Shinwa Co. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shinwa Co. Ltd. Bundle

Shinwa Co. Ltd. operates within a dynamic market, significantly shaped by the bargaining power of its buyers and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic positioning. The threat of new entrants, while present, may be mitigated by certain industry barriers.

The complete report reveals the real forces shaping Shinwa Co. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Shinwa Co. Ltd. is significantly shaped by supplier concentration, particularly for specialized raw materials and components essential for their digital tools. When only a handful of providers can offer critical items, such as high-grade metals or advanced electronic parts, these suppliers gain considerable leverage. This concentration can lead to increased costs for Shinwa or restricted access to necessary inputs if these few suppliers exert substantial market control.

Shinwa Rules Co., Ltd. faces significant supplier bargaining power when switching costs are high. If it's difficult or expensive for Shinwa to move from one supplier to another, current suppliers can demand higher prices or less favorable terms. This is especially relevant for specialized components crucial for their precision measuring instruments, where finding equally qualified replacements might be challenging.

For instance, if Shinwa needs to retool its manufacturing lines or undergo extensive re-qualification processes for new materials, the expense and time involved directly enhance the leverage of its existing suppliers. These switching costs can act as a barrier, making it less feasible for Shinwa to explore alternative sourcing options, thereby solidifying the power of their current suppliers.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Shinwa Co., Ltd. If the raw materials or components Shinwa needs for its rulers, squares, or levels have readily available alternatives, suppliers have less leverage to dictate terms and prices.

For instance, if plastic manufacturers can easily switch to different polymer grades without substantial cost increases, this limits the power of any single plastic supplier. In 2023, the global market for precision measuring instruments saw continued innovation, with some areas experiencing minor material substitution, though critical components often remained specialized.

However, for highly specialized or precision-engineered parts essential for Shinwa's high-accuracy measuring devices, the availability of substitutes might be limited. This scarcity can empower those suppliers, allowing them to command higher prices or stricter terms.

Uniqueness of Supplier Products/Services

Suppliers offering unique or highly differentiated products, like patented precision mechanisms or advanced sensor technologies, hold significant bargaining power. Shinwa Co. Ltd.'s commitment to high-quality and accurate instruments suggests a reliance on suppliers capable of delivering these specialized inputs, amplifying their influence.

This dynamic is particularly pronounced in the burgeoning market for smart and digital measuring tools, where proprietary technology and specialized components are crucial. For instance, the increasing demand for IoT-enabled measurement devices necessitates suppliers with advanced semiconductor or connectivity solutions. In 2024, the global market for industrial IoT is projected to reach over $115 billion, highlighting the critical role of specialized component suppliers.

- Supplier Differentiation: Suppliers with unique intellectual property or specialized manufacturing processes can command higher prices and more favorable terms.

- Technology Dependence: Shinwa's need for advanced features in its instruments means it is dependent on suppliers with cutting-edge technological capabilities.

- Market Trends: The shift towards smart and connected devices increases the bargaining power of suppliers providing essential digital components and software integration.

- Input Scarcity: If key components for advanced instruments are sourced from only a few specialized providers, their bargaining power is inherently strengthened.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing Shinwa's measuring instruments significantly boosts their bargaining power. If suppliers can produce these instruments themselves, they could bypass Shinwa and directly target Shinwa's customers. This would not only reduce Shinwa's revenue streams but also potentially restrict their access to critical components or inflate input costs. For instance, a key component supplier for precision measuring devices, if possessing the technical know-how and capital, might explore direct sales to end-users, thereby cutting out the intermediary like Shinwa.

However, the viability of this threat hinges on the complexity and capital requirements of instrument manufacturing. Such integration is often deterred by the high barriers to entry in specialized manufacturing. For example, developing the proprietary technology, establishing quality control processes, and building a distribution network for precision measuring instruments can be prohibitively expensive and time-consuming for many suppliers. In 2024, the average cost to establish a new manufacturing facility for complex electronic components, a segment relevant to measuring instruments, can range from tens to hundreds of millions of dollars, making forward integration a substantial undertaking.

- High Capital Investment: Significant upfront capital is needed to establish manufacturing capabilities for precision instruments.

- Technical Expertise: Specialized knowledge in design, engineering, and manufacturing is crucial, which not all suppliers may possess.

- Quality Control Demands: Meeting stringent quality and calibration standards for measuring instruments requires dedicated resources and processes.

- Market Access Challenges: Suppliers would need to develop their own sales, marketing, and distribution channels to compete effectively.

The bargaining power of suppliers for Shinwa Co. Ltd. is elevated when they offer highly differentiated or proprietary components, critical for Shinwa's precision instruments. Suppliers with patented technologies, like advanced sensor modules or unique calibration mechanisms, command significant leverage. This reliance is amplified in 2024 by the growing demand for smart measuring tools, where specialized digital components are essential, with the global industrial IoT market projected to exceed $115 billion.

The threat of suppliers integrating forward into manufacturing Shinwa's products is generally low due to the high capital investment and specialized technical expertise required for precision instrument production. For instance, establishing a new manufacturing facility for complex electronic components, relevant to measuring devices, can cost tens to hundreds of millions of dollars in 2024, creating substantial barriers for suppliers.

| Factor | Impact on Shinwa | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High for specialized parts, increasing costs. | Key for advanced electronic components. |

| Switching Costs | High for retooling, empowering existing suppliers. | Relevant for precision-engineered parts. |

| Input Differentiation | Strong leverage for unique or patented components. | Crucial for smart/digital measuring tools. |

| Forward Integration Threat | Low due to high capital and technical barriers. | Manufacturing costs for electronics remain high. |

What is included in the product

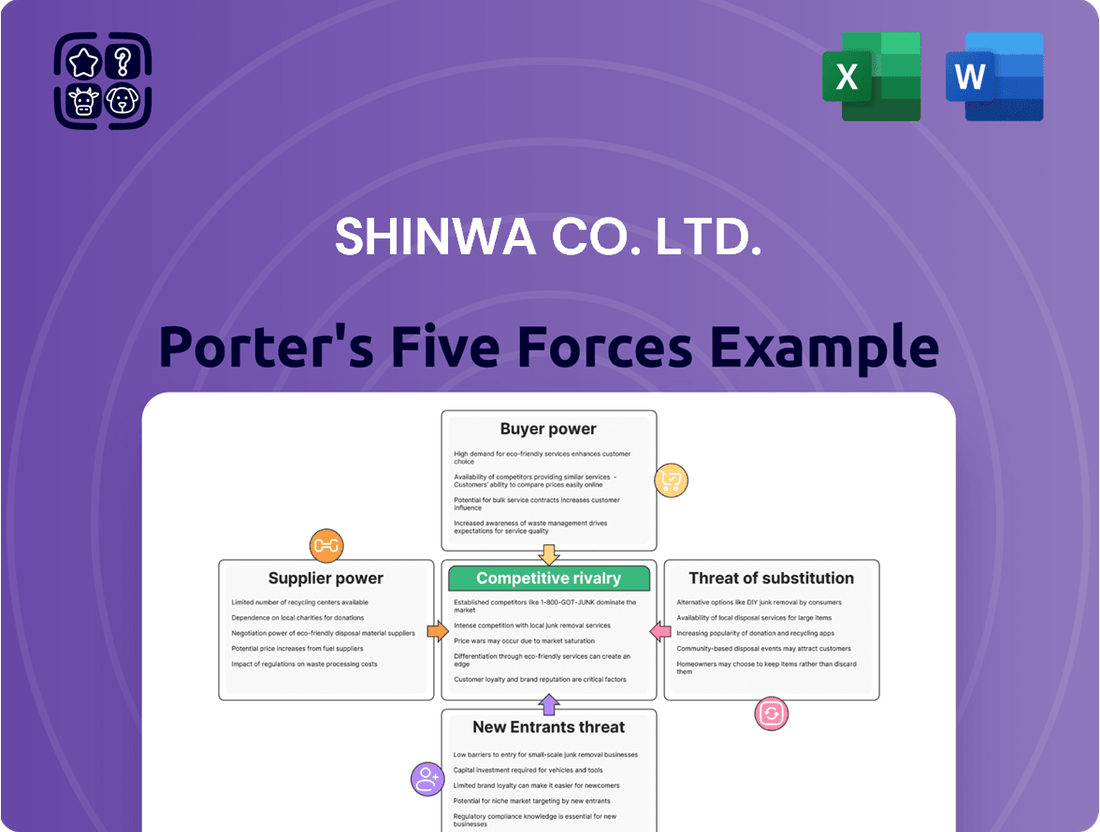

This Porter's Five Forces analysis for Shinwa Co. Ltd. dissects the competitive intensity of its industry, revealing the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall competitive rivalry impacting Shinwa.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Shinwa Co. Ltd.'s Porter's Five Forces.

Customers Bargaining Power

Shinwa Rules Co., Ltd.'s customer bargaining power is significantly influenced by buyer concentration. If a small number of large clients, such as major construction companies or key distributors, represent a substantial portion of Shinwa's revenue, these customers gain leverage. For instance, if the top 5 clients accounted for over 40% of Shinwa's sales in 2024, they could effectively negotiate lower prices or more favorable payment terms, thereby increasing their bargaining power.

Conversely, a fragmented customer base across various sectors, including DIY stores, hardware retailers, and industrial users, dilutes the influence of any single buyer. This broad distribution means no individual customer can significantly impact Shinwa's overall sales volume. In 2024, Shinwa's diversification efforts aimed to reduce reliance on any single customer segment, a strategy that generally lowers customer bargaining power by spreading risk and sales volume across a wider market.

Customers of Shinwa Rules Co., Ltd. find their bargaining power strengthened by the growing availability of substitute measuring tools. Options like laser distance meters, digital calipers, and even software-based measuring solutions provide viable alternatives, forcing customers to carefully consider Shinwa's products against these competitors.

These substitutes offer a spectrum of accuracy, speed, and features, compelling customers to conduct thorough comparisons based on both price and performance. For instance, the market for laser distance meters alone saw significant growth, with global sales projected to reach over $2 billion by 2024, indicating a robust competitive landscape that empowers buyers.

The bargaining power of Shinwa's customers is significantly influenced by switching costs associated with their measuring instruments. For specialized professional and industrial applications where Shinwa's tools are deeply integrated into operational workflows, the cost and effort to switch to a competitor, including retraining personnel and revalidating processes, can be substantial.

Conversely, for more commoditized or general-purpose measuring tools, the barriers to switching are considerably lower. This ease of transition for customers using these products grants them greater leverage in price negotiations and demands for better service, thereby increasing their bargaining power against Shinwa.

Customer Price Sensitivity

Customer price sensitivity for Shinwa's measuring tools hinges on how significant the tool's cost is within a client's total project expenditure. If the measuring tools represent a small fraction of the overall budget, customers are likely less sensitive to price. However, for more standardized products where Shinwa’s differentiation might be less pronounced, customers may indeed shop around more actively for better pricing.

In 2024, the global industrial tools market saw continued growth, with an estimated market size of over $100 billion. Within this, measuring instruments form a significant segment. While Shinwa has a reputation for high-quality, durable products, the increasing availability of competitive alternatives means that for certain product categories, particularly those considered commodities, price can become a more influential factor in purchasing decisions.

- Cost Proportion: The impact of a measuring tool's price on the customer's total project budget.

- Product Standardization: How easily a product can be substituted by competitors.

- Competitive Landscape: The presence of many similar products from other manufacturers.

- Perceived Value: The customer's view of Shinwa's product benefits versus its cost compared to alternatives.

Threat of Backward Integration by Customers

Customers, especially large industrial buyers or major retailers, possess the potential to threaten Shinwa Co. Ltd. through backward integration. This means they could start manufacturing their own measuring instruments, thereby reducing their reliance on Shinwa.

While the prospect of customers backward integrating is generally considered low for highly specialized and precision measuring instruments like those produced by Shinwa, it remains a theoretical bargaining chip. The significant capital outlay and the need for advanced technical knowledge and skilled labor are substantial barriers that typically prevent most customers from undertaking such a venture.

For instance, in the automotive sector, a large car manufacturer might consider in-house production of certain basic measurement tools, but the sophisticated calibration and quality control required for advanced metrology equipment makes this impractical for the vast majority. Shinwa's focus on high-precision, technologically advanced products inherently limits the feasibility of customer backward integration.

Consider the global industrial automation market, valued at approximately $200 billion in 2024, where specialized metrology equipment represents a significant, high-value segment. For companies operating within this market, the R&D investment and ongoing technical expertise needed to compete with established players like Shinwa are prohibitive.

- Customer Bargaining Power: Threat of Backward Integration

- Feasibility: Low due to high capital and expertise requirements for precision instruments.

- Market Context: Industrial automation market valued at ~$200 billion in 2024, with high barriers to entry for metrology.

- Shinwa's Position: Focus on high-precision, technologically advanced products mitigates this threat.

Shinwa's customer bargaining power is notably influenced by the number and size of its buyers. If a few large clients, such as major construction firms or key distributors, account for a significant portion of Shinwa's revenue, these customers gain considerable leverage to negotiate better terms.

Shinwa's strategy to diversify its customer base across various sectors, including DIY stores and industrial users, helps to dilute the influence of any single buyer, thereby lowering overall customer bargaining power.

The increasing availability of substitute measuring tools, like laser distance meters and digital solutions, significantly enhances customer bargaining power by providing viable alternatives. In 2024, the laser distance meter market alone was projected to exceed $2 billion globally, highlighting the competitive pressure on traditional measuring tools.

The bargaining power of Shinwa's customers is also shaped by switching costs. For specialized applications where Shinwa's tools are integrated into workflows, switching is costly. However, for more standard products, lower switching costs empower customers to demand better pricing and service, increasing their leverage.

Customer price sensitivity for Shinwa's products depends on how the tool's cost fits into their overall budget and the degree of product standardization. In 2024, the global industrial tools market, valued at over $100 billion, showed that while quality matters, competitive alternatives in standardized segments can drive price-based decisions.

| Factor Influencing Customer Bargaining Power | Shinwa Co. Ltd. Context | Impact on Bargaining Power |

|---|---|---|

| Buyer Concentration | High if a few large clients dominate sales (e.g., top 5 clients representing >40% of 2024 sales). | Increases power. |

| Customer Base Diversity | Broad distribution across DIY, hardware, and industrial sectors. | Decreases power. |

| Availability of Substitutes | Laser distance meters, digital calipers, software solutions. | Increases power. |

| Switching Costs | High for specialized tools, low for commoditized items. | High costs decrease power; low costs increase power. |

| Price Sensitivity | Depends on cost proportion in total budget and product standardization. | Higher sensitivity increases power. |

Preview Before You Purchase

Shinwa Co. Ltd. Porter's Five Forces Analysis

The preview you see here is the exact Shinwa Co. Ltd. Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces. This document details the intensity of rivalry among existing competitors, the bargaining power of buyers, and the bargaining power of suppliers within Shinwa's industry. Furthermore, it thoroughly assesses the threat of new entrants and the threat of substitute products or services, providing actionable insights. You'll receive this fully formatted and ready-to-use analysis immediately after completing your transaction.

Rivalry Among Competitors

Shinwa Co. Ltd. operates within markets featuring a substantial number of competitors, from large global entities to niche local producers. This means there are many companies vying for market share, creating a dynamic environment.

The competition isn't just about quantity; it's also about diversity. Companies specialize in different areas, such as general hand tools, high-precision measuring instruments, or sophisticated electronic test equipment, meaning Shinwa faces a varied set of rivals with different strengths.

For example, in the broader hand tool segment, players like Stanley Black & Decker and Apex Tool Group are major global players, while in specialized measuring instruments, companies such as Mitutoyo and Hexagon Manufacturing Intelligence are key competitors. This wide spectrum ensures Shinwa constantly adapts to different competitive pressures.

The global market for hand tools alone was valued at over $20 billion in 2023 and is projected to grow steadily. Within this, the test and measurement equipment sector is also robust, with significant investment in advanced technologies, further highlighting the diverse and active competitive landscape Shinwa navigates.

The global measuring instrument market is on a strong growth trajectory, projected to reach approximately $100 billion by 2024, fueled by increasing industrial automation and infrastructure projects worldwide. This expansion, while generally softening direct competitive pressures by offering ample room for all participants, also acts as a magnet for new entrants and spurs existing companies to pursue aggressive market share acquisition.

Shinwa Rules Co., Ltd. enjoys a reputation for high-quality, precise measuring instruments, offering a distinct product differentiation that appeals to demanding users. This quality focus creates a barrier for competitors seeking to directly match their product performance and reliability.

Despite Shinwa's quality edge, the broader market for measuring tools is experiencing a push towards standardization, with numerous manufacturers offering functionally similar products. This trend, evident in the growing availability of generic alternatives, can increase competitive pressure by making it easier for customers to find comparable, albeit less specialized, options.

Furthermore, for many of Shinwa's more common measuring tools, customer switching costs are notably low. This means customers can readily move to a competitor's product without significant financial or operational hurdles, which inherently intensifies the rivalry among players in the market.

Exit Barriers

Shinwa Co. Ltd., like many precision tool manufacturers, likely faces significant exit barriers. These are costs or difficulties that make it hard for a company to leave an industry, even when it's not doing well. For Shinwa, these barriers could include specialized machinery that's hard to repurpose or sell, and established distribution channels that represent sunk costs.

The presence of high exit barriers means companies like Shinwa might stick around in the precision tool market longer than they otherwise would, even if profits are slim. This can lead to a more aggressive competitive environment as firms fight to survive. For instance, if Shinwa has invested heavily in highly specific manufacturing equipment for niche precision tools, selling that equipment for anything close to its book value might be impossible, forcing continued operation.

Consider the financial implications: in 2024, the global industrial machinery market, which includes precision tools, saw continued demand but also faced challenges from supply chain disruptions and rising material costs, potentially exacerbating exit barriers for less capitalized players. Companies with long-term contracts with key clients also find themselves locked into the market.

- Specialized Assets: High investment in unique, industry-specific machinery for precision tool production.

- Distribution Networks: Established relationships and infrastructure for delivering precision tools to customers.

- Long-Term Contracts: Commitments to supply precision tools to specific clients, making early exit costly.

- Brand Loyalty: Customer reliance on Shinwa's reputation for quality and reliability in precision tools.

Strategic Stakes and Innovation

Competitive rivalry within Shinwa Co. Ltd.'s operating landscape is significantly fueled by a relentless pursuit of innovation. Companies are actively investing in new product extensions, refining ergonomic designs, and integrating cutting-edge smart technologies such as artificial intelligence (AI) and the Internet of Things (IoT). This intense focus on technological advancement and ongoing product development escalates competition as firms battle for market dominance and aim to capture consumer interest with novel features.

The strategic stakes are exceptionally high, as demonstrated by the rapid pace of technological adoption. For instance, the global AI market was valued at approximately $136.6 billion in 2022 and is projected to reach over $1.8 trillion by 2030, indicating a massive investment drive across industries. Similarly, the IoT market, valued at $548.5 billion in 2022, is expected to surpass $1.5 trillion by 2030. Shinwa Co. Ltd. must navigate this environment where early adoption and superior technological integration can translate directly into market share gains.

- Focus on AI Integration: Companies are embedding AI for predictive analytics and personalized customer experiences.

- Ergonomic Design as a Differentiator: Improved usability and aesthetics are becoming key competitive advantages.

- IoT Connectivity: Smart product features that offer seamless connectivity are driving demand.

- R&D Investment: Significant portions of revenue are being allocated to research and development to stay ahead.

Competitive rivalry for Shinwa Co. Ltd. is intense due to a crowded market with numerous global and niche players. This dynamic is further amplified by low switching costs for many of its products, allowing customers to easily opt for alternatives. Companies are heavily investing in innovation, particularly in AI and IoT integration, to gain an edge.

Shinwa faces a diverse set of competitors, ranging from large conglomerates in the broader hand tool market to specialized firms in precision instruments. The global test and measurement equipment market's projected growth to around $100 billion by 2024, driven by automation, fuels this rivalry. Shinwa's reputation for high-quality, precise instruments offers a degree of differentiation, but the trend toward standardization in some segments presents a challenge.

The battle for market share is fierce, with innovation being a key differentiator. Companies are pumping significant resources into R&D, focusing on smart technologies and improved design. For instance, the global IoT market was valued at $548.5 billion in 2022 and continues to expand rapidly, underscoring the importance of technological advancement in this competitive arena.

High exit barriers, such as specialized machinery and established distribution networks, can keep less profitable firms in the market, intensifying rivalry. Companies must continuously innovate and adapt to maintain their position amidst this robust competitive landscape.

| Competitor Type | Market Segment Example | Key Competitive Factor | 2023/2024 Data Point |

| Global Hand Tool Manufacturers | General Tools | Brand Recognition, Distribution Scale | Global Hand Tool Market > $20 Billion (2023) |

| Specialized Instrument Firms | Precision Measuring Instruments | Product Accuracy, Technological Integration | Global Measuring Instrument Market ~$100 Billion (2024 Projection) |

| Technology-Focused Competitors | Smart Tools, IoT Devices | AI/IoT Capabilities, R&D Investment | Global IoT Market $548.5 Billion (2022) |

SSubstitutes Threaten

The increasing availability and adoption of digital measuring tools represent a significant threat of substitutes for Shinwa Co. Ltd.'s traditional analog instruments. Digital calipers, levels, and multimeters offer users superior precision and easier readability, directly competing with Shinwa's core product offerings.

These digital alternatives also boast advanced features like data logging and system integration, which enhance efficiency and minimize the potential for human error. For instance, the global market for digital measuring instruments is projected to grow substantially, with reports indicating a compound annual growth rate of over 6% leading up to 2028, highlighting a clear shift in user preference towards these advanced technologies.

Laser measurement devices pose a significant threat to traditional measuring tools like tape measures, particularly for Shinwa Co. Ltd. These advanced tools offer speed and precision, especially for longer distances and intricate shapes. For instance, the global laser distance meter market was valued at approximately USD 1.5 billion in 2023 and is projected to grow steadily, indicating increasing adoption by professionals and DIY enthusiasts alike.

The ease of use and reduced manual input associated with laser measurement devices translate directly into improved efficiency on job sites. This is crucial for industries where time is money, such as construction and surveying. Studies in the construction sector show that laser measuring tools can reduce measurement time by up to 50% compared to traditional methods, directly impacting project timelines and labor costs.

Shinwa Co. Ltd., known for its precision measuring instruments, faces competition from manufacturers offering innovative laser technology. The increasing availability of affordable and user-friendly laser measuring devices means that customers have more choices, potentially diverting sales away from Shinwa's traditional product lines if they do not adapt or innovate in this area.

Advanced software and AI are increasingly acting as substitutes for traditional methods in industries like flooring and interior design. Technologies like mobile apps utilizing LiDAR can scan and measure room dimensions instantly and accurately, directly challenging manual measurement processes.

These digital tools streamline workflow by integrating directly with design and estimation software. For example, the global market for augmented reality (AR) in interior design was valued at approximately $1.2 billion in 2023 and is projected to grow significantly, indicating a strong shift towards these technological substitutes.

Multifunctional Tools and Integrated Systems

The rise of multifunctional tools and integrated measurement systems poses a significant threat to Shinwa Co. Ltd. These advanced solutions often embed smart sensors and utilize IoT connectivity, offering a holistic approach that can replace several specialized instruments. For instance, a single smart device might now perform tasks previously requiring separate calipers, micrometers, and inspection gauges, consolidating functionality and convenience for users.

These integrated systems deliver enhanced efficiency through real-time data analysis and remote monitoring capabilities. This allows for quicker decision-making and proactive problem-solving, potentially diminishing the demand for Shinwa's individual measuring tools. The market for industrial IoT devices, a key component of these integrated systems, was projected to reach $150 billion in 2024, highlighting the growing adoption of such substitute technologies.

- Consolidated Functionality: Multifunctional tools combine the capabilities of multiple single-purpose devices, reducing the need for a diverse tool inventory.

- Smart Sensor Integration: The incorporation of smart sensors allows for precise, automated measurements and data collection.

- IoT Connectivity: Real-time data transmission and remote monitoring capabilities enhance operational efficiency and data accessibility.

- Cost-Effectiveness: While initial investment might be higher, integrated systems can offer long-term cost savings by reducing the need for multiple tools and manual data handling.

Power Tools with Integrated Measurement

While not direct substitutes for all precision measuring instruments, power tools are increasingly integrating measurement capabilities, such as digital depth stops or laser guides. This trend, particularly visible in the woodworking and construction sectors, can lessen the demand for standalone measuring tools for specific applications. For instance, many modern cordless drills now offer integrated laser distance measurers, enhancing their utility and appeal.

The convenience and efficiency offered by these all-in-one solutions are significant selling points for many users. As of 2024, the global power tool market is projected to reach over $35 billion, with innovation in integrated features contributing to market growth. This suggests that consumers are receptive to tools that streamline workflows.

- Growing Integration: Power tools are incorporating features like laser guides and digital readouts.

- Reduced Need for Separate Tools: For certain tasks, these integrated features can eliminate the need for separate measuring devices.

- Market Trend: The global power tool market continues to expand, with integrated technology being a key driver.

- Convenience Factor: Efficiency and ease of use are paramount for users, making these combined tools attractive.

The threat of substitutes for Shinwa Co. Ltd. is substantial, driven by advancements in digital measurement technologies and integrated tools. Digital instruments offer enhanced precision and data logging, directly competing with Shinwa's traditional analog offerings. For example, the global digital measuring instruments market is expected to grow at a CAGR of over 6% up to 2028. Laser measurement devices, valued at approximately $1.5 billion in 2023, also present a strong alternative, offering speed and accuracy for various applications.

Furthermore, software and AI-driven solutions, such as AR apps for room scanning, are increasingly replacing manual measurement processes, with the AR in interior design market reaching about $1.2 billion in 2023. Multifunctional tools incorporating IoT connectivity and smart sensors consolidate capabilities, reducing the need for multiple specialized instruments. The market for industrial IoT devices, key to these systems, was projected to reach $150 billion in 2024. Even power tools are integrating measurement features, with the global power tool market exceeding $35 billion in 2024, indicating a trend towards combined functionality.

| Substitute Technology | Key Advantages | Market Context (Approximate) |

|---|---|---|

| Digital Measuring Instruments | Precision, Data Logging, Readability | Global market CAGR > 6% (to 2028) |

| Laser Measurement Devices | Speed, Long-Distance Accuracy, Ease of Use | Global market valued at $1.5 billion (2023) |

| Software/AI Measurement Apps | Instantaneous Room Scanning, Workflow Integration | AR in Interior Design market $1.2 billion (2023) |

| Integrated/Multifunctional Tools | Consolidated Functionality, IoT Connectivity | Industrial IoT Devices market $150 billion (2024 projection) |

| Power Tools with Integrated Measurement | Convenience, All-in-One Utility | Global Power Tool Market > $35 billion (2024) |

Entrants Threaten

The precision measuring instrument sector demands significant upfront capital for advanced machinery, dedicated research and development centers, and rigorous quality assurance infrastructure. For instance, acquiring a single high-precision CNC grinding machine can cost upwards of $500,000, and a fully equipped R&D lab easily runs into millions.

This necessity for substantial financial outlay creates a formidable barrier to entry for aspiring companies. Building state-of-the-art manufacturing facilities, capable of meeting the stringent accuracy and reliability standards expected in this industry, represents a considerable financial hurdle.

In 2024, the global market for precision measuring instruments was valued at approximately $25 billion, with significant growth projected. New entrants would need to secure substantial funding to compete with established players who have already amortized these initial capital costs over years of operation.

Shinwa Rules Co., Ltd. enjoys a strong brand reputation built on decades of delivering high-quality, precise measuring instruments. This established trust makes customers inherently loyal to Shinwa's products, creating a significant barrier for new companies attempting to enter the market. For instance, Shinwa's long-standing presence and consistent product performance have cultivated a perception of reliability that new entrants will struggle to replicate without substantial investment in marketing and proven product excellence.

Shinwa Co. Ltd., like many established players, benefits from a robust and pre-existing distribution infrastructure. This includes deep-rooted relationships with retailers, key industrial suppliers, and significant presence on various online marketplaces. Building such a network from scratch is a formidable hurdle for any newcomer.

For new entrants, gaining access to these crucial distribution channels presents a significant barrier. Developing these relationships can be a lengthy and capital-intensive process, often requiring substantial investment in sales teams and marketing to even be considered by established distributors.

In 2024, the e-commerce penetration rate in Japan reached approximately 72%, highlighting the importance of online channels. However, securing prime placement and visibility on these platforms, alongside traditional retail, demands significant resources that new entrants may struggle to allocate effectively compared to incumbents like Shinwa.

Proprietary Technology and Patents

Shinwa Co. Ltd.'s threat of new entrants is significantly mitigated by the proprietary technology and patents protecting its precision measuring instruments. Developing these instruments requires substantial R&D, making it difficult for newcomers to compete on technological grounds. Shinwa's consistent investment in innovation, evidenced by its patent portfolio, establishes a high barrier to entry. For instance, as of 2024, Shinwa continues to file patents in areas like digital caliper advancements and specialized measurement tools, reinforcing its technological moat.

The complexity and cost associated with replicating Shinwa's accumulated expertise and patented designs present a formidable challenge for potential new competitors. This deep well of knowledge, built over decades, cannot be easily acquired or duplicated. New entrants would need to invest heavily in research and development to match Shinwa's product quality and feature sets. Without such investment, their offerings would likely be inferior, struggling to gain market traction against Shinwa's established reputation and technological superiority.

- Proprietary Technology: Shinwa's measurement instruments often rely on unique, in-house developed technologies.

- Patent Protection: A robust patent portfolio safeguards Shinwa's innovations, preventing direct copying by rivals.

- R&D Investment: Significant and ongoing investment in research and development by Shinwa creates a continuous technological edge.

- Accumulated Expertise: Decades of experience in precision engineering translate into hard-to-replicate know-how.

Economies of Scale and Learning Curve

Shinwa Co. Ltd., operating in the measuring instrument market, faces a significant threat from new entrants due to existing economies of scale and a pronounced learning curve. Established players like Shinwa often achieve lower unit costs through large-scale production, bulk purchasing of raw materials, and amortized R&D investments. For instance, in 2024, major players in the industrial instrumentation sector reported production volumes that allowed for a 15-20% cost advantage over smaller, emerging companies.

Newcomers entering the measuring instrument industry at a smaller scale are inherently at a cost disadvantage. They cannot leverage the same purchasing power or spread fixed costs as thinly. This cost gap can make it challenging for new entrants to compete on price, a critical factor in many segments of the market.

Furthermore, the precision required in manufacturing high-quality measuring instruments involves a steep learning curve. Mastering the intricate processes, quality control, and calibration necessary to produce reliable instruments takes time and experience. This accumulated expertise acts as a substantial barrier, as new entrants need significant investment in training and process refinement to match the performance and consistency of incumbents.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to higher production volumes, impacting pricing strategies.

- Procurement Advantages: Large-scale purchasing by established firms secures better prices for raw materials and components.

- R&D Amortization: Existing companies can spread significant research and development expenses over a larger sales base, reducing the per-unit R&D cost.

- Learning Curve in Precision Manufacturing: The expertise gained through years of producing complex instruments creates a knowledge and efficiency gap that new entrants must overcome.

The threat of new entrants for Shinwa Co. Ltd. is relatively low. High capital requirements for advanced machinery and R&D, estimated at millions for a fully equipped lab, act as a significant financial barrier. Established brand loyalty and deep distribution networks further solidify Shinwa's position, making it difficult for newcomers to gain market traction.

Porter's Five Forces Analysis Data Sources

Our Shinwa Co. Ltd. Porter's Five Forces analysis is built upon a robust foundation of data, including Shinwa's official annual reports, investor presentations, and relevant industry trade publications. We also incorporate insights from market research firms specializing in the sector and relevant government economic data to ensure a comprehensive view.