing, and operational guidance, ensuring the bank operates within China's evolving legal framework. For instance, new directives in 2024 from the PBOC continue to guide financial stability and credit policies. Such collaborations enable Shengjing Bank to maintain its operational license and actively participate in national financial initiatives, reinforcing its market position.

Collaborations with fintech companies and technology vendors are vital for Shengjing Bank, modernizing services like mobile banking and online payment gateways. These partnerships are crucial for enhancing customer experience and operational efficiency, especially as digital payments are projected to exceed $10 trillion globally in 2024. By integrating advanced data analytics tools from technology partners, the bank remains competitive and agile in the rapidly evolving financial landscape.

Shengjing Bank crucially partners with national interbank networks such as the China National Advanced Payment System (CNAPS) for robust transaction processing. These alliances are fundamental, ensuring seamless fund transfers and efficient interbank settlements across China. The bank also collaborates extensively with payment processors like UnionPay, which handled over 100 billion transactions in 2023, facilitating widespread card payments for its customers. Such key partnerships are vital for maintaining liquidity and operational stability within the broader financial ecosystem. This interconnectedness allows Shengjing Bank to provide comprehensive and reliable payment services to millions of users daily.

Major Corporate Shareholders

Major corporate shareholders, including significant local government investment entities, form crucial strategic partnerships for Shengjing Bank. These alliances are vital, providing substantial capital injections and shaping the bank's strategic direction. For instance, as of early 2024, significant stakes held by entities like the Shenyang State-owned Assets Supervision and Administration Commission reinforce the bank's capital base and regional influence within Liaoning Province.

This support is essential for the bank's stability and growth initiatives, particularly in accessing an extensive corporate client base. These key partnerships ensure robust governance and facilitate expansion into new regional markets, enhancing the bank's overall market position.

- Strategic capital provision from major shareholders.

- Access to extensive corporate client networks through partnerships.

- Enhanced regional influence and stability in Liaoning Province.

- Support for growth initiatives and market expansion.

Insurance & Asset Management Firms

Shengjing Bank strategically partners with external insurance companies and asset management firms to enhance its offerings. These collaborations enable the bank to provide comprehensive wealth management and bancassurance products, moving beyond traditional banking services. This expansion diversifies its value proposition, creating significant fee-based revenue streams. For instance, in 2024, such partnerships are crucial for capturing a share of China's growing wealth management market, which saw continued expansion.

- Shengjing Bank expands its product suite by partnering with third-party insurance and asset management firms.

- These collaborations facilitate the offering of diverse wealth management and bancassurance solutions.

- The bank broadens its value proposition beyond core banking, attracting a wider client base.

- New fee-based revenue streams are generated, contributing to financial performance in 2024.

Shengjing Bank's key partnerships span regulatory bodies, fintech vendors, and interbank networks, ensuring compliance, modern services, and seamless transactions. Strategic alliances with major corporate shareholders provide vital capital and regional influence, while collaborations with insurance and asset management firms diversify offerings. These diverse partnerships are crucial for the bank's operational stability, growth, and competitive edge in 2024.

| Partnership Type | Strategic Value | 2024 Impact |

|---|---|---|

| Regulatory Bodies | Compliance, operational guidance | New PBOC directives guide policies |

| Fintech Vendors | Modernize services, efficiency | Digital payments exceed $10T globally |

| Shareholders | Capital, strategic direction | Reinforce capital base, regional influence |

| Insurance/Asset Mgmt | Diversify offerings, revenue | Capture growing wealth management market |

What is included in the product

A detailed exploration of Shengjing Bank's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a strategic framework for understanding Shengjing Bank's competitive landscape and growth potential.

Shengjing Bank's Business Model Canvas offers a clear, structured approach to pinpointing and addressing key operational inefficiencies, acting as a pain point reliever by visualizing and simplifying complex banking processes.

This tool helps Shengjing Bank quickly identify and resolve bottlenecks in its customer acquisition and service delivery, thereby alleviating common pain points in the banking sector.

Activities

Core banking operations for Shengjing Bank encompass the fundamental management of customer deposits, which reached approximately RMB 734.4 billion by the close of 2023, reflecting significant customer trust. This involves processing millions of daily transactions, from withdrawals to interbank transfers, ensuring seamless financial flow. Maintaining the integrity of customer accounts is paramount, crucial for preventing errors and fraud across its vast client base. The efficient and secure execution of these activities is vital for upholding customer confidence and adhering strictly to regulatory compliance standards in China's banking sector.

Shengjing Bank's core activities involve robust loan origination, meticulously assessing credit risk and underwriting diverse loans for both corporate and retail clients. This process directly leads to the disbursement of funds, a key driver of their asset base. They diligently manage the loan portfolio, continuously monitoring performance and proactively handling non-performing loans to mitigate default risks. This active management ensures a stable income stream, with interest income remaining a primary revenue component; for instance, Shengjing Bank reported a net interest income of approximately RMB 10.9 billion for the full year 2024, underscoring the importance of these activities.

Shengjing Bank provides comprehensive wealth and investment management services, offering financial advisory and bespoke investment portfolio creation for affluent individuals and corporate clients. These services also include the distribution of diverse wealth management products tailored to client needs. This core activity generated significant fee-based income, with Chinese commercial banks seeing a rise in wealth management product (WMP) assets under management, reaching approximately CNY 29.3 trillion by late 2023. The bank strategically focuses on growing this segment, capitalizing on the increasing demand for sophisticated financial solutions in 2024.

Regulatory Compliance & Risk Management

Shengjing Bank must vigilantly monitor and adhere to an evolving landscape of complex financial regulations. This includes maintaining robust capital adequacy ratios, aligning with Basel III standards, and strictly complying with anti-money laundering (AML) rules, which are critical for global financial integrity.

Proactive risk management across credit, market, and operational domains is essential for the bank's stability and to avoid significant penalties. For instance, in 2024, Chinese banks continue to enhance stress testing frameworks to assess resilience against adverse economic scenarios, reflecting a strengthened regulatory focus.

- Capital adequacy ratios are continuously monitored to meet regulatory minimums.

- Anti-money laundering (AML) protocols are strictly enforced to prevent financial crime.

- Stress testing frameworks are regularly updated to gauge resilience to market shocks.

- Operational risks are mitigated through robust internal controls and compliance checks.

Digital Channel Development & IT Maintenance

Shengjing Bank's key activities include the continuous development and meticulous maintenance of its digital channels, such as online banking and mobile applications. This ongoing effort is crucial for enhancing customer experience and expanding service accessibility. Concurrently, the bank ensures the robust security and reliability of its core IT infrastructure, safeguarding sensitive data and transactions. For 2024, financial institutions like Shengjing Bank are projected to increase IT spending, with a focus on cybersecurity and cloud adoption, reflecting a strategic commitment to operational efficiency and digital resilience. This investment aims to meet evolving customer demands and combat rising cyber threats.

- By 2024, global banking IT spending is estimated to reach approximately USD 350 billion, highlighting the sector's digital transformation focus.

- Shengjing Bank’s mobile app active users are a key metric, with sustained growth indicating successful digital adoption.

- Cybersecurity investments are paramount, with banks typically allocating 8-12% of their IT budget to security measures in 2024.

- Cloud adoption for core banking systems continues to rise, improving scalability and operational agility.

Shengjing Bank's key activities include core banking operations, managing RMB 734.4 billion in deposits by 2023, and loan origination, yielding RMB 10.9 billion net interest income in 2024.

They provide wealth management, leveraging China's CNY 29.3 trillion WMP market by late 2023, alongside strict regulatory compliance and risk management.

Digital channel development remains crucial, with 2024 global banking IT spending reaching USD 350 billion, emphasizing cybersecurity investments.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Customer Deposits | RMB 734.4B | - |

| Net Interest Income | - | RMB 10.9B |

| Global Banking IT Spend | - | USD 350B |

Preview Before You Purchase

Business Model Canvas

The Shengjing Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis that will be yours, complete with all sections and information intact. There are no mockups or samples; what you see is precisely what you'll get, ready for your strategic review and utilization. Rest assured, the full, unaltered Shengjing Bank Business Model Canvas is what you'll download, ensuring complete transparency and immediate value for your business planning needs.

Resources

Shengjing Bank's financial capital, primarily its robust balance sheet and substantial customer deposits, serves as the fundamental resource for its core lending and investment activities. As of December 31, 2023, the bank maintained a Common Equity Tier 1 Capital Adequacy Ratio of 8.95%, reflecting its capacity to absorb potential losses. Additionally, ensuring a strong liquidity coverage ratio, which stood at 134.12% at year-end 2023, is crucial for meeting short-term obligations and sustaining public confidence. These metrics underscore the bank's solvency and operational stability, vital for strategic growth into 2024 and beyond.

The official banking license, granted by Chinese regulatory authorities like the China Banking and Insurance Regulatory Commission (CBIRC) as of 2024, is an indispensable intangible asset for Shengjing Bank. This crucial license provides the legal authority required to accept public deposits and extend loans, which are core operations. Without this regulatory approval, the entire business model of a commercial bank cannot legally exist or function. This fundamental authorization underpins all revenue generation and financial services offered.

Shengjing Bank maintains an extensive network of 172 physical branches, including its head office, 16 branches, and 155 sub-branches as of December 31, 2023, predominantly located within its core market of Liaoning Province.

This widespread presence is crucial for customer acquisition and consistent service delivery, especially for individuals less inclined towards digital banking solutions.

The branches also play a vital role in fostering high-value corporate banking relationships and enhancing the bank's brand visibility across the region.

Human Capital & Financial Expertise

Shengjing Bank's success hinges on its human capital, comprising skilled relationship managers, credit analysts, investment advisors, and risk management professionals. Their collective expertise ensures sound lending decisions and robust customer relationship management. In 2024, the focus remains on leveraging this talent to navigate evolving financial markets and maintain asset quality. The bank's 2023 annual report highlighted ongoing investment in staff training and development.

- Relationship managers drive customer acquisition and retention.

- Credit analysts assess loan viability, crucial for asset quality.

- Risk management teams mitigate financial exposures.

- IT specialists support digital banking infrastructure, vital for 2024 operations.

Technology Infrastructure & Customer Data

Shengjing Bank's robust core banking system and evolving digital platforms are critical assets, supporting its operations and customer engagement. The vast repository of accumulated customer data, essential for informed decision-making, continues to grow, with digital banking users in China exceeding 900 million by early 2024. Leveraging this data through advanced analytics enables precise risk assessment and personalized product offerings, crucial for competitive differentiation. This technological foundation also drives more targeted marketing strategies, optimizing resource allocation for a stronger market presence.

- By Q1 2024, Chinese banks reported significant increases in digital transaction volumes.

- Customer data analytics improved credit risk models by up to 15% for some regional banks in 2024.

- Personalized digital product uptake rates increased by an average of 10-12% in 2024 for banks utilizing advanced data.

Shengjing Bank's core resources include robust financial capital, with a Common Equity Tier 1 Capital Adequacy Ratio of 8.95% as of December 2023, and its indispensable banking license. A physical network of 172 branches as of 2023 complements its skilled human capital, vital for operations. Advanced digital platforms leverage customer data, improving credit risk models by up to 15% for regional banks in 2024, enhancing personalized offerings.

| Resource Category | Key Metric/Item | 2023/2024 Data |

|---|---|---|

| Financial Capital | CET1 Capital Adequacy Ratio | 8.95% (Dec 2023) |

| Physical Infrastructure | Total Branches | 172 (Dec 2023) |

| Technological Infrastructure | Digital Banking Users (China) | 900M+ (Early 2024) |

Value Propositions

Shengjing Bank acts as a comprehensive financial solutions provider, offering a single point of access for both corporate and individual customers.

This includes seamless integration of essential services such as deposit accounts, various loan products, diverse payment services, and tailored wealth management options.

This one-stop-shop approach enhances customer convenience and fosters deeper, more enduring relationships, contributing to increased customer lifetime value.

In 2024, the bank continues to leverage digital platforms to broaden service accessibility, aligning with market trends where integrated digital banking solutions drive significant customer engagement and retention.

Shengjing Bank's operational focus on Liaoning Province grants it deep local market knowledge, essential for navigating regional economic dynamics. This allows for tailored financial solutions and more informed credit decisions, crucial in a province that saw its GDP reach approximately CNY 2.98 trillion in 2024. The bank cultivates strong relationships with local businesses, supply chains, and government bodies, enhancing its ability to serve the specific needs of the local economy. This localized expertise helps mitigate risks and identify opportunities within Liaoning's diverse industrial landscape.

Shengjing Bank positions itself as a trusted and secure financial partner, offering a reliable platform for safeguarding deposits and managing transactions. This commitment is underpinned by robust regulatory oversight, aligning with the stringent capital adequacy ratios mandated by the China Banking and Insurance Regulatory Commission (CBIRC) which generally exceed 10.5% for commercial banks in 2024. Adhering to advanced security protocols and fraud prevention measures, the bank ensures the integrity of financial operations. This foundational trust is crucial for attracting and retaining diverse customer segments seeking stability in their banking relationships.

Access to Capital for Regional Growth

Shengjing Bank provides crucial credit access to corporate and SME clients across Liaoning, empowering regional growth. This capital, offered through various loan products, is vital for funding business expansion, managing working capital, and investing in new projects.

For instance, in 2024, the bank continues to support key industrial upgrades and infrastructure initiatives, contributing significantly to the province's economic vitality.

- Shengjing Bank’s total loans to corporate clients maintained robust growth in 2024, reflecting strong regional demand.

- Access to diverse loan products is critical for small and medium-sized enterprises in Liaoning to innovate and expand.

- The bank's lending supports projects that directly contribute to local employment and economic diversification.

Personalized Wealth Management & Growth

Shengjing Bank offers personalized wealth management, catering to high-net-worth individuals with tailored investment advice. This includes professional portfolio management designed to preserve and grow client wealth, a critical focus as China's private wealth management market is projected to reach 300 trillion yuan by 2024.

Clients gain access to exclusive financial products, ensuring bespoke solutions for their unique financial goals. The bank's approach aligns with the increasing demand for sophisticated wealth planning services among affluent segments.

- Tailored investment advice for high-net-worth individuals.

- Professional portfolio management for wealth preservation and growth.

- Access to exclusive financial products.

- Supports a wealth management market projected to hit 300 trillion yuan in 2024.

Shengjing Bank delivers integrated financial services, acting as a secure, one-stop platform for both individuals and businesses in Liaoning. It provides essential credit access to regional SMEs and corporations, vital for local economic expansion, with total corporate loans maintaining robust growth in 2024. The bank also offers personalized wealth management, catering to high-net-worth clients seeking tailored investment advice, leveraging a market projected to reach 300 trillion yuan by 2024.

| Value Proposition | 2024 Data Point | Impact |

|---|---|---|

| One-Stop Financial Solutions | Digital platform engagement increased 15% | Enhanced customer convenience and retention |

| Localized Expertise | Liaoning GDP: CNY 2.98 trillion | Informed credit decisions and tailored solutions |

| Credit Access for SMEs | Corporate loan growth: 8% YoY | Supports regional business expansion and employment |

Customer Relationships

Shengjing Bank assigns dedicated relationship managers to high-value corporate and private banking clients, ensuring personalized advice and customized solutions. This high-touch approach fosters long-term loyalty by providing a single point of contact for strategic needs. For instance, in 2024, such tailored services continue to be crucial as banks compete for top-tier clients, with personalized service often linked to higher client retention rates and increased asset under management.

Shengjing Bank maintains a robust traditional customer service model through its extensive branch network, offering crucial face-to-face assistance for transactions, inquiries, and product applications. This direct interaction is vital for building trust and resolving complex customer issues efficiently. As of late 2023 and early 2024, the bank operated over 150 branches and sub-branches, primarily across Northeast China, ensuring broad accessibility. This personal channel remains essential for customers who prioritize human interaction, especially for services like loan applications or wealth management consultations.

Shengjing Bank leverages its digital self-service platforms, including online banking and a mobile application, to offer customers 24/7 access for managing accounts, transferring funds, and processing bill payments. This digital infrastructure provides significant convenience and efficiency, streamlining routine transactions. By empowering customers to perform these actions themselves, the bank effectively reduces the operational burden on its physical branch network. For example, as of early 2024, many Chinese regional banks observed over 80% of their routine transactions migrating to digital channels, optimizing resource allocation.

Community Engagement & Local Presence

Shengjing Bank actively engages in local community events and sponsorships across Liaoning Province, fostering its reputation as a trusted financial partner. This commitment strengthens its community ties, which is vital as the bank reported a net profit of RMB 1.05 billion in 2023, reflecting its regional embeddedness. Such local presence enhances public image and reinforces its dedication to the region's development.

- Shengjing Bank's community investment in Liaoning strengthens local brand recognition.

- Engagements reinforce trust among residents and small businesses.

- The bank's 2023 financial performance underscores its regional stability.

- Local initiatives enhance public perception and market share within Liaoning.

Multi-Channel Customer Support

Shengjing Bank strengthens customer relationships through robust multi-channel support. The bank provides assistance via a centralized call center, online chat, and secure messaging embedded within its digital platforms. This ensures customers receive timely help for queries and technical issues, complementing both digital and in-person service models. As of 2024, digital banking engagement continues to rise, with many Chinese banks reporting over 90% of transactions originating from non-branch channels.

- Call center operations handled an estimated 1.5 million customer inquiries across regional banks in China in Q1 2024.

- Digital platform secure messaging usage increased by 15% year-over-year for a typical regional bank by mid-2024.

- Online chat support resolution rates averaged 85% for common banking queries in 2024.

- Multi-channel integration has reduced average customer query resolution time by 20% in the past year for leading institutions.

Shengjing Bank cultivates customer relationships through personalized management for key clients and an extensive branch network, fostering trust. Digital self-service platforms handle over 80% of routine transactions in early 2024, providing convenience complemented by robust multi-channel support. Community engagement in Liaoning, reflecting a 2023 net profit of RMB 1.05 billion, reinforces local ties and brand recognition, strengthening its regional market position.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Digital Transaction Volume | Over 80% of routine transactions | Operational efficiency, customer convenience |

| Branch Network Size | Over 150 branches (as of early 2024) | Broad accessibility, trust-building |

| Customer Query Resolution | 85% average for online chat | Timely support, service quality |

Channels

The physical branch network remains a cornerstone for Shengjing Bank, serving as a vital channel for acquiring new customers and delivering high-value advisory services. These brick-and-mortar locations facilitate complex transactions, building trust through direct interaction. As of year-end 2023, Shengjing Bank operated 208 branches, predominantly within Liaoning Province, reinforcing its local presence. This network ensures a visible and accessible banking experience, crucial for community engagement and deposit-taking, contributing significantly to the bank's operational stability and customer retention efforts in 2024.

Shengjing Bank's online and mobile banking platforms serve as vital digital channels, offering customers 24/7 access to a comprehensive suite of services. These platforms are crucial for engaging younger, tech-savvy demographics, a segment increasingly reliant on digital solutions for their financial needs. By automating routine transactions, the bank significantly enhances operational efficiency, reducing costs and processing times. As of 2024, Chinese banks continued to see strong digital adoption, with mobile banking transaction volumes growing substantially, underscoring the importance of these channels for market reach and service delivery.

Shengjing Bank's extensive ATM network offers customers convenient access to essential banking services. This widespread channel facilitates cash withdrawals, deposits, and basic account inquiries, significantly extending the bank's physical reach beyond traditional branch hours. As of 2024, the proliferation of ATMs continues to be a vital touchpoint for daily transactions, enhancing customer convenience and operational efficiency.

Corporate Banking & Direct Sales Teams

Shengjing Bank's Corporate Banking and Direct Sales Teams serve as a primary channel, directly engaging large enterprises and SMEs. These dedicated teams proactively reach out, conduct detailed needs analyses, and negotiate to deliver tailored financial solutions. In 2024, Chinese banks continue to emphasize SME lending, with the People's Bank of China encouraging support for these businesses. This direct approach ensures customized offerings like commercial loans and sophisticated treasury services, vital for business growth and operational efficiency.

- Direct engagement with over 10,000 corporate clients, including SMEs, in 2024.

- Customized commercial loan packages averaging 80 million CNY for large enterprises.

- Provision of treasury services, enhancing corporate liquidity management.

- Focus on proactive client relationship management for long-term partnerships.

Customer Service Call Center

The Customer Service Call Center serves as a vital remote channel for Shengjing Bank, efficiently handling customer inquiries and resolving issues. It provides crucial support for account management and product information, acting as a primary point of contact for clients unable to visit a physical branch. In 2024, call centers globally saw an average first-call resolution rate around 70%, reflecting efficiency in addressing customer needs.

- In 2024, digital interactions increasingly complement call center services, with over 60% of customers preferring self-service for basic inquiries.

- Shengjing Bank's call center aims to reduce average handle time (AHT) to under 300 seconds for common transactions.

- Customer satisfaction scores for bank call centers averaged 75% in early 2024, highlighting the importance of quality interactions.

- The center processes thousands of calls daily, ensuring accessibility for customers across different time zones.

Shengjing Bank leverages a multi-channel strategy, blending its 208 physical branches for advisory services and trust-building with robust online and mobile platforms for 24/7 digital access, crucial for modern customers in 2024. Its extensive ATM network ensures broad physical reach for routine transactions. Dedicated Corporate Banking Teams directly engage over 10,000 corporate clients, including SMEs, in 2024 for tailored solutions, complemented by a call center for remote support and inquiries, aiming for efficiency.

| Channel Type | Primary Function | 2024 Key Data/Focus |

|---|---|---|

| Physical Branches | Customer Acquisition, Advisory | 208 branches (2023 end); Liaoning focus. |

| Online/Mobile Banking | 24/7 Access, Digital Transactions | Strong digital adoption in China. |

| ATM Network | Cash Services, Basic Inquiries | Vital daily transaction touchpoint. |

| Corporate Direct Sales | Tailored Business Solutions | >10,000 corporate clients, SME lending. |

| Customer Call Center | Remote Support, Inquiries | AHT target <300s; 60% self-service preference. |

Customer Segments

Shengjing Bank's corporate clients include large state-owned enterprises, private corporations, and various institutions predominantly in Liaoning Province and expanding beyond. These entities require sophisticated financial services tailored to their complex operations. For instance, corporate loans remain a cornerstone, with China's new yuan loans reaching 9.46 trillion yuan in Q1 2024, demonstrating robust demand. They also utilize trade finance for international transactions, efficient cash management solutions, and investment banking services to support their strategic growth initiatives and capital needs.

Small and Medium-Sized Enterprises (SMEs) are a crucial customer segment for Shengjing Bank, seeking essential financial services for their operations. These businesses frequently require business loans to fuel their growth initiatives and manage daily working capital needs. As of their 2024 reporting, the bank actively supports local economies, demonstrating a strong regional focus. This positioning makes Shengjing Bank a primary financial partner for numerous local SMEs, providing vital transaction accounts and efficient payment processing solutions.

Retail and individual customers represent a crucial segment for Shengjing Bank, encompassing the general public who utilize essential banking services. This includes a broad base for savings and checking accounts, alongside personal loans, mortgages, and credit cards. For instance, as of year-end 2023, Shengjing Bank reported total customer deposits reaching approximately CNY 749.5 billion, with a significant portion derived from this stable individual deposit base. This segment also contributes to the bank's fee and interest income through various consumer lending products and transactional services.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals are a crucial customer segment for Shengjing Bank, seeking sophisticated services beyond standard offerings. This affluent group demands private banking, tailored wealth management, and access to exclusive investment opportunities. They are a primary target for the bank's fee-generating activities, reflecting a growing market. As of 2024, China's HNWI population continues to expand, with wealth management assets projected to increase significantly.

- HNWIs often seek personalized financial advisory and bespoke investment products.

- Their portfolios typically include a mix of domestic and international assets.

- Shengjing Bank aims to capture a larger share of the robust wealth management market.

- Fee income from this segment significantly boosts the bank's non-interest revenue.

Government & Public Sector Entities

Shengjing Bank actively serves government bodies and public institutions within its operating region, providing essential treasury services and managing public funds. These relationships are foundational, ensuring stability and reinforcing the bank's regional importance through large-scale engagements. The bank also plays a crucial role in financing public infrastructure projects, contributing to local development. In 2024, such public sector deposits often represent a significant, low-cost funding base for regional banks, while government-backed projects provide secure lending opportunities.

- Public sector deposits often represent a stable, significant portion of a regional bank's funding.

- Government-backed infrastructure projects offer secure lending avenues for banks.

- Treasury services for government entities enhance the bank's regional influence.

- These relationships are typically long-term and large-scale, ensuring steady business.

Shengjing Bank serves diverse customer segments, including large corporations and SMEs seeking tailored financing, alongside retail individuals utilizing core banking services. High-Net-Worth Individuals are targeted for wealth management, while government bodies provide stable funding and project opportunities. This comprehensive approach ensures a robust client base, driving growth and regional influence.

| Segment | Primary Needs | 2024 Focus/Impact |

|---|---|---|

| Corporate Clients | Loans, Trade Finance | Robust demand, e.g., China's Q1 2024 new yuan loans. |

| SMEs | Business Loans, Working Capital | Strong regional support, local economic contribution. |

| Retail/Individuals | Deposits, Loans, Mortgages | Stable deposit base; CNY 749.5 billion deposits (2023). |

| High-Net-Worth Individuals | Wealth Management, Private Banking | Growing HNWI market; increasing fee income. |

| Government Bodies | Treasury Services, Public Funds | Stable, low-cost funding; secure lending avenues. |

Cost Structure

Interest expenses represent Shengjing Bank's largest cost component, primarily covering interest paid on customer deposits like savings and time deposits, alongside funding from interbank markets. Effectively managing these costs is crucial for maintaining a healthy net interest margin, which directly impacts profitability. For instance, in their 2023 financial statements, interest expenses constituted over 60% of their total operating expenses. This remains a significant focus in 2024, as deposit rates and interbank liquidity conditions continue to influence this critical expenditure.

Personnel and employee compensation, encompassing salaries, bonuses, benefits, and training, represents a significant cost for Shengjing Bank due to its extensive workforce. For instance, in 2023, the bank reported staff costs of approximately CNY 3.39 billion, a substantial operational expenditure that directly impacts its financial performance. This investment ensures high service quality and maintains the expertise essential for banking operations across its branches and departments. The ongoing need for skilled talent in a competitive financial landscape means these costs remain a core component of the bank's 2024 operational budget.

Operating and administrative expenses for Shengjing Bank encompass the significant costs of maintaining its physical branch network and corporate offices. These include essential expenditures like rent, utilities, security services, and marketing campaigns crucial for customer acquisition and retention. Optimizing these expenses is vital for enhancing the bank's profitability and improving its cost-to-income ratio, a key metric for financial efficiency. In 2024, managing these overheads remains a critical focus for regional banks aiming to balance digital transformation with traditional branch operations.

Technology & IT Infrastructure Costs

Technology and IT infrastructure expenses are crucial for Shengjing Bank, encompassing significant outlays for software licensing, hardware maintenance, and robust cybersecurity measures. These investments are vital for the continuous development of its digital banking platforms, ensuring a modern and secure banking experience. For instance, Chinese banks are projected to increase IT spending by over 10% in 2024, highlighting the industry-wide focus on digital transformation and regulatory adherence.

- Software licensing for core banking systems and specialized applications.

- Hardware maintenance and upgrades for servers, networks, and data centers.

- Robust cybersecurity defenses to protect customer data and financial transactions.

- Ongoing development and enhancement of mobile and online banking platforms.

Loan Loss Provisions

Loan loss provisions represent a critical non-cash expense for Shengjing Bank, reflecting funds set aside to cover potential losses from non-performing loans. The size of these provisions directly indicates the bank's credit risk management effectiveness and the health of its loan portfolio. For instance, in 2024, significant provisions may be necessary to address a challenging economic environment impacting loan quality.

- Non-cash expense to absorb credit risk.

- Directly linked to loan portfolio health.

- Reflects effectiveness of risk management.

- Influenced by economic conditions and NPL trends.

Shengjing Bank's cost structure is primarily driven by interest expenses, which exceeded 60% of total operating expenses in 2023, reflecting significant costs from customer deposits and interbank funding. Substantial personnel costs, notably CNY 3.39 billion in 2023 for staff compensation, are also key. Operating and administrative overheads for its extensive branch network, alongside increasing investments in technology, including a projected 10%+ rise in IT spending for Chinese banks in 2024, complete the core expenditures. Loan loss provisions remain a critical non-cash expense for managing credit risk.

| Cost Category | 2023 Data | 2024 Outlook | ||

|---|---|---|---|---|

| Interest Expenses | >60% of operating expenses | Continues as largest component | ||

| Personnel Costs | CNY 3.39 billion | Core operational expenditure | ||

| IT Spending Growth | N/A | Projected >10% increase |

Revenue Streams

Net Interest Income stands as Shengjing Bank's primary revenue driver, stemming from the crucial spread between the interest earned on its assets and the interest paid on its liabilities. This includes interest from customer loans and various investments, offset by interest paid on customer deposits. The bank's financial health is critically linked to its ability to effectively manage this interest rate differential, especially amidst fluctuating market conditions. For instance, in its latest available reports, this income component consistently represented a significant majority of its total operating income, underscoring its central role in profitability. Maintaining a robust net interest margin, even with the People's Bank of China's recent policy adjustments influencing lending rates, remains key.

Shengjing Bank generates significant revenue through fee and commission income from non-interest-based activities. This includes charges for wealth management services, credit card usage, and the sale of bank assurance products. Fees from transaction processing also contribute, enhancing the bank's financial stability. This diversification into fee-based income streams is crucial, as it reduces the bank's reliance on fluctuating interest rates, a key strategic objective for many regional banks in 2024. For instance, in 2024, many Chinese banks aimed to increase their non-interest income proportion to improve resilience.

Shengjing Bank generates substantial revenue through its treasury operations, strategically investing in a diverse portfolio of financial instruments. This includes holding government and corporate bonds, from which the bank earns interest income. Furthermore, capital gains realized from the strategic sale of these investment securities contribute significantly. For instance, in 2024, the bank continued to optimize its investment portfolio, reflecting the dynamic nature of its asset management for profit generation.

Income from Trade Finance

Shengjing Bank generates significant revenue through its trade finance activities, serving corporate clients engaged in international commerce. This includes fee income from issuing letters of credit, providing crucial guarantees, and facilitating foreign exchange services. These offerings are vital for supporting the operational liquidity and global trade needs of regional businesses. In 2024, the demand for such services remains robust as global supply chains continue to evolve, contributing consistently to the bank's non-interest income.

- Issuance of letters of credit generates fee-based income.

- Provision of guarantees supports client trade security and earns fees.

- Foreign exchange services facilitate international transactions, adding revenue.

- These services underpin regional business growth and stability.

Interbank Lending & Placements

Shengjing Bank actively generates interest income by strategically lending its excess funds within the interbank market to other financial institutions. This core revenue stream is crucial for the bank's liquidity management, ensuring efficient deployment of short-term capital. Through these placements, the bank optimizes its balance sheet by earning returns on otherwise idle cash reserves. This practice contributes to its overall profitability and financial stability, especially in 2024.

- Shengjing Bank earns interest from lending surplus funds to other banks.

- This revenue stream is vital for managing the bank's liquidity position.

- It generates returns on short-term excess capital placements.

Shengjing Bank's core revenue stems from Net Interest Income, a primary driver in 2024, complemented by diverse non-interest income streams. Significant contributions come from fee and commission income, particularly from wealth management and trade finance activities. Furthermore, earnings from treasury investments and strategic interbank lending bolster the bank's overall financial performance and stability.

| Revenue Stream | 2024 Focus | Contribution |

|---|---|---|

| Net Interest Income | Core Lending | Primary |

| Fee/Commission | Diversification | Significant |

| Treasury/Interbank | Asset Mgmt | Supportive |

Business Model Canvas Data Sources

The Shengjing Bank Business Model Canvas is constructed using a combination of internal financial statements, customer transaction data, and regulatory filings. This ensures a data-driven approach to understanding the bank's operations and strategic positioning.