Signify Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Signify Bundle

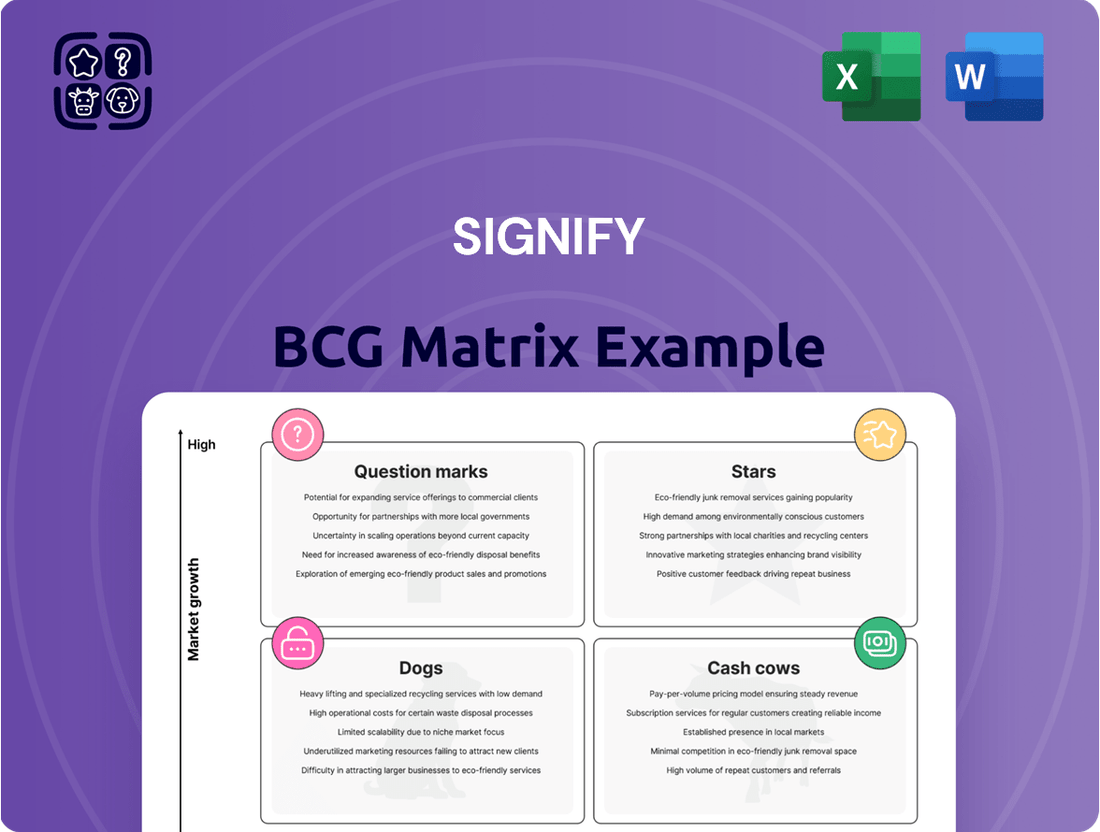

Curious about how Signify's product portfolio stacks up? Our preview offers a glimpse into their strategic positioning, hinting at potential Stars, Cash Cows, Dogs, and Question Marks. Don't just wonder – gain the full picture.

Unlock a comprehensive understanding of Signify's market performance by purchasing the complete BCG Matrix. This detailed analysis provides the crucial insights needed to identify growth opportunities and optimize resource allocation.

This isn't just a theoretical exercise; it's a strategic roadmap. The full Signify BCG Matrix report includes actionable recommendations tailored to their specific market dynamics, empowering you to make smarter, data-driven decisions.

Stop guessing and start acting. Get instant access to the full Signify BCG Matrix to clearly see which products are driving success, which are lagging, and where to strategically invest your capital next. Purchase now for immediate clarity and a competitive edge.

Stars

Signify's Interact Pro smart connected lighting systems are a clear Star in their BCG portfolio. These systems, integrating IoT, are gaining significant traction in the burgeoning smart building sector. In 2024, the global smart lighting market, a key segment for Interact Pro, was projected to reach over $15 billion, demonstrating robust growth.

Interact Pro’s ability to deliver advanced control, energy savings, and valuable data insights makes it highly attractive to businesses. Signify's strong market position in this high-growth, technologically driven area solidifies its Star status. The company’s focus on professional applications within this evolving landscape continues to drive demand.

Signify's UV-C disinfection lighting is positioned as a Star in the BCG matrix due to the escalating global emphasis on health and hygiene. This sector is experiencing robust demand and significant growth, especially within healthcare facilities, retail environments, and high-traffic public areas.

The market for UV-C disinfection is projected to reach approximately $11.8 billion by 2027, growing at a compound annual growth rate of over 15%, underscoring its Star status. Signify, a key innovator, benefits from this trend, leveraging its established market position and continuous product development in this essential area.

Signify's horticulture LED lighting solutions are a stellar example of a strong 'Star' in their portfolio. This segment is experiencing robust growth, fueled by the rise of indoor farming and the increasing demand for sustainable agricultural practices. In 2024, the global vertical farming market alone was projected to reach over $10 billion, showcasing the immense potential Signify is tapping into.

The company has strategically invested heavily in this sector, securing a dominant market position. This leadership is attributed to their cutting-edge spectral control technology, which optimizes plant growth, and their highly energy-efficient LED systems. These innovations are crucial for growers looking to reduce operational costs and improve yields, making Signify a preferred partner.

Signify's commitment to innovation and market penetration continues to pay off, with this product line consistently expanding its reach and market share. As the burgeoning indoor agriculture industry matures and scales, the demand for advanced lighting solutions like those offered by Signify is expected to accelerate, solidifying its 'Star' status for the foreseeable future.

LiFi (Light Fidelity) Technology

Signify's LiFi technology, which uses light for wireless communication, is a clear Star in their portfolio. Despite being a relatively new market, Signify has made significant strides with commercial deployments, indicating strong growth potential. The technology promises secure, high-speed data transfer, making it attractive for specialized environments.

This early mover advantage has allowed Signify to capture a substantial share of this emerging market. For instance, by early 2024, Signify had secured partnerships for LiFi integration in diverse sectors like healthcare and hospitality, showcasing tangible market penetration. The projected growth in niche applications for LiFi, such as secure data transmission in sensitive areas, further solidifies its Star status.

- Market Potential: LiFi is expected to grow significantly in niche applications requiring high security and speed.

- Signify's Position: Early commercial deployments and partnerships demonstrate Signify's leadership in this nascent field.

- Competitive Edge: Signify's pioneering work provides a strong early market share advantage.

- Growth Drivers: Increasing demand for secure wireless solutions in sectors like healthcare and finance fuels LiFi's expansion.

Sustainable and Circular Lighting Solutions

Signify's dedication to circular economy principles, including 'light as a service' models and the development of fully recyclable luminaires, positions them strongly in a market experiencing significant growth in demand for sustainable offerings. This commitment is crucial as the global market for sustainable lighting is projected to reach over $100 billion by 2028, with a compound annual growth rate of approximately 15%.

Their established brand recognition and continuous innovation in eco-friendly lighting solutions allow them to maintain a leading market share in a segment that is rapidly becoming a primary consideration for both businesses and consumers. For instance, Signify's circular approach contributed to a reduction of 1.4 million tons of CO2 emissions in 2023 by extending product lifecycles and enabling reuse.

- Market Growth: The sustainable lighting market is expanding, driven by environmental regulations and consumer preferences.

- Circular Economy: Signify's 'light as a service' and recyclable products address this trend directly.

- Competitive Advantage: Innovation and brand reputation secure a strong position in this growing segment.

- Impact: Their sustainability initiatives demonstrably reduce environmental impact, appealing to a conscious market.

Signify's Interact Pro systems are a clear Star, capitalizing on the booming smart building market. In 2024, the smart lighting sector alone was valued at over $15 billion, a testament to Interact Pro's strong position in this high-growth, technologically advanced area.

UV-C disinfection lighting is another Star, driven by the global focus on health and hygiene. This market is projected to hit $11.8 billion by 2027, with a growth rate exceeding 15% annually, highlighting Signify's success in this essential and expanding field.

Horticulture LED lighting solutions shine as Stars, benefiting from the surge in indoor farming and sustainable agriculture. The vertical farming market, a key segment, was expected to surpass $10 billion in 2024, showcasing Signify's strategic investment and dominance through advanced spectral control technology.

LiFi technology represents a Star, leveraging light for wireless communication in niche, high-security applications. Signify’s early commercial deployments by early 2024, including partnerships in healthcare and hospitality, underscore its leadership in this emerging, secure data transfer market.

Signify's circular economy initiatives, such as light as a service and recyclable products, position them as a Star in the rapidly growing sustainable lighting market. This segment is projected to exceed $100 billion by 2028, with a 15% annual growth rate, and Signify's 2023 CO2 emission reduction of 1.4 million tons further solidifies their appeal.

| Product Category | BCG Status | Market Growth | Signify's Position | Key Driver |

|---|---|---|---|---|

| Interact Pro (Smart Lighting) | Star | High (>$15B in 2024) | Leading | Smart Building Adoption |

| UV-C Disinfection Lighting | Star | High (>15% CAGR) | Innovator/Leader | Health & Hygiene Focus |

| Horticulture LED Lighting | Star | High (>$10B Vertical Farming in 2024) | Dominant | Indoor Farming Growth |

| LiFi Technology | Star | Emerging/High Niche Growth | Pioneer/Early Mover | Secure Wireless Data |

| Circular Economy Solutions | Star | High (>$100B by 2028) | Leading | Sustainability Demand |

What is included in the product

The Signify BCG Matrix analyzes its product portfolio by market share and growth rate.

It highlights which lighting solutions to invest in, divest from, or maintain.

The Signify BCG Matrix simplifies complex portfolio decisions, easing the pain of resource allocation by clearly visualizing each business unit's strategic position.

Cash Cows

Signify's core business in standard LED lamps and luminaires for homes and businesses continues to be a reliable source of income. Despite the LED market reaching maturity, Signify maintains a strong global position thanks to its well-known brand, vast sales channels, and efficient cost management.

These products are a significant cash cow, consistently generating substantial profits with minimal need for heavy marketing spend. For instance, in 2024, the company reported strong performance in its Brighter Lives segment, which heavily features these traditional lighting solutions, contributing significantly to overall profitability.

Signify's professional conventional lighting systems, while part of a mature market, continue to function as cash cows. These legacy systems, often found in older buildings or specialized industrial settings, represent a stable revenue source, especially where LED retrofitting is ongoing or not yet feasible. Their established presence means consistent demand for maintenance and replacement parts, requiring little in terms of new capital expenditure.

Despite the overall shift towards LED technology, these conventional systems still hold a significant installed base, ensuring ongoing, predictable cash flow for Signify. This segment benefits from existing infrastructure and long-term service agreements, contributing reliably to the company's financial stability. The minimal investment required allows these products to efficiently generate returns, supporting other growth areas within Signify's portfolio.

Signify's outdoor public lighting infrastructure, including streetlights and park lighting, functions as a solid cash cow. Their deep-rooted contracts and vast installed base provide a predictable revenue stream, primarily from ongoing maintenance and phased modernization projects.

This mature segment benefits from Signify's strong, long-standing partnerships with local governments and a proven history of reliability, securing a high market share and consistent recurring income.

In 2024, Signify continued to secure significant municipal lighting contracts, contributing to the stability of this segment. For instance, their ongoing work with several major European cities for LED upgrades and smart city integration projects underscores the recurring nature of their business in this area.

Lighting Components and Drivers

Signify's lighting components and drivers business functions as a significant cash cow, providing essential parts to other manufacturers and supporting internal production. This segment thrives on its economies of scale and well-developed supply chains, ensuring reliable revenue streams from a consistently stable demand.

The market for these components, while not experiencing rapid expansion, offers a dependable source of profit for Signify. In 2024, the demand for these foundational elements remained strong, underpinning the company's overall financial stability.

- Consistent Revenue: The steady demand for lighting components and drivers generates predictable income for Signify.

- Economies of Scale: Large-scale production in this segment leads to cost efficiencies and higher profit margins.

- Stable Market: While growth is modest, the segment benefits from a reliable, established market.

- Foundational Business: This area supports Signify's broader product offerings and contributes significantly to overall profitability.

Global Distribution and Supply Chain Network

Signify's global distribution and supply chain network is a powerful cash cow. This intricate web of operations ensures efficient product delivery across the globe, significantly reducing costs and maximizing market penetration for their established product lines. It's a highly optimized system that consistently generates substantial revenue through high-volume sales, operating with mature and effective processes that demand minimal additional strategic investment.

This robust network allows Signify to effectively manage its mature product portfolio, leveraging economies of scale. For instance, Signify reported a strong performance in its conventional lighting business segment in 2023, a testament to the efficiency of its existing supply chain. The company's ability to move large volumes of these products reliably underpins its cash-generating capacity.

The network's value lies in its ability to support high sales volumes of established products with minimal incremental capital expenditure. This operational efficiency translates directly into strong cash flow generation for Signify. Consider the logistics involved in distributing millions of LED bulbs annually; the optimization of these processes is key to their profitability.

Key strengths of Signify's cash cow network include:

- Global Reach: Extensive infrastructure enabling market access worldwide.

- Cost Efficiency: Minimized operational and logistics expenses through optimization.

- High Volume Support: Proven capability to handle large-scale distribution of mature products.

- Low Investment Requirement: Mature processes reduce the need for significant new capital outlays.

Signify's established product lines, particularly standard LED lamps and luminaires for residential and commercial use, continue to operate as robust cash cows. Despite the maturity of the LED market, Signify's strong brand recognition and extensive distribution channels allow it to maintain a significant market share, generating consistent profits with relatively low reinvestment needs.

These products are vital for Signify's financial stability, acting as reliable income generators. In 2024, the company's performance in its Brighter Lives segment, which encompasses these core lighting solutions, demonstrated continued profitability, underscoring their role as key cash cows.

Signify's legacy conventional lighting systems also function as cash cows. These systems, often found in older infrastructure, provide a stable revenue stream through ongoing maintenance and replacement parts, requiring minimal new capital expenditure.

The company's outdoor public lighting, including streetlights, represents another significant cash cow. Long-term contracts and a vast installed base ensure predictable revenue from maintenance and modernization projects, bolstered by strong partnerships with municipalities.

Signify's lighting components and drivers business is a strong cash cow. This segment benefits from economies of scale and a stable demand, providing essential parts to other manufacturers and supporting internal production, thereby ensuring reliable revenue streams.

The global distribution and supply chain network is a significant cash cow for Signify. This optimized infrastructure efficiently delivers established products worldwide, reducing costs and maximizing sales volume, which translates into substantial revenue with minimal incremental investment.

Signify's cash cow segments in 2024:

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Contribution (Illustrative) |

| Standard LED Lamps & Luminaires | Cash Cow | Mature market, strong brand, efficient cost management | High, stable profit margin |

| Conventional Lighting Systems | Cash Cow | Legacy installations, predictable maintenance revenue | Consistent, low-growth revenue |

| Outdoor Public Lighting | Cash Cow | Long-term contracts, vast installed base, recurring income | Significant recurring revenue |

| Lighting Components & Drivers | Cash Cow | Economies of scale, stable demand, essential parts | Reliable profit contribution |

| Global Distribution Network | Cash Cow | Optimized logistics, high-volume support, cost efficiency | Enables profitability of other segments |

Delivered as Shown

Signify BCG Matrix

The Signify BCG Matrix preview you are viewing is precisely the complete, unwatermarked document you will receive immediately after purchase. This means you get the full strategic analysis, ready for immediate application in your business planning and decision-making processes without any additional steps or modifications required.

Dogs

Traditional incandescent and halogen lamps, for Signify, would be firmly placed in the Dogs quadrant of the BCG Matrix. The company has made significant strides in phasing out these older technologies, with remaining sales representing a very small, niche portion of their business.

The market for incandescent and halogen lighting is experiencing a sharp contraction. This decline is driven by stringent energy efficiency regulations worldwide and a strong consumer shift towards more sustainable and cost-effective LED alternatives.

These products hold a minimal market share and operate within a market characterized by low or even negative growth. Consequently, they generate very little in terms of returns for Signify, making them a low priority for investment.

Early smart home lighting systems, like those from Belkin WeMo or early attempts at Wi-Fi connected bulbs that didn't achieve widespread adoption, would likely fall into the Dogs category of the BCG Matrix. These platforms often suffered from limited functionality, poor interoperability, and a lack of robust ecosystems compared to later market leaders. For instance, initial smart bulb technologies struggled with reliability and color accuracy, leading to consumer dissatisfaction.

These pre-Hue solutions typically had a very small market share, often in the low single digits, as consumers gravitated towards more integrated and user-friendly systems. The market segment for truly smart and sophisticated home lighting has significantly evolved, leaving these earlier, less capable platforms with minimal growth potential and little prospect for future profitability. Many of these early systems saw their user bases dwindle as newer, more advanced technologies emerged and gained dominance by 2024.

Occasionally, a company like Signify might dabble in highly specialized or avant-garde lighting concepts. These niche designs, while innovative, can sometimes miss the mark with consumers, resulting in minimal market adoption. For instance, a line of bio-adaptive lighting systems designed for specific therapeutic applications might have seen very low sales in 2024 due to high production costs and limited awareness, placing them firmly in the Dogs quadrant of the BCG matrix.

These experimental lighting solutions often represent a low market share within a very specific, unproven niche, or a segment where the unique design simply failed to capture interest. Such ventures, like a proposed smart lighting system for urban vertical farms that proved too complex for widespread adoption, consume valuable research and development resources without generating substantial revenue or demonstrating significant future growth potential.

Proprietary Communication Protocols (Non-Standard)

Proprietary communication protocols in legacy lighting systems represent a significant challenge within the Signify BCG Matrix. These systems, often reliant on unique, non-standardized communication methods, are increasingly becoming a liability as the market pivots towards open, interoperable solutions.

This characteristic places such offerings firmly in the 'Dog' category. Their limited market appeal stems from a lack of compatibility with newer technologies and a dwindling user base that requires ongoing, costly support for an obsolete infrastructure. For instance, a specialized protocol developed in the early 2000s might only be supported by a handful of aging control units, making it difficult and expensive to integrate with modern building management systems.

- Limited Market Appeal: As of 2024, the push for IoT and smart city integration favors universal protocols like DALI, KNX, and Matter. Systems relying on proprietary, non-standard communication struggle to connect with these evolving ecosystems.

- Low Growth Potential: With the industry's focus on interoperability, the demand for systems that cannot easily integrate or expand is diminishing. This restricts any potential for market share growth.

- Resource Drain: Maintaining and supporting these legacy systems diverts valuable R&D and technical support resources that could be allocated to more promising, standardized product lines.

- Competitive Disadvantage: Competitors offering solutions based on open standards can provide greater flexibility and future-proofing, making proprietary systems less attractive to new clients and potentially leading to obsolescence.

Segment-Specific Solutions with Limited Scalability

Segment-Specific Solutions with Limited Scalability, when viewed through the Signify BCG Matrix lens, represent products or services tailored for extremely narrow, non-replicable niche markets. These offerings, by their very nature, would struggle to gain significant market share or experience substantial growth beyond their initial deployment. This lack of scalability inherently makes them inefficient uses of Signify's capital and operational resources.

Consider a hypothetical scenario where Signify developed bespoke, ultra-specialized lighting for a single, unique historical preservation project with no foreseeable replication opportunities. While this might fulfill a specific client need, it wouldn't contribute meaningfully to Signify's overall market position or future revenue streams. In 2024, companies focusing on such highly customized, low-volume solutions often face challenges in achieving economies of scale, leading to higher per-unit costs and reduced profitability.

- Low Market Share: By definition, niche markets are small, inherently limiting the potential market share any single product can capture.

- Limited Growth Prospects: Without the ability to replicate or expand the application of the solution, growth potential remains confined to the initial project scope.

- Resource Inefficiency: Investing heavily in highly specialized, non-scalable solutions can divert resources from potentially higher-growth, more profitable segments of the business.

- Reduced ROI: The high development and production costs associated with custom solutions, coupled with limited sales volume, often result in a lower return on investment compared to mass-market products.

Products within the Dogs quadrant of the BCG matrix, like Signify's legacy incandescent bulbs, are characterized by low market share and low growth. These offerings often require significant investment to maintain but yield minimal returns. By 2024, the company's strategic shift towards LED and smart lighting has largely relegated older technologies to niche markets with declining demand.

The continued, albeit reduced, sales of these older lighting technologies represent a segment where Signify holds a minimal market share in a contracting market. While these products may still generate some revenue, their contribution to overall profitability is negligible, and they are not candidates for further investment or expansion efforts.

Companies like Signify actively manage their 'Dogs' by either divesting them or allowing them to naturally phase out, as seen with the discontinuation of many incandescent product lines. This strategic pruning allows resources to be reallocated to more promising business units, ensuring a healthier and more future-oriented product portfolio.

The financial implications of 'Dogs' are typically low revenue generation and potentially negative cash flow if significant maintenance or support costs are incurred. For instance, maintaining the production lines or specialized support for obsolete lighting technologies, as might have been the case for some proprietary systems in 2024, would represent a drain on resources.

Question Marks

Signify's advanced Human-Centric Lighting (HCL) solutions, designed to dynamically adjust light for human well-being, operate within a high-growth market segment. The global HCL market was valued at approximately USD 2.1 billion in 2023 and is projected to reach USD 7.5 billion by 2030, exhibiting a compound annual growth rate of around 19.8%.

However, widespread adoption of these truly integrated and personalized HCL systems is still in its nascent stages. While the potential for enhanced productivity, comfort, and health is significant, the current market penetration for sophisticated HCL compared to traditional lighting remains relatively modest.

These advanced solutions necessitate substantial investments in research and development, alongside dedicated efforts in market education and system integration. This focus is crucial to convert the current potential into market leadership, positioning HCL as a Star product for Signify.

Integrated lighting for urban and vertical farming, while a promising area for Signify, currently represents a segment with significant growth potential but relatively low market share for highly integrated, data-driven systems. Horticulture LEDs are a clear Star performer, but the specialized, end-to-end lighting solutions for large-scale operations are still developing and seeking traction.

Signify is actively investing in these advanced systems, recognizing the immense future demand. However, the market for these comprehensive, purpose-built solutions is still maturing.

The industry is moving towards more sophisticated, data-enabled lighting, with projections indicating substantial growth in controlled environment agriculture (CEA) lighting. For example, the global vertical farming market alone was valued at approximately $4.5 billion in 2022 and is projected to reach over $30 billion by 2030, highlighting the rapid expansion of this sector.

This presents a compelling opportunity for Signify to capture significant market share as these integrated solutions gain wider adoption and prove their value in optimizing crop yields and operational efficiency in these advanced farming environments.

Personalized and adaptive retail lighting, driven by sensors and AI to cater to individual shoppers and highlight specific products, represents a significant growth opportunity. This innovative approach aims to enhance the customer experience and drive sales, making it a key focus for forward-thinking retailers.

While the concept is promising, widespread market adoption for these advanced, dynamic lighting systems is still in its early stages. This suggests that Signify's current market share in this specific niche of truly sophisticated retail lighting solutions may be relatively small as the technology matures and customer understanding grows.

Successfully implementing these personalized lighting experiences requires considerable upfront investment from retailers to demonstrate a clear return on investment. Gaining broad acceptance hinges on proving the tangible benefits, such as increased dwell time or conversion rates, which can be challenging in the initial phases of adoption.

Smart City Data-as-a-Service Offerings

Signify's foray into data-as-a-service from its smart city lighting infrastructure positions it in a rapidly expanding market, tapping into valuable insights like traffic flow and air quality monitoring. The global smart city market was valued at approximately USD 977.7 billion in 2023 and is projected to reach USD 3,451.2 billion by 2030, growing at a CAGR of 19.7%.

While the potential is significant, the specific segment of 'lighting data as a service' is nascent, meaning Signify's current market share within this data analytics niche may not yet rival its established position in lighting hardware. This segment represents a strategic investment area where Signify is building its capabilities.

- High Growth Potential: The smart city data analytics market is experiencing robust expansion, driven by increasing urbanization and the need for efficient urban management.

- Nascent Market Segment: 'Lighting data as a service' is an emerging area, presenting both opportunity and the challenge of market development.

- Investment Required: Significant capital investment is necessary for Signify to scale its data service offerings and capture market share in this new domain.

- Competitive Landscape: While Signify has a strong hardware base, it faces competition from established data analytics firms and other technology providers entering the smart city space.

AI-Powered Predictive Maintenance for Lighting Systems

Developing AI-powered predictive maintenance for lighting systems represents a significant growth avenue for Signify, offering substantial cost reductions for clients by anticipating equipment failures. This advanced service, however, operates within an emerging market with nascent client adoption, likely resulting in a currently modest market share for Signify in this niche. Continued investment in technology and dedicated client education are crucial for capturing this opportunity.

- Market Potential: The global smart lighting market, a key enabler for AI-driven predictive maintenance, was projected to reach over $15 billion by 2024, indicating substantial room for service growth.

- Adoption Stage: While AI in maintenance is gaining traction across industries, its specific application to lighting infrastructure is still in early adoption phases, suggesting Signify is building a first-mover advantage.

- Client Benefits: Predictive maintenance can reduce unplanned downtime by up to 30% and maintenance costs by 10-40% in various industrial settings, a benchmark Signify aims to achieve for lighting clients.

- Strategic Investment: Signify's ongoing R&D in AI and IoT integration positions it to capitalize on this trend, requiring sustained focus on demonstrating value and building client trust.

Question Marks in Signify's portfolio represent areas with high growth potential but currently low market share. These are new or emerging product categories where Signify is investing heavily to establish a strong foothold. The challenge lies in converting this potential into significant market penetration, requiring substantial R&D, market education, and demonstrating clear value propositions to customers.

Signify's investment in advanced Human-Centric Lighting (HCL) solutions, for instance, targets a market projected to reach $7.5 billion by 2030. Despite this growth, sophisticated HCL adoption is still in its early stages, making it a Question Mark. Similarly, integrated lighting for vertical farming, a market expected to exceed $30 billion by 2030, is another area where Signify is building its presence.

The company's focus on data-as-a-service from smart city lighting infrastructure, within a market valued at $977.7 billion in 2023, also falls into the Question Mark category. While the overall smart city market is robust, the specific niche of 'lighting data as a service' is nascent, demanding strategic investment to define and capture market share.

AI-powered predictive maintenance for lighting systems is another emerging avenue. While the global smart lighting market is substantial, the application of AI for predictive maintenance within this sector is still in early adoption phases. This presents Signify with an opportunity to establish leadership, but it requires concerted efforts in technology development and client education to drive adoption.

BCG Matrix Data Sources

Our Signify BCG Matrix is constructed using a blend of internal financial performance data, independent market research reports, and industry expert analyses to ensure accurate strategic insights.