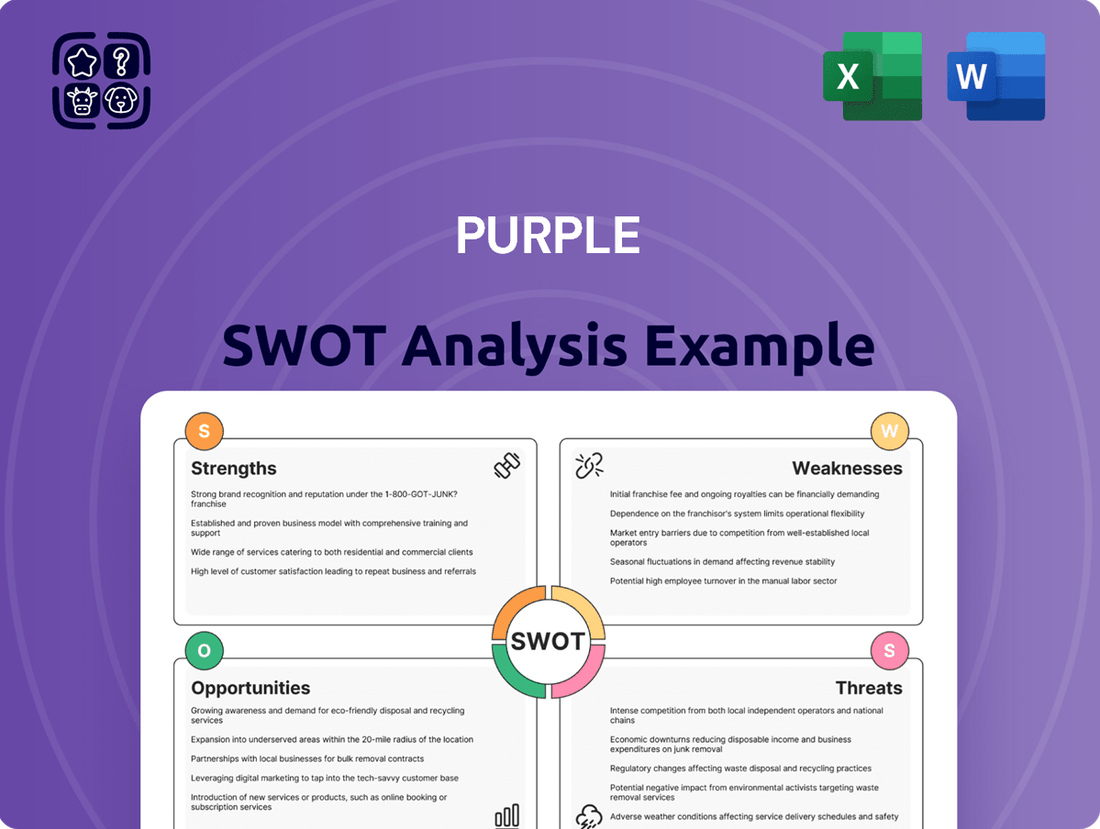

Purple SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Purple Bundle

You've seen a glimpse of the Purple company's strategic landscape, revealing key opportunities and potential challenges. But what truly sets Purple apart, and where do the most significant growth avenues lie?

Our comprehensive Purple SWOT analysis dives deeper, uncovering the nuanced strengths that fuel their market presence and the specific threats that demand strategic foresight. This isn't just about identifying weak points; it's about understanding the competitive environment and actionable steps for advancement.

Ready to transform these insights into a winning strategy? Purchase the full Purple SWOT analysis to access detailed breakdowns, expert commentary, and a bonus Excel version, perfect for shaping your next move.

Strengths

Purple's proprietary GelFlex Grid technology is a core strength, differentiating it from competitors reliant on traditional memory foam or spring systems. This patented innovation, engineered for superior pressure relief, adaptive support, and enhanced temperature regulation, creates a unique selling proposition difficult for rivals to replicate. The GelFlex Grid is foundational to Purple's product line, driving its brand identity as a comfort innovator. This distinct technology helps Purple maintain its market position, contributing to its reported gross margin of 35.6% as of Q1 2024.

Purple has cultivated significant brand recognition, largely driven by its highly effective and often viral digital marketing campaigns, including notable YouTube series and social media presence that have garnered hundreds of millions of views. This robust direct-to-consumer (DTC) marketing approach has fostered a loyal customer base, with online engagement remaining high through early 2025. The company's innovative use of digital channels has solidified its position as a leading brand within the competitive bed-in-a-box segment, giving it a distinct advantage in capturing market share. Purple's brand strength is reflected in its continued ability to attract new customers and maintain strong sales momentum despite increasing competition.

Purple's robust omnichannel sales strategy is a core strength, combining direct-to-consumer online sales with company-owned showrooms and a vast network of third-party retail partners. This multi-channel approach diversifies revenue streams and significantly broadens customer reach, catering to diverse shopping preferences. Major expansions, including the continued partnership with Mattress Firm, have substantially grown Purple's physical retail footprint to over 3,000 locations by early 2025. This strategic reach enhances brand visibility and revenue potential across various market segments.

Vertically Integrated Manufacturing and Innovation

Purple's vertical integration is a significant strength, as it designs and manufactures its proprietary equipment for GelFlex Grid technology. This control over production ensures superior quality and enables rapid innovation, crucial for competitive advantage. The company continues to refine its manufacturing footprint, with efficiency gains expected to impact operations through 2025. A dedicated R&D innovation center further solidifies its commitment to advancing patented technology. This strategic approach supports scalable production and sustained product differentiation.

- Proprietary manufacturing equipment provides direct control over GelFlex Grid quality and production.

- Vertical integration facilitates rapid innovation cycles, allowing for quicker market response.

- Consolidation of manufacturing aims to enhance operational efficiency and cost control into 2025.

- Dedicated R&D investment ensures continuous advancement of patented technology and product offerings.

Focus on Premium Product Segment

Purple's strategic pivot towards a premium sleep company, embodied by its 'Path to Premium Sleep' initiative, represents a significant strength. This involves focusing on high-margin offerings like the Rejuvenate collection, leveraging proprietary technology to justify elevated price points. Consumer demand for premium wellness and sleep solutions continues to grow, aligning perfectly with Purple's strategy for enhanced profitability. This focus positions Purple to capitalize on a market segment expected to expand significantly through 2025.

- Purple targets higher average selling prices (ASPs) through premium product innovation.

- The Rejuvenate collection aims for increased gross margins.

- Market trends show rising consumer willingness to invest in sleep quality.

- Technology differentiation supports premium pricing and brand perception.

Purple's patented GelFlex Grid technology provides a unique market differentiator, contributing to a 35.6% gross margin in Q1 2024. This is reinforced by a robust omnichannel strategy, expanding its retail presence to over 3,000 locations by early 2025. Vertical integration ensures product quality and rapid innovation, supporting a strategic pivot towards premium offerings. Strong brand recognition further enhances its competitive position in the evolving sleep solutions market.

| Metric | Q1 2024 | Early 2025 |

|---|---|---|

| Gross Margin | 35.6% | Projected Stability |

| Retail Locations | ~3,000 | 3,000+ |

| Premium Focus | Rejuvenate Line | Continued Expansion |

What is included in the product

Delivers a strategic overview of Purple’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats to inform future strategy.

Simplifies complex SWOT data into an actionable, visually digestible format.

Weaknesses

Purple has faced significant financial hurdles, including net losses and periods of negative operating cash flow, particularly evident in early 2024. While Q4 2024 did show a return to positive Adjusted EBITDA, maintaining this profitability consistently remains a key challenge for the company. Revenue has experienced year-over-year declines in recent quarters, with Q1 2025 seeing a notable decrease compared to the prior year, highlighting ongoing struggles with sustained growth. This inconsistent financial performance affects investor confidence and operational stability.

Purple's substantial reliance on its proprietary GelFlex Grid technology, while unique, creates a significant vulnerability. Competitors consistently launch new materials, like memory foam advancements or hybrid designs, potentially eroding Purple's market share. This dependence necessitates considerable R&D investment, with Purple reporting approximately $10-12 million in R&D expenses annually in recent periods, to maintain its technological edge. A superior alternative could swiftly diminish the GelFlex Grid's competitive advantage in the 2024-2025 sleep tech landscape.

Purple Innovation holds a comparatively small market share against industry behemoths like Tempur Sealy International and Serta Simmons Bedding. This limited market presence, with Purple's 2023 revenue around $500 million compared to Tempur Sealy's over $4.5 billion, constrains its negotiation leverage with key suppliers and retail partners. Consequently, Purple remains highly susceptible to aggressive marketing and pricing shifts from larger, more dominant competitors. The intensely competitive bedding sector continuously pressures smaller firms, demanding constant innovation and efficiency.

Vulnerability to Economic Downturns

Purple's reliance on mattresses and other premium comfort products, considered discretionary big-ticket purchases, leaves it vulnerable to economic downturns. Consumers often delay these significant buys or opt for more affordable alternatives during tighter financial periods, impacting Purple's sales given its premium pricing strategy. The company has already faced headwinds, reporting a net revenue decline of 12.8% to $127.3 million in Q1 2024, reflecting broader industry softness and macroeconomic pressures.

- Discretionary spending: Consumers defer or downsize high-cost purchases like premium mattresses during economic uncertainty.

- Premium pricing impact: Purple's higher price points become a disadvantage when consumer budgets tighten.

- Recent financial performance: Q1 2024 saw a 12.8% net revenue decrease to $127.3 million, highlighting market challenges.

Execution Gaps in E-commerce

Purple faces significant execution gaps in its e-commerce operations, despite its established brand recognition. The company has acknowledged challenges in converting online traffic into sales, with conversion rates potentially lagging behind competitors in the highly competitive online mattress market. Customer acquisition costs in this space remain elevated, often exceeding $200 per new customer as of Q1 2025. This indicates a struggle to effectively convey the unique value proposition of Purple products digitally, hindering sales growth in its primary direct-to-consumer channel.

- E-commerce conversion rates for Purple have been cited as a key area for improvement in recent investor calls.

- Online mattress market competition is intense, with high marketing spend required to capture market share.

- The inability to translate strong brand awareness into higher online sales represents a strategic vulnerability.

Purple's inconsistent financial performance, marked by net losses and revenue declines, creates instability. Its significant reliance on the GelFlex Grid and premium pricing makes it vulnerable to evolving competitor technologies and economic downturns. Additionally, a small market share and e-commerce execution gaps, with customer acquisition costs over $200 per new customer, hinder growth against larger rivals. These factors collectively challenge Purple's profitability and market position.

| Weakness Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Financial Performance | Q1 2024 Revenue: $127.3M (-12.8% YoY) | Reduced investor confidence, operational instability |

| Market Share | 2023 Revenue: ~$500M (vs. Tempur Sealy >$4.5B) | Limited negotiation power, competitive pressure |

| E-commerce Efficiency | Q1 2025 CAC: >$200/customer | High acquisition costs, hindered online growth |

Preview the Actual Deliverable

Purple SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

What you see here is the exact document you will receive after your purchase, offering complete transparency.

Rest assured, this preview accurately represents the comprehensive SWOT analysis that will be yours to download.

You are viewing the actual SWOT analysis document; the full, detailed report is unlocked immediately upon purchase.

Opportunities

A significant opportunity for Purple lies in expanding its brick-and-mortar retail presence through strategic wholesale partnerships. The recently announced major expansion with Mattress Firm is set to more than double Purple's retail footprint within those stores. This collaboration is projected to generate an impressive $70 million in incremental annual revenue by 2025. Growing these types of partnerships significantly boosts brand visibility and effectively captures customers who prefer the in-person shopping experience.

Purple's sales are currently heavily concentrated in North America, representing over 95% of its 2024 revenue. Expanding into international markets, particularly Europe and Asia, presents a substantial long-term growth opportunity, with the global mattress market projected to exceed $50 billion by 2025. While navigating potential existing licensing agreements is crucial, a strategic global expansion could unlock vast new revenue streams. This diversification beyond its core U.S. market would significantly enhance Purple's global market share and growth trajectory.

The consumer trend prioritizing sleep as fundamental to overall health and wellness presents a significant opportunity. The global sleep technology market is projected for robust growth, with estimates suggesting a market value potentially exceeding $35 billion by 2025, driven by demand for innovative rest solutions. Purple can leverage this by emphasizing the health and therapeutic advantages of its proprietary pressure-relieving technology. This aligns with consumers seeking advanced solutions for enhanced sleep quality and recovery.

Product Line Diversification

Purple can leverage its established brand recognition and proprietary comfort technology to strategically expand into new product categories. This includes developing ergonomic office chairs, adaptive seating solutions, and other therapeutic products beyond its core mattress offerings. Such diversification lessens reliance on the highly competitive mattress market, which saw a projected 2024 market size of around $17 billion globally, and opens up new revenue streams. For instance, the global ergonomic chair market is anticipated to reach over $5 billion by 2025, providing a substantial growth avenue.

- Expanding into the $5 billion global ergonomic chair market by 2025.

- Reducing dependency on the competitive $17 billion global mattress market.

- Leveraging proprietary GelFlex Grid technology for diverse comfort products.

- Tapping into the broader wellness industry, projected to exceed $7 trillion by 2025.

Operational Efficiency and Margin Improvement

Purple is strategically consolidating its manufacturing operations into a single facility, a move anticipated to generate substantial cost savings. This initiative is projected to yield an estimated $15 to $20 million in annual EBITDA benefits starting in 2025. Successfully executing this plan will streamline logistics, significantly improve gross margins, and foster a more resilient and profitable business model for the company.

- Targeted $15-20M annual EBITDA benefit from 2025.

- Consolidation to a single manufacturing facility.

- Expected improvements in gross margins and logistics.

- Enhances overall business model resilience.

Purple is poised for substantial growth by expanding its retail footprint, anticipating $70 million in incremental revenue by 2025 from partnerships like Mattress Firm. International expansion targets the global mattress market, projected to exceed $50 billion by 2025. Diversification into new product categories, such as ergonomic chairs, could tap into a market valued over $5 billion by 2025. Additionally, manufacturing consolidation is set to deliver $15 to $20 million in annual EBITDA benefits from 2025, enhancing profitability.

| Opportunity | 2025 Projection | Benefit |

|---|---|---|

| Retail Expansion | +$70M Revenue | Increased Visibility |

| International Growth | >$50B Market | New Revenue Streams |

| New Product Categories | >$5B Market | Diversified Portfolio |

| Manufacturing Consolidation | $15-20M EBITDA | Improved Margins |

Threats

The mattress and bedding industry is exceptionally saturated, presenting a significant threat to Purple. Legacy brands and numerous direct-to-consumer competitors fiercely vie for market share, with the global mattress market projected to exceed $50 billion by 2025. Competitors employ aggressive marketing, pricing strategies, and product innovation, directly impacting Purple's revenue, which was $108.9 million in Q1 2024, down from $120.7 million in Q1 2023. This intense competition compresses profit margins, as evidenced by Purple’s Q1 2024 gross margin of 36.8%, a decrease from 38.6% in Q1 2023. The continuous entry of well-capitalized players further escalates this battle for customers.

Economic uncertainty, driven by persistent inflation and elevated interest rates, poses a significant threat. For instance, the U.S. Federal Reserve maintained a target rate of 5.25%-5.50% through early 2024, impacting borrowing costs and consumer confidence. This environment can reduce discretionary spending on big-ticket items like premium mattresses, as consumers prioritize essential goods. A potential economic slowdown in late 2024 or early 2025 could lead customers to delay purchases or opt for cheaper alternatives, directly impacting Purple's revenue and market share.

The company faces significant threats from volatile raw material costs, with some commodities projected to rise by 3-5% into mid-2025, alongside persistent logistics disruptions. International trade policies and potential tariff escalations, like those seen affecting specific sectors in 2024, could further inflate the cost of goods sold, eroding profit margins or necessitating price hikes that may deter customers. While the recent manufacturing consolidation initiative aims to bolster resilience against these external shocks, it introduces near-term execution complexities and potential operational bottlenecks through late 2024.

Intellectual Property Challenges

The constant threat of intellectual property infringement poses a significant challenge for Purple, despite its robust portfolio of patents, particularly those protecting its proprietary Hyper-Elastic Polymer technology. The company has previously engaged in costly litigation to defend its IP rights and licensing agreements, with legal expenses impacting operating margins. Competitors frequently attempt to replicate Purple's unique technology, necessitating continuous monitoring and enforcement efforts. Defending these patents can consume substantial financial resources, potentially diverting funds from research and development or market expansion initiatives.

- Annual IP litigation costs for companies can reach tens of millions, impacting net income.

- The average patent infringement lawsuit costs over $3 million to litigate through discovery.

- Successful IP defense is crucial for maintaining market share and competitive advantage.

- Globally, IP disputes are projected to rise, increasing enforcement pressures on innovators.

Dependence on Key Retail Partners

While expanding its wholesale channel offers growth, Purple faces significant dependence on its key retail partners. A substantial portion of Purple's future growth is directly linked to its expanded partnership with Mattress Firm, which contributed significantly to wholesale revenue in early 2024. Any negative shifts in this crucial relationship, or a downturn in Mattress Firm's own business, could adversely impact Purple's sales and growth trajectory. This reliance presents a notable vulnerability for the company's financial performance.

- Wholesale channel represented over 60% of Purple's net revenue in Q1 2024.

- The expanded Mattress Firm partnership became fully operational in Q4 2023, driving significant wholesale volume.

- Any material disruption with a major partner could impact Purple's projected 2024 net revenue of $560-$590 million.

Purple faces intense competition in a market projected to exceed $50 billion by 2025, impacting Q1 2024 revenue of $108.9 million and gross margin of 36.8%. Economic uncertainty, with US Fed rates at 5.25%-5.50% in early 2024, and rising raw material costs (3-5% into mid-2025) threaten profitability. Significant dependence on wholesale partners like Mattress Firm, which contributed over 60% of Q1 2024 net revenue, creates vulnerability. Furthermore, intellectual property infringement poses ongoing legal expenses, with patent lawsuits averaging over $3 million.

| Threat Area | Key Metric | 2024/2025 Data |

|---|---|---|

| Market Competition | Global Mattress Market | >$50 Billion (2025 proj.) |

| Economic Headwinds | US Fed Rate | 5.25%-5.50% (Early 2024) |

| Raw Material Costs | Commodity Price Increase | 3-5% (Into Mid-2025) |

| Wholesale Dependence | Wholesale Net Revenue | >60% (Q1 2024) |

| IP Litigation | Avg. Patent Lawsuit Cost | >$3 Million |

SWOT Analysis Data Sources

This Purple SWOT analysis is built upon a robust foundation of diverse data sources, including internal company performance metrics, customer feedback surveys, and competitive landscape intelligence to provide a comprehensive and actionable strategic overview.