Charles Schwab PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles Schwab Bundle

Understand how political, economic, and technological forces impact Charles Schwab's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Government agencies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) enforce stringent regulations on financial services. These rules directly affect Charles Schwab's operational processes, the types of products it can offer, and the significant costs associated with maintaining compliance. For instance, in 2024, the SEC continued to focus on areas like Regulation Best Interest and enhanced disclosures, requiring substantial investment in compliance infrastructure and training for firms like Schwab.

Evolving regulatory requirements, particularly those aimed at bolstering investor protection or altering market structure, have a direct and measurable impact on how Schwab conducts its business and manages its inherent risks. For example, proposed rule changes in late 2024 regarding data privacy and cybersecurity could necessitate significant technological upgrades and policy revisions across the company, potentially impacting operational efficiency and overall risk exposure.

Changes in corporate and individual income tax rates, as well as capital gains and estate taxes, significantly influence how investors behave and the success of investment products at Charles Schwab. For instance, a reduction in capital gains tax rates, such as potential discussions around adjustments post-2025, could incentivize more trading activity, directly benefiting Schwab's transaction-based revenue.

Favorable tax environments, like those potentially seen with legislative proposals aiming to stimulate savings or investment in specific sectors, can encourage greater participation in the market, boosting Schwab's assets under management. Conversely, an increase in tax burdens might lead individuals to seek tax-advantaged accounts or potentially reduce their investment exposure, impacting Schwab's growth trajectory.

The 2024 US federal budget, for example, maintained current individual income tax rates but included proposals for future adjustments, highlighting the dynamic nature of tax policy. These ongoing policy considerations directly shape the financial planning landscape and, consequently, the demand for the services Charles Schwab provides.

Global political stability is a key driver for Charles Schwab's operations, influencing investor confidence and capital markets. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, as observed through late 2024 and into 2025, have contributed to increased market volatility, impacting asset valuations and client investment strategies.

Shifts in international trade agreements and tariff policies also pose significant challenges and opportunities. The renegotiation of trade deals, such as potential updates to the USMCA in 2025, could alter the competitive landscape for businesses and investment sectors, necessitating adjustments in portfolio management and risk assessment for Schwab's diverse client base.

Geopolitical events directly affect global economic growth forecasts, which in turn influence trading volumes and the demand for financial services. According to projections for 2025, a more stable geopolitical climate could foster stronger international investment flows, benefiting Schwab's wealth management and brokerage businesses.

Government Spending and Fiscal Policy

Government spending and fiscal policy are critical drivers of economic activity. For instance, the U.S. federal government's budget deficit was projected to be around $1.9 trillion in fiscal year 2024, a figure that can influence inflation and interest rates. These fiscal decisions directly shape the investment landscape, affecting everything from bond yields to equity valuations. Consequently, Charles Schwab must continually adapt its client strategies to navigate these evolving economic conditions, ensuring portfolio resilience and growth potential.

Government fiscal policies, encompassing spending programs and debt management, significantly impact interest rates and inflation, thereby influencing overall economic growth. Charles Schwab's clients' investment strategies and asset allocation decisions are directly affected by these macroeconomic shifts. For example, the Congressional Budget Office (CBO) projected that U.S. federal debt held by the public will reach 104% of GDP by 2034, a trend that often correlates with higher borrowing costs and potential inflation pressures.

- Government Spending Impact: Increased government spending, such as infrastructure projects or stimulus packages, can boost aggregate demand, potentially leading to higher economic growth but also inflationary pressures.

- Fiscal Deficits and Debt: Persistent fiscal deficits and rising national debt can lead to higher interest rates as governments compete for capital, making borrowing more expensive for businesses and consumers.

- Monetary Policy Interplay: Fiscal policy often works in conjunction with monetary policy; for example, a large deficit might prompt the Federal Reserve to consider higher interest rates to curb inflation.

- Client Strategy Adaptation: Charles Schwab must analyze these fiscal trends to guide clients in adjusting their asset allocation, potentially favoring sectors or asset classes that perform well in different interest rate and inflation environments.

Political Influence on Monetary Policy

While central banks like the Federal Reserve are designed to operate independently, political pressures can still subtly steer monetary policy. For instance, upcoming elections might see calls for lower interest rates to stimulate the economy, even if inflation concerns suggest otherwise. Such shifts directly impact Charles Schwab’s banking and lending activities by altering borrowing costs and the yield on fixed-income investments.

The Federal Reserve’s benchmark interest rate, for example, was maintained between 5.25% and 5.50% through early 2025, reflecting a complex balance between controlling inflation and supporting economic growth amidst political considerations. This rate directly influences Schwab's lending margins and the attractiveness of savings accounts and CDs.

Political stability, or lack thereof, also plays a role. Uncertainty stemming from policy debates or geopolitical tensions can lead to market volatility. In 2024, ongoing discussions around fiscal policy and potential government spending initiatives created a backdrop against which monetary policy decisions were made, impacting investor confidence and Schwab's wealth management advisory services.

- Interest Rate Sensitivity: Charles Schwab’s net interest revenue is highly sensitive to changes in the Federal Funds Rate. For example, a 0.25% increase in rates can boost net interest income, while a decrease can have the opposite effect.

- Regulatory Environment: Political decisions shape the regulatory landscape for financial institutions. New capital requirements or consumer protection laws enacted by political bodies can affect Schwab’s operational costs and business models.

- Fiscal Policy Influence: Government spending and taxation policies, driven by political agendas, impact overall economic activity and market performance. This can influence Schwab's investment banking and trading volumes.

Government regulations are a constant factor for Charles Schwab, impacting everything from product offerings to compliance costs. For instance, the SEC's ongoing focus on investor protection rules in 2024 meant substantial investment in adherence for firms like Schwab.

Tax policies directly influence client behavior and Schwab's revenue streams. Changes in capital gains taxes, for example, could spur more trading, boosting Schwab's transaction volumes, as seen in potential post-2025 adjustments.

Global political stability is crucial; geopolitical tensions observed through late 2024 and into 2025 have increased market volatility, affecting Schwab's client investment strategies and asset valuations.

Government fiscal policies, like the projected 2024 U.S. federal deficit of around $1.9 trillion, influence interest rates and inflation, requiring Schwab to adapt client strategies to navigate economic shifts.

What is included in the product

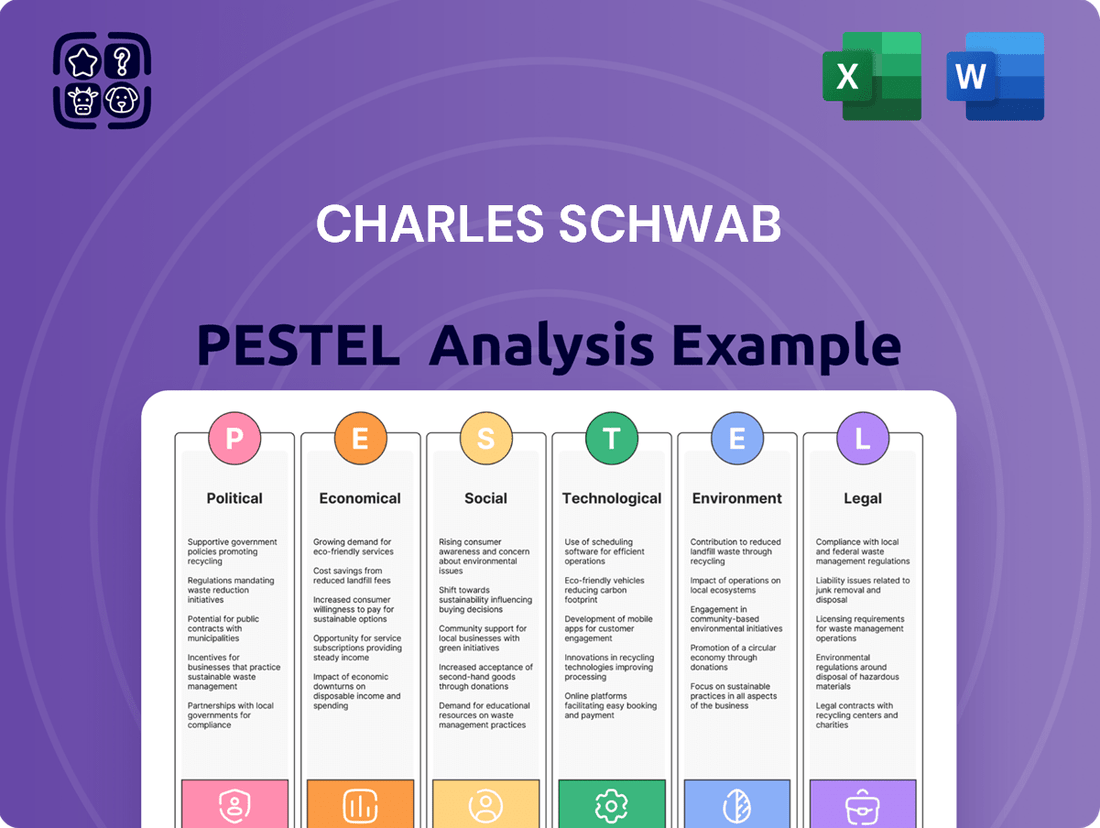

This Charles Schwab PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of its external operating landscape.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges across these critical macro-environmental factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate insights into external factors impacting Charles Schwab.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal influences on Charles Schwab.

Economic factors

The interest rate environment is a critical factor for Charles Schwab. Changes in rates, especially those set by the Federal Reserve, directly influence the company's net interest income because Schwab holds a substantial amount of client cash.

In periods of rising interest rates, Charles Schwab can benefit significantly. For instance, during 2022 and early 2023, as the Federal Reserve aggressively increased its benchmark rate, Schwab saw a notable uptick in its net interest margin. This was largely due to the higher yields earned on the firm's large cash balances held for clients.

Conversely, a low or declining interest rate environment can put pressure on Schwab's profitability. When rates are very low, the income generated from client cash balances is compressed, potentially impacting margins. Furthermore, lower rates can influence the performance of the bond markets, which are a key component of investment portfolios managed and serviced by Schwab.

As of late 2024 and projected into 2025, the market anticipates a more stable, or potentially slightly declining, interest rate trajectory compared to the rapid hikes of 2022-2023. This shift means Schwab's net interest income growth may moderate, but the company's diversified business model, including asset management and trading revenues, continues to provide resilience.

Inflationary pressures remain a key consideration for Charles Schwab and its clients. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 9.1% year-over-year in June 2022, though it moderated to 3.3% by May 2024. This volatility directly impacts clients' purchasing power and investment strategies.

High inflation erodes the real value of savings and investments, prompting clients to seek assets that can outpace rising prices. Schwab’s role is to provide guidance and financial products that serve as effective inflation hedges, such as Treasury Inflation-Protected Securities (TIPS) or commodities.

The firm must adapt its offerings to help clients maintain wealth in environments where the cost of living is increasing rapidly. This includes offering diversified portfolios and investment advice tailored to mitigate the negative effects of inflation.

The overall health of the economy, measured by indicators like Gross Domestic Product (GDP) growth and employment rates, significantly impacts investor sentiment and their capacity for accumulating assets. For Charles Schwab, periods of robust economic expansion, such as the projected 2.3% GDP growth for the US in 2024, typically translate into higher trading volumes and increased inflows of client assets as confidence rises.

Conversely, economic downturns or recessions can negatively affect Charles Schwab’s business. Asset values tend to decline during recessions, potentially leading to reduced client engagement and lower overall asset under management, as seen in the market volatility experienced during economic contractions.

Market Volatility and Performance

Market volatility significantly impacts Charles Schwab, as fluctuations in stock and bond markets directly affect the value of assets under its management. For instance, the S&P 500 experienced considerable swings throughout 2024, with periods of sharp declines followed by strong recoveries, directly influencing the net asset values clients hold with Schwab. This dynamic can also boost trading volumes as clients react to market movements, potentially increasing fee-based revenue for the firm.

Higher volatility can also create opportunities for Schwab's advisory services. When markets are turbulent, clients often seek guidance, leading to increased demand for financial planning and wealth management. For example, during periods of heightened uncertainty in early 2024, many investors turned to financial advisors for reassurance and strategic adjustments to their portfolios. This increased engagement can bolster Schwab's reputation and client retention.

The perceived value of advisory services can also be influenced by market performance. In stable or rising markets, clients might feel less need for active management, whereas in volatile periods, the expertise of advisors in navigating complex environments becomes more apparent. This was evident in Q1 2025, where Schwab reported a rise in assets under management attributed partly to clients seeking counsel during market adjustments.

Key impacts of market volatility on Charles Schwab include:

- Asset Valuation: Fluctuations in major indices like the Dow Jones Industrial Average or Nasdaq Composite directly alter the value of assets held by Schwab clients. For example, a 5% drop in the S&P 500 in a quarter can reduce the firm's reported assets under management by billions.

- Trading Activity: Increased market swings, such as those seen during the Q2 2024 earnings season, typically lead to higher client trading volumes, generating more commission and fee revenue.

- Demand for Advisory Services: Periods of uncertainty, like the geopolitical events impacting global markets in late 2024, often drive clients to seek professional advice, increasing engagement with Schwab's financial advisors.

- Risk Management: Schwab must manage its own investment portfolios and the risks associated with market downturns, which can affect its profitability and operational stability.

Consumer Spending and Wealth Accumulation

Consumer spending, a major driver of economic activity, directly impacts Charles Schwab's business by influencing the amount of disposable income available for investment. As of late 2024, personal consumption expenditures in the U.S. have shown resilience, with retail sales figures indicating continued, albeit moderating, consumer confidence. For instance, U.S. retail sales saw a modest increase of 0.3% in October 2024 compared to the previous month, reflecting ongoing consumer engagement.

Wealth accumulation is equally critical. Higher savings rates and growing asset values, such as those seen in equity markets throughout 2024, provide Schwab with a larger pool of assets to manage and attract new clients. The personal saving rate in the U.S. has fluctuated, but overall household net worth has trended upwards, buoyed by market performance, which is a positive indicator for wealth management services.

- Consumer Spending Resilience: U.S. retail sales growth in late 2024 suggests consumers are still actively spending, providing a foundation for investment.

- Wealth Growth Opportunities: Rising household net worth, partly due to positive market performance in 2024, expands the potential client base for wealth management.

- Disposable Income Impact: The level of disposable income directly correlates with an individual's capacity to invest, a key factor for Schwab's asset growth.

- Market Performance Correlation: Schwab's asset under management is closely tied to the performance of investment markets, which influences wealth accumulation.

Economic stability and growth directly influence investor confidence and asset valuations, impacting Charles Schwab’s client assets. For example, the US GDP growth projected at 2.3% for 2024 suggests a supportive environment for investment activity.

Inflation erodes purchasing power, potentially leading clients to seek inflation-hedging investments, a service Schwab provides. With US CPI moderating to 3.3% in May 2024 from a peak of 9.1% in June 2022, the firm navigates shifting client needs.

Interest rate policies remain pivotal; while aggressive hikes in 2022-2023 boosted Schwab's net interest income, a more stable rate environment in late 2024 and 2025 may moderate this growth, emphasizing Schwab's diversified revenue streams.

Full Version Awaits

Charles Schwab PESTLE Analysis

The Charles Schwab PESTLE Analysis you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Charles Schwab's operations and strategic outlook. Understand the key external forces shaping the financial services landscape and how Charles Schwab is positioned to navigate them.

Sociological factors

The U.S. population is aging, with the number of individuals aged 65 and over projected to reach 80.8 million by 2040, a significant increase from 54.1 million in 2019. This demographic trend fuels a massive generational wealth transfer, estimated to be as high as $84 trillion from Baby Boomers to Millennials and Gen Z. Charles Schwab must tailor its offerings, from digital platforms to investment advice, to resonate with the preferences and financial literacy levels of these younger, digitally-native generations who are inheriting this wealth.

Investor preferences are shifting significantly, with a notable surge in demand for personalized financial guidance and a strong inclination towards Environmental, Social, and Governance (ESG) investing options. Charles Schwab's 2024 client surveys indicated that over 60% of respondents expressed interest in ESG-focused investment products, reflecting a growing awareness of sustainability. This trend necessitates tailored advice and transparent product offerings to meet evolving client expectations.

Furthermore, the spectrum of financial literacy presents a key sociological factor. While a segment of investors possesses advanced knowledge, many others require accessible educational tools and user-friendly platforms. Charles Schwab's 2025 digital engagement reports show that clients utilizing their educational resources demonstrated a 15% higher retention rate, underscoring the importance of empowering investors through comprehensive learning initiatives.

Societal expectations for financial institutions like Charles Schwab are increasingly focused on ethical conduct, corporate responsibility, and stringent data privacy. Clients and the public demand transparency in fees, investment strategies, and how their personal information is handled. This heightened awareness means Schwab must actively demonstrate its commitment to client best interests to maintain and grow its customer base.

In 2024, data breaches and ethical lapses at other firms have amplified concerns about trust. Charles Schwab's efforts to bolster cybersecurity, with significant investments in protecting client data, are crucial. Maintaining a reputation for integrity and prioritizing client needs over profit is paramount for retaining existing clients and attracting new ones in this environment.

Digital Adoption and Lifestyle Integration

Clients increasingly expect financial management to be as intuitive and integrated as other aspects of their digital lives. Charles Schwab’s focus on enhancing its digital platforms, including mobile app functionality and online self-service options, is crucial for meeting these evolving expectations. For instance, by the end of 2024, it’s anticipated that over 80% of Charles Schwab’s client interactions will occur through digital channels, reflecting this strong trend.

This societal shift towards digital-first engagement means that user experience (UX) and accessibility are paramount. A seamless, personalized digital journey can be a significant differentiator, attracting and retaining clients who prioritize convenience and ease of use. Charles Schwab's continued investment in areas like AI-powered financial advice and streamlined onboarding processes directly addresses this sociological factor.

- Digital Engagement: A significant majority of Charles Schwab’s client base utilizes digital platforms for most of their banking and investment needs.

- Mobile-First Expectations: Clients expect robust mobile applications offering comprehensive functionality, from account management to trading and research.

- Personalization: The demand for personalized financial insights and tools, delivered digitally, continues to grow.

- Data Security and Trust: While embracing digital, clients also place a high premium on the security and trustworthiness of their financial institutions' digital offerings.

Influence of Social Media and Peer Networks

Social media and online communities are profoundly shaping investment landscapes, particularly for younger demographics. Platforms like TikTok and Reddit have become hubs for financial discussions, influencing sentiment and driving trends. For Charles Schwab, understanding this shift is crucial, as a significant portion of Gen Z and Millennial investors report using social media for financial research. For instance, a 2024 survey indicated that over 40% of retail investors under 30 follow financial influencers on social media.

Charles Schwab must actively monitor these digital spaces to gauge public opinion, manage its brand perception, and identify opportunities. Engaging with these platforms can help the company address misinformation, build community, and attract new clients. In 2024, Schwab launched educational content specifically tailored for social media channels, aiming to reach a broader audience and foster financial literacy.

The influence extends to investment choices, with viral stock recommendations or discussions on platforms like WallStreetBets having tangible market impacts. This peer-driven influence necessitates a strategic approach from financial institutions to stay relevant and responsive. Charles Schwab's ability to adapt to this evolving communication paradigm will be key to its continued success in client engagement and acquisition.

- Social Media Influence: Over 40% of investors under 30 use social media for financial research, according to 2024 data.

- Platform Engagement: Charles Schwab is developing social media strategies to connect with younger investors and manage brand reputation.

- Peer-Driven Trends: Online communities can significantly impact investment decisions, requiring financial firms to monitor and adapt to emerging sentiments.

- Client Acquisition: Leveraging social media for educational content is a key strategy for Charles Schwab to attract and retain clients in the digital age.

The aging U.S. population, with projections showing a significant increase in those over 65, is driving a substantial generational wealth transfer. Charles Schwab needs to adapt its services to cater to the digital preferences and financial understanding of younger inheritors. Investor preferences are also evolving, with a clear demand for personalized advice and a growing interest in ESG investments, as indicated by over 60% of Schwab clients expressing interest in such products in 2024.

Technological factors

Charles Schwab's analytical capabilities are significantly boosted by AI and machine learning, allowing for deeper market insights and more tailored client recommendations. These technologies are key to improving efficiency through the automation of back-office tasks and enhancing service delivery.

Predictive analytics and advanced fraud detection are critical applications of AI and ML for Schwab. For instance, in 2024, financial institutions are investing heavily in AI to combat sophisticated fraud schemes, with some reporting a 20-30% reduction in fraudulent transactions after implementing AI-driven systems.

Charles Schwab faces escalating cyber threats, making investments in advanced cybersecurity and data encryption crucial. The firm must safeguard sensitive client data, a responsibility underscored by the increasing sophistication of attacks targeting financial institutions globally. In 2023, the financial services sector experienced a significant rise in data breaches, with reported incidents costing an average of $5.9 million per breach, highlighting the financial and reputational risks involved.

Continuous innovation in cybersecurity is not just a defensive measure but a strategic imperative for Schwab to maintain client trust and adhere to evolving global data privacy regulations, such as GDPR and CCPA. Staying ahead of novel threats requires ongoing investment in cutting-edge technologies and talent. For instance, the global cybersecurity market was valued at over $200 billion in 2023 and is projected to grow substantially, indicating a strong market demand for robust security solutions.

Charles Schwab’s investment in digital platforms and mobile applications directly impacts client engagement. In 2023, Schwab reported that 78% of its retail client assets were held in digital accounts, highlighting the critical role of these user-friendly interfaces for account access and trading.

The ongoing development of intuitive design and advanced features within these platforms is paramount for retaining clients. For instance, Schwab's mobile app continues to be updated with tools for portfolio analysis and personalized financial guidance, aiming to keep users actively involved with their investments.

The company’s strategic focus on enhancing its digital offerings is a direct response to evolving client expectations for seamless and accessible financial management. This technological advancement is essential for maintaining a competitive edge in the brokerage industry, as seen with the increasing adoption of digital tools across all age demographics.

Automation and Robo-Advisory Services

The increasing adoption of automation and robo-advisory services presents a significant technological factor for Charles Schwab. These platforms leverage algorithms to provide cost-effective investment advice and manage portfolios, democratizing access to financial planning for a wider range of clients. This technological shift allows Schwab to scale its operations efficiently, potentially lowering overhead costs associated with traditional advisory models.

By automating routine tasks, human advisors can dedicate more time to addressing intricate client needs, such as complex estate planning or behavioral coaching. This hybrid approach enhances client satisfaction and advisor productivity. For instance, as of late 2023, robo-advisors managed over $1.5 trillion in assets globally, a figure projected to grow substantially, highlighting the market's embrace of these automated solutions.

- Cost Efficiency: Automation reduces operational expenses, enabling Schwab to offer competitive pricing for its services.

- Scalability: Robo-advisory platforms can handle a growing client base without a proportional increase in human resources.

- Enhanced Advisor Focus: Frees up human advisors to concentrate on high-value, personalized client interactions and complex financial strategies.

- Broader Market Reach: Makes sophisticated investment management accessible to a wider demographic, including younger or less affluent investors.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) represent a significant technological frontier that could reshape the financial services landscape. While still in development, these innovations promise to streamline transactions, improve clearing processes, and enhance transparency, potentially reducing operational costs and risks. Charles Schwab must actively investigate how these advancements can be integrated into their existing infrastructure or utilized to create novel client services.

The potential impact is substantial; for instance, by 2025, the global blockchain market is projected to reach hundreds of billions of dollars, indicating rapid adoption and investment. This growth suggests that firms like Charles Schwab cannot afford to overlook the strategic implications of DLT. Early exploration allows for a competitive advantage in areas such as faster settlement times and more secure record-keeping.

Key areas of exploration for Charles Schwab include:

- Streamlining back-office operations: DLT could automate and secure processes like trade reconciliation and asset servicing.

- Enhancing security and transparency: Immutable ledgers offer a robust solution for record-keeping and fraud prevention.

- Developing new digital asset services: As the market for tokenized assets grows, DLT will be foundational for their management and trading.

- Improving cross-border payments: Blockchain-based solutions can offer faster and cheaper international money transfers.

Charles Schwab's technological advancements are central to its competitive strategy, with AI and machine learning driving deeper market insights and personalized client experiences. The firm is also focusing on robust cybersecurity measures to protect sensitive data, a crucial investment given the rising threat landscape and increasing data breach costs, which averaged $5.9 million for financial services in 2023.

Digital platforms and mobile applications are key to client engagement, with 78% of Schwab's retail client assets in digital accounts as of 2023. The company continues to enhance these platforms with advanced features for portfolio analysis and financial guidance, reflecting client expectations for seamless financial management. Automation and robo-advisory services are also expanding access to financial planning, managing over $1.5 trillion globally by late 2023, demonstrating a significant market shift towards these efficient solutions.

Blockchain and DLT offer potential for streamlined transactions and enhanced transparency, with the global blockchain market projected to reach hundreds of billions by 2025. Schwab's exploration of these technologies could lead to improved back-office operations, enhanced security, new digital asset services, and more efficient cross-border payments.

Legal factors

Charles Schwab's operations are heavily influenced by a robust framework of securities regulations, primarily enforced by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These bodies dictate critical aspects of the financial services industry, including trading protocols, client asset protection, and the transparency of information provided to investors.

Compliance with these intricate rules is not merely a procedural requirement but a cornerstone of Schwab's operational integrity. Failure to adhere can result in severe penalties, such as significant financial fines, which can impact profitability. For example, in 2023, the SEC levied billions in fines against various financial firms for record-keeping and compliance failures, underscoring the financial risks involved.

Beyond monetary penalties, regulatory breaches can severely damage Charles Schwab's reputation, eroding client trust and potentially leading to a loss of market share. The company must continuously invest in robust compliance programs, employee training, and sophisticated technology to ensure adherence to evolving regulations governing areas like cybersecurity and data privacy, which are increasingly scrutinized.

Data privacy and protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), directly influence how Charles Schwab handles client information. These regulations mandate stringent requirements for data collection, storage, and usage, impacting operational procedures and technology investments. As of early 2024, the landscape continues to evolve with more states introducing their own privacy legislation, necessitating ongoing adaptation and compliance efforts.

Maintaining compliance with these evolving legal frameworks is crucial for Charles Schwab to avoid significant penalties and safeguard its reputation. Non-compliance can lead to substantial fines; for instance, GDPR violations can incur penalties up to 4% of global annual revenue or €20 million, whichever is higher. Proactive measures in data protection are therefore essential for mitigating legal risks and fostering client confidence in Schwab's commitment to security.

Charles Schwab faces significant legal obligations under Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for preventing financial crimes. These rules mandate thorough client verification, ongoing transaction surveillance, and the reporting of any suspicious dealings. For instance, in 2023, financial institutions globally reported billions of dollars in suspicious activity, underscoring the scale of compliance efforts required.

Adhering to these stringent laws necessitates substantial operational investment in technology and personnel for robust client onboarding and continuous monitoring systems. Failure to comply can result in severe penalties, including hefty fines and reputational damage. The Financial Crimes Enforcement Network (FinCEN) in the U.S., for example, actively enforces these regulations, making compliance a non-negotiable aspect of Schwab's operations.

Consumer Protection and Fiduciary Duties

Consumer protection regulations are a significant legal factor for Charles Schwab, shaping how it interacts with clients. Laws governing fair lending practices, the provision of investment advice, and transparency in disclosures directly impact the company's operations and client trust. For instance, the SEC's Regulation Best Interest, implemented in 2020, mandates that financial professionals act in the best interest of their retail customers when making recommendations, a standard Schwab prioritizes.

Adherence to fiduciary duties is a cornerstone of Charles Schwab's legal and ethical framework. This means the company is legally obligated to act in the best financial interests of its clients, putting client needs above its own. This principle is particularly relevant in the wealth management and advisory services sectors. In 2024, regulatory bodies continued to scrutinize firms for compliance with these duties, with potential fines and reputational damage for any lapses.

- Regulatory Scrutiny: Agencies like the SEC and FINRA continuously update and enforce consumer protection rules, impacting disclosure requirements and sales practices.

- Fiduciary Standard: Charles Schwab, as a registered investment advisor, is bound by a fiduciary duty, requiring it to prioritize client interests in all investment recommendations and advice.

- Compliance Costs: Maintaining robust compliance programs to meet these legal obligations represents a significant operational expense for Charles Schwab.

- Client Trust: Strong adherence to consumer protection laws and fiduciary duties is crucial for building and maintaining client trust, a key competitive advantage in the financial services industry.

Litigation and Class-Action Risks

Charles Schwab, like other major financial institutions, navigates a landscape fraught with litigation and class-action risks. These legal challenges can stem from various sources, including disputes over investment advice, fee structures, alleged data security breaches, or perceived failures in regulatory compliance. For instance, in 2023, Schwab continued to address ongoing legal matters, with its annual report detailing significant provisions for potential litigation settlements, reflecting the substantial financial exposure inherent in its operations.

Managing these legal exposures demands a vigilant approach, characterized by strong internal controls and a forward-thinking legal strategy. The company actively works to mitigate these risks through rigorous compliance programs and by proactively addressing customer concerns. In 2024, the focus remains on enhancing cybersecurity measures and ensuring transparency in fee disclosures to preemptively address potential legal challenges.

- Litigation Exposure: Schwab's financial statements for fiscal year 2023 reported total accrued expenses for litigation and regulatory matters, indicating ongoing legal challenges.

- Class-Action Focus: Common class-action suits target allegations of inadequate disclosure of fees or performance issues, impacting investor trust and profitability.

- Data Breach Risks: The increasing threat of cyberattacks means data breaches remain a significant legal liability, potentially leading to class-action lawsuits seeking damages for compromised customer information.

- Regulatory Scrutiny: Compliance failures can trigger investigations and penalties from regulatory bodies like the SEC, often leading to litigation and reputational damage.

Charles Schwab must navigate a complex web of federal and state laws governing financial services, including those related to consumer protection, data privacy, and anti-money laundering. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are key regulators, imposing strict rules on trading, client asset protection, and information transparency. For instance, in 2023, the SEC continued to emphasize robust record-keeping, with fines levied for non-compliance underscoring the financial risks.

The company's commitment to fiduciary duty, meaning acting in the client's best interest, is a critical legal and ethical standard, especially in advisory services. This adherence is under continuous scrutiny by regulators in 2024, with potential for significant penalties and reputational damage for any missteps. Failure to comply with consumer protection laws, such as Regulation Best Interest, can also lead to substantial financial repercussions.

Litigation and class-action risks are inherent for Charles Schwab, often arising from disputes over advice, fees, or alleged data breaches. The company’s 2023 financial disclosures indicated provisions for ongoing legal matters, highlighting the considerable financial exposure. Proactive risk mitigation, including enhanced cybersecurity and fee transparency, remains paramount in 2024 to preemptively address potential legal challenges.

Data privacy laws, like the CCPA and GDPR, significantly shape how Schwab handles client information, demanding strict protocols for data collection and usage. These regulations necessitate ongoing investment in technology and operational adjustments. As of early 2024, the evolving state-specific privacy legislation requires continuous adaptation to avoid substantial penalties, which can reach up to 4% of global annual revenue for GDPR violations.

Environmental factors

There's a significant upswing in client and societal desire for investment options that actively incorporate environmental, social, and governance (ESG) criteria. This isn't just a niche trend anymore; it's becoming mainstream, influencing how people want their money managed.

Charles Schwab needs to bolster its ESG product suite and embed these considerations into its wealth management guidance. This strategic move is crucial to align with evolving investor preferences and to draw in capital from those prioritizing social responsibility.

For instance, in 2023, assets in U.S. sustainable funds, which often align with ESG principles, reached an estimated $2.7 trillion, demonstrating a clear market appetite. Schwab's ability to meet this growing demand will be key to capturing market share and maintaining client loyalty in 2024 and beyond.

Climate change presents significant risks to investment portfolios, including physical damage to assets from extreme weather and transition risks arising from new environmental regulations. For instance, the increasing frequency of severe weather events in 2024 and projected into 2025 could impact real estate holdings and supply chains within client investments.

Conversely, these challenges create substantial opportunities. Charles Schwab can guide clients towards investments in renewable energy sectors, which saw global investment reach $1.7 trillion in 2023, and sustainable infrastructure projects.

The firm must proactively assess how these climate-related impacts affect diversified portfolios and develop tailored investment solutions that align with clients' financial goals and environmental considerations. This includes offering access to green bonds and ESG-focused funds.

Governments and financial regulators worldwide are intensifying their focus on sustainable finance, with new policies and disclosure requirements becoming commonplace. For Charles Schwab, this means a critical need to adapt its reporting frameworks, risk management strategies, and product offerings to meet these evolving environmental regulations, particularly concerning climate-related risks.

The push for greater transparency in sustainable investing is evident, with initiatives like the EU's Sustainable Finance Disclosure Regulation (SFDR) setting a precedent. As of early 2024, a significant portion of assets under management in Europe are subject to SFDR reporting, impacting how firms like Schwab must categorize and disclose the sustainability characteristics of their financial products.

This regulatory pressure directly influences how Charles Schwab manages its investment portfolios and advises clients, necessitating robust data collection and analysis on environmental, social, and governance (ESG) factors. Failure to comply can lead to reputational damage and potential financial penalties, underscoring the strategic importance of proactive adaptation.

Corporate Social Responsibility (CSR) and Reputation

Charles Schwab's dedication to environmental sustainability and broader corporate social responsibility (CSR) profoundly shapes its brand image, its ability to attract top talent, and its client retention rates. Companies that actively reduce their environmental impact and invest in community well-being often see improved stakeholder trust.

For instance, Charles Schwab reported in its 2023 ESG report that it achieved a 45% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, a key metric for environmental stewardship. This commitment not only resonates with environmentally conscious investors but also with employees seeking purpose-driven workplaces.

Furthermore, Schwab's community investment programs, which totaled over $45 million in grants and employee volunteer hours in 2023, bolster its reputation as a responsible corporate citizen. These initiatives contribute to client loyalty by aligning with the values of a growing segment of the financial services market.

- Environmental Commitment: Charles Schwab's focus on reducing its carbon footprint and promoting sustainable practices enhances its appeal to a socially conscious clientele and workforce.

- Community Impact: Significant investment in community programs and employee volunteerism strengthens Schwab's brand reputation and fosters deeper client relationships.

- Reputational Benefits: Demonstrable CSR efforts directly contribute to a positive brand image, aiding in talent acquisition and client retention in a competitive financial landscape.

- Stakeholder Alignment: By actively engaging in environmental and social initiatives, Charles Schwab aligns itself with the values of its diverse stakeholders, including customers, employees, and the wider community.

Resource Scarcity and Operational Sustainability

Charles Schwab faces growing considerations regarding resource scarcity, particularly in energy consumption and waste management, which directly influence its operational sustainability. As a financial services firm, its physical footprint, including offices and data centers, requires significant energy. For instance, in 2023, the U.S. commercial sector, which includes office buildings, accounted for about 19% of total energy consumption.

Implementing eco-efficient practices offers a dual benefit. These initiatives can lead to tangible cost savings through reduced energy bills and waste disposal fees. Furthermore, demonstrating a commitment to environmental stewardship through such practices can enhance the company's brand reputation among environmentally conscious clients and investors.

- Energy Efficiency: Investing in energy-efficient lighting, HVAC systems, and server virtualization for data centers.

- Waste Reduction: Implementing comprehensive recycling programs and reducing paper usage through digital transformation.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental track records for office supplies and technology.

- Water Conservation: Employing water-saving fixtures in office facilities.

The increasing demand for ESG investments, with U.S. sustainable funds reaching $2.7 trillion in 2023, directly impacts Charles Schwab’s product development and advisory services.

Climate change poses risks, evidenced by extreme weather events in 2024, but also opportunities in sectors like renewable energy, which saw $1.7 trillion invested globally in 2023, requiring Schwab to adapt its portfolio strategies.

Evolving environmental regulations, like the EU's SFDR impacting asset disclosure as of early 2024, necessitate robust data management and compliance for Schwab, influencing portfolio construction and client advice.

Charles Schwab's environmental initiatives, including a 45% reduction in greenhouse gas emissions intensity by 2023, enhance its brand image and appeal to stakeholders, while operational efficiency measures in its commercial sector footprint can yield cost savings.

PESTLE Analysis Data Sources

Our Charles Schwab PESTLE Analysis is built on comprehensive data from financial regulatory bodies, economic forecasting agencies, and industry-specific market research. We leverage insights from government reports, global economic databases, and reputable financial news outlets to ensure a thorough understanding of the macro-environment.