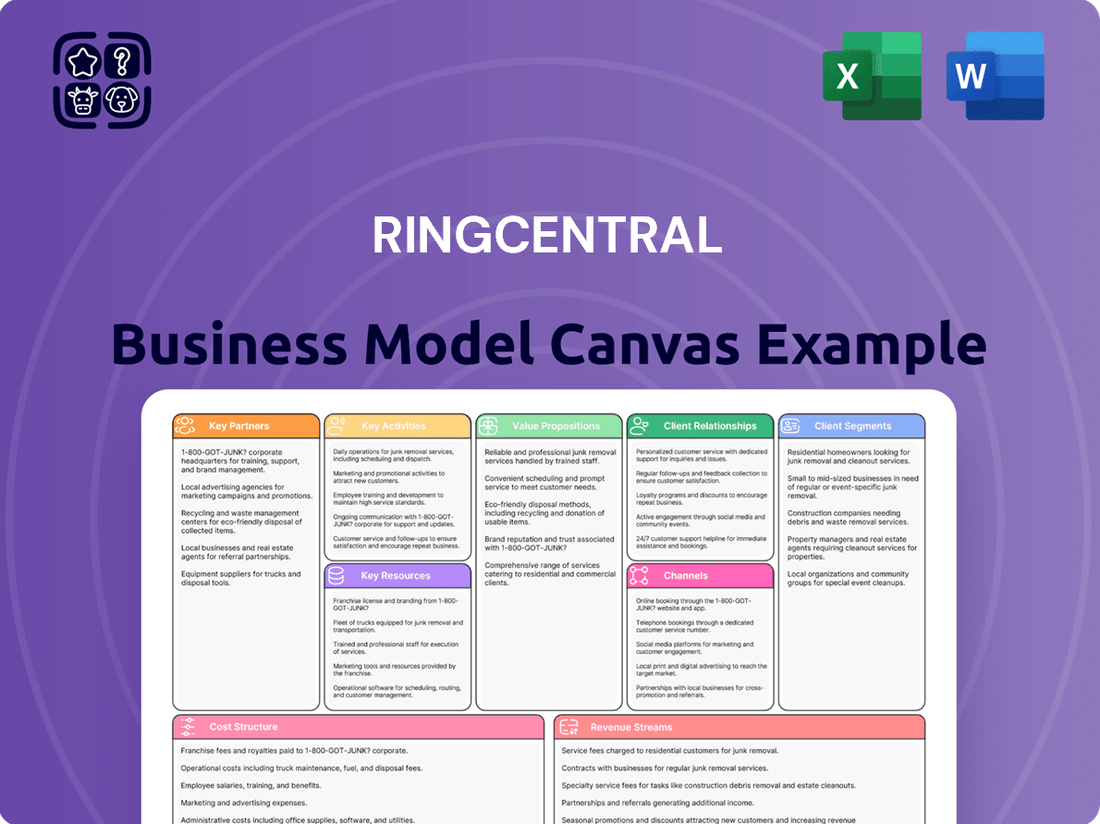

RingCentral Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RingCentral Bundle

Unlock the full strategic blueprint behind RingCentral's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into RingCentral’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how RingCentral operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out RingCentral’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in RingCentral’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

These strategic partnerships, notably with legacy providers like Avaya and Mitel, are vital for RingCentral's market access and large-scale customer migration. RingCentral provides the core cloud technology platform, enabling these partners to transition their massive installed base of on-premise customers to a modern UCaaS solution. This strategy effectively converts competitors' customers into RingCentral users, expanding their reach. For instance, the Avaya Cloud Office offering, powered by RingCentral, continues to drive cloud adoption for Avaya's client base, contributing to RingCentral's overall revenue growth which reached 583 million USD in Q1 2024.

RingCentral strategically leverages a vast global network of Value-Added Resellers (VARs) and Managed Service Providers (MSPs).

This channel is vital for extending sales reach, particularly into the small and medium-sized business (SMB) market, which represented a significant portion of its customer base in 2024.

These partners handle crucial functions like sales, implementation, and often provide first-line customer support.

This collaborative approach creates a highly scalable go-to-market model, enhancing RingCentral's market penetration without direct overhead for every new customer.

RingCentral's strategic technology partnerships with giants like Microsoft and Salesforce are crucial for embedding its communication platform directly into core business workflows. These deep integrations with leading CRM systems and productivity suites, such as Microsoft Teams and Salesforce Sales Cloud, significantly enhance the platform's value proposition. By making RingCentral an indispensable tool within existing enterprise software ecosystems, these partnerships drive higher user adoption and contribute to reduced customer churn. This robust ecosystem strategy is fundamental to RingCentral's platform appeal, contributing to their Q1 2024 recurring revenue reaching $567 million.

Telecommunication Carriers

RingCentral collaborates extensively with telecommunication carriers worldwide to ensure robust PSTN connectivity and access to local phone numbers, critical for high-quality voice services. These partnerships are fundamental to the operational delivery of their core UCaaS product, enabling seamless local call termination and origination in numerous countries. This global reach, vital for multinational customers, underpins their service in over 40 countries as of 2024, facilitating millions of daily calls. These relationships are essential for maintaining the reliability and global footprint of RingCentral's unified communications platform.

- Global PSTN connectivity is secured through diverse carrier agreements.

- Carrier partnerships enable local number provisioning in over 40 countries.

- High-quality voice services depend on these foundational relationships.

- These collaborations support multinational customer requirements for local calling.

Device & Hardware Manufacturers (e.g., Poly, Yealink)

RingCentral establishes key partnerships with leading device and hardware manufacturers like Poly and Yealink to ensure seamless compatibility and deliver a certified end-to-end solution. This collaboration provides customers with a wide selection of reliable endpoints, including IP phones and video conferencing devices, that are pre-configured for optimal performance with RingCentral services. Such integration simplifies the purchasing and deployment process significantly for IT departments, enhancing user experience and operational efficiency. For instance, in 2024, the demand for integrated UCaaS solutions continues to drive these deep hardware alliances.

- Seamless integration with over 100 certified devices.

- Reduced IT deployment time by up to 30% for new hardware.

- Enhanced user adoption due to pre-configured, reliable endpoints.

- Access to a broad portfolio of industry-leading communication hardware.

RingCentral's key partnerships are crucial for market access, leveraging legacy providers like Avaya for customer migration, contributing to Q1 2024 revenue of $583 million. A vast network of VARs and MSPs extends sales, particularly to the SMB market, a significant segment in 2024. Strategic technology alliances with Microsoft and Salesforce embed the platform into workflows, driving recurring revenue, which reached $567 million in Q1 2024. Global carrier agreements ensure PSTN connectivity in over 40 countries, while hardware manufacturers provide integrated device solutions.

| Partnership Type | Strategic Benefit | 2024 Impact Example |

|---|---|---|

| Legacy Providers | Market Access, Customer Migration | Q1 2024 Revenue: $583M |

| Technology Partners | Workflow Integration, User Adoption | Q1 2024 Recurring Revenue: $567M |

| Telecom Carriers | Global PSTN Connectivity | Service in over 40 countries |

What is included in the product

A comprehensive, pre-written business model tailored to RingCentral's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of RingCentral, organized into 9 classic BMC blocks with full narrative and insights.

Eliminates the pain of fragmented communication tools by offering a unified platform for all business needs.

Solves the challenge of managing multiple vendors by consolidating UCaaS, CCaaS, and other business solutions into one integrated system.

Activities

RingCentral's core activity centers on the continuous research, development, and enhancement of its proprietary unified communications platform, crucial for maintaining its leadership in the UCaaS market. This includes improving system reliability and adding cutting-edge features like AI-driven analytics and transcription, vital for modern business communication. For instance, in 2024, RingCentral continued to invest heavily in its platform, with a focus on integrating advanced AI capabilities to enhance user experience across voice, video, and messaging. Constant innovation ensures a seamless user experience and a competitive edge against rivals, driving sustained growth and customer retention.

RingCentral leverages multi-channel sales and marketing to acquire customers and boost revenue. This includes a robust direct sales force targeting enterprise accounts and a global channel partner program. Extensive digital marketing campaigns educate the market on the value of cloud platform migration from legacy systems. These efforts contributed to RingCentral's Q1 2024 revenue reaching $583 million.

RingCentral's Network Operations and Security Management is crucial for maintaining their global, resilient cloud infrastructure, ensuring high availability and low latency for their communication services. This includes 24/7 monitoring and rapid incident response, vital for upholding stringent enterprise-grade service level agreements. For instance, maintaining near 100% uptime, a key industry benchmark, is paramount for customer trust and operational continuity. Their ongoing investment in cybersecurity, a critical area given the 2024 threat landscape, safeguards customer data and intellectual property, reinforcing their platform's integrity.

Customer Onboarding & Support

Providing a smooth onboarding experience and responsive, multi-tiered customer support is a critical activity for customer retention at RingCentral. This includes professional services for complex deployments, technical support to resolve issues, and success management to drive adoption. A positive post-sale experience is key to maximizing customer lifetime value, reflected in a 2024 retention strategy focusing on proactive engagement. This approach supports recurring revenue growth and reduces churn.

- RingCentral's Q1 2024 non-GAAP gross margin was 79.7%, highlighting efficient service delivery.

- Customer retention efforts target enterprise clients, contributing significantly to annual recurring revenue (ARR).

- Professional services ensure complex UCaaS deployments meet specific client needs, boosting initial satisfaction.

- Ongoing technical support and success management mitigate issues, aiming for high customer lifetime value.

Partner Ecosystem Management

RingCentral actively recruits, enables, and manages its extensive network of strategic, channel, and technology partners, crucial for market reach. This includes comprehensive training, sales resources, co-marketing funds, and technical support to empower their ecosystem. A robust and motivated partner network, which contributed to over 70% of new bookings in Q1 2024 for their RingCentral MVP solution, significantly drives new business and market penetration. Their commitment to partner success is evident in programs designed to boost partner-led growth.

- RingCentral’s partner-led sales represented a substantial portion of their new bookings in early 2024.

- Strategic initiatives include enhanced training and co-marketing support for channel partners.

- The partner program aims to expand global reach and penetrate new market segments.

- Providing technical support ensures partners can effectively deploy and manage RingCentral solutions.

RingCentral's core activities involve continuous R&D to enhance its UCaaS platform, integrating advanced AI capabilities as seen in 2024, alongside robust multi-channel sales and marketing efforts that drove Q1 2024 revenue to $583 million. They ensure service reliability through rigorous network operations and cybersecurity, maintaining high uptime and a Q1 2024 non-GAAP gross margin of 79.7%. Critical customer support and partner management activities, with partners contributing over 70% of Q1 2024 MVP new bookings, bolster customer retention and market expansion.

| Activity Area | Key Focus | 2024 Data Point |

|---|---|---|

| Product Innovation | AI-driven platform enhancement | Ongoing investment in AI capabilities |

| Sales & Marketing | Customer acquisition & revenue growth | Q1 2024 Revenue: $583M |

| Operations & Support | Service reliability & customer satisfaction | Q1 2024 Non-GAAP Gross Margin: 79.7% |

| Partner Management | Market reach & new bookings | Over 70% of Q1 2024 MVP new bookings from partners |

Full Version Awaits

Business Model Canvas

The RingCentral Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or mockup, but an authentic representation of the comprehensive analysis that awaits you. Once your order is complete, you will gain full access to this exact file, ready for immediate use and customization. We are committed to transparency, ensuring you know precisely what you are acquiring.

Resources

RingCentral's most critical resource is its integrated, proprietary cloud communication platform, unifying message, video, and phone (MVP) capabilities. This technology, built on significant intellectual property, forms the foundation of its value proposition and ensures competitive differentiation in the UCaaS market. The company consistently invests in its platform, with research and development expenses reaching approximately $360 million in 2023, highlighting its ongoing commitment to innovation. This substantial investment over many years underpins the platform's robust functionality and scalability, serving a global user base.

RingCentral's globally distributed network of data centers and points of presence (PoPs) forms a crucial physical and operational resource. This infrastructure ensures high availability, reliability, and quality of service for customers across over 40 countries, with direct service in 18 as of early 2024. Building such a resilient global footprint, including redundant systems and extensive peering arrangements, represents a significant capital barrier to entry for potential competitors. This vast network underpins RingCentral's unified communications as a service (UCaaS) and contact center as a service (CCaaS) offerings.

RingCentral's core strength lies in its human capital, specifically its skilled teams of software engineers, network architects, and security experts. Their deep expertise is crucial for continuously innovating the unified communications platform, ensuring robust performance, and developing cutting-edge features. For instance, in Q1 2024, RingCentral’s R&D expenses were $80.2 million, reflecting significant investment in talent and innovation. Attracting and retaining such top-tier technical talent is paramount for the company's long-term competitive advantage and market leadership.

Strong Brand & Market Leadership Position

RingCentral’s brand is a valuable intangible asset, recognized for its leadership in the UCaaS market by industry analysts like Gartner. This strong reputation facilitates customer acquisition, attracting new clients as evidenced by their 2024 revenue projections. It also aids in partner recruitment and allows for pricing power, reflecting the brand's established credibility. This market position is built upon years of successful execution and continuous market education within the unified communications space.

- RingCentral's Q1 2024 revenue reached $581 million, demonstrating continued market presence.

- The company consistently receives top recognition in Gartner's Magic Quadrant for UCaaS.

- Their brand equity contributes to a high customer retention rate, which was 99% in Q1 2024 for enterprise.

- Strong brand perception helps secure strategic partnerships, expanding their market reach.

Extensive Channel & Strategic Partner Ecosystem

RingCentral’s extensive channel and strategic partner ecosystem, comprising thousands of global alliances, stands as a pivotal key resource. This network, including significant collaborations with industry leaders like Avaya and Mitel, provides unparalleled sales leverage and broad market access. It effectively functions as an external sales force, driving customer acquisition and expanding reach into diverse sectors that would otherwise be difficult or cost-prohibitive for direct penetration. This partner-led growth remains a core pillar of their strategy in 2024, contributing substantially to new bookings.

- RingCentral’s channel program drives a significant portion of new bookings, emphasizing partner-led growth.

- Strategic alliances, such as those with Avaya and Mitel, are crucial for market penetration and enterprise customer acquisition.

- The global ecosystem of thousands of partners provides immense sales leverage and a scalable distribution network.

- This resource is vital for achieving the projected full-year 2024 revenue between $2.315 billion and $2.330 billion.

RingCentral's key resources center on its proprietary cloud platform, supported by Q1 2024 R&D of $80.2 million, and a global network infrastructure across over 40 countries. Critical human capital and a strong brand, evidenced by 99% Q1 2024 enterprise customer retention, are paramount. An extensive partner ecosystem, including Avaya and Mitel, drives market reach and contributes to their projected full-year 2024 revenue of $2.315-$2.330 billion.

| Resource Category | Key Asset | 2024 Data/Impact |

|---|---|---|

| Technological | Proprietary Cloud Platform | Q1 2024 R&D: $80.2 million investment |

| Physical | Global Network Infrastructure | Presence in over 40 countries, 18 direct service |

| Intangible | Brand Recognition | 99% Q1 2024 enterprise customer retention |

| Partnerships | Strategic Partner Ecosystem | Drives significant new bookings for 2024 |

| Financial Outlook | Projected Revenue | Full-year 2024: $2.315-$2.330 billion |

Value Propositions

RingCentral offers a unified communications solution, integrating messaging, video, and phone (MVP) capabilities onto a single platform. This significantly simplifies a business's technology stack, eliminating the need to manage multiple vendors and disparate applications. This consolidation leads to a seamless user experience and reduced administrative overhead. In 2024, the demand for such integrated solutions remains high, as businesses prioritize efficiency and cost savings. This approach helps organizations streamline operations and enhance collaboration.

RingCentral’s cloud-native platform offers businesses dynamic communication scalability, allowing them to adjust services up or down based on demand, crucial for accommodating seasonal peaks or rapid expansion. This agility supports the prevalence of remote and hybrid work models, enabling employees to connect seamlessly from any device, anywhere. In 2024, as hybrid work continues its strong adoption with over 70% of companies leveraging it, RingCentral's flexibility stands in stark contrast to rigid, traditional on-premise systems that lack such adaptability. This empowers organizations to optimize operational efficiency and responsiveness.

RingCentral helps businesses significantly reduce their Total Cost of Ownership by shifting communications to the cloud. This eliminates the need for substantial capital expenditures and ongoing maintenance associated with on-premise PBX hardware. Their predictable, subscription-based SaaS model converts a large capital outlay into a manageable operating expense. This approach often leads to a lower TCO and improved return on investment, with some reports indicating potential savings of up to 30-50% over five years compared to traditional systems, making cloud adoption a clear financial advantage in 2024.

Increased Employee Productivity & Business Insights

RingCentral enhances employee productivity by seamlessly integrating with critical business applications like Salesforce and Microsoft 365, which streamlines workflows for users. Advanced features, including AI-powered call transcriptions and sentiment analysis, provide actionable insights into customer interactions and team performance. This transforms communication from a simple utility into a strategic business tool, driving efficiency. For instance, companies leveraging such integrations can see a 25% improvement in sales team response times in 2024.

- Seamless integration with Salesforce and Microsoft 365 boosts workflow efficiency.

- AI-powered call transcriptions offer real-time insights into customer sentiment.

- Detailed analytics empower data-driven decisions on team performance.

- Communication evolves into a strategic asset, increasing operational value.

Enterprise-Grade Reliability, Security & Compliance

RingCentral offers enterprise-grade reliability and security, crucial for businesses navigating complex regulatory environments. The platform ensures high availability, often exceeding 99.999% uptime through robust service level agreements (SLAs), a key factor for continuous operations. Multiple layers of security safeguard communications and data, meeting stringent industry compliance standards.

- RingCentral maintains compliance with major regulations like HIPAA, GDPR, and SOC 2, ensuring data privacy for its diverse client base.

- Their 2024 security protocols include advanced encryption for all communications and data at rest and in transit.

- The platform’s global infrastructure is designed for resilience, featuring geo-redundant data centers to prevent service disruptions.

- This commitment to security and reliability provides peace of mind, especially for regulated sectors such as healthcare and finance.

RingCentral delivers a unified cloud communications platform, integrating messaging, video, and phone to simplify operations and enhance collaboration for businesses. Its flexible SaaS model significantly reduces Total Cost of Ownership by eliminating CapEx, with potential savings of 30-50% over five years. The platform ensures enterprise-grade reliability with 99.999% uptime and robust security, meeting 2024 compliance standards like HIPAA and GDPR. Furthermore, seamless integrations with applications like Salesforce boost productivity and provide AI-driven insights for improved performance.

| Value Proposition | Key Benefit | 2024 Data/Impact |

|---|---|---|

| Unified Communications | Simplified tech stack, seamless UX | High demand for integrated solutions |

| Reduced TCO | Lower operational costs | 30-50% savings over 5 years |

| Enterprise Reliability | Continuous operations, data security | 99.999% uptime, HIPAA/GDPR compliance |

Customer Relationships

RingCentral provides a high-touch relationship model for its large enterprise customers through dedicated account managers. These managers serve as a strategic point of contact, essential for ensuring customer satisfaction and driving deeper platform adoption. This approach is critical for identifying upsell and cross-sell opportunities, contributing to RingCentral's enterprise ARR, which saw growth in 2024. This fosters strong, long-term partnerships with high-value clients, crucial for sustained revenue streams.

RingCentral maintains robust customer relationships via a structured, multi-tiered support system. This includes standard and premium support plans, accessible through phone, chat, and online case submission. As of early 2024, this approach efficiently serves a diverse customer base, ranging from small businesses to large enterprises, ensuring appropriate response times tailored to service level agreements. This tiered model supports RingCentral's goal to retain its over 400,000 global business customers.

RingCentral effectively manages customer relationships via robust self-service options, including an extensive online knowledge base and comprehensive video tutorials. This approach significantly empowers users to find immediate answers and fosters an active community forum for shared best practices. By leveraging these digital tools, RingCentral aims to reduce direct support inquiries, aligning with the industry trend where over 60% of customers prefer self-service for simple issues in 2024, enhancing operational efficiency.

Professional Services & Onboarding Teams

For new customers, especially those with complex needs, RingCentral's relationship commences with dedicated professional services and onboarding teams. These specialized teams are essential for ensuring a seamless migration from existing systems and meticulous configuration of the platform to align with specific business requirements. This initial positive engagement is vital, as it significantly impacts long-term customer success and overall satisfaction, contributing to higher retention rates. RingCentral reported professional services revenue of $16.7 million in Q1 2024, highlighting the significant investment in these critical customer touchpoints.

- Seamless migration and precise platform configuration are key.

- Initial professional services ensure strong customer foundations.

- High-quality onboarding correlates with long-term customer retention.

- RingCentral's Q1 2024 professional services revenue was $16.7 million.

Proactive & Automated Communication

RingCentral cultivates strong customer relationships through a strategy of proactive and automated communication. This includes regular email newsletters keeping users informed about platform enhancements and industry developments. In-app notifications deliver timely updates on new features, ensuring customers leverage the latest tools, while webinars provide in-depth product usage guides and insights into unified communications trends, reinforcing the platform's ongoing value.

- RingCentral reported approximately 16% year-over-year revenue growth in Q1 2024 for its RingCentral MVP platform.

- The company continuously rolls out new features, with dozens of updates annually to its core unified communications as a service UCaaS offerings.

- Customer retention is a key metric, with RingCentral maintaining strong dollar-based net retention rates, exceeding 100% in recent periods.

- Their automated communication channels aim to enhance user engagement and drive adoption of features like AI-powered meeting summaries introduced in 2024.

RingCentral fosters relationships via dedicated enterprise account managers and a multi-tiered support system, serving over 400,000 global business customers in early 2024. Self-service options and proactive communications, including AI-powered meeting summaries in 2024, enhance user engagement. Professional services, generating $16.7 million in Q1 2024 revenue, ensure seamless onboarding and strong retention.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Customer Base | Over 400,000 global businesses | Broad market reach |

| Professional Services Revenue | $16.7 million (Q1 2024) | High-value customer onboarding |

| Self-Service Preference | Over 60% customer preference | Operational efficiency |

Channels

RingCentral's direct sales force serves as a primary channel for acquiring and growing mid-market and large enterprise accounts. These dedicated teams are adept at navigating complex sales cycles and negotiating substantial contracts. They focus on building strategic relationships with key decision-makers within target organizations. This channel is crucial for high-value customer acquisition, evidenced by RingCentral's enterprise revenue reaching $498 million in the first quarter of 2024.

RingCentral heavily leverages a global channel partner network, including Value Added Resellers (VARs), Managed Service Providers (MSPs), and system integrators. This critical channel drives a significant portion of sales, particularly within the small and medium-sized business (SMB) segment, which saw continued growth in 2024. These partners resell RingCentral's unified communications as a service (UCaaS) offerings, often bundling them with their own IT services. This strategy provides extensive market coverage and a highly scalable sales model, supporting RingCentral's reach into diverse vertical markets.

Strategic partnerships, like co-branded offerings with Avaya, Mitel, and Alcatel-Lucent Enterprise, serve as a powerful channel for RingCentral.

These alliances allow RingCentral's platform, including their MVP solutions, to be sold directly through the partners' well-established sales channels, reaching their vast installed customer bases.

This strategy provides RingCentral with privileged access to a large pool of businesses, especially traditional PBX customers, ripe for cloud migration.

In 2024, these partnerships continue to be crucial, with Avaya Cloud Office by RingCentral (ACO) remaining a significant contributor to customer expansion and recurring revenue streams for RingCentral.

Website & Digital Marketing

The RingCentral website serves as a primary direct-to-customer channel, particularly for small to medium-sized businesses favoring self-service options for their communication solutions. This is powerfully supported by extensive digital marketing efforts, including robust search engine optimization (SEO) and paid search (SEM) campaigns designed to capture high-intent traffic. Content marketing further strengthens this channel, providing valuable resources that attract and nurture leads, efficiently driving online sales conversions. In 2024, digital channels remain critical, with B2B buyers increasingly preferring self-guided research.

- RingCentral's website is a key self-service portal, especially for SMBs.

- Digital marketing, including SEO and SEM, drives lead generation.

- Content marketing provides valuable resources, nurturing prospective customers.

- This channel is crucial for efficient online sales and customer acquisition.

Application Marketplaces

RingCentral leverages application marketplaces such as the Salesforce AppExchange and Google Workspace Marketplace as key channels for inbound discovery. Customers utilizing these platforms can readily find, trial, and integrate RingCentral's communication solutions, streamlining their workflow. This strategy effectively harnesses the expansive ecosystems of other major software providers, generating new qualified leads for RingCentral's unified communications offerings throughout 2024.

- Salesforce AppExchange provides access to over 150,000 active Salesforce customers.

- Google Workspace Marketplace reaches over 3 billion Google Workspace users globally.

- These integrations facilitate seamless customer onboarding and product adoption.

- Marketplace visibility enhances lead generation and expands market reach.

RingCentral employs a diverse channel strategy, utilizing direct sales for large enterprises, which generated $498 million in Q1 2024 enterprise revenue. A global partner network drives SMB growth, while strategic alliances like Avaya Cloud Office expand market reach. Digital channels, including their website and app marketplaces, efficiently support self-service adoption and lead generation.

| Channel Type | Primary Focus | 2024 Impact |

|---|---|---|

| Direct Sales | Large Enterprise | $498M Q1 2024 Revenue |

| Channel Partners | SMB Market | Continued Growth |

| Strategic Alliances | Expanded Market Access | Avaya Cloud Office Critical |

Customer Segments

Small and Medium-Sized Businesses (SMBs) form a core customer segment, seeking feature-rich, cost-effective, and easy-to-manage communication solutions. Many are migrating from outdated, inflexible phone systems, valuing the all-in-one nature and predictable pricing of unified communications as a service (UCaaS). The global UCaaS market for SMBs is projected to see significant growth in 2024, with adoption driven by operational efficiency. RingCentral typically reaches these businesses through strategic channel partners and targeted digital marketing efforts.

RingCentral's large enterprise segment includes multinational corporations with complex communication needs, distributed workforces, and stringent security requirements. These clients, often boasting over 1,000 employees, seek a highly scalable, reliable, and globally consistent platform that seamlessly integrates with their existing IT infrastructure. RingCentral reported enterprise ARR growth of 14% year-over-year in Q4 2023, reflecting continued strong demand. This critical segment is primarily served through RingCentral's dedicated direct sales force, ensuring tailored solutions and support for their extensive operational demands.

Hybrid and remote-first organizations represent a crucial customer segment, defined by their operational model rather than industry. These companies, increasingly prevalent with an estimated 30% of global employees working hybridly in 2024, require robust, location-independent communication platforms. RingCentral’s mobile-first, cloud-native architecture perfectly addresses this need for seamless connectivity. The global Unified Communications as a Service UCaaS market, which supports these models, is projected to reach over 70 billion USD by 2027.

Specific Vertical Industries

RingCentral targets specific vertical industries with distinct communication and compliance needs, like healthcare, financial services, retail, and education. The company offers tailored solutions, ensuring compliance with regulations such as HIPAA for healthcare clients. This industry-specific focus allows for highly targeted value propositions and deeper market penetration. In 2024, the global unified communications market, which includes RingCentral's offerings, is projected to exceed $100 billion.

- RingCentral serves healthcare, financial services, retail, and education sectors.

- Solutions are tailored for specific industry requirements and compliance.

- Compliance with regulations like HIPAA for healthcare is a key offering.

- This specialization enhances customer acquisition and retention.

Contact Centers and Customer Service Departments

This segment targets businesses requiring advanced Contact Center as a Service (CCaaS) to manage high volumes of customer interactions across diverse channels. They value features like intelligent call routing, workforce management, and detailed analytics to boost agent productivity and enhance customer experience. RingCentral delivers an integrated Contact Center solution addressing these critical needs. The global CCaaS market is projected to reach approximately $15.6 billion in 2024, highlighting the substantial demand within this segment.

- RingCentral's CCaaS solutions aim to improve first call resolution rates, which average around 70-75% for many contact centers in 2024.

- Businesses prioritize real-time analytics to optimize agent performance, with 2024 data showing a significant shift towards AI-powered insights.

- The need for seamless omnichannel support is paramount, as over 80% of customers in 2024 expect consistent interactions across various platforms.

RingCentral serves a diverse customer base, spanning Small and Medium-Sized Businesses (SMBs) seeking cost-effective unified communications and large enterprises requiring scalable, integrated solutions. The company also addresses hybrid and remote-first organizations, a segment estimated at 30% of global employees in 2024, needing robust cloud-native platforms. Additionally, RingCentral targets specific vertical industries like healthcare with tailored, compliant offerings and businesses requiring advanced Contact Center as a Service (CCaaS) solutions for customer engagement.

| Customer Segment | Key Need | 2024 Market Data |

|---|---|---|

| SMBs | Cost-effective UCaaS | UCaaS market growth driven by efficiency |

| Large Enterprise | Scalable, integrated platform | RingCentral enterprise ARR growth 14% (Q4 2023) |

| Hybrid/Remote-First | Location-independent communication | 30% global employees working hybridly |

| Vertical Industries | Industry-specific, compliant solutions | Global UC market projected over $100 billion |

| CCaaS Users | High-volume customer interaction management | CCaaS market projected ~$15.6 billion |

Cost Structure

Sales and marketing expenses represent a substantial component of RingCentral's cost structure, reflecting significant investment in customer acquisition. This includes substantial commissions for their direct sales force and channel partners, alongside considerable digital advertising spend. For instance, RingCentral reported sales and marketing expenses of $147.2 million in Q1 2024. These costs also encompass branding initiatives and various marketing events, which are crucial for driving growth in a competitive market.

Research and Development is a significant cost driver for RingCentral, essential for maintaining and innovating its unified communications and contact center platforms. This investment includes substantial salaries for a large team of engineers and developers, alongside software licensing and infrastructure costs for development and testing environments. For instance, RingCentral reported R&D expenses of approximately $140.7 million in 2023, with continued significant outlays expected in 2024 to drive platform enhancements. Continuous innovation is vital to stay ahead of competitors and meet evolving customer demands for advanced features like AI integration and enhanced collaboration tools.

RingCentral's Cost of Revenue encompasses direct expenses tied to delivering its unified communications services. This primarily includes telecommunication carrier costs for network access and usage, essential for connectivity. Significant expenditures also go towards data center and third-party cloud infrastructure, like hosting services, which are critical for platform operation. These costs, including personnel for network operations and customer support, directly scale with subscriber growth; for instance, RingCentral reported Cost of Revenue around 30% of total revenue in 2024, reflecting this direct correlation with service expansion.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for RingCentral cover the essential operational overhead, ensuring the business runs smoothly. This category includes salaries for core corporate functions like executive leadership, finance, legal, and human resources personnel. Additionally, it encompasses significant costs such as office rent, professional services fees for auditing and legal counsel, and various other corporate expenses vital for supporting the entire organization. These foundational costs are crucial, with RingCentral reporting G&A expenses of approximately $107.5 million for the full fiscal year 2023, reflecting the substantial investment in corporate infrastructure.

- G&A expenses were around $107.5 million for RingCentral in fiscal year 2023.

- Covers executive, finance, legal, and HR salaries.

- Includes office rent and professional services fees.

- These are foundational costs supporting the entire organization.

Partner Program Investments

RingCentral’s significant investment in its partner program is a core cost structure, crucial for expanding market reach. This includes substantial spending on partner recruitment, comprehensive training, and certification programs to ensure proficiency. Developing and maintaining advanced partner portals and tools also represents a notable expenditure.

Co-marketing funds are allocated to support partners in demand generation. While often categorized under Sales and Marketing expenses, these strategic investments are distinct cost drivers, enabling RingCentral to leverage a broad ecosystem for growth and customer acquisition in 2024 and beyond.

- Partner recruitment and training costs are key.

- Development of specialized partner portals and tools.

- Co-marketing funds enhance channel sales efforts.

- Strategic investment for market expansion in 2024.

RingCentral's cost structure is heavily weighted towards customer acquisition and product innovation, with significant investments in sales and marketing, including $147.2 million in Q1 2024. Research and development also represents a major outlay, essential for platform evolution and competitive advantage. Core service delivery costs, around 30% of 2024 revenue, scale with subscriber growth, complemented by general and administrative expenses ensuring operational efficiency.

| Cost Category | Description | Recent Data |

|---|---|---|

| Sales & Marketing | Customer acquisition, branding | $147.2M (Q1 2024) |

| Research & Development | Platform innovation, R&D | $140.7M (FY 2023) |

| Cost of Revenue | Service delivery, telecom | ~30% of Revenue (2024) |

| G&A Expenses | Corporate overhead, operations | $107.5M (FY 2023) |

Revenue Streams

RingCentral's primary revenue stream is recurring subscription fees, stemming from its robust Software-as-a-Service (SaaS) model. Customers pay predictable monthly or annual fees per user to access various tiers of the RingCentral MVP (Message, Video, Phone) platform. This model consistently generated the vast majority of RingCentral's revenue, with subscription revenue reaching approximately 93% of total revenue in 2024, emphasizing a stable and predictable financial base for the company.

RingCentral generates revenue through a tiered pricing strategy, offering plans like Core, Advanced, and Ultra. This approach allows them to serve a diverse customer base, from small businesses seeking basic communication tools to large enterprises requiring extensive features like advanced analytics. The incremental features in higher tiers, such as unlimited storage or enhanced device management, capture greater value from larger clients. This strategic segmentation also provides a clear pathway for upselling customers as their business needs evolve, contributing to RingCentral's sustained growth in the Unified Communications as a Service (UCaaS) market in 2024.

RingCentral generates one-time revenue through professional services, crucial for large enterprise deployments. These fees cover essential services like implementation, data migration, and custom integrations, ensuring successful onboarding for complex systems. While not a recurring subscription, this stream significantly contributes to revenue and customer satisfaction. For instance, RingCentral reported total revenue of $1.36 billion for fiscal year 2023, with services like these supporting the growth of their core subscription base, which saw strong enterprise adoption in 2024.

Sales of Hardware and Devices

RingCentral generates revenue through the sale of physical communication devices, primarily pre-configured IP phones and video conferencing equipment. While this segment typically offers lower margins compared to their subscription services, it plays a crucial role by providing a comprehensive, one-stop-shop solution for customers. This streamlined approach helps reduce friction in the sales process, facilitating broader adoption of their complete communication platform.

- In 2024, hardware sales remain a foundational element for new customer onboarding, despite contributing a smaller percentage to overall revenue.

- These sales ensure seamless integration with RingCentral's core software-as-a-service offerings.

- The company strategically bundles hardware to enhance the perceived value and ease of deployment for businesses.

- This lower-margin stream supports the higher-margin recurring subscription revenue.

Usage-Based and Add-On Services

RingCentral generates additional revenue from usage-based charges and the sale of various add-on features, complementing its core subscription services. This includes charges for services like international calling and toll-free numbers, which provide flexibility for global communication. Furthermore, customers can purchase licenses for premium add-on products such as RingCentral Contact Center or RingCentral Webinar, allowing them to tailor their communication solution precisely to their specific business needs. This model provides significant incremental revenue opportunities, reflecting a strong customer-centric approach. As of Q4 2023, RingCentral reported total revenue of $560 million, indicating the strength of its diversified revenue streams.

- Usage-based charges include international calling and toll-free numbers.

- Add-on services encompass products like RingCentral Contact Center and RingCentral Webinar licenses.

- This model allows customers to customize their solutions based on specific operational requirements.

- It provides incremental revenue, contributing to the company's financial performance.

RingCentral primarily relies on recurring subscription fees for its MVP platform, constituting around 93% of 2024 revenue.

Tiered plans drive growth and enable upselling across diverse customer segments.

Additional streams include professional services, hardware sales, and usage-based charges like international calling and add-ons such as Contact Center.

| Revenue Stream | 2024 % of Total | Key Contribution |

|---|---|---|

| Subscriptions | ~93% | Stable, predictable base |

| Professional Services | Minor | Complex deployments |

| Hardware Sales | Minor | Onboarding support |

| Usage/Add-ons | Minor | Incremental customization |

Business Model Canvas Data Sources

The RingCentral Business Model Canvas is constructed using a blend of internal financial reports, customer feedback, and competitive analysis. This comprehensive data approach ensures a robust and accurate representation of the business.