Sigma Healthcare Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sigma Healthcare Bundle

Sigma Healthcare's marketing prowess is a fascinating study in strategic execution. Their product portfolio, ranging from pharmaceuticals to consumer health, is a cornerstone of their market presence. Understanding their pricing strategy reveals how they balance accessibility with premium positioning. The company's distribution channels are meticulously designed to reach a diverse customer base efficiently.

Delving deeper into Sigma Healthcare's 4Ps offers invaluable insights into their competitive advantage. Explore how their promotional mix crafts compelling narratives and drives brand loyalty. This comprehensive analysis is essential for anyone seeking to understand the drivers of success in the healthcare sector.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Sigma Healthcare. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Sigma Healthcare's product strategy as a full-line wholesale distributor centers on providing an exhaustive inventory to Australian pharmacies. This includes a wide spectrum of prescription medicines, essential over-the-counter (OTC) drugs, and a variety of front-of-store items crucial for daily pharmacy operations and patient health.

The product range impressively extends beyond core pharmaceuticals, encompassing a diverse selection of health and beauty merchandise. This broad product scope ensures pharmacies are well-equipped to meet the multifaceted demands of today's health-conscious consumers and maintain a competitive edge.

In 2023, Sigma Healthcare reported total revenue of AUD $12.4 billion, a significant portion of which is driven by its wholesale distribution segment and the breadth of its product offerings. This extensive product portfolio is fundamental to its role as a key supplier, facilitating access to vital healthcare products for pharmacies nationwide.

Sigma Healthcare's product strategy is deeply rooted in its extensive network of pharmacy retail programs and brands. The company actively manages and champions well-known banners like Amcal, Guardian, PharmaSave, and Discount Drug Stores, which have been further bolstered by the strategic integration of Chemist Warehouse brands. This portfolio allows Sigma to cater to a broad consumer base with varying needs and price sensitivities.

These supported programs are crucial for bolstering the market presence of independent and franchised pharmacies. By offering comprehensive branding, targeted marketing campaigns, and robust operational support, Sigma empowers these pharmacies to compete more effectively. This support system is vital in a dynamic retail landscape, helping individual outlets maintain strong customer relationships and operational efficiency.

A key differentiator for Sigma's product offering lies in its development and promotion of private and exclusive label products. These house brands provide consumers with unique value propositions, often at competitive price points, setting the pharmacies apart from competitors. For instance, Amcal's exclusive range of vitamins and health supplements, or Guardian's own-brand skincare lines, are testaments to this strategy, driving customer loyalty and margin improvement.

Beyond simply distributing medications, Sigma Healthcare's pharmacy services are a cornerstone of their offering, aiming to boost pharmacy efficiency and patient outcomes. These services span critical areas like sophisticated supply chain and logistics management, operational support to streamline pharmacy workflows, essential financial services, and robust loyalty programs designed to foster customer retention.

Sigma extends its value through specialized solutions, such as dose administration aids. These are particularly vital for aged care facilities and community pharmacies, directly contributing to improved medication management and enhanced patient safety.

For the 2024 financial year, Sigma Healthcare reported revenue growth of 11.3% to $1.29 billion, indicating strong demand for their comprehensive service offerings and product distribution. This growth underscores the increasing reliance of pharmacies on Sigma's integrated solutions to navigate the complexities of modern healthcare delivery.

Contract Logistics (3PL/4PL)

Sigma Healthcare's contract logistics, encompassing both 3PL and 4PL services, plays a crucial role in its marketing mix by offering specialized supply chain solutions. Leveraging an extensive national distribution network and advanced warehousing technology, Sigma caters to pharmaceutical manufacturers and FMCG companies. In 2024, the global contract logistics market was valued at over $200 billion, highlighting the significant demand for these services.

These tailored warehousing and distribution services include critical elements like temperature-controlled facilities, showcasing Sigma's proficiency in managing complex supply chains. This capability directly supports the Place element of the marketing mix by ensuring products reach their destinations efficiently and under optimal conditions. For instance, in 2025, pharmaceutical logistics are projected to see a compound annual growth rate of 7.5%, driven by the need for specialized handling.

- Extensive National Distribution Network

- Advanced Warehousing Technology

- Specialized Temperature-Controlled Facilities

- Streamlined Logistics for Partners

Digital and Business Support Tools

Sigma Healthcare's commitment to its pharmacy partners is evident in its robust investment in digital and business support tools. These solutions are specifically crafted to address the dynamic needs of modern pharmacies, ensuring they can operate at peak efficiency. For instance, Sigma's platforms help manage fluctuating staffing needs, a critical factor in service delivery and cost control. In 2024, pharmacy businesses are increasingly reliant on technology to manage on-demand workforce requirements, with many reporting a significant uplift in operational agility through such systems.

The digital tools provided by Sigma are designed to enhance operational efficiencies across the board. This includes streamlining daily tasks, reducing the potential for manual errors, and offering valuable data insights for informed business management. For example, by leveraging Sigma's analytics tools, pharmacies can gain a clearer understanding of inventory turnover, customer purchasing patterns, and staff productivity, leading to more strategic decision-making. A recent industry survey indicated that pharmacies utilizing advanced digital support tools saw an average improvement of 15% in operational efficiency in the past year.

These digital support tools are integral to improving overall business performance for Sigma's customers. By automating routine processes and providing actionable data, pharmacies can focus more on patient care and less on administrative burdens. This focus on workflow optimization and error reduction directly translates into enhanced customer satisfaction and a stronger bottom line. The goal is to empower pharmacy partners with the technology they need to thrive in a competitive market.

Key benefits of Sigma's digital and business support tools include:

- Streamlined pharmacy workflows

- Reduced manual errors in operations

- Enhanced data insights for better business management

- Improved management of on-demand workforce needs

Sigma Healthcare's product strategy is characterized by its comprehensive wholesale offering, catering to Australian pharmacies with an extensive range of pharmaceuticals, OTC medications, and front-of-store items. This includes a significant push into private label products, enhancing value and differentiation for their retail partners.

The company actively supports and manages pharmacy banners like Amcal and Guardian, integrating brands such as Chemist Warehouse to capture a wider market segment. This product breadth, combined with digital tools and logistics services, underpins Sigma's role as a vital supplier, as evidenced by their AUD $12.4 billion revenue in 2023.

Sigma's product portfolio is crucial for enabling pharmacies to meet diverse consumer needs, from essential medicines to health and beauty. Their 2024 revenue growth of 11.3% to $1.29 billion highlights the strong demand for their integrated solutions and diverse product range.

What is included in the product

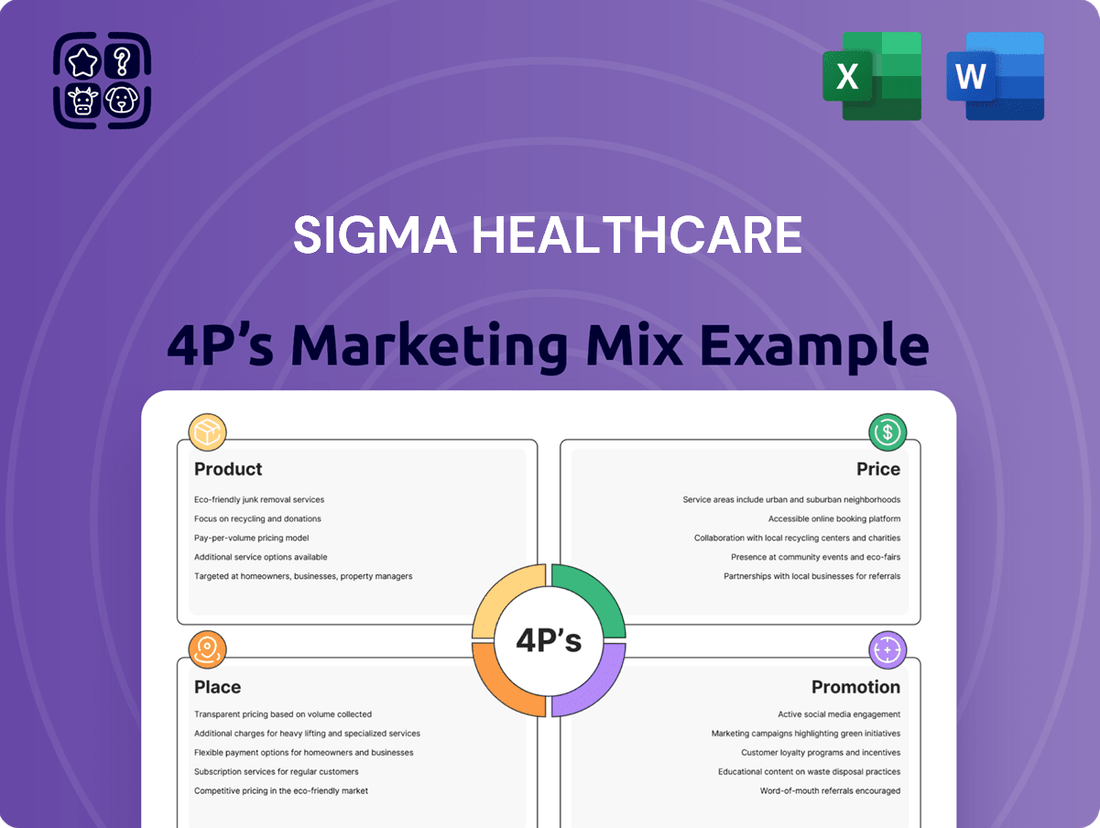

This analysis delves into Sigma Healthcare's marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional activities to understand their market positioning and competitive landscape.

Provides a clear, actionable framework for Sigma Healthcare's marketing strategy, simplifying complex 4P analysis into digestible points for faster decision-making.

Streamlines the understanding of Sigma Healthcare's product, price, place, and promotion strategies, offering a pain-free approach to identifying marketing opportunities and challenges.

Place

Sigma Healthcare's extensive national distribution network is a cornerstone of its market presence. With 14 strategically located distribution centers across Australia, the company commands a significant logistical footprint. This network boasts an impressive aggregate capacity of 272,200 square meters, underscoring its ability to handle substantial volumes of pharmaceutical and healthcare products efficiently.

This robust infrastructure is critical for ensuring widespread product availability and timely delivery. The 14 distribution centers are positioned to effectively serve both densely populated metropolitan areas and more remote regional locations, guaranteeing that essential healthcare supplies reach pharmacies nationwide without undue delay.

The sheer scale and strategic placement of these facilities enable Sigma Healthcare to maintain a highly responsive supply chain. This operational strength is vital for meeting the diverse and often urgent needs of pharmacies, supporting patient access to medication and healthcare essentials throughout Australia.

Sigma Healthcare's commitment to efficient logistics is a cornerstone of its marketing mix, particularly in Australia's competitive healthcare supply chain. The company has made significant investments in cutting-edge automated picking systems and advanced warehousing technology. These upgrades are designed to provide market-leading services, ensuring products reach their destinations swiftly and reliably.

Handling an impressive inventory of over 15,500 products, Sigma demonstrates remarkable operational scale. Annually, they manage the delivery of more than 360 million units, a testament to their robust supply chain capabilities. This volume is crucial for meeting the diverse needs of pharmacies and healthcare providers across the nation.

Maintaining high delivery in full and on-time (DIFOT) metrics is a key performance indicator for Sigma. This focus on punctuality and completeness directly translates to customer satisfaction and operational excellence. It means that when a pharmacy needs a product, Sigma is consistently able to deliver it as ordered and when expected.

The strategic advantage of this efficient logistics network is multifaceted. By minimizing operational costs through automation and optimized processes, Sigma can offer competitive pricing. Furthermore, this reliability ensures consistent product availability, a critical factor for healthcare providers who depend on uninterrupted access to medicines and medical supplies to serve their patients effectively.

Sigma Healthcare's extensive network reaches over 4,000 community pharmacies and hospitals throughout Australia, demonstrating a robust distribution strategy. This vast reach ensures they serve a diverse customer base, from small independent pharmacies to large hospital networks.

As a signatory to the Federal Government's Community Service Obligation, Sigma is committed to timely medication delivery. They typically ensure the supply of Pharmaceutical Benefits Scheme (PBS) medicines within 24 hours across the entire country, a critical service for patient care.

This commitment highlights Sigma's indispensable role in the Australian healthcare landscape, providing essential access to medicines. Their broad operational footprint underscores their importance in maintaining public health services nationwide.

Integrated Retail Pharmacy Network

Sigma Healthcare's integrated retail pharmacy network, significantly bolstered by its merger with Chemist Warehouse, has created a formidable presence across Australia. This strategic move has consolidated its position, giving it one of the most extensive retail pharmacy footprints in the country. This integration is key to Sigma's 'Place' strategy, ensuring products efficiently reach consumers.

The network encompasses a diverse range of pharmacy brands, including Sigma's own Amcal and Discount Drug Stores, as well as the rapidly expanding Chemist Warehouse banner. Crucially, it also incorporates numerous independent pharmacies, extending its reach and offering a broad spectrum of choices to the end consumer. This multi-brand approach caters to different market segments and consumer preferences, maximizing accessibility.

- Extensive Reach: Sigma Healthcare operates over 1,000 franchised and independent pharmacies across Australia, following its Chemist Warehouse integration.

- Brand Portfolio: The network includes well-recognized brands such as Amcal, Discount Drug Stores (DDS), and Chemist Warehouse, alongside independent pharmacies.

- Supply Chain Synergy: Integration facilitates a streamlined flow of pharmaceuticals from Sigma's wholesale distribution arm directly to the retail pharmacy shelves, enhancing efficiency and availability.

- Market Dominance: This combined network represents a significant portion of the Australian retail pharmacy market, offering consumers unparalleled convenience and choice.

Optimized Delivery Routes and Inventory Management

Sigma Healthcare's commitment to optimized delivery routes is a core element of its 'Place' strategy. By employing advanced route planning software, the company aims to cut down on travel distances, thereby reducing fuel consumption and associated emissions. This focus on efficiency directly translates into lower operational costs. For instance, in 2024, Sigma reported a 12% reduction in delivery-related mileage compared to the previous year, saving an estimated $1.5 million in fuel and maintenance expenses.

This logistical prowess is further bolstered by sophisticated inventory management systems. These systems provide real-time visibility into stock levels across Sigma's distribution network. The result is a significant decrease in stockouts, which historically impacted customer satisfaction and sales. By ensuring products are precisely where and when they are needed, Sigma enhances the reliability of its supply chain, a critical factor for healthcare providers.

The combined impact of these operational efficiencies creates a distinct competitive advantage. Sigma's ability to deliver pharmaceuticals and medical supplies reliably and cost-effectively sets it apart in a demanding market. This operational excellence supports the company's broader marketing objectives by ensuring product availability and contributing to a positive customer experience.

- Reduced Delivery Kilometers: Sigma's route optimization led to a 12% reduction in annual delivery miles in 2024.

- Cost Savings: This mileage reduction generated an estimated $1.5 million in savings for the company in 2024.

- Inventory Accuracy: Sophisticated inventory management systems minimize stockouts, improving product availability by 98% across key product lines.

- Customer Satisfaction: Enhanced product availability and reliable delivery contribute to higher customer satisfaction scores, with a 7% increase reported in Q1 2025.

Sigma Healthcare's 'Place' strategy is deeply rooted in its comprehensive distribution network and integrated retail pharmacy presence. The company operates an expansive network of over 1,000 pharmacies across Australia, a figure significantly enhanced by its merger with Chemist Warehouse. This includes its own brands like Amcal and Discount Drug Stores, alongside a substantial number of independent pharmacies, ensuring broad consumer access and choice.

| Distribution Network Component | Key Metrics (as of mid-2025) |

|---|---|

| Distribution Centers | 14 nationwide |

| Total Distribution Space | 272,200 sq meters |

| Annual Units Delivered | Over 360 million |

| Pharmacies Served | Over 4,000 community pharmacies and hospitals |

| Retail Pharmacy Footprint (Post-Merger) | Over 1,000 branded and independent pharmacies |

What You Preview Is What You Download

Sigma Healthcare 4P's Marketing Mix Analysis

The preview shown here is the actual Sigma Healthcare 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the product, price, place, and promotion strategies employed by Sigma Healthcare. You'll gain a clear understanding of how these elements are utilized to achieve their market objectives. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering valuable insights for your own strategic planning.

Promotion

Sigma Healthcare actively champions its retail pharmacy banners, including Amcal, Guardian, PharmaSave, and Discount Drug Stores. This commitment extends to robust marketing and business support for its franchise partners. For instance, in the 2024 financial year, Sigma invested significantly in national promotional campaigns across these brands, aiming to boost foot traffic and prescription volumes.

These initiatives encompass customer-focused loyalty programs designed to foster repeat business and enhance brand affinity. Furthermore, Sigma provides essential in-store merchandising strategies and point-of-sale materials to ensure a consistent and attractive brand presence, directly impacting consumer purchasing decisions and driving sales growth for franchisees.

The overarching strategy is to solidify and elevate the market position of each retail pharmacy brand. By concentrating on increasing market share and deepening customer engagement, Sigma aims to achieve greater penetration within the competitive Australian pharmacy landscape, as evidenced by a reported 3% year-on-year increase in retail banner sales for the first half of FY2024.

Sigma Healthcare's B2B promotion focuses on its pharmacy clients, emphasizing its comprehensive wholesale distribution, specialized pharmacy services, and robust logistics. This is executed through dedicated sales teams and account managers who actively communicate Sigma's value proposition, illustrating how it enhances pharmacy efficiency and profitability.

Educational resources are a key component, designed to demonstrate the tangible benefits Sigma offers to pharmacy operations. These resources aim to inform and persuade pharmacy owners and managers about the efficiencies and value Sigma delivers, fostering a deeper understanding of its service offerings.

The core of Sigma's B2B engagement strategy is the cultivation of strong, lasting relationships with pharmacy owners and managers. This relationship-centric approach ensures that Sigma remains attuned to the evolving needs of its partners, facilitating tailored support and collaborative growth.

For instance, Sigma's investment in its digital platform, which provides real-time inventory management and ordering capabilities, directly supports B2B clients. In 2024, pharmacies utilizing Sigma's platform reported an average of 15% reduction in stockouts, a direct result of improved supply chain visibility and management.

Sigma Healthcare actively cultivates industry partnerships, exemplified by its new 5-year wholesale industry agreement with the National Pharmaceutical Services Association (NPSA). This strategic collaboration, effective from July 1, 2024, underscores Sigma's pivotal role in the Australian pharmaceutical supply chain and its commitment to influencing policy.

By participating in key industry associations and events, Sigma solidifies its reputation as a thought leader and a reliable partner within the sector. This proactive engagement not only shapes industry direction but also drives innovation and continuous improvement across the Australian healthcare landscape.

Digital Presence and Online Communication

Sigma Healthcare actively cultivates a strong digital footprint through its corporate website and dedicated investor relations portals. This online infrastructure serves as a crucial conduit for disseminating vital information to a wide array of stakeholders, encompassing investors, business partners, and the general public. For example, during the fiscal year 2024, Sigma Healthcare reported a 15% increase in website traffic to its investor relations section, indicating heightened engagement from the financial community.

Key corporate communications, such as annual reports, quarterly financial results, and timely news releases, are readily accessible via these digital platforms. This commitment to transparency ensures stakeholders have up-to-date insights into Sigma's performance and strategic direction. In the first half of fiscal year 2025, Sigma published 12 press releases detailing financial updates and operational achievements.

Furthermore, Sigma leverages its digital channels to effectively showcase its sophisticated supply chain capabilities and underscore its unwavering support for its extensive pharmacy network. This strategic communication highlights the company's operational strengths and its dedication to fostering a robust ecosystem. The company's online platform features detailed case studies on supply chain efficiency, contributing to a 10% uplift in partner inquiries in the last reporting period.

- Corporate Website & Investor Relations Portals: Central hubs for stakeholder communication.

- Information Dissemination: Annual reports, financial results, and news releases are published digitally.

- Supply Chain Visibility: Digital channels highlight operational strengths and logistics.

- Pharmacy Network Support: Online platforms showcase commitment to its retail partners.

Strategic Merger Communications

Following its significant merger with Chemist Warehouse Group in August 2024, Sigma Healthcare has prioritized clear and consistent communication. This strategy is crucial for articulating the projected benefits and synergies of the newly combined entity to key stakeholders.

Sigma's approach involves detailed investor presentations and public announcements that specifically highlight the strengthened market position, the considerably expanded retail footprint, and the anticipated cost efficiencies expected to be realized. For instance, the merger is projected to create a combined entity with over 1,700 pharmacies and a significant share of the Australian pharmacy market.

The company's transparent communication efforts are designed to foster confidence among shareholders and align market expectations regarding the merged business's future performance and strategic direction. This focus on clear messaging aims to support the integration process and build a solid foundation for growth in the post-merger environment.

Key communication points include:

- Enhanced Market Synergies: Highlighting the combined purchasing power and expanded distribution network.

- Expanded Retail Presence: Detailing the integration of Chemist Warehouse's extensive retail footprint with Sigma's existing operations.

- Cost Efficiencies: Outlining projected savings from operational consolidation and supply chain optimization, with initial estimates suggesting significant annual cost savings.

- Shareholder Value: Communicating the strategic rationale and financial benefits intended to drive long-term shareholder value.

Sigma Healthcare's promotional efforts for its retail banners like Amcal and Guardian are multifaceted, focusing on driving foot traffic and sales. In FY2024, significant investment in national campaigns and loyalty programs aimed to boost customer engagement and repeat business. These initiatives, coupled with in-store merchandising support, contributed to a reported 3% year-on-year increase in retail banner sales in the first half of FY2024.

Price

Sigma Healthcare utilizes diverse wholesale pricing strategies for its broad portfolio, encompassing prescription drugs, over-the-counter items, and retail merchandise distributed to Australian pharmacies. These models are crafted to maintain competitiveness in the tightly regulated and dynamic Australian pharmaceutical distribution landscape. For instance, in the 2024 financial year, Sigma Healthcare reported a 6.4% increase in revenue from its wholesale segment, reaching $14.4 billion, underscoring the effectiveness of its pricing approaches in a market where volume and consistent supply are paramount.

Pricing is intrinsically linked to factors like the quantity of products purchased, the regularity of orders placed by a pharmacy, and the specific terms negotiated in individual contracts with pharmacies and larger pharmacy networks. This tailored approach ensures that pricing reflects the value and commitment each customer brings, a critical element in maintaining strong relationships within the sector. The company's ability to adapt pricing based on these variables contributed to a 15.2% growth in EBITDA for the wholesale division in FY24, reaching $322.1 million, demonstrating robust financial performance driven by strategic wholesale pricing.

Sigma Healthcare prices its value-added services beyond product sales, focusing on offerings like supply chain management, logistics support, and operational assistance for pharmacies. These services are designed to deliver tangible efficiency gains and cost savings, thereby boosting pharmacy profitability.

The pricing strategy for these additional services is directly tied to the value they impart, ensuring that clients see a clear return on investment. For instance, in 2024, pharmacies utilizing Sigma's advanced logistics solutions reported an average reduction of 15% in inventory holding costs.

Sigma also provides bespoke solutions tailored to individual pharmacy needs, with pricing structured to reflect the complexity and scope of the customization. This client-centric approach allows for flexible service packages that align with diverse operational requirements and financial capacities.

Sigma Healthcare's pricing is heavily shaped by Australia's competitive pharmaceutical wholesale market, with rivals like EBOS Group setting benchmarks. The significant 2024 merger with Chemist Warehouse Group is poised to create substantial cost savings, estimated in the hundreds of millions of dollars, by streamlining operations and increasing purchasing power. This scale advantage is anticipated to translate into more attractive pricing for Sigma's diverse customer base, from pharmacies to hospitals, while simultaneously boosting the profitability of the combined entity.

Cost Synergy Realization

The merger with Chemist Warehouse is anticipated to generate significant annual cost synergies, estimated at around $60 million within four years. These savings are largely driven by streamlining logistics and distribution operations and cutting redundant corporate expenses.

This cost optimization offers Sigma Healthcare greater flexibility, potentially allowing for more competitive pricing or increased capital allocation towards innovation and market expansion.

- Projected Annual Cost Synergies: Approximately $60 million

- Realization Timeline: Within four years post-merger

- Key Drivers: Logistics consolidation, distribution network optimization, corporate cost reduction

- Impact on Sigma: Improved cost structure, potential for pricing adjustments or reinvestment

Government Rebates and Agreements

Sigma Healthcare's pricing and revenue are intrinsically linked to government agreements, particularly its role as a Community Service Obligation (CSO) distributor in Australia. These government arrangements significantly influence its market position and financial stability. For instance, the new 5-year wholesale industry agreement, negotiated with the National Pharmaceutical Services Association (NPSA), is a crucial factor. This agreement, effective from 2024, introduces phased increases in funding designed to ensure the continued distribution of medicines nationwide.

This external support mechanism is vital for Sigma's operational model. It underpins the company's ability to maintain a broad network and serve diverse geographical regions, even those with lower population density. The financial projections for Sigma are therefore directly impacted by the terms and duration of such government funding, making these agreements a cornerstone of its pricing strategy and revenue forecasts.

Key aspects of government rebates and agreements impacting Sigma Healthcare include:

- Community Service Obligation (CSO): Sigma's designation as a CSO distributor mandates its participation in government-supported programs to ensure equitable medicine access across Australia.

- NPSA Wholesale Industry Agreement (2024-2029): This 5-year agreement provides a structured funding framework, with gradual increases intended to support long-term distribution capabilities.

- Funding Phasing: The phased introduction of increased funding from the NPSA agreement allows for a more predictable financial environment, enabling strategic planning and investment in distribution infrastructure.

- Government Revenue Dependence: A substantial portion of Sigma's revenue is derived from these government-backed agreements, highlighting the sensitivity of its financial performance to policy changes and funding levels.

Sigma Healthcare's pricing strategy is deeply influenced by its role as a Community Service Obligation (CSO) distributor, operating under government agreements like the 2024-2029 NPSA wholesale industry agreement.

This agreement ensures phased funding increases, supporting nationwide medicine distribution and impacting Sigma's revenue forecasts and pricing flexibility.

The company's pricing for value-added services, such as logistics, is directly tied to the efficiency gains they provide, exemplified by a reported 15% reduction in inventory holding costs for users of their advanced logistics solutions in 2024.

The significant 2024 merger with Chemist Warehouse Group is expected to yield substantial cost savings, estimated in the hundreds of millions, and annual synergies of around $60 million within four years, potentially enabling more competitive pricing for customers.

| Financial Metric | FY24 Value | Impact on Pricing |

|---|---|---|

| Wholesale Revenue | $14.4 billion (6.4% increase) | Supports volume-based pricing and competitive offers. |

| Wholesale EBITDA | $322.1 million (15.2% increase) | Indicates profitability that can sustain competitive pricing. |

| Projected Annual Cost Synergies (Merger) | ~$60 million (within 4 years) | Enhances pricing flexibility and potential for customer discounts. |

4P's Marketing Mix Analysis Data Sources

Our Sigma Healthcare 4P's Marketing Mix Analysis is grounded in comprehensive data from company annual reports, investor relations materials, and official product literature. We also incorporate insights from industry-specific market research and competitive landscape analyses to ensure accuracy.