Sigma Healthcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sigma Healthcare Bundle

Sigma Healthcare operates within a dynamic pharmaceutical landscape, where understanding the competitive forces is paramount for strategic success.

Our analysis delves into the bargaining power of buyers and suppliers, assessing their influence on Sigma's profitability and market position.

We also scrutinize the threat of new entrants and the intensity of rivalry among existing players, revealing the competitive pressures Sigma faces.

Furthermore, the threat of substitute products is examined, highlighting alternative solutions that could impact Sigma's offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Sigma Healthcare’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Concentrated pharmaceutical manufacturers wield considerable influence over distributors like Sigma Healthcare. In Australia, a handful of major global and local pharmaceutical companies dominate the market, controlling the supply of critical prescription and over-the-counter medications. This concentration means these suppliers can dictate terms, as switching to alternative suppliers is often impractical for wholesalers. For instance, major global players like Pfizer and Johnson & Johnson are key suppliers for many Australian distributors.

Sigma Healthcare's acquisition of Chemist Warehouse Group (CWG) in 2024 is a significant development that could alter this dynamic. The combined entity's enhanced scale and extensive national distribution network are expected to bolster Sigma's bargaining power with its pharmaceutical suppliers. This increased leverage might allow Sigma to negotiate more favorable pricing and supply agreements, potentially improving its margins.

The Australian government's Pharmaceutical Benefits Scheme (PBS) significantly influences the bargaining power of suppliers in the healthcare sector, particularly for Sigma Healthcare. The PBS controls the pricing and availability of many prescription drugs, which can cap the negotiation leverage that pharmaceutical manufacturers have with wholesalers and pharmacies. This governmental oversight creates a more controlled market environment.

The PBS dictates wholesale margins for community pharmacies, typically setting them at 7% for PBS-listed medicines. This fixed margin directly impacts the profitability of distributors and, consequently, their ability to negotiate more favorable terms with drug manufacturers. For Sigma Healthcare, this means that a substantial portion of its revenue from PBS-subsidized products is subject to government-mandated pricing structures.

Suppliers of patented drugs and specialized ingredients wield substantial bargaining power. This is largely due to the scarcity of direct substitutes and the immense investment required for research and development in these areas. For Sigma Healthcare, this translates into a dependence on these suppliers for a diverse product portfolio, potentially leading to increased procurement expenses and diminished negotiation leverage.

The Australian pharmaceutical market is anticipated to experience robust growth. Projections indicate a particular emphasis on innovative medicines and biologics, underscoring the critical role and influence of these specialized ingredient and drug suppliers. This trend suggests that their power is likely to remain, or even increase, in the coming years.

Switching Costs for Sigma

Sigma Healthcare faces significant switching costs when changing pharmaceutical suppliers. These costs include the expense of renegotiating existing contracts, the investment required to update logistics and inventory management systems, and the effort to ensure continued adherence to stringent regulatory requirements. For instance, the onboarding of the Chemist Warehouse supply contract, effective from July 2024, involved substantial initial setup costs, illustrating the financial commitment tied to such transitions.

These considerable switching costs create a form of supplier lock-in for Sigma. The disruption and financial outlay associated with switching providers often outweigh the potential benefits of sourcing from a new supplier, particularly if the price difference is marginal. This dynamic strengthens the bargaining power of Sigma's current pharmaceutical suppliers.

- High Renegotiation Costs: The effort and potential legal fees involved in altering existing supply agreements are substantial.

- System Integration Expenses: Updating IT infrastructure and inventory management software to accommodate a new supplier's processes incurs significant capital expenditure.

- Regulatory Compliance Burden: Ensuring new suppliers meet all pharmaceutical regulations requires thorough vetting and potentially system adjustments.

- Operational Disruption Impact: The time and resources spent managing a supplier transition can divert attention from core business operations, impacting efficiency.

Direct Supply from Manufacturers to Pharmacies

While Sigma Healthcare is a significant player in pharmaceutical wholesaling, the bargaining power of suppliers is influenced by direct supply arrangements. Larger pharmacy chains or hospital groups may negotiate directly with manufacturers for certain medications, bypassing wholesalers like Sigma. This can reduce the volume Sigma purchases from specific manufacturers, potentially weakening Sigma's overall purchasing leverage.

For instance, in 2024, while specific figures for direct-to-pharmacy supply volumes bypassing wholesalers are not publicly detailed, the trend towards consolidation among pharmacy groups suggests an increased capacity to negotiate such direct deals. This could mean a shift in purchasing power dynamics for those specific product lines.

However, Sigma's critical role in the Community Service Obligation (CSO) arrangements remains a significant factor. The CSO mandates that Sigma ensures the availability of pharmaceuticals across Australia, particularly in regional and remote areas. This responsibility underpins Sigma's continued importance and provides a counter-balance to the potential impact of direct supply channels.

The bargaining power of suppliers is therefore a nuanced consideration for Sigma. While direct supply agreements can erode purchasing volume for certain products, Sigma's mandated role in broader distribution networks, especially under CSO frameworks, preserves its essential function and influences supplier relationships.

- Direct Supply Impact: Large pharmacy chains and hospitals may bypass wholesalers for direct manufacturer agreements, reducing Sigma's purchase volumes for specific drugs.

- Leverage Reduction: Lower purchase volumes can diminish Sigma's overall bargaining leverage with those particular manufacturers.

- CSO Significance: Sigma's role in Community Service Obligation (CSO) arrangements ensures continued importance in broad pharmaceutical distribution.

- Counterbalance: The CSO role provides a critical counter-balance to the potential loss of leverage from direct supply channels.

Concentrated pharmaceutical manufacturers, especially those producing patented or specialized drugs, hold significant bargaining power over distributors like Sigma Healthcare. This is due to limited alternatives and high R&D costs, which Sigma faces when sourcing critical medications. For instance, the continued dominance of global pharmaceutical giants in Australia means Sigma often relies on these few key suppliers.

Sigma Healthcare's acquisition of Chemist Warehouse Group (CWG) in 2024 is expected to enhance its negotiating position. The increased scale from this merger, which became effective July 2024, could allow Sigma to secure more favorable terms from suppliers, potentially improving its profit margins.

The Australian government's Pharmaceutical Benefits Scheme (PBS) plays a crucial role by controlling drug pricing and availability. This oversight limits the negotiation leverage that pharmaceutical manufacturers can exert on wholesalers like Sigma, creating a more regulated market environment.

Suppliers of specialized and innovative medicines are expected to see their influence grow, driven by market trends favouring biologics and advanced therapies. This suggests that their strong bargaining power, stemming from high switching costs for Sigma and the unique nature of their products, will likely persist or even increase.

| Factor | Impact on Sigma Healthcare | Supporting Data/Context |

| Supplier Concentration | High Bargaining Power | Dominance of a few global pharmaceutical players in Australia. |

| Switching Costs | High Bargaining Power for Suppliers | Costs include contract renegotiation, system integration, and regulatory compliance. Onboarding CWG supply contract in July 2024 involved significant initial setup costs. |

| Product Differentiation | High Bargaining Power for Suppliers | Patented drugs and specialized ingredients have few substitutes. |

| Impact of CWG Acquisition (2024) | Potentially Reduced Supplier Power | Increased scale from CWG acquisition may improve Sigma's negotiation leverage. |

What is included in the product

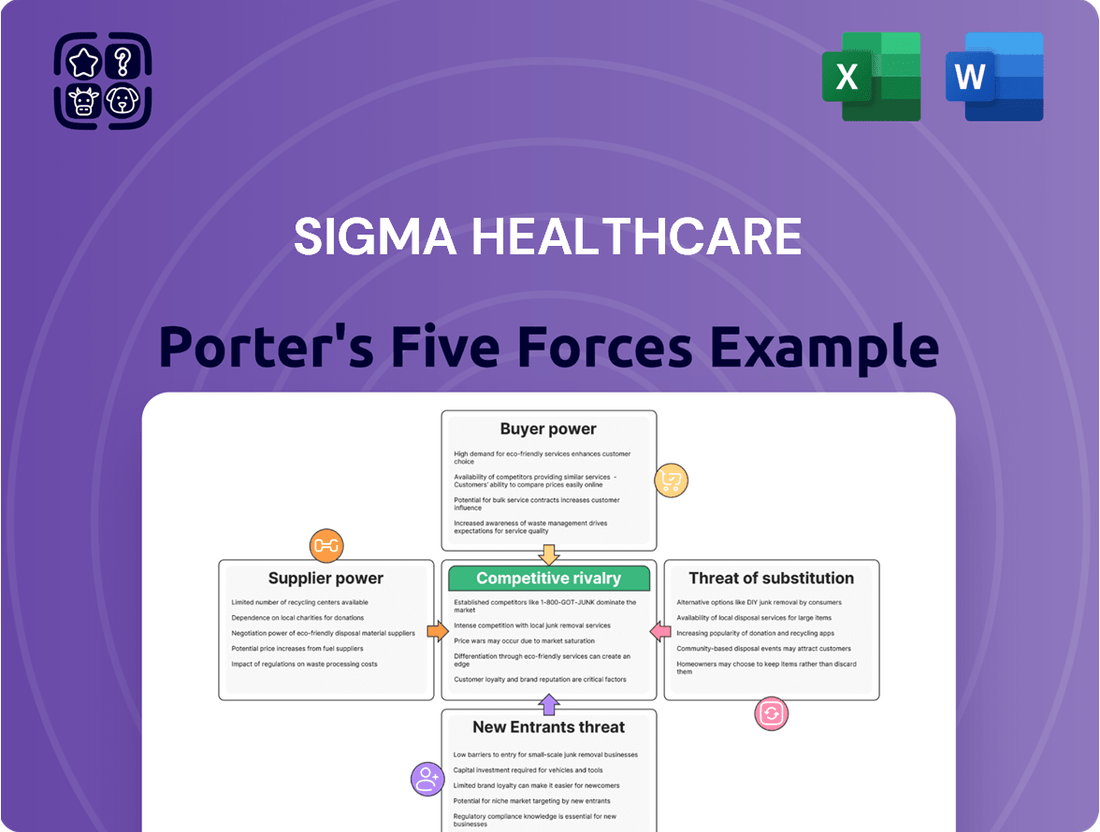

This Porter's Five Forces analysis unpacks the competitive intensity and profitability potential within Sigma Healthcare's operating environment. It scrutinizes the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry amongst existing players.

Instantly visualize the competitive landscape of Sigma Healthcare's industry, pinpointing key pressure points to inform strategic adjustments.

Customers Bargaining Power

The Australian pharmacy retail landscape has seen significant consolidation, notably with the merger of Chemist Warehouse. This move has amplified the bargaining power of large pharmacy chains and buying groups, including Sigma's own brands like Amcal and Discount Drug Stores, over wholesalers. These consolidated entities, by virtue of their substantial purchasing volumes, can negotiate more favorable terms, including discounts and enhanced services, directly impacting Sigma's margins.

Pharmacies, particularly smaller independent ones, often operate with thin profit margins. This makes them very sensitive to the prices of goods, especially for over-the-counter products and items sold at the front of the store. This price sensitivity directly impacts wholesalers like Sigma Healthcare, forcing them to maintain competitive pricing and favorable payment terms to retain these customers.

The ability of pharmacies to switch to different distributors if they find better deals significantly amplifies their bargaining power. This ease of switching means Sigma must constantly prove its value and competitive edge to keep its pharmacy clients. This dynamic is a key factor in pricing negotiations within the pharmaceutical supply chain.

Concerns raised by the Australian Competition and Consumer Commission (ACCC) highlight this issue. They have voiced apprehension that a merged entity, potentially involving Chemist Warehouse, might disadvantage non-Chemist Warehouse pharmacies by either prioritizing their own stores or offering less favorable terms to other businesses. This regulatory scrutiny underscores the potential for shifts in market power.

For instance, in the competitive retail pharmacy landscape, even small price differences on high-volume products can lead to significant cost savings for a pharmacy. If Sigma cannot match or beat the offers from competing wholesalers, pharmacies have a clear incentive to divert their business, thereby increasing Sigma's customer retention challenges.

Pharmacies in Australia have significant bargaining power due to the presence of alternative pharmaceutical wholesalers. Major players like Australian Pharmaceutical Industries (API) and EBOS Group offer comparable supply chains, meaning Sigma Healthcare cannot unilaterally impose terms. This competitive landscape was a key factor acknowledged by the Australian Competition and Consumer Commission (ACCC) when it reviewed the proposed Sigma-Chemist Warehouse merger, highlighting the constraint these rivals place on Sigma's pricing and service dictates.

Vertical Integration by Customers

Large pharmacy groups and hospital networks in Australia are increasingly exploring vertical integration. This strategy involves them taking on wholesale and distribution functions themselves for certain product lines, thereby diminishing their reliance on external wholesalers like Sigma Healthcare. For instance, as of 2024, some of the larger pharmacy chains have initiated pilot programs for direct sourcing and distribution, aiming to capture more margin and gain greater control over their supply chain.

This move towards self-distribution by customers directly impacts Sigma's bargaining power. When customers can perform these functions internally, they gain leverage, potentially negotiating lower prices or even bypassing Sigma altogether for specific medications or health products. The Australian pharmacy retail sector has seen significant consolidation, with several large groups emerging. This consolidation trend, observed throughout 2023 and continuing into 2024, means fewer, but larger, customers for Sigma, amplifying their potential bargaining power.

- Customer Vertical Integration: Pharmacy groups and hospitals performing their own wholesale and distribution.

- Reduced Reliance: Less dependence on third-party wholesalers like Sigma.

- Increased Bargaining Power: Customers can exert more pressure or bypass wholesalers.

- Market Evolution: Australian pharmacy retail market shows increasing consolidation and diverse business models in 2024.

Government Influence on Pharmacy Remuneration

The Australian government significantly influences pharmacy remuneration, primarily through the Pharmaceutical Benefits Scheme (PBS). This scheme dictates the dispensing fees and markups pharmacies receive for providing subsidized medications. In 2024, the PBS continues to be a major revenue driver, but its funding structure can create downward pressure on pharmacy margins.

Fluctuations in government funding or policy adjustments regarding the PBS can directly impact a pharmacy's financial health. When profitability is squeezed, pharmacies are incentivized to negotiate harder with wholesalers for better pricing on the medications they purchase. This dynamic amplifies the bargaining power of customers, even though the demand for essential pharmaceuticals remains relatively stable due to their non-discretionary nature.

- Government Regulation: The PBS is the primary mechanism through which the government controls pharmacy revenue.

- Margin Pressure: Changes in PBS remuneration can reduce pharmacy profit margins, leading to increased price sensitivity.

- Wholesaler Negotiations: Reduced pharmacy profits translate to stronger bargaining power when negotiating with pharmaceutical wholesalers.

- Essential Demand: Despite price pressures, the fundamental need for medications ensures a consistent baseline demand, somewhat tempering the suppliers' ability to dictate terms.

Pharmacies, especially larger consolidated groups like Chemist Warehouse, wield significant bargaining power over wholesalers such as Sigma Healthcare. This leverage stems from their substantial purchasing volumes, enabling them to negotiate favorable pricing and terms. As of 2024, the increasing consolidation within the Australian pharmacy sector means fewer, but larger, customers, further amplifying their ability to dictate terms or even pursue vertical integration.

The Australian Competition and Consumer Commission (ACCC) has noted that alternative wholesalers like API and EBOS Group provide competitive options, limiting Sigma's pricing power. Furthermore, government reimbursements through the Pharmaceutical Benefits Scheme (PBS) can squeeze pharmacy margins, making them more price-sensitive and thus more assertive in negotiations with their suppliers.

| Factor | Impact on Sigma Healthcare | Customer Bargaining Power |

|---|---|---|

| Consolidation of Pharmacy Chains | Reduced customer base, increased power per customer | High |

| Availability of Alternative Wholesalers | Limits Sigma's pricing and service control | High |

| Vertical Integration by Pharmacies | Potential loss of business, increased customer leverage | Increasing |

| PBS Margin Pressure on Pharmacies | Makes pharmacies more price-sensitive and demanding | High |

Preview Before You Purchase

Sigma Healthcare Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Sigma Healthcare, detailing the competitive landscape and strategic positioning. You're viewing the exact document that will be delivered instantly upon purchase, ensuring full transparency and no hidden surprises. This in-depth analysis explores the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Sigma Healthcare's industry. What you see here is the complete, ready-to-use report, professionally formatted and prepared for your immediate strategic planning needs.

Rivalry Among Competitors

The Australian pharmaceutical wholesaling market is characterized by a concentrated competitive landscape, featuring key players like Sigma Healthcare, Australian Pharmaceutical Industries (API), and EBOS Group, which operates Symbion. This means a few large companies hold a significant portion of the market share, making direct competition quite intense.

The recent merger of Chemist Warehouse (CWG) with Sigma Healthcare has dramatically reshaped this environment. This consolidation has created Australia's largest pharmacy group, boasting an expansive national network of over 1,000 outlets. This strategic move undoubtedly bolsters Sigma's market share and strengthens its competitive standing.

Despite the enhanced market position for Sigma post-merger, the rivalry within the sector remains exceptionally fierce. The combined entity now faces a more consolidated, yet still potent, competitive force from other major players, ensuring that price, service, and distribution efficiency remain critical battlegrounds.

Sigma Healthcare faces intense competition, not solely on product distribution, but significantly through value-added services. Their network of pharmacy retail programs, including well-known banners like Amcal, Guardian, and Discount Drug Stores, offers distinct advantages. These programs encompass crucial marketing support and technology solutions, helping to differentiate Sigma in a landscape where wholesale margins are often tight.

Sigma's strategic merger with Chemist Warehouse is a direct response to this competitive pressure. By integrating Chemist Warehouse's robust pharmacy franchise model and proven marketing acumen, Sigma aims to significantly enhance its retail strategy. This collaboration is expected to bolster Sigma's ability to stand out by leveraging Chemist Warehouse's established market presence and customer engagement capabilities, thereby strengthening its competitive position.

The Australian pharmaceutical wholesale market experiences significant pricing pressure, particularly on over-the-counter and front-of-store items due to fierce retail competition. This intense rivalry can squeeze profit margins for wholesalers like Sigma Healthcare. Consequently, companies often focus on achieving greater efficiency, leveraging scale, and pursuing cost synergies to maintain profitability.

Sigma Healthcare's FY25 performance demonstrated a strategic emphasis on improving operational efficiencies and bolstering margins. The company reported that the Chemist Warehouse Group (CWG) supply contract was a key driver of revenue growth, suggesting that securing and efficiently servicing large contracts can help mitigate some of the margin pressures felt in other segments of the business.

Market Growth Rate

The Australian pharmaceutical market shows steady growth, with projections indicating a compound annual growth rate (CAGR) of 2.60% between 2025 and 2033. The retail pharmacy sector is expected to grow even faster, at 5.00% during the same period. This consistent expansion means that companies like Sigma Healthcare operate in a mature market where competition for market share is significant.

Key factors fueling this growth are the demographic shifts in Australia, including an aging population and an increasing incidence of chronic diseases. These trends ensure a persistent demand for pharmaceutical products and services, making the market attractive but also heightening the intensity of rivalry among existing players.

- Market Growth Rate: The overall Australian pharmaceutical market is projected to grow at a CAGR of 2.60% from 2025-2033.

- Retail Pharmacy Growth: The retail pharmacy segment is anticipated to expand at a CAGR of 5.00% during the same forecast period.

- Demand Drivers: An aging population and the rising prevalence of chronic diseases are primary drivers of sustained market demand.

- Competitive Landscape: Stable market growth within an established industry intensifies competition as players vie for existing market share.

Impact of Chemist Warehouse Merger

The competitive rivalry within the Australian pharmacy sector intensifies significantly due to the merger between Sigma Healthcare and Chemist Warehouse, finalized in February 2025. This union creates a formidable, vertically integrated player with an expanded footprint, directly challenging existing market dynamics. Competitors are naturally concerned about the potential for increased market power and the impact on their own operations.

The Australian Competition and Consumer Commission (ACCC) recognized the substantial structural shift this merger represents. Their approval was contingent upon specific undertakings, highlighting the regulatory scrutiny surrounding the potential for anti-competitive practices arising from this consolidation. This move fundamentally alters the competitive intensity by concentrating significant market share.

- Market Consolidation: The merger brings together Sigma's wholesale and distribution network with Chemist Warehouse's extensive retail presence, creating a dominant force.

- Synergies and Efficiency: The combined entity is expected to achieve significant operational synergies, potentially leading to cost advantages that smaller rivals may struggle to match.

- Regulatory Oversight: ACCC undertakings aim to mitigate concerns about market concentration, but the long-term impact on competitive behavior remains a key focus.

- Pressure on Rivals: Smaller pharmacy chains and independent pharmacies will likely face increased pressure to innovate, differentiate, or seek their own strategic alliances to remain competitive.

The Australian pharmaceutical wholesale market is dominated by a few major players, including Sigma Healthcare, API, and EBOS Group. Sigma's 2025 merger with Chemist Warehouse has significantly intensified rivalry by creating Australia's largest pharmacy group, boasting over 1,000 outlets and a substantial market share. This consolidation means competitors must focus on efficiency and service differentiation to remain competitive in a market where pricing is a constant pressure point.

The fierce competition extends to value-added services, with Sigma leveraging retail programs like Amcal and Guardian to differentiate itself. These programs offer marketing and technology support, crucial for wholesalers operating on tight margins. The ongoing market growth, projected at 2.60% CAGR for pharmaceuticals and 5.00% for retail pharmacies between 2025-2033, ensures that companies continue to vie aggressively for market share.

Sigma's FY25 performance highlights the importance of securing and efficiently servicing large contracts, such as the Chemist Warehouse supply agreement, as a strategy to offset margin pressures. The regulatory approval of the Sigma-Chemist Warehouse merger, with undertakings from the ACCC, underscores the market's structural shift and the heightened competitive stakes for all participants.

| Key Competitors | Market Position | Competitive Strategy Examples |

| Sigma Healthcare (post-CWG merger) | Largest pharmacy group in Australia | Vertical integration, enhanced retail network, operational synergies |

| Australian Pharmaceutical Industries (API) | Major wholesaler and retail pharmacy operator | Brand portfolio, supply chain efficiency, loyalty programs |

| EBOS Group (Symbion) | Diversified healthcare services provider | Scale in distribution, strategic partnerships, focus on specialized services |

SSubstitutes Threaten

Pharmaceutical manufacturers are increasingly eyeing direct-to-consumer (DTC) models, especially for over-the-counter and certain specialty items, potentially sidestepping traditional wholesale channels. This trend, while facing some regulatory challenges for prescription drugs, is amplified by the burgeoning e-commerce and digital health sectors, posing a significant long-term threat to the established wholesale pharmaceutical distribution framework in Australia.

The Australian pharmaceutical market is witnessing a notable shift, with digital health integration, including the rise of e-prescriptions and online pharmacies, becoming a defining characteristic. This evolution makes direct engagement between manufacturers and consumers a more viable and potentially disruptive alternative to the current wholesale-dependent supply chain.

The growing accessibility of online pharmacies and telepharmacy services presents a significant threat of substitutes for traditional brick-and-mortar pharmacies and their wholesale distributors. These digital platforms offer consumers a convenient alternative for obtaining medications and health products, often at competitive prices.

Consumers are increasingly leveraging these online channels for their ease of use and potential cost savings, thereby reducing their reliance on physical pharmacy locations. This shift in consumer behavior directly impacts the market share and revenue streams of established players within the pharmaceutical supply chain.

In Australia, the online pharmacy market is projected to expand, further solidifying its role as a viable substitute. For instance, Chemist Warehouse, a major player, has a robust online presence that complements its physical stores, indicating a trend towards hybrid models that cater to evolving consumer preferences.

Consumers are increasingly turning to alternative healthcare providers like naturopaths and dietitians, or resorting to self-medication for common ailments. This trend diverts demand away from traditional pharmacy channels. For instance, the global over-the-counter (OTC) drug market, a significant beneficiary of self-medication, was valued at approximately USD 150 billion in 2023 and is projected to grow, indicating a substantial substitution threat.

Non-Pharmaceutical Interventions

For certain health concerns, alternatives to traditional pharmaceuticals exist. These non-pharmaceutical interventions, such as adopting healthier lifestyles, improving diet, increasing exercise, or exploring alternative therapies, can sometimes serve as substitutes for medicinal products. While these might not directly threaten the core business of distributing essential medicines, a growing societal focus on overall well-being and preventative health could influence the demand for specific over-the-counter products and complementary health items that Sigma Healthcare distributes.

The market is indeed showing a significant shift. For instance, the global dietary supplements market was valued at approximately $151.8 billion in 2023 and is projected to grow substantially. Similarly, the demand for vaccines, especially with ongoing public health initiatives, continues to be robust. Sigma Healthcare, as a wholesaler, needs to monitor these trends as they can impact the product mix and sales volumes for certain categories.

- Lifestyle changes and preventative health are increasingly viewed as viable alternatives to medication for managing certain chronic conditions.

- The global dietary supplements market is expanding, indicating consumer interest in non-pharmaceutical approaches to health.

- Vaccine demand remains strong, driven by both routine immunizations and public health campaigns.

- Sigma Healthcare's product portfolio may see shifts in demand for over-the-counter and complementary health products due to these evolving consumer preferences.

Generic and Biosimilar Drugs

The rise of generic and biosimilar drugs poses a threat by offering lower-cost alternatives to branded pharmaceuticals. While not replacing an entire drug class, they directly compete with higher-priced branded versions.

This dynamic significantly impacts revenue streams for drug manufacturers. For wholesalers like Sigma Healthcare, this translates to reduced pricing power and squeezed margins, as generics generally command lower wholesale price points.

The Australian pharmaceutical market is experiencing substantial growth in generic and biosimilar adoption. For instance, in 2023, generic medicines accounted for approximately 70% of all dispensed medicines in Australia, highlighting their significant market penetration and the ongoing pressure on branded drug sales.

- Increased Accessibility: Generic and biosimilar drugs make treatments more affordable and accessible, driving patient and prescriber preference away from more expensive branded options.

- Margin Erosion: Lower wholesale prices for generics directly reduce the profit margins for distributors like Sigma Healthcare.

- Market Share Shift: As patents expire, a growing number of blockbuster drugs face generic competition, leading to substantial market share erosion for originators and impacting the entire supply chain.

- Regulatory Support: Government initiatives and regulatory frameworks often promote the use of generics and biosimilars to control healthcare costs, further accelerating this trend.

The threat of substitutes for Sigma Healthcare primarily stems from the increasing accessibility of online pharmacies and the growing consumer preference for lifestyle changes and preventative health measures. These alternatives directly impact the demand for traditional pharmaceutical distribution channels. For instance, the Australian market saw generic medicines account for around 70% of dispensed medications in 2023, underscoring a significant shift towards lower-cost alternatives.

| Substitute Type | Impact on Sigma Healthcare | Market Trend Example (2023/2024) |

| Online Pharmacies & Telepharmacy | Reduced reliance on wholesale, potential margin pressure | Growing e-commerce in health sector, e.g., Chemist Warehouse's online presence |

| Lifestyle & Preventative Health | Shift in demand for certain OTC and complementary products | Global dietary supplements market valued at ~$151.8 billion in 2023 |

| Generic & Biosimilar Drugs | Lower wholesale prices, reduced pricing power | Generics constitute ~70% of dispensed medicines in Australia |

Entrants Threaten

The pharmaceutical wholesaling sector demands significant capital for infrastructure like distribution centers and advanced logistics systems, posing a substantial barrier to entry for newcomers. Sigma Healthcare, further solidified by its merger with Chemist Warehouse, now commands a vast national network exceeding 1,000 outlets, presenting a formidable challenge to potential entrants.

This scale, coupled with the high capital outlay, was specifically cited by the Australian Competition and Consumer Commission (ACCC) as a key factor contributing to a low threat of new entrants in the market.

The Australian pharmaceutical supply chain presents substantial regulatory hurdles, acting as a significant barrier to new entrants. Companies must obtain various licenses and accreditations to operate in wholesaling and distribution, demanding considerable time, expertise, and financial investment. The Therapeutic Goods Administration (TGA) enforces stringent safety and efficacy standards, further complicating market entry.

Established wholesalers like Sigma Healthcare benefit from deeply entrenched relationships with pharmaceutical manufacturers, often cemented by long-term supply contracts and loyalty programs. These existing connections create significant barriers for new entrants aiming to secure competitive supply agreements or build a comparable network of pharmacy customers.

Replicating Sigma's extensive network and securing similar terms with major manufacturers would be a formidable challenge for any newcomer. This is underscored by Sigma's recent achievement of a new 5-year wholesale industry agreement through the National Pharmaceutical Services Association (NPSA), highlighting the difficulty new players would face in negotiating such critical partnerships.

Brand Recognition and Network Effects

Sigma Healthcare benefits from robust brand recognition, particularly through its retail pharmacy programs like Amcal, Guardian, and Discount Drug Stores. This established presence is significantly amplified by the recent acquisition of the highly popular Chemist Warehouse brand. These well-known brands, coupled with an integrated network, generate powerful network effects.

These network effects create substantial barriers for potential new entrants. Building comparable trust, market share, and customer loyalty would require immense investment and time to overcome the established consumer preference for Sigma’s brands. The merged entity is strategically positioned to deliver enduring value by focusing on the seamless integration of these brands.

For instance, Chemist Warehouse reported a revenue of approximately AUD 2.4 billion for the 2023 financial year, highlighting its significant market penetration and brand equity. This scale makes it exceptionally difficult for newcomers to compete directly.

- Strong Brand Equity: Sigma’s portfolio, including the recent addition of Chemist Warehouse, possesses considerable brand recognition and customer loyalty, making it a formidable competitor.

- Network Effects: The integrated network of pharmacies and associated services fosters customer retention and creates a virtuous cycle that new entrants struggle to replicate.

- Customer Acquisition Cost: New entrants face high costs to attract customers away from established, trusted brands like those within Sigma’s network.

- Market Penetration: The combined entity's extensive reach across Australia presents a significant hurdle for any new pharmacy operator seeking to gain traction.

Vertical Integration of Existing Players

The threat of new entrants in the Australian healthcare sector is significantly amplified by the increasing trend of vertical integration among established players. A prime example is the proposed merger between Sigma Healthcare and Chemist Warehouse, which would unite a substantial wholesale pharmaceutical distribution network with a vast retail pharmacy presence. This integration creates considerable efficiencies and cost advantages, making it exceedingly challenging for new, independent wholesale distributors to enter the market and compete effectively without a comparable downstream retail footprint or the sheer scale of operations.

This strategic consolidation by existing entities erects substantial barriers to entry. New entrants would face immense difficulty in replicating the integrated supply chain and the established customer relationships that vertically integrated companies possess. The Australian Competition and Consumer Commission (ACCC) has explicitly recognized this heightened barrier to entry, noting how such vertical integration can stifle competition and limit opportunities for new players seeking to establish a foothold.

- Sigma Healthcare and Chemist Warehouse Merger: A key indicator of increasing vertical integration, combining wholesale distribution with a large retail footprint.

- Efficiency and Cost Advantages: Vertically integrated firms gain economies of scale and scope, making it harder for new entrants to match pricing and service levels.

- Barriers to Entry: The ACCC has identified vertical integration as a significant factor increasing barriers for new wholesale entrants, who lack the established retail channels and scale.

- Competitive Landscape Shift: This trend consolidates market power, requiring new entrants to possess substantial capital and a robust strategy to overcome these integrated advantages.

The threat of new entrants into Sigma Healthcare's market is low, primarily due to immense capital requirements for infrastructure and logistics, regulatory complexities, and the difficulty of replicating established relationships and brand loyalty. The proposed merger with Chemist Warehouse further solidifies these barriers by creating a vertically integrated entity with significant scale and market penetration.

Sigma Healthcare's extensive national network, bolstered by over 1,000 Chemist Warehouse outlets, presents a formidable challenge for any newcomer. This scale, combined with high capital investment for distribution centers and advanced logistics, creates a substantial barrier to entry, as acknowledged by the ACCC.

| Factor | Impact on New Entrants | Sigma Healthcare's Advantage |

|---|---|---|

| Capital Investment | High (distribution centers, logistics) | Established infrastructure, economies of scale |

| Regulatory Hurdles | Significant (licensing, TGA standards) | Existing compliance framework, expertise |

| Supplier Relationships | Difficult to secure competitive terms | Long-term contracts, loyalty programs |

| Brand Equity & Network Effects | Challenging to build trust and loyalty | Strong brands (Amcal, Guardian, Chemist Warehouse) |

| Vertical Integration | Hard to compete with integrated supply chains | Synergies between wholesale and retail |

Porter's Five Forces Analysis Data Sources

Our Sigma Healthcare Porter's Five Forces analysis leverages financial statements, investor relations materials, and industry-specific market research reports to assess competitive dynamics.

We supplement this with insights from regulatory filings and expert analyses to provide a comprehensive view of the healthcare sector's competitive landscape.