Rithm Capital Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rithm Capital Bundle

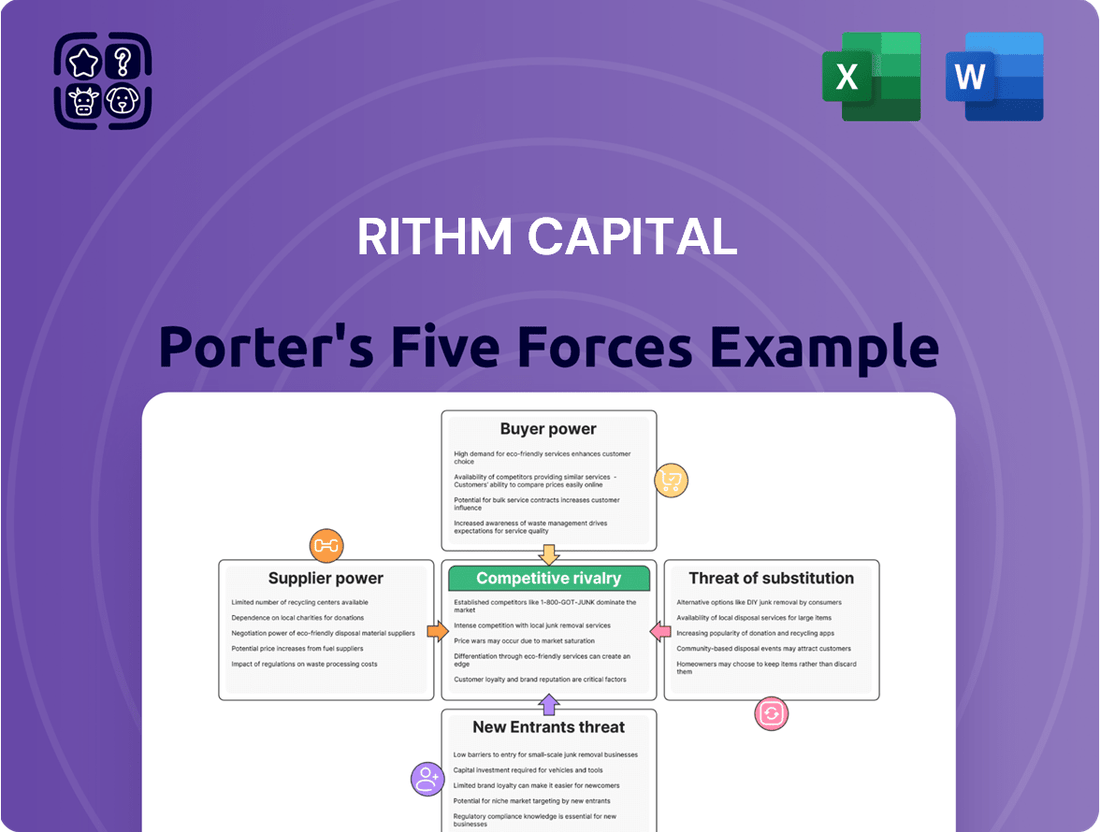

Rithm Capital operates in a dynamic financial services landscape, where understanding competitive forces is paramount. Our Porter's Five Forces analysis dissects the industry's structure, revealing key pressures that influence profitability.

We examine the bargaining power of both suppliers and buyers, crucial elements in Rithm Capital's operational efficiency and pricing strategies. The threat of new entrants and the intensity of rivalry among existing players also shape the market's competitive intensity.

Furthermore, our analysis scrutinizes the threat of substitute products or services, which can significantly alter customer choices and market share. This comprehensive overview provides a strategic lens on Rithm Capital's operating environment.

The complete report reveals the real forces shaping Rithm Capital’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Providers of capital, like banks offering warehouse lines of credit and investors in debt securities, hold considerable power over Rithm Capital. Rithm's ability to fund its mortgage origination and investment activities is directly tied to the availability and cost of this capital. For instance, in Q1 2024, Rithm Capital reported an average cost of funds on its warehouse lines and secured financings, which directly impacts its net interest margin. The terms dictated by these suppliers, including interest rates and covenants, significantly affect Rithm's profitability and operational flexibility, as seen in the broader mortgage market's sensitivity to interest rate fluctuations.

Government-sponsored enterprises like Fannie Mae and Freddie Mac, alongside regulatory bodies, wield significant power as suppliers of market standards and access. Their 2024 policies, such as the conforming loan limit of $766,550 for single-family homes, directly dictate mortgage eligibility and servicing requirements for Rithm Capital. Changes in these regulations can alter Rithm's cost structure, as seen with evolving capital rules, and influence the types of loans it can originate or acquire. This external regulatory framework profoundly shapes Rithm's operational landscape.

In the evolving digital mortgage landscape, suppliers of loan origination software, servicing platforms, and crucial data analytics tools hold significant bargaining power over Rithm Capital. These specialized technologies are indispensable for ensuring operational efficiency, maintaining compliance with regulations, and robust risk management. The high integration and specialized nature of these platforms create substantial switching costs for Rithm Capital, making it challenging to change providers. This leverage allows key technology suppliers to influence pricing and terms, impacting Rithm Capital's operational expenditures, which remain a focus in 2024 amidst rising tech investments across the industry.

Sellers of Mortgage Servicing Rights (MSRs)

The sellers of Mortgage Servicing Rights (MSRs), primarily other mortgage originators, represent a critical supplier segment for Rithm Capital. Their bargaining power influences the pricing and availability of MSR portfolios, which are essential for Rithm's investment strategy. A competitive market for MSR acquisitions, driven by factors like interest rate volatility and originators' liquidity needs, can elevate acquisition costs, directly impacting Rithm's potential returns.

- MSR valuations in early 2024 remained robust due to higher interest rates, which generally reduce prepayment speeds.

- The competitive landscape for MSRs saw significant activity, with various financial institutions seeking to optimize balance sheets.

- Rithm Capital actively expanded its MSR portfolio, reaching approximately $760 billion in unpaid principal balance (UPB) as of Q1 2024, indicating consistent market engagement.

- Increased demand from institutional buyers can empower sellers to command higher prices, affecting Rithm's strategic cost of acquisition.

Third-Party Service Providers

Rithm Capital relies extensively on third-party service providers for crucial operations like property appraisals, title insurance, and legal services. While many of these services are commoditized, specialized providers in specific niches or geographic areas can exert greater bargaining power. The quality and efficiency of these suppliers directly impact Rithm's loan processing times and operational costs, a critical factor given the competitive mortgage market. For instance, title insurance costs can represent a notable portion of closing expenses, influencing overall transaction efficiency.

- Rithm Capital's 2024 operational efficiency is directly tied to third-party service provider performance.

- Specialized legal or appraisal services, particularly in niche markets, command higher leverage.

- Commoditized services like standard title insurance offer less supplier bargaining power.

- Efficient supplier networks are crucial for minimizing Rithm's loan processing durations and costs.

Rithm Capital faces notable bargaining power from capital providers, technology vendors, and GSEs, impacting its funding costs and operational flexibility. Sellers of MSRs also exert influence on acquisition prices, with MSR valuations robust in early 2024. Specialized third-party services further contribute to operational expenses. This collective supplier leverage significantly shapes Rithm's cost structure and market strategy for 2024.

| Supplier Category | 2024 Impact | Key Metric |

|---|---|---|

| Capital Providers | Funding Cost | Average cost of funds (Q1 2024) |

| GSEs/Regulators | Market Access/Compliance | Conforming loan limit ($766,550) |

| MSR Sellers | Acquisition Cost | MSR portfolio UPB ($760B Q1 2024) |

What is included in the product

This analysis delves into the competitive forces impacting Rithm Capital, examining supplier and buyer power, threats from new entrants and substitutes, and the intensity of rivalry within its operating environment.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces at a glance.

Customers Bargaining Power

The bargaining power of individual mortgage borrowers is generally low for lenders like Rithm Capital, though it can fluctuate with market conditions.

While borrowers can shop around for loans, the complexity of the mortgage process and the significant financial commitment often limit their negotiating leverage.

For instance, with 30-year fixed mortgage rates hovering near 7% in mid-2024, affordability challenges can further reduce borrower flexibility.

However, in a buyer's market characterized by increased housing inventory, individual borrowers may gain some power.

Rithm Capital's primary customers for its mortgage-backed securities and real estate investments are major institutional investors, including pension funds, insurance companies, and large asset managers. These sophisticated buyers wield substantial bargaining power due to the immense volumes they acquire. Their ability to conduct thorough due diligence and access vast capital allows them to dictate specific risk-return profiles. For instance, in 2024, large institutional demand for stable income streams continues to shape MBS pricing. This strong buyer position enables them to influence pricing and terms significantly.

Rithm Capital, through its origination subsidiaries, heavily relies on independent mortgage brokers who act as crucial intermediaries. These brokers hold significant power, capable of directing loan applications to various lenders based on competitive pricing and service levels. For instance, in Q1 2024, maintaining strong broker relationships was vital for origination volumes amid fluctuating interest rates. A robust network of satisfied brokers is thus essential for Rithm to secure a steady flow of loan originations, directly impacting their market share and profitability.

GSEs and Government Agencies

When Rithm Capital sells mortgage loans to Government-Sponsored Enterprises like Fannie Mae and Freddie Mac, or securitizes them into government-guaranteed Ginnie Mae Mortgage-Backed Securities, these entities act as the ultimate customers. Their bargaining power is exceptionally high because they establish rigorous underwriting and servicing standards that Rithm must strictly adhere to. Failure to meet these demanding criteria can result in severe penalties, including loan buyback demands or the inability to sell future loan volumes, directly impacting Rithm’s liquidity and profitability.

- In Q1 2024, Fannie Mae and Freddie Mac continued to dominate the conforming mortgage market, setting terms for billions in new originations.

- Ginnie Mae, backing FHA and VA loans, maintained its strict guarantee standards for securitized pools.

- Rithm Capital’s operational efficiency is directly tied to its compliance with these evolving regulatory frameworks.

Users of Servicing Platforms

The users of Rithm Capital's servicing platforms are primarily the ultimate owners of the mortgage loans, including third-party investors and Rithm itself. Their bargaining power is significant, stemming from the ability to transfer servicing rights to another company if performance metrics are not met. This leverage is particularly potent given the focus on key performance indicators like delinquency rates and efficient reporting. As of early 2024, the mortgage servicing market remains competitive, with service quality directly impacting client retention.

- Servicing transfers can occur due to unmet performance metrics.

- Quality of service, including delinquency management, is critical for retention.

- Effective reporting and transparency are key factors for loan owners.

- The competitive 2024 servicing market empowers loan owners.

Rithm Capital faces varied customer bargaining power, from individual borrowers with limited leverage to powerful institutional investors, independent mortgage brokers, and government-sponsored entities.

Institutional buyers and GSEs, dominating markets in 2024, exert substantial influence over pricing and terms due to their scale and regulatory authority. Mortgage brokers also hold significant power by directing origination volumes.

Loan owners on Rithm’s servicing platforms maintain strong leverage through their ability to transfer servicing rights based on performance metrics.

| Customer Segment | Bargaining Power (2024) | Impact on Rithm Capital |

|---|---|---|

| Institutional Investors | High | Influences MBS pricing and demand. |

| GSEs/Ginnie Mae | Very High | Sets strict underwriting and servicing standards. |

| Independent Mortgage Brokers | High | Directs loan origination flow. |

Same Document Delivered

Rithm Capital Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces Analysis of Rithm Capital delves into the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights into Rithm Capital's strategic positioning.

Rivalry Among Competitors

The mortgage REIT sector faces intense competition, with numerous players vying for similar assets. Firms like Annaly Capital Management (NLY), AGNC Investment (AGNC), and Starwood Property Trust (STWD) directly compete with Rithm Capital for mortgage-related assets and capital. This intense rivalry, evident in 2024 market dynamics, continually pressures investment spreads and overall profitability within the sector. Each seeks to optimize asset acquisition and funding costs.

Rithm Capital’s origination and servicing operations face intense competition from traditional banks, credit unions, and other non-bank mortgage lenders. This competitive landscape includes major national players and numerous smaller regional institutions. For instance, the mortgage market saw significant shifts in 2024, with non-bank lenders holding a substantial share of originations. This high level of rivalry directly influences loan pricing, market share, and the company's ability to attract and retain customers effectively.

As an asset manager, Rithm Capital faces intense competitive rivalry for investment capital from a broad spectrum of firms. This includes specialized real estate managers, alongside diversified asset managers like BlackRock and Vanguard, which collectively manage trillions in assets globally in 2024. Key competitive factors include investment performance, fee structures, and the ability to offer unique, high-demand investment strategies. The industry continues to experience fee compression, pushing firms to differentiate through alpha generation and innovative product offerings.

Private Equity and Hedge Funds

Private equity firms and hedge funds significantly intensify competitive rivalry in real estate finance, directly vying with Rithm Capital for distressed debt and mortgage servicing rights (MSRs). These well-capitalized entities, like Blackstone Real Estate which deployed substantial capital in 2024, can quickly acquire high-yield assets, increasing competition. Their agility and financial power, with global private equity dry powder reaching over $2.9 trillion in early 2024, create a formidable challenge for opportunistic investments.

- Global private equity dry powder exceeded $2.9 trillion in Q1 2024, signifying immense capital available for deployment.

- Major players, such as Apollo Global Management and Starwood Capital, actively pursue real estate debt and equity opportunities.

- The competition for MSRs has intensified, with institutional investors seeking stable, long-term cash flows.

- Distressed real estate debt remains a key target, attracting significant capital from opportunistic funds.

Fintech Companies

The rise of financial technology (fintech) has introduced new, technology-driven competitors in the mortgage origination and servicing space. These companies often leverage digital platforms to streamline the mortgage process, competing on speed and convenience. This technological rivalry pressures traditional players like Rithm Capital to innovate and enhance their own digital capabilities. For instance, fintech mortgage originators captured approximately 11% of the total mortgage market share by volume in Q1 2024, reflecting their growing influence.

- Digital-first lenders like Rocket Mortgage continue to challenge traditional models.

- Fintechs offer faster application-to-close times, often under 30 days.

- Increased investment in AI and automation by fintech mortgage players reached over $500 million in H1 2024.

- Rithm Capital's digital transformation initiatives are crucial to maintaining competitiveness against these agile rivals.

Rithm Capital faces intense rivalry across its mortgage REIT, origination, servicing, and asset management segments. Competitors include major banks, fintech lenders, and private equity firms, each vying for market share and capital. This high competition, notably in 2024, pressures margins and necessitates continuous innovation. Fintechs captured 11% of mortgage volume in Q1 2024, while global PE dry powder exceeded $2.9 trillion.

| Rivalry Area | Key Competitors | 2024 Impact |

|---|---|---|

| Mortgage REITs | Annaly, AGNC | Pressures investment spreads |

| Origination/Servicing | Rocket Mortgage | Fintech 11% Q1 market share |

| Asset Management | BlackRock, Apollo | $2.9T PE dry powder Q1 |

SSubstitutes Threaten

Homebuyers can explore substitute financing options beyond traditional mortgages, such as seller financing, rent-to-own agreements, and private loans. While these alternatives are not mainstream, they cater to niche market segments. For instance, in 2024, seller financing might account for a small fraction, perhaps 1-2%, of total residential transactions. The availability of these options could marginally reduce overall demand for Rithm Capital’s traditional mortgage products, particularly for unique property deals or buyers with non-traditional financial profiles. This presents a limited but persistent threat of substitution.

The threat of substitutes for Rithm Capital arises from various alternative investment vehicles available to investors. Beyond Rithm's mortgage-backed securities, investors can choose other fixed-income products like corporate bonds or government bonds, with 10-year US Treasury yields frequently exceeding 4.0% in 2024, offering competitive returns. Direct investments in physical real estate or diverse asset classes such as equities also present viable alternatives. The appeal of these substitutes is heavily influenced by their respective risk-return profiles and prevailing market conditions.

Peer-to-peer lending platforms present a growing substitute, enabling direct connections between borrowers and investors, bypassing traditional mortgage originators like Rithm Capital. While still a niche segment, the global P2P lending market was projected to reach over $200 billion by 2025. This disintermediation could incrementally erode market share, posing a long-term competitive threat to conventional mortgage channels. Despite its current small footprint in the overall mortgage sector, its expansion warrants close monitoring.

Cash Purchases

A direct substitute for mortgage financing is an all-cash property purchase. While this option isn't viable for most homebuyers, a rise in cash buyers, especially from institutional investors, shrinks the overall pool of potential mortgage customers for companies like Rithm Capital. This trend is often more pronounced in high-end or investor-heavy real estate markets. For instance, reports indicate that around 30% of US home sales in early 2024 were all-cash transactions, a notable figure that directly impacts mortgage demand.

- Cash purchases directly reduce the need for mortgage products.

- Institutional investors are key drivers of increased cash transactions.

- High-end and investor markets see higher cash buyer prevalence.

- Approximately 30% of US home sales in early 2024 were all-cash.

Interest-Only and Balloon Mortgages

The mortgage market offers diverse structures beyond the traditional 30-year fixed-rate, posing a threat of substitution to Rithm Capital. Products like interest-only mortgages, which saw a slight uptick in lender offerings in early 2024 for specific high-net-worth borrowers, or balloon-payment loans, appeal to distinct borrower segments. These alternatives offer payment flexibility that can divert demand, particularly for those prioritizing lower initial payments or short-term property ownership strategies.

- Interest-only and balloon mortgages target borrowers with specific cash flow needs or investment horizons.

- While niche, these products can capture market share from standard offerings.

- In 2024, some lenders selectively expanded interest-only options for qualified individuals.

- Demand for these substitutes is highly sensitive to economic conditions and borrower risk appetite.

The threat of substitutes for Rithm Capital arises from diverse financing and investment alternatives. These include seller financing, peer-to-peer lending, projected to reach over $200 billion by 2025, and all-cash home purchases, which comprised around 30% of US sales in early 2024. Investors also consider other fixed-income products like government bonds, with 10-year US Treasury yields often exceeding 4.0% in 2024. These varied substitutes collectively reduce demand for Rithm’s traditional mortgage and MBS offerings.

| Substitute | 2024 Metric | Impact |

|---|---|---|

| All-Cash Purchases | ~30% US Home Sales | Reduces Mortgage Demand |

| 10-yr US Treasury | Often >4.0% Yield | Competitive Investment |

| P2P Lending Market | >$200B by 2025 | Erodes Market Share |

Entrants Threaten

The mortgage industry, where Rithm Capital operates, is heavily regulated, presenting a significant barrier for new entrants. Stringent licensing, compliance, and reporting requirements are mandated at both state and federal levels, ensuring market stability. For instance, adherence to the SAFE Act and diverse state financial regulator demands creates a complex web of rules that newcomers must navigate. This regulatory burden significantly increases operational costs and time-to-market for potential competitors, limiting the influx of new firms into the sector.

Entering the mortgage finance and investment market presents a significant barrier due to substantial capital requirements. New mortgage REITs, similar to Rithm Capital's scale, need billions to acquire a diversified portfolio of mortgage-backed securities and other assets. Mortgage originators, for instance, rely on access to warehouse lines of credit, which can easily exceed hundreds of millions or even billions of dollars in 2024 to fund loan pipelines. These immense capital costs inherently deter potential new competitors from establishing a foothold.

The mortgage servicing business inherently benefits from significant economies of scale. Larger, established servicers like Rithm Capital can effectively spread high fixed costs, such as advanced technology platforms and stringent regulatory compliance, across a vast portfolio of loans. This allows them to achieve a significantly lower per-loan servicing cost. In 2024, this cost advantage poses a formidable barrier, making it exceedingly difficult for new, smaller entrants to compete effectively on price within the highly competitive market.

Established Relationships and Networks

Rithm Capital, as an established player, benefits from long-standing relationships with key stakeholders like capital providers and mortgage brokers. Building these extensive networks, crucial for deal sourcing and financing, takes considerable time and presents a significant barrier for new entrants. For instance, Rithm Capital's diverse portfolio, including its mortgage origination platform, benefits from years of developed trust and operational efficiency.

Navigating the complex regulatory landscape also relies heavily on these established connections, making it difficult for newcomers to compete effectively. New firms would need substantial initial capital and time to replicate such deep-seated market integration.

- Rithm Capital's established network includes partnerships with over 7,000 mortgage brokers as of early 2024.

- These relationships facilitate a consistent pipeline of mortgage originations and asset acquisitions.

- New entrants face a high cost and time investment to build comparable trust and access to capital.

- Regulatory compliance and market navigation are smoother for firms with established governmental and industry ties.

Technological and Operational Expertise

Successfully managing a diverse portfolio of mortgage-related assets, as Rithm Capital does, requires specialized expertise in areas like credit analysis, risk management, and loan servicing. New entrants would face significant barriers, needing to either build or acquire this intricate operational knowledge. This process is both costly and time-consuming, deterring firms without a strong background in real estate finance. The operational complexity inherent in managing over $31.8 billion in assets as of December 31, 2023, acts as a strong deterrent for potential competitors.

- Specialized expertise in credit analysis and risk management is crucial.

- Acquiring or building this knowledge base is costly and time-consuming for new entrants.

- Operational complexity deters firms lacking strong real estate finance backgrounds.

- Rithm Capital managed over $31.8 billion in assets as of December 31, 2023, highlighting the scale of required expertise.

The threat of new entrants for Rithm Capital is significantly low due to the mortgage industry's stringent regulations, requiring extensive licensing and compliance, which notably increases operational costs in 2024. Substantial capital, often billions for diversified portfolios and warehouse lines of credit exceeding hundreds of millions in 2024, creates a formidable barrier. Established players also benefit from significant economies of scale and deep-seated industry relationships, like Rithm Capital's network of over 7,000 mortgage brokers as of early 2024. This, coupled with the need for specialized expertise to manage over $31.8 billion in assets as of December 31, 2023, makes market entry highly challenging.

| Barrier Type | Impact on New Entrants | 2024 Relevance |

|---|---|---|

| Regulatory Burden | High compliance costs | Ongoing, complex state/federal mandates |

| Capital Requirements | Billions needed for scale | Warehouse lines exceeding $100Ms |

| Economies of Scale | Cost disadvantage for small firms | Lower per-loan servicing costs for incumbents |

| Established Relationships | Difficulty in market access | Rithm Capital's 7,000+ broker network |

| Specialized Expertise | Costly knowledge acquisition | Managing $31.8B+ assets (2023) |

Porter's Five Forces Analysis Data Sources

Our Rithm Capital Porter's Five Forces analysis is built upon a foundation of robust data, including SEC filings, investor presentations, and proprietary market research reports. This ensures a comprehensive understanding of the competitive landscape and strategic positioning.