Scholastic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Scholastic Bundle

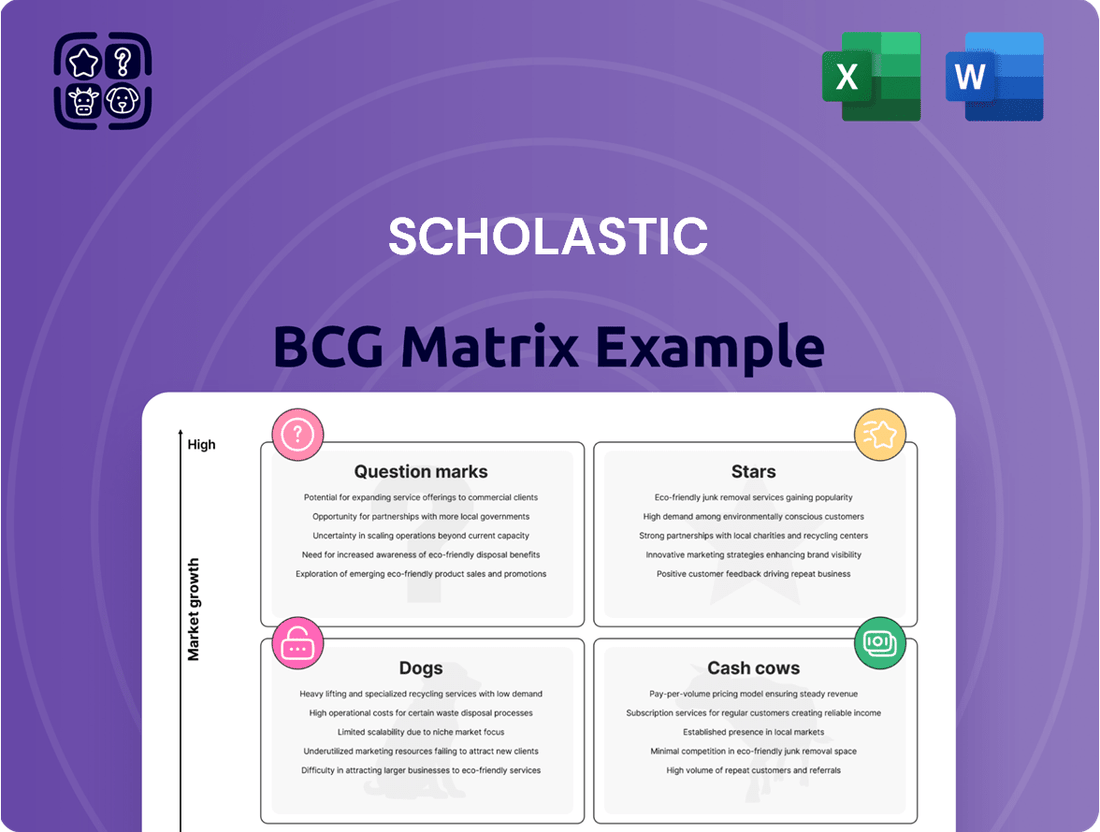

Curious about where this company's product portfolio truly shines and where it might be faltering? Our Scholastic BCG Matrix preview offers a glimpse into the strategic positioning of their offerings, categorizing them as Stars, Cash Cows, Dogs, or Question Marks.

Understand the dynamics driving their market share and growth potential at a glance. This initial overview hints at the crucial decisions the company must make to optimize its resources and capitalize on opportunities.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Don't miss out on the actionable intelligence that can transform your own business strategy. Unlock the full potential of strategic portfolio analysis today.

Stars

Scholastic's 2024 acquisition of 9 Story Media Group created a new Entertainment segment, a strategic move to bolster its media presence and IP monetization. This segment is anticipated to be a substantial revenue driver, with initial contributions already boosting Scholastic's Q1 FY25 earnings. The company is leveraging 9 Story's expertise to expand its reach across various platforms, including popular streaming services, tapping into a rapidly growing market.

Dav Pilkey's Dog Man series remains a powerhouse in children's publishing, solidifying its position as a star product for Scholastic. Its continued success, demonstrated by consistently topping bestseller lists, indicates high market share and strong growth potential. The release of 'Dog Man: Big Jim Begins' in December 2024 exemplifies Scholastic's ability to capitalize on this franchise's enduring popularity and market demand.

The graphic novel format, which Dog Man masterfully employs, is a significant driver of its success. This trend aligns perfectly with Scholastic's strategic focus on the expanding market for graphic novels in children's literature. This strategic alignment allows Scholastic to leverage the Dog Man series' appeal to capture a larger share of this growing segment.

The upcoming March 2025 release of Suzanne Collins' 'Sunrise on the Reaping,' the fifth installment in the Hunger Games saga, positions this franchise as a significant 'Star' for Scholastic within the BCG matrix. This new entry capitalizes on an established, globally recognized brand, tapping into a high-growth segment of the children's and young adult literature market.

Major releases from beloved franchises like Hunger Games consistently drive substantial pre-order numbers and immediate sales spikes, directly boosting Scholastic's revenue. For instance, the 2020 release of Collins' 'The Ballad of Songbirds and Snakes' generated over 1.5 million copies sold in its first week in North America alone, indicating the robust commercial power of new Hunger Games titles.

Digital-First Content Monetization (IP leveraging)

Scholastic is strategically increasing its digital content monetization by leveraging its intellectual property, particularly following the acquisition of 9 Story Media Group. This move is designed to capture revenue from advertising-supported platforms, a key component of their growth strategy.

The company has launched dedicated channels for popular franchises like 'The Magic School Bus' and 'Clifford Classic' on streaming services such as Tubi and YouTube. This digital-first approach directly addresses changing consumer viewing habits and broadens Scholastic's reach to new audiences.

- Digital Channel Growth: Scholastic's expansion onto platforms like Tubi and YouTube for 'The Magic School Bus' and 'Clifford Classic' exemplifies a commitment to digital-first IP monetization.

- Acquisition Synergies: The 9 Story Media Group acquisition is instrumental in enabling Scholastic to effectively manage and expand its IP across these new digital avenues.

- Advertising Revenue Focus: By establishing these digital channels, Scholastic aims to generate significant revenue through advertising, capitalizing on the broad reach of these platforms.

- Audience Expansion: This strategy is crucial for reaching younger demographics and a global audience that increasingly consumes content digitally, thereby extending the lifecycle and profitability of its beloved brands.

New Licensing Deals (e.g., Dora Books)

Scholastic's move into new licensing deals, exemplified by the upcoming Dora books in Fall 2025, positions them strategically in a high-growth segment. This leverages existing brand recognition and media tie-ins to attract a broad audience, even as Scholastic builds its market share within this specific product category. The potential for rapid expansion is significant due to the established popularity of characters like Dora. This strategy taps into a market where children are already familiar with and enthusiastic about the characters, reducing initial customer acquisition hurdles.

- Market Entry: Scholastic is entering a new market segment with the Dora books, aiming to capture a share of the lucrative licensed children's media publishing market.

- Growth Potential: The established popularity of the Dora brand suggests strong potential for rapid sales growth and market penetration for these new titles.

- Brand Synergy: Licensing deals like Dora capitalize on existing consumer affection for characters, creating immediate appeal and reducing the need for extensive brand building from scratch.

- Strategic Acquisition: Acquiring rights to popular media franchises allows Scholastic to diversify its portfolio and tap into proven demand, aligning with a growth-oriented business strategy.

Stars in the Scholastic BCG Matrix represent products or segments with high market share in a high-growth industry. These are the company's most promising ventures, requiring significant investment to maintain their leadership and capitalize on growth opportunities. Successful Stars can eventually become Cash Cows as market growth slows.

Scholastic's Dog Man series and the upcoming Hunger Games installment are prime examples of Stars. Their strong sales performance and the continued expansion of the graphic novel and YA literature markets indicate high growth potential and substantial market share. The company's strategic investments in these areas, including the acquisition of 9 Story Media Group to bolster its entertainment segment, underscore its commitment to nurturing these high-performing assets.

The acquisition of 9 Story Media Group, for instance, positions Scholastic to capitalize on the burgeoning entertainment market, an area of high growth where the company aims to establish significant market share. This strategic move, coupled with the continued success of franchises like Dog Man, highlights Scholastic's focus on identifying and investing in high-potential areas that can drive future revenue and market dominance.

| Product/Segment | Market Share | Market Growth | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Dog Man Series | High | High | Star | Continue investment for growth |

| Hunger Games Franchise (New Releases) | High | High | Star | Capitalize on brand loyalty and market demand |

| Entertainment Segment (Post 9 Story Acquisition) | Growing | High | Potential Star | Invest to gain market share and establish leadership |

| Licensed Books (e.g., Dora) | Developing | High | Question Mark (Potential Star) | Strategic investment to grow market share |

What is included in the product

Strategic analysis of Scholastic's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Identifies investment opportunities and divestment candidates based on market share and growth potential.

Quickly identify underperforming "Dogs" and reallocate resources from them.

Cash Cows

Scholastic Book Fairs are a definitive Cash Cow for Scholastic. The company aims to host 90,000 fairs in fiscal year 2025, demonstrating its continued commitment to this established revenue stream. Even with modest revenue growth per fair, the immense scale and deep integration within schools guarantee a reliable and substantial cash inflow.

This mature business benefits immensely from Scholastic's powerful brand recognition and its unique, proprietary distribution system directly within educational institutions. The Book Fairs capitalize on this established network, transforming a significant portion of their sales into consistent cash generation.

Scholastic's core children's book publishing and distribution, encompassing its extensive backlist of established titles, functions as a quintessential cash cow within its business portfolio. This segment, accounting for approximately two-thirds of Scholastic's overall revenue, represents a mature market where the company enjoys a substantial and enduring market share. These beloved, time-tested books continue to generate consistent sales and predictable earnings without necessitating significant new capital expenditure, thereby providing a reliable and substantial stream of cash flow.

Scholastic Book Clubs, after a strategic shift in fiscal 2024 towards a more focused and profitable core, demonstrated positive momentum and enhanced customer engagement throughout fiscal 2025.

This segment, characterized by its stable market share and dedicated customer base, continues to be a consistent contributor to Scholastic’s profitability, even without experiencing explosive growth.

The company's strategy for this channel centers on optimizing operational efficiency and maximizing the cash flow generated from this mature business unit.

For instance, Scholastic reported a 3% increase in direct-to-home sales through channels like Book Clubs in their Q3 fiscal 2025 earnings call, underscoring its reliable performance.

International Segment (major established markets)

Scholastic's International segment, focusing on established markets, acts as a reliable cash generator, contributing significantly to the company's operating margins. These mature operations are expected to see modest growth, leveraging Scholastic's strong global brand presence and well-developed distribution networks.

Recent performance highlights include continued revenue generation from these core international markets. For fiscal year 2024, Scholastic reported that its International segment, which includes major established markets, remained a stable revenue contributor.

- Revenue Contribution: The international segment consistently generates substantial revenue for Scholastic, underpinning its financial stability.

- Operating Margins: These established markets are key to maintaining healthy overall operating margins due to efficient operations and brand strength.

- Modest Growth Expectations: While not high-growth, these segments are anticipated to experience steady, albeit modest, revenue increases.

- Operational Efficiency: Initiatives, like those seen in the Canadian market, focus on streamlining operations to boost cash flow from these mature regions.

Classic Scholastic Brands (e.g., Clifford, Magic School Bus)

Classic Scholastic brands, such as Clifford the Big Red Dog and The Magic School Bus, function as established Cash Cows within Scholastic's portfolio. These enduring franchises generate consistent, reliable income through various avenues, including ongoing book sales, licensing for merchandise, and content re-runs. Their deep-rooted presence in popular culture ensures a high market share in the evergreen content segment, requiring relatively low ongoing investment.

Scholastic's efforts to digitize these brands, like the Stars digital platform, aim to further monetize these established assets. The enduring appeal of these characters and educational narratives across multiple generations solidifies their position as low-risk, high-return revenue generators. For instance, in fiscal year 2023, Scholastic reported continued strength in its Children's Book Publishing segment, which heavily features these iconic brands, contributing significantly to overall company revenue.

- High Market Share: Dominant presence in nostalgic and evergreen children's content.

- Consistent Revenue: Stable income from book sales, merchandising, and media rights.

- Low Investment: Minimal new capital required for maintenance and continued popularity.

- Brand Loyalty: Strong recognition and affection across multiple generations of readers.

Cash Cows represent mature businesses within Scholastic's portfolio that generate more cash than they consume, requiring minimal investment to maintain their strong market position. These segments leverage established brand loyalty and efficient operations to deliver consistent profitability.

Scholastic's core children's book publishing, including its extensive backlist of established titles, is a prime example. This segment, which accounts for a significant portion of overall revenue, benefits from a substantial and enduring market share. These beloved, time-tested books continue to generate predictable earnings without needing substantial new capital, providing a reliable cash stream.

The Book Fairs, with their immense scale and deep integration into schools, also function as a definitive cash cow. Scholastic aims to host 90,000 fairs in fiscal year 2025, underscoring their commitment to this established revenue stream.

| Business Segment | Market Position | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Children's Book Publishing (Backlist) | High, Mature Market Share | High, Predictable | Low |

| Book Fairs | Dominant in Educational Channel | High, Consistent | Low to Moderate (for scale) |

| Classic Brands (e.g., Clifford) | Strong Evergreen Presence | High, Diversified (sales, licensing) | Low |

Delivered as Shown

Scholastic BCG Matrix

The Scholastic BCG Matrix preview you are viewing is the identical, fully polished document you will receive immediately after purchase. Rest assured, there are no watermarks or placeholder content; this is the complete, professionally formatted strategic tool ready for your immediate application.

Dogs

The Supplemental Literacy Curriculum, a traditional offering within Scholastic's portfolio, saw its revenue shrink significantly in fiscal 2025. This downturn reflects reduced spending by school districts, a direct consequence of shifting federal education policies.

This segment operates in a low-growth market, and Scholastic's share within it has contracted. The company's decision to conduct a strategic review signals that this business unit is being considered for restructuring or even divestiture.

Within Scholastic's extensive library, numerous older backlist titles, often lacking franchise power, are currently experiencing very low sales. These books, while holding sentimental value, represent a drag on resources. For instance, in the fiscal year ending February 2024, Scholastic's inventory management costs are a significant factor in their operational expenses, and titles with negligible sales contribute to these costs without offsetting them through revenue.

These underperforming books are typically found in a low-growth segment of the market, holding a consequently low market share. Their presence ties up capital and warehouse space that could be allocated to more promising titles or new acquisitions. Scholastic's strategy often involves evaluating such backlist titles for potential delisting or reduced print runs to streamline operations and cut carrying costs.

Certain international retail channels, particularly those in Asia and Australia, have experienced a downturn in sales. This underperformance is attributed to a general softness within their respective retail markets.

If these specific geographic or channel operations consistently lag behind, possessing both low market share and low growth potential, they can be classified as Dogs within the BCG Matrix. For instance, Scholastic's Australian retail segment might be facing challenges, contributing to overall underperformance.

These underperforming segments may not be generating enough revenue to justify the ongoing operational and marketing investments. In 2024, the global retail sector continued to navigate economic uncertainties, impacting sales across various regions.

Outdated Classroom Libraries and Guided Reading Collections

Older classroom libraries and guided reading collections, especially those that don't incorporate modern teaching methods like the science of reading, are seeing less interest. This means they are in a slow-growing market, becoming less relevant, and likely losing market share for Scholastic.

Scholastic is phasing out these older collections, planning to introduce new knowledge-building libraries and decodable sets instead. This strategic shift highlights the declining appeal and increasing obsolescence of their current inventory in this category.

For example, in 2024, the broader educational publishing market for early literacy materials saw a shift towards evidence-based phonics and decodable texts, with publishers investing less in traditional leveled readers that may not align with current research. Scholastic's move reflects this industry-wide trend, impacting their product portfolio.

- Declining Demand: Older collections not aligned with the science of reading face reduced adoption.

- Low-Growth Segment: This product category represents a market with minimal expansion.

- Strategic Replacement: Scholastic is actively developing new, more relevant literacy resources.

- Market Relevance: The company is adapting its offerings to meet evolving educational standards and practices.

Legacy School Reading Event Models (low revenue per fair)

While Scholastic's overall Book Fairs are a strong performer, certain legacy or smaller fair models can be categorized as dogs within the BCG matrix due to their low revenue per event and limited growth potential. These smaller-scale events, often designed for specific school sizes or communities, may not generate the same level of sales as larger, more established fairs. For instance, a fair held in a very small elementary school with a limited student population might naturally bring in less revenue, even with strong community engagement.

These "dog" segments can tie up valuable resources, such as staffing, inventory management, and logistical support, without delivering a proportional return on investment. Scholastic's focus in recent years has been on optimizing its larger, more profitable fair formats, potentially leading to less emphasis on these smaller, lower-yield events. The challenge lies in balancing the desire to serve all schools with the economic realities of event profitability.

- Low Revenue per Event: Smaller school sizes and limited student participation inherently cap the revenue potential of these legacy fairs.

- Limited Growth Prospects: The demographic or geographic constraints of these locations often restrict opportunities for significant sales expansion.

- Resource Allocation: Staff time, inventory, and operational costs may not be efficiently utilized when the return per fair is consistently low.

- Strategic Re-evaluation: Scholastic may need to assess whether continuing to support these lower-revenue models aligns with overall business strategy, especially when compared to the success of its flagship fairs.

Dogs in Scholastic's portfolio represent business units or product lines with low market share in a low-growth industry. These segments often consume resources without generating significant returns, necessitating careful strategic evaluation. For instance, certain older backlist titles with minimal sales, or specific underperforming international retail channels, exemplify these "dog" classifications.

These underperforming areas, such as older classroom libraries that don't align with current teaching methodologies, are being phased out by Scholastic. The company's strategy involves replacing them with newer, more relevant educational materials, reflecting a move away from stagnant market segments.

Scholastic's Book Fairs, while generally strong, include smaller, legacy models that can be considered dogs. These events, characterized by low revenue per event and limited growth potential due to factors like school size, tie up resources that could be better allocated to more profitable ventures.

The financial implication for these "dog" segments is their inability to contribute meaningfully to overall profitability. In 2024, Scholastic's inventory management costs, for example, are impacted by slow-moving older titles, highlighting the drag these products can impose on operational efficiency.

Question Marks

Scholastic is launching new structured literacy programs for the 2025-2026 school year, targeting a rapidly expanding digital education and curriculum market. These initiatives are positioned as potential high-growth stars within Scholastic's portfolio.

The development of these programs reflects a strategic move to capture a share of the growing demand for evidence-based literacy instruction, with the U.S. K-12 literacy market projected to reach $28.7 billion by 2027. Scholastic's investment in this area acknowledges the evolving needs of school districts and the shift towards more comprehensive, digitally integrated learning solutions.

As these are new offerings, Scholastic's current market share in this specific segment is negligible, necessitating substantial upfront investment in marketing, development, and sales to establish a foothold. This aligns with the characteristics of a 'question mark' in the BCG matrix, requiring careful resource allocation to determine future market position.

Developing entirely new, interactive, and technology-integrated educational content platforms, such as AI-powered or AR educational tools, represents a significant investment for Scholastic.

The digital learning market is experiencing rapid expansion, with projections indicating it will reach $350 billion by 2025, highlighting a substantial growth opportunity.

Any new ventures by Scholastic in this dynamic and competitive digital learning space would likely begin with a low market share, characteristic of a question mark in the BCG matrix.

These initiatives are expected to consume considerable cash in their early stages, but they hold the promise of substantial future growth and market leadership if they achieve successful adoption and scalability.

Scholastic is developing innovative partnerships with philanthropic foundations, aiming to significantly boost book access for children in underserved communities. This strategic move targets a high-need market with substantial growth prospects, leveraging alternative funding streams to expand their reach.

These new models, while promising, are currently in their early phases, representing a minimal portion of Scholastic's total distribution. For instance, in 2024, philanthropic partnerships contributed less than 1% to Scholastic's overall revenue, indicating a nascent but promising growth avenue.

Specific New IP/Media Productions in Development

Scholastic is actively expanding its media production pipeline beyond its existing partnerships, focusing on developing entirely new intellectual properties (IP) and media productions. These ventures are positioned within the high-growth entertainment market, but as new creations, they currently hold a low or negligible market share.

Significant investment is being channeled into the development and production phases of these new IPs, reflecting the inherent uncertainty in their potential returns. However, this investment strategy is driven by the ambition for these properties to emerge as future market leaders, often referred to as Stars in the BCG matrix framework.

By 2024, the global media and entertainment market was projected to reach over $2.5 trillion, underscoring the vast potential for new IP to capture significant market share. Scholastic's commitment to this segment involves substantial upfront capital expenditure with the expectation of high future rewards should these productions resonate with audiences and achieve commercial success.

The current focus on new IP development aligns with a strategy to diversify Scholastic's revenue streams and build a portfolio of future entertainment franchises. These projects are essential for long-term growth, aiming to replicate the success of established brands by cultivating new, engaging content.

- New IP Development: Scholastic is investing in the creation of fresh intellectual properties for media production.

- High-Growth Market Focus: These productions target the dynamic and expanding entertainment industry.

- Low Initial Market Share: As new ventures, they begin with minimal to no established market presence.

- Significant Investment Required: Substantial capital is allocated for development and production, facing uncertain outcomes.

- Potential for Future Stars: The strategy aims to cultivate these IPs into successful, high-performing franchises.

Expansion into Niche Graphic Novel Genres (e.g., specific Manga titles)

Scholastic's Graphix imprint is strategically venturing into niche graphic novel genres, notably manga, tapping into a significant growth area within children's publishing. This expansion positions these new, specific manga titles as potential stars in the future, mirroring the overall success of the graphic novel market which saw a 30% increase in sales in 2023 alone, reaching $2.7 billion in the US market.

Within the BCG Matrix framework, these new manga ventures would initially be classified as question marks. Despite the burgeoning popularity of manga, individual titles or specific sub-genres within Scholastic's new offerings would likely start with a relatively low market share compared to established graphic novel categories.

These undertakings represent speculative investments for Scholastic. Significant marketing and promotional efforts will be crucial to build brand awareness and establish a foothold in a market that is both competitive and rapidly expanding, with manga sales projected to continue their upward trajectory through 2024 and beyond.

- Market Entry: Scholastic's Graphix imprint is entering the manga market, a segment experiencing substantial growth in children's publishing.

- BCG Classification: New manga titles are positioned as question marks due to their initial low market share in a growing, yet competitive, segment.

- Investment Rationale: These ventures require focused marketing to build presence and capitalize on the high-growth potential of manga.

- Market Context: The overall graphic novel market demonstrated robust growth, with US sales reaching $2.7 billion in 2023, indicating a favorable environment for expansion.

Question Marks represent business units or products with low market share in high-growth industries. Scholastic's new structured literacy programs exemplify this, aiming for a share of the rapidly expanding digital education market, projected to reach $350 billion by 2025.

These initiatives, while promising significant future returns, require substantial upfront investment in development and marketing, mirroring the typical resource needs of question marks. Their current market share is negligible, necessitating strategic allocation of capital to foster growth.

Scholastic's foray into new intellectual property development for media production also fits the question mark profile. The global media and entertainment market, valued at over $2.5 trillion in 2024, offers immense growth potential, but new IPs start with minimal market penetration.

The Graphix imprint's entry into the manga publishing sector is another example. Despite the overall graphic novel market's robust growth, with US sales reaching $2.7 billion in 2023, individual new manga titles begin with a low market share, demanding focused marketing to gain traction.

| Scholastic Business Unit/Product | Industry Growth Rate | Market Share | BCG Classification | Strategic Consideration |

|---|---|---|---|---|

| Structured Literacy Programs | High (Digital Education Market: $350B by 2025) | Low/Negligible | Question Mark | Invest for growth, monitor potential |

| New Intellectual Property (IP) Development | High (Global Media & Entertainment: >$2.5T in 2024) | Low/Negligible | Question Mark | Invest cautiously, aim for future Stars |

| Manga Publishing (Graphix) | High (Graphic Novels: $2.7B US sales in 2023) | Low/Negligible | Question Mark | Build awareness, targeted promotion |

BCG Matrix Data Sources

Our Scholastic BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.