RingCentral Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RingCentral Bundle

RingCentral operates in a dynamic communication and collaboration market, facing pressure from rivals and evolving customer needs. Understanding these forces is crucial for any stakeholder.

The threat of new entrants is moderate, as the high capital costs of building robust UCaaS platforms create some barrier, yet the appeal of the market attracts new players. Buyer power is significant, with customers able to switch providers relatively easily due to the commoditized nature of basic communication services.

The intensity of rivalry among existing competitors like Zoom, Microsoft Teams, and Cisco is exceptionally high, driving innovation and price competition. The threat of substitutes, such as on-premise solutions or alternative communication methods, is present but diminishing as cloud-based UCaaS becomes the norm.

Supplier power is relatively low, as many components and services needed for UCaaS are readily available from multiple vendors. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore RingCentral’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

RingCentral's operations heavily rely on cloud infrastructure from major providers like Amazon Web Services, Microsoft Azure, and Google Cloud. This dependency grants these dominant suppliers substantial bargaining power, as they collectively held over 67% of the cloud infrastructure market in Q1 2024. Consequently, any price adjustments or service interruptions from these essential partners directly influence RingCentral's operating expenses and service uptime. Such impacts can significantly affect the company's profitability and customer satisfaction, making supplier relationships critical for financial stability. This leverage underscores a key vulnerability in RingCentral's cost structure.

RingCentral heavily relies on strategic partnerships for critical hardware like VoIP phones and specialized software components, which impacts its supplier bargaining power. Collaborations, such as the one with Verint for AI-powered workforce management solutions, are essential for bolstering their product offerings. The quality and innovation from these suppliers directly influence RingCentral’s market competitiveness and ability to meet evolving customer demands. For 2024, maintaining strong supplier relationships is key, especially as they continue expanding their unified communications as a service (UCaaS) and contact center as a service (CCaaS) platforms globally.

Migrating RingCentral's core infrastructure or deeply integrated software from key suppliers can incur significant switching costs. These include contract termination penalties, which in 2024 can represent a substantial percentage of remaining contract value, alongside considerable technical migration expenses. Such transitions also carry the risk of service interruptions, potentially impacting RingCentral's 2024 revenue streams and customer satisfaction. This creates a strong lock-in effect, thereby reducing RingCentral's negotiating leverage and empowering its critical technology suppliers.

Supplier Concentration and Specialization

The limited number of top-tier cloud infrastructure providers, such as Amazon Web Services (AWS) or Google Cloud Platform (GCP), creates a concentrated supplier market for RingCentral. For instance, in Q1 2024, AWS and Microsoft Azure collectively held over 60% of the cloud infrastructure market share, significantly limiting RingCentral's negotiation leverage. Additionally, specialized software components often come from vendors with few viable alternatives, empowering them over pricing and terms. This concentration means RingCentral's ability to secure favorable agreements is constrained by the scarcity of alternative critical technology suppliers.

- Cloud infrastructure market concentration remains high in 2024, with major players dominating.

- Specialized software component vendors often possess unique intellectual property, reducing alternatives.

- RingCentral's operating expenses are influenced by these suppliers' pricing power.

- Maintaining strong supplier relationships is crucial due to limited alternatives.

Potential for Forward Integration

Major technology suppliers to RingCentral, particularly large cloud providers like Microsoft and Google, present a significant threat through their own communication services. Microsoft Teams, with its substantial enterprise penetration in 2024, and Google Voice, directly compete with RingCentral’s offerings. This represents a clear potential for forward integration, where a supplier becomes a direct competitor. This dynamic creates complex relationships and strategic challenges, influencing partnership negotiations and RingCentral's long-term strategy for market share.

- Microsoft Teams reported over 320 million monthly active users in early 2024.

- Google Workspace, which includes Google Voice, had over 3 billion users globally in 2024.

- These suppliers leverage their existing infrastructure and customer bases to enter the UCaaS market.

- Such integration can limit RingCentral's pricing power and negotiation leverage.

RingCentral faces high supplier bargaining power from dominant cloud providers, like AWS and Azure, controlling over 60% of the Q1 2024 market. High switching costs and the limited number of specialized component vendors further reduce RingCentral's negotiation leverage. Moreover, major suppliers such as Microsoft and Google pose a forward integration threat with their own competing communication services in 2024, impacting RingCentral's strategic flexibility and cost structure.

| Supplier Type | Market Share (Q1 2024) | Impact on RingCentral |

|---|---|---|

| Cloud Providers (AWS, Azure) | >60% | High pricing power, cost influence |

| Microsoft Teams | 320M+ MAU | Direct competition, forward integration threat |

| Google Workspace (Voice) | 3B+ users | Competition, potential for integration |

What is included in the product

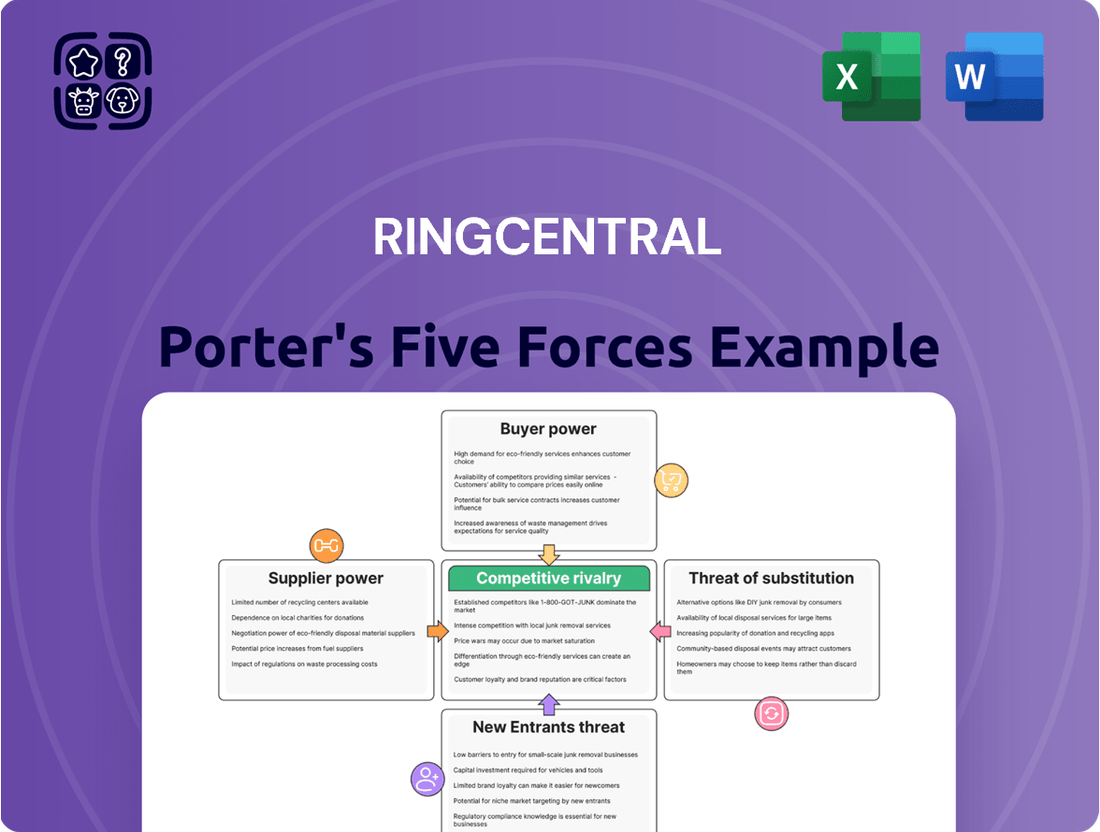

RingCentral's Porter's Five Forces Analysis reveals the intensity of competition, the power of buyers and suppliers, the threat of new entrants and substitutes, all within the UCaaS market.

A clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying potential threats to RingCentral's market position.

Instantly understand strategic pressure with a powerful spider/radar chart, helping RingCentral proactively address competitive challenges.

Customers Bargaining Power

Switching from RingCentral to competitors like Zoom Phone, Nextiva, or Dialpad involves moderate costs, not insurmountable barriers for businesses in 2024. While data migration and user retraining are necessary, the UCaaS market's extensive platform offerings make transitions viable for dissatisfied customers. This empowers customers to demand competitive pricing and high service levels, knowing alternatives are readily available. The operational disruption is manageable given the prevalence of similar feature sets across leading providers.

The Unified Communications as a Service (UCaaS) market features intense price competition, with providers like RingCentral offering tiered pricing for businesses of all sizes. Customers, particularly small and medium-sized enterprises, exhibit high price sensitivity and can easily compare offerings from numerous vendors. This pressure compels RingCentral to provide competitive pricing and flexible plans to attract and retain its client base. For example, in 2024, many UCaaS platforms continued to offer aggressive introductory rates or volume discounts to secure market share amidst a crowded landscape.

Customers have a wide array of alternative unified communication platforms to choose from, significantly increasing their bargaining power. Major competitors like Microsoft Teams, Zoom, Cisco Webex, 8x8, and Vonage all offer similar suites of services, including voice, video, and messaging. The UCaaS market is substantial, with projections indicating revenue reaching around US$42.52 billion in 2024, reflecting a highly competitive landscape. This extensive availability allows customers to easily switch providers if their needs are not met or if more competitive pricing emerges.

Demand for Feature-Rich, Integrated Solutions

Customers now expect more than just basic phone services from RingCentral; they demand fully integrated communication and collaboration tools. This growing demand includes advanced features like AI-powered analytics, seamless CRM integrations, and comprehensive omnichannel capabilities. Such high expectations compel RingCentral to continuously innovate and significantly invest in research and development to maintain its competitive edge and satisfy evolving customer needs. For instance, the global unified communications as a service market, which includes these integrated solutions, is projected to reach approximately $77 billion in 2024.

- Customers increasingly seek AI-powered analytics to gain deeper insights from communication data.

- Demand for seamless integration with leading CRM platforms like Salesforce remains critical.

- Omnichannel capabilities are essential for consistent customer experiences across various touchpoints.

- RingCentral’s R&D expenditure reflects this pressure, with continuous platform enhancements.

Low Brand Loyalty in a Crowded Market

In the unified communications as a service (UCaaS) market, customer loyalty remains low due to numerous competitors offering similar solutions. While RingCentral is a recognized leader, customers can easily switch providers seeking better pricing or specific features. For instance, in 2024, competitive pricing pressures intensified, with some rivals offering aggressive promotional bundles, impacting retention. This dynamic necessitates RingCentral to continuously enhance its product offerings and focus on superior customer satisfaction to maintain its significant market share.

- UCaaS market projected to reach $83.69 billion by 2029, indicating intense competition.

- Customer churn rates in the SaaS industry can range from 5-7% annually for enterprise clients.

- RingCentral's Q1 2024 revenue reached $584 million, showing continued growth despite market pressures.

- Companies like Zoom and Microsoft Teams provide alternative platforms, increasing customer choice.

RingCentral customers wield significant bargaining power, driven by numerous UCaaS alternatives and moderate switching costs. The intensely competitive market, projected at US$42.52 billion in 2024, allows customers to demand competitive pricing and advanced features like AI-powered analytics. Low customer loyalty means rivals offering aggressive 2024 promotional bundles can easily attract clients. This dynamic compels RingCentral to continuously innovate and enhance its offerings.

| Metric | 2024 Projection | Impact on Customers | ||

|---|---|---|---|---|

| UCaaS Market Size | US$42.52 billion | More choices, better deals | High | High |

| Customer Churn (SaaS) | 5-7% annually | Low loyalty, easy switching | High | High |

| RingCentral Revenue (Q1 2024) | $584 million | Growth despite pressure | Low | Low |

Preview Before You Purchase

RingCentral Porter's Five Forces Analysis

This preview shows the exact RingCentral Porter's Five Forces analysis you'll receive immediately after purchase, detailing its competitive landscape. You'll gain a comprehensive understanding of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of existing rivalry. This professionally formatted document is ready for your strategic planning, offering actionable insights into RingCentral's market position. No surprises, no placeholders – just the complete analysis you need.

Rivalry Among Competitors

The Unified Communications as a Service (UCaaS) market is intensely competitive, featuring numerous established giants and agile innovators. RingCentral faces direct competition from major players like Microsoft Teams, Zoom, Cisco Webex, 8x8, and Dialpad, all vying for market share. This high number of competitors fosters aggressive pricing strategies and a constant battle for technological innovation. In 2024, the global UCaaS market continues its robust expansion, with projections indicating a market size exceeding $30 billion, intensifying the competitive pressure for all participants.

While core unified communications services like voice and video remain standard, differentiation is increasingly driven by user experience, reliability, and advanced AI integration. Competitors such as Dialpad leverage proprietary AI engines, while Microsoft bundles Teams within its expansive ecosystem to attract and retain customers in 2024. RingCentral has proactively responded by integrating AI across its suite, rebranding its core offering to RingEX in early 2024. This strategic move aims to enhance features like transcription, summarization, and overall user productivity, crucial for competitive standing.

The Unified Communications as a Service (UCaaS) market, while still expanding, faces a decelerating growth rate following a period of rapid uptake. This shift intensifies competitive rivalry for companies like RingCentral. Omdia projects a modest 1.1% Compound Annual Growth Rate (CAGR) for the total UCaaS market through 2029, reflecting this slowdown. As overall market expansion becomes less of a driving force, firms must aggressively compete to secure and expand their market share from rivals. This heightened competition demands more innovative offerings and aggressive pricing strategies in 2024 and beyond.

Strategic Partnerships as a Competitive Tool

Strategic partnerships are increasingly vital for expanding market reach and capabilities within the competitive unified communications as a service (UCaaS) landscape. RingCentral has effectively leveraged this by partnering with legacy providers such as Avaya and Mitel, gaining access to their extensive installed base of on-premise phone users. This strategy allows RingCentral to convert traditional telephony customers to cloud-based solutions, directly impacting its subscription revenue growth, which was a key highlight in its 2024 financial reporting. Competitors are also forming significant alliances, exemplified by Mitel's partnership with Zoom, which further intensifies competitive rivalry and reshapes market dynamics.

- RingCentral's Q1 2024 subscription revenue reached $539 million, underscoring the success of its expansion strategies.

- The Avaya Cloud Office by RingCentral partnership continues to target Avaya's 100+ million global users.

- Mitel's collaboration with Zoom, announced in 2022, creates a formidable challenge for other UCaaS players.

- The UCaaS market is projected to reach $68.4 billion by 2024, highlighting the importance of strategic alliances for market share.

Convergence of UCaaS and CCaaS Markets

The lines between unified communications as a service (UCaaS) and contact center as a service (CCaaS) are significantly blurring, creating a unified market space. Vendors like RingCentral actively compete by integrating their solutions, exemplified by RingCentral's RingCX contact center often bundled with its core UCaaS platform. This strategic convergence intensifies competitive rivalry as companies from both sectors vie for the same enterprise customers seeking a single, seamless communication and customer engagement platform. As of 2024, market analysis indicates a strong customer preference for integrated offerings, driving this heightened competition.

- Integrated solutions are projected to capture a larger share of enterprise spending, with the global UCaaS market alone expected to reach over $30 billion in 2024.

- RingCentral's RingCX aims to expand its market footprint beyond traditional UCaaS, directly challenging established CCaaS providers.

- Competitors like Microsoft Teams Phone with Contact Center and Zoom Contact Center are also aggressively pursuing this converged market.

- The competitive landscape is characterized by bundling strategies and platform consolidation to offer comprehensive communication ecosystems.

The blurring lines between Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) significantly intensify competitive rivalry. Companies like RingCentral, with its RingCX offering, now bundle solutions to capture enterprise customers seeking integrated platforms. This strategic convergence, driven by a strong 2024 customer preference for unified offerings, forces aggressive competition from both traditional UCaaS and CCaaS players.

| Metric | Value (2024) | Impact | ||

|---|---|---|---|---|

| Global UCaaS Market Size | $30B+ | Increased opportunity & competition | ||

| Customer Preference | Integrated Solutions | Drives bundling strategies | ||

| RingCentral Strategy | RingCX Integration | Expands into CCaaS market |

SSubstitutes Threaten

Businesses often choose fragmented, cost-effective communication tools as substitutes for integrated platforms like RingCentral. For instance, a company might use Google Workspace for video conferencing, with Google Meet recording over 300 million daily meeting participants in 2024, alongside Slack for messaging, which reported over 2,000 paid customers spending over $100,000 annually. This piecemeal approach, combining services like a basic VoIP provider for calls, becomes a compelling alternative, particularly for small and medium-sized enterprises (SMEs) focused on managing operational expenses. This flexibility allows organizations to avoid the higher bundled costs of comprehensive UCaaS solutions.

While the market is indeed shifting towards cloud-based solutions, many organizations continue to operate traditional on-premise PBX phone systems. Businesses with substantial prior investments in their existing infrastructure or specific, stringent security requirements often exhibit reluctance to fully transition. Hybrid communication solutions, which bridge on-premise systems with select cloud features, also serve as a viable substitute for complete cloud migration. For instance, the global PBX market, though evolving, still saw significant on-premise installations in 2024, particularly in sectors prioritizing legacy integration.

The rise of powerful freemium communication platforms presents a significant substitute threat to RingCentral. Services like WhatsApp, the free versions of Slack, and Microsoft Teams offer robust communication tools at no initial cost. Microsoft Teams, for instance, reported over 320 million monthly active users in early 2024, showcasing widespread adoption. While these may lack RingCentral's enterprise-grade features, advanced security, and dedicated support, their no-cost model makes them a powerful substitute for certain business segments. This widespread availability impacts RingCentral's market penetration for basic communication needs.

Collaboration-Specific Software

The rise of specialized collaboration software presents a significant substitute threat to RingCentral. Instead of a full Unified Communications as a Service (UCaaS) suite, some businesses opt for platforms excelling in areas like project management with integrated communication. These tools substitute the need for a comprehensive system by centralizing communication around specific workflows and projects. This trend is particularly evident among teams prioritizing project-based collaboration over general business communication, with the global project management software market projected to reach $10.6 billion in 2024. Many companies, especially smaller and medium-sized enterprises (SMEs), might find these focused solutions more cost-effective and tailored to their immediate needs.

- Project management software market value: $10.6 billion (2024 projection).

- Key players: Asana, Monday.com, and Jira offer integrated communication.

- Target users: Teams prioritizing workflow-centric communication.

- Impact: Reduces reliance on broad UCaaS platforms like RingCentral.

Direct Carrier and Mobile Services

For many small businesses, basic mobile phone plans and direct carrier services remain viable substitutes for advanced UCaaS platforms like RingCentral. These businesses often prioritize simplicity and cost-effectiveness over features such as auto-attendant or complex integrations. The familiarity of standard mobile communication presents a compelling alternative, especially when budgets are tight or advanced functionalities are not deemed essential for daily operations. This is particularly true for very small businesses or sole proprietorships where a robust UCaaS suite might be overkill, despite the growing trend towards unified communications.

- In 2024, a significant portion of micro-businesses in the US continued to rely primarily on basic mobile plans, with average monthly costs for a single line often below $50.

- Many small enterprises opt for solutions that avoid the initial setup complexity and higher recurring costs associated with UCaaS subscriptions, which can start from $20-$30 per user per month.

- The simplicity of direct carrier services, offering voice and SMS, directly competes with the more comprehensive but potentially more complex UCaaS offerings.

RingCentral faces strong substitute threats from fragmented communication tools, freemium platforms like Microsoft Teams with over 320 million monthly active users in early 2024, and traditional on-premise PBX systems. Businesses also opt for specialized project management software, a market valued at $10.6 billion in 2024, or basic mobile phone plans, particularly for cost-conscious SMEs. These alternatives offer flexibility and lower costs, impacting RingCentral’s market penetration by providing viable, often simpler, communication solutions.

| Substitute Type | Key Examples | 2024 Data Point |

|---|---|---|

| Freemium Platforms | Microsoft Teams | 320M+ monthly active users |

| Project Management Software | Asana, Jira | $10.6B market value |

| Basic Mobile Plans | Direct Carrier Services | Avg. single line cost < $50/month |

Entrants Threaten

Entering the Unified Communications as a Service (UCaaS) market, like RingCentral's domain, demands substantial capital for robust, secure, and scalable cloud infrastructure. New entrants face immense hurdles, as developing such platforms requires significant upfront investment. Furthermore, continuous research and development is crucial to integrate advancements like AI, with major players investing hundreds of millions annually; for instance, leading UCaaS providers are projected to spend over $1 billion collectively on R&D in 2024. These high ongoing costs create a formidable barrier, deterring potential new competitors.

Leading players like RingCentral, Microsoft Teams, and Zoom command significant market share, establishing strong brand recognition and trust over many years. Microsoft Teams, for example, reported over 320 million daily active users in early 2024, highlighting its deep market penetration. New entrants face a substantial challenge in convincing businesses to switch from these deeply entrenched and reliable providers. Overcoming existing brand loyalty and proving service reliability is a major, costly hurdle for any newcomer in the UCaaS space.

Incumbent cloud communication providers like RingCentral benefit immensely from economies of scale in infrastructure, marketing, and customer support. Their established global data centers and extensive networks, refined over years, allow for significant cost efficiencies. This enables them to offer highly competitive pricing, with some enterprise plans seeing average annual cost reductions of 5-10% in 2024 due to scale. New entrants struggle to match this, as establishing a comparable global presence and achieving similar unit costs requires massive upfront investment and time, making market penetration very challenging.

Access to Distribution Channels and Partnerships

New entrants face a significant hurdle in replicating RingCentral's extensive distribution network. Established companies, including RingCentral, leverage robust direct sales forces, sophisticated online marketing engines, and critical strategic partnerships. RingCentral's alliances with global service providers like AT&T and legacy vendors such as Avaya provide exclusive access to millions of potential customers, a difficult feat for newcomers.

- RingCentral's partnership with AT&T continues to be a key driver for customer acquisition, particularly in the enterprise segment.

- The Avaya Cloud Office by RingCentral offering, launched in 2020, expanded RingCentral's reach into Avaya's substantial customer base, demonstrating a powerful channel for growth through existing vendor relationships.

- A new entrant would need substantial capital investment and time to build comparable channel relationships and market penetration.

Regulatory and Compliance Hurdles

The global communications industry, particularly UCaaS, is subject to complex regulations like GDPR and HIPAA. Navigating these legal frameworks demands significant expertise and resources from any potential new entrant. This regulatory burden acts as a substantial deterrent, as new companies often lack the established legal and operational infrastructure to ensure compliance. For instance, ensuring data privacy and security, as mandated by current regulations, requires substantial investment. Such intricate compliance requirements significantly elevate the barrier to entry for aspiring competitors.

- The global UCaaS market is projected to reach $201.7 billion by 2029, highlighting the scale of regulatory oversight needed.

- Data privacy regulations, such as GDPR in Europe and various state-level laws in the US, continue to evolve, requiring constant adaptation.

- Industry-specific compliance, like HIPAA for healthcare communications, adds layers of complexity for service providers.

- Achieving certifications like ISO 27001 or SOC 2 is often essential, representing a significant upfront investment for new players.

New entrants face substantial hurdles in the UCaaS market, primarily due to the immense capital required for infrastructure and R&D, with leading providers collectively investing over $1 billion in R&D in 2024. Established players like RingCentral benefit from strong brand loyalty and economies of scale, offering competitive pricing, seeing 5-10% average annual cost reductions in 2024. Replicating extensive distribution networks and navigating complex global regulations further elevate the barrier to entry for aspiring competitors.

| Barrier | 2024 Data Point | Impact on New Entrants |

|---|---|---|

| Capital Investment | UCaaS R&D: >$1B collective spending | Requires massive upfront investment |

| Market Penetration | Microsoft Teams: >320M daily active users | Difficult to gain market share |

| Economies of Scale | Enterprise Plans: 5-10% avg. annual cost reduction | Struggle to match pricing |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for RingCentral leverages a comprehensive mix of data, including company financial reports, industry analyst research, and market intelligence platforms. This ensures a robust understanding of competitive dynamics.

We incorporate insights from regulatory filings, competitor press releases, and customer reviews to accurately assess the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.