Sintokogio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sintokogio Bundle

Sintokogio operates in an industry shaped by moderate supplier power, as key components can be sourced from multiple vendors, though specialized machinery may present some leverage. The threat of new entrants is generally low due to significant capital requirements and established technological expertise. Buyers, while numerous, have moderate bargaining power, often seeking tailored solutions and competitive pricing.

The intensity of rivalry among existing competitors is high, with companies vying for market share through innovation and cost efficiency. Furthermore, the threat of substitute products is low, as Sintokogio's specialized equipment offers unique functionalities not easily replicated. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Sintokogio’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Sintokogio's reliance on suppliers for highly specialized components like advanced sensors and precision robotics significantly impacts its operational costs and product development timelines. The bargaining power of these specialized suppliers is considerable when alternative sources are scarce, or their components are proprietary and essential for Sintokogio's machinery performance. For instance, in 2024, the global semiconductor shortage, a key component for advanced sensors, led to price increases and extended lead times for many manufacturers, directly affecting industries that rely on such technology.

While many raw materials like steel and common metals are widely available, Sintokogio might face supplier power if specific, high-performance grades or alloys are needed for their advanced casting and surface treatment equipment. This concentration means a smaller group of suppliers could dictate terms.

The leverage these raw material providers hold is heavily influenced by broader economic conditions, geopolitical stability, and how easily alternative material specifications can be sourced. For instance, disruptions in major mining regions in 2024 could significantly tighten supply for certain metals.

Price volatility in these critical raw materials directly affects Sintokogio's cost of goods sold. For example, if the global price of a key alloy used in their machinery increases by 15% in a given year, as seen with some industrial metals in early 2024, it directly squeezes Sintokogio's profit margins unless passed on to customers.

As industrial machinery becomes more sophisticated with automation and AI, Sintokogio relies on technology and software vendors for crucial intellectual property. These suppliers can hold substantial leverage if their technology is patented, advanced, and indispensable for maintaining Sintokogio's competitive advantage in operational efficiency and product quality.

For example, in 2024, the industrial automation market saw significant growth, with companies investing heavily in AI and IoT. A key software provider whose proprietary AI algorithms enhance machine learning capabilities for predictive maintenance in heavy machinery could command higher licensing fees, impacting Sintokogio's cost structure if alternative solutions are limited.

Skilled Labor and Talent Pool

The availability of highly skilled engineers, technicians, and R&D specialists is critical for Sintokogio, a player in advanced industrial manufacturing. A limited supply of such talent, or concentration in a few institutions, significantly boosts the bargaining power of these skilled workers. For instance, in 2024, the global shortage of qualified manufacturing engineers was estimated to be around 300,000, driving up wage demands and benefit packages.

This increased leverage for skilled labor directly impacts Sintokogio's operational costs. When specialized skills are scarce, companies often face pressure to offer premium compensation, potentially increasing labor expenses by 10-15% year-over-year in high-demand fields. This financial strain can affect profitability and the company's ability to invest in other areas.

- Talent Scarcity Impact: In 2024, sectors requiring advanced robotics and automation expertise saw wage premiums of up to 20% for top-tier engineers.

- Innovation Capacity: A constrained pool of R&D specialists can slow down product development cycles, potentially delaying market entry for new technologies.

- Geographic Concentration: Regions with strong technical universities and research hubs tend to have more competitive labor markets, giving skilled individuals more options and thus greater bargaining power.

- Employee Retention: Companies must offer competitive packages to retain their skilled workforce, as the cost of replacing a specialized employee can be as high as 1.5 to 2 times their annual salary.

Logistics and Supply Chain Service Providers

Logistics and supply chain service providers hold significant bargaining power for companies like Sintokogio, which deals with heavy industrial machinery. The ability to efficiently and reliably transport large equipment globally is not universally available. A limited number of specialized providers capable of handling such complex needs can dictate terms, influencing delivery schedules and costs. For instance, in 2024, global shipping costs saw fluctuations due to geopolitical events and capacity constraints, directly impacting the leverage of logistics firms.

If Sintokogio relies on a few niche logistics partners for its international shipments of heavy machinery, these providers can exert considerable influence. This bargaining power can translate into higher transportation fees or less favorable delivery timelines, potentially affecting Sintokogio's overall operational efficiency and customer satisfaction. Maintaining strong, collaborative relationships with these critical service providers is therefore paramount to mitigating these risks.

- Limited Specialized Providers: The market for global, heavy-lift logistics is concentrated, meaning fewer companies possess the necessary infrastructure and expertise.

- Impact on Costs: Higher shipping rates from powerful logistics providers directly increase Sintokogio's cost of goods sold and operational expenses.

- Delivery Reliability: Dependence on a few key players means any disruption in their service can have a cascading effect on Sintokogio's production and delivery commitments.

- Customer Satisfaction: Delays or issues caused by logistics partners can damage Sintokogio's reputation and lead to lost business.

Sintokogio's suppliers for specialized components and critical raw materials wield significant bargaining power, particularly when alternatives are scarce or their offerings are proprietary. This leverage can drive up costs and impact production timelines. For example, in 2024, the semiconductor shortage exacerbated the power of chip suppliers, leading to price hikes and extended lead times for advanced machinery manufacturers.

The concentration of suppliers for high-performance alloys and proprietary software also amplifies their influence. In 2024, disruptions in key mining regions and the growing reliance on AI-driven industrial automation meant that specialized technology vendors could command higher licensing fees, directly affecting Sintokogio's cost structure.

Furthermore, the scarcity of highly skilled labor, especially in advanced manufacturing and R&D, grants employees substantial bargaining power. In 2024, the global shortage of manufacturing engineers led to wage increases of up to 20% for top talent, impacting operational expenses for companies like Sintokogio.

| Supplier Type | Key Factors Influencing Power | 2024 Impact Example | Sintokogio's Cost Exposure |

|---|---|---|---|

| Specialized Component Suppliers (e.g., Sensors) | Proprietary technology, limited alternatives, global shortages | Semiconductor shortage increased component prices by 10-15% | Increased Cost of Goods Sold (COGS) |

| Raw Material Suppliers (e.g., High-performance alloys) | Geopolitical stability, availability of specific grades, economic conditions | Price volatility for key industrial metals up by 15% | Margin compression |

| Technology & Software Vendors (e.g., AI/IoT) | Patented IP, essential for competitive advantage, market growth | Higher licensing fees for advanced AI algorithms | Increased operational expenses |

| Skilled Labor Force (e.g., Engineers) | Talent scarcity, geographic concentration, retention needs | Wage premiums of up to 20% for specialized engineers | Higher labor costs |

What is included in the product

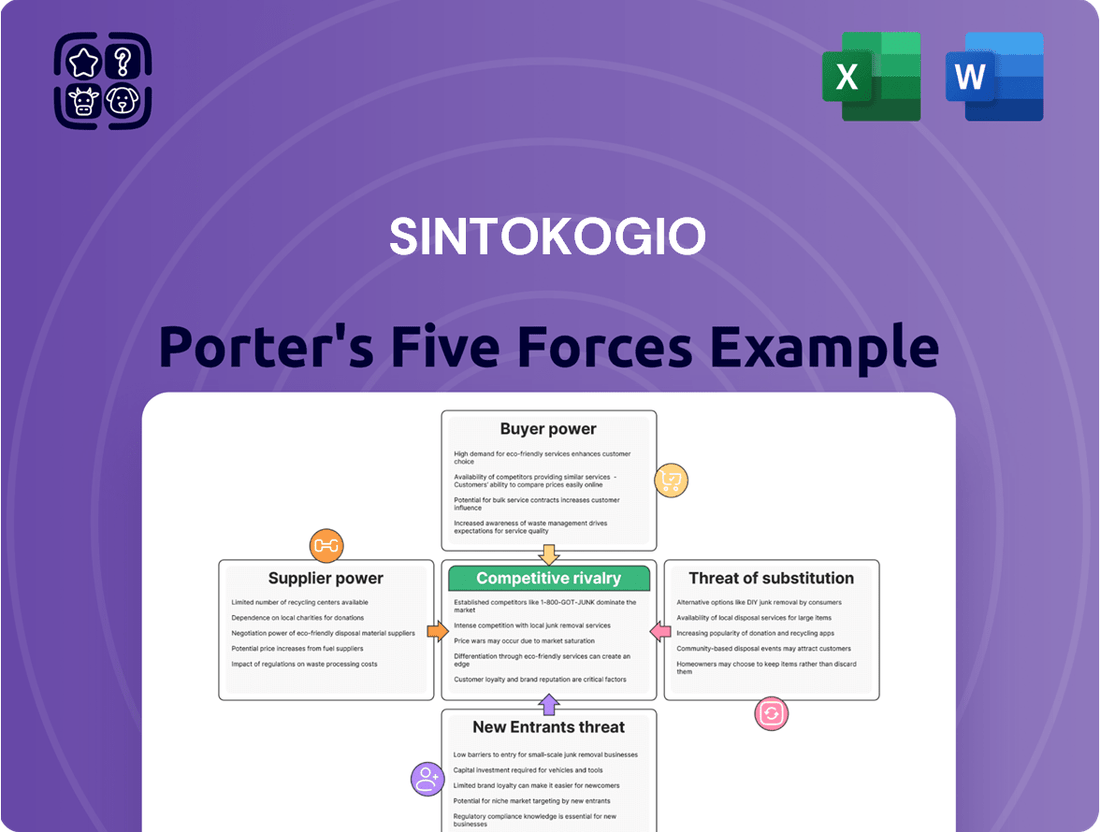

This Porter's Five Forces analysis for Sintokogio dissects the competitive intensity and profitability within its industry, examining threats from new entrants, substitute products, buyer and supplier power, and existing rivalry.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of industry power dynamics.

Customers Bargaining Power

Sintokogio's major clients, including prominent players in the automotive, aerospace, and broader manufacturing sectors, are typically large, experienced purchasers. These significant buyers, often representing substantial portions of Sintokogio's revenue, possess the leverage to influence pricing and demand tailored specifications and service agreements. Their considerable purchasing power stems from their scale and their ability to compare offers from various machinery providers.

While customers may possess initial bargaining power when purchasing Sintokogio's industrial machinery, this leverage can diminish significantly due to high switching costs. Once a Sintokogio molding machine or shot blasting equipment is deeply integrated into a customer's existing production processes, the cost and complexity of replacing it become substantial. These costs include not only the price of new machinery but also extensive retraining for personnel and the re-tooling of associated production lines. This creates a powerful lock-in effect, effectively reducing the customer's long-term bargaining power post-acquisition, even if initial negotiations are robust.

Sintokogio's capacity to deliver highly tailored or customized solutions that precisely address distinct manufacturing needs can significantly diminish the bargaining power of its customers. When Sintokogio's technological innovations provide demonstrable advantages in efficiency, quality, or environmental impact that competitors struggle to match, customers are often more amenable to accepting higher price points.

Conversely, if Sintokogio's offerings are perceived as standardized or easily substitutable, the bargaining power of customers escalates substantially. For instance, in the highly competitive industrial equipment sector, a lack of unique selling propositions can lead to price-based negotiations, eroding profit margins for the supplier.

Customer Concentration

Customer concentration significantly amplifies the bargaining power of buyers for Sintokogio. If a few large customers account for a substantial portion of its revenue, they can leverage this dependency to negotiate more favorable terms, potentially impacting pricing and profitability.

The potential impact of losing a major client is a critical consideration. For instance, if a single customer represented 15% of Sintokogio's total sales in 2023, their departure would create a considerable revenue gap that would be challenging to fill quickly.

To counter this, Sintokogio must focus on customer base diversification. Spreading sales across a broader range of clients, ideally in different sectors and geographical locations, reduces reliance on any single buyer.

- Customer Concentration Risk: High dependence on a few large clients grants them increased negotiation leverage.

- Financial Impact: The loss of a major customer can disproportionately affect Sintokogio's revenue and profitability.

- Mitigation Strategy: Diversifying the customer base across various industries and regions is essential.

- Data Point Example: If a key customer accounts for over 10% of revenue, their bargaining power is notably elevated.

Information Asymmetry and Price Transparency

In today's digital age, information asymmetry is rapidly diminishing. Customers, armed with readily available data on product features, competitor pricing, and market trends, possess a significantly enhanced bargaining power. This transparency compels companies like Sintokogio to be highly competitive and articulate their value clearly.

For instance, online marketplaces and review platforms allow consumers to compare offerings with unprecedented ease. In the industrial sector, where Sintokogio operates, procurement platforms and industry reports provide detailed insights into material costs and manufacturing efficiencies. This means customers can often identify if a price is out of line with market norms.

- Information Accessibility: Customers can easily access pricing data from multiple suppliers and compare product specifications online.

- Price Transparency: Increased online visibility of pricing makes it harder for companies to maintain significant price differentials without justification.

- Customer Empowerment: Well-informed customers are more likely to negotiate aggressively for better terms and lower prices.

- Sintokogio's Challenge: The company must continually demonstrate superior quality, innovation, or service to justify its pricing against informed buyers.

Sintokogio's customers, particularly those in large-scale manufacturing sectors, wield significant bargaining power due to their substantial purchasing volume and the potential for high switching costs if they were to change suppliers. For example, a major automotive manufacturer purchasing hundreds of industrial machines could demand better pricing or customized features, leveraging the potential loss of such a large, ongoing revenue stream for Sintokogio. This power is amplified when customers have viable alternatives from competitors, forcing Sintokogio to maintain competitive pricing and demonstrate unique value propositions.

| Factor | Impact on Sintokogio | Mitigation Strategies |

|---|---|---|

| Customer Concentration | High dependence on a few large clients increases their negotiation leverage. | Diversify customer base across industries and regions. |

| Switching Costs | High integration costs for customers can reduce long-term bargaining power. | Focus on product integration and customer support to enhance lock-in. |

| Information Availability | Increased customer access to pricing and product data empowers negotiations. | Emphasize superior quality, innovation, and service to justify pricing. |

| Customer Needs | Tailored solutions can reduce customer power if competitors cannot match them. | Invest in R&D for unique, high-value product offerings. |

What You See Is What You Get

Sintokogio Porter's Five Forces Analysis

This preview showcases the complete Sintokogio Porter's Five Forces Analysis, reflecting the exact document you will receive immediately after purchase. You're looking at the actual, professionally formatted analysis, ensuring there are no surprises or placeholders. What you see here is precisely what you'll be able to download and utilize for your business strategy. This detailed examination of Sintokogio's competitive landscape is ready for your immediate use.

Rivalry Among Competitors

Sintokogio navigates a fiercely competitive global landscape for industrial machinery. Key rivals hail from established manufacturing hubs like Japan, Germany, the United States, and increasingly, China. This rivalry is a constant battle for market share, driven by innovation in technology, aggressive pricing, and strategic expansion into emerging territories.

The intensity of competition is further amplified in mature market segments. For instance, the traditional casting machinery sector often sees price becoming a primary differentiator, squeezing profit margins for all players. Companies are therefore compelled to invest heavily in R&D to maintain a competitive edge through superior product offerings and efficiency.

In 2023, the global industrial machinery market was valued at approximately $2.9 trillion, with growth projected to reach $3.8 trillion by 2028. This significant market size attracts numerous players, intensifying the rivalry as companies vie for a larger slice of this expanding pie.

The industrial machinery sector thrives on technological advancement, with automation, smart manufacturing, and eco-friendly solutions at the forefront. Companies like Sintokogio face intense rivalry, where staying ahead means a constant commitment to research and development.

Significant R&D spending is crucial for developing cutting-edge products and enhancing operational efficiency. For instance, many leading industrial machinery firms in 2024 allocated substantial portions of their revenue to R&D, with some dedicating upwards of 5% to maintain a competitive edge. This investment is vital to meet increasingly stringent industry standards and customer expectations for performance and sustainability.

Lagging in innovation can rapidly erode market position. Rivals introducing more sophisticated or cost-effective machinery can quickly capture market share, making continuous R&D a non-negotiable aspect of survival and growth in this dynamic industry.

Rivals in the industrial equipment sector, including those that compete with Sintokogio, often vie for market share by emphasizing product differentiation. This means highlighting unique features, superior performance metrics, and unwavering reliability, alongside tailoring solutions for highly specialized applications. For instance, competitors might offer a wider array of casting machinery or possess deeper expertise in specific surface treatment technologies, directly challenging Sintokogio's core competencies.

Sintokogio itself carves out a competitive edge through its focus on casting, surface treatment, and environmental solutions, indicating a degree of specialization. However, the competitive landscape is dynamic. Some rivals may present broader product portfolios, encompassing a wider range of industrial processes, while others might possess very niche expertise in areas that could directly counteract Sintokogio's established strengths. For example, a competitor specializing solely in advanced foundry automation could pose a significant challenge.

To counter these competitive pressures, effective marketing and a robust brand reputation are paramount. These elements are crucial for clearly communicating the unique value proposition of Sintokogio's offerings. In 2024, many industrial manufacturers are investing heavily in digital marketing and customer experience to solidify their brand identity. Companies that can effectively showcase their innovation and reliability are better positioned to capture market attention and customer loyalty.

Market Growth Rate and Industry Maturity

Competitive rivalry intensifies in mature or slow-growing markets. Companies battle for existing market share, often leading to aggressive pricing strategies and increased promotional activities. For instance, the global industrial machinery market, while experiencing some growth in specialized areas like automation, generally exhibits characteristics of maturity, particularly in traditional segments.

This maturity fuels a drive for consolidation. Companies frequently explore mergers and acquisitions (M&A) to enhance their market position, gain economies of scale, and reduce competitive pressures. In 2024, the M&A landscape for industrial manufacturers continued to show activity, with strategic tuck-in acquisitions aimed at expanding product portfolios or geographic reach.

- Mature Markets Drive Rivalry: Slower market growth forces companies to compete more fiercely for existing customers.

- Pricing Pressure: Increased competition often results in downward pressure on prices as companies vie for market share.

- Consolidation Trends: Mergers and acquisitions are common strategies to gain scale and reduce competition in mature industries.

Exit Barriers and Capacity Utilization

High fixed costs in industrial machinery manufacturing, such as those for specialized production lines and extensive research and development, act as significant exit barriers. For instance, companies heavily invested in complex CNC machinery or large-scale foundries face substantial write-offs if they attempt to exit the market. This difficulty in leaving can trap even struggling firms, contributing to persistent overcapacity.

This overcapacity directly fuels intense price competition, as companies with high fixed costs are incentivized to maintain production levels, even at reduced margins, to cover their operational expenses. Companies like Sintokogio must therefore focus on optimizing their capacity utilization. In 2024, the global industrial machinery sector experienced varying capacity utilization rates, with some segments reporting figures around 70-80% while others, particularly those facing demand slowdowns, saw rates dip below 60%, exacerbating competitive pressures.

- High Fixed Costs: Significant investments in specialized machinery and R&D create substantial barriers to exiting the industrial machinery market.

- Capacity Overhang: Difficulty in exiting means underperforming firms often remain operational, leading to a surplus of production capacity.

- Intensified Price Wars: Overcapacity compels companies to cut prices to maintain sales volume and cover fixed costs, intensifying rivalry.

- Capacity Utilization Management: Sintokogio must efficiently manage its production capacity to navigate competitive pricing and avoid unsustainable losses.

Competitive rivalry is a defining characteristic for Sintokogio, driven by a global market with established players from Japan, Germany, the US, and emerging Chinese manufacturers. This intense competition is particularly sharp in mature segments where pricing often becomes the primary differentiator, squeezing profit margins and necessitating continuous innovation. In 2024, companies are heavily investing in R&D, with some allocating over 5% of revenue, to maintain an edge through superior technology and efficiency.

The industrial machinery market, valued at approximately $2.9 trillion in 2023 and projected to reach $3.8 trillion by 2028, attracts numerous competitors. This growth, coupled with high fixed costs and significant exit barriers, leads to overcapacity. Consequently, companies are pressured to maintain production, often resulting in aggressive pricing strategies and a focus on product differentiation through unique features and specialized solutions to capture market share.

| Key Competitive Factors | Impact on Sintokogio | 2024 Data/Trends |

| Market Maturity & Pricing Pressure | Squeezed profit margins, need for cost efficiency | Mature segments exhibit price wars; some sectors see utilization below 60% |

| Innovation & R&D Investment | Crucial for differentiation and market share; risk of obsolescence | Leading firms invest >5% of revenue in R&D |

| Product Differentiation | Essential to stand out from broad-portfolio or niche specialists | Focus on unique features, performance, and tailored solutions |

| Consolidation & M&A | Potential for strategic acquisitions or being acquired | Active M&A for portfolio expansion and geographic reach |

SSubstitutes Threaten

Alternative manufacturing processes represent a significant threat to Sintokogio. Innovations in areas like additive manufacturing, or 3D printing, can produce components with similar functionalities to those made using traditional casting methods, which often rely on Sintokogio's machinery. This technological evolution means customers might bypass the need for Sintokogio's core offerings.

For instance, the global 3D printing market was valued at approximately $17.8 billion in 2023 and is projected to grow substantially. As these technologies mature and become more cost-effective, they offer a viable substitute for certain applications where Sintokogio's casting solutions have historically been dominant.

Sintokogio must actively track these disruptive technologies to understand their impact. This awareness is crucial for developing strategies, which could involve integrating hybrid solutions that combine traditional and additive manufacturing or even developing entirely new machinery that complements these emerging processes.

The outsourcing of manufacturing functions presents a significant threat of substitutes for Sintokogio. Companies that might otherwise purchase Sintokogio's industrial machinery could instead opt to contract with specialized third-party manufacturers. These contract manufacturers often possess existing, advanced equipment, making outsourcing a potentially less capital-intensive and more agile choice for many businesses.

For instance, the global contract manufacturing market was valued at approximately $576 billion in 2023 and is projected to grow, indicating a substantial existing and expanding base of outsourced manufacturing capabilities. This trend means that potential customers may bypass the need for their own machinery altogether, directly impacting the demand for Sintokogio's products.

To counter this, Sintokogio needs to emphasize the long-term value proposition and the superior operational control that owning its machinery provides. This includes highlighting benefits like customization flexibility, quality assurance, and potential cost savings over the lifecycle of production, which might not be as readily available or controllable through outsourced arrangements.

The threat of substitutes for Sintokogio's surface treatment division is significant, as alternative methods like laser finishing, chemical polishing, and advanced coating technologies are continuously evolving. These substitutes can offer comparable or even superior results in specific applications, potentially reducing the demand for traditional shot blasting equipment. For instance, advancements in laser ablation can achieve precise surface texturing without mechanical wear, a capability that might appeal to industries requiring ultra-fine finishes.

The cost-effectiveness and performance of these substitutes are key drivers. While shot blasting has a long-established efficiency, emerging technologies are becoming more economically viable. For example, some chemical polishing processes, particularly for specific alloys, can offer a faster throughput and lower energy consumption compared to mechanical methods, impacting Sintokogio's market share if not addressed through competitive pricing or superior value propositions.

Evolution of Environmental Control Technologies

The threat of substitutes for Sintokogio's environmental control technologies is a significant consideration. In the environmental solutions sector, particularly for products like dust collectors, the landscape is constantly shifting due to technological advancements and evolving regulations. For example, the emergence of novel filtration materials or sophisticated biological air purification methods could present viable alternatives to traditional systems. Furthermore, the development of integrated factory-wide air management systems might offer a more holistic and efficient approach to pollution control, potentially diminishing the demand for standalone dust collection units.

Sintokogio must therefore prioritize continuous investment in research and development to stay ahead of these potential substitutes. For instance, companies in the air purification market are seeing increased investment, with global spending on air purifiers projected to reach over $16 billion by 2027, indicating a strong market for alternative solutions. Staying at the forefront of innovation is critical to maintaining market share and offering competitive solutions that address the evolving needs of industries facing environmental compliance.

- Technological Advancements: New filtration materials and biological purification offer alternatives to traditional dust collectors.

- Integrated Systems: Factory-wide air management solutions can provide a more comprehensive approach.

- Regulatory Impact: Stricter environmental regulations may drive the adoption of entirely new pollution control paradigms.

- Market Trends: The growing air purification market, estimated to exceed $16 billion by 2027, highlights the potential for substitute technologies to gain traction.

Less Capital-Intensive Solutions or Manual Processes

Smaller manufacturers or those with niche applications may indeed explore less capital-intensive alternatives to Sintokogio's offerings. This could include purchasing refurbished industrial equipment, which represented a significant secondary market in 2024, or even a return to more manual processes where feasible. For instance, some woodworking shops might opt for skilled artisans over automated machinery if the upfront cost and maintenance of advanced equipment outweigh the labor savings.

While a complete shift to manual labor isn't a major concern for Sintokogio's core large-scale industrial clients, it poses a tangible threat at the lower end of the market. Companies with tighter budgets or those producing lower volumes might find refurbished CNC machines or even skilled manual labor more economically viable. This segment of the market, while smaller in revenue per customer, is still a factor in overall market share.

Sintokogio's strategy must therefore continue to emphasize a clear return on investment, showcasing how its advanced solutions deliver superior efficiency, quality, and long-term cost savings that justify the initial capital outlay. The company's ability to demonstrate this value proposition is crucial in retaining customers who might otherwise be tempted by cheaper, albeit less advanced, substitutes.

Key considerations for Sintokogio in addressing this threat include:

- Highlighting Total Cost of Ownership: Demonstrating how the long-term operational savings of new equipment outweigh the upfront cost compared to refurbished or manual options.

- Offering Flexible Financing: Providing accessible financing or leasing options to reduce the initial capital barrier for smaller businesses.

- Focusing on Value-Added Services: Bundling solutions with training, maintenance, and support to enhance the overall customer value proposition beyond the equipment itself.

- Segmenting Market Offerings: Potentially developing scaled-down or more accessible versions of their technology for smaller market segments.

The threat of substitutes for Sintokogio's machinery arises from alternative production methods and technologies that can fulfill similar customer needs. Innovations in areas like additive manufacturing (3D printing) present a significant challenge, as these technologies can produce components with functionalities comparable to those made with traditional casting methods reliant on Sintokogio's equipment. This means customers might find ways to bypass the need for Sintokogio's core machinery altogether.

Another key substitute threat comes from the outsourcing of manufacturing. Businesses might opt to contract with third-party manufacturers who already possess advanced equipment, making outsourcing a more capital-efficient and agile choice than purchasing Sintokogio's industrial machinery. This trend directly impacts demand for new equipment as customers can fulfill their production needs externally.

For Sintokogio's surface treatment division, substitutes like laser finishing and advanced coating technologies pose a risk. These methods can achieve comparable or superior results, potentially reducing the need for traditional shot blasting equipment. Similarly, in environmental control, novel filtration materials or biological air purification offer alternatives to conventional dust collectors, especially as integrated factory-wide systems become more prevalent.

| Substitute Area | Example Substitute | 2024 Market Relevance/Trend | Potential Impact on Sintokogio |

|---|---|---|---|

| Manufacturing Processes | 3D Printing (Additive Manufacturing) | Global 3D printing market valued at over $20 billion in 2024, with continued strong growth. | Reduced demand for traditional casting machinery if 3D printing becomes cost-competitive for more applications. |

| Manufacturing Operations | Contract Manufacturing/Outsourcing | Global contract manufacturing market exceeded $600 billion in 2024, demonstrating significant adoption. | Customers may bypass machinery purchases by utilizing existing outsourced capacity. |

| Surface Treatment | Laser Ablation, Advanced Coatings | Growing interest in precision surface finishing technologies for specialized industries. | Potential decline in demand for shot blasting equipment for specific high-value applications. |

| Environmental Control | Novel Filtration, Biological Air Purification | The air purification market is projected to exceed $17 billion by 2025, indicating strong investment in alternatives. | Shift away from standalone dust collectors towards more integrated or advanced pollution control systems. |

Entrants Threaten

Entering the industrial machinery manufacturing sector, especially for advanced equipment like that produced by Sintokogio, demands enormous upfront capital. We're talking about significant investments in research and development to innovate, specialized factories equipped with cutting-edge machinery, and the tools needed to produce high-precision components. For instance, establishing a new manufacturing plant with the necessary automation and quality control systems could easily run into hundreds of millions of dollars.

This financial hurdle is a major deterrent for potential new competitors. Most companies simply do not have the deep pockets required to match the scale and technological sophistication of established players like Sintokogio. The ongoing need to invest in new technologies to remain competitive further solidifies this barrier, meaning new entrants would need not only a large initial sum but also a sustained commitment to capital expenditure.

Consider the global distribution and service networks that are crucial for industrial machinery. Building this infrastructure, from sales offices to maintenance depots worldwide, adds another layer of substantial cost. Without this, a new entrant would struggle to gain market traction against incumbents who already have these established networks in place. For example, a company like Sintokogio, with decades of global operations, has already amortized these setup costs over time, making it difficult for a newcomer to compete on operational cost.

The threat of new entrants in the industrial machinery sector, particularly for companies like Sintokogio, is significantly mitigated by the high barriers related to technological expertise and intellectual property. Developing and manufacturing complex equipment, such as precision casting machines or advanced surface treatment systems, requires years of specialized R&D and deep technical know-how. For instance, the lead time for developing a new generation of high-precision casting machinery can easily span 3-5 years, involving substantial investment in engineering talent and testing facilities.

New players would struggle to replicate the accumulated knowledge and proprietary technologies that established firms possess. This includes not only manufacturing processes but also the underlying scientific principles and software algorithms that optimize machine performance. Many of these advancements are protected by patents and trade secrets, making it difficult and costly for newcomers to enter the market without infringing on existing intellectual property rights. For example, the global industrial machinery market was valued at approximately $2.7 trillion in 2023, with a significant portion attributed to specialized equipment where IP protection is paramount.

Sintokogio's established brand reputation is a significant barrier. For decades, they've cultivated a name synonymous with quality and dependability in demanding industries like automotive and aerospace. This hard-won trust means new entrants face an uphill battle, needing substantial investment in marketing and sales to even begin chipping away at existing customer loyalty.

Regulatory Hurdles and Safety Standards

The industrial machinery sector, including companies like Sintokogio, faces significant threats from new entrants due to rigorous regulatory hurdles and safety standards. These requirements are particularly stringent across major global markets, demanding adherence to a complex web of compliance. For instance, in 2024, the European Union's Machinery Directive, alongside national safety regulations, mandates extensive product testing and documentation for all machinery sold within its borders. New companies must invest heavily in understanding and meeting these standards, which can involve lengthy certification processes and substantial upfront capital expenditure. Sintokogio's long-standing experience and established compliance frameworks represent a formidable barrier, making it difficult and expensive for newcomers to achieve the necessary certifications and gain market access. This regulatory landscape inherently limits the ease with which new players can enter and compete effectively.

Economies of Scale and Supply Chain Integration

Established companies like Sintokogio leverage significant economies of scale in their manufacturing processes. This means they can produce more goods at a lower per-unit cost due to bulk purchasing of raw materials and efficient production lines. For instance, in 2024, major players in the industrial equipment sector often reported operating margins that were several percentage points higher than smaller, emerging competitors, directly attributable to these scale advantages.

Furthermore, Sintokogio benefits from deeply integrated supply chains. This integration allows for better control over material flow, reduced lead times, and stronger relationships with suppliers, often resulting in preferential pricing. New entrants would face considerable challenges in replicating this level of supply chain efficiency and securing comparable supplier terms, placing them at an immediate cost disadvantage.

The threat of new entrants is therefore moderated by the substantial capital investment and operational expertise required to overcome these existing scale and supply chain advantages. Without achieving similar levels of efficiency, new companies would struggle to compete on price or delivery speed, especially in a market segment where cost-effectiveness and reliability are paramount.

- Economies of Scale: Larger production volumes lead to lower per-unit costs for Sintokogio.

- Supply Chain Integration: Sintokogio's established network provides cost and efficiency benefits.

- Cost Disadvantage for Newcomers: Entrants face higher initial operating costs and less favorable supplier agreements.

- Competitive Barrier: The difficulty in matching scale and supply chain efficiency acts as a significant barrier to entry.

The threat of new entrants for companies like Sintokogio is considerably low due to the immense capital required for entry, estimated in the hundreds of millions of dollars for a single modern manufacturing facility. Furthermore, building global distribution and service networks adds substantial cost, a hurdle most newcomers cannot easily clear. These combined financial barriers effectively discourage potential competitors from entering the industrial machinery sector.

| Barrier Type | Estimated Cost/Factor | Impact on New Entrants |

|---|---|---|

| Capital Investment (R&D, Factories) | Hundreds of millions of USD | Prohibitive upfront cost |

| Global Distribution & Service Network | Significant investment required | Difficulty gaining market traction |

| Technological Expertise & IP | Years of specialized R&D, patent protection | Replication is costly and time-consuming |

| Regulatory Compliance | Extensive testing, lengthy certifications | Increased time-to-market and upfront expenditure |

| Economies of Scale & Supply Chain | Lower per-unit costs, preferential supplier terms | New entrants face immediate cost disadvantages |

Porter's Five Forces Analysis Data Sources

Our Sintokogio Porter's Five Forces analysis is built upon a robust foundation of data, including Sintokogio's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant trade publications. This comprehensive approach ensures a deep understanding of the competitive landscape.