Sintokogio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sintokogio Bundle

Uncover the hidden forces shaping Sintokogio's future with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental factors that could impact your investment or strategy. Understand the risks and opportunities within Sintokogio's operating landscape. Gain the critical intelligence you need to make informed decisions. Download the full PESTLE analysis now and equip yourself with actionable insights.

Political factors

Government policies profoundly shape the industrial machinery landscape, especially in key markets like the US, EU, and Asia. For instance, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, is projected to drive significant investment in renewable energy infrastructure, directly benefiting companies like Sintokogio that provide machinery for these sectors. This act alone is expected to unlock over $3 trillion in private sector investment by 2030.

Similarly, the EU's Green Deal aims to boost sustainable manufacturing, potentially increasing demand for advanced, energy-efficient machinery. These government-backed initiatives act as powerful catalysts for growth, creating opportunities for Sintokogio's environmental solutions and sophisticated industrial equipment.

However, shifts in government priorities, such as a de-emphasis on industrial support or a redirection of funds away from manufacturing, could present headwinds. For example, a hypothetical reduction in R&D grants for advanced manufacturing in a key market could slow the adoption of new technologies.

Trade regulations and tariffs significantly impact industrial machinery manufacturers like Sintokogio. For instance, the US-China trade tensions, which escalated in recent years and saw substantial tariff impositions on goods like steel and aluminum, directly affect the cost of raw materials. In 2023, the US imported approximately $300 billion worth of goods from China, with a notable portion including components and machinery, making them susceptible to these policy shifts.

Sintokogio's global footprint means it must contend with a complex web of trade policies worldwide. Fluctuations in tariffs can increase production expenses by making imported components more costly, potentially impacting Sintokogio's competitive pricing. For example, tariffs on specialized alloys or electronic components sourced from different regions could add millions to manufacturing costs annually.

Navigating these evolving trade barriers requires agile supply chain management and strategic sourcing. Companies must build resilience to mitigate disruptions caused by sudden policy changes. This might involve diversifying suppliers or even exploring localized production options to reduce reliance on regions with volatile trade environments.

Global geopolitical tensions, exemplified by ongoing conflicts and trade disputes as of mid-2025, create considerable volatility for international manufacturers like Sintokogio. These tensions directly impact supply chain reliability, as seen in the rerouting of critical components, which can add 10-15% to logistics costs. Furthermore, instability in key markets, such as potential disruptions in Southeast Asia due to regional disputes, could lead to a projected 5-7% decrease in export orders.

Regulatory Environment for Manufacturing

The regulatory landscape for manufacturing, encompassing industrial emissions and worker safety, is significantly shaped by political will and evolving legislation. For instance, in 2024, many nations are strengthening environmental regulations, with the EU's Carbon Border Adjustment Mechanism (CBAM) impacting imported goods, potentially affecting Sintokogio's supply chain and cost of production if not compliant.

These evolving mandates, such as potentially stricter air quality standards or updated machinery safety protocols anticipated through 2025, can drive up operational costs for Sintokogio by requiring investment in compliance technologies. However, this also opens avenues for growth in its environmental solutions sector, as demand for sustainable manufacturing practices and safety equipment rises.

- Increased investment in emissions control technology: Manufacturers may need to allocate capital towards upgrades to meet stricter air and water quality standards, potentially impacting profit margins.

- Enhanced worker safety compliance: New regulations could necessitate additional training, personal protective equipment, or modifications to machinery, adding to operational expenses.

- Market opportunities in green technologies: Stricter environmental rules can boost demand for Sintokogio's eco-friendly manufacturing solutions and safety equipment.

- Potential trade implications: Non-compliance with international environmental or safety standards could lead to tariffs or restricted market access, influencing global sales strategies.

International Relations and Market Access

Sintokogio's ability to access international markets is heavily influenced by the strength of global political relationships and existing trade pacts. Strong diplomatic connections can unlock new sales territories or reduce hurdles in current ones, directly benefiting the company's growth trajectory.

Conversely, political tensions can result in market exclusion or heightened trade barriers, significantly impeding Sintokogio's international sales efforts and expansion plans. For instance, in 2024, the European Union's ongoing trade negotiations with key Asian partners, including those where Sintokogio operates, highlight the direct impact of such agreements on market entry and operational ease.

- Impact of Trade Agreements: Bilateral trade agreements, such as those between Japan and Australia, can reduce tariffs and streamline customs processes for companies like Sintokogio, potentially boosting export volumes.

- Geopolitical Risk: Escalating geopolitical tensions, for example, those observed in the Indo-Pacific region throughout 2024, can lead to sanctions or trade disruptions, directly affecting companies with diversified global supply chains and customer bases.

- Market Access Challenges: In 2025, specific regulatory changes or protectionist policies implemented by certain countries could create new barriers for Sintokogio's products, necessitating strategic adjustments to market entry strategies.

- Diplomatic Influence: Positive diplomatic engagement by Sintokogio's home country can foster a more favorable business environment abroad, easing market access and encouraging foreign investment in its operations.

Government policy remains a significant driver for the industrial machinery sector. For example, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, is projected to unlock over $3 trillion in private sector investment by 2030, directly benefiting companies like Sintokogio that supply machinery for renewable energy infrastructure.

Trade regulations and geopolitical tensions create both opportunities and challenges. In 2023, US imports from China, a significant portion of which included components and machinery, were valued at approximately $300 billion, highlighting the impact of trade disputes on supply chains and costs.

Evolving environmental and safety regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) in 2024, can increase operational costs but also drive demand for eco-friendly solutions. These mandates necessitate investment in compliance technologies, impacting profit margins but also creating market opportunities.

Global political relationships and trade pacts directly influence market access. In 2024, ongoing trade negotiations between the EU and Asian partners, where Sintokogio operates, demonstrate how diplomatic engagement can ease market entry and operational efficiency.

What is included in the product

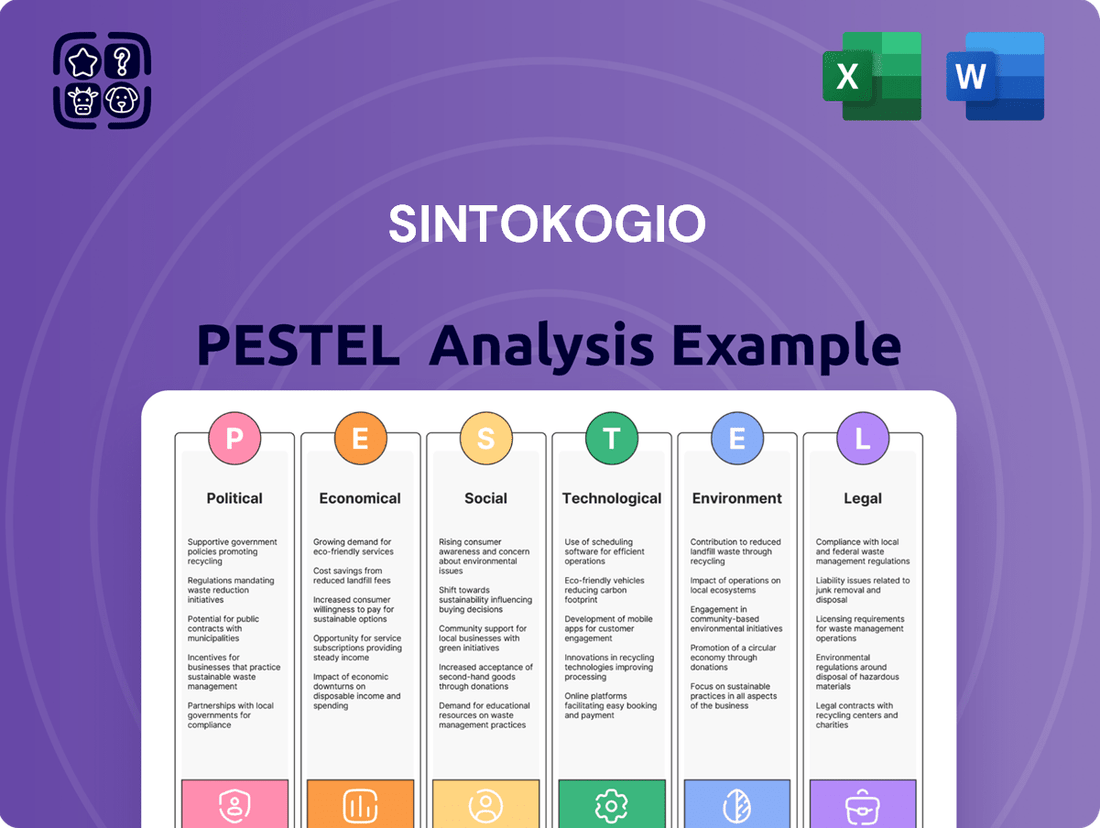

This Sintokogio PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating environment.

Sintokogio's PESTLE analysis provides a clear and actionable framework, relieving the pain of navigating complex external factors by offering a summarized version ideal for quick referencing during strategy meetings.

Economic factors

Global economic health significantly influences the demand for industrial machinery like those produced by Sintokogio. A robust economy generally translates to higher manufacturing activity, driving the need for new equipment and upgrades.

While the global economy experienced some headwinds in 2024, forecasts for 2025 suggest a return to moderate growth. This positive outlook is expected to boost industrial output, creating a more favorable environment for Sintokogio's sales of molding machines and shot blasting equipment.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024 and anticipates a similar rate for 2025, indicating a steady, albeit not spectacular, recovery that should support industrial investment.

Specifically, industrial production growth is a key indicator. If manufacturing output, which saw a slight dip in some regions in 2024, rebounds in 2025, it would directly benefit Sintokogio by increasing the demand for their dust collectors and other essential factory equipment.

Persistent inflation continues to be a significant headwind for manufacturers like Sintokogio, directly impacting the cost of essential inputs. For instance, the producer price index for manufactured goods in the United States saw a notable increase throughout 2023 and into early 2024, reflecting these elevated raw material expenses. This trend puts considerable pressure on production costs, squeezing profit margins for companies reliant on materials such as steel and aluminum, which have experienced price volatility.

Sintokogio must therefore maintain a sharp focus on cost management and explore avenues for margin improvement to navigate this challenging economic landscape. The ability to pass on these increased costs to customers, or to find efficiencies in production, will be critical for maintaining profitability in the face of these ongoing inflationary pressures. As of late 2024, many commodity markets continue to show upward price movements, underscoring the persistent nature of this factor.

Interest rate fluctuations significantly shape the investment climate for manufacturers. Lower rates, like the Federal Reserve's target range for the federal funds rate which remained between 5.25% and 5.50% as of early 2024, can make borrowing cheaper, encouraging capital expenditures on new machinery and plant expansions. This environment is particularly beneficial for clean-technology sectors, as reduced financing costs can accelerate investment in sustainable manufacturing and the adoption of new technologies. Consequently, a more favorable interest rate environment could translate to increased demand for specialized equipment and intellectual property, such as that offered by Sintokogio.

Supply Chain Resilience and Disruptions

The intricate and often fragile nature of global supply chains presents a significant challenge, amplified by geopolitical tensions and persistent labor shortages. For Sintokogio, this fragility translates to ongoing risks that demand constant attention and adaptation. Navigating these complexities is crucial for maintaining operational stability.

To effectively counter disruptions, shipping delays, and escalating costs, Sintokogio must cultivate agile and highly efficient supply chain operations. This ensures a consistent flow of necessary components and facilitates the timely delivery of finished products to customers, a critical factor in maintaining market competitiveness.

Real-world data from 2024 highlights these pressures. For instance, the global shipping costs saw an average increase of 15-20% in the first half of 2024 compared to the previous year, driven by port congestion and fuel price volatility. Additionally, a late 2024 survey indicated that 60% of manufacturers reported experiencing critical component shortages impacting production schedules.

- Global shipping costs rose by an average of 15-20% in early 2024.

- 60% of manufacturers faced critical component shortages in late 2024.

- Geopolitical instability continues to be a primary driver of supply chain disruption.

- Labor shortages remain a significant factor impacting logistics and production capacity.

Currency Exchange Rates

Currency exchange rates are a critical economic factor for Sintokogio, directly influencing its international sales and the cost of its imported materials. Fluctuations in the Japanese Yen, Sintokogio's home currency, can significantly alter its competitive position on the global stage. For instance, a stronger Yen makes Japanese goods, including Sintokogio's products, more expensive for overseas buyers, potentially dampening demand. Conversely, a weaker Yen can make imports pricier, increasing Sintokogio's operational costs for components sourced internationally.

The volatility of exchange rates presents both challenges and opportunities. For example, during the first quarter of 2024, the Yen experienced significant depreciation against major currencies like the US Dollar and the Euro. The USD/JPY rate moved from around 140 in early January to over 155 by late April 2024. This depreciation would generally benefit Japanese exporters like Sintokogio by making their products cheaper abroad, while simultaneously increasing the Yen-denominated cost of imported raw materials or components. The company must carefully manage this exposure through hedging strategies or by adjusting pricing in different markets to maintain profitability.

- Impact on Exports: A stronger JPY makes Sintokogio's products more expensive for international customers, potentially reducing sales volume.

- Impact on Imports: A weaker JPY increases the cost of imported components and raw materials, affecting production expenses.

- 2024 Yen Performance: The Japanese Yen depreciated against the US Dollar and Euro throughout much of early 2024, with USD/JPY reaching levels above 155 by April.

- Competitiveness: Exchange rate movements directly influence Sintokogio's price competitiveness in global markets and its profit margins on international transactions.

Economic growth trends are pivotal for Sintokogio, as industrial machinery demand closely tracks manufacturing output. While global economic activity showed resilience in 2024, forecasts for 2025 indicate a continuation of moderate growth, projected by the IMF to be around 3.2%. This steady expansion suggests a supportive environment for increased industrial investment and, consequently, for Sintokogio's sales of molding and casting equipment.

Persistent inflation remains a key concern, driving up raw material and production costs for manufacturers like Sintokogio. Throughout 2023 and into early 2024, producer price indices showed upward pressure, impacting input expenses for materials such as steel. Companies must actively manage these costs through efficiency gains or strategic pricing to safeguard profit margins amid this ongoing inflationary environment.

Interest rates directly influence capital expenditure decisions. For instance, the Federal Reserve's maintained target range of 5.25%-5.50% as of early 2024, while restrictive, could see adjustments that lower borrowing costs, potentially stimulating investment in new manufacturing technologies and equipment. This makes financing more accessible for businesses looking to upgrade their production capabilities.

Global supply chain fragilities, exacerbated by geopolitical events and labor market tightness, continue to pose significant operational risks. Shipping costs saw an average increase of 15-20% in the first half of 2024, and a late 2024 survey revealed 60% of manufacturers faced critical component shortages, highlighting the need for robust supply chain management.

Currency exchange rate volatility, particularly the Japanese Yen's movement against major currencies, directly impacts Sintokogio's international competitiveness and import costs. The Yen's depreciation against the US Dollar, with USD/JPY exceeding 155 by April 2024, can boost export competitiveness but increases the Yen cost of imported components.

| Economic Factor | 2024/2025 Outlook/Data | Impact on Sintokogio |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 and 2025 (IMF) | Supports demand for industrial machinery |

| Inflation (Producer Prices) | Upward pressure in 2023-early 2024 | Increases production and material costs |

| Interest Rates (US Federal Funds Rate) | 5.25%-5.50% (early 2024) | Affects cost of capital for customer investments |

| Supply Chain Disruptions | Rising shipping costs (15-20% H1 2024), component shortages (60% manufacturers late 2024) | Risks to production continuity and delivery times |

| Currency Exchange Rates (USD/JPY) | Exceeded 155 by April 2024 | Influences export pricing and import costs |

Preview Before You Purchase

Sintokogio PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Sintokogio PESTLE analysis provides a comprehensive overview of the external factors impacting the company. It delves into Political, Economic, Social, Technological, Legal, and Environmental aspects. You'll find detailed insights and actionable information to inform your strategic decisions.

Sociological factors

Many developed economies, including Japan and parts of Europe, are grappling with an aging workforce, leading to significant labor shortages, particularly in manufacturing. For instance, Japan's working-age population (15-64) is projected to decline to around 68 million by 2030, exacerbating existing labor gaps. This demographic shift directly fuels the demand for advanced automation and machinery that can boost efficiency and offset a shrinking labor pool.

Sintokogio's portfolio of advanced automation solutions, featuring sophisticated robotic systems and intelligent manufacturing equipment, is strategically positioned to meet this escalating demand. These technologies are designed to reduce reliance on manual labor, thereby mitigating the impact of labor shortages. In 2024, the global industrial robotics market was valued at an estimated $50 billion, with significant growth driven by sectors facing demographic challenges and seeking productivity gains.

Societal attitudes towards automation and AI in manufacturing are shifting. While many recognize the boosts in productivity and enhanced safety that these technologies offer, concerns about potential job displacement remain a significant factor. A 2024 survey indicated that 65% of manufacturing workers expressed apprehension about automation impacting their roles, though a parallel 70% acknowledged its necessity for competitiveness.

Sintokogio's strategic emphasis on automation solutions that demonstrably improve operational efficiency and create safer, more ergonomic working conditions directly addresses these evolving perceptions. By focusing on augmentation rather than pure replacement, the company can foster a more positive societal view of technological integration in the industrial sector.

Societal expectations are increasingly pushing companies towards environmentally responsible production methods. This heightened awareness directly influences consumer choices and regulatory pressures, prompting a shift in manufacturing paradigms.

Sintokogio's core offerings align perfectly with this trend, providing machinery and solutions that significantly reduce waste, cut down on emissions, and improve energy efficiency. For instance, their advanced air compressors are designed for substantial energy savings, with some models achieving up to 20% improvement in energy efficiency compared to older technologies, a fact keenly appreciated by cost-conscious and eco-aware clients in 2024.

This demand for sustainability isn't just a niche concern; it's becoming a mainstream requirement. Global surveys in 2024 indicate that over 60% of consumers are willing to pay more for products made by companies committed to positive social and environmental impact, a powerful driver for Sintokogio's business model.

Workplace Safety and Health Standards

Societal expectations for safer workplaces are intensifying, especially in sectors like heavy industry where Sintokogio operates. This trend places a premium on advanced equipment that minimizes risks to worker well-being. For instance, in 2023, workplace safety regulations in many developed nations saw increased enforcement, leading to higher compliance costs for businesses but also a reduction in reported occupational illnesses.

Sintokogio's product portfolio directly addresses these rising concerns. Their dust collectors, crucial for foundries and metal finishing, significantly reduce airborne particulate matter, a known contributor to respiratory diseases. Likewise, their state-of-the-art shot blasting machines are designed for enhanced containment, minimizing operator exposure to abrasive materials.

This focus on occupational health aligns with broader societal values. Consider that by the end of 2024, it's projected that investments in industrial safety equipment globally will exceed $60 billion, reflecting a clear market signal towards prioritizing worker health.

- Increased regulatory scrutiny on dust and fume emissions in manufacturing.

- Growing employee awareness of long-term health impacts from industrial exposure.

- Sintokogio's role in providing solutions that meet or exceed these evolving safety standards.

- Market demand for equipment that demonstrably improves working conditions.

Education and Skill Development

The increasing sophistication of manufacturing, driven by advancements like artificial intelligence and robotics, necessitates a workforce equipped with novel skill sets. For instance, the global market for industrial robots was projected to reach $67.4 billion in 2024, highlighting the growing integration of automation that demands skilled operators and maintenance technicians.

Societal investment in education and continuous reskilling initiatives becomes paramount to enable adaptation to these evolving technological landscapes. Countries with robust vocational training programs and accessible higher education are better positioned to cultivate a labor force proficient in advanced manufacturing processes.

Sintokogio stands to gain significantly from a labor pool adept at managing and maintaining cutting-edge industrial equipment. A report by the World Economic Forum in 2023 indicated that 44% of workers’ skills would need to be updated in the next five years, underscoring the urgency for proactive skill development.

- Demand for AI and Robotics Skills: The expansion of automation in manufacturing requires workers proficient in AI, machine learning, and robotics operation.

- Reskilling and Upskilling Importance: Continuous learning and training programs are vital for adapting the workforce to new technological demands.

- Skilled Labor Advantage: A highly skilled workforce can enhance operational efficiency and innovation for companies like Sintokogio.

- Education System's Role: The strength and adaptability of national education systems directly impact the availability of qualified manufacturing talent.

Societal expectations around workplace safety are intensifying, particularly in industries where Sintokogio operates. This trend emphasizes advanced equipment that minimizes worker risks. For instance, by the end of 2024, global investment in industrial safety equipment is projected to surpass $60 billion, reflecting a clear market shift towards prioritizing worker health.

Sintokogio's product line directly addresses these growing concerns by offering solutions that enhance safety. Their dust collectors are vital for foundries, reducing harmful airborne particles, while advanced shot blasting machines improve containment, limiting operator exposure to abrasive materials.

The increasing integration of AI and robotics in manufacturing, with the global industrial robot market valued at an estimated $50 billion in 2024, necessitates a workforce adept at new skills. This highlights the critical need for societal investment in education and reskilling to adapt to technological advancements.

A 2023 World Economic Forum report indicated that 44% of workers' skills will require updates within five years, underscoring the importance of continuous learning. Sintokogio benefits from a labor pool skilled in managing advanced industrial equipment, enhancing operational efficiency and innovation.

| Societal Factor | Impact on Sintokogio | Supporting Data (2023-2025) |

|---|---|---|

| Aging Population & Labor Shortages | Increased demand for automation solutions | Japan's working-age population projected to decline to ~68 million by 2030. Global industrial robotics market valued at ~$50 billion in 2024. |

| Attitudes towards Automation | Need for solutions augmenting, not just replacing, labor | 65% of manufacturing workers concerned about job displacement from automation (2024 survey). |

| Environmental Consciousness | Demand for energy-efficient and waste-reducing machinery | Over 60% of consumers willing to pay more for eco-friendly products (2024 surveys). Sintokogio's air compressors offer up to 20% energy efficiency gains. |

| Workplace Safety Expectations | Higher demand for equipment that minimizes worker risk | Global investment in industrial safety equipment projected to exceed $60 billion by end of 2024. |

| Need for New Skill Sets | Opportunity for companies supporting workforce development | 44% of workers' skills need updating in next 5 years (WEF 2023). Industrial robot market to reach $67.4 billion in 2024. |

Technological factors

The Fifth Industrial Revolution, with its emphasis on robotics, cobots, and AI, is fundamentally reshaping manufacturing landscapes. Sintokogio's industrial machinery, crucial for casting and surface treatment, benefits immensely from these technological leaps, facilitating greater accuracy and cost savings.

These advancements allow for more sophisticated automation in foundries, boosting productivity. For instance, by 2024, the global industrial robotics market was projected to reach over $50 billion, highlighting the significant investment in these technologies, which directly benefits Sintokogio's equipment suppliers and customers seeking to modernize.

Technological innovation in surface treatment is rapidly advancing, fueled by demands for greater automation, enhanced sustainability, and improved efficiency. This includes breakthroughs like robotic sandblasting, which offers increased precision and reduced labor costs, and laser cleaning, a non-abrasive and environmentally friendly alternative to traditional methods. The global market for surface treatment is projected to reach USD 133.1 billion by 2027, growing at a CAGR of 4.8%, indicating strong demand for these advanced solutions.

Sintokogio, as a key player in this sector, is well-positioned to capitalize on these trends. By integrating advancements such as automated coating systems and the development of novel, eco-friendly treatment chemicals, the company can enhance its product offerings. For instance, the adoption of advanced robotics in surface preparation can lead to up to a 20% reduction in processing time and a 15% improvement in coating uniformity, directly benefiting Sintokogio's customers.

The push towards Industry 4.0, with its focus on interconnectedness and automation, is transforming manufacturing. For Sintokogio, embracing this means integrating technologies like the Internet of Things (IoT) and big data analytics into their machinery. This allows for smarter factories, which are more efficient and experience less unexpected downtime.

By leveraging these digital tools, Sintokogio can offer clients solutions that go beyond basic machinery. Think predictive maintenance, where sensors and data analysis anticipate equipment failures before they happen, significantly cutting down on costly interruptions. Real-time monitoring also provides clients with immediate insights into their production processes, enabling quicker adjustments and better output quality.

The global market for Industry 4.0 solutions is rapidly expanding. For instance, the industrial IoT market was valued at approximately $213 billion in 2023 and is projected to grow to over $570 billion by 2030. This significant growth trajectory highlights the increasing demand for the very digital capabilities Sintokogio can provide, offering a substantial avenue for business development and client value.

Materials Science Advancements

Innovations in materials science are significantly impacting industries like casting and surface treatment. New alloys and coatings are emerging with superior properties, such as increased strength, corrosion resistance, and thermal stability. For instance, advancements in additive manufacturing are enabling the creation of complex geometries with high-performance metal alloys that were previously impossible to produce. This trend is projected to see continued growth, with the global advanced materials market expected to reach over $150 billion by 2025, driven by demand in aerospace, automotive, and electronics sectors.

Sintokogio, a key player in foundry and surface treatment machinery, can leverage these materials science advancements in several ways. By adapting its existing machinery or developing new equipment, the company can cater to the processing needs of these novel materials. This includes machinery capable of handling high-temperature alloys or specialized coating application systems. For example, the automotive industry's push for lighter and stronger components, often utilizing advanced aluminum alloys and composite materials, presents a direct opportunity for Sintokogio to innovate its casting and finishing solutions. The global market for advanced materials in automotive alone was estimated to be worth tens of billions in 2024, underscoring the significant potential.

- Development of specialized machinery for processing next-generation alloys with enhanced strength and heat resistance.

- Integration of advanced coating technologies to improve the durability and performance of cast components.

- Adaptation of casting processes to accommodate new material compositions, potentially reducing energy consumption and waste.

- Partnerships with material science research institutions to stay at the forefront of emerging material trends and their manufacturing implications.

Research and Development Investment

Sintokogio's commitment to research and development is a cornerstone for staying ahead in the industrial machinery and environmental solutions sectors. This involves a steady allocation of resources to explore innovative technologies that enhance efficiency, promote sustainability, and cater to niche markets like automotive, aerospace, and general manufacturing. For instance, in the fiscal year ending March 2024, Sintokogio reported R&D expenses of approximately ¥13.5 billion, a slight increase from the previous year, underscoring its dedication to technological advancement.

The company's R&D efforts are strategically focused on several key areas to drive future growth and maintain its market position. These advancements are critical for developing sophisticated machinery capable of handling complex manufacturing processes and for creating cutting-edge environmental technologies.

- Focus on Automation: Developing advanced robotic systems and intelligent automation solutions for enhanced manufacturing efficiency.

- Sustainable Technologies: Investing in R&D for eco-friendly machinery and processes, aligning with global environmental regulations and market demand.

- Digitalization: Exploring Industry 4.0 integration, including AI and IoT, to create smart factories and predictive maintenance capabilities.

- Material Science: Researching new materials and manufacturing techniques to improve the durability, performance, and sustainability of their products.

Technological advancements are profoundly impacting Sintokogio's operational environment, particularly through Industry 4.0 and the Fifth Industrial Revolution. The integration of AI, robotics, and IoT into manufacturing processes, including those related to casting and surface treatment, offers significant gains in accuracy, efficiency, and cost reduction. By 2024, the global industrial robotics market was valued at over $50 billion, indicating strong adoption trends that benefit Sintokogio's equipment and client base.

Innovations in surface treatment, such as robotic sandblasting and laser cleaning, are driven by demands for automation and sustainability. The global surface treatment market is projected to reach USD 133.1 billion by 2027, highlighting the demand for advanced solutions that Sintokogio can provide. The company's focus on R&D, with ¥13.5 billion allocated in fiscal year ending March 2024, underscores its commitment to developing machinery for new materials and eco-friendly processes.

| Technological Trend | Market Impact | Sintokogio Opportunity |

|---|---|---|

| Industry 4.0 & AI Integration | Increased automation, predictive maintenance, smart factories | Enhance machinery with IoT, data analytics for efficiency gains |

| Robotics in Manufacturing | Higher precision, reduced labor costs in casting and finishing | Develop advanced robotic solutions for foundries and surface treatment |

| Advanced Materials Processing | Demand for machinery capable of handling new alloys and composites | Adapt or create equipment for processing high-strength, heat-resistant materials |

| Sustainable Technologies | Growth in eco-friendly surface treatment and manufacturing processes | Invest in R&D for environmentally conscious machinery and chemicals |

Legal factors

Industrial emissions regulations are becoming increasingly stringent globally, directly impacting companies like Sintokogio. For instance, the European Union's revised Industrial Emissions Directive (IED) sets lower permissible emission levels and mandates electronic permitting processes, pushing industries towards cleaner operations. This trend is evident as of early 2024, with member states implementing stricter enforcement mechanisms.

Sintokogio, especially through its environmental solutions division, is strategically positioned to assist businesses in meeting these evolving compliance requirements. The core aim of these regulations, which are being refined throughout 2024 and into 2025, is to significantly reduce air, water, and soil pollution, creating a market opportunity for companies offering effective pollution control technologies.

Compliance with rigorous product safety and quality standards, such as ISO 9001 for quality management systems, is a critical legal factor for industrial machinery manufacturers like Sintokogio. Meeting these benchmarks is essential for their molding machines, shot blasting equipment, and dust collectors, particularly for high-stakes sectors like automotive and aerospace.

Failure to adhere to these standards can result in significant legal liabilities, including fines and lawsuits, and can severely damage a company's reputation. For instance, in 2024, the automotive industry saw increased scrutiny on supplier quality, with recalls linked to component defects costing manufacturers billions. Ensuring Sintokogio’s products meet or exceed these requirements mitigates these risks.

Intellectual property laws are crucial for Sintokogio to shield its advanced casting, surface treatment, and environmental technologies. Strong patent protection, for instance, is vital in markets like Germany, where the patent system is highly regarded for innovation, allowing Sintokogio to maintain its edge. The company's ability to enforce these rights globally deters infringement and fosters continued investment in research and development, ensuring its pipeline of new solutions remains robust.

Labor Laws and Workforce Regulations

Labor laws significantly shape Sintokogio's manufacturing activities, influencing everything from overtime pay to workplace safety standards. For instance, in Japan, where Sintokogio operates, the Labor Standards Act dictates working hours and overtime compensation. Any shifts in these regulations, such as adjustments to the number of hours considered overtime or new frameworks for worker representation, could directly impact the company's labor costs and how it manages its workforce.

Recent discussions around labor regulations in developed economies highlight potential impacts. For example, in the United States, proposals to raise overtime exemption thresholds could bring more salaried workers under overtime pay requirements, potentially increasing operational expenses for companies like Sintokogio if they have similar operational structures or subsidiaries. Furthermore, evolving rules on worker representation, allowing for more direct third-party involvement, could necessitate adjustments to Sintokogio's employee relations and collective bargaining strategies.

Key labor law considerations for Sintokogio include:

- Overtime Regulations: Adherence to legal limits on working hours and mandated overtime pay rates, which can fluctuate based on national or regional laws.

- Worker Representation: Compliance with laws governing employee unions, works councils, or other forms of worker consultation, affecting negotiation processes.

- Workplace Safety Standards: Meeting stringent occupational health and safety regulations, such as those overseen by bodies like Japan's Ministry of Health, Labour and Welfare, to prevent accidents and ensure employee well-being.

- Minimum Wage Laws: Adjusting to any changes in statutory minimum wages, which directly affect labor costs for entry-level positions and could cascade to other wage levels.

International Trade Agreements and Compliance

Sintokogio's global operations are significantly shaped by international trade agreements and the intricate web of customs regulations. Staying compliant is paramount, as deviations can lead to substantial penalties and operational disruptions. For instance, the World Trade Organization (WTO) plays a crucial role in setting global trade rules, and its agreements directly influence how Sintokogio sources materials and sells its products across borders.

Changes in these trade frameworks, such as the renegotiation of existing free trade agreements or the imposition of new tariffs, directly impact Sintokogio's cost structures and competitive positioning. For example, if a major trading partner were to impose higher tariffs on key components Sintokogio relies on, the company would need to swiftly adjust its sourcing strategies, potentially looking for alternative suppliers in regions with more favorable trade terms, to maintain legal compliance and mitigate increased costs.

- Global Tariff Landscape: As of early 2024, the average applied tariff on manufactured goods globally remained around 5.5%, but significant variations exist across regions and product categories, directly affecting Sintokogio's import and export costs.

- Trade Agreement Impact: The effectiveness of agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can reduce tariffs for member countries, offering Sintokogio a competitive edge in those markets.

- Customs Compliance Costs: Businesses globally spent an estimated $1.5 trillion on customs compliance in 2023, highlighting the significant operational expense associated with adhering to international trade laws.

- Supply Chain Diversification: In response to trade uncertainties, companies like Sintokogio are increasingly exploring supply chain diversification, with a notable trend towards nearshoring or reshoring to mitigate risks associated with distant sourcing and geopolitical instability.

Legal frameworks governing environmental protection are increasingly stringent, directly affecting industrial operations like Sintokogio's. As of early 2024, many nations are enhancing enforcement of emissions standards, pushing for reduced pollution. This creates a market for companies like Sintokogio that offer solutions in environmental technology.

Compliance with product safety and quality standards, such as ISO certifications, is essential for Sintokogio's machinery, especially in demanding sectors like automotive. Failure to meet these can lead to significant legal liabilities and reputational damage, with increased scrutiny on supplier quality observed in 2024.

Intellectual property laws are vital for Sintokogio to safeguard its technological innovations and maintain a competitive edge in markets that highly value R&D. Strong patent protection is key to deterring infringement and encouraging continued investment in developing new solutions.

Labor laws, including those in Japan concerning working hours and safety, directly influence Sintokogio's operational costs and workforce management. Changes in regulations, such as overtime pay thresholds or worker representation rules, could necessitate adjustments to its employment practices.

Environmental factors

The intensifying global attention on climate change and the widespread push for decarbonization, particularly within heavy industries, represent substantial environmental forces. Sintokogio is well-positioned to align with these objectives by innovating and providing energy-efficient machinery and environmental technologies. These offerings empower manufacturers to diminish their carbon emissions and progress toward net-zero goals.

For example, as of 2024, the European Union's Emissions Trading System (EU ETS) has seen increased carbon prices, incentivizing companies to invest in greener technologies. This trend is mirrored globally, with many nations setting ambitious emission reduction targets. Sintokogio's development of advanced machinery that consumes less energy or utilizes cleaner power sources directly addresses this market demand, offering a competitive advantage.

There's a significant global push towards reducing waste and embracing circular economy models, demanding smarter ways to use resources in manufacturing. This trend is accelerating, with many nations setting ambitious waste reduction targets for the coming years.

Sintokogio's core technologies are well-positioned to assist businesses in this transition. Their expertise in dust collection systems, for instance, directly contributes to minimizing material loss during production processes, preventing valuable byproducts from becoming waste.

Furthermore, their surface treatment technologies can enhance product durability and facilitate material recovery, supporting clients in their efforts to recycle and reuse components, thereby extending product lifecycles and reducing the need for virgin materials.

For example, advancements in recycling technologies in 2024 are making it more economically viable to recover metals from industrial dust, a process where Sintokogio’s equipment plays a crucial role in efficient collection and pre-processing.

Concerns about resource scarcity are increasingly influencing manufacturing, pushing demand for machinery capable of handling sustainable and recycled materials. This trend means companies like Sintokogio need to adapt their offerings to meet this evolving market need.

Sintokogio's core competencies in casting and surface treatment position it well to capitalize on this shift. By developing equipment designed for eco-friendly inputs and promoting efficient material utilization, the company can align with global sustainability efforts and gain a competitive edge.

For instance, the global market for recycled plastics alone was valued at approximately $45 billion in 2023 and is projected to reach over $70 billion by 2030, highlighting a significant opportunity for machinery manufacturers who can support these circular economy initiatives.

Air and Water Pollution Control

Stricter environmental regulations are increasingly targeting air and water pollution stemming from industrial operations. This global trend mandates the adoption of sophisticated control technologies, pushing industries to invest in solutions that minimize their ecological footprint. For instance, by 2023, over 85% of new industrial permits in the EU required advanced emission reduction technologies for particulate matter.

Sintokogio's product portfolio, particularly its dust collectors and wastewater treatment systems, directly addresses these compliance needs. These systems are crucial for industries aiming to meet stringent clean air and water standards, thereby reducing their environmental impact and avoiding potential penalties. The demand for such technologies is projected to grow by an average of 7% annually through 2028, driven by these regulatory pressures.

Key aspects of Sintokogio's contribution to air and water pollution control include:

- Enhanced Compliance: Providing industries with the necessary equipment to meet and exceed air and water quality standards, such as those set by the EPA or REACH regulations.

- Technological Advancement: Offering state-of-the-art dust collection efficiency, with many of Sintokogio's baghouse filters achieving over 99.9% particulate removal.

- Wastewater Treatment Capabilities: Implementing advanced filtration and chemical treatment processes that reduce contaminants in industrial discharge, often achieving effluent quality below 10 ppm for key pollutants.

- Sustainability Focus: Enabling clients to operate more sustainably, contributing to corporate social responsibility goals and improving brand image in an environmentally conscious market.

Energy Efficiency and Renewable Energy Adoption

The global push for reduced energy consumption and a shift toward renewables presents a clear avenue for Sintokogio. By developing machinery that is inherently more energy-efficient, the company can appeal to a growing market segment prioritizing operational cost savings and environmental responsibility. For instance, the International Energy Agency reported in 2024 that industrial energy efficiency improvements could cut global energy demand by over 20% by 2050.

Sintokogio can further capitalize on this trend by offering solutions that facilitate the integration of renewable energy sources into clients' manufacturing processes. This could involve specialized equipment for solar or wind power utilization within industrial settings, aligning with the increasing investment in green energy infrastructure. Global investment in renewable energy reached a record $634 billion in 2023, indicating strong market demand for such technologies.

- Market Demand: Growing client focus on sustainability and cost reduction drives demand for energy-efficient machinery.

- Innovation Opportunity: Develop and market equipment designed for lower energy footprints and renewable energy integration.

- Competitive Advantage: Differentiate Sintokogio by offering solutions that directly address environmental regulations and client ESG goals.

- Revenue Streams: Potential for new product lines and service offerings related to energy efficiency and renewable energy solutions.

The growing emphasis on environmental sustainability and stringent regulations regarding pollution are key external forces. Sintokogio's dust collection and wastewater treatment systems directly address these concerns, helping clients meet compliance standards and reduce their ecological footprint.

For example, by 2023, over 85% of new industrial permits in the EU mandated advanced emission reduction technologies for particulate matter. Sintokogio's baghouse filters, achieving over 99.9% particulate removal, provide a critical solution for these requirements.

The global drive towards a circular economy and waste reduction also presents opportunities. Sintokogio's dust collection and surface treatment technologies support resource efficiency by minimizing material loss and enabling material recovery, thereby extending product lifecycles.

The increasing focus on energy efficiency and renewable energy integration is another significant environmental factor. Sintokogio's development of energy-efficient machinery and solutions that support renewable energy use aligns with this trend, offering cost savings and environmental benefits to its clients.

| Environmental Factor | Impact on Sintokogio | Supporting Data (2023-2025) |

|---|---|---|

| Decarbonization Push | Increased demand for energy-efficient machinery and environmental technologies. | EU ETS carbon prices incentivizing green tech investment. Global emission reduction targets are rising. |

| Circular Economy & Waste Reduction | Opportunity for dust collection and surface treatment technologies that minimize material loss and enhance material recovery. | Global market for recycled plastics projected to exceed $70 billion by 2030. |

| Pollution Control Regulations | Demand for advanced dust collectors and wastewater treatment systems to meet stricter air and water quality standards. | Over 85% of new EU industrial permits in 2023 required advanced emission reduction tech. Sintokogio's filters achieve >99.9% particulate removal. |

| Energy Efficiency & Renewables | Opportunity to offer energy-efficient machinery and solutions for renewable energy integration. | Industrial energy efficiency improvements could cut global energy demand by >20% by 2050 (IEA 2024). Global renewable energy investment reached $634 billion in 2023. |

PESTLE Analysis Data Sources

Our Sintokogio PESTLE Analysis is grounded in a robust dataset, incorporating official government publications, reputable industry forecasts, and international economic reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business landscape.