Sigma Healthcare PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sigma Healthcare Bundle

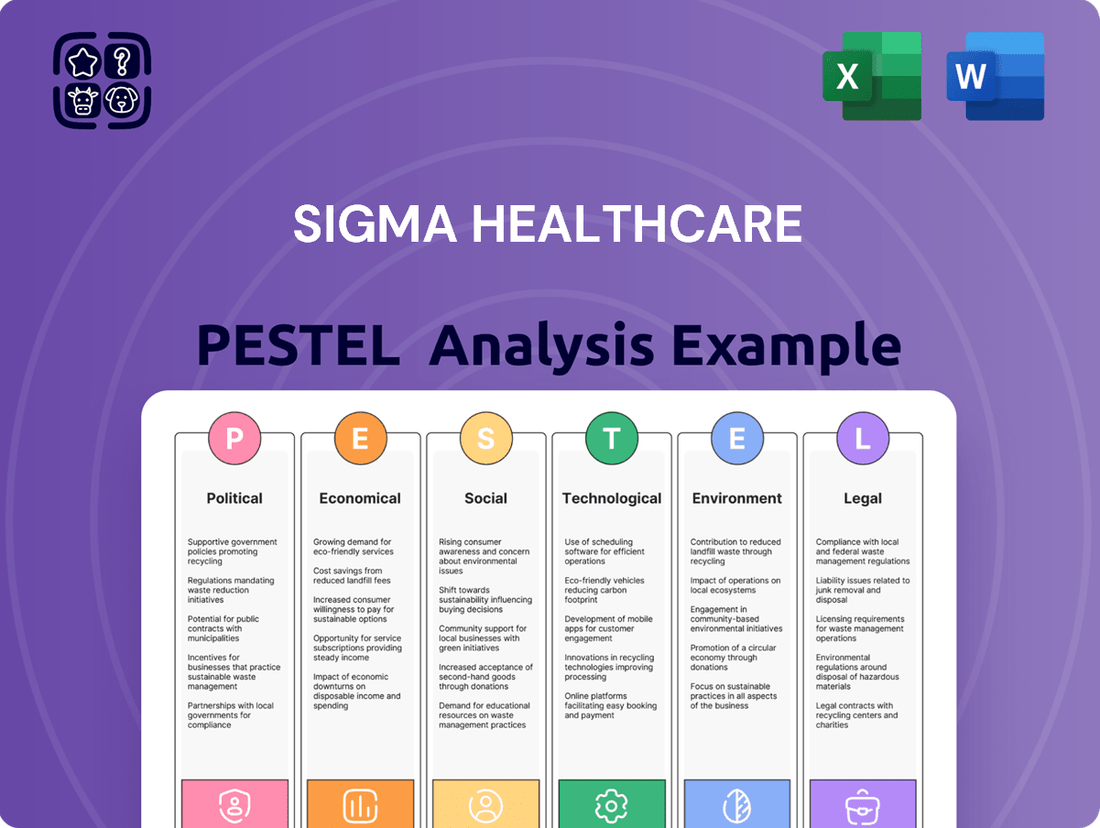

Navigate the complex external forces shaping Sigma Healthcare's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors create both opportunities and threats for the company. This in-depth report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a critical competitive edge.

Political factors

Government healthcare policies are a major driver for Sigma Healthcare. For instance, the US government's Medicare Part D spending, a significant revenue source for pharmaceutical distributors, was projected to reach $160 billion in 2024. Adjustments to reimbursement rates or formulary inclusions by agencies like CMS directly affect Sigma's sales volumes and profitability.

Shifts in government health spending priorities, such as increased funding for preventative care or specific disease management programs, can create new avenues for Sigma to distribute related pharmaceuticals and medical supplies. Conversely, budget cuts or changes in regulatory frameworks, like those impacting drug pricing negotiations, present considerable challenges.

In 2024, the Inflation Reduction Act's provisions, allowing Medicare to negotiate prices for certain high-cost drugs, are a key policy to watch. This could alter the landscape of drug sales and, by extension, the distribution margins for companies like Sigma Healthcare.

Furthermore, public health initiatives, like vaccination campaigns or programs addressing chronic diseases, represent significant opportunities for Sigma to expand its reach and product offerings. The success and funding levels of these initiatives directly correlate with demand for the products Sigma distributes.

The Pharmaceutical Benefits Scheme (PBS) plays a significant role in Australia's healthcare landscape by subsidizing prescription medications. Changes to the PBS, such as new drugs being listed or adjustments to pricing frameworks, can directly impact Sigma Healthcare's sales volumes and profit margins for those specific products. For instance, a decision to list a new high-cost innovative drug on the PBS could boost revenue for Sigma if they are a key distributor.

In 2023-24, the Australian government allocated approximately $15.5 billion to the PBS, underscoring its substantial economic influence on the pharmaceutical sector. Any shifts in co-payment amounts or eligibility criteria for subsidized medicines under the PBS can alter patient demand for pharmaceuticals distributed by Sigma Healthcare. For example, an increase in patient co-payments might lead to reduced demand for certain non-essential medications.

Regulations on who can own pharmacies, where they can be located, and how they must operate are paramount for Sigma Healthcare, given its role in supplying and managing retail pharmacy programs. For instance, changes in ownership laws, such as those debated in various Australian states regarding corporate ownership versus pharmacist ownership, directly shape the competitive environment.

Strict adherence to these existing regulations, or adapting to any proposed reforms, can significantly influence market access for Sigma Healthcare's pharmacy network. For example, proposed changes to the Pharmacy Location Rules in Australia, aimed at ensuring geographic distribution of pharmacies, could impact where new Sigma-affiliated pharmacies can establish themselves, thereby affecting the company's growth strategy.

Any shifts in these regulatory frameworks can alter the competitive landscape, potentially introducing new players or consolidating existing ones. This directly influences the overall business model of Sigma Healthcare's pharmacy network, affecting everything from supply chain logistics to brand presence and customer reach.

For example, if a state were to relax regulations on the number of pharmacies a single entity can own, it could lead to increased consolidation, potentially benefiting larger players like Sigma Healthcare if they are positioned to acquire, but also intensifying competition from other consolidated groups.

Trade Agreements and Import/Export Regulations

Trade agreements and import/export regulations significantly shape Sigma Healthcare's global operations. For instance, the Australia-United States Free Trade Agreement (AUSFTA) has historically influenced bilateral trade, though specific pharmaceutical tariffs are complex and often subject to ongoing negotiations and adjustments. Changes in customs procedures or the imposition of new tariffs on active pharmaceutical ingredients (APIs) or finished products imported into Australia could directly impact Sigma's cost of goods sold and necessitate price adjustments.

Sigma Healthcare's reliance on international sourcing for certain medicines and raw materials makes it susceptible to shifts in trade policy. For example, if a major supplier is located in a country that imposes new export restrictions or if Australia implements stricter import controls on specific drug categories, it could disrupt Sigma's supply chain. In 2024, ongoing discussions surrounding global supply chain resilience, particularly post-pandemic, highlight the potential for evolving trade policies that could affect the pharmaceutical sector.

- Impact on Supply Chain: Fluctuations in tariffs or quotas on imported pharmaceutical components can directly affect Sigma Healthcare's manufacturing costs.

- Product Availability: New customs procedures or import bans on specific medicines could lead to stock shortages for Sigma's product lines.

- Operational Expenses: Changes in trade agreements might necessitate renegotiating supplier contracts or exploring alternative sourcing strategies, impacting operational budgets.

- Market Access: Trade pacts can also create opportunities by reducing barriers to export Sigma's products to new international markets.

Political Stability and Public Health Priorities

Political stability is a cornerstone for predictable business operations, allowing companies like Sigma Healthcare to plan long-term strategies with confidence. In countries experiencing frequent governmental changes or unrest, policy implementation can become erratic, impacting regulatory frameworks and market access.

Public health priorities represent a dynamic political factor that can significantly influence Sigma Healthcare's market. For instance, the ongoing focus on managing post-pandemic health challenges and the potential for new infectious disease outbreaks in 2024-2025 will likely sustain demand for diagnostic tools and antiviral treatments. Governments may also launch specific national health campaigns, such as those targeting chronic diseases or mental health awareness, directly affecting the sales of related pharmaceuticals and healthcare services.

- Government Spending on Healthcare: In 2024, many developed nations, including the UK and Germany, continued to allocate substantial portions of their national budgets to healthcare, often exceeding 10% of GDP, to address aging populations and the lingering effects of the COVID-19 pandemic. This trend is expected to persist into 2025, providing a stable revenue environment for healthcare providers and manufacturers.

- Regulatory Changes: Anticipated regulatory shifts in pharmaceutical pricing and approval processes in major markets like the United States and the European Union during 2024-2025 could impact Sigma Healthcare's product launch timelines and profitability.

- Public Health Initiatives: The World Health Organization's continued emphasis on global health security and disease surveillance in 2024, with projected funding increases for 2025, signals a sustained political commitment to public health infrastructure, benefiting companies involved in infectious disease management.

Government healthcare policies significantly shape Sigma Healthcare's operational landscape. For example, the projected US Medicare Part D spending of $160 billion in 2024 directly influences pharmaceutical distribution revenue. Conversely, regulatory changes like the Inflation Reduction Act's drug price negotiation provisions for Medicare could impact Sigma's sales margins.

Shifts in public health priorities, such as increased funding for preventative care or chronic disease management in 2024-2025, create new distribution opportunities for Sigma. The Australian government's allocation of $15.5 billion to the PBS in 2023-24 highlights the financial impact of such schemes on pharmaceutical demand.

Regulations governing pharmacy ownership and operation are critical for Sigma's retail pharmacy network. Changes in these rules, like those debated in Australian states concerning corporate versus pharmacist ownership, directly affect market access and competition. For instance, proposed changes to Australia's Pharmacy Location Rules could influence Sigma's expansion strategies.

International trade agreements and import/export regulations also play a key role, influencing Sigma's supply chain costs for APIs and finished products. Evolving global supply chain resilience discussions in 2024 may lead to policy shifts impacting pharmaceutical trade.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Sigma Healthcare, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present distinct challenges and opportunities.

Sigma Healthcare's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain of sifting through complex data for easier referencing during meetings and strategic planning.

Economic factors

The Australian economy’s vitality, measured by its Gross Domestic Product (GDP) growth, directly influences healthcare expenditure. As of the March quarter 2024, Australia's GDP grew by 0.1%, indicating a period of slower economic expansion. This can indirectly affect Sigma Healthcare by impacting overall consumer spending patterns.

Consumer confidence is another key indicator. While essential pharmaceuticals remain a necessity, a dip in consumer confidence, often linked to economic uncertainty, can lead to reduced spending on non-essential pharmacy items like cosmetics and health supplements. This impacts Sigma's front-of-store revenue streams.

In 2023, Australian household spending on health increased by 4.3%, reaching $137.8 billion, according to ABS data. This shows resilience in the healthcare sector, but broader economic slowdowns can still affect discretionary purchases within pharmacies, influencing Sigma's wholesale and retail operations.

Economic downturns may also limit Sigma Healthcare's capacity for strategic investments, such as pharmacy network upgrades or new distribution centre developments. The ability to invest in such areas is often tied to the company's financial performance, which is itself influenced by the prevailing economic climate and consumer spending.

Inflation presents a significant challenge for Sigma Healthcare, with rising costs impacting everything from essential medical supplies to operational expenses. For instance, the Australian Bureau of Statistics reported a 5.4% annual increase in the Consumer Price Index (CPI) for the year ending December 2023, indicating broad inflationary pressures that translate to higher procurement and service delivery costs for Sigma.

The current interest rate environment, with the Reserve Bank of Australia (RBA) maintaining a cash rate of 4.35% as of early 2024, directly affects Sigma Healthcare's financial strategy. This elevated cost of capital makes borrowing for new facilities, technology upgrades, or even managing day-to-day working capital more expensive, potentially dampening profitability and slowing down planned growth initiatives.

National healthcare expenditure continues to climb, a trend significantly influenced by an aging demographic and the increasing prevalence of chronic conditions. In 2024, global healthcare spending was projected to reach over $10 trillion, a figure expected to grow steadily. This sustained expansion in healthcare budgets directly fuels demand for pharmaceutical distribution, creating a more robust market for Sigma Healthcare.

Technological advancements in medical treatments and diagnostics also contribute to rising healthcare costs but simultaneously expand the market for distributing newer, often more expensive, medications. For instance, the market for biologics, a rapidly growing segment, necessitates sophisticated distribution networks. Sigma Healthcare, by facilitating access to these innovations, stands to benefit from this ongoing economic shift.

Looking ahead, forecasts for 2025 and beyond indicate continued upward pressure on healthcare spending, with an estimated annual growth rate of around 5-7% globally. This predictable growth trajectory in the broader healthcare economy provides a stable and expanding base for Sigma Healthcare's distribution services, underscoring the sector's economic importance.

Competitive Landscape and Market Consolidation

The pharmaceutical wholesale and retail pharmacy sectors are characterized by a dynamic competitive landscape. In 2024, the Australian pharmaceutical market saw continued activity in mergers and acquisitions, with larger players often acquiring smaller ones to expand their reach and efficiency. This consolidation trend, exemplified by ongoing discussions and potential deals within the pharmacy group space, directly influences Sigma Healthcare's market share and its ability to negotiate pricing. Increased consolidation can indeed lead to tighter operating margins for Sigma, as larger, more powerful entities may exert greater pressure on distribution agreements and wholesale pricing. Furthermore, shifts in distribution channels, potentially favoring vertically integrated models, could necessitate strategic adjustments for Sigma to maintain its competitive edge.

Key factors influencing Sigma Healthcare's position include:

- Market Concentration: The degree to which a few large competitors dominate the market, impacting Sigma's pricing power. For instance, the Australian pharmacy sector has seen a trend towards larger banner groups gaining market share, potentially influencing wholesale purchasing power.

- Mergers and Acquisitions (M&A) Activity: Ongoing M&A among competitors can reshape the competitive environment, potentially leading to fewer, larger rivals for Sigma.

- Distribution Channel Evolution: Changes in how pharmacies source their products, such as increased direct-to-pharmacy sales or the rise of integrated pharmacy groups, can affect Sigma's traditional wholesale model.

- Pricing Pressures: As the market consolidates, there's an increased likelihood of intensified price competition, which can compress margins for wholesale distributors like Sigma.

Supply Chain Costs and Currency Fluctuations

Sigma Healthcare's profitability is directly tied to the volatility of supply chain costs and currency movements. Fluctuations in global energy prices, for example, directly impact freight charges, a significant component of their distribution expenses. In 2024, continued geopolitical tensions and the transition to cleaner energy sources are expected to keep energy prices somewhat elevated, maintaining pressure on logistics costs.

The Australian dollar's exchange rate plays a crucial role, especially for a company sourcing many of its products internationally. A weaker Australian dollar, as seen periodically in 2024, increases the cost of imported pharmaceuticals and health products. For instance, if the AUD depreciates by 5%, the cost of imported goods for Sigma could rise proportionally, impacting their cost of goods sold.

Rising fuel costs directly translate to higher transportation expenses for Sigma Healthcare's extensive distribution network across Australia. This increase in operational overhead can squeeze profit margins if not effectively passed on to consumers or mitigated through operational efficiencies. The Australian Institute of Petroleum reported average unleaded petrol prices around AUD 1.70-1.80 per litre in early 2024, a level that significantly influences transport expenditures.

- Energy Price Volatility: Global energy markets continue to influence freight costs, impacting Sigma's logistics expenses.

- Currency Exchange Rates: A weaker Australian dollar increases the cost of imported pharmaceutical goods.

- Freight Costs: Elevated fuel prices directly increase the cost of distributing products nationwide.

Economic growth directly impacts healthcare spending, with Australia's GDP growing by 0.1% in the March quarter of 2024. While essential medicines are resilient, a dip in consumer confidence can affect non-essential pharmacy sales, impacting Sigma's front-of-store revenue. Despite a 4.3% increase in household health spending in 2023, broader economic slowdowns can still influence discretionary purchases within pharmacies.

Full Version Awaits

Sigma Healthcare PESTLE Analysis

The preview shown here is the exact Sigma Healthcare PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will receive a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Sigma Healthcare.

The content and structure shown in the preview is the same document you’ll download after payment. It meticulously analyzes each PESTLE element relevant to Sigma Healthcare's strategic planning and operational environment.

The file you’re seeing now is the final version—ready to download right after purchase, providing you with actionable insights for navigating the complexities of the healthcare sector.

Sociological factors

Australia's population is aging, with the proportion of those aged 65 and over projected to reach 22% by 2050, up from around 16% in 2023. This demographic trend, coupled with a rising incidence of chronic diseases, such as cardiovascular conditions and diabetes, creates a consistent and expanding demand for pharmaceutical goods and healthcare services. Sigma Healthcare is well-positioned to capitalize on this, as the need for prescription medications and associated health products will only grow.

Consumers are increasingly focused on health and wellness, driving demand for products that support a healthy lifestyle. This heightened awareness, combined with a growing inclination towards self-medication for everyday health concerns, directly impacts the market for over-the-counter (OTC) drugs and complementary medicines. For instance, the global vitamins and dietary supplements market was valued at approximately $177 billion in 2023 and is projected to reach over $270 billion by 2030, showcasing a significant upward trend in consumer spending on self-care solutions.

Sigma Healthcare's strategic advantage lies in its capacity to efficiently stock and distribute a wide array of these health-focused products. Meeting the evolving preferences of consumers who are actively seeking solutions for minor ailments and proactive health management is paramount. In 2024, the Australian Pharmaceutical Benefits Scheme (PBS) reported significant expenditure on prescription medicines, but the OTC market, which Sigma Healthcare operates within, represents a substantial and growing segment for self-managed health.

Consumers are actively prioritizing convenience and seamless integration in their healthcare journeys, with a growing demand for online pharmacies, telehealth consultations, and accessible health checks offered within community pharmacies. This shift is evident as telehealth usage surged during the pandemic and continues to be a preferred option for many, with some reports indicating a sustained adoption rate of over 30% for virtual visits even post-peak.

Sigma Healthcare must adapt its strategy to better support its retail pharmacy banners like Amcal and Guardian, ensuring they can effectively facilitate these evolving consumer access points. This involves investing in digital infrastructure for online prescription fulfillment and expanding the range of in-pharmacy health services that cater to preventative care and minor ailment management.

Public Trust in Pharmaceutical Companies and Pharmacies

Public trust is a cornerstone for Sigma Healthcare. Consumers' belief in the safety and effectiveness of medications, and the integrity of dispensing pharmacies, directly influences purchasing decisions. A recent 2024 survey indicated that while overall trust in healthcare providers remains relatively high, specific segments of the pharmaceutical industry have faced scrutiny, potentially impacting consumer confidence.

Any erosion of this trust, perhaps due to product recalls or pricing controversies, could lead to decreased demand for Sigma Healthcare's products and increased regulatory oversight. Conversely, strong public faith in pharmaceutical companies and pharmacies solidifies the foundation of Sigma Healthcare's operations, ensuring a more predictable market. For instance, a 2023 report highlighted that a significant percentage of patients would switch pharmacies if they experienced poor customer service or perceived a lack of professionalism, underscoring the importance of consistent quality.

- Consumer Confidence: In 2024, public perception of pharmaceutical safety and efficacy directly impacts product demand.

- Regulatory Impact: Widespread concerns can trigger stricter regulatory scrutiny, affecting Sigma Healthcare's operational landscape.

- Pharmacy Reliability: Trust in pharmacies is crucial; a 2023 study showed patients may switch providers based on service quality.

- Business Stability: High public trust underpins the stability of Sigma Healthcare's core business model and market position.

Workforce Demographics and Labor Availability in Healthcare

The availability of skilled labor is a critical sociological factor for Sigma Healthcare, especially for roles like pharmacists, pharmacy assistants, and logistics personnel. For instance, as of late 2024, the US Bureau of Labor Statistics projects a 2.5% growth for pharmacists between 2022 and 2032, which is slower than the average for all occupations, indicating potential future tightness in supply.

These workforce dynamics directly influence Sigma's operational efficiency and service delivery. Labor shortages or shifts in demographics can drive up labor costs, affecting both Sigma's internal operations and the pricing it offers to its pharmacy clients. This is particularly relevant given an aging workforce in many developed nations, which could exacerbate shortages in key healthcare support roles.

Sociological trends also impact the pool of available talent. Factors like changing educational pathways, workforce participation rates among different age groups, and the increasing demand for flexible work arrangements all play a role. For example, a 2024 report by the American Association of Colleges of Pharmacy highlighted ongoing efforts to increase pharmacy school enrollment, but the pipeline for experienced professionals remains a concern.

Consider these key workforce aspects:

- Pharmacist Shortages: Projected slower-than-average growth for pharmacists could lead to recruitment challenges and increased wage pressures.

- Pharmacy Assistant Demand: Increased reliance on pharmacy assistants for tasks like dispensing and inventory management heightens the need for a readily available and trained workforce.

- Logistics Personnel: Efficient supply chain operations depend on a consistent supply of qualified logistics staff, a segment that can be affected by broader economic labor market trends.

- Aging Workforce: As experienced healthcare professionals approach retirement, Sigma must plan for knowledge transfer and recruit new talent to maintain service levels.

Australia's aging population, with those over 65 projected to be 22% by 2050, alongside a rise in chronic illnesses, fuels a steady demand for healthcare products and services. Sigma Healthcare's business model, focusing on pharmaceuticals and health items, directly benefits from this demographic shift. The increasing prevalence of conditions like diabetes and heart disease means a consistent need for prescription medications.

The growing consumer focus on health and wellness is a significant sociological driver. People are actively seeking products for self-care and preventative health, boosting the market for over-the-counter (OTC) drugs and supplements. This trend is evidenced by the global vitamins and dietary supplements market, which was valued at around $177 billion in 2023 and is expected to exceed $270 billion by 2030.

Consumers now prioritize convenience, driving demand for online pharmacies and telehealth services. Sigma Healthcare needs to ensure its retail banners, like Amcal and Guardian, can support these digital access points and offer expanded in-pharmacy health services. Public trust in pharmaceutical safety and reliability is also paramount, with customer service quality being a key factor in pharmacy loyalty, as noted in a 2023 study.

Technological factors

Technological leaps in pharmaceutical manufacturing are reshaping Sigma Healthcare's product landscape. Innovations like mRNA vaccine platforms and advanced biologics require sophisticated handling and specialized distribution channels. For instance, the rise of personalized medicine, driven by genomic sequencing, necessitates flexible supply chains capable of managing smaller, more tailored batches, a shift Sigma Healthcare must actively integrate.

Distribution is also undergoing a significant technological overhaul, directly impacting Sigma Healthcare's operational efficiency. Investments in automated warehousing and AI-powered logistics are becoming standard, aiming to reduce delivery times and minimize errors. In 2024, the global pharmaceutical logistics market was valued at approximately $225 billion, with automation playing a key role in its growth, a trend Sigma Healthcare is capitalizing on to streamline its operations and cut costs.

Digital health adoption is rapidly transforming healthcare delivery. E-prescribing and telehealth services are becoming commonplace, simplifying how patients get their medications and access medical advice. For instance, by the end of 2024, it's projected that over 90% of US pharmacies will be integrated with e-prescribing networks, a significant jump from previous years.

Sigma Healthcare must actively integrate its systems with these burgeoning digital platforms. This integration is crucial for maintaining a smooth supply chain, ensuring timely delivery of pharmaceuticals, and effectively supporting its extensive pharmacy network as telehealth appointments and digital prescriptions increase.

Leveraging big data analytics and AI offers Sigma Healthcare a powerful toolkit for optimizing its intricate supply chain operations. These technologies can refine demand forecasting, streamline inventory management, and enhance route planning for deliveries, ultimately driving efficiency and cost savings.

For instance, advanced analytics can predict product demand with greater accuracy, minimizing stockouts and overstocking. In 2024, companies utilizing AI in supply chain management reported an average reduction in inventory holding costs by up to 15%, according to industry surveys.

AI-powered route optimization can lead to faster delivery times and reduced fuel consumption. By analyzing real-time traffic and delivery data, Sigma Healthcare could potentially cut logistics costs by 10-20% in the coming years, improving overall operational performance and customer satisfaction.

Cybersecurity Risks and Data Privacy

Sigma Healthcare's deep reliance on digital platforms for everything from patient records to supply chain management makes it a prime target for cyberattacks. A breach could compromise sensitive health information and disrupt critical operations. The company must invest heavily in cybersecurity to safeguard data and maintain patient trust.

Data privacy is not just a technical challenge but a legal and ethical imperative. In 2024, global spending on cybersecurity solutions in healthcare was projected to reach over $125 billion, highlighting the immense pressure to protect data. Sigma Healthcare needs to ensure its practices align with evolving regulations like HIPAA and GDPR to avoid substantial penalties and reputational damage.

- Cybersecurity Investment: Sigma Healthcare must prioritize ongoing investment in advanced threat detection and prevention systems.

- Data Breach Impact: A significant data breach could lead to millions in fines, loss of patient confidence, and operational paralysis.

- Regulatory Compliance: Adherence to stringent data privacy laws is crucial for maintaining legal standing and customer trust.

- Employee Training: Regular cybersecurity awareness and training for all staff is essential to mitigate human-error related vulnerabilities.

Automation in Warehousing and Logistics

The integration of automated guided vehicles (AGVs) and robotic picking systems within warehouses is transforming logistics operations. These technologies are designed to boost the speed and precision of fulfilling customer orders, a critical factor for distributors like Sigma Healthcare. For instance, projections suggest the global warehouse automation market could reach over $100 billion by 2027, indicating significant investment and adoption. This advancement directly translates into potential cost reductions and expanded operational capacity.

Key benefits of this technological shift include:

- Enhanced Order Fulfillment Speed: Robots can process orders significantly faster than manual labor, reducing turnaround times.

- Improved Accuracy: Automation minimizes human error in picking and sorting, leading to fewer incorrect shipments.

- Cost Efficiencies: Reduced labor costs and fewer errors contribute to substantial savings.

- Increased Throughput: Greater speed and accuracy allow for a higher volume of goods to be processed.

Technological advancements are fundamentally altering Sigma Healthcare's operational framework, from product development to delivery. Innovations like AI-driven demand forecasting and automated warehousing are key, with the global warehouse automation market projected to exceed $100 billion by 2027. These technologies enhance efficiency, reduce costs, and improve delivery accuracy, crucial for a distributor of Sigma Healthcare's scale.

The increasing reliance on digital health platforms, including e-prescribing and telehealth, necessitates seamless integration for Sigma Healthcare to support its pharmacy network effectively. By late 2024, over 90% of US pharmacies are expected to be integrated with e-prescribing networks, highlighting the digital shift. This digital transformation also brings heightened cybersecurity risks, with healthcare cybersecurity spending projected to surpass $125 billion globally in 2024, demanding robust data protection measures.

| Technology Area | Impact on Sigma Healthcare | Key Data Point (2024/2025) |

| AI & Automation in Logistics | Streamlined supply chain, reduced delivery times, lower operational costs | Global warehouse automation market to exceed $100B by 2027; AI in supply chain management can reduce inventory costs by up to 15% |

| Digital Health Platforms | Enhanced patient access, need for system integration, support for telehealth | >90% of US pharmacies integrated with e-prescribing by end of 2024 |

| Cybersecurity | Protection of sensitive data, mitigation of operational disruption, regulatory compliance | Global healthcare cybersecurity spending projected >$125B in 2024 |

Legal factors

The Therapeutic Goods Administration (TGA) in Australia mandates rigorous standards for all medicines and medical devices, directly affecting Sigma Healthcare's operations. Compliance with TGA regulations is paramount for ensuring the quality, safety, and effectiveness of products distributed by the company. For instance, in 2024, the TGA continued its focus on post-market surveillance, with increased scrutiny on medical device software and digital health technologies, potentially requiring Sigma to update its product lifecycle management processes.

Changes in TGA regulations can significantly influence product availability and introduce additional compliance costs for Sigma Healthcare. For example, evolving requirements for evidence of therapeutic efficacy or updated manufacturing practices could necessitate product reformulation or re-registration, impacting supply chains and market access. The TGA's ongoing efforts to align with international regulatory standards, such as those from the International Council for Harmonisation (ICH), also mean Sigma must adapt to evolving global best practices in 2025.

Australian competition laws, such as the Competition and Consumer Act 2010, are designed to prevent anti-competitive practices and ensure fair market conduct. Sigma Healthcare must navigate these regulations, which impact its pricing strategies, distribution agreements, and any potential market dominance it holds within the pharmaceutical sector. For instance, the Australian Competition and Consumer Commission (ACCC) actively monitors mergers and acquisitions to prevent undue concentration of market power.

Consumer protection laws are also critical, dictating stringent requirements for product information, labeling accuracy, and robust recall procedures for pharmaceuticals. Sigma Healthcare's adherence to these mandates, including clear communication of drug efficacy and side effects, is paramount to maintaining consumer trust and avoiding significant penalties. In 2023, the ACCC continued its focus on misleading advertising and product safety across various industries.

Pharmacy practice standards and licensing are foundational for Sigma Healthcare, directly shaping its customer base. These regulations dictate who can operate a pharmacy and what services they can offer, influencing the demand for Sigma's distribution network.

For instance, in the US, the National Association of Boards of Pharmacy (NABP) sets model rules, but each state has its own specific licensing requirements for both individual pharmacists and the pharmacies themselves. In 2024, ongoing discussions around scope of practice for pharmacists, particularly regarding advanced services like immunizations and medication therapy management, continue to evolve, potentially expanding the client pool for distributors like Sigma.

Compliance with these evolving standards, including any updates to dispensing regulations or quality control measures, is non-negotiable for pharmacies. Failure to meet these legal benchmarks can result in operational shutdowns, directly impacting Sigma Healthcare's revenue streams. Therefore, staying abreast of changes from bodies like the US Food and Drug Administration (FDA) or equivalent international regulatory agencies is critical for business continuity and stable demand for Sigma's services.

Intellectual Property Rights for Pharmaceuticals

Intellectual property laws, particularly patents on new drugs, are crucial for pharmaceutical companies like Sigma Healthcare. These patents grant exclusive marketing rights, typically for 20 years from the filing date, which significantly impacts the competitive landscape by delaying the entry of lower-cost generic versions. For instance, as of early 2025, the patent expiry of several blockbuster drugs in the prior decade has led to substantial market share shifts and pricing pressures, directly affecting the product mix and profitability of distributors.

The strength and duration of these intellectual property rights directly influence Sigma Healthcare's ability to secure and distribute innovative medicines. This legal framework dictates when generic competitors can enter the market, thereby shaping pricing strategies and the overall product portfolio available for distribution. The ongoing global debate around patent extensions and compulsory licensing also presents a dynamic legal environment that Sigma Healthcare must navigate.

- Patent Protection: Grants exclusive rights to drug manufacturers, typically for 20 years from filing, impacting generic availability.

- Market Exclusivity: Delays generic competition, influencing drug pricing and Sigma Healthcare's product mix.

- Regulatory Landscape: Evolving laws on patent enforcement and compulsory licensing create market uncertainties.

- Innovation Incentives: Strong IP protection encourages pharmaceutical R&D, leading to new products for distribution.

Labor Laws and Employment Regulations

Sigma Healthcare's operations in Australia are subject to a robust framework of labor laws and employment regulations. These govern everything from minimum wage requirements, which saw an increase in the national minimum wage to $23.23 per hour from July 1, 2023, to stringent workplace safety standards designed to protect its large workforce.

Navigating these legal requirements is paramount for maintaining operational continuity and employee well-being. For instance, adherence to the Fair Work Act 2009 and its various awards ensures compliance with entitlements like annual leave, sick leave, and redundancy pay. Failure to comply can lead to significant penalties, impacting financial performance and reputation.

Potential shifts in these regulations, such as changes to superannuation contribution rates or new rules around casual employment, could directly influence Sigma Healthcare's labor costs and staffing strategies. Furthermore, ongoing union negotiations or industrial relations disputes can introduce uncertainty, affecting staff morale, productivity, and the overall stability of business operations. In 2024, Australian businesses are also keenly watching for potential legislative updates concerning flexible work arrangements and gender pay equity, which could necessitate further adjustments to HR policies and practices.

- Minimum Wage Compliance: Adherence to Australia's national minimum wage, which reached $23.23 per hour in mid-2023, is a baseline operational cost.

- Workplace Safety: Strict compliance with Work Health and Safety (WHS) laws is essential to prevent accidents and associated liabilities.

- Industrial Relations: Managing relationships with unions and navigating enterprise bargaining agreements impacts labor costs and operational flexibility.

- Legislative Changes: Monitoring and adapting to potential 2024/2025 legislative shifts regarding flexible work and pay equity is crucial for ongoing compliance.

Legal factors significantly shape Sigma Healthcare's operational landscape, particularly concerning product regulation and market conduct. Australia's Therapeutic Goods Administration (TGA) imposes stringent quality and safety standards on medicines and medical devices, with ongoing scrutiny in 2024 on digital health technologies requiring adaptive management. Evolving TGA regulations and alignment with international standards in 2025 necessitate continuous adaptation in product lifecycle and market access strategies.

Compliance with Australian competition and consumer protection laws is vital for Sigma Healthcare, influencing pricing, distribution, and advertising practices to ensure fair market conduct and product safety. The Australian Competition and Consumer Commission (ACCC) actively monitors market practices, with a continued focus in 2023 on misleading advertising and product safety.

Intellectual property laws, especially patent protection for new drugs, directly impact Sigma Healthcare by determining the availability of generic alternatives and influencing product portfolio strategies. As of early 2025, patent expiries of key drugs have already led to market shifts and pricing pressures, highlighting the dynamic nature of this legal area.

Environmental factors

The proper disposal of pharmaceutical waste, including expired or unused medicines, presents a significant environmental challenge for Sigma Healthcare. Strict regulations govern how such waste must be managed, impacting operations across their supply chain and pharmacy network. For example, in 2024, the Australian government continued to emphasize safe disposal initiatives, with programs like the National Pharmaceutical Disposal Program facilitating returns and minimizing environmental harm from discarded medications.

Sigma Healthcare faces increasing scrutiny regarding its supply chain's environmental impact. In 2024, global supply chain emissions for the healthcare sector were a significant concern, with logistics and packaging contributing substantially. The company is therefore focusing on optimizing transportation routes to cut fuel usage, a key driver of its carbon footprint.

Sourcing from suppliers committed to sustainability is paramount. By prioritizing partners with robust environmental policies, Sigma Healthcare aims to reduce the embodied carbon in its products. This shift is driven by both regulatory pressures and growing consumer demand for eco-conscious healthcare solutions, with many businesses now setting ambitious net-zero targets by 2030.

Minimizing packaging waste is another critical area. Efforts include exploring biodegradable materials and implementing returnable packaging systems. This strategy not only lowers waste disposal costs but also directly contributes to reducing Sigma Healthcare's overall carbon footprint, aligning with broader industry movements towards circular economy principles.

Climate change presents significant operational hurdles for Sigma Healthcare, particularly concerning supply chain stability. Extreme weather events, such as intensified storms or prolonged droughts, recorded with increasing frequency in 2024 and projected to continue into 2025, can severely disrupt transportation networks and damage manufacturing facilities, impacting the timely delivery of essential medical supplies.

Furthermore, the escalating prevalence of climate-related health issues, like heatstroke or respiratory ailments exacerbated by air pollution, is anticipated to drive shifts in healthcare demand. This necessitates Sigma Healthcare to proactively adjust its inventory management and distribution models to meet the evolving needs of patient populations affected by these environmental factors.

Packaging Regulations and Plastic Reduction

Sigma Healthcare faces increasing regulatory pressure concerning packaging, particularly around plastic reduction. Governments globally, including in Australia where Sigma operates, are implementing stricter rules on single-use plastics and mandating higher recycled content in packaging. For instance, by 2025, many regions aim to significantly increase the recyclability of packaging or ban certain problematic materials. This evolving landscape necessitates Sigma Healthcare to adapt its packaging strategies to ensure compliance and align with environmental goals.

The company's response to these environmental factors will likely involve significant investment in sustainable packaging solutions. This could include exploring biodegradable materials, increasing the use of recycled plastics, or redesigning packaging to minimize material usage. For example, a shift towards plant-based plastics or compostable materials might be necessary to meet future standards. Consumer demand for eco-friendly products also plays a crucial role, pushing companies like Sigma Healthcare to proactively adopt greener practices beyond mere regulatory compliance.

- Regulatory Shifts: Australia's National Plastics Plan aims to phase out problematic and unnecessary plastics by the end of 2025, impacting packaging choices for companies like Sigma Healthcare.

- Consumer Expectations: Surveys consistently show a growing consumer preference for brands demonstrating strong environmental responsibility, influencing purchasing decisions.

- Investment Needs: Companies may need to allocate substantial capital towards research and development for new packaging materials and retooling manufacturing processes to accommodate these changes.

- Supply Chain Adaptations: Sourcing and integrating new, sustainable packaging materials can require significant adjustments to existing supply chains and supplier relationships.

Corporate Social Responsibility (CSR) Initiatives

Sigma Healthcare faces increasing pressure from stakeholders, including investors, customers, and employees, to demonstrate strong corporate social responsibility (CSR), particularly concerning its environmental impact. This heightened scrutiny means that the company's environmental performance is a key factor in its public image and overall valuation. For instance, in 2024, a significant portion of consumers indicated they would switch brands if a company had poor environmental practices, highlighting the direct link between sustainability and market share.

Proactive engagement in CSR initiatives offers Sigma Healthcare a strategic advantage. By implementing programs focused on energy efficiency across its facilities or actively supporting environmental conservation efforts, the company can significantly bolster its brand reputation. This positive image not only resonates with environmentally conscious consumers but also appeals to a growing segment of investors prioritizing Environmental, Social, and Governance (ESG) criteria. Reports from 2025 show a substantial increase in ESG-focused investment funds, with many explicitly targeting companies with demonstrable environmental stewardship.

Sigma Healthcare's commitment to CSR can translate into tangible financial benefits. Enhancing brand reputation through environmental initiatives can lead to increased customer loyalty and attract new, value-aligned customers. Furthermore, attracting environmentally conscious investors can provide access to capital at potentially more favorable terms, supporting long-term growth and operational sustainability.

- Growing Stakeholder Scrutiny: In 2024, consumer surveys indicated that over 60% of individuals consider a company's environmental practices when making purchasing decisions.

- Brand Reputation Enhancement: Proactive CSR, such as investing in renewable energy for healthcare facilities, can improve public perception and attract environmentally aware consumers.

- Investor Attraction: The global sustainable investment market was projected to reach over $50 trillion by the end of 2025, making strong ESG performance a key differentiator for attracting capital.

- Operational Efficiency: Implementing energy efficiency programs can lead to cost savings; for example, a 10% reduction in energy consumption can directly impact operating margins positively.

Sigma Healthcare faces evolving environmental regulations, particularly concerning waste disposal and packaging. For instance, Australia's National Plastics Plan, targeting the phase-out of problematic plastics by the end of 2025, directly impacts packaging choices. This regulatory landscape, coupled with growing consumer demand for eco-friendly products, necessitates adaptive strategies, including investment in sustainable materials and revised packaging designs.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Sigma Healthcare draws upon a robust blend of data from official government health agencies, leading market research firms, and reputable industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the healthcare sector.