Signify PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Signify Bundle

Navigate the complex external forces shaping Signify's future with our meticulously crafted PESTLE analysis. Understand how political stability, economic shifts, societal trends, technological advancements, environmental regulations, and legal frameworks are impacting the lighting giant. This comprehensive report provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive competitive advantage.

Political factors

Signify’s operations are significantly impacted by government energy efficiency directives worldwide. For instance, the European Union’s Ecodesign and Energy Labelling regulations, updated through 2024 and into 2025, mandate stricter performance standards for lighting products. These regulations directly drive demand for Signify’s high-efficiency LED and connected lighting systems, as non-compliant products face market restrictions.

In 2023, the EU alone saw a substantial portion of its new lighting sales adhering to these increasingly stringent efficiency criteria. Signify’s proactive development of smart lighting solutions, like Interact City and Interact Industry, positions them to meet and exceed these evolving governmental requirements, ensuring continued market access and a competitive edge in key regions.

Governments globally are channeling significant funds into smart city development, with urban lighting infrastructure a key focus. This trend is particularly beneficial for companies like Signify, which excels in connected and data-driven lighting solutions. For instance, the European Union's NextGenerationEU recovery plan allocates substantial investment towards digital and green transitions, including smart city projects, creating a robust demand environment.

These public infrastructure investments directly translate into market opportunities for Signify's advanced lighting systems. Political backing for urban modernization initiatives, such as the UK's £300 million Urban Mobility Fund or similar programs in North America and Asia, signals a strong governmental push for smart city technologies, directly boosting demand for Signify's specialized offerings.

Changes in international trade policies and the imposition of tariffs directly influence Signify's global operations. For instance, a shift in tariffs on electronic components could significantly increase Signify's cost of goods sold, impacting its pricing strategies and profit margins. As of early 2024, ongoing trade discussions between major economic blocs continue to create uncertainty regarding future tariff structures.

Geopolitical tensions, such as those impacting key manufacturing regions or shipping routes, can disrupt Signify's supply chain. This disruption might lead to production delays or necessitate seeking alternative, potentially more expensive, suppliers. Such events can erode market competitiveness if Signify cannot efficiently absorb or pass on these increased costs.

Adapting to evolving trade agreements is crucial for Signify's profitability. For example, new regional trade pacts might offer preferential access to certain markets but could also introduce new compliance requirements. Signify's ability to navigate these changes effectively will be a key determinant of its financial performance in the coming years.

Regulatory Stability and Business Environment

The stability of regulatory frameworks and the overall business environment in Signify's primary markets significantly shape its investment strategies. Predictable and supportive government policies are crucial for fostering investor confidence and facilitating long-term planning. For instance, in 2024, many European Union countries continued to refine energy efficiency standards, directly impacting Signify's lighting solutions business, requiring adaptability and consistent compliance.

Conversely, frequent or unexpected shifts in regulations can introduce considerable uncertainty and operational risks. These changes might affect product certifications, market access, or even the cost of doing business. Signify's ability to navigate these evolving landscapes without major disruptions is a testament to its proactive approach to regulatory monitoring and engagement.

A stable political climate generally supports sustained business growth and encourages capital expenditure. Signify’s operational presence across numerous countries means it must continuously assess the political landscape, from trade agreements to environmental legislation. For example, the ongoing geopolitical shifts in 2024 continue to influence supply chain resilience and market access for Signify's diverse product portfolio.

Key considerations for Signify’s political factor analysis include:

- Consistency of energy efficiency regulations across major markets, impacting demand for Signify's LED and smart lighting products.

- Government incentives for smart city initiatives and sustainable infrastructure development, creating opportunities for Signify's integrated solutions.

- Trade policies and tariffs, which can affect the cost of raw materials and the competitiveness of Signify's manufactured goods.

- Political stability in regions where Signify has significant manufacturing or sales operations, influencing operational continuity and investment decisions.

Public Procurement and Green Building Codes

Public procurement policies are increasingly steering towards sustainability, directly benefiting companies like Signify that champion energy efficiency and circular economy principles in their lighting solutions. Governments worldwide are setting ambitious targets for green building, influencing the types of products and services they purchase.

This trend translates into a more receptive market for Signify's environmentally conscious offerings. Stricter building codes and a governmental preference for products with recognized sustainability certifications create a significant advantage, potentially boosting demand for Signify's portfolio.

For instance, in the European Union, the Public Sector Buy-Green Guide highlights the growing emphasis on environmental criteria in public tenders. By 2025, the EU aims for all new buildings to be nearly zero-energy buildings, a mandate that directly supports the adoption of advanced, energy-saving lighting systems. Signify's commitment to reducing its environmental footprint, aiming for 100% renewable electricity use in its operations by 2025, further aligns with these governmental priorities.

- Growing Government Mandates: Many countries are implementing or strengthening green building regulations, such as LEED and BREEAM certifications, which often include specific requirements for lighting efficiency and material sourcing.

- Increased Public Tender Weighting: Public procurement processes are increasingly assigning higher scores or weight to bids that demonstrate superior environmental performance and the use of sustainable materials.

- Focus on Circular Economy: Governments are promoting circular economy principles, favoring products designed for longevity, repairability, and recyclability, areas where Signify has been investing in product innovation.

- Energy Efficiency Targets: National and regional energy efficiency targets, such as those set by the International Energy Agency (IEA) for lighting, create a policy environment that favors the adoption of high-efficiency LED technologies, a core offering for Signify.

Governmental focus on energy efficiency directly boosts demand for Signify's LED and smart lighting solutions, as regulations increasingly favor high-performance products. For instance, the EU's stringent energy labeling for lighting, evolving through 2024 and into 2025, requires manufacturers to meet higher standards, benefiting Signify's compliant offerings.

Public investment in smart city infrastructure, supported by initiatives like the EU's NextGenerationEU, creates significant market opportunities for Signify's connected lighting systems. These investments underscore a global political push towards digitized and sustainable urban environments, directly translating into demand for Signify's specialized technologies.

Trade policies and geopolitical stability are critical. Shifts in tariffs, as seen in ongoing trade discussions in early 2024, can impact Signify's cost of goods, while regional instability can disrupt supply chains, necessitating agile adaptation to maintain market competitiveness.

What is included in the product

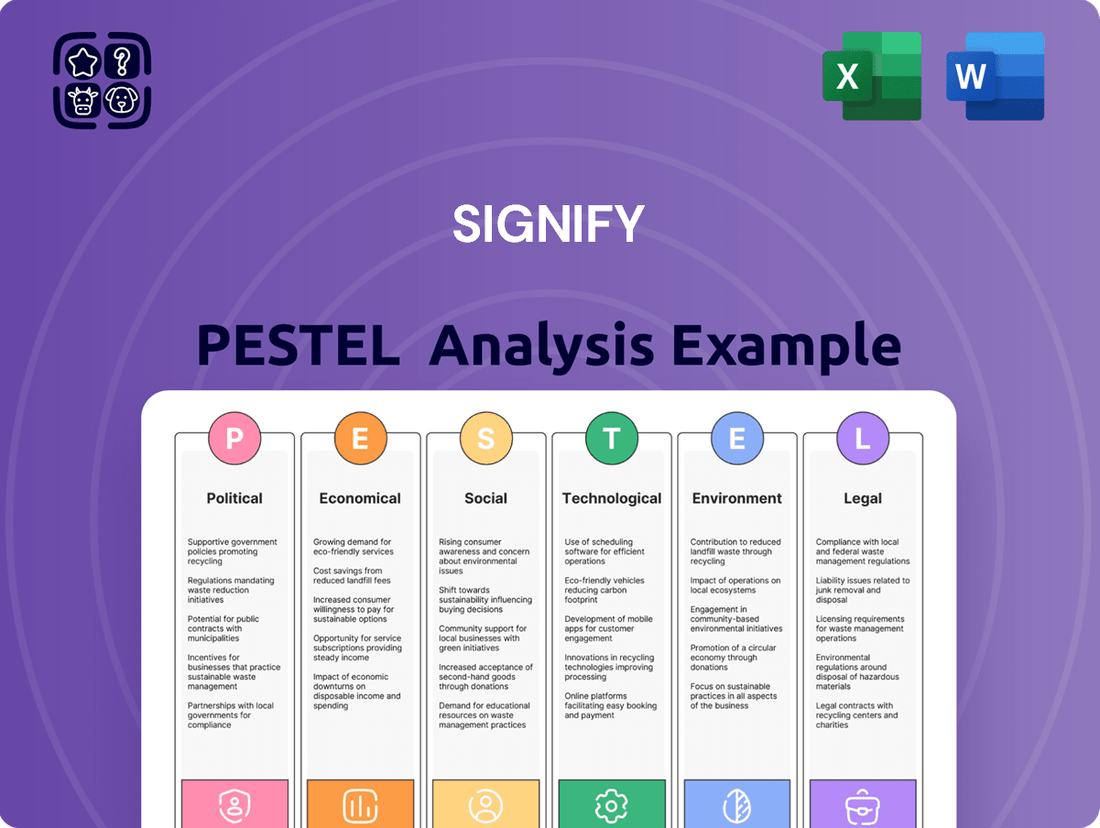

Explores how external macro-environmental factors uniquely affect Signify across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal, providing a comprehensive understanding of its operating landscape.

Signify's PESTLE analysis offers a clear, summarized version of external factors, simplifying strategic discussions and ensuring everyone is aligned on key market influences.

Economic factors

Global economic growth is a key driver for Signify, especially in its professional lighting segment. When economies are expanding, businesses are more likely to invest in new construction and renovations, which directly translates to higher demand for Signify's products. For instance, in 2024, while Signify's overall revenue saw a dip, the U.S. market demonstrated notable resilience, suggesting that regional economic health can significantly influence performance.

Construction activity, in particular, is a critical factor. An increase in new commercial and industrial building projects means more opportunities for Signify to supply lighting solutions. Conversely, a slowdown in construction can lead to reduced sales. The pace of global infrastructure development and private sector investment in building projects will be closely watched indicators for Signify's future sales trajectory.

Fluctuations in energy prices directly impact the demand for energy-efficient lighting, a core offering for Signify. For instance, in early 2024, global oil prices saw considerable swings, often exceeding $80 per barrel, which in turn influences electricity generation costs and consumer energy bills. This volatility makes the long-term cost savings offered by LED lighting, such as Signify's Philips Hue and Interact systems, a more attractive proposition for both commercial and residential customers seeking to stabilize their operational expenses.

Higher energy expenditures naturally encourage investment in efficiency. Businesses, facing rising utility costs, are increasingly looking at lighting retrofits as a way to achieve significant operational cost reductions. In 2024, many companies are reporting that energy costs represent a substantial portion of their overhead, making payback periods for LED installations, which can be as short as 1-3 years depending on usage and local energy rates, a compelling economic argument.

Government incentives further bolster the economic case for energy-efficient lighting adoption. Many countries and regions offer tax credits, rebates, or grants for businesses and homeowners upgrading to LED technology. For example, the Inflation Reduction Act in the United States, continuing into 2024 and beyond, provides significant tax credits for energy-efficient building improvements, including lighting, directly benefiting companies like Signify by making their solutions more affordable.

Consumer disposable income directly influences spending on discretionary items like smart home technology. As incomes rise, so does the willingness to invest in devices that offer convenience and energy efficiency, directly impacting demand for Signify's Philips Hue products.

The global smart lighting market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 21.5% through 2028, reaching an estimated value of $37.3 billion.

This expansion is fueled by consumers seeking enhanced home automation, cost savings through energy efficiency, and seamless integration with broader smart home ecosystems.

Signify, a leader in connected lighting, is well-positioned to capitalize on this trend, as consumer purchasing power directly correlates with their adoption of these advanced lighting solutions.

Technological Cost Reductions and Market Competitiveness

The ongoing decline in LED manufacturing costs is a significant driver making advanced lighting solutions like those Signify offers more attainable for a wider customer base. This trend is evident in the continued price drops for LED components, which have made LED lighting systems significantly cheaper than traditional incandescent or fluorescent options. For instance, the average price per lumen for LEDs has fallen dramatically over the past decade, a trend that is expected to continue into 2025.

While this cost reduction is a boon for market penetration and adoption of energy-efficient lighting, it simultaneously intensifies price competition. Signify, a major player in this space, faces the challenge of maintaining its market leadership and healthy profit margins. Competitors, both established and emerging, can leverage these lower costs to offer attractive pricing, necessitating continuous innovation in product development and operational efficiency from Signify.

This competitive pressure demands that Signify not only focuses on cost-effective production but also on differentiating its offerings through superior technology, smart features, and integrated systems. The company’s investment in research and development, particularly in areas like connected lighting and sustainable materials, becomes crucial. For example, Signify's commitment to increasing the use of recycled materials in its products by 2025 aims to not only meet sustainability goals but also potentially reduce material costs.

- Declining LED costs: Continued price erosion in LED components is making advanced lighting solutions more accessible.

- Increased competition: Lower manufacturing costs empower competitors, intensifying pressure on Signify's pricing.

- Innovation imperative: Signify must continuously innovate to maintain market leadership and profit margins amidst price wars.

- Smart lighting growth: The market for connected and smart lighting systems is expanding rapidly, offering differentiation opportunities.

Currency Exchange Rate Fluctuations

Signify's global operations mean its financial results are directly influenced by currency exchange rate movements. When Signify converts earnings from foreign subsidiaries back into euros, the reporting currency, fluctuations in exchange rates can significantly alter reported revenues and profitability. For instance, a stronger euro can make its products more expensive for foreign buyers, potentially dampening demand, while a weaker euro can increase the cost of imported components used in its manufacturing processes.

These currency dynamics play a crucial role in Signify's competitive positioning and cost management. For example, if the US dollar weakens against the euro, Signify's sales denominated in dollars will translate into fewer euros, impacting its top line. Conversely, if Signify sources a substantial portion of its raw materials or finished goods from countries with weaker currencies, a favorable exchange rate can reduce its cost of goods sold.

Looking at recent trends, the euro experienced volatility against major currencies throughout 2024 and into early 2025. For example, the EUR/USD exchange rate saw fluctuations impacting cross-border transactions. Such movements directly affect Signify’s reported financial figures, making it essential for the company to employ hedging strategies to mitigate these risks and ensure more predictable financial outcomes.

- Impact on Revenue: A stronger euro can reduce the euro value of sales made in USD or other depreciating currencies.

- Impact on Costs: A weaker euro can increase the euro cost of components imported from countries with appreciating currencies.

- Competitive Pricing: Exchange rates affect the price competitiveness of Signify's products in international markets.

- Hedging Strategies: Signify likely utilizes financial instruments to manage exposure to currency fluctuations.

Economic growth directly fuels demand for Signify's lighting solutions, especially in professional and consumer segments. Stronger economies encourage construction and renovation, boosting sales. For instance, resilient U.S. markets in 2024 showed how regional economic health impacts performance.

Energy price volatility makes energy-efficient lighting, a Signify specialty, more attractive. Rising utility costs in 2024 pushed companies to seek efficiency gains, with LED retrofits offering quick paybacks, often 1-3 years, solidifying the economic argument for adoption.

Government incentives, like those under the U.S. Inflation Reduction Act continuing into 2024, further reduce the cost of adopting energy-efficient technologies, directly benefiting Signify by making its products more appealing and affordable.

Declining LED manufacturing costs, expected to continue into 2025, are broadening market access for advanced lighting. However, this also intensifies price competition, compelling Signify to innovate and differentiate through superior technology and smart features to maintain its market position.

Preview the Actual Deliverable

Signify PESTLE Analysis

The preview shown here is the exact Signify PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Signify's operations. Gain strategic insights to navigate the complex landscape Signify operates within.

Sociological factors

Societal awareness regarding light's influence on well-being is surging. This growing understanding fuels a significant demand for Human-Centric Lighting (HCL) systems, which aim to optimize human performance and health by mimicking natural light patterns. Signify is well-positioned to meet this demand by innovating in HCL technology.

Signify can leverage this trend by developing and marketing products that dynamically adjust light color and intensity. These HCL solutions are designed to support natural circadian rhythms, thereby enhancing user experience and well-being in diverse environments like homes, offices, and healthcare facilities. This focus aligns with a broader societal shift towards prioritizing health and productivity.

Globally, over 56% of the population lived in urban areas in 2023, a figure projected to reach 68% by 2050, according to UN data. This rapid urbanization necessitates innovative solutions for managing resources and improving urban living. Cities are increasingly embracing smart technologies to enhance efficiency and resident well-being, creating a fertile ground for advanced lighting systems.

Smart city initiatives are a key driver for Signify, as these projects often require integrated lighting solutions that connect with the Internet of Things (IoT). These systems can offer adaptive lighting, energy savings, and data collection capabilities, directly aligning with Signify's expertise in connected LED lighting and IoT platforms. For instance, the company's Interact City platform enables cities to manage their lighting infrastructure remotely and gather valuable data.

The demand for safer, more energy-efficient, and connected urban environments is on the rise. Smart lighting can contribute significantly to these goals, by reducing energy consumption—potentially by up to 80% compared to traditional lighting—and improving public safety through better illumination and integrated surveillance. Signify's 2023 financial reports highlight continued investment in R&D for these connected solutions, signaling a strategic focus on this growing market segment.

Consumers are increasingly prioritizing sustainability, with a significant portion of the global population actively seeking out eco-friendly and ethically produced goods. This trend directly benefits Signify, as demand for its energy-efficient LED lighting and smart home solutions, designed for reduced environmental impact, continues to grow. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions, a number expected to climb further.

This societal shift translates into tangible market opportunities for Signify. The company's commitment to using recyclable materials in its products and developing solutions that promote energy savings and waste reduction resonates strongly with this conscious consumer base. Signify’s focus on circular economy principles, aiming to minimize waste throughout the product lifecycle, aligns perfectly with these evolving consumer preferences.

Digital Lifestyle and Connectivity Expectations

The increasing integration of digital technology into daily life means consumers expect their home devices to work together seamlessly. This is particularly true for smart lighting, with users wanting to control their lights through apps or voice commands, often alongside other connected devices. Signify's strategy, which emphasizes connected lighting and services that leverage data, directly addresses this expectation for a more automated and convenient lifestyle. For instance, by 2024, the global smart home market was projected to reach over $150 billion, highlighting the strong consumer demand for interconnected devices.

This digital lifestyle also fuels a demand for personalized experiences and enhanced control. Consumers are no longer content with basic illumination; they want lighting that can adapt to their routines, moods, or specific activities. Signify's connected lighting solutions, such as Philips Hue, offer this level of customization, allowing users to create dynamic lighting scenes and schedules. In 2023, over 70% of consumers surveyed expressed interest in smart home technology that could automate daily tasks, a significant driver for connected lighting adoption.

- Smart Home Market Growth: The global smart home market is expected to continue its robust expansion, driving demand for integrated lighting solutions.

- Consumer Expectations: A significant majority of consumers expect smart devices to offer automation and seamless connectivity.

- Personalization Demand: Users are increasingly seeking lighting that can be customized to their individual needs and preferences.

- Voice Assistant Integration: The widespread adoption of voice assistants makes interoperability a key factor in consumer purchasing decisions for smart home devices.

Workplace Evolution and Well-being Focus

The shift towards hybrid work models and a heightened focus on employee well-being are significantly reshaping workplace design. This trend fuels demand for lighting solutions that offer flexibility, adaptability, and actively promote health. For instance, studies in 2024 continue to highlight the link between lighting quality and employee productivity, with some reports suggesting potential increases of up to 20% in task performance with optimized lighting.

Signify's professional lighting portfolio is well-positioned to address these evolving workplace needs. By offering dynamic lighting systems that can adjust color temperature and intensity throughout the day, the company supports human-centric lighting principles. These systems aim to enhance comfort, reduce eye strain, and boost alertness, contributing to a more positive and productive work environment. The global smart lighting market, a key indicator for this trend, was projected to reach over $35 billion by 2024, demonstrating substantial investment in intelligent lighting solutions.

- Hybrid Work Impact: Increased adoption of hybrid work models necessitates adaptable lighting that accommodates varied office usage patterns and individual preferences.

- Well-being Emphasis: A growing corporate commitment to employee mental and physical health drives demand for lighting that supports circadian rhythms and reduces fatigue.

- Productivity Gains: Research consistently shows that well-designed lighting environments can lead to measurable improvements in employee concentration and overall job satisfaction.

- Technological Integration: Smart lighting controls and IoT integration are becoming standard, enabling personalized lighting experiences and energy efficiency.

Societal awareness regarding light's influence on well-being is surging, fueling demand for Human-Centric Lighting (HCL) systems that mimic natural light patterns to optimize health and performance. Signify is capitalizing on this by developing dynamic lighting solutions that adjust color and intensity, aligning with a global trend prioritizing health and productivity, especially as over 56% of the world's population lived in urban areas in 2023.

The increasing integration of digital technology into daily life means consumers expect seamless connectivity for their devices, including smart lighting. This fuels demand for personalized lighting experiences, with users wanting control via apps or voice commands. Signify's connected lighting and data-leveraging services directly address this, as the global smart home market was projected to exceed $150 billion by 2024.

The shift towards hybrid work models and a focus on employee well-being are reshaping workplaces, increasing demand for adaptable and health-promoting lighting. Signify's professional lighting portfolio offers dynamic systems that support HCL principles, enhancing comfort and productivity. The global smart lighting market, a key indicator, was projected to reach over $35 billion by 2024.

Technological factors

Continuous innovation in LED technology is a significant technological factor, driving improvements in energy efficiency, light quality, and overall cost-effectiveness. For Signify, this translates directly into enhanced product offerings and a stronger competitive edge.

These advancements allow Signify to develop more powerful and efficient lighting solutions. For instance, by mid-2024, the average efficacy of LED lamps available in the market has surpassed 150 lumens per watt, a substantial leap from earlier generations.

This technological progress directly supports Signify's strategy to provide high-performance products. It also aids in reducing the company's environmental footprint, aligning with global sustainability goals and consumer demand for eco-friendly solutions.

By leveraging these ongoing developments, Signify can offer increasingly competitive pricing and superior functionality, solidifying its leadership in the evolving lighting industry.

The integration of IoT and AI is revolutionizing lighting, making systems smarter and more efficient. Signify's connected lighting solutions utilize AI for adaptive lighting, adjusting automatically to occupancy and natural light, while IoT enables remote management and valuable data insights. This convergence allows for enhanced user experiences and significant energy savings, a key driver for adoption in commercial and residential sectors.

Signify's strategic advantage hinges on its advancement in smart connected lighting. These systems go beyond illumination, offering predictive maintenance and real-time data analytics for efficient facility management. This technological evolution allows for seamless integration with other smart building ecosystems, unlocking significant new business value.

By 2025, the global smart lighting market is projected to reach an estimated $30 billion, with connected systems driving a substantial portion of this growth. Signify’s investment in these areas positions it to capitalize on this expanding market, generating revenue streams from software and data services alongside hardware sales.

3D Printing and Advanced Manufacturing Techniques

The integration of 3D printing and advanced manufacturing techniques presents significant opportunities for Signify in the lighting industry. These technologies enable highly customized luminaire designs, allowing for unique aesthetic and functional solutions tailored to specific projects or customer needs. This shift towards personalized lighting is a key trend in the market.

Furthermore, 3D printing accelerates the prototyping phase, drastically reducing the time it takes to develop and test new product concepts. This agility is crucial for staying competitive in a rapidly evolving technological landscape. Signify's own utilization of 3D printed luminaires underscores its commitment to leveraging these innovations for enhanced design flexibility.

Sustainability is another major advantage. 3D printing often leads to more efficient material usage, minimizing waste compared to traditional manufacturing methods. This aligns with growing environmental consciousness and regulatory pressures. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to reach over $60 billion by 2030, indicating substantial growth and investment in these advanced techniques.

- Customization: 3D printing allows for unique, project-specific luminaire designs.

- Prototyping Speed: Faster iteration cycles for new product development.

- Sustainability: Reduced material waste through additive manufacturing.

- Market Growth: The 3D printing market is experiencing robust expansion, signaling industry-wide adoption.

Li-Fi Technology Development

Li-Fi, or Light Fidelity, is an emerging technology that uses light waves, rather than radio frequencies, for data transmission. This presents a unique opportunity for Signify, a leader in lighting, to integrate communication capabilities directly into its products. The potential for secure, high-speed wireless connectivity through existing lighting infrastructure could be a significant differentiator.

If Li-Fi gains wider adoption, Signify could leverage its lighting systems to offer novel data services. Imagine a retail environment where customers receive product information or personalized offers directly to their devices via the store's lighting. This integration could also enhance workplace productivity and smart building functionalities, moving beyond simple illumination to active data exchange.

The market for Li-Fi is still developing, but projections indicate substantial growth. For instance, some analysts predict the global Li-Fi market could reach several billion dollars by the late 2020s. Signify's existing global presence and expertise in lighting position it well to capitalize on this trend.

- Growth Potential: The Li-Fi market is anticipated to experience significant expansion in the coming years, driven by the need for faster and more secure wireless communication.

- Infrastructure Integration: Signify's core business of lighting provides a ready-made platform for Li-Fi deployment, reducing the need for entirely new infrastructure.

- Security Advantages: Li-Fi offers inherent security benefits as light signals cannot easily penetrate walls, limiting eavesdropping compared to traditional Wi-Fi.

- Data Speeds: Li-Fi has demonstrated the potential for very high data transmission speeds, exceeding those of many current Wi-Fi standards in laboratory settings.

Advancements in LED efficiency continue to be a cornerstone. By early 2024, the average efficacy of LED lamps had surpassed 150 lumens per watt, offering Signify enhanced product performance and cost-effectiveness.

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) is transforming lighting into intelligent systems. Signify's connected lighting solutions leverage AI for adaptive responses and IoT for remote management, projected to drive substantial growth in the smart lighting market, estimated to reach $30 billion by 2025.

Emerging technologies like Li-Fi present opportunities for Signify to integrate data transmission into its lighting infrastructure, potentially reaching multi-billion dollar market valuations by the late 2020s.

Legal factors

Signify operates within a landscape of evolving international and regional energy efficiency mandates. For instance, the European Union's Ecodesign Directive and its accompanying Energy Labelling Framework Regulation set stringent minimum performance standards and transparency requirements for lighting products. These regulations directly impact Signify's product development cycles and market access strategies, pushing for innovation in more efficient lighting technologies.

The impact of these regulations is substantial, influencing Signify's research and development investments. By 2023, the EU's energy efficiency targets continued to drive demand for LED lighting, a core product category for Signify, with the directive aiming to phase out less efficient lighting technologies. Compliance ensures Signify's products remain competitive and legally marketable across key global regions.

Signify navigates a landscape of stringent product safety and quality standards, crucial for its global operations. These include directives like the Low Voltage Directive for electrical safety and the RoHS Directive restricting hazardous substances, impacting all lighting products sold within the European Union. Failure to comply can lead to significant legal repercussions and costly product recalls, directly affecting brand trust and financial performance.

As Signify's connected lighting systems gather more user data, adhering to stringent data privacy rules like the EU's General Data Protection Regulation (GDPR) is critical. GDPR imposes significant obligations on how personal data is collected, processed, and stored, with fines for non-compliance reaching up to 4% of global annual revenue, or €20 million, whichever is greater.

Maintaining robust cybersecurity measures is essential to protect this collected data from breaches, which could lead to substantial legal penalties and damage consumer confidence. In 2024, the average cost of a data breach globally reached $4.73 million, highlighting the financial risks involved.

Intellectual Property Rights and Patent Protection

Signify's robust intellectual property (IP) portfolio, particularly its patents covering LED and smart lighting innovations, is a cornerstone of its competitive advantage. These legal protections are crucial for safeguarding its technological advancements and ensuring a return on its substantial R&D expenditures. As of 2023, Signify held over 10,000 patents globally, a testament to its commitment to innovation in connected lighting systems and energy-efficient solutions.

The legal frameworks governing patent protection directly enable Signify to deter and prosecute any unauthorized use of its proprietary technologies. This legal recourse is essential for maintaining market exclusivity and preventing competitors from unfairly benefiting from Signify's innovation pipeline. For instance, in 2023, Signify reported R&D expenses of €397 million, underscoring the significant investment protected by its IP strategy. The company actively monitors the market for potential patent infringements, taking legal action when necessary to defend its innovations and market position.

- Global Patent Portfolio: Signify actively manages a vast global patent portfolio, protecting its innovations across key markets.

- R&D Investment Protection: Patents secure the substantial financial investments Signify makes in research and development for lighting technologies.

- Monetization Opportunities: IP rights allow Signify to license its technologies, creating additional revenue streams and strategic partnerships.

- Defensive Strategy: Patent protection serves as a critical defense against competitors infringing on Signify's unique lighting solutions.

Circular Economy Legislation and Waste Management Directives

Signify's operations are increasingly shaped by growing legislative emphasis on circular economy principles. Directives like extended producer responsibility (EPR) and those concerning waste electrical and electronic equipment (WEEE) are directly influencing how Signify manages its products from creation to disposal. For instance, the EU's updated WEEE directive, aiming for higher collection and recycling rates, necessitates more robust end-of-life management strategies for lighting products.

These regulations are actively pushing Signify to innovate in product design, prioritizing longevity, ease of repair, and enhanced recyclability. This means a greater focus on material choices and modular design to facilitate upgrades and component replacements, thereby extending product lifespans and reducing waste. The company's commitment to sustainability aligns with these legal frameworks, driving investment in research and development for more eco-friendly solutions.

- EU WEEE Directive Targets: The EU aims to improve collection rates for WEEE, with specific targets for lighting products to be met by member states, encouraging better take-back schemes.

- Extended Producer Responsibility (EPR) Impact: EPR schemes place financial and operational responsibility on producers like Signify for the management of their products at the end of their life, incentivizing design for recyclability.

- Circular Economy Goals: Legislation is increasingly mandating the use of recycled materials and the reduction of hazardous substances, influencing Signify's supply chain and manufacturing processes.

- Product Lifespan Extension: Regulations are promoting repairability and modularity, pushing companies to design products that are easier to maintain and upgrade, thereby reducing the frequency of replacement.

Signify operates under a complex web of international and regional regulations, including those from the EU's Ecodesign Directive and Energy Labelling Framework, which mandate energy efficiency standards for lighting products. These regulations directly influence Signify's product development and market access, encouraging innovation in more efficient lighting technologies. By 2023, the EU's targets continued to drive demand for LED lighting, a core Signify product, with directives phasing out less efficient options. Compliance ensures Signify's products remain competitive and legally marketable in key global regions.

The company also adheres to stringent product safety and quality standards, such as the EU's Low Voltage Directive and RoHS Directive, which restrict hazardous substances. Non-compliance can lead to significant legal penalties and product recalls, impacting brand trust and financial performance. Furthermore, as connected lighting systems grow, Signify must comply with data privacy rules like GDPR, facing potential fines up to 4% of global annual revenue for breaches. In 2024, the average global cost of a data breach was $4.73 million, highlighting these risks.

Signify's intellectual property, particularly patents in LED and smart lighting, is a critical competitive asset. These legal protections safeguard over 10,000 global patents as of 2023, supporting the company's substantial R&D investments, which totaled €397 million in 2023. These patents deter infringement and maintain market exclusivity, allowing for potential technology licensing and partnerships. Signify actively monitors for and prosecutes patent infringements to defend its innovations.

Legislative focus on circular economy principles, such as extended producer responsibility (EPR) and waste electrical and electronic equipment (WEEE) directives, is also shaping Signify's operations. The EU's updated WEEE directive, aiming for higher collection and recycling rates, requires robust end-of-life management strategies. This drives Signify to prioritize product longevity, repairability, and recyclability in its design processes, aligning with growing legal mandates for sustainable product lifecycles.

Environmental factors

Signify has set a clear path towards a sustainable future, aiming for net-zero emissions by 2040. This ambitious goal includes a significant 90% reduction in greenhouse gas emissions by the same year, using 2019 as its baseline. These targets are not just numbers; they are intrinsically linked to the Paris Agreement, shaping Signify's entire approach to business. This commitment directly impacts how the company operates, manages its supply chain, and innovates its product lines, all with the aim of lessening its environmental footprint.

Signify is actively addressing resource scarcity by prioritizing sustainable materials, a move crucial given the growing environmental strain from raw material extraction. This commitment is evident in their ambitious packaging goals; by 2025, they aim for 100% plastic-free packaging, a significant step towards reducing waste. Their exploration of bio-circular and recyclable components in their products directly tackles the reliance on virgin resources.

This strategic shift not only aligns with environmental responsibility but also bolsters Signify's supply chain resilience. By reducing dependence on finite virgin materials, the company mitigates risks associated with price volatility and availability disruptions. This proactive approach to sourcing ensures a more stable operational foundation in the face of increasing global resource constraints.

The global push to cut energy use, especially in lighting which uses a substantial chunk of electricity, is a major environmental win for companies like Signify. Lighting alone accounted for roughly 15% of global electricity consumption in 2023, a figure that governments worldwide are keen to reduce.

Signify's focus on LED technology and intelligent lighting systems allows both individuals and companies to save significant amounts of energy. For example, their connected lighting systems can reduce energy consumption by up to 80% compared to traditional lighting, directly supporting international sustainability targets.

This trend fuels demand for energy-efficient solutions, creating a strong market for Signify's offerings as regulations tighten and environmental awareness grows. By 2025, it's projected that the global smart lighting market will reach over $30 billion, a testament to this increasing demand.

Waste Reduction and Circular Economy Principles

Signify is making significant strides in waste reduction, aiming to achieve a 50% reduction in waste from its operations by 2025. This commitment is deeply rooted in embracing circular economy principles across its product lifecycle. By 2023, the company reported that 55% of its sales were from circular revenues, demonstrating a tangible shift towards more sustainable business models.

The company's strategy focuses on designing products for longevity, ensuring they are easily serviceable and recyclable, thereby tackling the pervasive issue of electronic waste. This approach not only minimizes environmental impact but also aligns with growing consumer and regulatory demand for sustainable products.

- Circular Revenue Target: Signify aims to double its circular revenues by the end of 2025.

- Waste Reduction Goal: A 50% reduction in operational waste by 2025.

- Current Circularity: 55% of sales derived from circular revenues as of 2023.

- Product Design Focus: Emphasis on longevity, serviceability, and recyclability to combat e-waste.

Light Pollution Concerns and Biodiversity Impact

Growing global awareness of light pollution's detrimental effects on human health, wildlife, and astronomical observation is significantly shaping lighting design and public policy. For instance, the International Dark-Sky Association (IDA) continues to advocate for stricter regulations, with over 200 IDA-certified International Dark Sky Places globally as of early 2024, highlighting a tangible push for responsible lighting. This trend directly impacts companies like Signify, which are increasingly pressured to innovate in this area.

Signify is actively responding to these environmental concerns by developing and promoting specialized lighting solutions. Their commitment is evident in their 'Dark Sky compliant' luminaires and advanced intelligent lighting systems. These technologies are engineered to minimize upward light spill and glare, and offer dynamic control over light intensity and timing. This approach not only addresses regulatory pressures but also aligns with a broader corporate responsibility towards environmental stewardship and preserving natural nightscapes. In 2023, Signify reported a significant portion of its new product portfolio meeting stringent environmental criteria, including light pollution reduction standards.

- Growing Environmental Awareness: Public and governmental concern over light pollution's impact on ecosystems and human well-being is on the rise.

- Regulatory Influence: International and national bodies are implementing or strengthening regulations for outdoor lighting to mitigate negative environmental effects.

- Signify's Response: The company is investing in and marketing 'Dark Sky compliant' luminaires and smart lighting systems designed to reduce light trespass and skyglow.

- Market Opportunity: Demand for sustainable and responsible lighting solutions is creating a growing market segment for companies like Signify that can offer compliant products.

Signify's environmental strategy is deeply intertwined with global sustainability goals, targeting net-zero emissions by 2040 and a 90% reduction in greenhouse gases from a 2019 baseline. This commitment directly influences their product development, supply chain management, and operational practices to minimize ecological impact.

The company is actively tackling resource scarcity and waste, aiming for 100% plastic-free packaging by 2025 and increasing circular revenues to 60% by the end of 2025, having already achieved 55% in 2023. Signify is also focused on reducing operational waste by 50% by 2025 and designs products for longevity and recyclability to combat electronic waste.

Energy efficiency in lighting, which accounted for about 15% of global electricity consumption in 2023, presents a significant market opportunity. Signify's LED and intelligent lighting systems can reduce energy use by up to 80%, aligning with governmental efforts to curb energy consumption and contributing to the projected over $30 billion global smart lighting market by 2025.

Growing awareness of light pollution is driving demand for responsible lighting solutions. Signify is responding with 'Dark Sky compliant' luminaires and smart systems that minimize light spill, addressing regulatory pressures and consumer demand for environmentally conscious products, with a notable portion of their 2023 new product portfolio meeting stringent environmental criteria.

| Environmental Target | 2025 Goal | 2023 Status | 2040 Goal |

|---|---|---|---|

| Net-Zero Emissions | - | Progressing | Achieved |

| Greenhouse Gas Reduction | - | Progressing | 90% reduction from 2019 |

| Plastic-Free Packaging | 100% | Progressing | - |

| Circular Revenues | 60% | 55% | - |

| Operational Waste Reduction | 50% | Progressing | - |

PESTLE Analysis Data Sources

Our Signify PESTLE Analysis is meticulously crafted using data from reputable sources including international organizations like the World Bank, government statistical agencies, and leading market research firms. We prioritize current economic indicators, regulatory updates, and technological advancements to provide a comprehensive and accurate overview.