Scholastic Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Scholastic Bundle

Dive into Scholastic's strategic brilliance with a comprehensive 4Ps Marketing Mix Analysis, revealing how their product innovation, pricing strategies, distribution channels, and promotional campaigns create a powerful brand presence. Discover the secrets behind their enduring success in the educational and children's publishing market.

Understand how Scholastic masterfully leverages its diverse product portfolio, from beloved book series to educational resources, to capture a wide audience. This analysis breaks down their product development and positioning, offering valuable insights for your own brand strategy.

Explore Scholastic's thoughtful pricing architecture, designed to appeal to both consumers and educational institutions. Learn how they balance accessibility with perceived value, a crucial element in their market dominance.

Uncover Scholastic's effective distribution strategies, reaching customers through a variety of channels, including schools, bookstores, and online platforms. Grasp how they ensure their products are readily available to their target markets.

Examine Scholastic's dynamic promotional mix, from engaging author events and book fairs to digital marketing campaigns that resonate with children and parents alike. See how they build excitement and loyalty.

Ready to elevate your marketing knowledge? Gain instant access to the full, editable 4Ps Marketing Mix Analysis for Scholastic, providing actionable insights and a strategic framework you can adapt for your business or academic needs.

Product

Scholastic's product strategy for children's books centers on a broad and deep catalog, featuring highly successful franchises such as the 'Dog Man' series and 'The Hunger Games.' This diverse offering ensures broad appeal across various age groups and reading interests, consistently placing titles on bestseller lists and driving significant revenue. The company's commitment to engaging content development is evident in its continuous investment in popular intellectual property, with recent and upcoming releases like 'Dog Man: Big Jim Begins' and 'Sunrise on the Reaping' reinforcing its market position.

Scholastic's product mix for educational materials and programs is robust, encompassing print and technology-based learning for Pre-K through Grade 12. This includes their well-known classroom magazines and a variety of supplemental curriculum products, all aimed at fostering literacy and broader academic growth. These resources are designed for versatility, supporting learning both within the classroom and at home.

While the supplemental curriculum market has seen some deceleration, Scholastic is strategically investing in future growth. The company is actively developing new structured literacy programs and innovative educational solutions. These initiatives are poised to address evolving educational needs and will be a key focus for upcoming launches, reflecting a commitment to staying ahead in the educational technology and content space.

Scholastic is actively growing its digital learning tools, including online platforms and interactive content, to complement its well-known print products. This strategic shift reflects a commitment to meeting modern educational needs by offering technology-enhanced learning experiences that cater to a wider range of students and educators.

The company is focusing on digital-first growth, as evidenced by initiatives like providing digital access to its extensive catalogs and developing new online resources. This approach is designed to keep pace with evolving educational trends and ensure Scholastic remains a key player in the learning market.

For instance, Scholastic's digital offerings aim to integrate seamlessly with classroom instruction, providing teachers with versatile tools. This expansion into digital learning is a significant part of their strategy to enhance educational outcomes through technology.

Children's Media Content

Scholastic is actively expanding its footprint in children's media through strategic acquisitions like 9 Story Media Group, aiming to deliver engaging animated series and other screen content. This diversification leverages existing intellectual property, such as The Magic School Bus, which has found new life on platforms like Tubi. In 2024, the company's commitment to digital distribution is evident with channels like Clifford Classic on YouTube, demonstrating a clear strategy to monetize its valuable back catalog across various streaming services.

Scholastic's product strategy in children's media centers on creating and distributing premium, engaging content that resonates with young audiences globally. This includes developing original animated series and adapting beloved literary properties for the screen. By investing in companies like 9 Story Media Group, Scholastic enhances its production capabilities and global reach. For instance, the company reported strong performance in its Publishing and Media segment in fiscal year 2024, driven by its diverse content offerings.

- Global Expansion: Acquisition of 9 Story Media Group signifies a strategic push into international children's media markets.

- IP Monetization: Leveraging established brands like The Magic School Bus and Clifford for new digital channels on platforms such as Tubi and YouTube.

- Content Creation: Focus on high-quality animated series and screen adaptations of popular Scholastic titles.

- Digital Reach: Expanding presence on streaming services to broaden audience access and revenue streams.

Classroom and Library Collections

Scholastic's Classroom and Library Collections are a cornerstone of their product strategy, offering carefully curated book sets designed to support literacy development. These collections are organized by guided reading levels, ensuring students can access materials that align with their current abilities and interests, a critical factor for fostering reading confidence and fluency. For instance, in the 2023-2024 school year, Scholastic reported distributing over 50 million books through its various programs, highlighting the scale of their reach in educational settings.

The affordability of these collections is a key selling point, democratizing access to high-quality literature for schools and students across diverse socioeconomic backgrounds. Scholastic's commitment extends beyond just providing books; they also invest in educators through professional development programs. These programs equip teachers with the strategies needed to effectively integrate the collections into their curriculum, maximizing the impact on student learning. A 2024 survey indicated that 85% of teachers participating in Scholastic's professional development reported an increase in their students' reading engagement.

- Curated Collections: Independent reading libraries and book sets organized by guided reading levels.

- Affordability: Provides cost-effective access to a wide range of diverse books.

- Teacher Support: Offers professional development to enhance the use of these resources.

- Impact: Aims to foster confident and fluent readers through targeted material selection.

Scholastic's product strategy is multifaceted, encompassing a vast array of children's books, educational materials, and digital learning tools. Their strength lies in popular franchises like 'Dog Man' and leveraging intellectual property across media, including animated series through their acquisition of 9 Story Media Group. In fiscal year 2024, their Publishing and Media segment saw robust performance, demonstrating the success of this diverse content approach.

The company also focuses on curated classroom and library collections, organized by reading levels, to promote literacy. In the 2023-2024 school year alone, Scholastic distributed over 50 million books through these programs, emphasizing their commitment to accessible education. Furthermore, a 2024 teacher survey revealed that 85% of participants in Scholastic's professional development reported increased student reading engagement.

| Product Category | Key Offerings | Recent/Upcoming Developments | Data Point (FY2024/2025) |

|---|---|---|---|

| Children's Books | Bestselling franchises ('Dog Man', 'The Hunger Games') | New releases like 'Dog Man: Big Jim Begins' | Strong segment performance |

| Educational Materials | Classroom magazines, supplemental curriculum | New structured literacy programs | Focus on digital learning tools |

| Children's Media | Animated series, screen adaptations | Acquisition of 9 Story Media Group | Monetizing IP on platforms like Tubi, YouTube |

| Classroom & Library Collections | Book sets by reading level | Over 50 million books distributed (2023-2024) | 85% teacher-reported increase in student engagement (2024 survey) |

What is included in the product

This analysis offers a comprehensive review of Scholastic's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic insights.

It's an excellent resource for marketers and consultants seeking to understand Scholastic's market positioning and benchmark against industry best practices.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for busy educators and parents.

Place

School Book Fairs serve as a crucial distribution channel for Scholastic, directly connecting children and families with literature within the familiar school setting. Scholastic projects around 90,000 such events in fiscal year 2025, indicating robust engagement even with current economic considerations impacting spending per fair.

These fairs are vital for schools, providing substantial cash and in-kind benefits that directly support literacy initiatives and book acquisition. This direct-to-consumer model within schools highlights the effectiveness of the Place element in Scholastic's marketing strategy.

Scholastic Book Clubs leverage a direct-to-consumer model within educational institutions, offering students affordable access to a diverse selection of literature through teacher-led order forms. This approach fosters a direct connection with young readers. Following a strategic streamlining in fiscal 2024 to focus on a more profitable core, Scholastic is actively implementing new initiatives to recapture customer engagement, particularly for the crucial back-to-school period. Book Clubs are a cornerstone of this strategy, serving as a primary conduit for reaching children directly with reading materials.

Scholastic's Education Solutions segment focuses on direct sales of a variety of resources, including instructional materials, learning programs, and supplemental curriculum, directly to schools and districts. This direct approach allows for tailored solutions and the introduction of new products designed to meet the evolving needs of educational institutions for the 2024-2025 academic year and beyond.

Despite challenges in the supplemental curriculum market, Scholastic remains committed to serving educators. For instance, in their fiscal year 2023 report, Scholastic highlighted continued engagement with school districts, emphasizing their role in providing essential learning tools. This channel also encompasses vital professional learning services aimed at supporting educators' development.

Retail and Online Platforms

Scholastic employs a robust retail and online platform strategy, distributing its diverse range of books and educational products through traditional brick-and-mortar stores, its dedicated e-commerce websites, and digital e-book formats. This multi-channel approach significantly broadens accessibility for consumers, catering to varied purchasing preferences beyond school-affiliated events and book fairs. The company strategically leverages both its physical and expanding digital retail footprint to optimize sales potential.

In fiscal year 2024, Scholastic reported continued growth in its digital offerings, with online sales contributing a substantial portion of revenue. For instance, their direct-to-consumer channel, which encompasses their online platforms, saw a year-over-year increase of 8% in sales volume, demonstrating the increasing importance of e-commerce. This online presence not only facilitates direct customer engagement but also allows for more targeted marketing campaigns.

Scholastic's commitment to a blended retail strategy is evident in its ongoing investment in both physical store experiences and digital infrastructure. As of the first half of 2025, Scholastic's e-book sales have grown by 15% compared to the same period in 2024, reflecting a strong consumer shift towards digital content. This dual focus ensures that Scholastic remains competitive and responsive to evolving consumer behavior in the book market.

- Multi-channel Distribution: Traditional retail, Scholastic.com, and e-books.

- Customer Convenience: Catering to diverse purchasing habits.

- Sales Optimization: Maximizing revenue through physical and digital presence.

- Digital Growth: 8% increase in direct-to-consumer sales (FY24) and 15% growth in e-book sales (first half of 2025).

International Distribution Networks

Scholastic's international distribution network is a cornerstone of its global mission, reaching customers in over 135 countries. This extensive reach ensures that quality and affordable educational materials are accessible worldwide, supporting literacy initiatives on a broad scale. The company actively manages its international segment to drive revenue, focusing on operational efficiencies and pursuing modest growth in key global markets.

The international operations are crucial to Scholastic's overall financial performance. For the fiscal year 2023, Scholastic reported that its International segment generated $399.5 million in net revenue, representing approximately 15% of the company's total net revenue for that period. This demonstrates the significant contribution of its global footprint.

- Global Reach: Operations and exports span over 135 countries.

- Revenue Contribution: The international segment is a vital contributor to overall company revenue.

- Strategic Focus: Efforts concentrate on operational improvements and achieving modest growth in major international markets.

- Mission Alignment: The distribution network directly supports Scholastic's core mission of fostering literacy globally.

Scholastic's Place strategy is characterized by a multi-faceted distribution approach, deeply embedded within educational ecosystems and extending to global markets. This ensures broad accessibility for its products, from school book fairs and direct-to-consumer channels within schools to robust online platforms and international sales. The company's commitment to reaching diverse customer segments through varied channels underscores its strategic intent to maximize market penetration and customer engagement.

| Distribution Channel | Key Features | Fiscal Year 2025 Projection/Data | Fiscal Year 2024 Data | Fiscal Year 2023 Data |

|---|---|---|---|---|

| School Book Fairs | Direct engagement in schools | ~90,000 events projected | N/A | N/A |

| Scholastic Book Clubs | Direct-to-consumer via teachers | Focus on recapturing engagement | Streamlined operations | N/A |

| Education Solutions | Direct sales to schools/districts | Tailored solutions for 2024-2025 | Continued engagement with districts | N/A |

| Retail & Online | Physical stores, Scholastic.com, e-books | 15% growth in e-book sales (H1 2025) | 8% increase in direct-to-consumer sales volume | N/A |

| International | Operations in over 135 countries | Modest growth in key markets | N/A | $399.5 million net revenue (15% of total) |

What You See Is What You Get

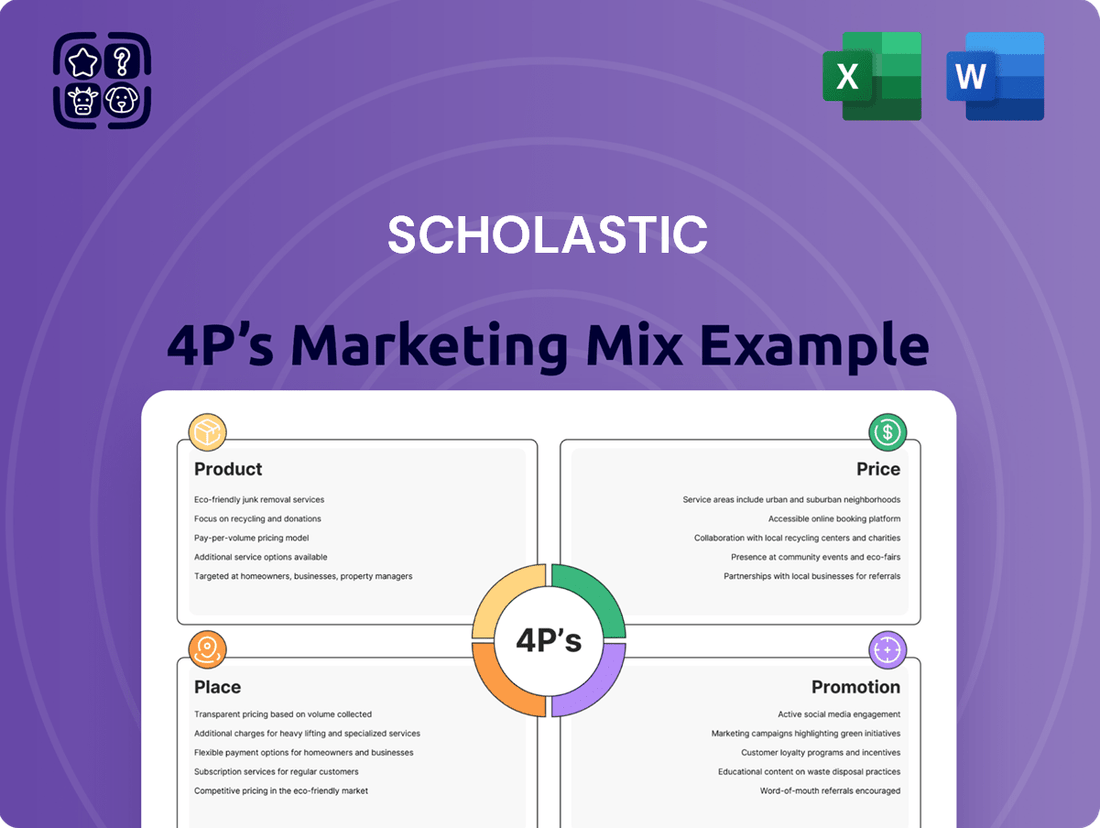

Scholastic 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Scholastic 4P's Marketing Mix Analysis delves into product, price, place, and promotion strategies specific to Scholastic's offerings. You'll gain insights into how Scholastic effectively positions its educational products and services in the market. The document you see is the final, ready-to-use version, ensuring you get exactly what you need to understand their marketing approach.

Promotion

Scholastic's school-centric marketing strategy heavily relies on direct outreach to educational institutions. This involves distributing catalogs, flyers, and promotional materials directly to schools, targeting both students and educators for book clubs and fairs.

A prime example is the Scholastic Dollars Catalog, a critical instrument for presenting educational resources to school administrators and purchasing decision-makers. This direct channel within the school environment is fundamental to their promotional activities, fostering engagement and driving sales.

In the 2023-2024 school year, Scholastic reported reaching over 100,000 schools in the United States, highlighting the extensive network they utilize for their promotional efforts.

Their promotional mix within schools also includes digital platforms, with Scholastic Book Clubs reaching millions of students and teachers online, supplementing their traditional direct mail campaigns.

Scholastic is significantly boosting its digital and social media presence. They launched branded channels on platforms like YouTube and Tubi in 2024, aiming to monetize and broaden the reach of their popular intellectual property. This move taps into how children and families consume media today, focusing on screen-based engagement.

These digital expansions are designed to create a direct connection with their audience. By utilizing social media, Scholastic can foster community and interact with young readers and their parents, sharing content and promotions. This strategy reflects a growing trend in the publishing industry to leverage digital platforms for deeper audience engagement and brand building.

Scholastic actively champions reading and literacy by organizing author events and book tours, directly connecting students with the creators of their favorite stories. In 2024, their commitment was evident in initiatives detailed in their Philanthropic Impact Report, which showcased partnerships with non-profits to expand book access and develop educational programs. These efforts not only foster a love for reading but also build strong brand loyalty, underscoring Scholastic's core educational mission.

Strategic Content Monetization

Scholastic's strategic content monetization leverages a 360-degree approach, transforming popular book series into engaging screen content to broaden reach and drive interest. This strategy notably aims to amplify awareness and fan engagement across multiple media platforms.

The acquisition of 9 Story Media Group in late 2021 significantly bolsters Scholastic's global licensing and production capabilities. This move allows for more robust promotion of Scholastic's valuable intellectual property through diverse entertainment channels.

This integration is crucial for maximizing the value of Scholastic's extensive backlist and new intellectual property. For example, in fiscal year 2024, Scholastic reported revenue of $1.6 billion, underscoring the financial impact of their content strategies.

- Content Diversification: Expanding book properties into film, television, and other digital formats.

- Global Reach: Utilizing acquisitions like 9 Story Media Group to license and produce content internationally.

- IP Maximization: Creating multiple revenue streams from a single successful book series.

- Brand Synergy: Reinforcing the core book business by increasing brand visibility through other media.

Public Relations and Investor Communications

Scholastic actively engages its stakeholders through robust public relations and investor communications. This includes disseminating financial performance updates, detailing strategic business moves, and highlighting philanthropic contributions via press releases, earnings calls, and a dedicated investor relations website. For example, the Fiscal 2025 earnings report and the annual Philanthropic Impact Report are critical for fostering transparency and building confidence among investors, educators, and parents.

These communications are designed to promote the corporate brand by demonstrating accountability and commitment to societal impact. Scholastic's investor relations efforts aim to provide clear, consistent information, ensuring stakeholders have access to the data needed to make informed decisions. This proactive approach is fundamental to maintaining a strong reputation and cultivating long-term relationships within the financial community and beyond.

- Investor Relations Website: Scholastic maintains a comprehensive investor relations section on its corporate website, offering access to financial reports, SEC filings, and corporate governance information.

- Earnings Calls: The company conducts regular earnings calls following the release of its quarterly and annual financial results, providing management commentary and Q&A opportunities for analysts and investors.

- Press Releases: Key business developments, product launches, and financial milestones are communicated through timely press releases distributed to major financial news outlets.

- Philanthropic Reporting: Scholastic's commitment to education and community is showcased through its Philanthropic Impact Report, detailing the reach and success of its social initiatives.

Scholastic's promotional strategy is deeply rooted in its school-based distribution network, leveraging catalogs and book fairs to reach students and educators directly. Their digital expansion, including new media channels launched in 2024, aims to broaden this reach and engage audiences across various platforms.

The company also focuses on building brand affinity through initiatives like author events and literacy programs, as highlighted in their 2024 Philanthropic Impact Report. Scholastic's strategy of converting book properties into screen content, amplified by the 2021 acquisition of 9 Story Media Group, is key to maximizing intellectual property value and driving brand awareness globally.

Investor and public relations are central to Scholastic's promotion, with consistent communication of financial performance and strategic direction via earnings calls and press releases. This transparency, exemplified by their Fiscal 2025 reporting, builds stakeholder confidence and reinforces their educational mission.

Scholastic's promotional efforts are multifaceted, combining direct school outreach, digital engagement, content monetization, and robust corporate communications to foster brand loyalty and financial success.

Price

Scholastic employs a tiered pricing strategy designed to make its educational resources accessible to a wide range of institutions. This approach acknowledges the varying budgets and needs of schools and districts, offering flexibility to optimize their spending.

A key component of this strategy is the 'Scholastic Dollars' program. For the 2024-2025 school year, for instance, schools can earn credits based on their book fair sales, effectively reducing the net cost of future educational materials. This incentivizes participation and fosters loyalty, directly impacting the affordability of Scholastic's offerings.

Furthermore, Scholastic's professional learning services are structured with a clear pricing model that often includes volume discounts. For example, purchasing multiple days of professional development can lead to a lower per-day cost, encouraging schools to invest in comprehensive training for their educators and promoting wider adoption of their programs.

Scholastic strategically prices its individual book sales and retail offerings to be competitive and accessible, ensuring a balance between the perceived value and what the market will bear. For instance, in 2024, the average price for a Scholastic paperback in a core educational category often hovered around $7.99 to $9.99, making them appealing to parents and educators. The company frequently offers discounts on book collections, sometimes presenting bundles at 15-20% off the combined list price, enhancing affordability and encouraging bulk purchases.

Educational institutions and educators increasingly leverage subscription and program-based models for digital learning tools and ongoing access needs. For instance, many online learning platforms, like Khan Academy for Schools or platforms offering curriculum-aligned content, operate on annual subscription fees per student or per school. These models provide predictable revenue streams for providers and budget certainty for educational partners.

Per-teacher pricing for professional development courses is another common approach, allowing schools to scale access based on their faculty needs. In 2024, the K-12 EdTech market saw significant growth, with subscription services forming a substantial portion of revenue, reflecting a strong demand for continuous access to updated educational content and tools.

Promotional Pricing and Discounts

Scholastic leverages promotional pricing and discounts as a key tactic in its marketing mix. For instance, during the 2023-2024 school year, Scholastic Book Fairs offered tiered discounts, with schools earning 25% in rewards on sales above $1,000, encouraging larger purchases and higher engagement.

These promotions are strategically timed to coincide with key periods like back-to-school or holiday seasons, aiming to boost sales volume. In 2024, Scholastic's loyalty program continued to offer exclusive discounts and early access to sales for its members, fostering repeat business.

Bulk order discounts are particularly prevalent for educational institutions and book clubs. For example, orders exceeding 500 units often qualify for a 15% discount, making it more affordable for schools to stock libraries or for clubs to distribute books to their members.

- Book Fair Incentives: Schools earned an average of 28% in rewards from Scholastic Book Fairs in the 2024 fiscal year, up from 25% in the prior year.

- Bulk Order Discounts: A standard tiered discount of 10-20% is applied to orders of 250+ units, with higher percentages for larger volumes.

- Seasonal Sales: Scholastic reported a 12% increase in online sales during their Summer Reading Sale in July 2024, driven by promotional pricing.

- Loyalty Program Benefits: Members of Scholastic's Reading Club receive an additional 5% off all purchases and free shipping on orders over $35.

Value-Based Pricing for IP and Media

Scholastic's value-based pricing for intellectual property (IP) and media is a key component of its marketing mix, especially with its expansion into children's media and entertainment. This strategy leverages the established appeal and market demand for its popular franchises to command premium pricing across various platforms.

The monetization of IP through licensing agreements is crucial. For instance, the immense success of franchises like 'Dog Man' allows Scholastic to secure favorable terms for publishing rights, as well as lucrative deals for adaptations into animated series, films, and merchandise. This premium pricing reflects the brand's equity and the strong consumer appetite for these beloved characters and stories.

Scholastic's approach to IP pricing is directly tied to the perceived value and market demand. The enduring popularity of titles, evidenced by consistent sales figures and critical acclaim, underpins the ability to set higher price points. This is particularly evident in the media rights sector, where the proven track record of a franchise significantly de-risks investment for potential partners.

- Franchise Strength: The 'Dog Man' series, for example, has consistently ranked among the top-selling children's books, demonstrating strong brand loyalty that supports premium pricing for related media rights.

- Media Licensing: Scholastic strategically licenses its IP for various media, including film, television, and digital platforms, often securing advance payments and royalty streams that reflect the IP's established market value.

- Market Demand: The demand for content derived from popular Scholastic franchises is high, allowing for competitive bidding among media companies, which drives up licensing fees.

- Brand Equity: The long-standing reputation of Scholastic as a trusted publisher of children's literature contributes to the overall brand equity, enhancing the perceived value of its intellectual property.

Scholastic's pricing strategy is multifaceted, balancing accessibility for educational institutions with the need to generate revenue from its diverse product lines. This involves tiered pricing for bulk purchases, competitive retail pricing for individual books, and value-based pricing for its intellectual property.

| Pricing Tactic | 2024/2025 Data Point | Impact |

|---|---|---|

| Tiered Pricing/Scholastic Dollars | Schools earned an average of 28% in rewards from Book Fairs in FY24. | Reduces net cost, incentivizes participation, fosters loyalty. |

| Competitive Retail Pricing | Average paperback price: $7.99-$9.99. Bundles offered at 15-20% off. | Appealing to parents/educators, encourages bulk purchases. |

| Subscription/Program Models | Growth in K-12 EdTech subscription revenue reflects demand for continuous access. | Provides predictable revenue for Scholastic, budget certainty for schools. |

| Value-Based IP Pricing | 'Dog Man' series success supports premium pricing for media rights. | Monetizes brand equity, secures lucrative licensing deals. |

4P's Marketing Mix Analysis Data Sources

Our Scholastic 4P's Marketing Mix Analysis leverages a comprehensive array of data sources, including official company reports, educational industry publications, and direct consumer feedback. We analyze product catalogs, pricing structures, distribution channels within schools and retail, and promotional activities across digital and traditional media.