Charles Schwab Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charles Schwab Bundle

Unlock the full strategic blueprint behind Charles Schwab's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a financial giant.

Partnerships

Charles Schwab collaborates with numerous technology and software providers, a crucial element in maintaining its competitive edge. These partnerships are vital for developing and enhancing Schwab’s robust digital platforms, including its trading interfaces and client management systems.

In 2024, Schwab continued to invest heavily in its technology infrastructure, leveraging partnerships to integrate advanced cybersecurity measures and sophisticated data analytics tools. This focus ensures the protection of client data and enables personalized financial insights, critical for client retention and acquisition.

These collaborations are instrumental in optimizing back-office operations, leading to greater efficiency and cost savings. For example, partnerships in cloud computing and artificial intelligence streamline processes from account opening to trade execution, directly impacting service delivery speed and client satisfaction.

By partnering with leading software providers, Schwab ensures its offerings remain at the forefront of innovation. This strategy allows them to deliver a seamless and intuitive user experience, supporting the diverse needs of their broad client base, from novice investors to seasoned professionals.

Charles Schwab collaborates with a wide array of financial product and service providers. These include third-party asset managers, mutual fund companies, and insurance providers. These partnerships are crucial for offering clients a comprehensive suite of investment options, going beyond Schwab's in-house products.

By integrating offerings from these external partners, Schwab significantly broadens its product shelf. This allows clients to access a diverse range of investment vehicles, such as specialized ETFs, alternative investments, and various insurance products, thereby catering to a wider spectrum of financial goals and risk profiles.

In 2023, Charles Schwab reported significant growth in assets under management, with a substantial portion likely influenced by the variety of third-party products available on its platform. This strategic expansion of offerings through partnerships directly contributes to client retention and acquisition by providing a one-stop-shop for financial needs.

Charles Schwab leverages key partnerships for custodial and clearing services, even with its strong self-custody capabilities. For specialized assets or global markets, Schwab collaborates with other clearinghouses and dedicated custodial providers. This ensures the safe and efficient settlement of all transactions and the secure holding of customer assets, which is critical for maintaining operational reliability.

Regulatory and Compliance Bodies

Charles Schwab actively engages with regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This engagement is vital for maintaining compliance with evolving financial laws and industry best practices, ensuring operational integrity and client trust.

These partnerships involve regular reporting, audits, and participation in industry forums to stay ahead of regulatory changes. For instance, in 2024, Schwab continued its commitment to transparency by adhering to SEC disclosure requirements and FINRA's rules on advertising and sales practices.

- SEC Oversight: Charles Schwab is subject to the SEC's regulations concerning broker-dealers, investment advisers, and public companies, ensuring investor protection and market integrity.

- FINRA Membership: As a FINRA member, Schwab adheres to rules governing the conduct of securities firms and their associated persons, promoting fair dealing with investors.

- Compliance Investment: In 2023, the financial services industry saw significant spending on compliance technology and personnel, a trend continuing into 2024 as firms like Schwab adapt to new data privacy and cybersecurity mandates.

Data and Research Providers

Charles Schwab collaborates with key data and research providers to enhance its service offerings. These partnerships are crucial for accessing timely market data, financial news, and in-depth research reports. For instance, Schwab's integration with providers like Refinitiv and FactSet ensures clients have access to comprehensive financial information, enabling more informed investment strategies.

These alliances allow Schwab to provide a richer analytical experience. By leveraging data from established financial news agencies and independent research firms, Schwab equips its clients with the necessary tools to navigate complex markets. This access to quality insights is a cornerstone of Schwab's value proposition for both retail and professional investors.

The impact of these partnerships is significant, directly contributing to improved client decision-making. For example, in 2024, Schwab continued to refine its platforms, offering clients access to a wider array of research, including analyst reports and proprietary market commentary, which are vital for understanding investment opportunities.

- Market Data Access: Partnerships provide real-time pricing, historical data, and analytics.

- Research Integration: Inclusion of third-party analyst reports and economic forecasts.

- News Feeds: Direct access to financial news from reputable agencies to stay updated on market-moving events.

- Client Empowerment: Offering these resources allows clients to conduct thorough due diligence and make well-reasoned investment choices.

Charles Schwab's Key Partnerships are foundational to its business model, enabling it to offer a comprehensive suite of financial services. These alliances span technology, financial product providers, data and research, and regulatory bodies, all contributing to operational efficiency, innovation, and client trust. By strategically collaborating, Schwab expands its market reach and enhances its value proposition for a diverse client base.

What is included in the product

A detailed breakdown of how Charles Schwab serves diverse customer segments with tailored financial services through multiple channels, emphasizing its value proposition of accessible, comprehensive wealth management and investment solutions.

Charles Schwab's Business Model Canvas acts as a pain point reliever by offering a structured approach to visualize and address the complexities of financial services, enabling clearer identification of customer needs and service gaps.

It helps alleviate the pain of overwhelming data by condensing intricate financial strategies into a digestible, one-page snapshot for efficient decision-making and problem-solving.

Activities

Charles Schwab's wealth management and financial planning activities are central to its business. They provide a wide array of services, including comprehensive financial advice, retirement planning, and estate planning. This caters to both individual and institutional clients, aiming to guide them toward their long-term financial goals.

Central to this is the creation of personalized investment strategies. This involves in-depth client consultations to understand their unique needs and risk tolerance, leading to the construction of tailored portfolios. Ongoing monitoring ensures these portfolios remain aligned with evolving market conditions and client objectives.

As of the first quarter of 2024, Charles Schwab reported $8.57 trillion in total client assets. This vast client base underscores the scale of their wealth management operations and the trust placed in their planning and advisory services.

Charles Schwab's core activity involves facilitating the seamless buying and selling of a vast array of securities, encompassing stocks, bonds, options, and exchange-traded funds (ETFs). This is achieved through their user-friendly online platforms and also via assisted channels, catering to a broad spectrum of investor needs.

The company's commitment to robust trading infrastructure is paramount, ensuring efficient trade execution and providing essential market access for a diverse investor base. This operational strength underpins their ability to serve millions of clients effectively.

In 2024, Schwab continued to see significant trading volumes across its platforms. For instance, their daily average client trades often surpassed 1.5 million, highlighting the sheer scale of their brokerage operations and the active engagement of their customer base.

Charles Schwab's key activities include offering a comprehensive suite of banking and lending services. This encompasses essential products like checking and savings accounts, credit cards, and a variety of lending solutions. These lending options are crucial, including margin loans for investors and mortgage services for homeowners.

These banking services are designed to deepen the financial relationship with clients. By integrating banking with investment accounts, Schwab provides a convenient, all-in-one financial hub for its customers. This holistic approach enhances client stickiness and offers a more streamlined financial management experience.

In 2024, Charles Schwab Bank reported significant growth in its deposit base, which is a direct reflection of the success of these banking services. For instance, total deposits reached over $400 billion by the end of Q1 2024, demonstrating strong client adoption of their banking products. This expansion is vital for the company's funding strategy and its ability to offer competitive lending rates.

Asset Management and Fund Operations

Charles Schwab actively manages a suite of proprietary mutual funds and exchange-traded funds (ETFs), offering investors diverse investment opportunities. This includes the design, ongoing management, and rigorous performance monitoring of these products to ensure they align with investor objectives and regulatory requirements. As of the first quarter of 2024, Schwab reported approximately $7.9 trillion in total client assets, with a significant portion managed within its investment and banking segments.

Beyond its own offerings, Schwab also oversees third-party asset allocations, providing clients with access to a broader universe of investment strategies. This necessitates a deep understanding of various asset classes and the ability to integrate external managers effectively into client portfolios. The firm’s commitment to compliance is paramount, ensuring all managed products adhere to strict financial regulations.

- Proprietary Fund Management: Schwab designs, launches, and manages its own mutual funds and ETFs, covering various asset classes and investment styles.

- Third-Party Asset Allocation: The company provides services to manage and allocate assets from external investment managers for its clients.

- Performance Monitoring: Continuous oversight of fund performance against benchmarks and objectives is a core activity to ensure investor value.

- Regulatory Compliance: Strict adherence to all relevant financial regulations is maintained across all asset management and fund operations.

Technology Development and Platform Maintenance

Charles Schwab's core activities heavily rely on the continuous development and upkeep of its technological infrastructure. This includes building and refining their trading platforms, mobile apps, and the internal systems that power their operations. The goal is to make sure clients have a smooth, secure, and easy-to-use experience for managing their finances and making investments.

This commitment to technology is crucial for staying competitive. In 2024, Schwab continued to invest in its digital offerings, aiming to provide clients with cutting-edge tools. For instance, their platform development often focuses on improving trading execution speeds and enhancing data analytics capabilities available to users.

- Platform Enhancement: Ongoing updates to trading platforms and mobile applications to improve user interface and functionality.

- Security Maintenance: Regular security audits and updates to protect client data and financial transactions.

- Internal Systems: Development and maintenance of backend systems supporting client onboarding, account management, and trading operations.

- Innovation Investment: Allocating resources to explore and integrate new technologies like AI for personalized client services and improved operational efficiency.

Charles Schwab's key activities encompass the provision of comprehensive wealth management and financial planning services. This involves creating personalized investment strategies, offering retirement and estate planning, and guiding clients toward their financial objectives. Their extensive client base, managing $8.57 trillion in total client assets as of Q1 2024, highlights the success of these advisory functions.

What You See Is What You Get

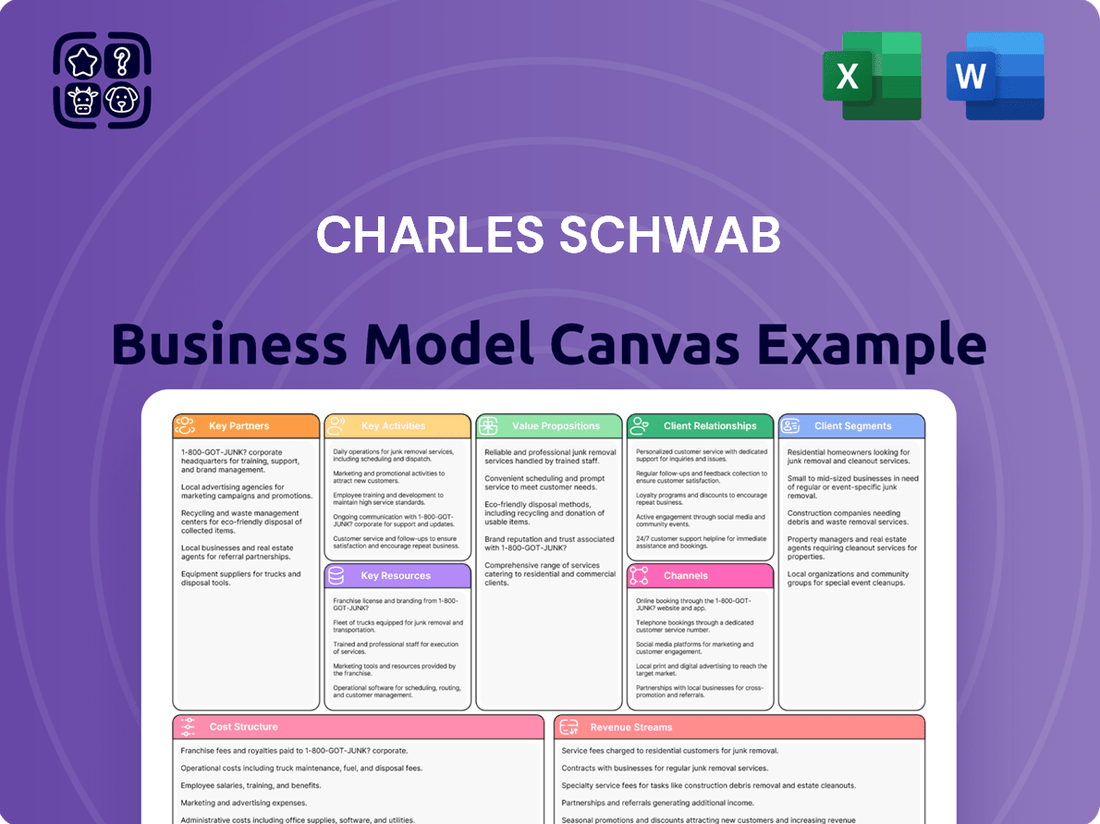

Business Model Canvas

The Charles Schwab Business Model Canvas preview you're examining is the precise document you will receive upon purchase. This is not a generic template or a simplified version; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your transaction, you'll download this exact file, complete with all its detailed sections and strategic insights, ready for your immediate use.

Resources

Charles Schwab's financial capital is a cornerstone of its business model, primarily represented by its substantial client assets under management (AUM). As of the first quarter of 2024, Schwab reported total client assets of $8.55 trillion, a testament to the trust and scale it commands in the financial services industry. This massive pool of capital is crucial for facilitating a wide range of client transactions, from everyday trading to complex wealth management solutions.

Beyond client AUM, Schwab maintains robust capital reserves and strong liquidity positions. These elements are vital for ensuring operational stability, meeting stringent regulatory requirements, and providing a buffer against market volatility. For instance, the company consistently demonstrates a strong capital adequacy ratio, a key indicator of its financial health and ability to absorb potential losses, which is essential for maintaining client confidence and supporting ongoing business expansion initiatives.

The company's financial strength directly enables significant investments in technological innovation and strategic growth opportunities. This capacity allows Schwab to enhance its digital platforms, develop new product offerings, and pursue acquisitions that strengthen its market position. In 2023, Schwab continued to invest heavily in technology and client service, underscoring how financial capital fuels its competitive edge and long-term development strategy.

Charles Schwab's business model heavily relies on its human capital and the deep expertise embedded within its workforce. This includes a vast array of financial advisors who guide clients, technology professionals who build and maintain cutting-edge platforms, market analysts who interpret complex financial landscapes, and customer service representatives dedicated to client satisfaction. Their combined knowledge is the engine driving superior client experiences, fostering innovation in financial products and services, and ensuring the effective execution of the company's strategic objectives across its diverse business segments.

The company’s investment in its employees is evident. For instance, as of the first quarter of 2024, Charles Schwab reported approximately 33,400 employees. This significant human resource is crucial for delivering personalized financial advice, developing sophisticated trading platforms, and providing responsive support, all of which are cornerstones of Schwab’s value proposition to its diverse client base.

Charles Schwab's proprietary technology and infrastructure are foundational to its operations. This includes advanced trading platforms like thinkorswim, offering sophisticated tools for active traders. In 2023, Schwab reported that over 80% of its trades were placed digitally, highlighting the reliance on its robust online portals and trading systems.

Secure online portals and extensive data center networks are critical for safeguarding client assets and ensuring uninterrupted service. These investments enable efficient processing of millions of transactions daily and support a scalable business model, allowing Schwab to serve a growing client base.

Proprietary software underpins everything from client onboarding and portfolio management to regulatory compliance and analytics. This technological backbone provides a significant competitive advantage by allowing for innovation, cost efficiency, and a superior client experience in the rapidly evolving digital financial landscape.

Brand Reputation and Trust

Charles Schwab's brand reputation and trust are foundational to its business model, acting as a powerful magnet for new clients and a key reason for existing clients to stay. This long-standing reputation for reliability, a client-focused approach, and commitment to low-cost investing is more than just a good image; it's a tangible asset that fosters deep client loyalty.

The trust Schwab has cultivated over decades is a significant differentiator in the crowded financial services industry. It directly translates into a more stable and predictable client base, reducing churn and the associated costs of client acquisition. For instance, Schwab consistently ranks high in customer satisfaction surveys, reflecting this deep-seated trust.

- Client-Centricity: Schwab's focus on putting clients first, offering educational resources, and providing accessible support solidifies trust.

- Low-Cost Advantage: A persistent commitment to competitive pricing, particularly with $0 commission trades, builds confidence and attracts value-conscious investors.

- Reliability and Stability: As a well-established firm, Schwab's history of financial stability reassures clients about the safety of their assets.

- Brand Recognition: High brand awareness, often reinforced by significant marketing efforts and positive media coverage, contributes to its trusted status.

Extensive Client Base and Network

Charles Schwab's extensive client base, encompassing millions of individual investors, thousands of independent advisors, and numerous institutional clients, is a cornerstone of its business model. This broad reach fuels a significant portion of its recurring revenue streams through asset management fees and brokerage services. For instance, as of the first quarter of 2024, Schwab reported $8.8 trillion in client assets.

This diverse clientele also creates a fertile ground for cross-selling opportunities, allowing Schwab to offer a wider array of financial products and services, from banking and lending to retirement planning and wealth management. The network effect is also substantial, as satisfied clients and advisors often lead to organic growth through valuable referrals, reinforcing Schwab's market position.

- Individual Investors: A vast number of retail customers utilize Schwab for their investment needs, contributing to consistent asset growth.

- Independent Advisors: Schwab serves a large community of financial advisors who custody assets with the firm, generating fee-based revenue.

- Institutional Clients: This segment includes retirement plans, endowments, and foundations, representing significant asset pools and long-term relationships.

Charles Schwab's intellectual property is a critical asset, encompassing its proprietary trading platforms like thinkorswim, advanced analytical tools, and the intellectual capital of its financial experts. This intellectual property allows Schwab to offer differentiated services and maintain a competitive edge in product development and service delivery.

The company's extensive research capabilities and market insights are also vital components of its intellectual property. These insights inform investment strategies, product design, and client advisory services, contributing to Schwab's reputation as a thought leader in the financial industry.

Value Propositions

Charles Schwab's commitment to low-cost and commission-free investing significantly lowers the barrier to entry for a wide range of investors. This strategy directly appeals to those who are mindful of fees and aim to maximize their returns by minimizing transactional costs. For instance, as of early 2024, Schwab continues to offer commission-free online trading for stocks and exchange-traded funds (ETFs), a policy that has been a cornerstone of their appeal since its introduction.

This competitive pricing structure is a critical component of their business model, attracting a large and diverse client base. By eliminating commissions, Schwab enables individuals to invest more of their capital, directly enhancing the potential for growth. This approach is particularly beneficial for active traders and long-term investors alike who can see substantial savings over time.

The firm's dedication to affordability is not merely a marketing tactic; it's a fundamental aspect of their strategy to democratize investing. This value proposition has been instrumental in Schwab's sustained growth and market share expansion in the increasingly competitive financial services landscape. It underscores their focus on client-centricity, ensuring that cost is not an impediment to financial participation.

Charles Schwab offers a comprehensive suite of financial services, integrating brokerage, banking, wealth management, and financial planning. This all-in-one approach simplifies financial management, allowing clients to consolidate their financial lives with a single, trusted provider. As of the first quarter of 2024, Schwab reported $8.79 trillion in assets under management and administration, demonstrating the scale of their integrated offerings.

Charles Schwab offers advanced technology through intuitive and robust digital platforms, including sophisticated mobile apps and trading tools. This allows clients seamless access to their accounts, real-time market data, and a wide array of investment capabilities. The company's commitment to technology makes investing more accessible and efficient, catering to both novice and experienced investors.

In 2024, Schwab continued to invest heavily in its digital infrastructure, aiming to enhance user experience. The company reported a significant increase in mobile app engagement, with a large percentage of daily active users interacting with their accounts via smartphones. This focus on user-friendly technology directly translates to greater client satisfaction and retention.

Expert Guidance and Personalized Advice

Charles Schwab offers access to experienced financial advisors, providing personalized guidance. This spectrum ranges from self-service digital tools to dedicated, one-on-one advisory relationships.

This approach caters to a wide client base, accommodating those who prefer to manage their investments independently as well as those seeking comprehensive financial planning tailored to their unique circumstances.

For instance, in 2024, Schwab continued to invest in its digital platforms and advisor network, aiming to enhance client experience across all service models.

The firm’s commitment to personalized advice is evident in its tiered service offerings, ensuring clients receive the level of support that best aligns with their financial goals and complexity.

- Personalized Guidance: Access to financial advisors for tailored investment and planning advice.

- Tiered Services: Options from self-service tools to dedicated advisory relationships.

- Client-Centric Approach: Catering to diverse needs for financial education and comprehensive planning.

- Digital and Human Integration: Combining technology with expert human advice.

Security and Trustworthiness

Charles Schwab's value proposition centers on providing a secure and trustworthy platform for its clients' financial endeavors. This commitment is fundamental to building and maintaining client confidence, especially in the dynamic financial landscape. By prioritizing the protection of client assets and the safeguarding of sensitive data, Schwab cultivates an environment where individuals feel secure managing their investments and financial futures.

Regulatory compliance is a cornerstone of this security. Schwab adheres to stringent financial regulations, which not only ensures legal operation but also reinforces trust. This dedication to operating within established frameworks provides clients with assurance that their financial activities are conducted responsibly and ethically. For example, in 2023, Charles Schwab Corporation reported total client assets of $7.9 trillion, underscoring the significant trust placed in their security measures.

The company's extensive history, dating back to 1983, coupled with its robust risk management practices, further solidifies its reputation for trustworthiness. This long-standing presence demonstrates resilience and a proven ability to navigate economic fluctuations, instilling a deep sense of confidence among its diverse clientele. This history translates into a palpable sense of reliability that is crucial for financial institutions.

- Client Asset Protection: Schwab implements multi-layered security protocols to safeguard client funds and investments.

- Data Security: Advanced cybersecurity measures are employed to protect personal and financial information from unauthorized access.

- Regulatory Compliance: Strict adherence to SEC, FINRA, and other regulatory bodies ensures a secure and transparent operating environment.

- Risk Management: Proactive risk assessment and mitigation strategies are integral to maintaining stability and client trust.

Charles Schwab's value proposition is built on offering a seamless, integrated experience that simplifies financial management. By combining brokerage, banking, and wealth management services, clients can consolidate their financial lives with a single, trusted provider. As of the first quarter of 2024, Schwab managed $8.79 trillion in assets, showcasing the breadth and depth of these integrated offerings and the trust clients place in them.

Customer Relationships

Charles Schwab empowers its clients with robust self-service digital engagement, allowing for seamless account management, trading, and research via its online platform and mobile app. This approach caters particularly to independent investors who value autonomy and the convenience of managing their finances digitally. For instance, Schwab's mobile app consistently ranks highly among financial apps, reflecting strong user adoption for self-directed activities.

Charles Schwab offers dedicated financial advisors for clients prioritizing comprehensive wealth management and personalized guidance. This high-touch approach involves regular consultations and customized strategies to navigate complex financial needs.

In 2024, Schwab's Investor Services segment, which includes its advisory services, continued to see strong client engagement. The company reported significant net new assets, indicating that clients value these personalized relationships for their financial planning and wealth management goals.

These advisor relationships are crucial for addressing sophisticated financial requirements, offering proactive support, and building long-term trust. The personalized nature of this service is a key differentiator in attracting and retaining clients who seek expert, tailored financial advice.

Charles Schwab offers a vast library of educational resources, including thousands of articles, over 100 webinars annually, and interactive workshops. This commitment to financial literacy aims to equip clients with the knowledge to navigate markets confidently, fostering a stronger, more informed relationship. For instance, in 2023, Schwab reported over 7 million client interactions with its educational content, demonstrating significant client engagement.

Customer Support and Service Centers

Charles Schwab prioritizes accessible and responsive assistance through a multi-channel customer support strategy. This includes readily available phone support, efficient online chat for quick queries, and a network of physical branches for clients who prefer in-person interactions. These channels are designed to address a wide range of client needs, from general inquiries and technical troubleshooting to specific transactional requests, ensuring a consistently supportive client experience.

In 2024, Schwab continued to invest in its support infrastructure. For instance, the company reported significant call volumes handled by its service centers, with an average of millions of client interactions monthly across all support channels. This commitment to human interaction remains a cornerstone of their business model, aiming to build trust and loyalty.

- Phone Support: Dedicated teams available to assist with complex issues and personalized guidance.

- Online Chat: Real-time digital assistance for faster resolution of common questions and tasks.

- Physical Branches: Offering face-to-face service for account management, consultations, and financial planning discussions.

- Self-Service Options: Extensive online resources and FAQs to empower clients to find answers independently.

Community and Peer-to-Peer Interaction

Charles Schwab actively cultivates online communities, fostering robust forums and social media engagement. This allows clients to share valuable insights, pose questions, and learn from one another's experiences, building a strong sense of belonging. As of late 2023, Schwab reported millions of active users across its digital platforms, indicating a significant appetite for peer-to-peer interaction.

These digital spaces serve as powerful conduits for collective knowledge, enabling clients to tap into a broad spectrum of perspectives. This indirect engagement with Schwab's brand reinforces loyalty and trust by demonstrating a commitment to client empowerment beyond traditional advisory services. For instance, the platform’s active user base in 2024 highlights the ongoing demand for such interactive financial learning environments.

- Fostering Online Communities: Schwab provides dedicated online forums and social media channels.

- Peer-to-Peer Learning: Clients share insights, ask questions, and learn from each other.

- Brand Engagement: This interaction indirectly strengthens client connection to Schwab's brand.

- Leveraging Collective Knowledge: Clients benefit from the shared wisdom of the community.

Charles Schwab offers a tiered approach to customer relationships, blending digital self-service with personalized advisory and robust support channels. This multi-faceted strategy aims to cater to diverse client needs and preferences, fostering loyalty through convenience, expertise, and accessibility.

In 2024, Schwab continued to emphasize client engagement across its platforms. For example, the company reported substantial growth in advisory solutions, indicating a strong demand for personalized financial guidance. This growth underscores the value clients place on human interaction for complex financial planning.

Schwab's commitment to educational resources also plays a vital role in relationship building. By providing extensive learning materials, they empower clients to make informed decisions, thereby strengthening trust and long-term engagement. This proactive approach to financial literacy is a key differentiator.

Furthermore, the company's investment in multi-channel support, including phone, online chat, and physical branches, ensures clients can connect with the firm in ways that best suit them. This accessibility, coupled with efforts to build online communities, reinforces a sense of belonging and shared experience among Schwab's clientele.

| Relationship Type | Key Features | 2024 Data/Insight |

|---|---|---|

| Self-Service Digital | Online platform, mobile app for trading, research, account management | High user adoption for autonomous financial management; consistently high app ratings. |

| Personalized Advisory | Dedicated financial advisors, comprehensive wealth management, tailored strategies | Strong net new assets in Investor Services segment, reflecting client value for expert guidance. |

| Educational Engagement | Articles, webinars, workshops, interactive tools | Millions of client interactions with educational content annually, fostering informed decision-making. |

| Multi-Channel Support | Phone, online chat, physical branches | Significant monthly client interactions across all support channels, demonstrating commitment to human interaction. |

| Online Communities | Forums, social media engagement, peer-to-peer learning | Millions of active users across digital platforms, indicating strong demand for interactive financial learning and shared insights. |

Channels

Online platforms and websites are Charles Schwab's primary digital channel for client interaction. These platforms offer comprehensive access to brokerage accounts, banking services, research tools, and financial planning resources, acting as the central hub for self-directed investing and managing financial affairs. In 2024, Schwab reported that its digital platforms handled a significant majority of client trades and interactions, underscoring their critical role in customer engagement and service delivery.

Charles Schwab's mobile applications, available on both iOS and Android, are a cornerstone of its customer engagement strategy, offering seamless on-the-go access to trading, account management, and real-time market data. These platforms are crucial for the significant segment of clients who prefer managing their financial lives through their smartphones and tablets, a trend that has only accelerated in recent years. In the first quarter of 2024, Schwab reported that approximately 77% of its active trading clients were using the company's mobile app, highlighting its importance in reaching and serving a digitally-native customer base.

Charles Schwab's physical branch network serves as a cornerstone for in-person client engagement, offering financial consultations and educational workshops. This tangible presence fosters deeper relationships with clients who value face-to-face interactions and local support. As of December 31, 2023, Schwab operated 321 branches across the United States, providing a physical touchpoint for its diverse clientele.

Call Centers and Phone Support

Charles Schwab operates dedicated call centers that serve as a primary channel for customer interaction. These centers offer direct phone access to support staff, allowing clients to get immediate assistance with account management, trading activities, and technical troubleshooting. In 2024, Schwab reported handling millions of customer calls annually, demonstrating the significant volume and reliance on this channel for prompt service. This direct line ensures clients receive personalized guidance from licensed professionals, fostering trust and facilitating efficient problem resolution.

The call center infrastructure is crucial for providing a high level of customer support, especially for complex inquiries or when clients prefer human interaction over digital self-service options. Financial consultants are available to offer advice on investments and financial planning, further solidifying the value proposition of this channel. Schwab's investment in its call centers reflects a commitment to accessibility and a responsive customer experience.

Key functions supported through call centers include:

- Account Inquiries: Customers can check balances, transaction history, and update personal information.

- Trading Support: Assistance with placing trades, understanding market orders, and resolving trade execution issues.

- Technical Assistance: Help with online platform navigation, mobile app usage, and resolving login problems.

- Financial Advice: Access to licensed brokers and financial consultants for investment guidance and portfolio reviews.

Independent Investment Advisors (RIAs)

Charles Schwab acts as a critical custodian for Independent Investment Advisors (RIAs), offering them robust technology, efficient trading platforms, and comprehensive operational support. This allows RIAs to effectively manage their clients' investments, fostering growth and client satisfaction. As of the first quarter of 2024, Schwab reported approximately $7.8 trillion in client assets, a significant portion of which is managed by RIAs on their platform, highlighting the scale of this channel.

This indirect distribution strategy is vital for Schwab, as it extends their market reach significantly. By empowering RIAs, Schwab gains access to a diverse and extensive client base that might otherwise be difficult to reach directly. This symbiotic relationship benefits both parties, with RIAs leveraging Schwab's infrastructure to serve their clients better.

- Custodial Services: Provides essential back-office support, including account administration, trade execution, and reporting for RIAs.

- Technology and Tools: Offers a suite of digital platforms designed to streamline advisor workflows and enhance client experience.

- Market Reach: Extends Schwab's client base through the aggregated assets managed by thousands of independent advisory firms.

- Industry Growth: The RIA channel has seen consistent growth, with many advisors moving to independence, benefiting Schwab's custodial business.

Charles Schwab's advisor services represent a significant channel, providing technology, trading, and operational support to independent investment advisors (RIAs). This allows RIAs to manage client assets effectively, expanding Schwab's reach. As of Q1 2024, Schwab custodied approximately $7.8 trillion in client assets, with a substantial portion managed by RIAs, demonstrating the channel's immense scale.

This indirect distribution is key to Schwab's growth, leveraging the extensive client networks of thousands of independent advisory firms. The RIA channel has seen consistent expansion, with advisors increasingly opting for independence, directly benefiting Schwab's custodial operations.

| Channel Component | Description | Key Metrics/Data (as of early 2024) |

| RIA Custody Services | Back-office support, trade execution, reporting for RIAs. | $7.8 trillion in client assets custodied (Q1 2024). |

| Advisor Technology | Digital platforms to streamline advisor workflows. | Supports thousands of independent advisory firms. |

| Market Access | Extends Schwab's client base through RIA networks. | Significant portion of custodied assets managed by RIAs. |

Customer Segments

Individual investors who prefer to manage their own portfolios are a core customer segment for Charles Schwab. These clients are looking for efficient, low-cost access to a broad array of investment options, from stocks and bonds to ETFs and mutual funds. Schwab’s digital trading platforms are designed to meet this need, offering intuitive interfaces and advanced tools for self-directed management.

This segment highly values control over their investment decisions and seeks out resources that empower them to research and analyze securities independently. They are often cost-conscious, making Schwab’s competitive pricing and minimal fees particularly attractive. As of early 2024, Schwab continued to see strong engagement from this demographic, with millions of active retail accounts leveraging their digital capabilities.

Individual investors seeking advice value a personal touch. They want a dedicated financial advisor to help them navigate their financial journey, from retirement planning to investment management. This segment is willing to pay for the expertise and ongoing support that a trusted advisor provides, looking for comprehensive strategies tailored to their unique circumstances.

For these clients, Charles Schwab offers a robust advisory service. In 2024, Schwab's advisory services continue to be a cornerstone, serving millions of clients who rely on personalized guidance. Many of these clients have complex financial goals, such as funding education or planning for early retirement, and they look to Schwab advisors for expert direction.

The emphasis for this customer segment is on building a long-term relationship. They seek not just investment advice, but a holistic financial plan that considers their entire financial picture. This often includes estate planning, tax considerations, and risk management, all delivered through a trusted, expert relationship.

Independent Investment Advisors, often referred to as Registered Investment Advisors (RIAs), represent a critical customer segment for Charles Schwab. These professionals utilize Schwab as a custodian, entrusting the firm with the safekeeping and administration of their clients' investment portfolios. This relationship allows RIAs to tap into Schwab's robust technology platforms, efficient trading capabilities, and comprehensive operational support, streamlining their day-to-day business activities.

Schwab empowers RIAs by providing a suite of tools and services designed to enhance their business operations and client service. This includes advanced portfolio management software, research and analytics, and dedicated support teams. By leveraging Schwab's infrastructure, RIAs can focus more on client relationships and strategic advice, rather than administrative burdens.

In 2024, Schwab continued to strengthen its commitment to the RIA channel. The firm reported significant growth in assets held by RIAs, underscoring the value RIAs place on Schwab's custodial services. Schwab's ongoing investments in technology, such as their advisor platform enhancements, directly address the evolving needs of these financial professionals.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for Charles Schwab, demanding highly sophisticated wealth management. These clients require comprehensive services that extend beyond basic investment, encompassing intricate estate planning, strategic philanthropic advising, and access to specialized investment solutions. Schwab caters to this segment by offering tailored services and often assigns dedicated teams to manage their complex and evolving financial needs.

The needs of HNWIs are distinct and require a personalized approach. For instance, in 2024, the average investable assets for HNWIs globally continued to grow, with many seeking advice on intergenerational wealth transfer and tax optimization strategies. This segment also shows a strong interest in alternative investments and ESG (Environmental, Social, and Governance) focused portfolios, reflecting a desire for both financial growth and impact.

- Sophisticated Wealth Management: HNWIs need advanced strategies for portfolio construction, risk management, and capital preservation.

- Estate and Philanthropic Planning: Services are vital for wealth transfer, legacy building, and charitable giving.

- Specialized Investment Solutions: Access to alternative investments, private equity, and customized hedging strategies is often sought.

- Dedicated Client Service: A personalized approach with dedicated advisors and teams is a hallmark of serving this affluent demographic.

Institutional Clients

Institutional clients, including corporations, retirement plans, and non-profit organizations, represent a crucial segment for Charles Schwab. These entities require sophisticated financial services tailored to their unique needs. In 2023, Schwab's institutional business saw significant growth, reflecting the demand for their offerings.

This segment relies on comprehensive solutions such as institutional brokerage for trading and execution, asset management to grow and preserve capital, and treasury solutions to manage cash flow and liquidity. The complexity of these organizations necessitates robust reporting and analytical tools, which Schwab provides to meet regulatory and internal oversight requirements.

- Institutional Brokerage: Facilitating large-scale trading and investment activities for corporate treasuries and asset managers.

- Asset Management: Providing tailored investment strategies and portfolio management services to meet long-term institutional objectives.

- Treasury Solutions: Offering services like cash management, payments, and liquidity management to optimize corporate financial operations.

- Reporting and Analytics: Delivering detailed performance reports and data analysis to support informed decision-making and compliance.

Charles Schwab serves a diverse range of customer segments, each with distinct financial needs and expectations. From individual investors managing their own portfolios to high-net-worth individuals requiring sophisticated wealth management, Schwab offers tailored solutions. The firm also caters to independent investment advisors and large institutional clients, providing robust platforms and services to support their diverse objectives.

| Customer Segment | Key Needs | Schwab Offerings |

|---|---|---|

| Individual Investors (Self-Directed) | Low-cost access, trading tools, research resources | Digital platforms, ETFs, stocks, bonds, mutual funds |

| Individual Investors (Seeking Advice) | Personalized financial planning, retirement, investment management | Dedicated advisors, holistic financial plans, retirement accounts |

| Independent Investment Advisors (RIAs) | Custodial services, technology platforms, operational support | Portfolio management tools, research, trading capabilities, dedicated support |

| High-Net-Worth Individuals (HNWIs) | Advanced wealth management, estate planning, specialized investments | Tailored services, dedicated teams, alternative investments, philanthropic advising |

| Institutional Clients | Brokerage, asset management, treasury solutions, reporting | Large-scale trading, institutional brokerage, cash management, performance analytics |

Cost Structure

Charles Schwab dedicates significant capital to its technology and infrastructure, a necessity for providing reliable and secure digital financial services. These investments are crucial for maintaining and enhancing their trading platforms, robust data centers, and advanced cybersecurity defenses.

The firm's commitment to innovation in digital financial services means substantial outlays for software licenses and ongoing upgrades. For instance, in 2023, Schwab reported technology and related expenses of $3.5 billion, underscoring the scale of investment required to support millions of clients and billions in assets under management.

Charles Schwab's cost structure is significantly impacted by employee salaries and benefits, a substantial expense given its large workforce. This includes compensation for financial advisors, customer service representatives, IT professionals, and administrative staff, reflecting the human capital required to deliver comprehensive financial services and support.

In 2024, Schwab's compensation and benefits expenses represented a major operational cost. For instance, in the first quarter of 2024, Schwab reported total compensation and benefits expenses of approximately $1.08 billion. This figure underscores the significant investment in its employees, which is essential for maintaining service quality and driving business growth.

Charles Schwab invests heavily in marketing and advertising to build its brand and acquire new clients. These costs encompass promoting a wide array of financial products, from investment accounts to banking services, across various media platforms. In 2024, the company's commitment to marketing remains a key driver for maintaining its competitive edge and expanding its client base in the dynamic financial services landscape.

Regulatory and Compliance Costs

Charles Schwab, like all major financial institutions, incurs substantial expenses to comply with stringent regulations. These costs are essential for maintaining legal and ethical operations within the highly regulated financial services industry. This includes significant outlays for legal counsel, the salaries of dedicated compliance officers, and the complex systems required for reporting to various regulatory bodies.

In 2024, the financial services sector continued to see increased regulatory scrutiny, translating into higher compliance expenditures. For a firm like Schwab, these costs are not merely operational but a fundamental aspect of risk management and maintaining customer trust. The ongoing evolution of financial laws and reporting standards necessitates continuous investment in compliance infrastructure and expertise.

- Legal Fees: Costs associated with legal advice, contract reviews, and defending against potential regulatory actions.

- Compliance Staff: Salaries and training for compliance officers, analysts, and support personnel.

- Reporting Systems: Investment in technology and software to meet diverse and evolving reporting requirements.

- Audits and Examinations: Expenses related to internal and external audits and regulatory examinations.

Real Estate and Branch Operations

Charles Schwab incurs significant costs related to its physical presence. These include expenses for leasing or owning its numerous branch locations, administrative offices, and data centers. In 2024, the company continued to invest in its network of over 400 investor centers, which serve as crucial touchpoints for client engagement and personalized service.

Ongoing operational expenditures for these facilities are substantial. This encompasses regular maintenance, property taxes, insurance, utilities like electricity and water, and the costs associated with securing and managing these physical assets. While digital adoption is high, these physical locations remain vital for fostering trust and providing in-person support, especially for complex financial needs.

- Branch Network: Costs associated with maintaining a national network of investor centers, facilitating client interactions and financial advice.

- Administrative Overhead: Expenses for corporate offices, housing support staff, technology infrastructure, and general administrative functions.

- Property Expenses: Outlays for rent or mortgage payments, property taxes, insurance, and upkeep for owned or leased real estate.

- Utilities and Services: Ongoing costs for electricity, water, internet, security, and other essential services for all operational sites.

Charles Schwab's cost structure is heavily influenced by its significant investments in technology and marketing. In 2024, the company continued to prioritize digital innovation and client acquisition through robust advertising campaigns, reflecting the competitive landscape of financial services.

Employee compensation and benefits represent a substantial portion of Schwab's expenses. This investment in human capital is crucial for delivering quality client service and driving business operations across its vast network. The firm's commitment to compliance and regulatory adherence also adds to its operational costs, ensuring legal and ethical standards are met.

Physical infrastructure, including its network of investor centers and administrative offices, contributes significantly to the cost structure. These facilities are essential for client engagement and support, necessitating ongoing expenses for maintenance, utilities, and property management.

| Cost Category | Key Components | 2024 Impact (Illustrative) |

|---|---|---|

| Technology & Infrastructure | Platform development, data centers, cybersecurity | Significant capital outlays for innovation and security |

| Marketing & Advertising | Brand building, client acquisition campaigns | Ongoing investment to maintain competitive edge |

| Compensation & Benefits | Salaries, bonuses, healthcare for employees | Major operational expense, crucial for service delivery |

| Compliance & Legal | Regulatory adherence, legal counsel, reporting systems | Essential for risk management and trust |

| Physical Infrastructure | Branch network, office leases, maintenance | Costs for client engagement and operational sites |

Revenue Streams

Net Interest Revenue is a core component of Charles Schwab's business model, reflecting the income generated from the spread between interest earned on its assets and interest paid on its liabilities. This revenue stream is particularly robust in environments where interest rates are climbing, as it directly benefits from higher yields on client balances and investments.

For instance, in the first quarter of 2024, Charles Schwab reported net interest revenue of $2.6 billion. This figure highlights the substantial contribution of this segment to the company's overall financial performance, demonstrating its sensitivity to macroeconomic interest rate trends and its importance as a consistent revenue generator.

Charles Schwab generates significant revenue through asset management and administration fees. These fees are typically a percentage of the assets clients entrust to Schwab for management, covering services for proprietary mutual funds, ETFs, and various advisory offerings.

This fee structure, often based on assets under management (AUM), creates a predictable and recurring revenue stream. As Schwab's AUM grows, so does the income from these fees, demonstrating a scalable business model.

For context, as of the first quarter of 2024, Charles Schwab reported total client assets of $8.55 trillion, highlighting the substantial base upon which these management fees are levied.

Charles Schwab generates revenue from trading commissions and transaction fees, particularly on more complex financial instruments. While many retail stock and ETF trades are commission-free, fees are still applied to options contracts, futures, and certain mutual funds. This segment of revenue, though evolving, remains a consistent contributor, especially from active traders and those engaging in specialized investment activities.

Banking and Lending Product Fees

Charles Schwab earns significant revenue from fees associated with its banking and lending products, diversifying its income beyond core brokerage services. These fees can include those charged for overdrafts, out-of-network ATM usage, and other transactional banking activities. In 2024, it's estimated that such fees contribute a notable portion to the company's overall financial health.

Lending products also represent a substantial revenue stream. This is particularly true for interest generated from margin loans, where clients borrow money to purchase securities, and mortgage interest, as Schwab offers home lending services. For instance, in Q1 2024, Schwab reported net interest revenue of $2.7 billion, underscoring the importance of its lending portfolio.

- Overdraft Fees: Charges applied when a customer withdraws more money than available in their account.

- ATM Fees: Fees incurred for using ATMs outside of Schwab's network.

- Margin Loan Interest: Revenue generated from interest paid by clients on funds borrowed to trade securities.

- Mortgage Interest: Income derived from interest on mortgages originated and serviced by Schwab.

Advisory and Financial Planning Fees

Charles Schwab generates significant revenue from advisory and financial planning fees. These fees are earned by providing clients with comprehensive financial planning, wealth management services, and tailored investment advice. For instance, as of the first quarter of 2024, Schwab reported that its advisory revenue, a substantial portion of which comes from these services, reached $3.3 billion.

The fee structure often correlates with Assets Under Management (AUM), meaning clients pay a percentage of the total assets Schwab manages for them. Alternatively, flat fees are charged for specific planning engagements, such as retirement or estate planning. This model directly reflects the value clients place on expert guidance in navigating complex financial landscapes.

- Advisory Revenue: Schwab's advisory revenue was $3.3 billion in Q1 2024, highlighting the importance of these services.

- Fee Basis: Fees are typically based on Assets Under Management (AUM) or a flat fee for defined planning services.

- Value Proposition: These fees compensate for the expertise in providing personalized financial guidance and wealth management.

- Client Focus: The model serves individuals and families seeking professional support for their financial goals.

Charles Schwab's revenue streams are multifaceted, encompassing both traditional financial services and evolving digital offerings. The company capitalizes on its vast client base and asset holdings through a variety of fee-based and interest-based income generation strategies.

These diverse revenue channels allow Schwab to maintain profitability across different market conditions and client needs, solidifying its position as a leading financial services provider.

| Revenue Stream | Description | Q1 2024 Data (Approximate) |

|---|---|---|

| Net Interest Revenue | Income from lending activities and interest-bearing deposits. | $2.7 billion |

| Asset Management & Administration Fees | Fees charged on assets managed for clients, including mutual funds and ETFs. | Part of $8.55 trillion in client assets |

| Trading Commissions & Transaction Fees | Revenue from executing trades, especially on options and futures. | Consistent contributor, evolving with market activity |

| Advisory Revenue | Fees for financial planning and wealth management services. | $3.3 billion |

Business Model Canvas Data Sources

The Charles Schwab Business Model Canvas is informed by a combination of proprietary customer data, extensive market research reports, and internal financial statements. This comprehensive data integration ensures each component of the canvas accurately reflects Schwab's current operations and strategic direction.