Shengjing Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shengjing Bank Bundle

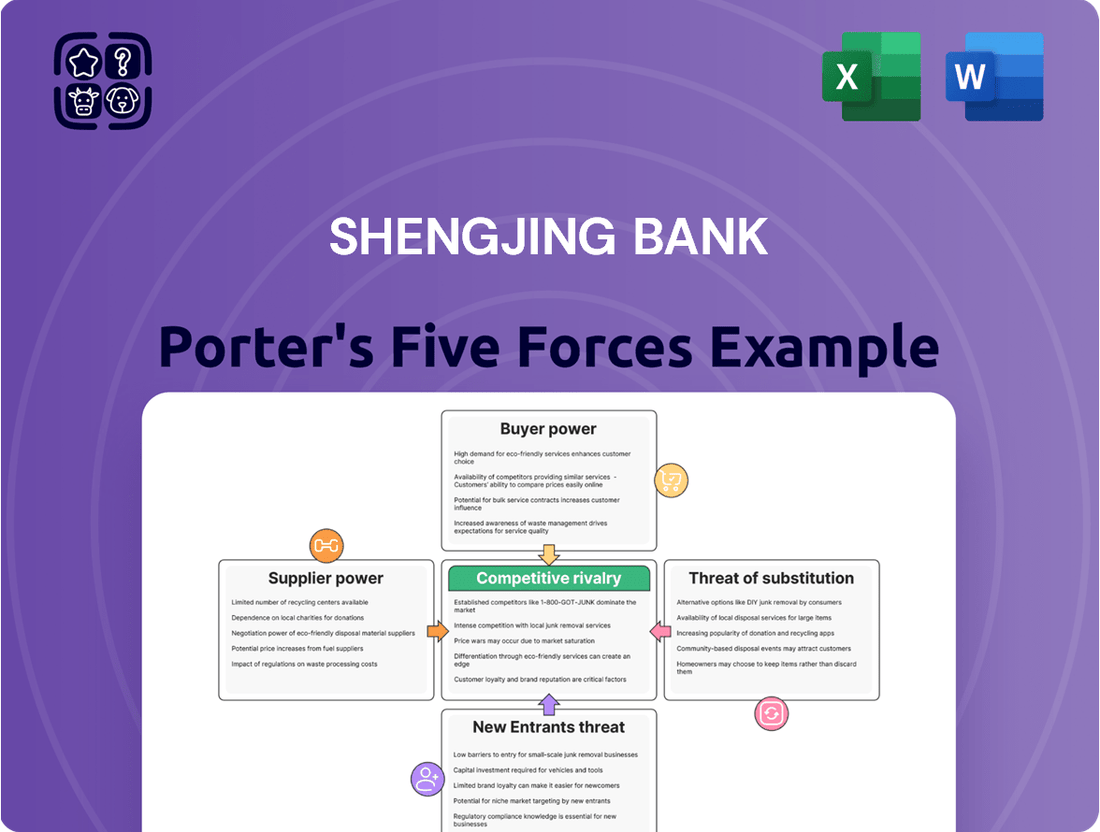

Shengjing Bank operates within a dynamic financial landscape where understanding competitive pressures is paramount. Our initial look at Porter's Five Forces reveals the intricate interplay of industry rivalry, buyer and supplier power, and the threats of new entrants and substitutes. These forces collectively shape the bank's strategic environment and profitability potential.

The complete report reveals the real forces shaping Shengjing Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Shengjing Bank's key 'suppliers' are its depositors, providing the essential capital for its lending operations. The cost of these funds, influenced by depositor behavior and market interest rates, directly affects the bank's profitability. In 2024, Chinese banks faced intense competition for deposits, with regulators intervening to manage practices, highlighting the critical importance of this funding source.

The interbank market is a primary source for banks like Shengjing Bank to secure short-term funds. Changes in interbank interest rates, such as the China Three Month Interbank Rate (Shibor), directly impact the cost for Shengjing Bank to manage its liquidity needs or finance specific activities. For instance, Shibor rates can fluctuate based on the PBOC's monetary policy decisions and overall market liquidity conditions.

As Shengjing Bank, like many financial institutions, increasingly embraces digital transformation, technology and software providers wield considerable influence. The bank’s reliance on advanced IT infrastructure, data analytics platforms, and sophisticated risk management tools places these suppliers in a strong position. In 2024, the global banking software market was valued at approximately $35 billion, highlighting the significant investment banks are making in these critical technologies.

The specialized nature of these technological solutions often means that switching providers can be complex and costly. This creates high switching costs for Shengjing Bank, further enhancing the bargaining power of its technology and software suppliers. For instance, integrating a new core banking system can take years and involve substantial capital expenditure, making continuity with existing, proven systems more appealing.

Human Capital and Talent Acquisition

Shengjing Bank's reliance on skilled human capital, especially in fintech, risk management, and wealth management, highlights the bargaining power of its suppliers – its employees. The intense competition for these specialized professionals within China's financial industry can significantly elevate their leverage, directly affecting the bank's labor costs and operational expenses. For instance, in 2023, the average salary for a financial analyst in China saw an increase, reflecting this demand.

Attracting and retaining top-tier talent is paramount for Shengjing Bank's continued expansion and its capacity for innovation. This necessitates competitive compensation packages and a strong employer brand. Failure to do so can lead to higher recruitment costs and potential disruptions to service delivery.

- Talent Demand: High demand for specialized skills in finance, particularly in rapidly evolving areas like AI in finance and sustainable finance.

- Employee Bargaining Power: Skilled professionals can negotiate higher salaries and better benefits due to scarcity and demand.

- Cost Impact: Increased talent acquisition and retention costs can directly impact Shengjing Bank's profitability.

- Innovation Link: Access to and retention of top talent are critical drivers for the bank's innovation pipeline and competitive edge.

Regulatory Compliance and Infrastructure

Regulatory bodies and the necessary infrastructure for compliance act as significant suppliers for Shengjing Bank. China's dynamic regulatory environment, especially with recent updates to capital adequacy ratios and data protection laws, requires substantial financial commitment and operational adjustments. For instance, the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) have consistently tightened rules, pushing banks to invest more in risk management systems and cybersecurity. This ongoing need for adaptation and investment, driven by these regulatory "suppliers," directly influences the bank's operational costs and strategic flexibility.

The bargaining power of these regulatory entities is inherently high because compliance is not optional. Shengjing Bank, like all financial institutions in China, must adhere to directives such as those outlined in the "Administrative Measures for the Financial Consumer Rights Protection" which came into effect in 2023, demanding robust consumer data handling protocols. Failure to comply can result in severe penalties, including fines and reputational damage, effectively granting regulators considerable leverage. This means Shengjing Bank has limited ability to negotiate the terms of these requirements; it must simply meet them.

Key aspects of this supplier power include:

- Mandatory Capital Requirements: Regulators dictate capital adequacy ratios, forcing banks to hold specific levels of capital, impacting how funds can be deployed.

- Data Security and Privacy Laws: Increasingly stringent regulations around customer data necessitate significant investments in IT infrastructure and compliance personnel.

- Operational Standards: Rules governing lending practices, risk assessment, and reporting require banks to maintain specific operational frameworks and systems.

- Technological Upgrades: Directives often push for adoption of new technologies for fraud detection and AML (Anti-Money Laundering) compliance, adding to infrastructure costs.

Shengjing Bank's suppliers are diverse, ranging from depositors and interbank lenders to technology providers and skilled employees. Depositors provide essential capital, but competition for their funds in 2024 intensified, potentially increasing Shengjing Bank's cost of capital. The bank's reliance on technology suppliers, in a market valued at $35 billion in 2024, also grants these firms significant leverage due to high switching costs. Furthermore, the scarcity of specialized talent in areas like fintech, with average analyst salaries increasing in 2023, strengthens employee bargaining power, directly impacting labor costs.

| Supplier Type | Key Dependence | Bargaining Power Factors | 2024 Relevance |

|---|---|---|---|

| Depositors | Capital funding | Competition for funds, interest rate sensitivity | Intensified competition for deposits |

| Interbank Market | Short-term liquidity | Market liquidity, PBOC policy | Shibor fluctuations impact funding costs |

| Technology Providers | Core banking systems, analytics | Specialized solutions, high switching costs | Global banking software market ~ $35 billion |

| Skilled Employees | Fintech, risk management expertise | Talent scarcity, demand for specialized skills | Increased demand and salary pressures for analysts |

What is included in the product

This analysis unpacks the competitive forces shaping Shengjing Bank's operating environment, detailing the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Identify and mitigate competitive threats with a clear visualization of Shengjing Bank's market position across all five forces.

Customers Bargaining Power

Shengjing Bank's customers, whether they are individuals or businesses, benefit from a crowded financial landscape in China. With numerous state-owned banks, national commercial banks, and a multitude of regional and city commercial banks, consumers have a vast selection of institutions to choose from.

This abundance of choice directly translates into greater bargaining power for customers. They can readily compare offerings and switch to financial providers that offer more attractive interest rates on deposits, more competitive loan terms, or superior service quality. For instance, by mid-2024, the average lending rate for corporate loans across major Chinese banks hovered around 4.0-5.0%, creating a benchmark for customers to negotiate from.

For basic banking services such as checking accounts, savings accounts, and simple personal loans, individual and small business customers often face minimal costs when switching providers. This low barrier to entry allows customers to easily move their funds and business to a competitor offering more favorable terms, such as higher interest rates or lower fees. For instance, in 2024, many neobanks and digital-first financial institutions continued to attract customers by offering streamlined onboarding processes and waiving many of the traditional account transfer fees that once deterred switching.

Shengjing Bank operates in a market where customers are highly attuned to interest rates on deposits and loans, and also to banking fees. This price sensitivity is amplified by narrowing net interest margins prevalent throughout China's banking sector.

In 2024, the trend of deposit rate cuts across major Chinese banks highlights this sensitivity; banks must offer competitive rates to attract and retain customers without compromising their own profitability.

For Shengjing Bank, managing this delicate balance is crucial. Offering slightly higher deposit rates or lower loan rates could attract more business, but it directly impacts the bank's earnings if not carefully managed against operational costs and fee structures.

The intense competition means customers can readily switch to institutions offering more favorable terms, underscoring the significant bargaining power they wield through their choices.

Access to Information and Digital Comparison

Customers now have unprecedented access to information about financial products, thanks to the digital age. This transparency allows them to easily compare Shengjing Bank's offerings against competitors regarding interest rates, fees, and features. For instance, by mid-2024, numerous financial comparison websites in China were actively listing and detailing banking products, enabling consumers to make well-informed choices and increasing their leverage.

This ease of comparison significantly boosts the bargaining power of customers. If Shengjing Bank's terms are less favorable, customers can readily identify and switch to alternatives. This dynamic forces banks to remain competitive, as demonstrated by the increasing use of digital channels for customer acquisition and retention strategies observed across the banking sector in 2024.

- Enhanced Information Accessibility: Digital platforms and financial news outlets provide readily available data on bank products.

- Informed Decision-Making: Customers can easily compare interest rates, service charges, and product features across institutions.

- Increased Negotiation Power: Greater knowledge empowers customers to negotiate better terms or switch providers if unsatisfied.

- Competitive Pressure: This transparency compels banks like Shengjing Bank to offer more attractive products and services to retain customers.

Influence of Large Corporate and Government Clients

Large corporate clients and government entities wield significant influence over Shengjing Bank. These major customers, particularly within the bank's corporate banking division, can negotiate more favorable terms due to their substantial transaction volumes and the potential for enduring partnerships. For instance, in 2023, Shengjing Bank's corporate banking segment contributed a significant portion of its revenue, highlighting the importance of these client relationships.

The ability of these powerful clients to shift their business to competitors or bring their banking needs in-house exerts considerable pressure on Shengjing Bank to offer competitive pricing and tailored financial solutions. This bargaining power translates into demands for lower interest rates on loans, preferential fees, and customized credit facilities, impacting the bank's profitability margins.

- Significant Client Base: Shengjing Bank serves a considerable number of large corporations and government agencies, forming a crucial segment of its business.

- Negotiating Leverage: Due to high transaction volumes and the strategic importance of these relationships, clients can negotiate better terms on financial products.

- Impact on Margins: This bargaining power can lead to reduced interest margins and fees for the bank, directly affecting its profitability.

- Client Retention Focus: Shengjing Bank must prioritize client satisfaction and competitive offerings to retain these high-value customers.

Shengjing Bank faces considerable customer bargaining power due to a highly competitive Chinese banking market, where numerous institutions offer comparable services. Customers can easily compare rates and switch providers for better deposit interest, loan terms, or service quality. In 2024, many digital banks attracted clients with lower fees and streamlined processes, increasing customer mobility.

The availability of online comparison tools and financial news in 2024 has significantly enhanced customer awareness of interest rates and fees, empowering them to negotiate or switch. This transparency forces banks like Shengjing to offer competitive pricing and superior service to retain their customer base, especially as net interest margins narrow.

Large corporate clients and government entities hold substantial influence, leveraging their transaction volumes to negotiate preferential terms on loans and fees. Shengjing Bank's corporate segment revenue in 2023 underscores the importance of these relationships and the pressure they exert on the bank's profitability margins.

| Factor | Impact on Shengjing Bank | 2024 Data/Trend |

|---|---|---|

| Market Competition | High customer bargaining power, forcing competitive pricing. | Abundance of state-owned, commercial, and regional banks. |

| Information Accessibility | Customers easily compare rates and switch providers. | Growth of financial comparison websites and digital banking platforms. |

| Price Sensitivity | Customers are highly responsive to interest rates and fees. | Narrowing net interest margins across the sector; deposit rate cuts observed. |

| Large Client Influence | Major clients negotiate favorable terms, impacting margins. | Corporate banking remains a crucial revenue driver for Shengjing. |

Same Document Delivered

Shengjing Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Shengjing Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the institution. You're viewing the actual, professionally crafted document that will be yours to download immediately upon purchase, offering no hidden surprises or placeholder content. This in-depth analysis covers the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all presented in a ready-to-use format. The document you see here is precisely what you’ll receive, providing valuable insights for strategic decision-making regarding Shengjing Bank.

Rivalry Among Competitors

Shengjing Bank faces intense competition within China's banking landscape, especially in its core Liaoning Province. The market is crowded with not only the dominant state-owned "Big Four" banks but also numerous national joint-stock commercial banks, and a multitude of other city and rural commercial banks. This dense competitive environment significantly pressures Shengjing Bank to differentiate its offerings and capture market share.

The Chinese banking sector, including Shengjing Bank, faces heightened competitive rivalry due to persistently narrowing net interest margins (NIMs). In 2024, NIMs for many Chinese banks saw a decline, with projections indicating this trend would continue into 2025. This squeeze on core profitability compels institutions to engage in more aggressive pricing strategies for both lending and deposit-taking.

This intense competition on pricing can manifest as a 'price war,' particularly in segments with high demand for credit or readily available deposits. Banks are pressured to offer lower interest rates on loans and higher rates on deposits to attract and retain customers, directly impacting their profitability. For instance, data from early 2024 indicated a significant drop in average lending rates across key sectors, reflecting this competitive dynamic.

Homogenized core banking products significantly intensify competitive rivalry. Basic offerings like savings accounts and personal loans are largely seen as interchangeable, leaving little room for differentiation based on features alone. This commoditization pushes banks to compete primarily on price and operational efficiency. For instance, in 2024, the average interest rate spread for major banks remained tight, reflecting this intense price-based competition.

High Exit Barriers in the Banking Sector

High exit barriers significantly fuel competitive rivalry within China's banking sector. These barriers are largely driven by stringent regulatory requirements that make winding down operations complex and costly. For instance, the China Banking and Insurance Regulatory Commission (CBIRC), now the National Financial Regulatory Administration (NFRA), imposes strict capital adequacy ratios and liquidity management rules that must be met even during an exit, making it a protracted process.

The substantial investments in physical infrastructure, such as bank branches and IT systems, represent large fixed assets that are difficult to divest or liquidate without significant losses. This immobility of assets discourages struggling banks from exiting. As of the end of 2023, Chinese banks collectively operated hundreds of thousands of branches, illustrating the scale of these fixed costs.

Furthermore, the systemic importance of financial institutions means that regulators are hesitant to allow any bank failure that could trigger a wider financial crisis. This often leads to forced mergers or restructurings rather than outright exits, keeping underperforming entities in the market. This environment fosters an oversupply of banking services, intensifying competition as all players strive to maintain market share and profitability.

The result is a market where numerous banks, including Shengjing Bank, contend for customers, leading to price competition on loans and deposits. This sustained rivalry is a direct consequence of the difficulty banks face in leaving the industry, a situation that persisted through early 2024.

- Regulatory Hurdles: NFRA oversight complicates and extends bank exit procedures.

- Asset Immobility: Large fixed assets like extensive branch networks are hard to liquidate.

- Systemic Risk Aversion: Regulators prioritize stability, often preventing clean exits.

- Market Oversupply: Difficulty in exiting leads to more banks competing for business.

Impact of Regulatory Landscape and Consolidation Efforts

China's National Financial Regulatory Administration (NFRA) is actively working to consolidate smaller rural banks and mitigate financial risks, a move that directly shapes the competitive arena for institutions like Shengjing Bank. This regulatory push aims for greater stability across the financial sector. For instance, in 2023, the NFRA continued its efforts to address risks in the rural banking sector, though specific consolidation figures for that year are still being fully compiled.

- Regulatory Consolidation: The NFRA's drive to consolidate smaller rural banks intensifies competition.

- Risk Management Focus: Efforts to manage financial risks can lead to industry restructuring.

- Mergers and Acquisitions: Reforms may spur M&A activity, altering regional market structures.

- Pressure on Standalone Banks: Shengjing Bank, as a regional player, faces increased pressure from these evolving dynamics.

Shengjing Bank operates in a hyper-competitive Chinese banking market, particularly in its home province of Liaoning. The presence of the "Big Four" state-owned banks, numerous national joint-stock banks, and a dense network of city and rural commercial banks means constant pressure to differentiate and capture market share. This intense rivalry is exacerbated by narrowing net interest margins, a trend that continued into 2024, forcing banks into aggressive pricing strategies for both loans and deposits. The commoditization of basic banking products further fuels this competition, pushing institutions to compete primarily on price and operational efficiency, as evidenced by tight average interest rate spreads observed in early 2024.

| Metric | 2023 (Approx.) | 2024 Outlook |

|---|---|---|

| Net Interest Margin (NIM) Trend | Narrowing | Continued Narrowing |

| Number of Competing Banks (Regional) | High (Dozens) | Stable/Slightly Increasing |

| Deposit Growth Pressure | High | High |

| Loan Pricing Competition | Intense | Intense |

SSubstitutes Threaten

The burgeoning fintech sector in China presents a formidable threat of substitutes for traditional banking services, particularly in payments. Platforms such as Alipay and WeChat Pay have fundamentally reshaped how consumers transact, offering seamless mobile payment solutions that increasingly replace traditional bank transfers and even cash. In 2023, mobile payments in China were estimated to account for over 80% of all retail transactions, a stark indicator of this substitution effect.

The rise of online lending and peer-to-peer (P2P) platforms presents a significant threat of substitution for Shengjing Bank. These platforms offer alternative avenues for borrowing and lending, often bypassing the more traditional, time-consuming bank loan application processes.

For instance, by mid-2024, the global P2P lending market was projected to reach hundreds of billions of dollars, demonstrating a clear preference for these digital alternatives among a growing segment of consumers and businesses seeking capital.

These fintech solutions can provide faster access to funds, particularly for individuals and small enterprises that may find themselves underserved by conventional banking systems, directly competing with and substituting Shengjing Bank's core lending services.

While regulatory scrutiny is increasing, the inherent convenience and potential for better rates offered by these substitute channels continue to erode the market share traditionally held by banks like Shengjing Bank.

The growing availability of wealth management products (WMPs) and direct financing channels presents a significant threat to Shengjing Bank. Savers are increasingly finding alternatives to traditional bank deposits, with WMPs in China offering potentially higher yields. For instance, by the end of 2023, the total assets under management in China's WMP market were nearing 27 trillion yuan, indicating a substantial pool of capital that could be diverted from bank deposits.

Furthermore, large corporations are finding it more feasible to raise capital directly through channels like corporate bond issuance and equity markets. This bypasses the need for traditional bank loans, diminishing Shengjing Bank's role as a primary capital provider. In 2024, the Chinese bond market saw robust issuance, with corporate bond volumes reaching trillions of yuan, providing ample alternative funding avenues for businesses.

Shadow Banking Activities

Shadow banking activities, such as peer-to-peer lending platforms and private credit funds, offer compelling alternatives to traditional Shengjing Bank services. These unregulated entities can often provide faster approvals and potentially higher returns on investments, drawing in both borrowers and lenders seeking greater flexibility and yield. For instance, by mid-2024, the global shadow banking sector was estimated to be worth trillions of dollars, demonstrating its substantial market presence.

These substitute offerings can siphon away valuable customers and capital from Shengjing Bank. As of early 2024, reports indicated a growing trend of retail investors diverting funds into alternative investment vehicles that fall outside the purview of traditional banking regulations. This shift puts pressure on Shengjing Bank to innovate and compete on both service and return.

- Increased competition for deposits and loans: Shadow banking entities can attract customers with specialized products.

- Potential for disintermediation: Direct lending and borrowing bypass traditional banking channels.

- Regulatory arbitrage: Less stringent oversight can allow shadow banks to offer more competitive terms.

- Systemic risk implications: The growth of unregulated finance can pose broader economic challenges.

Emergence of Digital Currencies

The rise of digital currencies, such as China's e-CNY, presents a potential threat of substitution to traditional banking services. As these digital alternatives gain traction, they could bypass conventional payment rails, diminishing the reliance on commercial banks for transaction processing. This shift might erode revenue streams for banks involved in payment services and potentially impact their deposit-gathering capabilities by offering alternative holding mechanisms for funds. For instance, by mid-2024, the e-CNY had seen significant pilot program expansion, indicating a growing ecosystem that could eventually challenge existing payment intermediaries.

This evolution could redefine the intermediary role banks play in the financial system. If digital currencies become widely adopted for everyday transactions and savings, the need for traditional bank accounts and payment networks might decrease. Consider the potential impact on transaction fees and the overall customer relationship, which could be reintermediated by digital currency platforms. The global exploration of central bank digital currencies (CBDCs) underscores this trend, with numerous countries actively researching or piloting their own digital currencies, aiming to improve payment efficiency and financial inclusion.

- Digital Currency Adoption: The increasing pilot programs and potential for wider consumer adoption of digital currencies, like the e-CNY, offer an alternative to traditional bank payment systems.

- Impact on Payment Processing: A successful transition to digital currencies could reduce the volume of transactions processed by commercial banks, impacting fee income.

- Deposit-Taking Challenges: Digital currencies might offer alternative store-of-value options, potentially affecting banks' ability to attract and retain deposits.

- Regulatory Landscape: Evolving regulations around digital currencies will play a crucial role in shaping their competitive impact on the banking sector.

The threat of substitutes for Shengjing Bank is substantial, driven by the rapid evolution of fintech and alternative financial channels. These substitutes offer convenience, potentially better returns, and faster access to capital, directly challenging the bank's traditional revenue streams and customer base.

Fintech platforms like Alipay and WeChat Pay have captured a significant share of the payment market, with mobile payments accounting for over 80% of retail transactions in China by 2023. Online lending and P2P platforms are also growing, with the global P2P lending market projected to reach hundreds of billions of dollars by mid-2024, diverting borrowers and lenders from traditional banking services.

Wealth management products (WMPs) and direct financing channels are further eroding the deposit base, with WMP assets under management nearing 27 trillion yuan by the end of 2023. Similarly, a robust Chinese bond market in 2024, with corporate bond volumes in the trillions of yuan, provides corporations with alternatives to bank loans.

| Substitute Category | Key Characteristics | Impact on Shengjing Bank | 2023/2024 Data Point |

|---|---|---|---|

| Fintech Payments | Seamless mobile transactions | Reduced transaction fee revenue | Over 80% of retail transactions via mobile payments (2023) |

| Online Lending/P2P | Faster loan approvals, alternative capital access | Loss of lending market share | Global P2P lending market projected to reach hundreds of billions (mid-2024) |

| Wealth Management Products (WMPs) | Potentially higher yields than deposits | Siphoning of deposit base | WMP assets under management nearing 27 trillion yuan (end-2023) |

| Direct Financing (Bonds/Equity) | Bypassing traditional bank loans | Reduced corporate lending opportunities | Chinese corporate bond volumes in trillions of yuan (2024) |

Entrants Threaten

Establishing a commercial bank in China, like Shengjing Bank, demands immense capital. For instance, as of late 2023 and early 2024, the minimum registered capital requirements for commercial banks in China have been substantial, often running into billions of Renminbi, making it difficult for new, less capitalized entities to even consider entering. This high barrier effectively deters many potential competitors.

Beyond just initial capital, new entrants must prove exceptional financial strength to gain regulatory approval from bodies like the China Banking and Insurance Regulatory Commission (CBIRC). This involves demonstrating a strong balance sheet, profitable operations, and sound risk management practices, which are difficult for smaller or non-financial companies to achieve and maintain, thereby limiting the threat of new entrants significantly.

Stringent regulatory frameworks significantly deter new entrants into China's banking sector. Authorities like the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC) impose rigorous compliance standards. Obtaining a banking license is an arduous and complex process, requiring substantial capital and adherence to strict operational guidelines, effectively creating a high barrier to entry for potential competitors.

Established banks, including Shengjing Bank, leverage strong brand loyalty and deep customer trust cultivated over years of service. For instance, by the end of 2023, Shengjing Bank reported a significant deposit base, reflecting sustained customer confidence. Newcomers must overcome this hurdle, as building comparable credibility to attract customers from established institutions is a considerable challenge.

Extensive Distribution Networks and Infrastructure

Shengjing Bank, like many traditional financial institutions, benefits from an extensive network of physical branches and ATMs. Establishing such infrastructure is a substantial capital investment and takes considerable time, acting as a significant barrier for potential new entrants. This existing physical footprint provides a tangible advantage in customer reach and service delivery, especially for demographics that still prefer in-person banking interactions.

While the digital shift is undeniable, a complete absence of physical touchpoints can still deter certain customer segments. New entrants must either invest heavily in replicating a broad physical presence or develop a digital-only strategy that can convincingly overcome the trust and accessibility advantages of established networks. For instance, in 2024, the cost of opening and maintaining a single bank branch can range from hundreds of thousands to millions of dollars, depending on location and scale.

- High Capital Investment: Building and maintaining a widespread network of branches and ATMs requires significant upfront capital.

- Time to Market: Developing a comparable physical infrastructure takes years, if not decades.

- Customer Trust and Accessibility: Established networks offer immediate accessibility and a perceived level of trust that new entrants struggle to replicate quickly.

- Digital Integration Challenges: Even digital-first banks often find it necessary to partner for physical cash services, highlighting the persistent value of established infrastructure.

Economies of Scale and Cost Advantages of Incumbents

Shengjing Bank, like other established financial institutions, benefits from significant economies of scale. This means their operational, technological, and risk management costs are spread over a larger base, allowing for more competitive pricing. For instance, in 2024, major banks continued to invest heavily in digital infrastructure, a cost that is more manageable for incumbents than for new entrants needing to build from scratch.

New banks entering the market would face substantial hurdles in achieving similar cost efficiencies. Without established customer bases and existing infrastructure, they would struggle to match the per-unit cost of services offered by larger, more scaled competitors. This cost disadvantage is a major barrier, as achieving profitability often requires significant initial investment and a considerable time to build market share.

- Economies of Scale: Large banks leverage scale in IT, compliance, and marketing, reducing per-transaction costs.

- Cost Advantages: Incumbents benefit from lower funding costs due to established reputations and access to diverse funding sources.

- Barriers to Entry: New entrants require massive capital for technology, regulatory compliance, and customer acquisition to compete on price.

- Shengjing Bank's Position: As of mid-2025, Shengjing Bank's extensive branch network and digital platforms contribute to its scale efficiencies, making it challenging for smaller, newer banks to replicate its cost structure.

The threat of new entrants for Shengjing Bank is considerably low due to the immense capital requirements and stringent regulatory landscape in China's banking sector. New entities must navigate complex licensing procedures and demonstrate substantial financial health, often requiring billions of Renminbi in registered capital, as seen with minimum requirements in late 2023 and early 2024. This high barrier, coupled with the need for robust risk management and operational soundness, effectively deters most potential competitors from entering the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Shengjing Bank leverages data from the bank's official annual reports, regulatory filings with the China Banking and Insurance Regulatory Commission (CBIRC), and reputable financial news outlets to gauge competitive pressures.