Rithm Capital Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rithm Capital Bundle

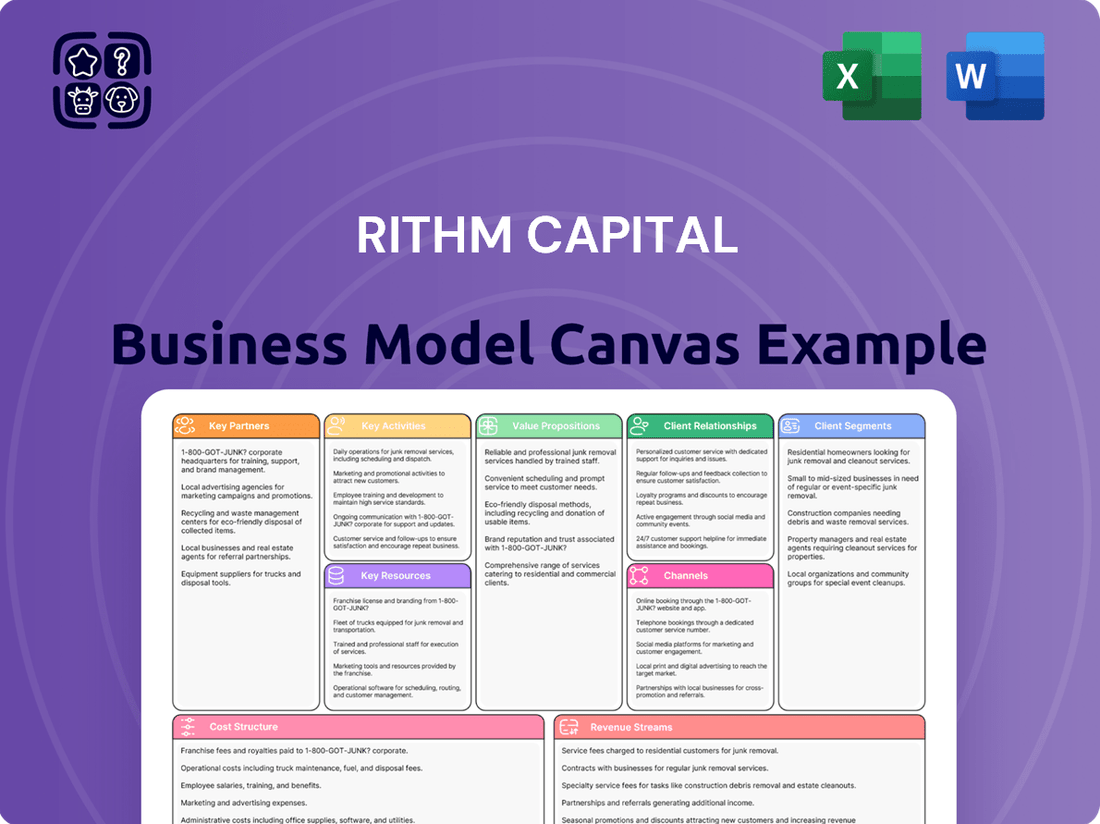

Unlock the strategic blueprint behind Rithm Capital's innovative approach to real estate and financial services. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams.

Discover how Rithm Capital leverages key partnerships and resources to deliver unique solutions, while understanding their cost structure and channels to market.

This in-depth canvas provides actionable insights into Rithm Capital's competitive advantages and growth strategies, making it invaluable for investors and business strategists.

Want to dissect Rithm Capital's success? Download the full Business Model Canvas to gain a clear, professionally written snapshot of their thriving business model and identify future opportunities.

Partnerships

Rithm Capital actively partners with a broad network of banks and financial institutions, which are essential for its operations. These collaborations secure vital credit facilities and warehouse lines of credit, directly funding loan originations and asset acquisitions across its diverse portfolio. For example, as of early 2024, Rithm Capital maintained over $10 billion in committed credit capacity, underpinning its lending and investment activities. These partnerships also facilitate syndication and participation in larger investment opportunities, significantly expanding Rithm's capital base and operational flexibility.

Key partnerships with Government-Sponsored Enterprises like Fannie Mae and Freddie Mac are vital for Rithm Capital. The company originates a significant volume of loans, ensuring they meet the strict underwriting standards set by these entities. Once originated, these loans are sold to the GSEs, which generates immediate gains and allows Rithm Capital to retain valuable mortgage servicing rights. This consistent outlet for loan products provides essential liquidity, supporting the firm's robust origination volume, which reached over $12 billion in mortgage originations in the first quarter of 2024 alone.

Rithm Capital actively collaborates with large institutional investors, including pension funds and insurance companies, for co-investment ventures and third-party capital management. These strategic partnerships enable Rithm to pursue significantly larger deals than it could independently, leveraging its expertise in diverse asset classes. This approach diversifies Rithm’s capital sources, enhancing its market presence and generating substantial asset management fees. For example, as of early 2024, Rithm continued to expand its third-party capital base, reflecting ongoing institutional confidence in its investment strategies.

Mortgage Brokers & Correspondent Lenders

Rithm Capital relies heavily on its vast network of independent mortgage brokers and correspondent lenders, which serves as a primary channel for loan origination. Rithm empowers these partners by providing a robust platform, diverse product offerings, and competitive pricing structures. This strategic business-to-business network grants Rithm access to a broad and geographically diverse stream of new loans, crucial for maintaining high origination volumes in 2024.

- Rithm Capital's mortgage origination platform, Newrez, actively leverages wholesale channels.

- This model significantly reduces Rithm's direct marketing costs.

- Broker relationships are vital for accessing niche markets and varied borrower profiles.

- The network contributes substantially to Rithm's overall loan portfolio growth.

Technology & FinTech Providers

Rithm Capital actively partners with leading technology vendors to enhance its core servicing platforms, data analytics software, and robust risk management systems. These collaborations are crucial for boosting operational efficiency and refining the customer experience, especially as the industry increasingly relies on data-driven underwriting and precise asset valuation. For instance, in 2024, continued investment in these partnerships supports Rithm's strategy to leverage advanced AI and machine learning for better portfolio management. Collaborating with FinTech firms also propels innovation across the entire mortgage process, from origination to servicing.

- Rithm Capital utilizes advanced data analytics software from technology partners to inform its investment decisions and risk assessments, a key differentiator in 2024.

- Partnerships with FinTech providers enable Rithm to explore new mortgage origination and servicing technologies, aiming to reduce operational costs.

- The integration of third-party risk management systems ensures Rithm maintains strong compliance and minimizes exposure across its diverse asset portfolio.

- These strategic alliances enhance Rithm's ability to quickly adapt to market changes and maintain a competitive edge through technological superiority.

Rithm Capital's key partnerships are fundamental, encompassing banks providing over $10 billion in credit facilities as of early 2024 and GSEs, which facilitate the sale of over $12 billion in Q1 2024 mortgage originations. The firm also relies on independent mortgage brokers for broad loan origination and technology vendors to enhance its servicing and risk management systems. These alliances ensure capital access, operational efficiency, and market reach.

| Partnership Type | 2024 Impact | Key Metric (Early 2024) |

|---|---|---|

| Financial Institutions | Credit Facilities | >$10 Billion Committed Capacity |

| GSEs (Fannie Mae/Freddie Mac) | Loan Sales/MSRs | >$12 Billion Q1 Mortgage Originations |

| Independent Brokers | Origination Channels | Significant Contribution to Loan Volumes |

What is included in the product

A detailed Business Model Canvas for Rithm Capital, outlining its strategy for mortgage origination, servicing, and investment in real estate-related assets.

This model focuses on leveraging technology and operational efficiency to deliver value across diverse customer segments in the financial and real estate markets.

Rithm Capital's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to diagnose and address inefficiencies in their diverse real estate and financial services operations.

It offers a visual, one-page snapshot of Rithm Capital's strategic levers, enabling swift identification and resolution of operational friction points across their business segments.

Activities

Rithm Capital actively manages a diverse portfolio, focusing on mortgage servicing rights (MSRs), residential mortgage loans, and real estate securities. This core activity involves strategic acquisitions and dispositions, alongside robust hedging strategies to optimize risk-adjusted returns. As of Q1 2024, Rithm Capital's MSR portfolio was valued at approximately $29.9 billion, showcasing their significant exposure. The team continuously analyzes market conditions to rebalance the portfolio, capitalizing on opportunities within the evolving real estate and credit markets. This dynamic approach ensures consistent performance across their substantial asset base.

Rithm Capital, primarily through its subsidiary Newrez, is a significant player in mortgage loan origination, operating across direct-to-consumer, wholesale, and correspondent channels. This core activity encompasses the meticulous process of underwriting, processing, and funding new loans for a diverse range of borrowers. High origination volumes are crucial for generating substantial fee income, a key revenue stream for the company. Furthermore, this process is vital for creating new mortgage servicing rights (MSR) assets, which contribute to Rithm's long-term recurring revenue. In Q1 2024, Newrez reported a total origination volume of $11.1 billion, showcasing its continued market presence.

Rithm Capital actively manages a substantial portfolio of mortgage loans, both for its own holdings and for third-party clients. This crucial activity involves diligently collecting principal and interest payments and overseeing escrow accounts for taxes and insurance. Efficient and compliant servicing, which includes customer service and default management, generates a consistent stream of fee income. For instance, as of early 2024, Rithm Capital's servicing portfolio exceeded $400 billion in unpaid principal balance, making it a significant component of their MSR valuation and overall profitability.

Capital Allocation & Risk Management

A core activity for Rithm Capital involves dynamically allocating capital across diverse investment strategies, rigorously managing associated risks. This entails sophisticated hedging to mitigate interest rate risk, especially crucial given market volatility in 2024. Disciplined underwriting practices address credit risk, while robust internal controls manage operational exposure.

Effective risk management is paramount for protecting the balance sheet and ensuring long-term profitability, with Rithm Capital reporting a book value of $11.08 per common share as of Q1 2024.

- Capital allocation dynamically shifts across mortgage servicing rights, real estate, and financial technology.

- Interest rate risk is managed through a substantial hedging portfolio.

- Credit risk is controlled via strict underwriting standards for loan originations.

- Operational risk is minimized through robust internal controls and compliance frameworks.

Securitization & Capital Markets Execution

Rithm Capital actively participates in capital markets by pooling originated loans and structuring them into mortgage-backed securities for sale to investors. This securitization activity is a primary driver of liquidity and profitability, enabling the company to recycle capital efficiently. By selling MBS, Rithm can reinvest funds into new loan originations and other strategic investments, sustaining its operational cycle.

- For Q1 2024, Rithm Capital reported GAAP net income of $197.8 million, demonstrating robust capital markets engagement.

- The company’s securitization efforts contribute significantly to its ability to generate recurring income streams.

- This process enhances Rithm’s capacity to manage interest rate risk and optimize its balance sheet.

Rithm Capital's key activities encompass managing a diverse mortgage asset portfolio, including $29.9 billion in MSRs as of Q1 2024, and originating loans through Newrez, with Q1 2024 volume at $11.1 billion. They also service over $400 billion in loans and actively engage in capital markets, reporting $197.8 million GAAP net income in Q1 2024. Dynamic capital allocation and robust risk management are central to their strategy, supporting a Q1 2024 book value of $11.08 per share.

| Activity | Q1 2024 Data | Impact |

|---|---|---|

| MSR Portfolio Management | $29.9 billion | Optimizes risk-adjusted returns |

| Mortgage Loan Origination | $11.1 billion | Generates fee income, MSR assets |

| Loan Servicing | >$400 billion UPB | Provides consistent fee income |

| Capital Markets & Securitization | $197.8 million GAAP Net Income | Drives liquidity, profitability |

Delivered as Displayed

Business Model Canvas

The Rithm Capital Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a generic template or a simplified example; it's a direct representation of the comprehensive analysis you'll unlock. You'll gain full access to this meticulously detailed canvas, allowing you to immediately leverage Rithm Capital's strategic framework. This ensures that what you see is precisely what you get, providing a clear and actionable understanding of their business operations and future plans.

Resources

Rithm Capital's primary resource is its robust access to diverse capital, including corporate debt, securitization markets, warehouse lines, and equity. This financial flexibility, supported by a strong balance sheet, allows Rithm to be opportunistic in acquiring assets and scaling its origination business. For instance, as of early 2024, Rithm maintained significant liquidity and a diversified funding base, enabling strategic investments. A strong credit rating remains essential for sustaining this critical access to funding for ongoing operations and growth initiatives.

Rithm Capital's integrated technology, encompassing its robust loan servicing and origination platforms, provides a significant competitive advantage. This proprietary infrastructure drives operational efficiency at scale, crucial for managing a diverse portfolio that included approximately $350 billion in total UPB serviced as of early 2024. The platform enhances data analytics for informed decision-making and elevates the customer experience. Ongoing investment in this technology is vital for sustaining a low-cost operating structure, contributing to their financial performance.

Rithm Capital's extensive portfolio of Mortgage Servicing Rights (MSRs) stands as a unique and valuable asset, generating a consistent stream of fee income. This resource provides a natural hedge against rising interest rates, which typically benefit MSR valuations while other fixed-income assets decline. As of early 2024, the company continued to actively manage a large MSR portfolio. Valuing and strategically managing this complex asset is a core competency, crucial for navigating market fluctuations and maintaining profitability.

Expert Human Capital

Rithm Capital's success significantly hinges on its expert human capital, encompassing seasoned teams in asset management, capital markets, loan origination, servicing, and risk management. This deep intellectual capital empowers the company to adeptly navigate complex market cycles, identify unique investment opportunities, and efficiently operate its multifaceted business. Talent acquisition and retention are therefore paramount for sustaining Rithm's competitive edge, especially as the firm manages significant assets. As of Q1 2024, Rithm Capital reported a substantial portfolio, a testament to the strategic capabilities of its specialized professionals.

- Specialized expertise drives Rithm Capital's strategic investments.

- Intellectual capital enables effective navigation of volatile markets.

- Talent acquisition and retention are crucial for operational excellence.

- Skilled teams directly contribute to managing the firm's diverse portfolio.

Nationwide Licenses & Regulatory Compliance

Operating in the highly regulated U.S. mortgage industry, Rithm Capital relies on its extensive nationwide state and federal licenses. This established regulatory footprint, encompassing compliance with agencies like the CFPB, serves as a significant barrier to entry for potential competitors. It is a critical resource, enabling the company to originate and service loans across all 50 states, a key operational advantage in 2024.

- Rithm Capital maintains licensure to operate in all 50 U.S. states for mortgage origination and servicing.

- Compliance costs for large mortgage servicers can exceed $100 million annually, highlighting the regulatory burden.

- The company manages a portfolio exceeding $300 billion in unpaid principal balance for serviced loans as of early 2024.

- Regulatory compliance ensures operational stability and market access, unlike smaller, less licensed entities.

Rithm Capital's key resources include robust capital access and integrated technology, servicing approximately $350 billion in UPB as of early 2024. A valuable MSR portfolio offers a natural interest rate hedge, complementing their nationwide licensing across all 50 U.S. states. Expert human capital further drives their strategic investments and market navigation. This combination underpins their competitive edge in 2024.

| Resource Type | Key Asset/Capability | 2024 Data/Impact |

|---|---|---|

| Financial Capital | Diverse Funding Sources | Significant liquidity, strong balance sheet |

| Technological | Integrated Platforms | ~$350B UPB serviced early 2024 |

| Tangible/Intangible | MSR Portfolio | Interest rate hedge, consistent fee income |

| Human Capital | Expert Teams | Manages substantial Q1 2024 portfolio |

| Regulatory | Nationwide Licenses | Operates across all 50 U.S. states |

Value Propositions

Rithm Capital offers shareholders attractive risk-adjusted returns through its potential for robust dividend yields and long-term capital appreciation. Its diversified business model, spanning mortgage origination, servicing, and strategic investments, is engineered to perform resiliently across varied interest rate environments. This comprehensive approach provides a more stable and appealing return profile compared to less diversified, monoline mortgage companies. For instance, Rithm maintained a consistent quarterly dividend of $0.25 per share through Q1 2024, underscoring its commitment to shareholder returns.

Rithm Capital, through its operating companies like Caliber Home Loans, offers a comprehensive suite of mortgage products, addressing diverse borrower needs from first-time homebuyers to those refinancing. In Q1 2024, Caliber Home Loans originated $8.1 billion in mortgages, showcasing its reach. The core value proposition centers on a streamlined process, competitive pricing, and unwavering commitment to customer service throughout the loan's lifecycle. This is effectively delivered via a multi-channel approach, ensuring accessibility for all customers.

Rithm Capital serves as a crucial, large-scale partner for mortgage brokers and correspondent lenders, providing essential liquidity by purchasing loans. This robust support enables smaller institutions to effectively compete in the dynamic mortgage market. Rithm offers a diverse product set, enhancing the capabilities of its partners. Its efficient, technology-driven processes streamline operations, which is vital as mortgage originations are projected to reach approximately $1.95 trillion in 2024. By facilitating access to capital and advanced tools, Rithm empowers its network to thrive.

Liquidity & Stability for the Housing Finance System

Rithm Capital, as a significant non-bank entity, provides crucial capital and liquidity to the U.S. housing finance system. By actively originating, servicing, and investing in a diverse portfolio of mortgage assets, the company ensures that vital credit remains accessible for homebuyers across the nation. This comprehensive involvement, encompassing a substantial servicing portfolio that reached approximately $550 billion in unpaid principal balance as of early 2024, plays a direct role in fostering stability within the broader housing market. Rithm's strategic investments and operational scale underscore its systemic importance.

- Rithm Capital's servicing portfolio reached about $550 billion in unpaid principal balance in early 2024.

- The company actively originates and invests in mortgage assets.

- Ensures essential credit availability for homebuyers.

- Contributes significantly to the stability of the U.S. housing finance system.

Synergistic, All-Weather Business Model

The core value proposition for Rithm Capital is the powerful synergy achieved by integrating various segments of the mortgage value chain. For instance, their origination businesses, like Newrez, actively create Mortgage Servicing Rights (MSRs), which their servicing arm then expertly manages. These MSRs inherently act as a crucial hedge for the broader investment portfolio, providing stability.

This deeply integrated structure is specifically designed to consistently generate profits and maintain resilience across diverse economic conditions and interest rate fluctuations, ensuring an all-weather business model.

- Rithm Capital reported a GAAP net income of $264.4 million for Q1 2024.

- Their MSR portfolio value stood at $8.6 billion as of March 31, 2024.

- Newrez, their mortgage origination arm, funded $13.6 billion in loans during Q1 2024.

- The servicing portfolio managed by their platforms exceeded $600 billion in UPB in early 2024.

Rithm Capital delivers robust shareholder returns through its diversified, integrated mortgage ecosystem, ensuring resilience across market cycles. Its comprehensive approach provides essential liquidity and a wide range of mortgage products, supporting both homebuyers and industry partners. This strategy generated $264.4 million in GAAP net income in Q1 2024, underscoring its financial strength.

| Metric | Q1 2024 Data | Source |

|---|---|---|

| GAAP Net Income | $264.4 million | Company Report |

| Dividend Per Share | $0.25 | Company Report |

| Servicing UPB | ~$600 billion | Company Report |

Customer Relationships

Rithm Capital maintains a direct relationship with millions of homeowners through its robust loan servicing platform. This engagement is primarily managed via accessible online portals, intuitive mobile applications, and dedicated call centers. In 2024, the company's servicing portfolio managed over 1.4 million loans, providing essential support for payments, escrow inquiries, and critical hardship assistance. The superior quality of this direct relationship is crucial for customer retention and directly impacts the overall performance of the serviced mortgage portfolio, ensuring stability and long-term value.

Rithm Capital fosters robust B2B relationships within its wholesale and correspondent channels through dedicated account management teams. These teams provide essential training and support, serving as a singular point of contact for partners, ensuring streamlined and efficient business operations. This strong relationship management is crucial for maintaining a consistent flow of loan originations, a key driver as the company reported over $22 billion in total loan originations in 2024. Such focused B2B engagement helps secure Rithm's market position and supports its diverse financial offerings.

Rithm Capital fosters strong shareholder trust through a proactive investor relations program. This includes consistent engagement, such as the company's Q1 2024 earnings call held on May 8, 2024, providing detailed financial updates. They maintain transparency through comprehensive financial reporting and frequent investor presentations, ensuring clear communication of their strategic direction. Participation in key industry conferences also allows direct interaction, reinforcing investor confidence in Rithm's performance and future outlook.

Digital Self-Service Tools

Rithm Capital significantly leverages digital self-service tools to enhance customer relationships at scale. For individual borrowers, this means streamlined online loan applications and secure self-service portals for account management, reflecting a broader industry shift where approximately 70% of mortgage applications are now initiated online as of early 2024. B2B partners benefit from dedicated portals for efficient loan submissions and tracking, improving operational efficiency and user satisfaction. These digital channels reduce processing times, aiming to lower customer service costs while handling an expanding portfolio.

- Online applications for borrowers accelerate loan origination.

- Self-service portals empower customers with 24/7 account access.

- B2B partner portals streamline loan submissions and status checks.

- Digital tools aim to reduce operational overhead by enhancing efficiency.

Dedicated Institutional Client Services

Rithm Capital maintains a high-touch, dedicated client service model for its asset management clients and large capital partners. This bespoke approach includes customized reporting and regular strategic reviews, ensuring tailored solutions for institutional mandates. Clients gain direct access to senior portfolio managers, fostering robust relationships crucial for attracting and retaining significant capital, such as their reported $34.2 billion in AUM as of Q1 2024.

- Customized reporting and strategic reviews are standard.

- Direct access to senior portfolio managers is provided.

- This model supports attracting large institutional mandates.

- Rithm Capital's AUM reached $34.2 billion by Q1 2024.

Rithm Capital employs a multi-faceted approach to customer relationships, engaging directly with 1.4 million homeowners serviced in 2024 and fostering B2B connections through dedicated teams supporting over $22 billion in 2024 loan originations. Digital self-service tools enhance efficiency, while a high-touch model serves asset management clients, contributing to $34.2 billion in AUM by Q1 2024. Strong investor relations maintain shareholder trust.

| Customer Segment | Relationship Model | Key 2024 Data |

|---|---|---|

| Homeowners | Direct servicing, digital portals | 1.4M loans serviced |

| B2B Partners | Dedicated account management | $22B loan originations |

| Asset Management Clients | High-touch, bespoke service | $34.2B AUM (Q1 2024) |

Channels

Rithm Capital leverages its Retail & Direct-to-Consumer (D2C) channel primarily through its Newrez brand, directly engaging homebuyers and homeowners. This channel efficiently originates and refinances mortgages utilizing a robust strategy of online advertising, targeted direct mail campaigns, and a dedicated team of loan officers. As of Q1 2024, this D2C approach contributes significantly to Rithm's mortgage volume, allowing for higher profit margins and fostering direct customer retention. Newrez continues to be a cornerstone for capturing market share directly, enhancing overall portfolio quality and client relationships.

Rithm Capital leverages a nationwide network of independent mortgage brokers to distribute its mortgage products, a strategy that significantly expands its reach. The company empowers these brokers by providing essential underwriting services, diverse product offerings, and necessary funding, while brokers manage the direct relationship with the end borrower. This approach has proven to be a highly cost-effective method for Rithm Capital to achieve broad market coverage and substantial origination volume. For example, in 2024, the wholesale channel continued to be a foundational component of their origination strategy, contributing significantly to overall mortgage loan production.

Rithm Capital's Correspondent Lending Channel is pivotal, acquiring newly originated and funded loans from a broad network of smaller banks, credit unions, and independent mortgage lenders. This channel serves as a major source for Rithm's loan volume and Mortgage Servicing Rights (MSRs), which stood at approximately $394 billion in unpaid principal balance as of late 2023, carrying into 2024. Rithm provides essential liquidity and scale, enabling these smaller originators to operate effectively in the dynamic mortgage market without holding significant capital on their books.

Capital Markets & Institutional Sales

Rithm Capital effectively engages institutional investors, banks, and other financial players through its robust capital markets desk. This crucial channel is instrumental for trading securities, executing complex securitizations, and efficiently raising capital. It serves as the primary conduit for interacting with its institutional investor customer segment, which includes major pension funds and asset managers. As of Q1 2024, Rithm Capital continued to optimize its funding channels, reflecting ongoing market dynamics.

- Rithm Capital's Q1 2024 earnings highlighted strong performance in its investment portfolio.

- Securitization activities remain a core component of its capital markets strategy.

- The firm actively participates in bond markets to manage liquidity and funding.

- Institutional client relationships are central to its capital deployment.

Digital Platforms & Corporate Website

Rithm Capital heavily leverages its digital platforms, including the main Rithm Capital site and the Newrez consumer portal, for crucial information dissemination and transaction processing. The investor relations section on the corporate website serves as the primary channel for transparent shareholder communication, ensuring stakeholders have access to the latest financial disclosures. Consumer-facing portals are essential for managing loan servicing interactions efficiently, providing self-service options and support. These digital channels are integral to Rithm Capital's operations, facilitating engagement across its diverse user base.

- Rithm Capital's digital ecosystem streamlines information access for investors and mortgage consumers.

- The investor relations platform is key for shareholder updates, reflecting ongoing engagement with its approximately 389 million shares outstanding as of late 2023, carrying into 2024.

- Newrez's consumer portals manage an extensive portfolio, processing a significant portion of the company's nearly $20 billion in mortgage originations reported in Q4 2023.

- These digital channels enhance operational efficiency and user experience across Rithm Capital's diverse business segments in 2024.

Rithm Capital utilizes a multi-channel approach, combining its direct-to-consumer Newrez brand for customer engagement with a robust wholesale broker network and correspondent lending for broad market reach. Its capital markets desk actively engages institutional investors for securitization and funding optimization, reflecting ongoing market dynamics in Q1 2024. Digital platforms like the Newrez consumer portal streamline loan servicing for approximately $20 billion in Q4 2023 originations, while the investor relations site provides transparent shareholder communication for around 389 million shares outstanding in 2024. These channels collectively support Rithm's diverse operations and its substantial $394 billion MSR portfolio.

| Channel Type | Primary Function | Key 2024 Data Point |

|---|---|---|

| Retail & D2C | Direct mortgage origination | Significant Q1 2024 volume contribution |

| Wholesale | Broker-originated mortgages | Foundational for 2024 origination strategy |

| Correspondent Lending | Loan & MSR acquisition | ~$394B MSR portfolio (early 2024) |

| Digital Platforms | Information & Servicing | Manages ~$20B Q4 2023 originations |

Customer Segments

Homeowners and mortgage borrowers are Rithm Capital's largest customer segment, encompassing individuals and families across the U.S. who require mortgage loans for purchases or refinancing. Rithm serves this group through its robust origination and servicing operations, providing diverse loan products. In 2024, despite fluctuating rates, with the 30-year fixed mortgage rate generally hovering above 6.5%, the demand for homeownership remains steady. Rithm prioritizes a positive customer experience, supporting this vital segment through their home financing journey.

Shareholders and equity investors form a core customer segment, including both individual and institutional holders of RITM stock. These stakeholders are direct consumers of Rithm Capital's corporate strategy and financial performance. Rithm serves them by aiming to deliver strong, sustainable dividends, with the company paying a 2024 quarterly dividend of $0.25 per share. The goal is to also provide consistent capital growth, reflecting the company's operational strength.

Rithm Capital actively partners with independent mortgage brokers and correspondent lenders, a vital B2B segment relying on Rithm for essential products, competitive pricing, and crucial secondary market access for their loan originations. This strategic collaboration provides these partners with the necessary tools and liquidity, empowering them to efficiently operate their businesses. This partnership is a significant driver of origination volume, contributing to Rithm’s robust mortgage segment performance. For instance, in 2024, maintaining strong relationships with these partners helps sustain consistent loan acquisition flows.

Institutional Investment Clients

Institutional Investment Clients are crucial for Rithm Capital, encompassing pension funds, sovereign wealth funds, and other asset managers. These entities invest in Rithm’s diverse funds or co-invest alongside the company, leveraging its specialized expertise in mortgage and real estate assets. This segment is a key driver for Rithm's asset management ambitions, contributing significantly to its fee-generating assets. As of late 2023, Rithm Capital reported a substantial asset management portfolio, indicating strong institutional engagement.

- Rithm targets large-scale institutional capital for its investment strategies.

- The company offers access to its deep knowledge in complex real estate and credit markets.

- Growth in this segment directly expands Rithm's assets under management.

- Institutional clients seek Rithm's proven track record in alternative investments.

Secondary Market Participants

Secondary Market Participants are crucial for Rithm Capital, encompassing buyers of the mortgage-backed securities (MBS) and other real estate-related assets that Rithm originates and sells. These customers are typically large financial institutions, banks, and investment funds seeking structured credit products. Rithm serves this segment by consistently providing a robust supply of well-underwritten and expertly structured securities. In Q1 2024, Rithm Capital's asset management business continued to generate significant capital, underscoring the ongoing demand from these institutional buyers for their diversified portfolio offerings.

- Rithm Capital's total assets under management reached approximately $34.3 billion as of Q1 2024, indicating substantial activity with secondary market participants.

- The company reported a GAAP net income of $223.0 million for Q1 2024, reflecting the value generated from its various financial activities, including asset sales.

- Rithm's mortgage company originated $11.0 billion in mortgages during Q1 2024, with a significant portion destined for securitization and sale into the secondary market.

- Institutional investors continue to seek high-quality MBS, with the U.S. MBS market value exceeding $11 trillion in 2024, demonstrating robust demand for Rithm's offerings.

Rithm Capital serves a broad array of customer segments, from individual homeowners seeking mortgage financing to a network of independent mortgage brokers. The company also caters to its equity investors, aiming for consistent dividends and capital growth. Furthermore, Rithm engages with large institutional investment clients and crucial secondary market participants who purchase its mortgage-backed securities and other real estate assets.

| Customer Segment Focus | Key 2024 Metric | Data Point |

|---|---|---|

| Homeowners/Borrowers | 30-Year Fixed Mortgage Rate | ~6.5%+ (2024) |

| Equity Investors | Quarterly Dividend | $0.25 (2024) |

| Institutional Clients | AUM (Q1 2024) | ~$34.3 Billion |

Cost Structure

As a finance company, Rithm Capital's single largest cost is typically the interest it pays on the capital borrowed to fund its investments. This includes interest on warehouse lines, corporate bonds, and other credit facilities. Managing this cost relative to asset yields is fundamental to profitability. For the first quarter of 2024, Rithm Capital reported substantial interest expense, illustrating its reliance on leveraged financing. This direct cost significantly impacts net interest margin and overall financial performance.

Employee compensation and benefits represent a substantial operating expense for Rithm Capital, covering salaries, commissions, bonuses, and comprehensive benefits for thousands of employees. These costs are critical across all functions, including loan origination, servicing, investment management, and corporate support. Labor costs are a significant component of the overall expense to originate and service loans, directly impacting profitability. Managing headcount efficiently and optimizing employee productivity remains a core focus for the company in 2024 to control these vital expenditures.

Loan Origination and Servicing Costs for Rithm Capital encompass direct non-personnel expenses vital to its mortgage operations. These variable costs scale with business volume, covering essential items like technology platform fees, credit report fees, and appraisal costs. For instance, in Q1 2024, Rithm Capital reported significant non-interest expenses related to its mortgage segment, reflecting these operational outlays. These expenses are crucial for efficiently managing loan production and maintaining the existing mortgage portfolio.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the essential overhead costs Rithm Capital incurs to operate its corporate functions. These encompass critical outlays for robust technology infrastructure, vital professional services like legal and accounting, corporate office rent, and targeted marketing initiatives. Effective control over G&A is paramount for enhancing operating leverage and maintaining profitability.

- Rithm Capital reported G&A expenses of approximately $36.7 million for Q1 2024.

- This figure excludes compensation expenses.

- Efficient G&A management directly impacts net income.

- Technology investments within G&A support operational scalability.

Hedging and Risk Mitigation Costs

Rithm Capital incurs substantial hedging and risk mitigation costs, primarily to protect its mortgage servicing rights (MSR) portfolio from adverse interest rate movements. This involves significant expenses for derivatives and other financial instruments, which are crucial for safeguarding the company's earnings and book value. For instance, in Q1 2024, Rithm reported derivative losses that reflect these ongoing hedging activities, demonstrating the continuous investment in managing market volatility.

- Primary cost driver: interest rate hedging for MSRs.

- Includes expenses for derivatives and financial instruments.

- Essential for protecting company earnings and book value.

- Reflected in Q1 2024 financial reports with derivative losses.

Rithm Capital's cost structure is primarily driven by substantial interest expense on its leveraged capital, essential for funding investments. Significant operating costs include employee compensation and benefits, alongside variable loan origination and servicing expenses that scale with volume. General and Administrative costs amounted to approximately $36.7 million for Q1 2024, while hedging and risk mitigation expenses, vital for protecting assets like MSRs, also represent a continuous outlay.

| Cost Category | Description | Q1 2024 Data Point |

|---|---|---|

| Interest Expense | Cost of borrowed capital | Substantial |

| G&A Expenses | Corporate overhead | ~$36.7 million |

| Hedging Costs | Risk mitigation | Reflected in derivative losses |

Revenue Streams

Rithm Capital generates a primary revenue stream from its massive mortgage servicing portfolio, a key element of its business model. This includes the base servicing fee collected on the unpaid principal balance of loans, ancillary income, and the mark-to-market valuation changes of the MSR asset itself. This revenue stream performs well when interest rates rise, as seen in early 2024. For instance, Rithm Capital reported a significant increase in MSR fair value as rates remained elevated through Q1 2024.

Net Interest Income for Rithm Capital represents the crucial spread between interest earned on its extensive portfolio of loans and securities and the interest expense incurred on its borrowings. For the first quarter of 2024, Rithm Capital reported a significant net interest income of $276.9 million. This figure directly reflects the fundamental earnings power generated from the assets held on its balance sheet, which totaled approximately $33.6 billion as of March 31, 2024. The size and strategic composition of this investment portfolio are the primary drivers of this essential income stream, underpinning the company's financial performance.

Rithm Capital generates substantial revenue from its loan origination activities, primarily through its subsidiary, Newrez. This gain on sale represents the premium received when these originated loans are sold into the secondary market, exceeding their face value. For instance, Newrez reported a gain on sale margin of 107 basis points in Q1 2024. This revenue stream is highly sensitive to fluctuations in loan origination volumes and prevailing capital markets conditions.

Loan Origination Fees & Other Income

Rithm Capital's loan origination fees and other income represent crucial revenue streams, encompassing all charges to borrowers during the loan creation process, such as underwriting and processing fees. This fee-based income is directly tied to the volume of new loans originated, reflecting market activity. Additionally, this stream includes diverse income from various business activities beyond core loan origination. For instance, in Q1 2024, Rithm Capital reported a significant contribution from its mortgage origination segment.

- Underwriting and processing fees are core components.

- Income is directly linked to new loan volume.

- Diversified other income contributes to overall revenue.

- Q1 2024 results highlighted strong mortgage origination contributions.

Asset Management & Incentive Fees

Rithm Capital is significantly expanding its alternative asset management capabilities, generating revenue through management and performance-based incentive fees from third-party capital. This stream comes from managing funds and investment vehicles for institutional clients. It represents a growing and high-margin component of Rithm's diversified earnings base, enhancing overall financial stability. In the first quarter of 2024, Rithm reported $40 billion in assets under management (AUM).

- Rithm Capital's AUM reached $40 billion as of Q1 2024.

- Asset management fees are derived from third-party capital.

- These fees include both fixed management fees and performance-based incentives.

- This revenue stream diversifies Rithm's earnings and boasts high margins.

Rithm Capital generates diverse revenue from its mortgage servicing portfolio, which benefits from rising interest rates, and substantial net interest income from its $33.6 billion asset base as of March 2024. Loan origination, through gain on sale and associated fees, contributes significantly, with a Q1 2024 gain on sale margin of 107 basis points. A growing stream is alternative asset management, deriving fees from $40 billion in Q1 2024 AUM.

| Revenue Stream | Key Metric (Q1 2024) | Value |

|---|---|---|

| Net Interest Income | NII | $276.9 million |

| Loan Origination | Gain on Sale Margin | 107 basis points |

| Alternative Asset Management | Assets Under Management (AUM) | $40 billion |

Business Model Canvas Data Sources

The Rithm Capital Business Model Canvas is informed by a robust blend of financial disclosures, market intelligence, and internal operational data. This ensures a comprehensive and accurate representation of our strategic framework.