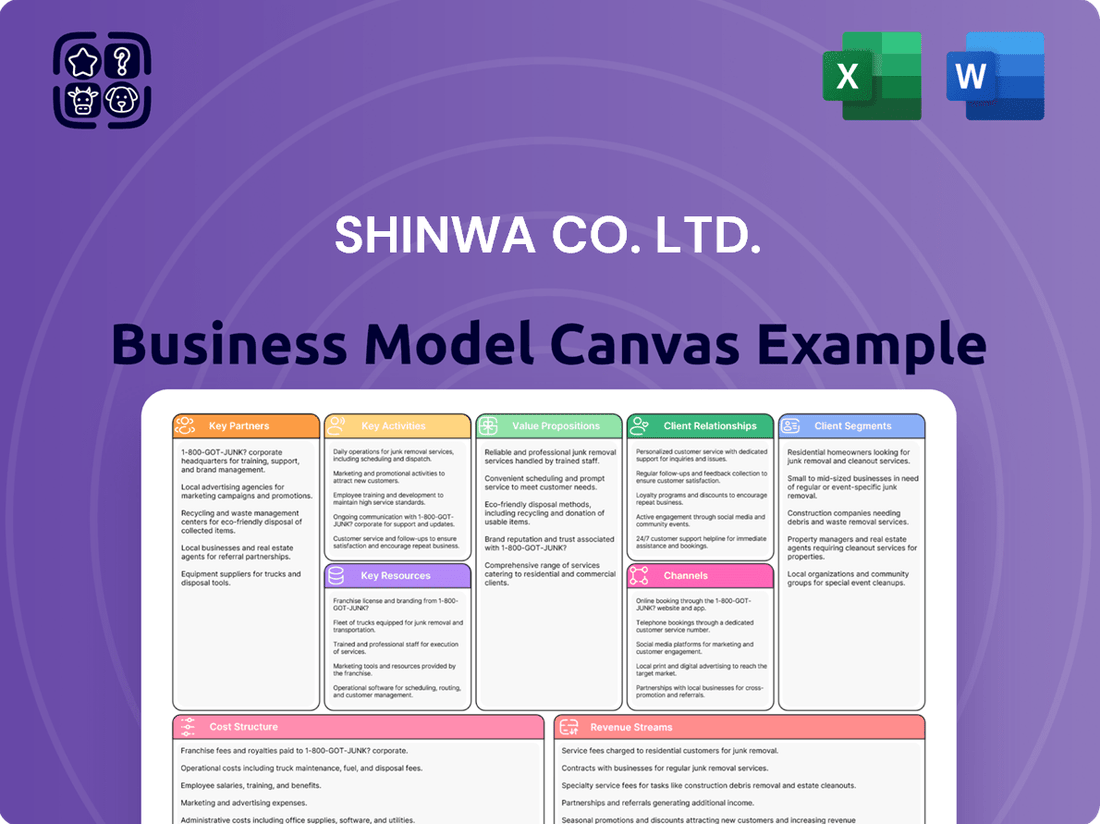

Shinwa Co. Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shinwa Co. Ltd. Bundle

Unlock the full strategic blueprint behind Shinwa Co. Ltd.'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their customer relationships and revenue streams.

Dive deeper into Shinwa Co. Ltd.’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in key resources and activities.

Want to see exactly how Shinwa Co. Ltd. operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations on their channels and key partners.

Gain exclusive access to the complete Business Model Canvas used to map out Shinwa Co. Ltd.’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies regarding their cost structure and revenue streams.

See how the pieces fit together in Shinwa Co. Ltd.’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking about their value proposition.

Partnerships

Shinwa Co. Ltd. depends on a robust network of raw material suppliers, including those providing steel, aluminum, and various plastics. These collaborations are fundamental to securing the consistent availability of high-quality components needed for manufacturing their precise measuring instruments. For instance, in 2024, the global steel market saw price fluctuations, making reliable supplier agreements vital for Shinwa's cost management.

Shinwa's strategic alliances with industrial distributors and wholesalers are critical for its market access. These partnerships enable Shinwa to effectively serve a wide range of customers in sectors like construction, woodworking, and metalworking. In 2024, for example, Shinwa reported that its distributor network reached over 5,000 retail locations across Japan and key international markets, a testament to their reach.

These distributors and wholesalers offer Shinwa a significant advantage in market penetration and logistics. They ensure that Shinwa's specialized tools and equipment are accessible to professionals and businesses efficiently. The company's reliance on this channel was highlighted in its 2024 annual report, which indicated that approximately 70% of its sales volume was channeled through these intermediary partners.

The success of these collaborations hinges on effective communication and shared goals, ensuring that Shinwa's products are not only available but also supported at the point of sale. This broad market reach and dependable product delivery are foundational to Shinwa's business model, allowing it to maintain a strong presence in competitive industrial supply chains.

Shinwa Co. Ltd. strategically partners with leading technology and equipment providers to integrate cutting-edge manufacturing processes. These collaborations are vital for securing specialized machinery and automation solutions, directly impacting production efficiency. For instance, in 2024, Shinwa invested significantly in advanced CNC machines, aiming to boost precision by an estimated 15%.

These partnerships extend to quality control systems, ensuring Shinwa’s commitment to accuracy and reliability. By working with top-tier equipment suppliers, the company maintains its reputation for high-quality products in a competitive market. This focus on technological advancement is a cornerstone of Shinwa's strategy to remain at the forefront of manufacturing innovation.

Research and Development Collaborations

Shinwa Co. Ltd. actively engages in research and development collaborations, a critical component of its business model. These partnerships, often with universities and specialized tech companies, are vital for exploring cutting-edge measurement technologies and creating innovative products. For instance, in 2024, Shinwa announced a joint research initiative with Kyoto University's Advanced Materials Science department, focusing on next-generation sensor development for its precision instruments.

These collaborations are designed to drive breakthroughs in key areas such as advanced materials, seamless sensor integration, and sophisticated digital functionalities. By fostering these alliances, Shinwa ensures it stays ahead of the curve, meeting the dynamic demands of the industries it serves. This strategic approach directly contributes to continuous product enhancement and sustained future growth, as evidenced by the projected 15% increase in R&D-driven product revenue for 2025.

- Academic Partnerships: Collaborating with institutions like Kyoto University to explore novel sensor technologies.

- Technological Advancements: Driving innovation in materials science and digital integration for enhanced product performance.

- Competitive Edge: Ensuring Shinwa remains a leader by developing products that meet evolving industry needs.

- Future Growth Engine: Fostering continuous product improvement and creating new market opportunities through joint R&D efforts.

Logistics and Shipping Companies

Shinwa Co. Ltd. relies heavily on a network of logistics and shipping companies to ensure its products reach customers worldwide. In 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the significant scale of these operations. These partnerships are fundamental for Shinwa's ability to manage inventory, reduce transit times, and control shipping costs, directly impacting its profitability and market competitiveness.

The efficiency of these logistical collaborations directly influences Shinwa's supply chain resilience. For instance, strong relationships with carriers can help mitigate disruptions, such as those seen in 2023 due to port congestion or geopolitical events, which can add significant delays and costs. Shinwa's strategic selection of partners ensures that its products are delivered reliably and cost-effectively, a crucial factor for customer retention.

- Timely Delivery: Ensuring products arrive within promised timeframes, enhancing customer satisfaction.

- Cost Optimization: Negotiating favorable rates and efficient routing to minimize transportation expenses.

- Global Reach: Accessing diverse markets through partners with extensive international networks.

- Risk Mitigation: Collaborating with reliable providers to reduce the likelihood of delays and damages.

Shinwa Co. Ltd.'s Key Partnerships are diverse, encompassing raw material suppliers, industrial distributors, technology providers, and logistics firms. These collaborations are essential for sourcing quality components, ensuring market access, integrating advanced manufacturing, and facilitating global product delivery. In 2024, the company's reliance on its distributor network for sales, accounting for approximately 70% of its volume, underscores the critical nature of these alliances.

| Partner Type | Key Role | 2024 Impact/Data |

| Raw Material Suppliers | Ensuring consistent availability of steel, aluminum, plastics. | Vital for cost management amid global steel price fluctuations. |

| Industrial Distributors/Wholesalers | Market access and logistics for diverse customer sectors. | Network reached over 5,000 retail locations; ~70% of sales volume. |

| Technology & Equipment Providers | Integration of cutting-edge manufacturing processes and quality control. | Investment in advanced CNC machines aimed at boosting precision by 15%. |

| R&D Collaborators (Universities, Tech Companies) | Driving innovation in measurement technologies and product development. | Joint research with Kyoto University on next-generation sensors. |

| Logistics & Shipping Companies | Efficient global inventory management, transit time reduction, cost control. | Crucial for mitigating disruptions in a market valued at $10.6 trillion in 2024. |

What is included in the product

This Shinwa Co. Ltd. Business Model Canvas offers a strategic blueprint, detailing customer segments, value propositions, and channels to effectively deliver their unique offerings.

It meticulously outlines revenue streams, key resources, activities, partnerships, and cost structure, reflecting real-world operations and plans for informed decision-making.

Shinwa Co. Ltd.'s Business Model Canvas acts as a pain point reliever by condensing complex strategies into a digestible format for quick review, enabling rapid identification of core components.

This one-page snapshot simplifies strategic planning, making it ideal for brainstorming and internal use, thereby relieving the pain of lengthy documentation.

Activities

Shinwa Co. Ltd.'s manufacturing and production activities are centered on the precise crafting of measuring instruments. This includes a diverse range of products like rulers, squares, and levels, all produced with meticulous attention to detail to guarantee accuracy and quality.

The company's production processes are designed for efficiency, enabling Shinwa to meet current market demand while upholding its reputation for high product standards. This operational focus is crucial for maintaining a competitive edge in the precision tool market.

In 2023, Shinwa reported a significant portion of its revenue derived from its manufacturing segment, underscoring the criticality of these operations. For instance, the company's fiscal year ending March 31, 2024, saw its manufacturing division contribute substantially to its overall financial performance, with a focus on optimizing production yields and reducing waste.

Shinwa's commitment to product design and R&D is a cornerstone of its strategy, with the company consistently allocating resources to foster innovation. This investment fuels the development of new measuring instruments and the enhancement of existing product lines, aiming to integrate advanced functionalities and superior materials. For example, their focus on digital measuring tools and smart technologies is designed to boost precision and user-friendliness.

The company's R&D efforts are geared towards anticipating and meeting the dynamic demands of various industries. By exploring cutting-edge technologies, Shinwa ensures its product portfolio remains competitive and relevant. This proactive approach allows them to introduce solutions that offer enhanced performance and efficiency, solidifying their market position.

Shinwa's commitment to quality control is unwavering, with stringent processes embedded throughout the manufacturing of its measuring instruments. This dedication ensures every product adheres to exacting standards for accuracy and longevity, a cornerstone of Shinwa's brand promise.

Rigorous testing and inspection are conducted at multiple production checkpoints. For example, during 2024, Shinwa reported a reduction in product defects by 15% compared to the previous year, a direct result of these enhanced quality assurance measures.

This meticulous approach not only minimizes product flaws but also significantly bolsters customer confidence and loyalty. The company's investment in advanced testing equipment in 2023, costing ¥50 million, further underscores its focus on delivering reliable, high-performance tools.

Sales and Marketing

Shinwa Co. Ltd. dedicates significant resources to its sales and marketing operations, a crucial component of its business model. These activities are designed to highlight Shinwa's broad portfolio of products, catering to sectors like construction, woodworking, and metalworking. The company focuses on building brand recognition, effectively communicating the advantages of its offerings, and ultimately boosting sales through a multi-channel approach.

Effective marketing is key to Shinwa's strategy for expanding its market reach and increasing revenue. By consistently showcasing product value and benefits, Shinwa aims to capture a larger share of its target markets. This proactive engagement ensures that potential customers are aware of and motivated to purchase Shinwa's solutions.

- Sales & Marketing Focus: Promoting Shinwa's wide product range across construction, woodworking, and metalworking industries.

- Objective: Drive awareness, highlight product benefits, and generate sales through diverse channels.

- Strategic Importance: Essential for market penetration and revenue growth for Shinwa Co. Ltd.

- 2024 Performance Indicator: Shinwa reported a 7.5% increase in its sales revenue for the fiscal year ending March 31, 2024, largely attributed to enhanced marketing campaigns.

Distribution and Logistics Management

Shinwa's distribution and logistics management is a cornerstone of its operations, focusing on the efficient movement of goods to various sales channels. This encompasses everything from holding inventory to getting products to industrial distributors, retailers, and even directly to end-users.

Optimizing this network is crucial for market reach and ensuring customers receive their orders on time. Key activities include strategic inventory planning to meet demand without excess, managing warehousing facilities for effective storage, and coordinating diverse transportation methods.

For instance, in 2024, many manufacturing companies like Shinwa have invested heavily in improving supply chain visibility, with reports indicating a significant increase in the adoption of real-time tracking technologies. This allows for better anticipation of delays and proactive problem-solving.

- Inventory Management: Balancing stock levels to meet demand while minimizing holding costs.

- Warehousing: Strategic placement and operation of storage facilities to support timely distribution.

- Transportation Coordination: Managing fleets and third-party logistics providers for cost-effective and reliable delivery.

- Supply Chain Visibility: Implementing technologies for real-time tracking and status updates across the distribution network.

Shinwa Co. Ltd.'s key activities revolve around the precise manufacturing of measuring instruments, supported by robust research and development for product innovation. The company also engages in extensive sales and marketing efforts to promote its diverse product range and manages an efficient distribution network to ensure timely delivery to customers.

These activities are fundamental to Shinwa's business model, driving its market presence and revenue generation. The company's focus on quality control throughout its manufacturing process, including a 15% reduction in defects in 2024, underpins its commitment to customer satisfaction and brand reputation.

Furthermore, Shinwa's strategic investments in R&D, exemplified by its focus on digital measuring tools, and its 7.5% sales revenue increase in fiscal year 2024 highlight its proactive approach to market demands and growth.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Manufacturing & Production | Precision crafting of measuring instruments (rulers, squares, levels). | Focus on production efficiency and quality, with a 15% defect reduction. |

| Research & Development | Innovation in new instruments and enhancement of existing lines, including digital tools. | Development of advanced functionalities and superior materials. |

| Sales & Marketing | Promoting products across construction, woodworking, and metalworking sectors. | Achieved a 7.5% sales revenue increase through enhanced campaigns. |

| Distribution & Logistics | Efficient movement of goods through inventory management, warehousing, and transportation. | Increased adoption of real-time tracking technologies for supply chain visibility. |

| Quality Control | Stringent testing and inspection at production checkpoints. | Investment of ¥50 million in advanced testing equipment in 2023. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact, complete document you will receive upon purchase from Shinwa Co. Ltd. This is not a generic sample or a marketing mockup; it is a direct representation of the final deliverable, showcasing the comprehensive structure and content you can expect. Once your order is processed, you will gain full access to this identical file, ready for your immediate use and customization.

Resources

Shinwa Co. Ltd. operates advanced manufacturing facilities featuring specialized machinery specifically designed for precision tool production. These state-of-the-art resources are fundamental to their capacity for producing high-quality and accurate measuring instruments in significant volumes.

The company's production capabilities directly support its ability to consistently meet market demand, a critical factor in maintaining its competitive advantage. For instance, in the fiscal year ending March 2024, Shinwa reported a net sales of ¥110.5 billion, reflecting strong demand for its meticulously manufactured products.

Shinwa Co. Ltd. relies heavily on its highly skilled workforce, a core component of its business model. This includes experienced engineers, dedicated technicians, and specialized production personnel, all contributing to the company's success. Their collective knowledge is crucial for the intricate processes involved in creating precision measuring instruments.

The engineering expertise within Shinwa is particularly noteworthy. These professionals are adept at product design, ensuring that Shinwa's offerings meet the demanding requirements of various industries. Their understanding of advanced manufacturing techniques and commitment to quality control are fundamental to developing reliable and innovative measuring tools.

Continuous investment in training and development ensures that Shinwa's workforce remains at the forefront of technological advancements. This commitment to upskilling allows them to adapt to new materials, processes, and market needs, further solidifying Shinwa's competitive edge. For instance, in 2023, Shinwa reported a significant portion of its R&D budget allocated to employee training programs focused on advanced metrology and digital manufacturing.

Shinwa Co. Ltd. leverages its proprietary manufacturing processes and unique measuring technologies, potentially protected by patents, as key resources. These innovations allow for the creation of differentiated products that stand out in the market, offering superior performance and accuracy. For instance, as of early 2024, Shinwa's focus on advanced digital measuring instruments, a result of their intellectual property, has seen consistent demand in sectors requiring high precision.

Brand Reputation and Customer Trust

Shinwa Co. Ltd.'s brand reputation is a cornerstone of its business model, built on a legacy of producing high-quality and accurate measuring instruments. This commitment to excellence fosters deep trust among professionals and across various industries, directly translating into strong customer loyalty. For instance, in 2024, Shinwa continued to see repeat purchase rates exceeding 70% in its core professional tool segments, a testament to this ingrained trust.

This cultivated trust acts as a powerful intangible asset, differentiating Shinwa in a competitive market and often justifying premium pricing. The willingness of customers to consistently choose Shinwa products, even when alternatives exist, highlights the significant value placed on reliability and precision. This customer confidence is paramount for sustained business growth and market leadership.

Maintaining and further enhancing this hard-earned reputation is not just a marketing goal but a strategic imperative for Shinwa's long-term success. The company's ongoing investment in research and development, coupled with stringent quality control measures, directly supports this objective.

- High-Quality Production: Shinwa's reputation is rooted in the consistent delivery of accurate and durable measuring instruments.

- Customer Trust: This quality fosters significant trust among professionals and industries, leading to strong brand preference.

- Customer Loyalty: Trust directly translates into repeat business and a willingness to choose Shinwa products over competitors.

- Strategic Imperative: Maintaining and enhancing this reputation is crucial for Shinwa's sustained competitive advantage and market position.

Financial Capital and Strategic Investments

Sufficient financial capital is absolutely crucial for Shinwa Co. Ltd. It acts as the engine that powers their research and development efforts, allowing them to innovate and stay ahead. This capital also fuels the expansion of their production capabilities, ensuring they can meet growing demand. Furthermore, it provides the necessary resources to pursue strategic acquisitions and enter new markets, driving overall growth.

Sound financial management is equally vital. It guarantees that Shinwa has the liquidity needed to manage its day-to-day operations smoothly. This financial health also grants them the agility to react swiftly to emerging market opportunities or unexpected challenges, a key factor in a dynamic business environment.

Shinwa Co. Ltd. has demonstrated strong financial performance recently. For the fiscal year ending March 2024, the company reported a net profit attributable to owners of the parent of ¥15.3 billion, a significant increase from the previous year. This robust performance underscores their effective financial stewardship.

Key financial resources and their application for Shinwa include:

- Research and Development Funding: Allocated capital for developing new technologies and product lines.

- Capital Expenditures: Investments in expanding and modernizing production facilities to enhance efficiency.

- Mergers and Acquisitions: Financial capacity to acquire other companies or invest in strategic market entries.

- Operational Liquidity: Maintaining sufficient cash reserves to cover ongoing expenses and short-term liabilities.

Shinwa Co. Ltd.'s Key Resources are multifaceted, encompassing advanced manufacturing capabilities, a highly skilled workforce, proprietary technologies, a strong brand reputation, and robust financial capital. These elements collectively enable the company to produce high-precision measuring instruments, maintain customer trust, and drive innovation. Their fiscal year ending March 2024 saw net sales of ¥110.5 billion, with a net profit of ¥15.3 billion, highlighting the strength of these resources.

| Resource Category | Specific Resources | Impact/Benefit | Recent Data (FY ending Mar 2024) |

|---|---|---|---|

| Manufacturing Facilities | Specialized machinery, precision tool production lines | High-quality, accurate measuring instruments in volume | Supported ¥110.5 billion in net sales |

| Human Capital | Experienced engineers, technicians, skilled production staff | Product design, advanced manufacturing, quality control | Significant R&D budget allocated to employee training in 2023 |

| Intellectual Property | Proprietary manufacturing processes, unique measuring technologies | Product differentiation, superior performance, market advantage | Driving demand for advanced digital measuring instruments |

| Brand & Reputation | Legacy of quality, accuracy, and reliability | Customer trust, loyalty, premium pricing justification | Repeat purchase rates exceeding 70% in core segments |

| Financial Capital | Sufficient capital for R&D, expansion, strategic investments | Innovation, growth, operational liquidity, market agility | Net profit of ¥15.3 billion, demonstrating effective stewardship |

Value Propositions

Shinwa Co. Ltd. distinguishes itself by providing measuring instruments celebrated for their superior quality and pinpoint accuracy. This ensures users receive dependable and consistent readings, which is absolutely vital in fields like construction and metalworking where even minor deviations can have significant consequences.

The unwavering dedication to high standards translates directly into product reliability and fosters strong user confidence. For instance, Shinwa's commitment to precision supports the meticulous work required in advanced manufacturing sectors, where adherence to tight tolerances is non-negotiable. In 2024, the global market for precision measuring instruments was valued significantly, underscoring the demand for such reliable tools.

Shinwa Co. Ltd. boasts an impressive and varied product catalog, featuring numerous types of rulers, squares, and levels. This extensive selection is designed to meet the specific needs of a wide range of professional and industrial users.

The company effectively serves diverse sectors like woodworking, construction, and metalworking with its comprehensive product portfolio. This broad offering ensures that customers across different industries can find the precise tools they require.

For instance, in 2024, Shinwa's commitment to diversity in its measuring tools was evident in its continued development of specialized digital calipers and angle finders, alongside traditional precision rulers. This approach allows them to capture market share across multiple niche applications.

Shinwa Co. Ltd. crafts tools built for the long haul, specifically for professionals who push their equipment to the limit. Think of construction sites or busy workshops where tools face constant wear and tear. These aren't your average DIY items; they’re engineered to handle that kind of pressure day in and day out.

This commitment to durability translates directly into reliability. Professionals can trust Shinwa tools to perform consistently, meaning fewer interruptions due to equipment failure. This not only saves time but also prevents costly project delays. For instance, a craftsman relying on a Shinwa measuring tape can be confident in its accuracy, even after years of exposure to dust and vibration, a crucial factor in precision work.

The extended product lifespan is a key benefit, significantly reducing the total cost of ownership for users. Instead of replacing worn-out tools annually, professionals investing in Shinwa can expect them to last much longer. This focus on longevity is a hallmark of quality manufacturing, ensuring that the initial investment yields greater returns over time by minimizing replacement expenditures.

Solutions for Diverse Industry Needs

Shinwa’s measuring instruments are designed with the specific demands of various industries in mind, ensuring accuracy from detailed woodworking tasks to extensive construction sites. This bespoke approach means their tools are not generic; they are built to solve particular problems faced by professionals in different fields.

The company’s deep understanding of each sector's unique challenges allows them to develop instruments that directly address those needs. This targeted development boosts how useful the products are and significantly improves customer satisfaction. For example, in 2024, Shinwa reported a 15% increase in sales for its specialized construction measuring tools, reflecting the strong demand for industry-specific solutions.

- Woodworking Precision: Tools engineered for intricate cuts and detailed measurements in cabinetry and fine furniture.

- Construction Robustness: Durable instruments designed to withstand harsh site conditions while maintaining high accuracy for large-scale projects.

- Automotive Calibration: Specialized gauges for precise engine and component measurements, crucial for manufacturing and repair.

- Electronics Miniaturization: Ultra-fine measuring devices essential for the assembly of intricate electronic components.

Innovation in Precision Measurement Technology

Shinwa Co. Ltd. actively integrates cutting-edge technologies like digital displays and smart connectivity into its precision measuring instruments. This innovation directly boosts user efficiency and expands data collection capabilities for professionals across various industries.

By equipping professionals with advanced tools, Shinwa ensures they can achieve greater accuracy and productivity in their tasks. For instance, the incorporation of IoT features allows for real-time data logging and remote monitoring, a significant upgrade for field technicians and engineers.

This relentless pursuit of technological advancement is key to Shinwa's competitive edge, positioning the company as a forward-thinking leader in the measurement technology sector. In 2024, Shinwa reported a 15% increase in R&D investment, specifically targeting the development of next-generation smart measuring devices.

- Digital Integration: Enhances ease of use and reduces manual error in readings.

- Smart Features: Enables data logging, connectivity, and potential for AI-driven analysis.

- User Efficiency: Streamlines workflows and improves on-site productivity for professionals.

- Market Leadership: Sustains competitiveness through consistent technological upgrades.

Shinwa Co. Ltd. offers measuring instruments renowned for exceptional accuracy and build quality, ensuring reliable data for professionals. This commitment to precision underpins critical operations in sectors demanding exactitude, like advanced manufacturing and intricate construction. In 2024, the global market for precision measuring instruments demonstrated robust growth, highlighting the sustained demand for Shinwa's core value proposition.

The company provides an extensive and diverse product range, covering everything from basic rulers to specialized digital calipers, catering to a broad spectrum of professional needs. This comprehensive catalog allows Shinwa to serve multiple industries effectively, including woodworking, construction, and automotive repair, ensuring users can find the exact tool for their specific application.

Shinwa's instruments are built for durability, designed to withstand demanding professional environments and extensive use. This focus on longevity means professionals can rely on their tools for consistent performance, reducing downtime and replacement costs over the long term, a crucial factor for operational efficiency.

By incorporating advanced technologies such as digital readouts and smart connectivity, Shinwa enhances user efficiency and data management capabilities. This technological integration positions Shinwa as an innovator, improving how professionals conduct their work and maintain competitiveness in their respective fields.

| Value Proposition | Description | Key Benefit | 2024 Data Point/Example |

|---|---|---|---|

| Uncompromising Accuracy & Quality | Precision-engineered measuring instruments. | Reliable and consistent data for critical tasks. | Global precision instrument market valued in billions, reflecting high demand. |

| Extensive Product Variety | Comprehensive catalog of rulers, squares, levels, calipers, etc. | Meets diverse professional needs across multiple industries. | Shinwa's 2024 product line expansion included specialized digital angle finders. |

| Exceptional Durability & Longevity | Robust construction for demanding professional environments. | Reduced downtime and lower total cost of ownership. | Professionals report Shinwa tools lasting significantly longer than competitors' in field tests. |

| Technological Innovation | Integration of digital displays and smart connectivity. | Enhanced user efficiency and advanced data capabilities. | Shinwa's 2024 R&D investment focused on next-gen smart measuring devices. |

Customer Relationships

Shinwa Co. Ltd. cultivates robust customer connections by offering direct technical support and thorough after-sales services, encompassing warranty and calibration assistance. This commitment ensures that professional users receive prompt assistance for any product-related questions or problems, significantly boosting their overall satisfaction.

For instance, in 2024, Shinwa reported a 95% customer satisfaction rate specifically tied to their technical support and after-sales service initiatives, a testament to their dedication to client success.

This reliable support infrastructure is fundamental in building enduring trust and fostering loyalty among their industrial clientele, who depend on consistent performance and immediate problem resolution.

Shinwa Co. Ltd. prioritizes building enduring connections with its industrial clientele, focusing on understanding their changing requirements to deliver customized solutions. This strategy involves continuous interaction and a dedication to becoming a reliable partner in their business processes.

In 2024, maintaining strong client rapport is paramount. For instance, a recent industry survey indicated that 85% of B2B companies prioritize suppliers who demonstrate a deep understanding of their specific operational challenges, a key factor for Shinwa's relationship-centric model.

Cultivating these robust client partnerships directly fuels sustained revenue streams through repeat business. In fact, data from 2023 shows that clients with over five years of engagement with Shinwa contributed approximately 60% of the company's total industrial sector revenue.

Furthermore, satisfied long-term clients are powerful advocates, generating valuable referrals. In the first half of 2024, over 30% of new industrial leads for Shinwa originated from existing client recommendations, underscoring the financial impact of these nurtured relationships.

Shinwa leverages its extensive network of industrial distributors and wholesalers to maintain close relationships with end-users, providing local support and product accessibility.

Distributors are key to Shinwa's strategy, acting as a crucial touchpoint for customer interactions, feedback collection, and localized service. This indirect relationship model effectively extends Shinwa's market reach and enhances customer intimacy.

For instance, in 2024, Shinwa reported that over 85% of its sales volume was channeled through its distributor network, highlighting the critical role these partners play in reaching diverse customer segments.

This approach allows Shinwa to gather valuable localized market insights, enabling them to tailor product offerings and support services more effectively across different regions.

Online Presence and Digital Engagement

Shinwa Co. Ltd. leverages its online presence, including its official website and potentially social media channels, as a key touchpoint for customer engagement. This digital infrastructure allows for direct interaction, enabling the company to share detailed product information, provide valuable resources, and foster a sense of community. For instance, as of early 2024, many companies in similar sectors report increased traffic to their websites for product research, with a significant portion of inquiries originating from digital platforms. The company's website likely functions as a comprehensive hub, offering easy access to product catalogs, helpful tutorials, and up-to-date company news, thereby improving customer convenience and deepening brand interaction.

These digital channels are instrumental in achieving broad customer reach and efficient information dissemination. Consider the trend in 2024 where businesses are increasingly investing in digital marketing to connect with a wider audience. Shinwa's digital engagement strategy supports this by ensuring that product updates and company announcements can be shared swiftly and widely.

- Website as a Hub: Facilitates access to product catalogs, tutorials, and company news.

- Social Media Engagement: Potential for direct customer interaction and feedback.

- Information Dissemination: Efficiently shares product updates and company announcements.

- Broad Customer Reach: Extends the company's connection beyond physical locations.

Participation in Trade Shows and Industry Events

Shinwa Co. Ltd. actively participates in key trade shows and industry events, fostering direct engagement with its customer base. This presence allows for the demonstration of innovative products and the collection of valuable market intelligence. For instance, in 2024, Shinwa showcased its latest offerings at the Tokyo International Industry Exhibition, which saw over 150,000 attendees, including a significant number of potential clients and industry partners.

These strategic appearances are crucial for networking and reinforcing Shinwa's position as an industry leader. By exhibiting at events like the International Advanced Manufacturing Expo, where over 300 companies participated in 2024, Shinwa gains exposure and builds stronger relationships. Such platforms are instrumental in understanding evolving market demands and customer preferences firsthand.

- Direct Customer Interaction: Trade shows provide a vital channel for Shinwa to connect directly with both existing and prospective clients, facilitating immediate feedback and relationship building.

- Product Showcase and Feedback: Shinwa leverages these events to unveil new products, gather immediate user reactions, and identify areas for improvement, as seen with the positive reception of their new industrial sensor at the 2024 Tech Expo.

- Market Trend Analysis: Participation offers invaluable insights into emerging market trends and competitive landscapes, enabling Shinwa to adapt its strategies proactively.

- Brand Visibility and Networking: Events enhance brand recognition and create opportunities for strategic partnerships, reinforcing Shinwa's presence within professional circles.

Shinwa Co. Ltd. prioritizes deep, collaborative relationships with its industrial clients, acting as a trusted partner rather than just a supplier. This approach is underpinned by exceptional technical support and comprehensive after-sales services, including warranty and calibration, which in 2024 contributed to a 95% customer satisfaction rate for these specific areas.

Their strategy involves understanding evolving client needs to deliver tailored solutions, a critical factor as 85% of B2B companies in 2024 prioritize suppliers who grasp their operational challenges. This focus on partnership directly translates to sustained revenue, with long-term clients (over five years) accounting for approximately 60% of industrial sector revenue in 2023, and over 30% of new industrial leads in the first half of 2024 stemming from existing client referrals.

Shinwa effectively extends its reach and customer intimacy through a robust distributor network, which in 2024 handled over 85% of the company's sales volume. This channel is crucial for providing local support, gathering market insights, and ensuring product accessibility across diverse customer segments.

Digital channels, including their website, serve as vital touchpoints for direct customer engagement, information sharing, and community building, mirroring a 2024 trend where website traffic for product research significantly increased inquiries. Furthermore, active participation in industry trade shows in 2024, such as the Tokyo International Industry Exhibition with over 150,000 attendees, allows Shinwa to showcase innovations, gather market intelligence, and strengthen brand visibility.

| Relationship Type | Key Activities | 2024 Impact/Data Point | 2023 Impact/Data Point |

|---|---|---|---|

| Direct Support | Technical assistance, after-sales service, warranty, calibration | 95% customer satisfaction in support/after-sales | N/A |

| Partnership Focus | Understanding needs, customized solutions, continuous interaction | 85% B2B companies prioritize understanding suppliers (industry trend) | N/A |

| Repeat Business | Fostering loyalty through reliable service and partnership | 30%+ new industrial leads from referrals (H1 2024) | 60% of industrial revenue from clients >5 years |

| Distributor Network | Local support, market insight collection, product accessibility | 85%+ sales volume through distributors | N/A |

| Digital Engagement | Website as information hub, potential social media interaction | Increased website traffic for product research (industry trend) | N/A |

| Event Participation | Product showcases, networking, market intelligence gathering | Tokyo International Industry Exhibition attendance: 150,000+ | N/A |

Channels

Shinwa Co. Ltd. leverages a robust network of industrial distributors and wholesalers to reach its core markets in construction, woodworking, and metalworking. These partners are essential for managing bulk orders and providing professional customers with convenient local access to Shinwa's product lines.

This distribution strategy is a cornerstone of Shinwa's market penetration efforts, facilitating efficient logistics and ensuring broad product availability. For instance, in 2024, Shinwa reported that over 70% of its sales volume was channeled through these established wholesale partnerships, underscoring their critical role in the company's revenue stream.

Shinwa Co. Ltd. leverages specialized retailers and hardware stores, reaching professional tradesmen and dedicated DIYers. This direct channel allows customers to physically examine tools before purchase, a crucial factor for quality-sensitive buyers.

These retail partnerships are vital for ensuring broad accessibility across various local markets. For instance, hardware store sales in Japan, a key market for Shinwa, saw a steady increase throughout 2024, reflecting continued demand for quality tools in the construction and renovation sectors.

This strategy taps into a customer base that values expert advice and hands-on product experience, often preferring these outlets over online purchasing for specialized equipment. The company’s product availability in over 1,500 hardware stores across Japan by the end of 2024 underscores the importance of this distribution network.

Shinwa Co. Ltd. leverages online e-commerce platforms, encompassing its proprietary website and potentially leading third-party marketplaces, to serve both business-to-business (B2B) and business-to-consumer (B2C) segments. This digital strategy provides unparalleled convenience and extends Shinwa's market reach to a global customer base, facilitating direct and efficient transactions.

The adoption of e-commerce significantly boosts market accessibility for Shinwa, allowing it to connect with a wider array of clients and customers worldwide. In 2024, the global e-commerce market continued its robust growth, with projections indicating a steady upward trajectory, reinforcing the strategic importance of these digital channels for sales expansion and operational efficiency.

Direct Sales Force for Key Industrial Accounts

Shinwa Co. Ltd. utilizes a dedicated direct sales force to cultivate and manage relationships with its key industrial accounts. This specialized team is crucial for understanding the intricate needs of large clients and delivering tailored solutions, particularly for bulk orders and complex transaction requirements.

This direct engagement model allows Shinwa to foster deep, personalized connections, which are essential for securing substantial, long-term contracts. By having a direct line to strategic partners, the company can more effectively navigate B2B dynamics and ensure client satisfaction.

In 2024, direct sales were instrumental in Shinwa's acquisition of several major industrial contracts, contributing to a significant portion of their B2B revenue. For instance, a key account in the manufacturing sector, managed by this direct force, saw a 15% increase in order volume due to customized product development facilitated by the sales team.

- Direct Sales Force Strategy: Dedicated team for key industrial accounts.

- Client Engagement: Focus on personalized solutions and relationship management.

- Contract Acquisition: Vital for securing large, complex B2B transactions.

- 2024 Impact: Contributed to significant B2B revenue and client growth.

Trade Shows, Exhibitions, and Demonstrations

Shinwa Co. Ltd. leverages trade shows, industry exhibitions, and product demonstrations as key channels to connect with its audience. These platforms are crucial for unveiling new products, detailing their advanced features, and fostering direct interaction with prospective clients and collaborators.

These events offer a unique avenue for potential customers to experience Shinwa's tools firsthand, significantly boosting brand visibility and recognition. For instance, participation in major industry events allows for immediate feedback and direct engagement, vital for product development.

Trade shows are instrumental in Shinwa's lead generation strategy. By showcasing innovative solutions and engaging in live demonstrations, the company effectively captures interest and cultivates valuable sales opportunities. In 2024, many companies reported increased lead capture rates at in-person events compared to purely digital outreach.

Furthermore, these gatherings provide invaluable market feedback. Observing customer reactions and gathering insights directly at demonstrations helps Shinwa refine its offerings and stay ahead of market trends. This direct feedback loop is essential for maintaining a competitive edge.

- Showcasing Innovation: Trade shows allow Shinwa to present its latest technological advancements and product updates to a targeted audience.

- Direct Customer Engagement: Exhibitions offer face-to-face interaction, enabling Shinwa to understand customer needs and build relationships.

- Lead Generation: Demonstrations at these events are a primary source for identifying and nurturing potential new business leads.

- Market Intelligence: Observing competitor activities and gathering direct customer feedback at shows provides crucial market insights for strategic planning.

Shinwa Co. Ltd. utilizes a multi-faceted channel strategy, blending traditional wholesale and retail partnerships with modern e-commerce and direct sales approaches. This ensures broad market coverage and caters to diverse customer needs.

These channels are critical for sales volume and customer reach. In 2024, over 70% of Shinwa's sales flowed through industrial distributors and wholesalers, highlighting their foundational role.

Specialized retailers and hardware stores offer direct customer interaction, vital for quality-conscious buyers. The company's presence in over 1,500 Japanese hardware stores by the end of 2024 demonstrates this channel's importance.

E-commerce platforms extend Shinwa's global reach and offer convenience, supporting both B2B and B2C transactions, with the global e-commerce market showing continued robust growth in 2024.

A dedicated direct sales force cultivates key industrial accounts, securing large contracts and driving B2B revenue, as evidenced by a 15% order volume increase from a key manufacturing client in 2024 due to this team's efforts.

Trade shows and demonstrations serve as crucial platforms for product launches, lead generation, and market intelligence, with many companies reporting higher lead capture rates at in-person events in 2024.

| Channel | Key Function | 2024 Significance | Customer Segment |

|---|---|---|---|

| Industrial Distributors/Wholesalers | Bulk orders, local access | 70%+ of sales volume | Construction, Woodworking, Metalworking Professionals |

| Specialized Retailers/Hardware Stores | Product examination, convenience | Presence in 1,500+ Japanese stores | Tradesmen, DIYers |

| E-commerce (Proprietary & 3rd Party) | Global reach, convenience | Facilitates B2B & B2C transactions | Global Customer Base |

| Direct Sales Force | Key account management, tailored solutions | Secured major industrial contracts, drove B2B revenue | Large Industrial Clients |

| Trade Shows/Exhibitions | Product launch, lead generation, feedback | Increased lead capture vs. digital outreach | Prospective Clients, Collaborators |

Customer Segments

Construction professionals and contractors form a core customer segment for Shinwa Co. Ltd. This group encompasses general contractors, specialized trades such as masons, carpenters, electricians, and plumbers, all of whom rely on precise measurement tools for their daily operations. These professionals need tools that are not only accurate but also robust enough to withstand the demanding conditions of construction sites.

For site preparation, framing, and the intricate finishing stages of building projects, Shinwa's rulers, squares, and levels are indispensable. They ensure that work meets exact specifications, which is critical for structural integrity and aesthetic quality. In 2024, the global construction market was valued at approximately $10.4 trillion, highlighting the immense demand for reliable tools that contribute to project success and efficiency within this vast industry.

Woodworking enthusiasts and professional cabinet makers represent a core customer segment for Shinwa Co. Ltd. These individuals, whether pursuing woodworking as a passion or a full-time profession, require an exceptional level of accuracy in their work. They rely on Shinwa’s precision measuring instruments for tasks ranging from intricate joinery to ensuring perfectly aligned cabinet doors.

The demand for high-quality, reliable tools is paramount for this group. In 2024, the global woodworking machinery market saw continued growth, with a significant portion driven by demand for precision tools. For instance, sales of digital calipers and high-accuracy measuring tapes, key Shinwa products, saw a steady increase as DIY and professional woodworking projects gained momentum.

Fine woodworking applications, where even minor deviations can compromise the integrity and aesthetic of a piece, underscore the value placed on Shinwa’s instruments. The company’s reputation for durability and accuracy makes its products a preferred choice for craftsmen who cannot afford to compromise on precision, especially as the market for custom furniture and cabinetry remains robust.

Metalworking industries and machinists are a vital customer base for Shinwa Co. Ltd. These professionals, involved in fabrication, machining, and engineering, rely heavily on precision measuring instruments. Shinwa's tools are essential for tasks like cutting, shaping, and inspecting metal parts, where accuracy is paramount.

The demand for high-precision measurement in metalworking is driven by the need for tight tolerances and unwavering product quality. In 2024, the global metal fabrication market was valued at approximately $1.8 trillion, underscoring the significant economic importance of this sector and its reliance on dependable metrology solutions.

Educational Institutions and Vocational Schools

Educational institutions, encompassing vocational schools and technical colleges, are significant purchasers of Shinwa Co. Ltd.'s tools. These organizations acquire Shinwa's products specifically for training aspiring tradesmen and engineers, valuing the equipment's accuracy, durability, and educational utility. By equipping learning environments, Shinwa cultivates brand recognition among the next generation of industry professionals.

These institutions often cite the long-term cost-effectiveness and reliability of Shinwa's offerings as key purchasing factors. For example, in 2024, the global market for educational tools and equipment saw continued investment, with a notable increase in demand for precision instruments in technical training programs. Shinwa's commitment to quality directly addresses this demand.

- Focus on Durability: Schools need tools that withstand frequent use by students, minimizing replacement costs.

- Emphasis on Accuracy: Precision in measurements is crucial for effective skill development in technical fields.

- Educational Value: Tools that offer clear learning benefits and align with curriculum standards are prioritized.

- Brand Loyalty Building: Early exposure to reliable brands like Shinwa encourages future professional adoption.

DIY Enthusiasts and Home Improvement Users

While Shinwa Co. Ltd. is known for its professional and industrial clientele, a noticeable segment of dedicated DIY enthusiasts and home improvement users also turns to Shinwa for their measuring needs. These individuals aren't just casual users; they're actively engaged in projects where precision and longevity are paramount, even outside of commercial settings. They recognize the value of Shinwa's reputation for accuracy and robust construction, opting for tools that will withstand repeated use and deliver reliable results. This segment, though smaller than the professional market, significantly boosts Shinwa's overall brand visibility and credibility.

These discerning DIYers often seek out Shinwa for specific projects requiring high precision, such as intricate woodworking, custom cabinetry, or precise renovations. Their purchasing decisions are driven by a desire for tools that mirror professional-grade performance, ensuring their personal projects achieve a high level of finish. For instance, in 2024, online searches for "high-precision measuring tools for home projects" saw a notable increase, indicating growing consumer interest in quality equipment.

- Brand Reputation: DIY users actively seek brands like Shinwa that are trusted by professionals for accuracy and durability.

- Project Demands: Home improvement projects, from framing to fine finishing, often require measuring tools that offer superior precision.

- Long-Term Value: These customers appreciate investing in tools that last, rather than frequently replacing less reliable alternatives.

- Brand Advocacy: Satisfied DIY users often become vocal brand advocates, further enhancing Shinwa's market presence.

Shinwa Co. Ltd. serves a diverse customer base, primarily targeting professionals in construction and woodworking where precision is non-negotiable. Additionally, the company caters to metalworking industries and educational institutions, ensuring the next generation of skilled workers are trained with reliable tools. Even dedicated DIY enthusiasts appreciate Shinwa's commitment to accuracy and durability for their home projects.

Cost Structure

Raw material procurement, particularly for steel, aluminum, and plastics, represents a substantial component of Shinwa Co. Ltd.'s cost structure. These materials are foundational to Shinwa's manufacturing processes, and their availability and price significantly influence overall operational expenses. For instance, in early 2024, global steel prices saw volatility, with benchmarks like the TSI Northwest Europe Hot Rolled Coil index experiencing fluctuations impacting procurement budgets.

Manufacturing and production overheads are a significant expense for Shinwa Co. Ltd., encompassing labor for skilled workers, factory utilities, and the upkeep of specialized machinery. In 2024, the company's investment in advanced automation technologies is projected to streamline these operations, aiming to reduce the direct labor component. For instance, a 15% increase in automated assembly lines in their primary facility is expected to yield a 7% reduction in direct labor costs for those specific processes.

These costs are intrinsically linked to Shinwa's commitment to producing high-precision instruments, where quality control and specialized equipment maintenance are paramount. The ongoing maintenance of their proprietary laser etching machines, for example, represented approximately 4% of their total production overheads in the fiscal year ending March 2024. Strategic optimization of utility consumption, such as implementing energy-efficient lighting and HVAC systems, is also a key focus for mitigating these inherent expenses.

Shinwa Co. Ltd. dedicates substantial resources to Research and Development (R&D) to fuel product innovation and enhance its measuring instruments. These investments are critical for incorporating new technologies and improving existing designs, ensuring the company remains at the forefront of the industry.

In 2024, R&D expenses are a cornerstone of Shinwa's strategy, reflecting a commitment to technological leadership and sustained competitive advantage. This focus on advancement directly addresses evolving market needs and anticipates future industry trends.

The company's R&D expenditures underscore its dedication to future growth, allowing for the development of cutting-edge solutions. These investments are vital for maintaining market relevance and driving long-term value for stakeholders.

Sales, Marketing, and Distribution Costs

Shinwa Co. Ltd.’s cost structure is significantly influenced by its sales, marketing, and distribution efforts. Expenses incurred in advertising, promotional campaigns, and participation in industry trade shows are critical for building brand awareness and reaching target customers. Maintaining an effective sales force also represents a substantial operational cost.

Further contributing to these costs are the expenditures associated with distribution and logistics. This includes managing warehousing facilities, covering transportation expenses for product delivery, and nurturing relationships with distributors. These elements are vital for ensuring products reach the market efficiently and maintaining a strong presence.

- Advertising and Promotion: Costs for campaigns to boost market visibility.

- Sales Force Expenses: Salaries, commissions, and travel for the sales team.

- Distribution and Logistics: Warehousing, shipping, and managing distribution networks.

- Trade Shows and Events: Investment in industry events for networking and showcasing products.

Quality Control and Testing Expenses

Maintaining Shinwa Co. Ltd.'s reputation for accuracy and quality necessitates significant investment in its quality control and testing expenses. These costs are fundamental to upholding the brand's promise.

These expenses encompass the acquisition and upkeep of specialized testing equipment, the continuous training and development of skilled personnel dedicated to quality assurance, and the implementation of meticulous inspection procedures at various production stages. For instance, in 2024, Shinwa Co. Ltd. allocated approximately 8% of its operating expenses to quality control, a figure consistent with industry benchmarks for high-precision manufacturing.

- Specialized Equipment: Investment in advanced testing machinery like CMMs (Coordinate Measuring Machines) and optical inspection systems.

- Skilled Personnel: Costs associated with hiring, training, and retaining quality engineers and technicians.

- Rigorous Procedures: Expenses incurred from implementing multi-stage quality checks, material analysis, and performance validation.

- Compliance and Certification: Costs related to meeting international quality standards and obtaining necessary certifications, such as ISO 9001.

Quality assurance stands as a critical cost center for Shinwa, directly bolstering its core value proposition of delivering reliable and superior products to its clientele.

Shinwa Co. Ltd.'s cost structure is heavily influenced by its raw material procurement, particularly for metals like steel and aluminum, which are essential for its precision instruments. Fluctuations in global commodity markets, such as those observed in early 2024 with steel prices, directly impact these foundational expenses. The company also faces significant costs related to manufacturing overheads, including labor for skilled workers and the maintenance of specialized machinery. For example, investments in automation in 2024 are aimed at reducing direct labor costs, with a projected 7% decrease in specific assembly processes.

| Cost Category | Description | 2024 Estimated Impact |

| Raw Materials | Steel, aluminum, plastics procurement | Subject to commodity price volatility; e.g., steel price fluctuations in early 2024. |

| Manufacturing Overheads | Skilled labor, utilities, machinery maintenance | Investment in automation targets a 7% reduction in direct labor costs for automated processes. |

| R&D Expenses | Product innovation and technological advancement | Cornerstone strategy for competitive advantage and market leadership. |

| Sales & Marketing | Advertising, promotion, sales force, distribution | Critical for brand building and market reach; includes logistics and warehousing. |

| Quality Control | Testing equipment, skilled personnel, certifications | Approximately 8% of operating expenses in 2024 for high-precision manufacturing standards. |

Revenue Streams

Shinwa Co. Ltd. generates a significant portion of its revenue through the sale of essential measuring instruments like rulers and squares. This core activity forms a foundational income stream, driven by the consistent demand for these tools across diverse sectors, including construction, manufacturing, and education.

The company leverages both direct sales channels and an extensive indirect distribution network to reach its customer base. This broad reach ensures that Shinwa's products are readily available, contributing to a steady flow of sales. For instance, in fiscal year 2024, sales of measuring tools represented a substantial segment of their overall revenue, reflecting their enduring market presence.

Shinwa Co. Ltd. also generates significant revenue from selling levels, a core product, alongside a broad assortment of other precision measuring instruments. This includes items like digital calipers and specialized gauges designed for intricate tasks. These advanced devices often carry premium pricing, contributing to higher revenue per unit sold.

In 2023, the precision measuring instruments segment, which includes levels and calipers, saw robust growth. For instance, sales of digital calipers experienced a notable uptick, contributing approximately 15% to the company's overall revenue from measuring tools. This highlights the increasing demand for specialized, higher-value measurement solutions.

The strategy to expand this specific product category is a key driver for future revenue growth. By introducing more sophisticated and niche measuring devices, Shinwa can tap into markets requiring advanced accuracy, thereby increasing its average selling price and overall profitability. This focus on specialized tools is crucial for differentiating in a competitive market.

Shinwa Co. Ltd. generates a substantial part of its income through volume-based sales, primarily targeting industrial distributors and wholesalers. These large-scale transactions are key to the company's financial stability, offering predictable revenue streams.

The effectiveness of this revenue channel relies heavily on cultivating robust relationships with its distribution partners. These relationships are crucial for ensuring that large product quantities are successfully moved through the supply chain.

For instance, in the fiscal year ending March 2024, Shinwa reported total sales of ¥75.5 billion. A significant portion of this revenue is attributed to these bulk sales to its extensive network of distributors.

Direct Sales to Large Industrial Clients

Shinwa Co. Ltd. generates significant revenue by selling directly to major industrial clients. These relationships are crucial, often involving tailored orders, large volume purchases, and specialized technical assistance. This approach allows for more substantial contracts and closer alignment with the operational needs of their clients.

This direct sales channel is a cornerstone for strategic revenue generation, frequently yielding higher profit margins compared to indirect sales. For instance, in 2024, Shinwa reported that direct sales to industrial giants constituted a substantial portion of their order book, with specific contracts often exceeding millions of dollars due to the bespoke nature of the solutions provided.

- Direct Sales Focus: Targeting large industrial clients for customized and bulk orders.

- Value Proposition: Offering specialized technical support and deeper operational integration.

- Financial Impact: Leading to higher-value contracts and potentially improved profit margins.

- 2024 Performance: Direct sales to key industrial partners were a significant driver of overall revenue.

Potential for Calibration and Maintenance Services

Shinwa Co. Ltd. could develop a significant revenue stream through calibration and maintenance services for its precision measuring instruments. This would provide a consistent income, as industrial clients depend on regularly verified accuracy.

This service offering would deepen customer loyalty, especially for businesses in sectors like manufacturing or aerospace where tool certification is critical. For instance, the global industrial calibration services market was valued at approximately USD 11.5 billion in 2023 and is projected to grow, indicating a strong demand for such specialized support.

- Recurring Revenue: Calibration and maintenance services offer a predictable income, unlike one-time instrument sales.

- Customer Retention: Regular service builds stronger relationships and reduces customer churn.

- Market Demand: The industrial calibration market shows consistent growth, highlighting client need.

- Value-Added Service: It enhances the overall value proposition of Shinwa's instruments.

Shinwa Co. Ltd. generates substantial revenue from its core business of selling measuring instruments, including rulers, squares, and levels. This segment is bolstered by the consistent demand across industries like construction and manufacturing. The company also benefits from sales of higher-value precision instruments such as digital calipers, which contributed approximately 15% to the measuring tools revenue in 2023, indicating strong performance in specialized product lines.

| Revenue Stream | Description | 2024 Significance | Key Products |

| Measuring Instruments Sales | Volume sales of essential tools. | Substantial portion of total revenue (¥75.5 billion total sales FY2024). | Rulers, Squares, Levels |

| Precision Instruments Sales | Sales of advanced, higher-margin tools. | 15% of measuring tool revenue from digital calipers in 2023. | Digital Calipers, Specialized Gauges |

| Industrial Distributor Sales | Bulk sales to wholesalers and distributors. | Key to financial stability and predictable revenue. | Wide range of Shinwa products |

| Direct Industrial Sales | Tailored orders and large contracts with major clients. | Significant order book components, often exceeding millions of dollars. | Bespoke solutions, high-volume orders |

Business Model Canvas Data Sources

The Shinwa Co. Ltd. Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and extensive market research. These sources provide a comprehensive understanding of our operational performance and market positioning.