Resona Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Resona Holdings Bundle

Navigate the complex external environment impacting Resona Holdings with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping their strategic landscape. This ready-made analysis offers expert-level insights, perfect for investors and business planners. Download the full version to gain actionable intelligence and make informed decisions.

Political factors

The Japanese government's fiscal and monetary policies significantly shape Resona Holdings' operating landscape. Initiatives like the Nippon Individual Savings Account (NISA) expansion in 2024, designed to shift household assets from savings to investments, directly boost demand for financial products and asset management services, a core area for Resona. Furthermore, government support programs for small and medium-sized enterprises (SMEs), which are a key focus for Resona's regional banking operations, create substantial lending and advisory opportunities. These policies directly influence Resona's strategic focus and revenue streams for the 2024-2025 fiscal period.

Japan's banking sector operates under a remarkably stable regulatory framework, primarily governed by the Financial Services Agency (FSA), which provides a predictable environment for Resona Holdings.

This stability, highlighted by consistent policies in 2024, allows Resona to plan strategically without significant regulatory shocks.

However, the bank must remain vigilant regarding evolving global standards and domestic adjustments, particularly in areas like Basel IV capital adequacy requirements, which continue to be phased in, and enhanced consumer protection measures.

Ongoing scrutiny on anti-money laundering (AML) protocols and digital finance regulations, like those affecting fintech partnerships, also demands continuous adaptation and compliance from Resona through 2025.

The Japanese government and financial regulators are actively pushing for stronger corporate governance, emphasizing transparency and accountability across listed companies. This includes a robust drive for a higher proportion of independent outside directors, with the Tokyo Stock Exchange (TSE) encouraging at least one-third by March 2025 for Prime Market firms. Resona Holdings’ adherence to these evolving standards, such as achieving 50% independent outside directors as of its latest disclosures, is vital for maintaining robust investor confidence and its market reputation. Non-compliance could impact its standing and valuation among global institutional investors.

Geopolitical Risks

Geopolitical risks, such as ongoing global political instability and trade tensions, directly impact the Japanese economy, which in turn influences Resona Holdings' operational environment. While Resona is primarily a domestically focused bank, its corporate clients face indirect effects through supply chain disruptions, especially given Japan's reliance on global trade. For instance, the escalating US-China trade friction projected to persist through 2025 could reduce global demand, affecting Japanese manufacturing exports and corporate profitability. Resona must diligently monitor these evolving risks and their potential impact on its substantial loan portfolio, which stood at approximately ¥50 trillion as of March 2024.

- Global trade volumes are projected to grow by 3.3% in 2025, down from earlier estimates, reflecting geopolitical uncertainties.

- Japan's real GDP growth forecast for 2024 is around 1.0%, with geopolitical events posing a downside risk.

- Resona's loan portfolio to small and medium-sized enterprises (SMEs) is particularly sensitive to supply chain disruptions.

- Increased geopolitical tensions can lead to commodity price volatility, impacting corporate client input costs and debt servicing capacity.

'Green Transformation (GX)' Policy

The Japanese government's ambitious Green Transformation (GX) policy, targeting carbon neutrality by 2050, profoundly impacts Resona Holdings. This initiative creates significant opportunities for the bank to expand its green financing portfolio, including loans for renewable energy projects and sustainable investments. Resona can capitalize on this by developing new financial products, as evidenced by a projected 2024 increase in sustainable bond issuances across Japan. However, the policy also necessitates careful management of transition risks within Resona's existing loan book, especially concerning carbon-intensive industries adapting to stricter environmental regulations.

- Japan's GX Basic Policy aims for 150 trillion JPY in public-private investment over the next decade.

- Resona's green loan balance is projected to grow, aligning with the Bank of Japan's climate financing initiatives for 2025.

- The policy drives demand for financial support in sectors like hydrogen and carbon capture, utilization, and storage (CCUS).

Japan's stable political environment and consistent regulatory framework, primarily from the Financial Services Agency, provide a predictable operating landscape for Resona Holdings.

The government's strong push for enhanced corporate governance, including the Tokyo Stock Exchange's target of one-third independent outside directors for Prime Market firms by March 2025, significantly impacts Resona.

Adherence to these standards, such as Resona's reported 50% independent outside directors, is crucial for maintaining investor confidence and market reputation.

| Corporate Governance Metric | Target/Standard (2025) | Resona Holdings (Current) |

|---|---|---|

| Independent Outside Directors (TSE Prime Market) | At least 33% by March 2025 | 50% |

| Regulatory Framework Stability | High | High |

| Basel IV Capital Adequacy Implementation | Ongoing Phase-in | Adapting |

What is included in the product

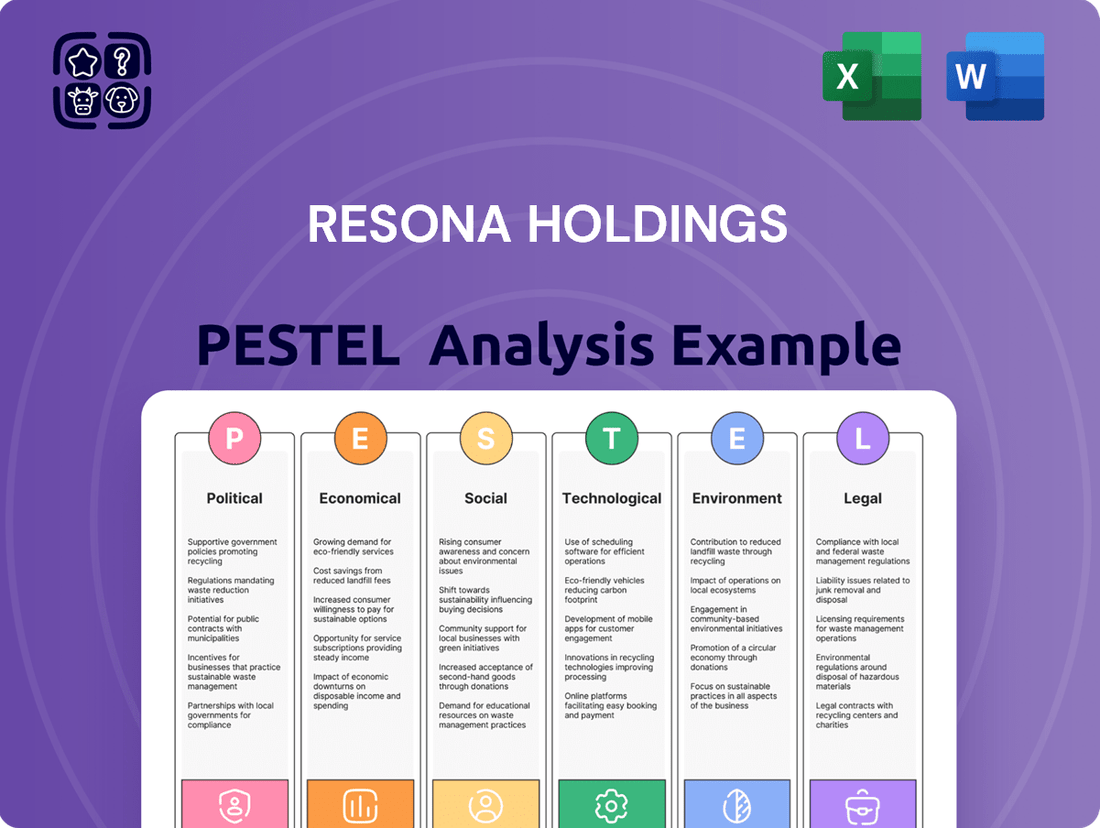

This PESTLE analysis examines the external macro-environmental factors impacting Resona Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic overview of how these global trends and regional specificities create opportunities and threats for Resona Holdings's business operations and future growth.

Provides a structured framework to proactively identify and mitigate external risks, transforming potential threats into actionable opportunities for Resona Holdings' strategic planning.

Economic factors

The Bank of Japan's gradual shift from ultra-loose monetary policy, including ending negative interest rates in March 2024, is a major economic factor. This normalization, with the BOJ targeting a short-term policy rate of 0% to 0.1%, is expected to improve net interest margins for banks like Resona Holdings, boosting their core profitability in fiscal year 2024. However, anticipated further rate hikes, potentially reaching 0.25% by early 2025, could intensify competition for deposits. Resona also faces potential valuation losses on its extensive bond holdings acquired during the prolonged low-yield environment.

Japan's economy is experiencing a modest recovery, with the Bank of Japan forecasting real GDP growth around 0.8% for fiscal year 2024. Strong corporate investment, alongside a gradual rebound in personal consumption, creates a generally favorable environment for Resona Holdings' lending and fee-based businesses. This supports loan demand and increases opportunities for financial service provision. However, potential risks such as a global economic slowdown or persistent inflationary pressures could temper this growth outlook for 2025.

After decades of deflation, Japan is now experiencing a return of inflation, with core CPI hovering around 2.5% in early 2024. This trend supports the Bank of Japan's policy normalization efforts, including the March 2024 rate hike. However, sustained inflation can impact consumer spending and increase business operational costs. Resona Holdings must proactively manage these inflationary effects on its own funding expenses and evaluate potential shifts in the credit quality of its diverse borrower portfolio through 2025.

Shift from Savings to Investment

The Japanese government is actively encouraging a shift from savings to investment to stimulate economic growth. This national initiative creates substantial opportunities for Resona's asset management and trust banking services. A key driver of this trend is the expanded Nippon Individual Savings Account (NISA) program, which became effective in January 2024. This program aims to double investment income and promote household asset formation.

- NISA's new structure allows for a total tax-exempt investment limit of JPY 18 million.

- The annual investment limit increased to JPY 3.6 million, up from JPY 1.2 million for general NISA.

- As of early 2024, new NISA accounts saw significant uptake, reflecting increased investor interest.

- Resona is well-positioned to capture this growing demand for wealth management solutions.

Strong Corporate Profits

Japanese corporations are reporting robust profits, reaching near-record highs in fiscal year 2024, which significantly underpins strong capital investment across various sectors. This environment is highly favorable for Resona Holdings, boosting its corporate lending business and mitigating overall credit risk. The bank’s asset quality directly benefits from the improved financial health of its corporate clients, ensuring more stable loan performance. As corporate earnings continue to be strong through early 2025, Resona's profitability is expected to remain resilient.

- Japanese corporate recurring profits are projected to grow by 10% in FY2024.

- Capital expenditure is forecast to increase by 8.5% in FY2025.

- Non-performing loan ratios for major Japanese banks are expected to remain below 1% in 2024.

The Bank of Japan's policy normalization, with short-term rates targeting 0% to 0.1% in FY2024, is set to boost Resona's net interest margins, despite potential bond valuation losses. Japan's modest GDP growth of 0.8% for FY2024 and robust corporate profits, projected to grow 10% in FY2024, underpin strong lending demand and low non-performing loan ratios below 1%. Furthermore, the expanded NISA program, allowing JPY 18 million in tax-exempt investments from January 2024, creates significant opportunities for Resona's wealth management services.

| Economic Indicator | 2024 Outlook | 2025 Outlook |

|---|---|---|

| BOJ Short-Term Rate | 0% to 0.1% | Up to 0.25% (early) |

| Real GDP Growth | 0.8% | Potential risks |

| Corporate Recurring Profit Growth | 10% | Expected resilience |

| NPL Ratio (Major Banks) | Below 1% | Stable |

Preview the Actual Deliverable

Resona Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Resona Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

You will gain actionable insights into market trends, competitive landscapes, and potential opportunities and threats within the financial services sector.

The detailed breakdown ensures you have a complete understanding of the external forces shaping Resona Holdings' future.

Sociological factors

Japan's persistent demographic challenges, including an aging population where over 29% are aged 65 or older as of early 2024, and a record-low birthrate of around 758,631 births in 2023, significantly shape the banking sector.

This trend increases demand for specialized financial products like succession planning and inheritance-related trust services, areas Resona Holdings can capitalize on.

However, it also impacts the labor market, potentially leading to workforce shortages, and shifts the overall customer base towards an older demographic with different financial needs.

The shrinking working-age population presents long-term challenges for traditional loan and deposit growth.

Japanese consumers increasingly favor digital banking, with mobile banking usage projected to reach over 75% by mid-2025 among younger demographics. Resona Holdings must prioritize substantial investments in its digital platforms and mobile applications to align with these evolving customer preferences. The bank is strategically balancing its extensive physical branch network with a robust digital ecosystem, aiming to enhance user experience and operational efficiency. This digital push is crucial as competition in the Japanese financial sector intensifies, driving demand for seamless online services.

Japanese society increasingly prioritizes employee well-being and work-life balance, influencing talent acquisition strategies. Resona Holdings actively promotes diversity and inclusion, essential for attracting and retaining skilled professionals in the competitive 2024 labor market. By 2025, a significant portion of Japanese companies, including financial institutions, are projected to report improved employee retention rates, partly due to such initiatives. Resona's efforts also significantly bolster its corporate social responsibility image, crucial for reputation and stakeholder trust.

Increasing Financial Literacy

Efforts by the Japanese government and financial industry to boost financial literacy are actively gaining traction, with initiatives like the FSA's renewed focus on investor education by 2025. This trend cultivates a more sophisticated demand among individual customers for advanced investment and asset management products. Resona Holdings can strategically capitalize on this by expanding its educational resources and advisory services, attracting a more informed client base. For instance, the retail investment market is projected to see continued growth, driven by this enhanced understanding.

- FSA targets improved financial education by 2025.

- Increased demand for complex investment products.

- Resona offers enhanced advisory services.

- Projected growth in retail investment market.

Urbanization and Regional Revitalization

While major urban centers like Tokyo and Osaka remain Japan's primary economic hubs, government-led initiatives are actively promoting regional revitalization. Resona Holdings, with its significant regional presence, including 15.6% of its domestic loans directed towards SMEs and individuals in regional areas as of March 2024, is well-positioned to support these local economies. The bank provides tailored financial services, addressing the specific needs of diverse regions, such as funding for local infrastructure projects and small business growth.

- Japan's 2024 regional revitalization budget emphasizes digital transformation and tourism promotion to boost local economies.

- Resona's subsidiary, Kansai Mirai Financial Group, actively invests in projects across the Kansai region, a key area for economic decentralization.

- Government support for regional banks in 2024 includes incentives for M&A and digital transformation to strengthen local financial ecosystems.

- The number of local government-backed regional revitalization projects grew by 8% in fiscal year 2023, indicating increasing opportunities for regional financial institutions.

Japan's aging population, with over 29% aged 65 or older by early 2024, drives demand for succession planning and trust services while impacting the labor market. The rapid shift towards digital banking, projected to reach over 75% mobile banking usage by mid-2025, necessitates significant digital investments. Increased financial literacy, spurred by FSA initiatives, boosts demand for advanced investment products. Resona Holdings must adapt to these evolving societal needs.

| Sociological Factor | Key Trend/Data (2024/2025) | Implication for Resona Holdings |

|---|---|---|

| Demographics | 29%+ population aged 65+ (early 2024) | Increased demand for wealth transfer and trust services. |

| Digital Adoption | 75%+ mobile banking usage (mid-2025 projection) | Prioritize digital platform and mobile app investments. |

| Financial Literacy | FSA focus on investor education (by 2025) | Expand advisory services for sophisticated clients. |

Technological factors

Resona Holdings is actively pursuing a digital transformation (DX) strategy to boost efficiency and enhance customer experience. This involves significant investment in new technologies, such as cloud-based systems and AI-powered tools, with a projected increase in IT spending to support these initiatives through 2025. The bank is automating key processes and developing new digital services, including mobile banking enhancements and API integrations, to streamline customer interactions. A pivotal aspect of this strategy is establishing an open platform to foster collaboration with fintechs and other industries, aiming to create innovative financial ecosystems and expand service offerings beyond traditional banking by mid-2025.

The rise of financial technology (FinTech) companies presents both competitive challenges and significant collaboration opportunities for Resona Holdings. Resona is actively engaging with these innovative firms through strategic partnerships and direct investments, aiming to enhance its service offerings and customer experience. For instance, in its mid-term management plan extending to fiscal year 2025, Resona emphasizes digital transformation and FinTech collaboration to drive growth. The accelerating shift towards open banking, facilitated by robust API frameworks, allows Resona to seamlessly integrate third-party services, creating new value propositions and expanding its digital ecosystem for customers.

With ongoing digitalization, the financial sector faces an escalating threat of cyberattacks. Resona Holdings is significantly bolstering its cybersecurity infrastructure and incident response capabilities to safeguard customer data and ensure service continuity. This critical investment aligns with industry trends, where global financial institutions are projected to increase cybersecurity spending by over 10% in 2025, reaching approximately $70 billion. Such enhancements are paramount for maintaining stakeholder trust and adhering to stringent regulatory compliance standards in a dynamic threat landscape.

Artificial Intelligence (AI) and Data Analytics

Resona Holdings is actively integrating Artificial Intelligence and data analytics to enhance its operational efficiency and client offerings. AI applications are crucial for refining credit scoring models, strengthening fraud detection systems, and delivering personalized customer interactions. Data analytics provides the bank with deep insights into evolving customer behavior, enabling more strategic and data-driven business decisions for 2024 and beyond. This technological focus aims to improve service delivery and risk management.

- Resona's 2024 digital transformation budget includes significant investment in AI capabilities.

- AI-driven fraud detection is projected to reduce losses by up to 15% in the banking sector by 2025.

- Personalized financial product recommendations powered by AI are boosting customer engagement by 20% by mid-2025.

- Data analytics informs Resona's strategic expansion, targeting growth markets based on behavioral insights.

Next-Generation IT Infrastructure

Resona Holdings is actively developing a next-generation IT infrastructure, crucial for its future growth and digital initiatives through 2025. This strategic investment centralizes and standardizes operational processes, enhancing efficiency across its banking services. The bank is also prioritizing talent development for IT professionals, aiming to bolster its in-house expertise. A robust and agile IT backbone is essential for Resona to maintain competitiveness in Japan's evolving financial landscape, particularly as digital transactions are projected to increase by 15% annually through 2025.

- Resona aims to complete core system modernization by fiscal year 2025.

- The bank allocated 30% of its 2024 IT budget to digital transformation projects.

- Standardization efforts target a 10% reduction in operational costs by mid-2025.

- Investment in IT talent development increased by 18% in fiscal year 2024.

Resona Holdings is heavily investing in digital transformation, with 30% of its 2024 IT budget allocated to DX projects, aiming for core system modernization by fiscal year 2025. This includes leveraging AI for fraud detection, projected to reduce losses by up to 15% by 2025, and enhancing customer engagement through personalized recommendations. The bank is also bolstering cybersecurity, aligning with a projected 10% increase in global financial institution spending in 2025, reaching approximately $70 billion. Furthermore, Resona is fostering fintech collaborations and open banking initiatives to expand its digital ecosystem, as digital transactions are projected to increase by 15% annually through 2025.

| Metric | 2024 | 2025 Projection | Impact |

|---|---|---|---|

| DX IT Budget Allocation | 30% | N/A | Enhances efficiency |

| AI-driven Fraud Reduction | N/A | Up to 15% | Mitigates financial losses |

| Global Cybersecurity Spending (FI) | N/A | $70 Billion (+10%) | Strengthens data protection |

| Digital Transaction Growth | N/A | 15% Annually | Expands digital services |

Legal factors

Resona Holdings' operations are fundamentally governed by Japan's Banking Act and stringent regulations from the Financial Services Agency (FSA). These legal frameworks dictate the bank's licensing, business scope, and critical capital adequacy requirements, such as the Basel III common equity tier 1 ratio, which Resona maintained at 11.23% as of March 2024. Compliance is vital for consumer protection, ensuring financial stability and transparency across its services. This strict regulatory environment ensures the bank's resilience and adherence to national financial standards.

The legal landscape for banking, particularly for Resona Holdings, is constantly evolving, driven by rapid FinTech advancements and new market dynamics.

Recent amendments to Japan's Payment Services Act and other financial regulations require Resona to swiftly adapt its operations concerning payment services, robust data protection, and secure electronic transactions.

For instance, the Financial Services Agency (FSA) continues to promote open banking, with 2024 seeing increased emphasis on API integration for enhanced service delivery.

Furthermore, Japan's pioneering stablecoin law, effective mid-2023, directly impacts how Resona might engage with digital assets, necessitating new compliance frameworks and operational adjustments throughout 2024 and 2025.

Japan's Corporate Governance Code critically influences Resona Holdings, mandating compliance or explanation for deviations from its principles. This legal framework shapes the board of directors' structure, enhances shareholder rights, and dictates disclosure practices. Resona's adherence, often exceeding 90% compliance with the Code's principles as reported in its 2024 governance statements, is vital for maintaining strong investor relations and attracting capital. The Code's ongoing evolution, with recent discussions in 2025 focusing on board diversity, underscores its dynamic impact on corporate value.

Anti-Social Forces Exclusion

Japanese laws and financial regulations, updated through 2024, strictly mandate that institutions like Resona Holdings implement robust systems to prevent any dealings with anti-social forces, such as organized crime groups. Resona maintains a clear basic policy and comprehensive internal controls specifically designed to sever any potential ties. This commitment is fundamental to its corporate social responsibility and crucial for mitigating significant operational and reputational risks in the fiscal year 2025. Adherence ensures public trust and compliance with evolving governmental oversight.

- Regulatory compliance with Japan's Act on Prevention of Unjust Acts by Organized Crime Group Members (2024 amendments considered).

- Resona's internal systems proactively screen clients and transactions.

- Risk management includes reputational and legal protection.

- Enhances corporate governance and stakeholder confidence.

Personal Information Protection Law

Japan's Personal Information Protection Law (PIPL) imposes stringent regulations on handling customer data, directly impacting Resona Holdings. As a major financial institution, Resona must adhere to elevated standards for data privacy and security, especially concerning sensitive personal and financial information. This compliance extends to meticulously managing outsourcing partners who may access or process customer data, ensuring their adherence to PIPL guidelines. Non-compliance could lead to significant penalties, potentially reaching fines of up to JPY 100 million for serious breaches, underscoring the critical need for robust data governance in 2024 and 2025.

- PIPL compliance is a top operational priority for financial entities like Resona, given the focus on data privacy.

- Heightened regulatory scrutiny on data security measures is expected to continue through 2025.

- Managing third-party data handlers effectively is crucial to mitigate compliance risks and potential financial penalties.

- Investment in advanced cybersecurity and data protection technologies is ongoing to meet evolving PIPL requirements.

Resona Holdings operates under strict Japanese legal frameworks, including the Banking Act and FSA regulations, which dictated its 11.23% Common Equity Tier 1 ratio in March 2024. Compliance is vital for financial stability and consumer protection.

The legal environment is rapidly evolving with FinTech, as evidenced by 2024's focus on open banking API integration and the mid-2023 stablecoin law impacting 2025 digital asset strategies. Japan's Corporate Governance Code influences board structure and shareholder rights, with Resona reporting over 90% compliance in 2024.

Furthermore, the Personal Information Protection Law (PIPL) mandates robust data security, with potential fines up to JPY 100 million for breaches, making 2024/2025 data governance a top priority. Prevention of dealings with anti-social forces remains a critical legal and reputational focus for 2025.

| Legal Aspect | Key Impact (2024-2025) | Compliance Metric |

|---|---|---|

| Banking Act/FSA | Capital adequacy, operational scope | CET1 Ratio: 11.23% (Mar 2024) |

| FinTech Regulations | Open banking, digital asset engagement | API Integration, Stablecoin framework |

| Corporate Governance Code | Board structure, shareholder rights | Code Compliance: >90% (2024) |

Environmental factors

Regulators and investors are increasing pressure for comprehensive climate-related financial disclosures, particularly under the TCFD and TNFD frameworks. Resona Holdings is enhancing its reporting, aiming for full alignment with these recommendations by fiscal year 2024. This involves detailed scenario analysis, assessing climate-related risks across its loan portfolio, which totaled approximately JPY 39 trillion as of March 2024. The bank is also strengthening its governance and risk management processes to address climate change impacts effectively.

Resona Holdings has established a clear commitment to achieve net-zero greenhouse gas emissions across its investment and loan portfolio by 2050. This ambitious target, consistent with global climate goals, mandates the bank to rigorously manage the carbon footprint associated with its extensive financing activities. As of early 2025, Resona is actively implementing interim targets, particularly focusing on high-emission sectors like electric power, aiming for a significant reduction in financed emissions by 2030, aligning with a 1.5°C pathway. This strategic environmental focus impacts lending criteria and portfolio composition.

The Japanese government's strong push for a Green Transformation is creating a substantial market for sustainable finance, valued at trillions of yen by 2025. Resona Holdings is actively responding to this shift by significantly increasing its volume of transition financing, targeting over ¥1 trillion in sustainable finance commitments by fiscal year 2024. This strategic focus includes developing a range of green financial products, such as providing loans for large-scale renewable energy projects across Japan. Furthermore, Resona is a prominent issuer of green bonds, with recent issuances in 2024 supporting climate-friendly initiatives and aligning with global ESG investment trends. This proactive stance positions Resona to capitalize on the growing demand for environmentally conscious financial solutions.

Biodiversity and Natural Capital

Beyond climate change, there is a heightened focus on the financial risks tied to biodiversity loss and natural capital degradation. Resona Holdings recognizes these critical issues and is actively integrating them into its risk management and sustainability frameworks for 2024-2025. This proactive stance aligns with the emerging global recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD), which saw its final recommendations released in September 2023, influencing financial institutions to assess nature-related dependencies and impacts. The estimated global economic cost of biodiversity loss is significant, prompting banks like Resona to consider these non-financial risks as material financial threats.

- Resona is enhancing its due diligence processes to identify nature-related risks in client portfolios, especially in sectors with high environmental impact.

- Globally, financial institutions are increasingly committing to TNFD adoption, with over 320 organizations endorsing the framework by early 2024.

- The World Economic Forum estimates that over half of global GDP, approximately $44 trillion, is moderately or highly dependent on nature.

- Resona's 2024 sustainability initiatives include exploring nature-positive investment opportunities and engaging with clients on biodiversity best practices.

Environmental Risk Management in Lending

Resona Holdings integrates environmental, social, and governance (ESG) factors into its comprehensive risk assessment processes, reflecting a strategic pivot towards sustainable finance. This involves rigorously evaluating the environmental risks associated with its lending portfolio, particularly for major corporate borrowers, to identify potential credit vulnerabilities. The bank actively engages with clients to promote more sustainable business practices, aiming to align its entire loan book with long-term environmental objectives. Such proactive risk management is crucial for mitigating credit risk and ensuring the bank’s resilience against evolving climate-related financial disclosures expected by 2025 from the Financial Services Agency of Japan.

- Resona aims for a 10% reduction in financed emissions by fiscal year 2025 across key sectors, aligning with its sustainability targets.

- By early 2024, Resona had increased its green finance commitments, with a focus on renewable energy and sustainable infrastructure projects.

- The Japan Bank for International Cooperation (JBIC) announced new guidelines in late 2024, influencing how Japanese banks like Resona assess environmental project risks.

Resona Holdings is enhancing climate-related disclosures, aligning with TCFD and TNFD by fiscal year 2024, and targeting net-zero GHG emissions by 2050. The bank aims for over JPY 1 trillion in sustainable finance by FY2024, capitalizing on Japan's Green Transformation. It integrates biodiversity risks into its 2024-2025 frameworks, driven by TNFD recommendations. ESG factors are crucial for risk assessment, ensuring resilience against evolving climate regulations expected by 2025.

| Focus | Target/Status (2024/2025) | Impact |

|---|---|---|

| Climate Disclosure | Full TCFD/TNFD alignment by FY2024 | Enhanced risk assessment |

| Sustainable Finance | JPY 1 trillion+ by FY2024 | Capitalizing on green market |

| Net-Zero Goal | 2050 (interim 2030 targets) | Portfolio decarbonization |

PESTLE Analysis Data Sources

Our PESTLE analysis for Resona Holdings is meticulously constructed using data from reputable financial news outlets, regulatory filings, and economic research reports. We integrate insights from international bodies and industry-specific publications to ensure a comprehensive understanding of the macro-environment.