Rithm Capital PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rithm Capital Bundle

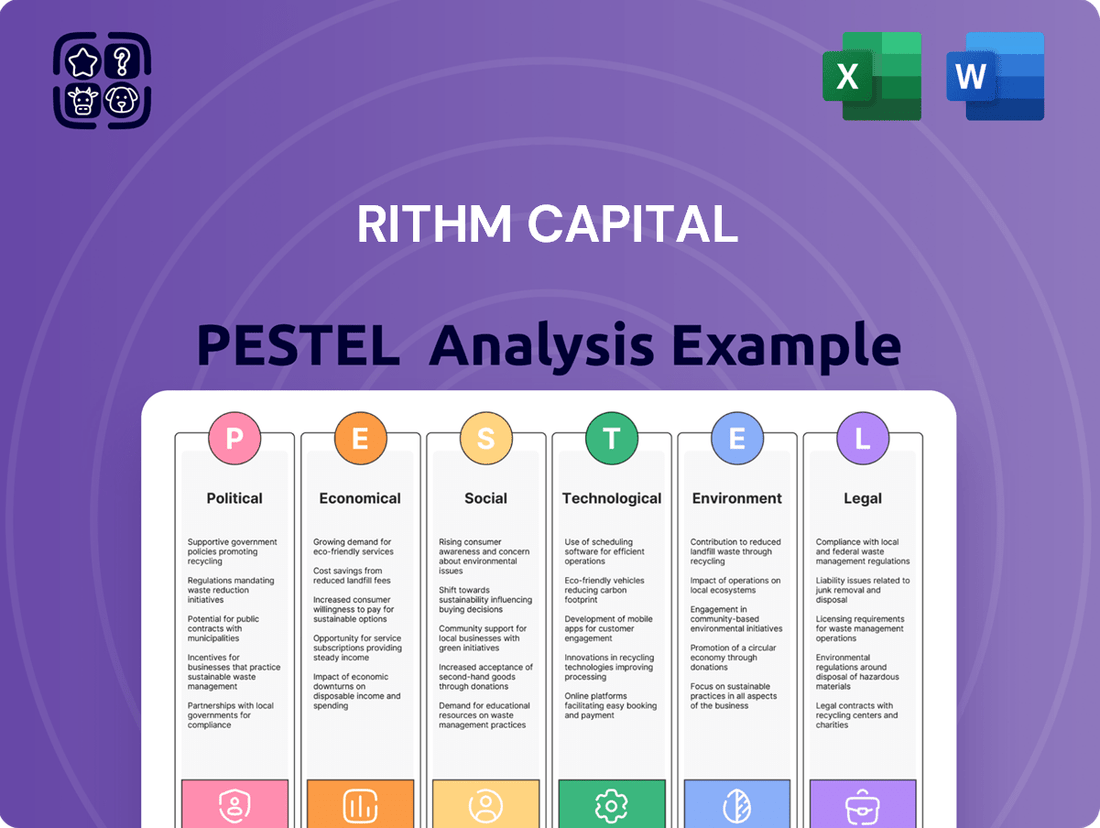

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Rithm Capital. Discover how external forces, from evolving economic policies to shifting technological landscapes, are shaping the company’s future. Use these insights to strengthen your own market strategy and anticipate competitive moves.

Understand how political stability, economic growth, and technological advancements directly impact Rithm Capital's performance and investment opportunities. This ready-made PESTEL Analysis delivers expert-level insights, perfect for investors, consultants, and business planners seeking a competitive advantage.

Whether you're building a robust business plan or analyzing the competitive landscape, our PESTEL Analysis of Rithm Capital offers comprehensive, up-to-date market intelligence, ready to use and fully editable. Download now and gain the clarity you need to make informed decisions.

Our professionally prepared PESTEL Analysis goes beyond surface-level observations. Explore how real external trends, including social demographics and environmental regulations, are impacting Rithm Capital's operations and long-term strategy. Get the full analysis instantly.

From navigating complex regulatory frameworks to capitalizing on emerging social trends, this PESTEL Analysis provides the complete external landscape shaping Rithm Capital. Download the complete version to access deep-dive insights you can’t afford to miss for strategic planning.

Political factors

Government housing policies, including ongoing discussions around government-sponsored enterprise (GSE) reform, directly influence Rithm Capital's mortgage investment and servicing segments. Shifts in the roles of Fannie Mae and Freddie Mac, for example, could alter capital requirements and market access for non-bank servicers, impacting Rithm's over $1 trillion in servicing rights as of early 2025. New affordable housing initiatives, such as expanded down payment assistance programs, could create fresh opportunities for loan origination and servicing by increasing the pool of eligible borrowers. Conversely, changes in regulatory oversight or increased compliance burdens, potentially stemming from new consumer protection policies, could introduce operational risks and higher costs for Rithm's diverse financial services portfolio.

Rithm Capital, as a significant entity in mortgage and real estate finance, navigates a complex regulatory landscape. Anticipated adjustments to consumer protection laws, such as potential updates from the CFPB concerning mortgage servicing in 2025, directly influence Rithm's operational framework and profitability. Changes in capital requirements for financial institutions, including ongoing discussions around Basel III Endgame proposals impacting lending partners, necessitate Rithm's adaptive strategies. Heightened regulatory scrutiny within the mortgage sector, a consistent trend, demands robust compliance protocols and proactive risk management to maintain operational stability and market standing.

Changes in corporate tax rates, currently at 21% under the Tax Cuts and Jobs Act, directly impact Rithm Capital's profitability. As a Real Estate Investment Trust, Rithm benefits from specific tax provisions, notably the ability to deduct dividends paid to shareholders, largely avoiding corporate income tax if 90% of taxable income is distributed. Any legislative modifications to these REIT rules or the 20% qualified business income deduction for pass-through entities could significantly alter Rithm's financial structure and shareholder returns. The company continuously monitors potential tax law shifts, such as discussions around future corporate tax rate adjustments, to optimize its operational efficiency and maximize investor value.

Geopolitical and Trade Relations

While Rithm Capital primarily focuses on the U.S. market, global geopolitical events and international trade relations can indirectly affect its operations. For instance, worldwide economic instability, such as that seen with ongoing supply chain reconfigurations in early 2025, can influence U.S. interest rates and capital flows, impacting the broader financial markets Rithm operates within. Furthermore, evolving trade policies might affect the cost of materials for new construction, potentially influencing the housing market and Rithm's mortgage and real estate segments.

- Global economic forecasts for 2025 indicate continued volatility, potentially affecting capital availability.

- U.S. Federal Reserve interest rate decisions through late 2024 and early 2025 are highly sensitive to international economic signals.

- Trade tariffs on building materials, like steel or lumber, can increase construction costs, impacting housing affordability into 2025.

- Cross-border investment trends in real estate, influenced by geopolitical stability, may shift capital flows relevant to Rithm.

Political Stability and Elections

The political climate, especially with the US presidential election in November 2024, introduces significant shifts in economic policy and regulatory priorities. Uncertainty surrounding election outcomes can lead to considerable volatility in financial markets, directly impacting Rithm Capital's diversified portfolio. A change in administration could usher in new approaches to housing finance, such as reforms affecting Fannie Mae and Freddie Mac, or revised financial regulations from bodies like the CFPB. Such policy shifts would necessitate strategic adjustments for Rithm's mortgage origination, servicing, and investment activities, influencing its profitability and growth outlook for 2025.

- The November 2024 US Presidential Election creates policy uncertainty for Rithm Capital.

- Potential shifts in housing finance policy could impact mortgage market dynamics into 2025.

- Regulatory changes from agencies like the CFPB may alter Rithm's operational landscape.

- Market volatility linked to political outcomes can influence Rithm Capital's asset valuations.

The upcoming US presidential election in November 2024 introduces significant policy uncertainty, potentially reshaping housing finance and regulatory environments for Rithm Capital. Anticipated shifts in government-sponsored enterprise reform and consumer protection from agencies like the CFPB could alter market dynamics and operational costs by 2025. Corporate tax rate discussions, currently at 21%, also pose a key political risk or opportunity for Rithm's profitability. Geopolitical events indirectly influence capital flows and interest rates, impacting Rithm's over $1 trillion in servicing rights.

| Factor | Relevance (2024/2025) | Potential Impact | ||

|---|---|---|---|---|

| US Election | November 2024 | Policy shifts, market volatility | ||

| Corporate Tax Rate | Current 21% | Profitability, REIT structure | ||

| CFPB Regulations | Expected 2025 updates | Servicing costs, compliance |

What is included in the product

This Rithm Capital PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic positioning.

It provides actionable insights into market dynamics and regulatory landscapes, empowering stakeholders to identify both risks and avenues for growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Rithm Capital's strategic discussions.

Economic factors

Interest rate fluctuations are a primary economic driver for Rithm Capital. As the Federal Funds Rate held near 5.25%-5.50% in early 2024, higher rates generally increased the value of the company's mortgage servicing rights (MSRs). However, this elevated rate environment, with 30-year fixed mortgage rates often above 6.5% in early 2024, simultaneously dampened mortgage origination volumes as borrowing became more expensive for consumers. Conversely, a projected decline in rates in late 2024 or 2025 could spur an increase in refinancing activity, which would generate new business, but might also lead to a runoff of existing MSRs as prepayments accelerate. Therefore, Rithm's performance is highly sensitive to the Federal Reserve's monetary policy decisions and market rate movements.

The health of the U.S. housing market is crucial for Rithm Capital's success. Factors like home price appreciation, housing inventory levels, and the pace of home sales directly impact mortgage demand and the value of Rithm's real estate-related assets. For instance, the average 30-year fixed mortgage rate is projected to trend towards 6.5% by late 2024, potentially boosting affordability. Forecasts for 2025 suggest a gradual improvement, with existing home sales potentially reaching 4.8 million units, which could significantly benefit Rithm's various business lines.

Broader economic conditions significantly impact Rithm Capital, as inflation and GDP growth shape consumer confidence and employment. High inflation, like the 3.3% year-over-year CPI in May 2024, can strain household budgets, potentially increasing mortgage delinquencies, though Q1 2024 saw rates at a low 3.22%. Conversely, a robust economy with a projected 2.0-2.5% GDP growth for 2024 generally fosters a healthy housing market. This supports strong demand for Rithm Capital's financial products, ensuring borrowers can meet their obligations. Continued economic stability into 2025 is crucial for sustained portfolio performance.

Mortgage Market Trends

The overall volume of mortgage originations, including both purchase and refinance activity, directly impacts Rithm Capital's revenue from its platforms. Projections for 2025 indicate a rise in mortgage originations, with the Mortgage Bankers Association forecasting a total of $2.24 trillion, up from an estimated $1.64 trillion in 2024. The competitive landscape within the mortgage industry significantly influences pricing and profitability margins for firms like Rithm.

- 2025 mortgage originations are projected to reach $2.24 trillion.

- Purchase originations are expected to be $1.66 trillion in 2025.

- Refinance activity is forecast at $580 billion for 2025.

- The 2024 total mortgage origination volume is estimated at $1.64 trillion.

Credit Market Conditions

Credit market conditions significantly influence Rithm Capital's ability to finance its diverse investments and operations. The availability and cost of capital directly impact their profitability, especially as spreads on mortgage-backed securities (MBS) and other credit-sensitive assets are central to their returns. For instance, tighter lending standards or elevated benchmark rates, such as the Secured Overnight Financing Rate (SOFR) hovering around 5.3% in mid-2024, can increase Rithm's borrowing costs. Disruptions, like those seen in early 2020, can sharply reduce liquidity and elevate borrowing costs across the financial sector, directly affecting institutions reliant on robust credit markets.

- In Q1 2024, Rithm Capital reported a significant portion of its portfolio in credit-sensitive assets, underscoring market spread impact.

- The Federal Reserve's monetary policy, including interest rate decisions, directly shapes Rithm's cost of funds.

- Access to diverse financing channels, including securitization markets, remains crucial for managing liquidity risk.

Rithm Capital's performance is critically tied to interest rates and U.S. housing market health. While 30-year fixed mortgage rates near 6.5% in early 2024 impact origination, 2025 forecasts project increased home sales and $2.24 trillion in mortgage originations. Broader economic stability and credit market conditions directly influence Rithm's asset values and borrowing costs, shaping profitability.

| Economic Factor | 2024 Data/Trend | 2025 Projection |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% | Potential decline |

| Mortgage Originations | $1.64 Trillion (est.) | $2.24 Trillion |

| Existing Home Sales | Dampened | 4.8 Million Units |

What You See Is What You Get

Rithm Capital PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Rithm Capital PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Rithm Capital's strategy and future growth. This detailed report provides actionable insights derived from thorough research.

Sociological factors

Trends in US population growth, projected to reach approximately 338 million by mid-2025, and consistent household formation, estimated at 1.2-1.5 million new households annually through 2025, directly influence long-term housing demand. As younger generations like Gen Z, with a growing share of first-time homebuyers, increasingly enter the housing market by 2025, demand for tailored mortgage products will shift. Rithm Capital must adapt its offerings to these demographic changes, including the aging population and diverse household structures. Understanding these shifts is crucial for Rithm to meet the evolving needs of its customer base and maintain market relevance.

Societal aspirations for homeownership heavily influence mortgage demand, yet affordability remains a significant hurdle. While homeownership is a core desire for many, rising home prices, like the median existing-home price of $407,600 in April 2024, coupled with elevated interest rates nearing 7.02% for a 30-year fixed mortgage by mid-2024, have constrained market entry. This dynamic directly impacts the volume and types of loans Rithm Capital originates and services. Consequently, the pool of eligible borrowers may shrink, shifting demand towards more accessible or government-backed loan products.

Changes in consumer financial behavior significantly impact the mortgage sector. The US personal saving rate, recorded at 3.2% in March 2024, reflects evolving financial resilience, while total household debt reached $17.69 trillion in Q1 2024, influencing borrowing capacity. A growing preference for digital financial services, with over 60% of mortgage applications initiated online in 2024, necessitates technological investment. Rithm Capital must enhance its digital platforms for mortgage applications and servicing to meet these evolving consumer expectations and maintain competitiveness.

Geographic Population Movements

Geographic population movements significantly shape Rithm Capital's market landscape. Shifts, such as the continued migration from dense urban centers to suburban and exurban areas, as seen with over 400,000 people relocating to Sun Belt states in 2023, directly alter regional housing market dynamics. These trends create new growth opportunities for Rithm in expanding markets like Florida and Texas while potentially dampening activity in historically strong but now declining areas. Monitoring these demographic shifts is crucial for strategic resource allocation and identifying emerging investment hotspots. For instance, the demand for single-family rentals has surged in suburban corridors.

- Interstate migration saw states like Florida gain over 250,000 residents in 2023.

- Suburban housing demand remains elevated, with median home prices in many suburban areas outpacing urban cores in early 2024.

- Remote work continues to fuel relocations to more affordable, less dense regions.

- Rithm Capital must adapt its portfolio strategy to align with these evolving demographic patterns.

Social Responsibility and ESG Investing

Investors and the public are increasingly prioritizing environmental, social, and governance (ESG) factors. For Rithm Capital, operating in real estate finance, this means focusing on fair lending practices and robust community investment initiatives. A strong ESG profile, including assessing the environmental impact of financed properties, enhances corporate reputation and attracts capital. Sustainable investment assets are projected to exceed $50 trillion globally by 2025, underscoring this trend.

- ESG-focused funds attracted over $100 billion in inflows in 2023, signaling sustained investor interest.

- Companies with strong ESG ratings often exhibit lower capital costs and enhanced market valuation.

Sociological factors reshape Rithm Capital's market through demographic shifts, with the US population nearing 338 million by mid-2025 driving evolving housing demand, particularly from Gen Z. Homeownership aspirations remain strong, yet affordability is challenged by median home prices at $407,600 in April 2024 and mortgage rates near 7.02% by mid-2024. Consumer financial behaviors, including a 3.2% saving rate in March 2024 and over 60% online mortgage applications, necessitate digital adaptation. Geographic population movements, such as the 400,000 people relocating to Sun Belt states in 2023, create new regional market opportunities for Rithm.

| Factor | 2024/2025 Data | Impact on Rithm |

|---|---|---|

| US Population Growth | ~338 million by mid-2025 | Influences long-term housing demand |

| Median Home Price | $407,600 (April 2024) | Affects affordability and loan volume |

| 30-Year Mortgage Rate | ~7.02% (mid-2024) | Constrains market entry for borrowers |

| Online Applications | >60% (2024) | Necessitates digital platform investment |

Technological factors

The mortgage industry is undergoing a significant digital transformation, with an estimated 70% of mortgage applications projected to involve substantial digital components by mid-2025. Rithm Capital's ability to invest in and leverage technology, such as AI-driven automation within platforms like Newrez, is crucial for streamlining mortgage origination and servicing processes. This integration is vital for improving efficiency, potentially reducing average loan origination costs which exceeded $9,500 per loan in early 2024, and enhancing the customer experience. The widespread adoption of digital tools by consumers, with over 65% preferring a fully or mostly digital mortgage process by 2024, is a primary driving force behind this ongoing trend. Future strategic investments in these platforms are key for competitive advantage.

Advancements in artificial intelligence are increasingly transforming the mortgage industry, with applications spanning underwriting, fraud detection, and customer service. Rithm Capital's strategic investments in AI can lead to more accurate risk assessments, potentially reducing default rates and enhancing profitability. For instance, AI-driven models can process loan applications 30% faster than traditional methods, improving operational efficiencies. The continued development of AI presents significant opportunities for personalized customer interactions, necessitating ongoing investment to maintain competitive advantage in the rapidly evolving financial landscape through 2025.

The ability to harness data analytics and big data is a critical competitive advantage for Rithm Capital in the evolving financial landscape of 2024/2025. By leveraging sophisticated data models, Rithm can identify emerging market trends and assess intricate investment opportunities with greater precision. This analytical edge also significantly enhances risk management, for instance, by predicting borrower behavior more accurately. Such data-driven insights are crucial for optimizing portfolio performance and maintaining a competitive edge in sectors like mortgage origination and servicing, where data volume is immense. The financial industry's investment in AI and big data analytics is projected to grow substantially, further emphasizing this strategic imperative.

Cybersecurity Threats

Rithm Capital, as a financial services firm, consistently faces advanced cybersecurity threats targeting sensitive customer data. The company must continually allocate significant capital to fortify its digital defenses, with projected spending on cybersecurity for financial institutions expected to rise by 15-20% in 2024-2025 to counter evolving risks. A successful breach could incur substantial financial losses, potentially exceeding tens of millions in remediation costs, severe reputational damage, and significant regulatory fines, such as those imposed under New York's DFS Cybersecurity Regulation, making robust security a paramount technological investment.

- Global average cost of a data breach in financial services reached $5.97 million in 2023, with projections for 2024-2025 indicating further increases.

- Regulatory penalties for data breaches can be severe, with GDPR fines alone reaching €1.7 billion as of Q1 2024 across all sectors.

- Investment in AI-powered cybersecurity solutions is a key trend, with market growth expected to reach $60 billion by 2028.

Fintech Competition and Collaboration

The rise of financial technology (fintech) companies presents both competitive challenges and collaboration opportunities for Rithm Capital within the mortgage sector. By mid-2025, the fintech market is projected to exceed $300 billion globally, intensifying the need for traditional players to innovate. Rithm can acquire or partner with fintech startups, enhancing its technological capabilities and expanding its product offerings, such as AI-driven underwriting or blockchain-based mortgage processes. Staying abreast of the latest fintech developments, like the growth in digital mortgage originations which are expected to comprise over 60% of the market by 2025, is essential for Rithm to maintain a competitive edge and drive efficiency.

- Fintech market projected to exceed $300 billion globally by mid-2025.

- Digital mortgage originations expected to comprise over 60% of the market by 2025.

- Potential for Rithm to acquire or partner with innovative fintech startups.

Rithm Capital must prioritize digital transformation, with over 70% of mortgage applications projected to be digital by mid-2025, to streamline operations and enhance customer experience. Strategic investments in AI and robust data analytics are crucial for improving risk assessment and optimizing portfolio performance, potentially reducing loan processing times by 30%. Mitigating escalating cybersecurity threats, with financial institutions' spending projected to rise by 15-20% in 2024-2025, is essential to avoid significant financial and reputational damage. Engaging with the rapidly growing fintech market, expected to exceed $300 billion by mid-2025, through innovation or partnerships is vital for competitive advantage.

| Technological Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Digital Transformation | Operational Efficiency, Customer Experience | 70% mortgage applications digital by mid-2025 |

| AI & Data Analytics | Risk Assessment, Processing Speed | 30% faster loan processing with AI |

| Cybersecurity | Data Protection, Financial Stability | 15-20% rise in financial cybersecurity spending |

Legal factors

Rithm Capital and its subsidiaries must strictly comply with a vast array of federal and state consumer protection laws, particularly those enforced by the CFPB, ensuring fair practices in mortgage origination and servicing. This encompasses regulations like RESPA and TILA, which significantly impact their operations. The evolving legal landscape, including potential new rules in 2024-2025 concerning data privacy or lending standards, necessitates continuous updates to their compliance frameworks. Non-compliance could lead to substantial penalties, impacting their 2025 financial outlook.

The mortgage industry, where Rithm Capital operates, frequently faces litigation, including consumer class-action lawsuits and regulatory enforcement actions. Rithm, through its lending and servicing subsidiaries like Newrez, is exposed to legal disputes concerning practices such as loan origination and servicing. For instance, the Consumer Financial Protection Bureau (CFPB) continues its vigilant oversight; in fiscal year 2023 alone, the CFPB secured over $1.7 billion in consumer relief, with mortgage-related issues contributing significantly. Such legal challenges can result in substantial financial penalties and severe reputational damage, impacting Rithm Capital's operational stability and market perception through 2024 and 2025.

Rithm Capital's operations are deeply intertwined with real estate, making it highly susceptible to state and local property laws, including those governing foreclosures and title validity. Shifts in these legal frameworks directly influence the company's capacity to enforce its rights as a mortgage lender and servicer. Recent legal scrutiny in 2024 has intensified around issues like deed theft and the status of dormant 'zombie' second mortgages. For instance, New York enacted stricter deed theft prevention measures in late 2023, impacting property transfer processes. Such legislative changes, particularly those affecting foreclosure timelines or borrower protections, can alter Rithm's portfolio risk and servicing efficiency.

Securitization and Capital Markets Regulations

As an active issuer of mortgage-backed securities (MBS), Rithm Capital must strictly adhere to evolving securities laws governing the securitization process. These regulations, like those enforced by the SEC, aim to protect investors and ensure transparency within capital markets. For instance, the SEC’s 2024 agenda continues to prioritize robust disclosure requirements for complex financial products. Any changes to securitization regulations directly impact Rithm’s ability to raise capital and manage its substantial investment portfolio, which exceeded $34 billion in assets as of Q1 2025.

- Regulatory compliance ensures Rithm’s continued access to capital markets for funding.

- Potential 2025 SEC rule adjustments could alter MBS issuance costs.

- Investor confidence relies heavily on transparent securitization practices.

- Changes in Basel III capital rules for banks may indirectly affect MBS demand.

Data Privacy and Security Laws

Rithm Capital faces a complex landscape of data privacy and security laws, which are continuously expanding globally. These regulations, such as the GDPR in Europe or the CCPA/CPRA in California, dictate how customer information is collected, used, and safeguarded. Non-compliance is a significant risk, with potential fines reaching billions of dollars, as seen with some tech giants. The company must invest heavily in robust compliance frameworks to mitigate these legal and financial exposures.

- Global data privacy fines collectively exceeded $2 billion in 2023.

- The average cost of a data breach is projected to reach $5.2 million by 2025 for financial services.

- Over 15 US states have enacted comprehensive data privacy laws as of early 2024.

- Financial institutions face stringent data protection requirements under regulations like GLBA.

Rithm Capital navigates a complex legal framework, facing stringent consumer protection and securities regulations. Evolving data privacy laws, with global fines exceeding $2 billion in 2023, mandate robust compliance. Litigation risks, including CFPB actions, and shifts in state-level property laws directly impact operations and financial stability through 2025.

| Legal Area | Key Risk | 2024/2025 Impact |

|---|---|---|

| Consumer Protection | Regulatory Fines | CFPB vigilance continues |

| Data Privacy | Breach Costs | Projected $5.2M by 2025 |

| Securities Law | Compliance Burden | SEC 2024 disclosure focus |

Environmental factors

Climate change presents significant physical risks to the real estate assets that collateralize Rithm Capital's mortgage investments. The increasing frequency and severity of natural disasters, such as the estimated $100 billion in global insured losses from natural catastrophes in 2023, directly threaten property values. Events like intensifying hurricanes and widespread wildfires can lead to extensive property damage, escalating repair costs, and a rise in mortgage defaults. Proactive assessment and management of these physical risks are becoming critical considerations for portfolio resilience.

The transition to a low-carbon economy creates significant shifts for real estate finance, impacting Rithm Capital. There is increasing demand for financing energy-efficient green buildings, which can command rental premiums of 7% to 10% and higher asset values by 2025. Conversely, properties with poor environmental performance face devaluation and increased operating costs due to evolving regulations and carbon pricing. This necessitates strategic investment in sustainable assets to mitigate risks and capitalize on market opportunities.

A growing body of environmental regulations at federal, state, and local levels significantly impacts Rithm Capital's property portfolio. These mandates, including new energy efficiency standards effective in 2024 for commercial buildings and water conservation requirements, directly influence property management. Compliance with evolving waste management protocols, like those becoming stricter in major metros, can elevate operating costs. For instance, achieving 2025 energy efficiency benchmarks could necessitate capital expenditures, affecting the value of underlying real estate assets. This regulatory landscape demands ongoing strategic adaptation to maintain asset performance and value.

Investor and Stakeholder Pressure for ESG Integration

Investors and stakeholders are increasingly demanding that companies, including Rithm Capital, integrate environmental, social, and governance (ESG) factors into their core business strategies. This pressure reflects a growing recognition that strong ESG performance correlates with long-term financial resilience and reduced risk. For Rithm, this specifically means evaluating the environmental footprint of its real estate and credit investments, such as energy efficiency of properties or climate-related risks in mortgage portfolios. Failure to address these concerns could lead to significant reputational damage and a decline in investor confidence, potentially impacting capital raising efforts in 2024 and 2025.

- Global ESG assets are projected to exceed $50 trillion by 2025, driving investor scrutiny.

- Major institutional investors now routinely screen portfolios for ESG compliance.

- Rithm Capital's Q1 2024 earnings calls highlighted growing questions on sustainable investment practices.

Environmental Due Diligence in Lending

Environmental due diligence is increasingly vital for Rithm Capital when originating or acquiring loans, especially regarding potential liabilities from underlying properties. This process involves evaluating risks such as soil and groundwater contamination to protect asset value. As reported in its 2023 annual SEC filings, Rithm Capital has stated it is not aware of any environmental concerns that would materially adversely affect its financial position. This proactive assessment mitigates future environmental impact and financial risk.

- Thorough environmental due diligence is crucial for loan origination and acquisition.

- Potential liabilities like soil and groundwater contamination are key assessment areas.

- Rithm Capital's 2023 SEC filings confirm no known material adverse environmental impact.

Rithm Capital faces increasing environmental risks from climate change, with 2023 natural catastrophe losses reaching $100 billion, impacting property values. The shift to a low-carbon economy drives demand for green buildings, which can see 7-10% rental premiums by 2025, while new 2024 energy efficiency regulations raise compliance costs. Growing investor demand for ESG performance, with global ESG assets projected to exceed $50 trillion by 2025, pressures Rithm to integrate sustainability. Environmental due diligence remains critical for mitigating liabilities.

| Environmental Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Climate Risk | Property devaluation, defaults | $100B insured losses (2023) |

| Green Transition | Asset valuation, market demand | 7-10% green building premium (2025) |

| Regulatory Changes | Operational costs, compliance | New energy efficiency standards (2024) |

| ESG Pressure | Investor confidence, capital access | >$50T ESG assets projected (2025) |

PESTLE Analysis Data Sources

Our Rithm Capital PESTLE analysis is meticulously constructed using data from reputable government agencies, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental factors impacting Rithm Capital.