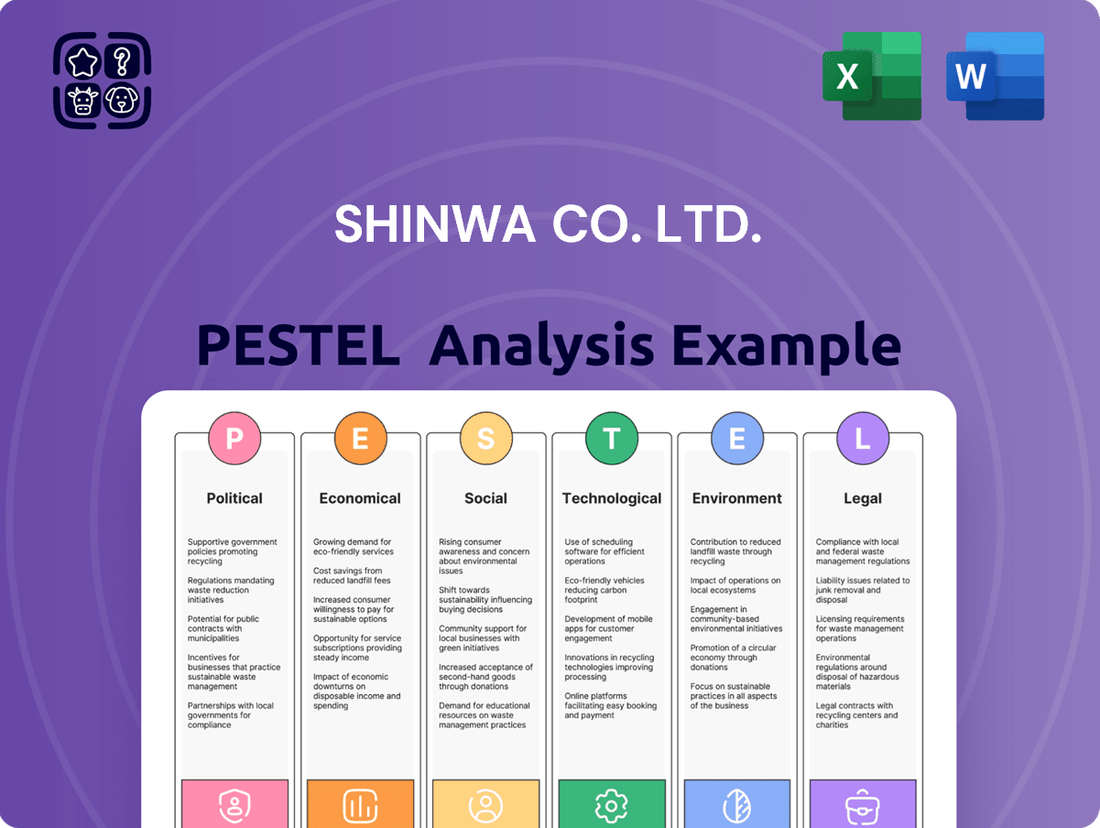

Shinwa Co. Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shinwa Co. Ltd. Bundle

Political shifts and economic fluctuations present both challenges and opportunities for Shinwa Co. Ltd., influencing its operational landscape. Sociocultural trends are also a significant factor, impacting consumer behavior and workforce dynamics. Technologically, advancements offer avenues for innovation but also necessitate adaptation. Environmental concerns are increasingly critical, demanding sustainable practices. Legal frameworks worldwide shape Shinwa's compliance and strategic direction. Gain a competitive edge with our complete PESTLE analysis, packed with actionable insights for Shinwa Co. Ltd. Download now and make informed decisions!

Political factors

Government infrastructure spending, particularly on projects like new highway construction and urban renewal, directly fuels demand for Shinwa Co. Ltd.'s precision measuring instruments. For instance, the Japanese government's commitment to rebuilding infrastructure following natural disasters and investing in smart city initiatives, as seen in the FY2024 budget allocating significant funds to public works, creates a robust market for Shinwa's surveying and construction measurement tools.

Increased public investment in transportation networks and public utilities translates into higher sales volumes for Shinwa’s specialized equipment used in civil engineering and building construction. The projected 5% year-on-year growth in construction output for Japan in 2024, partly driven by these infrastructure investments, suggests a positive outlook for Shinwa's related product lines.

Conversely, any slowdown in government infrastructure spending or a shift in budgetary priorities away from construction could negatively impact Shinwa's sales. For example, a hypothetical 10% reduction in public works budgets for FY2025 would likely lead to a corresponding slowdown in orders for high-precision measuring devices.

Changes in international trade agreements and tariffs directly impact Shinwa Co. Ltd.'s operational costs and market competitiveness. For instance, the ongoing adjustments in global trade dynamics, particularly concerning major economies, could lead to increased import duties on components or finished goods, affecting Shinwa's profit margins. As of early 2024, many countries are re-evaluating their trade relationships, with some implementing new tariffs on specific goods, which necessitates a close watch on these evolving policies.

Fluctuations in trade relations between key manufacturing hubs and Shinwa's sales regions require agile adjustments to pricing and sourcing strategies. For example, a dispute between two major trading partners could disrupt Shinwa's supply chain, forcing a pivot to alternative suppliers or markets. The World Trade Organization (WTO) reported a notable increase in trade restrictions globally in 2023, underscoring the importance of proactive risk management in this area.

Understanding these evolving trade policies is paramount for Shinwa's global operations. A shift in export regulations in a key market, for example, could limit Shinwa's access to customers or increase the cost of doing business. Companies like Shinwa must maintain a deep awareness of trade policy shifts to ensure continued market access and cost-effective production, especially as geopolitical tensions continue to shape international commerce throughout 2024 and into 2025.

Shinwa Co. Ltd. operates within a dynamic regulatory landscape that directly impacts its manufacturing. Policies governing manufacturing standards, worker safety, and product quality assurance are critical. For instance, in 2024, the global average cost of non-compliance with occupational health and safety regulations in manufacturing sectors was estimated to be around 3-5% of annual revenue, a figure Shinwa must consider.

Stricter regulations, such as those being implemented in key markets for advanced electronics manufacturing in 2025, may necessitate significant capital expenditure for upgraded machinery and enhanced employee training programs. Conversely, a predictable and stable regulatory framework, like the one observed in Japan's automotive component sector for much of 2024, offers Shinwa the certainty needed for effective long-term strategic planning and investment decisions. Maintaining rigorous adherence to these evolving standards is paramount for safeguarding Shinwa's brand image and product integrity.

Political Stability in Key Markets

Political stability in Japan, a core market for Shinwa Co. Ltd., remains a key consideration. Japan's political landscape has shown consistent stability, with the Liberal Democratic Party (LDP) holding a strong majority for many years, fostering a predictable regulatory environment. This stability supports Shinwa's long-term planning and investment strategies.

However, Shinwa also operates in or sources from other regions where political dynamics can introduce volatility. For instance, ongoing geopolitical tensions in East Asia, while not directly impacting Shinwa's primary operations as of mid-2025, could indirectly influence global trade routes and raw material costs. A stable political climate is crucial for ensuring uninterrupted business operations and maintaining access to its diverse markets.

- Japan's political stability underpins Shinwa's operational continuity and market access, with the LDP's consistent governance providing a predictable business environment.

- Geopolitical tensions in the wider East Asian region, though not directly impacting Shinwa's core business as of mid-2025, pose indirect risks to supply chains and input costs.

- Policy shifts in any of Shinwa's operational or sales markets can affect business continuity and market access, highlighting the need for constant monitoring.

- A stable political climate across all operational territories is vital for minimizing investment risks and fostering predictable market conditions for Shinwa's products.

Industrial Policy and Support

Government initiatives aimed at bolstering sectors like advanced manufacturing and precision engineering present significant opportunities for Shinwa Co. Ltd. These policies often translate into tangible benefits such as grants, tax credits, and funding for research and development projects. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has been actively promoting investment in high-tech industries, with a notable focus on semiconductors and next-generation manufacturing technologies. This support can directly fuel Shinwa's innovation pipeline and sharpen its competitive standing in the global market.

Access to these government programs can provide a crucial financial advantage, enabling Shinwa to undertake ambitious projects that might otherwise be cost-prohibitive. This strategic alignment with national industrial priorities can unlock new avenues for growth and technological advancement.

- Government grants for R&D in advanced materials: These can directly fund Shinwa's innovation efforts.

- Tax incentives for capital investment in precision machinery: Lowering the cost of upgrading facilities.

- Subsidies for export promotion of high-tech goods: Expanding Shinwa's international market reach.

- Support for industry-academia collaborations: Fostering a stronger knowledge-sharing ecosystem.

Government policies directly influence Shinwa's market opportunities, particularly through infrastructure spending and support for advanced manufacturing. Japan's FY2024 budget, emphasizing public works and smart city initiatives, is a key driver for demand of Shinwa's measuring instruments, with construction output projected to grow by 5% in 2024.

Trade policy shifts and geopolitical tensions present both risks and opportunities, impacting supply chains and market access. The WTO's observation of increased global trade restrictions in 2023 highlights the need for Shinwa to manage these evolving international dynamics proactively.

Regulatory frameworks, including those for manufacturing standards and worker safety, necessitate ongoing compliance and potential capital investment, as evidenced by the estimated 3-5% revenue cost of non-compliance in manufacturing sectors.

Political stability in Japan provides a predictable environment for Shinwa's strategic planning, while geopolitical factors in East Asia could indirectly affect costs and supply chains.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Shinwa Co. Ltd., offering strategic insights into political, economic, social, technological, environmental, and legal influences.

It equips stakeholders with actionable intelligence to navigate market dynamics, identify opportunities, and mitigate risks for informed decision-making and strategic planning.

Shinwa Co. Ltd.'s PESTLE analysis serves as a pain point reliever by offering a clear, summarized version of external factors for easy referencing during meetings and presentations.

It provides a concise, easily shareable summary format ideal for quick alignment across teams, helping to support discussions on external risks and market positioning during planning sessions.

Economic factors

Global economic health is a significant driver for Shinwa Co. Ltd., impacting its core markets like construction, woodworking, and metalworking. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable but moderate pace. This generally supports demand for precision tools as construction projects and industrial activities expand.

However, the specter of recession cycles remains. For instance, the lingering effects of inflation and geopolitical tensions in early 2025 could potentially slow down economic activity, leading to reduced capital expenditure by businesses. This would directly translate to a softening in demand for Shinwa's measuring instruments.

Historically, construction and manufacturing sectors are highly sensitive to economic cycles. A robust expansion phase, like that seen in some regions during 2023 with manufacturing output increasing by an average of 1.5% globally according to OECD data, typically fuels higher sales of Shinwa's products. Conversely, contractions, such as the slight global manufacturing slowdown experienced in late 2022, can significantly dampen sales volumes.

Rising inflation significantly impacts Shinwa Co. Ltd. by increasing the cost of essential raw materials like steel and aluminum, as well as energy prices. For instance, the Producer Price Index for manufactured goods in Japan saw a notable increase in early 2024, directly affecting input costs for companies like Shinwa. This surge in expenses can squeeze profit margins if Shinwa cannot fully pass these higher costs onto its customers through price adjustments.

Effective cost management strategies and building a resilient supply chain are therefore paramount for Shinwa to navigate these inflationary pressures. The ability to secure raw materials at stable prices or find alternative, more cost-effective suppliers becomes a key differentiator in maintaining profitability. Shinwa's operational efficiency and procurement expertise are critical in mitigating the impact of these escalating raw material and energy expenses.

Higher interest rates, such as those seen in the US Federal Reserve's ongoing tightening cycle through 2024 and projected into early 2025, increase borrowing costs for businesses and individuals. This can dampen demand for capital-intensive projects, potentially impacting Shinwa's sales of precision instruments used in construction and industrial sectors. For instance, if commercial lending rates rise significantly, developers may postpone new building projects, directly reducing the need for advanced measuring tools.

Shinwa's own investment decisions are also sensitive to interest rates. If the company plans to fund new manufacturing facilities or R&D initiatives through debt, a higher interest rate environment, with benchmark rates potentially remaining elevated through 2025, would increase the cost of capital. This could lead to a reassessment or delay of capital expenditure plans, affecting future growth and operational capacity.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Shinwa Co. Ltd., a global manufacturer. As of early 2024, the Japanese Yen (JPY) experienced volatility against major currencies like the US Dollar (USD) and Euro (EUR). For instance, a stronger JPY can increase the cost of Shinwa's products for overseas buyers, potentially dampening export sales volumes, while simultaneously lowering the cost of imported raw materials. Conversely, a weaker JPY makes exports more competitive but raises the expense of foreign inputs.

These shifts directly affect Shinwa's profitability by altering the value of international sales and the cost of goods sold. For example, if Shinwa sources a significant portion of its components from the United States and the USD strengthens against the JPY, the company's manufacturing costs in Japan will rise.

- Export Competitiveness: A stronger Yen can make Shinwa's products more expensive for international customers, potentially reducing demand.

- Import Costs: Conversely, a weaker Yen increases the cost of imported raw materials and components, impacting production expenses.

- Profit Margins: Exchange rate volatility directly influences the translation of foreign earnings back into Yen, affecting reported profitability.

- Hedging Strategies: Shinwa likely employs financial instruments like forward contracts or currency options to mitigate the financial risks associated with unpredictable currency movements.

Construction and Industrial Sector Health

The economic vitality of the construction, woodworking, and metalworking industries directly impacts Shinwa Co. Ltd.'s demand. For instance, a robust housing market, indicated by rising housing starts, fuels the need for precision measuring tools. In 2024, the US housing market saw a slight uptick in new home sales, reaching an annualized rate of over 600,000 units in early 2024, signaling potential for increased demand for construction-related equipment.

Commercial development and overall industrial production are also key economic indicators. Growth in these areas means more factory expansions and infrastructure projects, both of which require accurate measurement for their execution. The US Industrial Production Index has shown modest growth through much of 2024, suggesting a steady, though not explosive, environment for industrial demand.

Sustained growth in these foundational sectors is crucial for Shinwa's continued success. As of mid-2024, global construction spending projections for 2025 anticipate a continued expansion, albeit at a tempered pace, particularly in developed economies. This indicates a generally positive, but carefully watched, economic climate for companies like Shinwa.

- Housing Starts: A key driver for Shinwa, as new home construction directly correlates with demand for measuring instruments.

- Industrial Production Indices: Reflect the health of manufacturing and heavy industry, areas where Shinwa's products are essential for precision.

- Commercial Development: Expansion in retail, office, and other commercial spaces necessitates significant investment in construction and related tools.

- Woodworking and Metalworking Sectors: These industries rely heavily on accurate measurement for production efficiency and quality control, directly benefiting Shinwa.

Global economic health directly influences Shinwa's sales, with IMF projections for 3.2% global growth in 2024 supporting demand. However, rising inflation, as evidenced by Japan's Producer Price Index increases in early 2024, raises input costs for raw materials and energy, squeezing profit margins. Elevated interest rates, like those in the US Federal Reserve's cycle, increase borrowing costs and can slow capital-intensive projects, impacting demand for Shinwa's precision tools.

Full Version Awaits

Shinwa Co. Ltd. PESTLE Analysis

The preview you see here is the exact Shinwa Co. Ltd. PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Shinwa Co. Ltd., providing valuable insights for strategic decision-making. You can trust that the detailed breakdown of each PESTLE component, including specific examples and their implications for Shinwa Co. Ltd., is precisely what you will download.

Sociological factors

Changes in Japan's workforce demographics, such as an aging population, directly influence the demand for Shinwa's measuring tools. As of 2024, Japan's median age is around 48.7 years, indicating a significant proportion of older workers who may prefer tools with enhanced ergonomics or automated features. Furthermore, a declining birthrate and a shortage in skilled trades, like machinists and carpenters, could constrain manufacturing output and potentially increase demand for precision tools that improve efficiency and reduce reliance on highly specialized labor.

Societal expectations for enhanced workplace safety are growing, directly influencing demand for tools that minimize human error and improve operational integrity. This heightened awareness of safety standards, particularly in sectors like construction and manufacturing where Shinwa operates, encourages investment in precision measurement technology. For instance, construction site accidents in the US have seen a persistent focus on prevention, with OSHA data consistently highlighting fall protection and struck-by-object incidents as key areas for improvement, underscoring the need for reliable measurement tools.

The increasing demand for precision in manufacturing and construction directly benefits companies like Shinwa, known for its high-quality measuring instruments. As industries strive for greater accuracy to meet stringent quality control and regulatory requirements, there's a clear market push towards advanced tools. In 2024, the global precision measuring instruments market was projected to reach over $38 billion, with a compound annual growth rate expected to continue into 2025, reflecting this societal and industrial drive for accuracy.

The DIY and hobbyist markets significantly impact the demand for measuring tools, particularly for home improvement and crafting. While Shinwa's core business is professional, a robust DIY sector presents opportunities for their more accessible product lines. For instance, the global DIY market was valued at approximately $100 billion in 2023 and is projected to grow, indicating sustained interest in home projects.

Consumer engagement in hobbies like woodworking, 3D printing, and intricate model building often requires precise measurement, even at a non-professional level. This trend can drive sales for Shinwa's entry-level digital calipers or specialized rulers. The continued rise of online tutorials and maker communities further fuels this engagement, making these tools more visible and desirable to a broader audience.

Education and Training in Trades

The availability and quality of vocational education significantly impact the pool of skilled workers. In 2023, the US Bureau of Labor Statistics reported that occupations in skilled trades, such as construction and installation, are projected to grow, with some trades like wind turbine technicians expected to see job growth of over 40% by 2032. This increasing demand highlights the importance of robust training programs. Shinwa's high-precision instruments are directly relevant to these trades, and a more skilled workforce is likely to recognize and value the accuracy their tools offer.

Shinwa can leverage this trend by actively partnering with trade schools and vocational colleges. For instance, offering product demonstrations or sponsoring specific training modules can introduce students to Shinwa's quality early on. In 2024, many vocational institutions are enhancing their curriculum to include advanced techniques and technologies, creating a receptive environment for premium tools. Such collaborations can foster brand loyalty and ensure that future professionals are adept at using precision measuring instruments.

- Skilled Trade Demand: Projections indicate strong job growth in skilled trades through 2032, emphasizing the need for quality training.

- Worker Skill Appreciation: Better-trained professionals are more inclined to invest in and utilize high-quality, precise measuring tools.

- Educational Partnerships: Shinwa can foster brand recognition and loyalty by engaging with vocational institutions.

Sustainability and Ethical Consumption

Societal shifts are increasingly pushing businesses towards sustainability and ethical consumption. Consumers are becoming more discerning, actively seeking out brands that align with their values. This trend directly impacts purchasing decisions, with a growing segment willing to pay a premium for environmentally friendly and ethically sourced products. For instance, in 2024, a significant portion of global consumers, estimated to be around 60%, indicated that they consider sustainability when making purchasing decisions, according to a Deloitte study.

While Shinwa's core business of measuring tools may not directly face the same ethical sourcing scrutiny as, say, apparel, the broader industry sentiment still matters. Companies that supply Shinwa, or those Shinwa partners with, are increasingly expected to demonstrate environmental responsibility. This can translate into preferring suppliers who have robust sustainability programs or certifications. A 2025 report by McKinsey noted that over 70% of companies surveyed are increasing their focus on supply chain sustainability.

Shinwa has a strategic opportunity to leverage this societal trend. Highlighting its own sustainable manufacturing processes, such as waste reduction initiatives or energy-efficient operations, can resonate with customers and business partners alike. Furthermore, emphasizing the durability and longevity of its products speaks to a form of sustainability by reducing the need for frequent replacements. This aligns with a circular economy approach, which is gaining traction in industrial sectors.

- Growing Consumer Demand: Approximately 60% of global consumers consider sustainability in purchasing decisions as of 2024.

- Supply Chain Expectations: Over 70% of surveyed companies are increasing their focus on supply chain sustainability (McKinsey, 2025).

- Brand Differentiation: Shinwa can appeal to ethically-minded consumers by showcasing durable product design and eco-friendly manufacturing.

The increasing emphasis on precision across various industries, from advanced manufacturing to specialized construction, directly fuels demand for Shinwa's high-quality measuring instruments. This societal drive for accuracy, evident in global market growth projections, means that businesses and professionals are more willing to invest in tools that ensure exact measurements. For instance, the global market for precision measuring instruments was projected to exceed $38 billion in 2024, underscoring this trend.

Societal expectations for improved workplace safety are also a significant factor, influencing demand for tools that minimize errors and enhance operational integrity. As safety standards become more stringent, the adoption of reliable measurement technology becomes paramount. This is reflected in ongoing efforts across industries to reduce accidents, highlighting the need for precision tools.

Consumer interest in DIY projects and intricate hobbies, such as woodworking and model building, creates a secondary market for Shinwa's products. The sustained growth of the DIY sector, valued at approximately $100 billion in 2023, demonstrates a broad consumer base seeking tools for detailed work. This trend encourages engagement with more accessible, yet precise, measuring devices.

Technological factors

Technological progress in measurement is constantly evolving, with innovations like laser guidance, digital readouts, and the Internet of Things (IoT) becoming more prevalent. For Shinwa Co. Ltd., these advancements offer a chance to create products that are not only more accurate and efficient but also easier for customers to use.

Embracing these new measurement technologies can significantly enhance Shinwa's product offerings, leading to greater precision and operational efficiency. For instance, the adoption of IoT sensors in 2024 allows for real-time data collection, improving quality control and predictive maintenance, a key factor in the competitive electronics manufacturing sector where Shinwa operates.

However, integrating these cutting-edge measurement tools demands substantial investment in research and development. Companies like Shinwa must allocate resources to R&D to ensure they can keep pace with technological shifts, with a significant portion of the 2025 R&D budget earmarked for exploring AI-driven measurement systems.

Maintaining a leading position in innovation is therefore paramount. Shinwa's commitment to staying ahead means continuous evaluation and adoption of emerging measurement technologies to maintain its competitive edge and deliver superior value to its clientele.

The manufacturing and construction sectors are seeing a significant uptick in automation and robotics, which directly affects the demand for measuring tools. This shift could mean less need for traditional manual instruments and a greater demand for advanced, sensor-based measurement systems designed to work seamlessly with robotic arms and automated processes.

Shinwa Co. Ltd. must evaluate how its current product portfolio aligns with these evolving automated workflows. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automation.

This presents an opportunity for Shinwa to develop or adapt its offerings to include smart, connected measuring devices that can provide real-time data integration with robotic systems. For example, high-precision laser scanners or automated digital calipers could become essential components in automated quality control loops on assembly lines.

The ongoing digital transformation is reshaping expectations for measuring instruments, with a growing demand for digital outputs and seamless integration into software ecosystems. This shift allows for sophisticated data analysis, streamlined project management, and enhanced quality control processes. For instance, the global market for industrial IoT, which enables such integration, was projected to reach over $100 billion in 2024, highlighting the significant potential for connected devices.

Shinwa has a clear opportunity to leverage this trend by developing smart tools equipped with digital connectivity. These advanced instruments could connect to various digital platforms, offering professional users significant added value beyond basic measurement. By providing data-driven insights directly from their tools, Shinwa can empower users to boost productivity and make more informed decisions in their work.

Materials Science Innovations

Innovations in materials science are directly impacting the precision instrument sector. For instance, advancements in composite materials offer the potential for lighter yet stronger components, which can enhance the portability and durability of Shinwa's measuring devices. The development of novel ceramics and polymers could also lead to more wear-resistant and temperature-stable parts, improving accuracy in demanding environments.

Shinwa's adoption of these new materials can translate into tangible benefits. For example, if a new alloy reduces the weight of a key component by 15% without compromising structural integrity, it could significantly improve user experience for handheld instruments. Furthermore, materials with self-healing properties, currently under development in research labs, could dramatically extend the operational lifespan of sensitive measuring equipment, reducing the need for frequent replacements.

The strategic integration of cutting-edge materials provides a distinct competitive advantage. By being an early adopter of materials that allow for enhanced performance, such as those offering superior electrical conductivity or reduced thermal expansion, Shinwa can differentiate its product offerings. Companies investing in materials research and development, like those focused on graphene composites or advanced silicon carbide, are positioning themselves for leadership in high-performance instrumentation markets, which saw a global growth of approximately 6% in 2024.

- Enhanced Durability: New materials can increase resistance to wear and tear, extending product life.

- Weight Reduction: Lighter components improve portability and user ergonomics for measuring instruments.

- Improved Precision: Materials with lower thermal expansion coefficients contribute to greater measurement accuracy.

- Cost Efficiency: While initial investment may be higher, advanced materials can reduce long-term manufacturing and warranty costs.

3D Printing and Additive Manufacturing

The advancement of 3D printing and additive manufacturing presents opportunities for Shinwa Co. Ltd. to innovate in its production of measuring tools. These technologies could facilitate the creation of more intricate component designs and allow for quicker customization of products. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating a strong trend towards adopting these advanced manufacturing techniques. This could lead to more efficient prototyping cycles and the development of specialized measuring instruments tailored to specific client needs.

While not a complete replacement for established methods, 3D printing can streamline Shinwa's manufacturing processes. It offers the potential to reduce lead times for certain parts and enable the production of novel product variations that might be difficult or costly to achieve with traditional manufacturing.

- Prototyping Efficiency: Faster iteration of new measuring tool designs.

- Customization Potential: Ability to produce bespoke components for niche applications.

- Process Streamlining: Reduction in manufacturing time and complexity for specific parts.

- Innovation in Product Lines: Development of advanced measuring tools with unique geometries.

Technological advancements are fundamentally reshaping how measurement tools are designed and utilized. Innovations like IoT integration and AI-powered analytics are becoming standard, enabling real-time data exchange and smarter diagnostics for instruments. For Shinwa, this means an opportunity to embed connectivity into its offerings, allowing for remote monitoring and predictive maintenance, crucial in sectors like advanced manufacturing and construction.

The increasing automation across industries, particularly in manufacturing and construction, directly impacts the demand for measuring instruments. As robotics and automated systems become more prevalent, there's a growing need for measurement tools that can seamlessly interface with these technologies, providing integrated data for quality control. The global industrial robotics market, already significant, is expected to see substantial growth, highlighting this trend.

Digital transformation is driving a demand for measuring instruments that offer digital outputs and integrate smoothly with software platforms. This facilitates sophisticated data analysis and streamlined workflows. Shinwa can capitalize on this by developing smart, connected tools that provide valuable data-driven insights, enhancing user productivity and decision-making, especially as the industrial IoT market continues its strong expansion.

Materials science innovations are enhancing the performance of precision instruments. New composites and alloys offer lighter, more durable, and more accurate components for measuring devices, improving portability and reliability. Companies investing in advanced materials research are positioned for leadership in high-performance instrumentation markets, which experienced notable growth in 2024.

Legal factors

Shinwa Co. Ltd., as a manufacturer of measuring instruments, must navigate a complex web of national and international product safety and quality standards. These regulations, covering everything from design and manufacturing processes to rigorous testing protocols, are essential for gaining market entry and fostering consumer confidence. For instance, in 2024, adherence to ISO 9001 standards remained a key differentiator, with a significant percentage of global suppliers indicating it as a prerequisite for business partnerships.

Failure to meet these evolving standards can result in substantial legal liabilities and reputational damage. The continuous updates to these requirements, driven by technological advancements and consumer protection initiatives, demand ongoing investment in compliance and quality assurance. As of early 2025, several key markets were implementing stricter electromagnetic compatibility (EMC) directives, requiring manufacturers like Shinwa to re-evaluate their product designs and testing methodologies to ensure continued market access.

Protecting Shinwa's patents, trademarks, and design rights is crucial to safeguard its precision tools from counterfeiting and unauthorized copying, a significant concern in the global manufacturing sector. Strong intellectual property rights (IPR) enforcement directly translates into Shinwa maintaining its competitive edge, built upon unique designs and technological advancements. For instance, in 2024, the global counterfeit goods market was estimated to be worth over $500 billion, highlighting the substantial risk to companies like Shinwa.

The ongoing legal challenge for Shinwa involves vigilant monitoring and robust defense of its IP across various international markets. This proactive approach is essential as infringement can erode market share and brand reputation. In 2025, the World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings, indicating a heightened global focus on innovation and IP protection, which Shinwa must actively navigate.

Shinwa Co. Ltd. must strictly adhere to labor laws concerning minimum wages, working hours, and workplace safety, particularly in its manufacturing sectors. For instance, in Japan, the minimum wage varies by prefecture, with Tokyo having the highest at ¥1,113 per hour as of October 2023, impacting Shinwa's labor costs. Failure to comply can lead to fines and reputational damage.

Evolving employment regulations, such as those related to remote work or new safety standards, could necessitate adjustments in Shinwa's operational procedures and increase human resource management expenses. For example, the implementation of stricter industrial safety regulations in 2024 might require investment in updated equipment and training for its workforce.

Maintaining fair labor practices and ensuring a safe working environment is not only a legal obligation but also crucial for employee morale and productivity, directly affecting Shinwa's overall efficiency and its ability to attract and retain talent.

Environmental Regulations and Compliance

Environmental regulations significantly shape Shinwa Co. Ltd.'s operations, particularly in areas like waste disposal, emissions control, chemical usage, and energy efficiency. For instance, strict rules on industrial emissions can necessitate costly upgrades to manufacturing equipment to meet new standards.

Compliance is not merely a legal obligation but a strategic imperative. Failure to adhere to environmental laws, such as those dictating the responsible sourcing of raw materials or limits on factory air pollutants, can result in substantial fines and damage Shinwa's reputation. For example, in 2024, companies in Japan faced increased scrutiny over wastewater discharge, with penalties for non-compliance reaching millions of yen.

These legal mandates often drive the adoption of sustainable business practices. Shinwa's commitment to environmental stewardship, therefore, is frequently a direct response to evolving legal frameworks.

- Waste Disposal Laws: Regulations like Japan's Waste Management and Public Cleansing Act require proper segregation, treatment, and disposal of industrial waste, impacting Shinwa's supply chain and production line costs.

- Emissions Standards: Air quality standards, such as those set by the Ministry of the Environment, dictate permissible levels of greenhouse gases and other pollutants from manufacturing facilities, potentially requiring investment in abatement technologies.

- Chemical Management: Laws like the Chemical Substances Control Law govern the import, manufacture, and use of chemical substances, affecting Shinwa's material procurement and product formulation.

- Energy Efficiency Mandates: Government initiatives promoting energy conservation can influence Shinwa's investment in energy-saving technologies and operational procedures to reduce its carbon footprint.

International Trade Laws and Customs Regulations

Shinwa Co. Ltd.'s import and export operations are heavily influenced by a web of international trade laws and customs regulations. These rules govern everything from the tariffs applied to goods entering or leaving a country to specific restrictions on certain products. For instance, in 2024, the World Trade Organization (WTO) continued to emphasize the importance of predictable and transparent trade policies, impacting how companies like Shinwa manage their cross-border transactions. Navigating these complexities, including varying country-specific requirements and the nuances of different trade agreements, is paramount for ensuring smooth global distribution and preventing costly delays or penalties.

Maintaining robust customs compliance is not just a procedural necessity but a strategic imperative for international sales success. For example, the average tariff rate on manufactured goods globally in 2024 remained a key consideration for Shinwa's pricing strategies. Understanding and adhering to these regulations, such as those related to product origin, labeling, and documentation, directly impacts Shinwa's ability to reach new markets efficiently and cost-effectively. Failure to comply can result in significant fines, seizure of goods, and damage to the company's reputation, highlighting the critical need for specialized expertise in this area.

- Customs Duties: Tariffs and duties on imported goods can significantly impact the landed cost of products, requiring careful calculation and strategic sourcing. For example, tariffs on electronics, a key sector for many international businesses, can fluctuate based on geopolitical factors and trade negotiations.

- Import/Export Restrictions: Certain goods may face outright bans or require special licenses and permits for import or export, necessitating thorough due diligence before engaging in international trade.

- Trade Agreements: Bilateral and multilateral trade agreements, such as those involving major economic blocs, can offer preferential tariff rates or reduced regulatory burdens, creating opportunities for cost savings and market access.

- Compliance Expertise: Companies must invest in or partner with experts who understand the intricacies of customs declarations, valuation, and classification to ensure adherence to international trade laws.

Shinwa Co. Ltd. must navigate a complex landscape of product safety and quality regulations, essential for market access and consumer trust. Adherence to standards like ISO 9001 remains a critical factor for partnerships, with evolving directives, such as stricter electromagnetic compatibility (EMC) regulations in key markets as of early 2025, necessitating ongoing compliance investments.

Protecting intellectual property, including patents and trademarks, is vital to combat counterfeiting, a market estimated to be worth over $500 billion globally in 2024. Vigilant IP defense is crucial for maintaining Shinwa's competitive edge, especially with a reported 3.5% increase in international patent filings in 2025, indicating a heightened global focus on innovation protection.

Labor laws, covering minimum wages, working hours, and workplace safety, are paramount, with regional variations in minimum wage, such as Tokyo's ¥1,113 per hour (as of Oct 2023), impacting labor costs. Adapting to new regulations, like enhanced industrial safety standards implemented in 2024, may require investment in updated equipment and training.

Environmental regulations concerning waste disposal, emissions, and chemical usage are critical, with penalties for non-compliance, such as those for wastewater discharge in Japan in 2024, potentially reaching millions of yen. These mandates often drive sustainable practices, influencing operational procedures and investment in energy-saving technologies.

Environmental factors

Shinwa Co. Ltd. faces potential challenges related to resource scarcity. The availability and cost of essential raw materials, such as specialized metals and plastics integral to their instrument manufacturing, are susceptible to environmental pressures like resource depletion and stricter mining regulations. For instance, the global supply of certain rare earth metals, crucial for advanced electronics, saw price volatility in early 2024, with some grades increasing by 10-15% due to heightened demand and limited extraction.

To mitigate these risks and ensure supply chain resilience, Shinwa must prioritize sustainable sourcing. This involves exploring and adopting environmentally responsible procurement practices and actively investigating alternative materials that offer comparable performance but with a more stable and less environmentally impactful origin. This strategic shift is vital for long-term operational continuity and cost management, especially considering the energy-intensive nature of manufacturing processes.

Climate change presents significant environmental challenges for industries reliant on outdoor operations, impacting Shinwa's customer base. Extreme weather events, becoming more frequent, could delay construction projects and outdoor maintenance, directly affecting demand for Shinwa's tools. For example, a 2024 report indicated a 15% increase in weather-related project disruptions globally.

Shinwa, like many manufacturers, will likely face increasing pressure to scrutinize and reduce its own carbon footprint, extending to its entire supply chain. This could involve sourcing more sustainable materials or optimizing logistics, potentially adding to operational costs.

Furthermore, Shinwa may need to adapt its product offerings to meet the evolving needs of its customers who are themselves facing changing operating conditions. As industries shift towards more resilient infrastructure or climate-friendly practices, Shinwa's tools might need to evolve to support these new demands, ensuring continued relevance in a changing climate.

Growing regulatory scrutiny and public demand for reduced industrial waste are pushing companies like Shinwa Co. Ltd. to re-evaluate their environmental footprint. This includes stricter rules around product end-of-life disposal, making responsible waste management a critical operational factor. For instance, by 2025, many regions are expected to implement advanced waste sorting and recycling mandates for manufacturers.

Shinwa should proactively adopt sustainable waste management strategies throughout its production processes. Exploring opportunities for material recycling and designing products with easier disassembly in mind can significantly improve resource recovery. This focus on circular economy principles is becoming essential for long-term business viability and compliance.

Energy Consumption and Efficiency

The energy needed for manufacturing is a key part of Shinwa Co. Ltd.'s environmental impact and how much it costs to run the business. In 2024, the industrial sector globally accounted for roughly 30% of total final energy consumption, highlighting the significant role energy plays in production. Shinwa’s operations, like many in manufacturing, rely heavily on consistent energy supply.

By investing in energy-efficient technologies and exploring renewable energy sources, Shinwa can achieve a dual benefit: lowering its environmental footprint and boosting its cost efficiency. For instance, companies adopting advanced machinery in 2024 reported an average reduction of 15% in energy use per unit of output. This trend is driven by both regulatory pressures and a growing awareness of sustainability.

There's increasing pressure on companies like Shinwa to be transparent about their energy consumption. Stakeholders, including investors and consumers, are paying closer attention to corporate environmental performance. As of early 2025, over 60% of global investors consider environmental, social, and governance (ESG) factors, including energy usage, when making investment decisions.

- Energy Consumption Impact: Manufacturing processes are significant energy users, directly affecting Shinwa's operational costs and environmental impact.

- Efficiency Gains: Adopting energy-efficient technologies and renewables can reduce both environmental impact and operational expenses.

- Market Scrutiny: Companies face growing scrutiny from investors and consumers regarding their energy consumption patterns and sustainability efforts.

- Cost Savings Potential: Improvements in energy efficiency can lead to substantial cost reductions, with some industries seeing savings of up to 10% on energy bills annually.

Supply Chain Environmental Footprint

Shinwa Co. Ltd. faces increasing pressure to address the environmental impact of its entire supply chain, encompassing everything from raw material sourcing to final product delivery. This indirect environmental footprint is becoming a critical area of focus for stakeholders. Companies like Shinwa are increasingly held accountable for managing and reducing these emissions. For instance, in 2024, the average carbon footprint of global logistics operations saw a slight increase, underscoring the challenge. This means actively engaging with suppliers to ensure they also meet stringent environmental standards is paramount. Optimizing transportation routes and methods to cut down on emissions is also a key strategy for Shinwa to mitigate its indirect environmental impact.

Managing this footprint involves several key actions:

- Supplier Audits: Implementing regular environmental performance audits for all key suppliers.

- Logistics Optimization: Investing in route planning software and exploring lower-emission transport options, such as rail or electric vehicles for last-mile delivery.

- Circular Economy Practices: Encouraging suppliers to adopt recycling and waste reduction programs.

- Data Transparency: Reporting on supply chain emissions, with a target to reduce Scope 3 emissions by 15% by 2027.

Shinwa Co. Ltd. is increasingly impacted by environmental regulations focused on waste reduction and responsible product lifecycle management. Stricter mandates, expected in many regions by 2025, will require enhanced material recovery and circular economy principles in product design. This necessitates proactive adoption of sustainable waste management, including material recycling and designing for disassembly, to ensure compliance and long-term viability.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Shinwa Co. Ltd. is meticulously crafted using data from reputable sources, including government economic reports, international trade statistics, and industry-specific market research. We incorporate insights from technological advancement forecasts and environmental impact studies to provide a comprehensive overview.