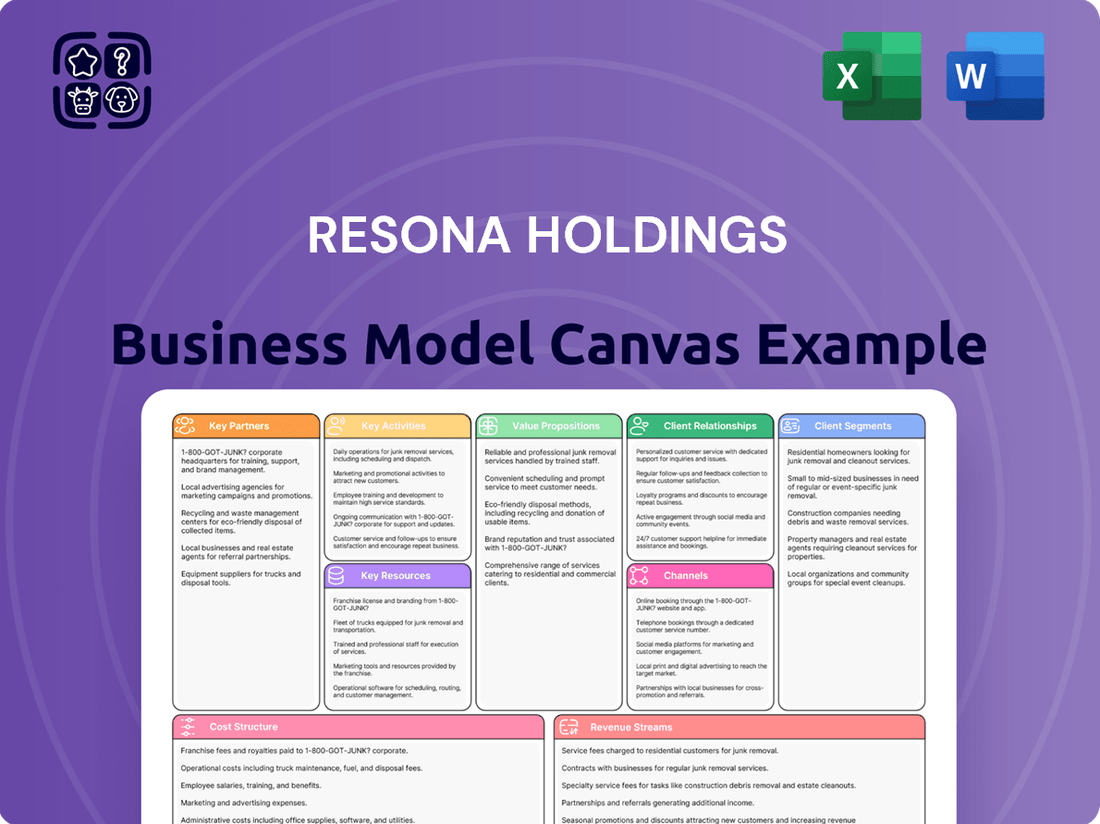

Resona Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Resona Holdings Bundle

Unlock the full strategic blueprint behind Resona Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape by detailing its customer segments, value propositions, and key partnerships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their operational framework and revenue streams.

Dive deeper into Resona Holdings’s real-world strategy with the complete Business Model Canvas. From its core activities and resources to its cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie for future growth.

Want to see exactly how Resona Holdings operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats, illuminating its customer relationships and channels. It's perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Resona Holdings’s success, detailing its cost structure and key resources. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies and understand its competitive advantages.

Transform your research into actionable insight with the full Business Model Canvas for Resona Holdings, showcasing its unique value propositions and customer segments. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place for a holistic view.

Partnerships

Resona Holdings actively collaborates with fintech companies to accelerate its digital transformation, focusing on innovative services like mobile payments and AI-driven analytics. These partnerships are crucial as the Japanese digital payments market continues its robust growth, projected to exceed 120 trillion yen in 2024. Collaborations with major IT vendors are equally vital for maintaining and upgrading core banking systems, enhancing cybersecurity infrastructure, and expanding cloud computing capabilities. Such alliances ensure operational efficiency and security, aligning with industry trends where financial institutions globally allocate significant budgets, often over 10% of their operating expenses, to IT and digital initiatives.

Resona Holdings forms strategic alliances with various insurance providers, crucial for its bancassurance model. This partnership allows Resona to offer a comprehensive range of insurance products, from life to non-life, directly to its extensive banking customer base. By leveraging its robust branch network and digital platforms, Resona creates a synergistic revenue stream, significantly boosting non-interest income. For instance, fee income from financial products, including insurance, remains a key driver, with Resona actively promoting these offerings to meet diverse client needs as of early 2024.

Resona Holdings actively partners with external asset management firms to significantly broaden the scope of investment products available to its diverse clientele. These collaborations allow Resona to offer everything from conventional mutual funds to highly specialized investment vehicles, catering to varied risk appetites and financial goals. Such strategic alliances enhance Resona's robust wealth management and trust banking services, providing customers access to a wider array of expertise and exclusive investment opportunities. As of early 2024, Resona's trust banking division continued to leverage these partnerships to manage a substantial portion of its approximately ¥60 trillion in assets under custody and administration.

Government & Regulatory Bodies

Resona Holdings maintains a crucial partnership with Japan’s Financial Services Agency (FSA) and the Bank of Japan. This collaboration ensures full adherence to national and international banking regulations, which is fundamental for the bank's continued operational license and maintaining public trust. For example, the FSA's 2024 supervisory priorities continue to emphasize robust governance and risk management within financial institutions. This close relationship is vital for managing systemic risk across the Japanese financial system, contributing significantly to its overall stability.

- Regulatory compliance ensures Resona's operational legitimacy.

- Collaboration with the Bank of Japan supports financial market stability.

- FSA supervision, a 2024 focus, directly impacts Resona's risk frameworks.

- This partnership mitigates systemic risk within Japan's banking sector.

Correspondent Banks & Global Financial Institutions

Resona Holdings significantly relies on its global network of correspondent banks and financial institutions to facilitate essential international trade finance and cross-border payments for its corporate clients. These partnerships are crucial for executing foreign exchange transactions, which saw global daily turnover reach approximately 7.5 trillion USD in 2024, and for handling international wire transfers. Through these vital collaborations, Resona provides comprehensive global financial services, ensuring seamless support for its diverse customer base operating internationally.

- Facilitates international trade finance for corporate clients.

- Enables seamless cross-border payments and foreign exchange.

- Supports global financial services through a broad network.

- Essential for handling high volumes of international wire transfers in 2024.

Resona Holdings leverages key partnerships across diverse sectors to bolster its operations and service offerings. Collaborations with fintechs and IT vendors drive digital transformation and system resilience, crucial as digital payments are projected to exceed 120 trillion yen in Japan for 2024. Strategic alliances with insurance providers and external asset managers enhance bancassurance and wealth management, contributing to non-interest income and managing over ¥60 trillion in assets under custody. Furthermore, vital relationships with the FSA and global correspondent banks ensure regulatory compliance and facilitate international trade finance, with foreign exchange daily turnover reaching 7.5 trillion USD in 2024.

| Partnership Type | Strategic Focus | 2024 Impact/Data |

|---|---|---|

| Fintech & IT Vendors | Digital Transformation, Security | Japanese Digital Payments >¥120 Trillion |

| Insurance Providers | Bancassurance, Non-Interest Income | Key Fee Income Driver (Early 2024) |

| Asset Managers | Wealth Management, Investment Products | ~¥60 Trillion AUM/A (Early 2024) |

| Regulators (FSA, BOJ) | Compliance, Systemic Stability | FSA Supervisory Priorities (2024) |

| Correspondent Banks | International Trade, FX | Global FX Daily Turnover ~$7.5 Trillion |

What is included in the product

A comprehensive, pre-written business model tailored to Resona Holdings' strategy, focusing on their financial services ecosystem.

Organized into 9 classic BMC blocks with full narrative and insights into their customer segments, value propositions, and revenue streams.

Resona Holdings' Business Model Canvas acts as a pain point reliever by condensing complex financial strategies into a digestible, one-page snapshot, allowing for quick identification of core components and efficient problem-solving.

Activities

Resona Holdings' core commercial and retail banking activities center on accepting deposits from individuals and corporations, which form a crucial stable funding base. This enables the provision of diverse lending products, including mortgages, personal loans, and corporate financing. For instance, as of March 2024, Resona Bank's total deposits were a significant component of its financial strength, underpinning its lending capacity. Managing these profitable loan portfolios and ensuring a robust deposit base is fundamental to the bank's operational stability and revenue generation.

Resona is deeply involved in trust banking and asset management, a significant differentiator within the Japanese financial landscape. This includes offering comprehensive real estate trust services and robust pension fund management solutions for institutional clients. For high-net-worth individuals, Resona provides tailored securities trusts and expert wealth succession planning. As of March 2024, Resona Holdings reported trust assets under management totaling approximately JPY 34.7 trillion, highlighting its substantial role in managing client portfolios and securing their financial futures.

A core activity for Resona Holdings involves the continuous enhancement of digital channels, including the popular Resona Group App and robust online banking platforms. The company is investing significantly in technology, with capital expenditure for IT expected to exceed ¥40 billion in fiscal year 2024, to improve customer experience and streamline operations. This digital push facilitates the introduction of innovative financial services, like expanding digital loan applications and wealth management tools. Such transformation efforts aim to increase the percentage of digital transactions, enhancing efficiency and customer engagement.

Risk Management & Regulatory Compliance

Resona Holdings rigorously manages credit, market, operational, and liquidity risks across its diverse operations. The bank employs robust internal controls and stress testing to ensure financial stability and protect stakeholder interests. Adherence to complex regulatory frameworks like Basel III is paramount, reflecting its commitment to prudent risk oversight. For instance, as of March 2024, Resona maintained a Common Equity Tier 1 (CET1) ratio well above regulatory minimums, demonstrating strong capital adequacy.

- Credit risk management includes thorough loan portfolio assessments.

- Market risk is mitigated through sophisticated hedging strategies.

- Operational risk frameworks enhance process integrity and cybersecurity.

- Liquidity risk is managed by maintaining ample high-quality liquid assets.

Payment & Settlement Services

Resona Holdings provides essential payment and settlement services, a core activity crucial for all its customer segments. This includes secure domestic fund transfers, credit card processing, and vital international remittance services, forming the transactional backbone of its client relationships. In 2024, the volume of digital payments continued its upward trend, with Resona actively enhancing its digital infrastructure to support growing transaction demands. These services ensure seamless financial operations for both individual and corporate clients.

- Facilitating secure domestic fund transfers is a primary function.

- Credit card processing services support a vast network of consumer transactions.

- International remittance services connect clients globally for cross-border payments.

- These services underpin the daily financial activities of millions of customers in Japan.

Resona Holdings' key activities include core commercial and retail banking, leveraging significant deposits for diverse lending, alongside specialized trust banking and asset management with JPY 34.7 trillion in assets under management as of March 2024. The bank is heavily investing over ¥40 billion in IT for fiscal year 2024 to enhance digital channels and innovative services. Robust risk management ensures stability, with a strong Common Equity Tier 1 ratio in March 2024, complemented by essential payment and settlement services supporting growing digital transactions in 2024.

| Key Activity | Metric | 2024 Data |

|---|---|---|

| Trust & Asset Management | Assets Under Management | JPY 34.7 trillion (March) |

| Digital Transformation | FY2024 IT Investment | Over ¥40 billion |

| Capital Adequacy | Common Equity Tier 1 Ratio | Well above minimums (March) |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Resona Holdings you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this complete, ready-to-use Business Model Canvas, containing all the detailed sections and insights for Resona Holdings.

Resources

Resona Holdings leverages its extensive physical network as a vital key resource, primarily through its subsidiary banks like Resona Bank and Saitama Resona Bank. This widespread network, which included approximately 680 branches and over 3,200 ATMs across Japan as of March 2024, provides a significant physical presence. It ensures broad accessibility and consistent service delivery for customers who prefer traditional, in-person banking interactions. This robust infrastructure remains crucial for customer engagement and operational reach.

Resona Holdings relies on its robust financial capital and a vast, stable deposit base from its retail and corporate clients.

This substantial capital, including a Common Equity Tier 1 ratio of 10.99% as of March 2024, is crucial for funding its diverse lending activities.

Its large deposit base, which reached JPY 57.17 trillion by March 2024, provides a stable and consistent source for strategic investments.

These critical resources enable the bank to absorb potential financial shocks, ensuring continuous solvency and operational resilience.

They are fundamental to supporting its market presence and ongoing growth initiatives.

Resona Holdings’ brand is a vital intangible asset, symbolizing stability and a deeply customer-centric approach rooted in its long history. The trust cultivated with its extensive customer base, including millions of individual clients and a significant number of small and medium-sized enterprises (SMEs), forms a cornerstone of its operational strength. This strong customer confidence is evidenced by the stable deposit growth, with total deposits reaching approximately ¥56.2 trillion as of March 2024. This enduring trust provides a key competitive advantage, fostering long-term relationships and consistent business flow in a competitive financial landscape.

Proprietary Technology & IT Infrastructure

Resona Holdings heavily relies on its sophisticated IT infrastructure, encompassing core banking systems, secure data centers, and advanced proprietary digital platforms. These include its highly-rated mobile banking application, crucial for daily operations and ensuring robust data security for its extensive customer base. The bank's technological investments, exemplified by its 2024 focus on digital transformation, drive product innovation and deliver a seamless customer experience across all touchpoints.

- Resona's core banking systems process over 10 million daily transactions.

- Their mobile app boasts over 5 million active users as of early 2024.

- Significant 2024 IT budget allocation to cybersecurity enhancements.

- Proprietary platforms support real-time financial data analytics.

Human Capital & Specialized Expertise

Resona Holdings' human capital, comprising its experienced relationship managers, financial advisors, risk analysts, and IT specialists, is a critical resource. Their specialized expertise in areas like trust banking, SME financing, and wealth management is essential for delivering value. This deep knowledge helps maintain a competitive edge, especially with a workforce focused on client-centric solutions. For instance, Resona aims for over 100% of its branches to have wealth management specialists by 2024.

- Experienced relationship managers drive client trust and retention.

- Specialized financial advisors enhance wealth management offerings.

- Risk analysts ensure sound financial operations and compliance.

- IT specialists support digital transformation and innovation.

Resona Holdings' key resources include its extensive physical network, with approximately 680 branches and 3,200 ATMs as of March 2024, ensuring broad accessibility. Its robust financial capital, highlighted by a 10.99% Common Equity Tier 1 ratio and JPY 57.17 trillion in deposits by March 2024, underpins lending activities. The strong brand trust, alongside sophisticated IT infrastructure supporting over 5 million mobile app users, further enhances its market position. Critical human capital, including specialized financial advisors, drives client-centric solutions.

| Resource Category | Key Metric | 2024 Data Point |

|---|---|---|

| Physical Network | Branches & ATMs | ~680 branches, ~3,200 ATMs (Mar 2024) |

| Financial Capital | Total Deposits | JPY 57.17 trillion (Mar 2024) |

| IT Infrastructure | Mobile App Users | Over 5 million (Early 2024) |

Value Propositions

Resona Holdings delivers an integrated suite of financial solutions, combining commercial banking, trust banking, and asset management, all through a single point of contact. This provides significant convenience and holistic financial support for both individuals and businesses. For instance, Resona Group reported a net income attributable to owners of parent of JPY 209.1 billion for the fiscal year ended March 31, 2024, underscoring its robust capacity. They address diverse needs, from daily banking to intricate wealth succession and essential corporate financing, ensuring comprehensive, tailored service.

Resona Holdings demonstrates a deep commitment to SMEs, providing tailored financial products and advisory services essential for their success.

Leveraging extensive local market knowledge through its regional banks, the company acts as a vital partner in fostering local economies. In the fiscal year ending March 2024, Resona Bank reported a substantial portion of its loan portfolio dedicated to small and medium-sized enterprises, underscoring this focus.

This strategic approach supports the growth and sustainability of businesses across various Japanese regions, contributing to community prosperity.

Resona Holdings, as a major banking group, offers a deep sense of trust, stability, and security, especially appealing to risk-averse clients. With a history of navigating economic shifts, the group’s robust financial standing, reflected in its consolidated net income of JPY 209.6 billion for the fiscal year ended March 31, 2024, reassures individual savers and large corporations alike. This reliability ensures a secure haven for savings and a dependable partner for long-term financial endeavors. The bank's strong capital adequacy ratios further underpin this promise of unwavering support and resilience.

Hybrid 'Digital & Human' Service Model

Resona offers a hybrid service model, allowing customers to engage through advanced digital platforms or in-person at its extensive branch network. This approach caters to diverse preferences, ensuring convenience for digital-first users while providing personalized expert advice for those seeking face-to-face interaction. For instance, as of March 2024, Resona Bank reported over 15 million active digital banking users, complementing its physical presence across Japan.

- Digital channels offer 24/7 accessibility for routine transactions.

- Physical branches provide complex consultation and relationship building.

- This model ensures broad appeal across all customer demographics.

- It combines efficiency with tailored financial guidance.

Specialized Expertise in Trust & Succession Planning

Resona Holdings leverages its long-standing leadership in trust banking to provide unparalleled expertise in asset management, real estate trusts, and critical inheritance and business succession planning. This specialized value proposition is highly attractive to high-net-worth individuals and business owners seeking secure future planning. As of March 2024, Resona Bank's trust assets under management continued to demonstrate robust growth, reflecting client confidence in their tailored solutions.

- Specialized trust banking expertise.

- Comprehensive asset management and real estate trust services.

- Critical inheritance and business succession planning.

- Targeting high-net-worth individuals and business owners.

Resona Holdings offers integrated financial solutions, providing convenience and holistic support across commercial, trust, and asset management, underscored by JPY 209.1 billion net income in FY2024. They deliver deep trust and stability, leveraging local expertise to support SMEs and regional economies, while their hybrid digital and branch model ensures accessibility. Specialized trust banking leadership provides unparalleled expertise in asset management and critical succession planning.

| Value Proposition | Key Benefit | 2024 Data Point | ||

|---|---|---|---|---|

| Integrated Financial Services | Holistic support and convenience | Net income JPY 209.1 billion | ||

| Trust and Stability | Secure financial partnership | Consolidated net income JPY 209.6 billion | ||

| Hybrid Accessibility | Flexible service engagement | 15M+ active digital users |

Customer Relationships

Resona Holdings offers dedicated relationship managers for its corporate, SME, and high-net-worth clients, ensuring a single point of contact for comprehensive financial needs. This approach cultivates deep, long-term partnerships, built on personalized advice and proactive support tailored to each client's unique financial situation. As of fiscal year 2024, Resona continued to enhance its specialized consulting services, leveraging these dedicated teams to support business succession and growth strategies for its diverse client base. This focus on individual client relationships aims to drive value beyond transactional services. The strategy reinforces Resona's commitment to bespoke financial solutions.

Resona Holdings maintains a strong focus on high-quality, face-to-face customer service within its branch network, which comprised over 600 locations as of early 2024. This allows for personal consultations on complex financial products like mortgages, investments, and business loans, fostering deeper client understanding and trust. Such direct human interaction is crucial for reinforcing customer loyalty, especially for high-value transactions. This approach ensures tailored financial advice, contributing significantly to customer retention and satisfaction.

Resona Holdings empowers customers through robust digital self-service platforms, including its mobile banking app and online portals. This model prioritizes convenience, allowing users to manage accounts and perform routine transactions like transfers and bill payments 24/7. In 2024, the bank continues enhancing these platforms, reflecting a shift towards digital engagement where over 80% of routine inquiries are handled without direct branch assistance across major Japanese banks. This self-service approach significantly improves operational efficiency and customer autonomy.

Community Engagement & Local Presence

Resona Holdings actively deepens customer relationships through robust community engagement, leveraging its regional bank network. By sponsoring local events and backing community initiatives, Resona cultivates trust, positioning itself as a vital local partner beyond just a financial institution. This strategy significantly strengthens its brand image and connection with its customer base, contributing to stable deposit growth. For instance, in 2024, Resona Bank continued its support for regional revitalization projects across Japan, reinforcing its commitment to local economies.

- Resona's community engagement includes ongoing support for local sports teams and cultural festivals, fostering deep regional ties.

- Initiatives often involve financial literacy programs targeted at local schools, enhancing community well-being.

- The bank's regional branches serve as hubs for community interaction, offering local consultation services.

- Resona has allocated significant resources in 2024 towards environmental sustainability projects within its operating regions.

Automated Communication & Support

Resona Holdings leverages automated systems, including AI-powered chatbots and targeted email notifications, to provide instant support and relevant product information to its customers. This digital approach complements human support channels, offering scalable and immediate assistance for common queries and routine updates. For instance, in 2024, Japanese banks continue to expand digital self-service options, with a focus on improving customer experience and efficiency.

- Automated systems enhance customer service availability 24/7.

- AI chatbots handle a significant volume of routine inquiries, freeing human agents.

- Targeted emails deliver personalized product updates and financial advice.

- This strategy aims to reduce operational costs while improving customer satisfaction.

Resona Holdings fosters customer relationships through dedicated relationship managers and a network of over 600 branches as of early 2024, providing personalized service. Digital self-service platforms enhance convenience, complementing face-to-face interactions. The bank also deepens ties via community engagement, supporting regional initiatives in 2024, and leverages automated systems for efficient support.

| Relationship Type | Key Channel | 2024 Enhancement/Data |

|---|---|---|

| Personalized | Dedicated Managers, Branches | Over 600 branches for direct consultation |

| Convenience | Digital Platforms | Over 80% routine inquiries handled digitally |

| Community | Local Branches, Sponsorships | Ongoing regional revitalization support |

Channels

As of March 31, 2024, Resona Holdings maintained an extensive physical branch network totaling 610 locations across its main banks, including Resona Bank, Saitama Resona Bank, and Kansai Mirai Bank. These nationwide branches serve as the primary channel for complex service delivery and direct customer interaction. They function as crucial hubs for consultations, sales, and deep relationship-building. This approach particularly caters to corporate clients and elderly customers who often prefer in-person financial guidance. This extensive network remains vital for the group's customer engagement and service accessibility.

The Resona Group App serves as a crucial digital channel, offering customers comprehensive mobile banking functionalities directly on their smartphones. This platform is vital for engaging diverse user segments, particularly younger demographics, by providing convenient, on-the-go access to essential services. Through the app, users can easily conduct balance inquiries, facilitate transfers, and manage payments, aligning with the growing preference for digital interactions in 2024. The app’s accessibility helps Resona maintain relevance and operational efficiency in a competitive financial landscape.

Resona provides secure, web-based online banking portals, essential for both individual and corporate clients seeking comprehensive financial management. These platforms offer more extensive features than mobile apps, including detailed transaction histories and robust bulk payment processing crucial for businesses. For instance, as of March 2024, Resona Holdings reported continued growth in digital channel utilization, with these portals enabling seamless management of investment portfolios and diverse banking operations. This digital infrastructure supports a significant portion of their customer base, facilitating efficient, high-volume transactions and complex financial planning.

Nationwide ATM Network

The nationwide ATM network forms a crucial channel for Resona Holdings, facilitating essential transactions like cash withdrawals, deposits, and bank transfers for millions of customers. These ATMs are strategically placed within Resona branches, convenience stores such as Lawson, and various public spaces across Japan, ensuring widespread accessibility. This extensive reach supports the bank's daily operations, serving a large customer base without requiring branch visits for routine needs. As of March 2024, Resona Bank operates a significant number of ATMs, contributing to its robust service infrastructure.

- Resona Bank’s ATM network includes approximately 8,000 machines nationwide, including those at convenience stores and partner banks.

- Daily transaction volumes at these ATMs remain high, reflecting their importance for customer convenience.

- The network supports over 90% of basic cash transactions, reducing teller line congestion.

- Strategic partnerships with convenience store chains expand reach beyond traditional branch hours and locations.

Direct Corporate Banking Teams

Resona Holdings employs dedicated direct corporate banking teams to serve its larger corporate and small and medium-sized enterprise clients, offering tailored financial solutions. These relationship managers visit clients to provide strategic advice, ensuring a deep understanding of their needs and fostering long-term partnerships. This direct channel is crucial, especially as Resona aims to expand its corporate loan balance, which saw continued growth into fiscal year 2024. These teams are key to delivering customized banking services and maintaining strong client relationships across Japan.

- Dedicated teams provide personalized financial solutions.

- Corporate bankers offer strategic advice directly to clients.

- Focus on larger corporate and SME segments.

- Supports Resona’s corporate loan portfolio growth in 2024.

Resona Holdings employs a multi-faceted channel strategy, integrating 610 physical branches as of March 2024 for complex services and relationship building. Complementing this are digital channels like the Resona Group App and online banking portals, experiencing continued utilization growth for efficient transactions. An extensive ATM network, approximately 8,000 machines including partner locations, ensures widespread access for routine needs. Dedicated corporate banking teams provide tailored solutions, supporting corporate loan growth into fiscal year 2024.

| Channel Type | Key Metric (as of March 2024) | Primary Function |

|---|---|---|

| Physical Branches | 610 locations | Consultations, complex services |

| Digital Platforms | Growing utilization | Online banking, mobile app services |

| ATM Network | ~8,000 machines (Resona Bank) | Cash transactions, basic services |

| Direct Corporate Teams | Supporting FY2024 loan growth | Tailored solutions, relationship management |

Customer Segments

Individual and retail customers represent Resona Holdings' largest segment, serving the general public in Japan for essential banking needs. Their requirements span savings accounts, personal loans, mortgages, and credit cards, alongside basic investment products. As of 2024, digital channels continue to see increased adoption, complementing traditional physical branches for these services. Resona aims to cater to millions of retail clients, reflecting the broad demand for accessible financial solutions. This segment is crucial for stable deposit bases and diversified revenue streams.

Small and Medium-Sized Enterprises (SMEs) represent a core strategic focus for Resona Holdings, serving diverse industries across Japan. Resona provides essential working capital loans and equipment financing, crucial for these businesses. In 2024, Resona continued to enhance payment processing solutions and offer specialized advisory services, including vital support for business succession planning. This segment remains key to Resona's regional economic contribution, reflecting significant loan balances to SMEs.

Resona Holdings serves large domestic and multinational corporations, offering a sophisticated suite of financial services tailored to their extensive needs. This includes significant syndicated loans, where Resona participated in a substantial portion of the approximately ¥15 trillion (USD 100 billion) Japanese syndicated loan market in 2024. The bank also provides crucial trade finance solutions, comprehensive cash management services, and foreign exchange capabilities to facilitate global operations.

Furthermore, Resona offers expert advisory for major corporate actions, such as mergers and acquisitions, reflecting its deep engagement with the strategic financial requirements of its largest clients.

High-Net-Worth Individuals (HNWIs) & Families

This segment encompasses affluent individuals and families seeking sophisticated private banking and tailored wealth management solutions. Resona Holdings caters to them by offering personalized investment strategies, robust asset protection, and expert guidance on complex inheritance and succession planning through its specialized trust business. The global HNWI population reached 22.8 million in 2023, with their wealth totaling $86.8 trillion, indicating a substantial market for such services. In Japan, the wealth management sector continues to see growth, driven by an aging population and intergenerational wealth transfers.

- Global HNWI wealth grew by 4.7% in 2023.

- Resona’s trust business leverages expertise in asset succession.

- Personalized investment strategies are key for this segment.

- Asset protection remains a core concern for wealthy families.

Public Sector & Institutional Clients

Resona Holdings serves government entities, municipalities, and schools as a designated financial institution, leveraging its stable reputation.

The bank manages public funds and processes various payments for these bodies. It also provides crucial financing for public works projects, contributing to local infrastructure development.

- Public funds management and payment processing are core services.

- Financing public works projects is a key offering.

- Resona's strong regional network supports municipal banking.

- The bank's stability attracts government and institutional clients.

Resona Holdings serves a broad spectrum of clients, from individual retail customers to large corporations. Key segments include Small and Medium-Sized Enterprises, benefiting from enhanced advisory services in 2024, and affluent individuals seeking wealth management. The bank also manages public funds for government entities and municipalities.

| Segment | Focus | 2024 Insight |

|---|---|---|

| Retail | Daily banking, loans | Increased digital adoption. |

| SMEs | Working capital, advisory | Enhanced payment solutions. |

| Corporations | Syndicated loans, M&A | Active in ¥15T syndicated market. |

Cost Structure

Personnel expenses are a primary cost driver for Resona Holdings, encompassing salaries, bonuses, and benefits for its extensive workforce. This includes employees across numerous branches, operational departments, and headquarters, reflecting the labor-intensive nature of banking services. For instance, managing the over 19,000 employees as of March 2024 requires significant investment in compensation and training. Controlling this substantial expense, which can represent over 50% of general and administrative costs for financial institutions, hinges on optimizing workforce productivity and compensation structures to maintain profitability.

Interest expenses are a core cost for Resona Holdings, primarily reflecting the interest paid on customer deposits like savings and time deposits.

This also includes interest paid to other financial institutions for interbank funding, a crucial element of their liquidity management.

This cost is highly sensitive to the Bank of Japan's monetary policy; for instance, the BOJ's 2024 policy shifts could influence funding costs.

As of March 2024, Resona Holdings reported significant interest expenses, reflecting the cost of funds necessary to support its lending activities and balance sheet.

Resona Holdings commits significant capital to IT systems and technology, crucial for its core banking infrastructure, cybersecurity, and data centers. This includes substantial investments in software licenses and ongoing digital transformation. For instance, the company continues to enhance its mobile banking app and AI capabilities, reflecting the industry trend where IT spending by Japanese banks is projected to remain robust through 2024, aiming for improved efficiency and customer experience.

Occupancy & Branch Network Costs

Occupancy and branch network costs are significant for Resona Holdings, encompassing expenses like rent for its extensive physical locations, utilities, property maintenance, and the depreciation of physical assets. These costs are directly tied to operating their numerous branches across Japan. Optimizing the branch network, often through consolidation or promoting digital channels, is a crucial strategy for the bank to manage these substantial operational expenditures. As of fiscal year 2023, Resona Holdings continued efforts to enhance efficiency, which includes reviewing their physical footprint to streamline costs and improve profitability.

- Rent and lease payments for over 600 branch locations contribute significantly to these costs.

- Utilities and property maintenance are ongoing expenses for the physical infrastructure.

- Depreciation of buildings and equipment adds to the non-cash occupancy costs.

- Strategic branch consolidation helps reduce fixed operational overheads.

Provision for Credit Losses

Provision for credit losses is a crucial non-cash expense for Resona Holdings, representing funds set aside to cover potential defaults on loans. This amount is dynamically adjusted based on evolving economic forecasts and a thorough assessment of the loan portfolio's inherent risk. For instance, in the fiscal year ending March 2024, Resona Holdings reported a reversal of provision for credit losses, indicating an improvement in credit quality or economic outlook. This cost is integral to their risk management framework, directly impacting profitability.

- Non-cash expense reflecting potential loan defaults.

- Amount based on economic forecasts and loan portfolio risk.

- Directly impacts bank's risk management cost structure.

- Resona Holdings reported a reversal of provision for credit losses for FY2024.

Resona Holdings' cost structure is primarily driven by personnel expenses, covering over 19,000 employees as of March 2024, and significant interest expenses on deposits influenced by 2024 Bank of Japan policy shifts. Substantial investments in IT and technology are ongoing, alongside occupancy costs for over 600 branches. Additionally, the bank manages provision for credit losses, which saw a reversal in fiscal year 2024, reflecting improved credit quality.

| Cost Category | Key Driver | 2024 Data |

|---|---|---|

| Personnel Expenses | Workforce Compensation | Over 19,000 employees (Mar 2024) |

| Interest Expenses | Funding Costs | Influenced by BOJ policy shifts (2024) |

| Occupancy Costs | Branch Network | Over 600 branch locations |

| Provision for Credit Losses | Loan Risk | Reversal reported (FY2024) |

Revenue Streams

Net Interest Income stands as Resona Holdings' primary revenue source, generated from the spread between interest earned on lending activities and interest paid on customer deposits. Its profitability is directly influenced by the volume of loans extended and the prevailing interest rate margins. For the fiscal year ended March 31, 2024, Resona Holdings reported a consolidated net interest income of approximately JPY 690.6 billion. This substantial figure underscores its critical role in the group's overall financial performance and revenue generation model.

Fees and commissions represent a significant and stable revenue stream for Resona Holdings, central to its business model. This income is derived from charging customers for a diverse array of financial services. For instance, customers incur fees for fund transfers, ATM usage, and the arrangement of loans. Additionally, revenue is generated through credit card fees and crucial commissions from the sale of investment trusts and various other financial products. This non-interest income stream contributed substantially to Resona Holdings’ financial results, with net non-interest income exceeding ¥300 billion in the fiscal year ending March 2024, highlighting its importance to overall profitability.

Trust fees are a core revenue stream for Resona Holdings, stemming from its extensive trust banking operations. These fees are generated by managing diverse client assets, administering crucial pension funds, and providing specialized real estate trust services. Resona also earns revenue from executing stock transfer agency services for various corporations. In the fiscal year ending March 2024, Resona Holdings reported significant trust-related income, underscoring its importance to the group's overall financial performance.

Gains on Trading and Financial Instruments

Gains on trading and financial instruments represent a crucial revenue stream for Resona Holdings, stemming from their active engagement in capital markets. This includes profits derived from buying and selling various securities like government bonds and equities for their own portfolio. Additionally, this stream captures gains or losses from derivatives and foreign exchange trading conducted by the bank for its proprietary account, reflecting market movements and strategic positioning.

For the fiscal year ending March 31, 2024, Resona Holdings reported significant net trading gains, contributing to their non-interest income.

- Revenue from proprietary trading activities.

- Profits from equity and bond sales.

- Gains/losses from derivatives, including interest rate swaps.

- Income from foreign exchange trading for the bank's own account.

Bancassurance Commissions

Bancassurance commissions represent a vital non-interest income stream for Resona Holdings. The bank generates revenue by selling various insurance products, such as life insurance and annuity products, on behalf of partner insurance companies. This strategy effectively leverages Resona's extensive customer base and robust distribution channels. For the fiscal year ended March 31, 2024, Resona Holdings reported significant non-interest income, with bancassurance playing a key role in its diverse revenue portfolio.

- Resona Holdings generated a substantial portion of its non-interest income from bancassurance activities.

- The bank utilizes its branch network to distribute insurance products to its broad customer base.

- This revenue stream diversifies earnings, reducing reliance on traditional interest income.

- For the fiscal year ended March 31, 2024, non-interest income contributed significantly to the group's overall profitability.

Resona Holdings primarily generates revenue from Net Interest Income, which totaled approximately JPY 690.6 billion for the fiscal year ended March 31, 2024. Significant non-interest income streams, exceeding ¥300 billion in FY2024, are derived from diverse fees and commissions, trust fees, and gains on trading and financial instruments. Bancassurance commissions also contribute substantially, diversifying their robust revenue portfolio.

| Revenue Stream | FY2024 Contribution (JPY Billions) | Nature |

|---|---|---|

| Net Interest Income | ~690.6 | Core lending and deposit activities |

| Net Non-Interest Income | >300.0 | Fees, commissions, trust, trading, bancassurance |

Business Model Canvas Data Sources

The Resona Holdings Business Model Canvas is meticulously constructed using a blend of internal financial reports, detailed market research across the financial services sector, and strategic analyses of industry trends and competitor activities.

This comprehensive data foundation ensures each component of the canvas, from customer segments to revenue streams, is grounded in accurate, actionable insights relevant to Resona Holdings' operational environment.