RingCentral SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RingCentral Bundle

RingCentral, a leader in cloud-based unified communications, boasts significant strengths like its robust platform and strong market share. However, it also faces challenges such as intense competition and the need for continuous innovation to maintain its edge. Understanding these dynamics is crucial for anyone looking to invest or strategize in the UCaaS space.

Discover the complete picture behind RingCentral’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

RingCentral offers a unified MVP platform, integrating message, video, and phone into one solution. This comprehensive approach streamlines workflows and significantly boosts productivity for businesses globally. The platform’s all-in-one nature is a key differentiator in the competitive Unified Communications as a Service (UCaaS) market, where RingCentral held an estimated 17% market share in early 2024. This integration enables seamless communication, driving efficiency and collaborative advantages.

RingCentral has solidified its position as a leader in AI-powered business communications, strategically integrating artificial intelligence across its entire portfolio. Innovations like RingSense AI, offering advanced conversation intelligence, and the AI Receptionist (AIR) significantly enhance customer interactions and operational efficiency. This focus on AI helps unlock actionable insights from vast amounts of voice data, a valuable and often underutilized asset for businesses. For instance, RingSense AI's capabilities, expanded in early 2024, are pivotal for leveraging over 17 billion minutes of voice data processed annually on the platform. This technological edge provides a significant competitive advantage in the unified communications as a service (UCaaS) market.

RingCentral holds a strong market position, consistently recognized as a leader in the unified communications as a service (UCaaS) market by industry analysts. The company commands a significant market share and boasts a robust brand presence, particularly with enterprise customers. This leadership is further reinforced by a substantial and growing base of annual recurring revenue (ARR). By early 2025, RingCentral's ARR had already exceeded $2.5 billion, demonstrating its strong financial health and market dominance.

Strategic Partnerships Driving Growth

RingCentral has forged powerful strategic partnerships with industry giants like Avaya, Mitel, and Vodafone. These collaborations significantly expand RingCentral's market reach, tapping into a vast installed base of on-premise customers ripe for cloud migration. The partnership with Vodafone is a prime example, extending their unified communications as a service (UCaaS) solution to over 30 international markets by early 2025, substantially boosting global presence.

- Vodafone partnership reaching over 30 markets by early 2025.

- Access to large installed bases of on-premise customers.

- Strategic alliances with Avaya and Mitel enhance market penetration.

Focus on Profitability and Financial Discipline

RingCentral has demonstrated strong financial discipline, achieving GAAP operating profitability for multiple consecutive quarters, a significant shift from prior growth strategies. This focus has led to improved free cash flow, with projections showing continued strength into fiscal year 2025. The company's strategic pivot includes reducing stock-based compensation and paying down debt, strengthening its balance sheet. This commitment to a healthy financial profile is clearly translating into robust free cash flow per share growth.

- Achieved GAAP operating profitability for several consecutive quarters through Q1 2024.

- Projected free cash flow to exceed $200 million for fiscal year 2024.

- Reduced stock-based compensation as a percentage of revenue in recent quarters.

- Demonstrated consistent growth in free cash flow per share since 2023.

RingCentral dominates the UCaaS market with its unified MVP platform, holding an estimated 17% market share in early 2024. Strong AI integration, like RingSense AI, processes over 17 billion minutes of voice data annually. Strategic partnerships, including Vodafone reaching over 30 international markets by early 2025, and robust financial health with over $2.5 billion in ARR by early 2025, underscore its market leadership.

| Metric | Value (2024/2025) | Source |

|---|---|---|

| UCaaS Market Share | ~17% (early 2024) | Industry Estimates |

| Annual Recurring Revenue | >$2.5 Billion (early 2025) | Company Reports |

| Voice Data Processed Annually | >17 Billion Minutes | Company Data |

What is included in the product

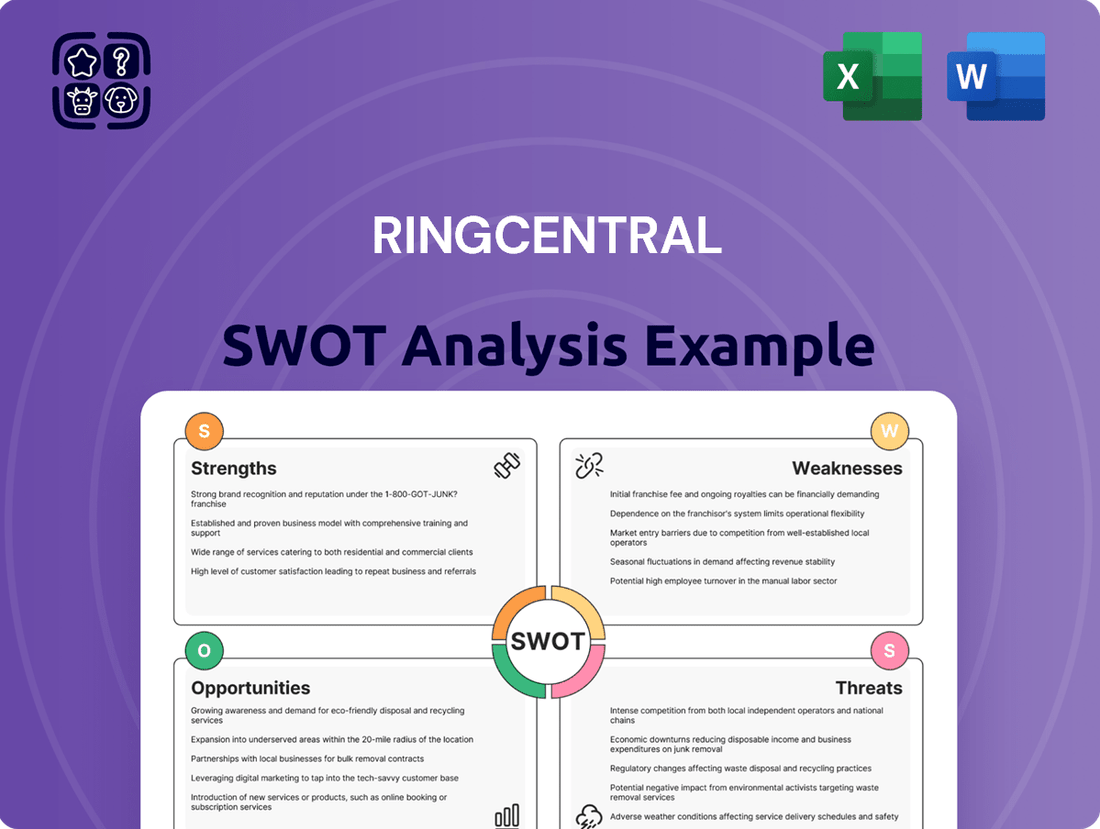

Analyzes RingCentral’s competitive position through key internal and external factors, highlighting its strengths in UCaaS and opportunities in enterprise adoption, while also acknowledging weaknesses in brand awareness and threats from established competitors.

Offers a clear visualization of RingCentral's competitive landscape, simplifying complex strategic planning.

Helps pinpoint areas for improvement and leverage strengths, directly addressing the pain of strategic uncertainty.

Weaknesses

RingCentral faces intense competition, primarily from tech giants like Microsoft and Zoom, which significantly pressures its market share. Microsoft Teams, in particular, is a dominant force in the unified communications market, leveraging its extensive ecosystem and integrated voice solutions. As of early 2024, Microsoft Teams' user base continued its robust growth, posing a direct threat to RingCentral's enterprise clients. This competitive landscape necessitates continuous, substantial investment in product innovation and marketing, impacting profitability and market positioning.

RingCentral's revenue growth has notably decelerated, now settling into the mid-single digits. For fiscal year 2025, the company's guidance projects total revenue growth between 4% and 6%, which is a significant slowdown from its historical expansion rates. This reduced growth trajectory, as observed by analysts, reflects increased market maturity and intense competitive pressures within the unified communications as a service (UCaaS) sector. Such deceleration is a core concern for investors, signaling a shift in the company's growth profile.

RingCentral's go-to-market strategy heavily relies on strategic partners like Avaya and Mitel, providing access to a substantial customer base. This dependence, however, introduces significant risks. For instance, any financial instability or shifting strategies from partners, such as Avaya's 2023 emergence from Chapter 11, could directly impact RingCentral's enterprise seat growth and revenue. While partner-led channels contributed meaningfully to RingCentral's 2024 revenue, this reliance means potential disruptions in partner performance could hinder its 2025 expansion goals. Such external vulnerabilities make RingCentral susceptible to factors beyond its direct control.

Perceived High Cost and Complex Plans

RingCentral's pricing structure can be a significant barrier, especially for smaller businesses where budgets are tighter. The perceived high cost of its comprehensive solutions, particularly advanced plans, often deters potential customers in the SMB segment. Moreover, the complexity of various packages and add-ons can overwhelm smaller teams lacking dedicated IT support, making plan selection and management cumbersome. This perception impacts market penetration among cost-sensitive segments, despite the robust feature set offered.

- RingCentral's premium tier plans, for example, typically start at over $30 per user per month, which can be prohibitive for many small businesses compared to competitors offering basic VoIP services under $20.

- A 2024 market analysis indicated that price sensitivity remains a top factor for SMBs selecting UCaaS providers, with over 60% prioritizing cost-effectiveness.

- The extensive array of features, while powerful, contributes to a higher entry price point, potentially excluding a segment of the market focused on essential communication tools.

Balance Sheet Vulnerabilities

RingCentral's balance sheet shows vulnerabilities, including a substantial total debt of approximately $1.6 billion as of late 2024, significantly outweighing its cash and equivalents. This results in total liabilities, around $2.3 billion, exceeding total assets, leading to a shareholders' deficit. While the company is focused on debt reduction initiatives, this financial structure could constrain its operational flexibility and ability to pursue strategic investments or acquisitions in 2025.

- Total debt of roughly $1.6 billion as of Q4 2024.

- Total liabilities exceed total assets, resulting in a shareholders' deficit.

RingCentral faces challenges in market perception, often viewed as a premium, feature-rich solution rather than a cost-effective one for smaller enterprises. This can limit its appeal against competitors offering more basic, budget-friendly options. The company's brand, while established, doesn't always resonate with the agility or ubiquity of rivals like Zoom or Microsoft Teams in certain market segments.

| Metric (FY2025 Est.) | RingCentral | Microsoft Teams | Zoom |

|---|---|---|---|

| Projected Revenue Growth | 4%-6% | ~15% (Microsoft 365) | ~5%-7% |

| Enterprise Market Share (UCaaS) | Mid-Single Digit % | Dominant (High % penetration) | High-Single Digit % |

| SMB Price Sensitivity (2024) | High impact | Medium impact | Medium impact |

What You See Is What You Get

RingCentral SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at RingCentral's strategic positioning. This detailed analysis covers their Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for your business. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

RingCentral is actively expanding into the Contact Center as a Service (CCaaS) market with its RingCX product, tapping into a projected $44.8 billion global CCaaS market by 2027. This move capitalizes on the growing convergence of UCaaS and CCaaS, as businesses increasingly seek unified communication platforms. The expansion significantly increases RingCentral's total addressable market and diversifies revenue streams beyond traditional UCaaS offerings. This strategic focus aims to capture a larger share of enterprise communication spending, enhancing long-term growth prospects.

RingCentral has a substantial opportunity for growth through strategic international expansion. Key partnerships, such as the one with Vodafone, are central to this strategy. This collaboration aims to make RingCentral's solutions available in over 30 countries across South America, the Middle East, Africa, and Asia Pacific by early 2025. Tapping into these global markets represents a significant runway for future revenue growth, potentially adding billions to its total addressable market by 2025.

Artificial intelligence offers a significant opportunity for RingCentral to create more intelligent and automated communication tools. The company is actively integrating AI across its portfolio, evidenced by features like automated call summaries and sentiment analysis in its RingCentral MVP platform, enhancing user efficiency. Further development of these AI capabilities can drive substantial product differentiation, providing greater value to customers and improving both employee and customer experiences. This strategic focus aims to maintain RingCentral's competitive edge in the evolving UCaaS market, with AI-powered features expected to grow in adoption through 2025.

Supporting the Hybrid Work Model

The global shift towards hybrid and remote work continues to drive strong demand for robust cloud communication solutions. Businesses increasingly require flexible, scalable, and secure platforms enabling seamless collaboration from any location. RingCentral's core offerings are perfectly aligned with this enduring trend, providing a solid foundation for sustained demand as the unified communications as a service (UCaaS) market is projected to exceed $60 billion by 2025, reflecting significant growth. This widespread adoption of hybrid models, with over 70% of companies planning continued hybrid work in 2024, directly fuels the need for integrated communication platforms like RingCentral.

- Global UCaaS market expected to surpass $60 billion by 2025.

- Over 70% of businesses anticipate maintaining hybrid work models through 2024 and 2025.

- Demand for secure, scalable communication platforms is rising.

- RingCentral's solutions directly support widespread enterprise hybrid work strategies.

Industry-Specific Solutions

There is a significant opportunity for RingCentral to develop UCaaS solutions tailored to specific industry needs, like healthcare, finance, and retail. This addresses a growing demand, as the global UCaaS market is projected to reach over $200 billion by 2025, driven partly by vertical-specific requirements. Creating these specialized offerings can unlock new revenue streams and foster deeper, more enduring customer relationships. Such tailored solutions can effectively meet unique compliance, security, and workflow demands, providing a distinct competitive edge in a crowded market.

- Healthcare UCaaS solutions can integrate with EMR systems.

- Financial services require robust security and compliance (e.g., FINRA).

- Retail solutions can enhance in-store communication and customer service.

- Targeted solutions drive higher customer lifetime value.

RingCentral has significant growth opportunities by expanding its CCaaS market presence, tapping into a projected $44.8 billion global market by 2027. Strategic international expansion via partnerships, such as Vodafone, will reach over 30 countries by early 2025. Leveraging AI to enhance product features and developing vertical-specific UCaaS solutions, targeting a $200 billion market by 2025, further boosts potential. The enduring shift to hybrid work also sustains demand, with the UCaaS market expected to surpass $60 billion by 2025.

| Opportunity | Market Size/Impact (2025) | Key Driver |

|---|---|---|

| CCaaS Expansion | $44.8B (by 2027) | UCaaS/CCaaS convergence |

| International Growth | Billions added to TAM | 30+ countries by early 2025 |

| AI & Vertical Solutions | $200B (UCaaS vertical) | Product differentiation & specific needs |

Threats

The Unified Communications as a Service (UCaaS) market is intensely competitive and increasingly crowded, with major players like Microsoft Teams and Zoom vying for market share. This fierce competition puts significant pressure on pricing and margins for providers such as RingCentral, particularly as enterprises increasingly favor integrated platforms.

Microsoft Teams, for instance, reported over 320 million monthly active users by early 2024, presenting a formidable challenge to standalone UCaaS offerings. Sustaining growth in this environment necessitates substantial investment in research and development and aggressive marketing efforts to differentiate services and retain customers.

As a prominent cloud-based UCaaS provider, RingCentral remains a prime target for cybersecurity threats, including sophisticated data breaches and ransomware attacks, which could severely impact its operations. A major security incident, such as the 2024 rise in cloud-targeted phishing attempts, could significantly erode customer trust and lead to substantial financial penalties and remediation costs. Navigating the complex and evolving landscape of data privacy regulations, like the GDPR and various state-level privacy acts effective in 2025, presents an ongoing operational and compliance challenge across its global footprint, increasing legal and reputational risks.

As the Unified Communications as a Service (UCaaS) market matures into 2025, RingCentral faces an increasing risk of saturation and the commoditization of its core services. With numerous vendors offering similar features, including Microsoft Teams and Zoom Phone, differentiation based on technology alone becomes challenging, intensifying price-based competition. This market dynamic could pressure profit margins, as evidenced by the stabilization of average revenue per user (ARPU) across the industry. To mitigate this, RingCentral must prioritize innovation with value-added services like advanced AI capabilities and strategically expand into adjacent, higher-growth markets such as Contact Center as a Service (CCaaS).

Economic Downturns and Shifting Business Priorities

An economic downturn could lead businesses to significantly reduce their spending on technology, directly impacting RingCentral's revenue growth. As the macroeconomic environment shifts, collaboration tools might become a lower spending priority for some companies compared to other essential IT projects, such as cybersecurity. This could slow down new customer acquisition and reduce expansion within the existing customer base, potentially affecting RingCentral's projected 2025 revenue growth, which analysts anticipate to be in the low single digits. Businesses might opt for cost-cutting measures, impacting discretionary software spending.

- Projected 2025 UCaaS market growth could decelerate if economic headwinds persist, influencing enterprise IT budgets.

- Customers may defer upgrades or reduce seat counts to manage costs, impacting RingCentral's recurring revenue streams.

Misconfiguration and Human Error

A significant threat to RingCentral stems from misconfigurations of cloud services, often due to human error rather than malicious attacks. These errors create vulnerabilities attackers can exploit, impacting data integrity and privacy. For instance, the Verizon 2024 Data Breach Investigations Report indicates that human error, including misconfigurations, remains a top cause of breaches. Ensuring proper setup and ongoing management of RingCentral's platform is critical for both the company and its customers to mitigate these pervasive security risks.

- Human error contributes to over 80% of cloud security incidents.

- Misconfigurations expose 65% of cloud environments to potential breaches in 2024.

- Automated security checks can reduce misconfiguration risks by 40%.

- Staff training and robust access controls are crucial by mid-2025.

RingCentral faces intense competition from market leaders like Microsoft Teams, which had over 320 million monthly active users by early 2024, pressuring pricing and margins. Cybersecurity threats, including cloud-targeted phishing and human error-driven misconfigurations, pose significant risks to data integrity and customer trust. The maturing UCaaS market by 2025, coupled with potential economic downturns, could lead to service commoditization and impact RingCentral's projected low single-digit revenue growth.

| Threat Category | Key Metric/Data Point | Impact/Context (2024/2025) |

|---|---|---|

| Market Competition | Microsoft Teams MAU | 320M+ by early 2024, intensifying pricing pressure. |

| Cybersecurity Risks | Cloud Misconfigurations | 65% of cloud environments exposed; human error causes 80% of cloud incidents. |

| Economic Downturn | RingCentral 2025 Revenue Growth | Anticipated low single-digit growth due to reduced enterprise IT spending. |

SWOT Analysis Data Sources

This analysis is built on a robust foundation of RingCentral's official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide verified data on market share, competitive landscapes, and technological advancements.