Purple Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Purple Bundle

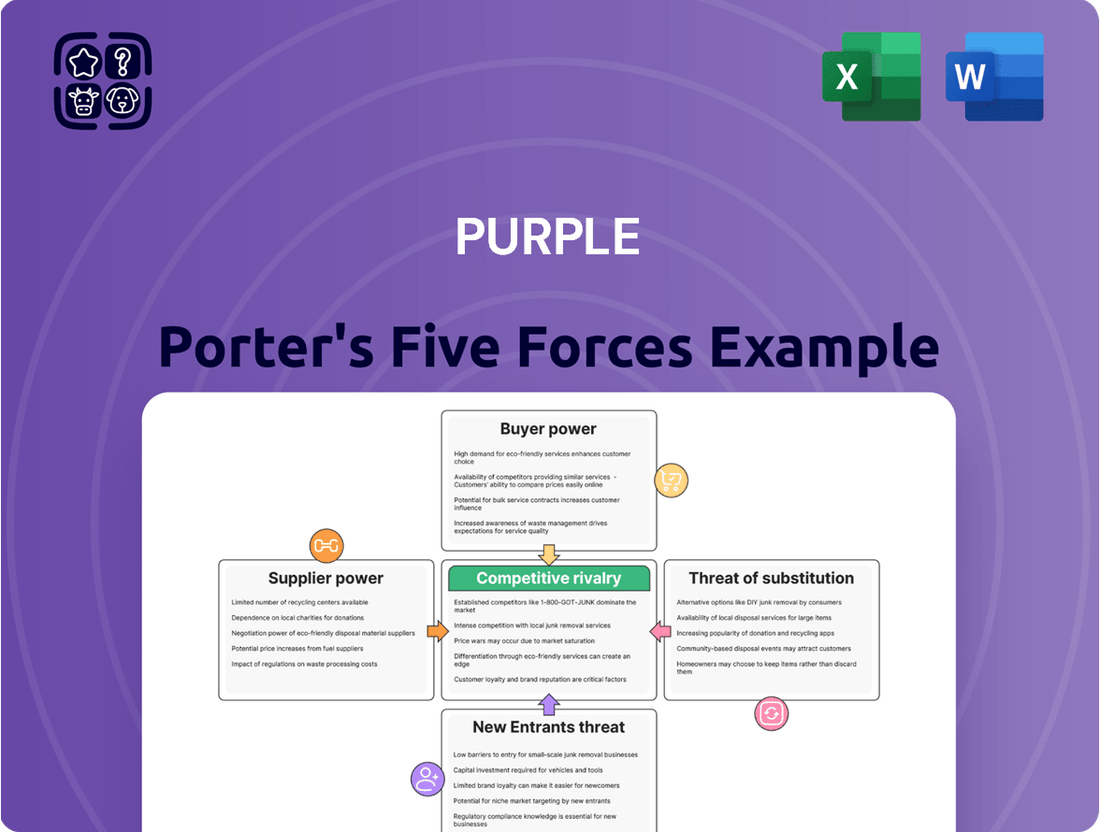

Purple's market landscape is shaped by five powerful forces, revealing its competitive intensity and strategic positioning.

Understanding the threat of new entrants and the bargaining power of buyers is crucial for navigating this dynamic industry.

We've outlined the core pressures, but the full analysis delves into the nuances of supplier power and the ever-present threat of substitutes.

The complete report reveals the real forces shaping Purple’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Purple’s core competitive advantage stems from its patented GelFlex Grid technology, crucial for its mattresses. While Purple manufactures this grid in-house at its US-based facilities, it relies on external suppliers for specialized raw materials like hyper-elastic polymer. If these inputs are specialized or sourced from a limited number of suppliers, those suppliers could exert significant pricing power. However, Purple has actively pursued supplier diversification to mitigate this risk, aiming to create competition for its business and secure favorable terms in 2024. This strategy helps maintain cost control for key components.

Beyond its proprietary grid technology, Purple relies on common mattress components like various foams, fabrics for covers, and steel for coils in hybrid models. These essential materials are largely commoditized, with a robust global supply chain featuring numerous vendors in 2024. This competitive landscape significantly diminishes the bargaining power of individual suppliers, as Purple can readily source inputs from a diverse pool of manufacturers worldwide. The availability of multiple suppliers prevents over-reliance on any single entity, allowing Purple to maintain strong leverage in price negotiations and effectively manage its procurement costs.

Purple has strategically partnered for manufacturing and logistics, shifting supplier bargaining power. For instance, an expanded relationship with Somnigroup's Sherwood unit for assembling certain product lines provides Sherwood some leverage. However, Purple maintains control over its core GelFlex Grid manufacturing and intellectual property. These partnerships, while expanding Purple's reach, create interdependencies requiring careful management, as seen in their ongoing operational adjustments in 2024 to optimize supply chains and cost efficiencies.

Supplier Switching Costs

Purple faces relatively low switching costs for common materials, given the availability of numerous alternative suppliers. However, for specialized polymers used in its GelFlex Grid, switching could involve significant costs in 2024 related to qualifying new sources and ensuring material consistency. This situation enhances the bargaining power of incumbent specialized suppliers. Purple's strategic focus on diversifying its supplier base for key materials actively aims to reduce these switching costs and bolster its own negotiating position.

- Common materials: Low switching costs for Purple.

- GelFlex polymers: High switching costs due to qualification in 2024.

- Supplier diversification: Strategic focus to reduce reliance.

Threat of Forward Integration

The threat of raw material suppliers integrating forward to produce and sell their own mattresses is low for Purple. This move requires significant investment in branding, marketing, and establishing distribution channels, which falls outside the core competency of most chemical or fabric suppliers. The direct-to-consumer mattress market, fiercely competitive, demands substantial marketing outlays, acting as a strong deterrent.

- The global mattress market is projected to reach over $50 billion in 2024, highlighting intense competition.

- Establishing a new mattress brand in 2024 could necessitate over $50 million in initial marketing and distribution investment.

- Major players like Purple and Tempur Sealy already dominate significant market share, making new entry challenging.

Purple faces mixed supplier power. While specialized GelFlex polymer suppliers hold some leverage due to high 2024 switching costs, Purple actively diversifies to mitigate this. For common mattress materials, numerous global vendors ensure low supplier bargaining power and strong cost control for Purple.

| Material | Supplier Power | Purple's Strategy |

|---|---|---|

| GelFlex Polymer | Moderate-High | Diversification |

| Common Foams | Low | Multiple Vendors |

| Fabrics/Steel | Low | Global Sourcing |

What is included in the product

The Purple Porter's Five Forces analysis dissects the competitive intensity and profitability of the industry in which Purple operates, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Pinpoint and neutralize competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Gain immediate clarity on market dynamics by easily identifying the most impactful forces affecting your business.

Customers Bargaining Power

The mattress market faces intense price competition, making buyers highly sensitive to cost. Consumers, with access to diverse brands and price points, actively seek promotions; for instance, many retailers offered significant discounts, often exceeding 20% during key sales events in early 2024. The widespread availability of financing options like buy now, pay later, used by an estimated 40% of online shoppers in 2024, further empowers consumers to prioritize affordability, driving down potential profit margins for manufacturers and retailers.

For a mattress consumer, the effort and cost to switch brands for their next purchase are minimal, virtually zero in many cases. The bed-in-a-box model, popularized by brands like Purple, has significantly simplified the shopping experience, allowing effortless online comparison and purchase. This frictionless environment empowers buyers, as they can easily pivot to competitors based on price or features. The ease of returns and trial periods further enhance customer power, making switching a seamless process in 2024.

The digital age has significantly empowered customers, granting them vast access to information through online reviews, user ratings, and sophisticated price comparison platforms. This transparency dramatically erodes information asymmetry, enabling consumers to make highly informed purchasing decisions. For instance, a 2024 Deloitte study indicated that over 80% of consumers check online reviews before making a significant purchase, directly pressuring companies on competitive products and pricing. While direct-to-consumer models foster communication, they also intensify the need for meticulous online reputation management as customer feedback is immediately visible and influential.

Brand Differentiation vs. Saturated Market

Purple's proprietary GelFlex Grid technology aims to foster brand loyalty, setting it apart from traditional foam or innerspring mattresses.

However, the mattress market is highly saturated, with numerous brands touting unique innovations from advanced cooling foams to integrated smart features, making true differentiation challenging. This intense competitive landscape means that even strong brand claims, such as Purple's, face dilution as consumers are presented with a continuous stream of purported breakthroughs. In Q1 2024, the competitive pressure was evident as Purple reported a net loss of $19.4 million, reflecting the struggle for market share amidst aggressive marketing by competitors.

- The global mattress market size was estimated at $35.6 billion in 2024.

- Purple's net revenue for Q1 2024 was $108.9 million, a decrease from previous periods.

- Customer acquisition costs remain high across the industry due to intense promotional activity.

- Over 175 online mattress brands compete for consumer attention in the US alone.

Power of Retail Distribution Channels

While Purple maintains a strong direct-to-consumer presence, a significant portion of its sales still flows through wholesale retail partners like Mattress Firm. These major retailers wield substantial bargaining power, influencing terms, pricing, and crucial in-store placement for Purple products. Purple's ongoing expansion with Mattress Firm, notably in 2024, underscores the considerable leverage these distribution channels hold. This reliance means retailers can negotiate favorable conditions, impacting Purple's margins and market access.

- Mattress Firm accounted for approximately 25% of Purple's net revenue in Q1 2024.

- Retail partners often dictate promotional strategies and inventory levels.

- Purple's retail footprint expanded to over 2,000 Mattress Firm locations by late 2023, continuing into 2024.

Customers in the mattress market wield significant bargaining power due to intense price competition and easy access to information. High switching ease, facilitated by bed-in-a-box models and minimal costs, empowers consumers to seek the best deals. Financing options, used by 40% of online shoppers in 2024, further drive affordability demands. Over 80% of consumers check online reviews before purchasing, forcing brands like Purple to compete aggressively on value.

| Metric | 2024 Data | Impact on Customer Power |

|---|---|---|

| Online Shoppers Using BNPL | 40% | Increases affordability, demand for deals |

| Consumers Checking Online Reviews | Over 80% | Enhances transparency, competitive pressure |

| Typical Discounts Early 2024 | Over 20% | Highlights price sensitivity |

Full Version Awaits

Purple Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for Purple Porter delves into the competitive landscape, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Understanding these forces is crucial for Purple Porter to strategize effectively and maintain a competitive edge in its industry. The insights provided are actionable and designed to inform strategic decision-making.

Rivalry Among Competitors

The mattress industry, particularly the bed-in-a-box segment, faces intense competitive rivalry due to high market saturation. Hundreds of direct-to-consumer and legacy brands vie for consumer attention, making it a highly crowded space. Competitors range from established players like Sleep Number and Tempur-Pedic, which collectively held significant market share in 2023, to a multitude of online startups. This fierce competition drives aggressive pricing and marketing strategies, with the global mattress market projected to exceed $50 billion in 2024, intensifying the battle for market share and consumer loyalty.

Customer acquisition in the online mattress space demands substantial marketing and advertising expenditure. Brands fiercely compete across digital channels to capture consumer attention, driving up overheads and pressuring profit margins. This aggressive spending is critical; a reduction in advertising can directly lead to a decline in revenue, as evidenced by Purple's net revenue of $120.3 million in Q1 2024, a decrease from prior periods. Maintaining market share necessitates continuous, costly promotional activity, highlighting the intense competitive rivalry.

Competitive rivalry in the mattress industry is intensely focused on product innovation, with companies constantly launching new materials, features, and technologies. This includes advancements like smart beds, cooling fabrics, and proprietary foams, all vying for consumer attention. While Purple's unique GelFlex Grid remains a key differentiator, competitors such as Tempur Sealy and Sleep Number heavily invest in research and development to introduce their own advanced products. For instance, Sleep Number continues to emphasize their smart bed technology, aiming to enhance sleep quality monitoring in 2024. This continuous cycle of innovation is crucial for maintaining market relevance and capturing share in a dynamic market.

Intense Price and Promotion-Based Competition

The mattress industry faces intense price and promotion-based competition, a standard practice where price wars and frequent promotions are common. This high level of rivalry compels companies like Purple to heavily rely on discounting and bundling strategies to attract price-sensitive consumers. Such aggressive competition directly impacts profitability, making it challenging to maintain premium pricing without robust brand justification.

- In 2024, industry estimates suggest average mattress discounts often exceed 20-30% during sales events.

- Online retailers frequently offer bundles including pillows or sheets, increasing perceived value.

- Profit margins for some direct-to-consumer brands have seen pressure, with net income percentages often in the low single digits.

- Consumer spending data from Q1 2024 showed continued responsiveness to promotional offers in home goods.

Consolidation and Strategic Partnerships

The mattress industry is undergoing significant consolidation and strategic partnerships, profoundly reshaping the competitive landscape. Tempur Sealy’s proposed $4 billion acquisition of Mattress Firm, expected to close in 2024, exemplifies this trend by integrating a major manufacturer with the largest US retailer. Purple Innovation itself has expanded its wholesale agreements, reporting net revenues of $108.9 million in Q1 2024.

These moves empower larger, more integrated entities, increasing pressure on smaller, independent companies struggling to compete with broader distribution networks and economies of scale. Such consolidation often leads to fewer but more powerful players dominating market share.

- Tempur Sealy’s $4 billion acquisition of Mattress Firm, anticipated to finalize in 2024, creates a dominant integrated entity.

- Purple Innovation’s expanded retail agreements aim to leverage a broader wholesale footprint.

- Larger players, like the combined Tempur Sealy and Mattress Firm, will control significant market share and distribution channels.

- Smaller companies face heightened competitive pressure due to the increased scale and efficiency of consolidated rivals.

The mattress industry faces intense rivalry from numerous brands, driving aggressive pricing and significant marketing spend. High market saturation and continuous innovation, including smart bed technology in 2024, fuel competition. Price wars and promotional offers, often exceeding 20-30% discounts, are common. Industry consolidation, like Tempur Sealy’s 2024 acquisition of Mattress Firm, further intensifies the battle for market share.

| Metric | 2023 Est. | 2024 Proj. |

|---|---|---|

| Global Market | $49B | $50B+ |

| Avg. Discount | 20%+ | 20-30% |

| Purple Q1 Rev. | $127.5M | $120.3M |

SSubstitutes Threaten

Alternative sleeping surfaces, such as futons, sofa beds, and air mattresses, pose a threat to Purple's traditional mattress market. These substitutes fulfill the basic need for a sleeping surface at a significantly lower price point; for example, a decent air mattress can be purchased for under $100 in 2024, contrasting sharply with Purple's entry-level mattresses starting around $1,500. While they may not offer comparable comfort or advanced support, their affordability makes them viable for budget-conscious consumers or temporary sleeping arrangements. This cost disparity could divert a segment of potential buyers, particularly those prioritizing price over long-term comfort or specialized features.

Consumers can easily opt for basic, traditional innerspring or foam mattresses from local furniture stores, which, lacking advanced technology, are significantly cheaper. This decision presents a clear trade-off between the perceived comfort and support benefits of a premium product like Purple and the substantial cost savings of a simpler substitute, with conventional mattresses often retailing for hundreds less than Purple’s premium offerings in 2024. Furthermore, the inherent durability of mattresses means consumers can delay purchases, effectively substituting with their existing mattress for an extended period, dampening immediate demand for new, innovative solutions.

A significant threat to Purple Porter emerges from the growing focus on overall sleep wellness, which extends beyond just mattresses. Consumers are increasingly investing in non-product substitutes like sleep aids, meditation apps, and blackout curtains to improve sleep quality. For instance, the global sleep aids market was valued at USD 64.2 billion in 2023, with continued growth expected in 2024. This holistic approach means a mattress is merely one component of the sleep equation, and consumers may prioritize these alternative solutions, diverting spending from the mattress market.

Rental and Second-Hand Markets

While the second-hand market for mattresses remains minimal due to hygiene concerns, the emergence of furniture rental services poses a growing threat of substitution. These services appeal to transient consumers or those hesitant about significant upfront investments in 2024. This trend provides a flexible alternative to outright mattress purchases, potentially diverting sales from Purple’s traditional model.

- The global furniture rental market is projected to reach $18.9 billion by 2030, reflecting increasing consumer acceptance.

- In 2024, rental services cater to urban dwellers and students seeking temporary home solutions.

- Flexible payment options and shorter commitment periods reduce the barrier to entry for consumers.

- The focus on sustainability and circular economy models further boosts the appeal of renting over buying.

DIY and Customized Solutions

A small but present substitute threat for Purple stems from DIY and highly customized sleeping solutions. Some consumers, seeking personalization, opt for mattress toppers on simple bases or combine materials like latex and foam layers purchased separately to create their own beds. This niche approach, though representing a small segment of the overall $50 billion global mattress market in 2024, highlights a willingness to bypass mainstream branded products for tailored comfort.

- DIY solutions bypass traditional mattress retailers.

- Consumers seek specific material combinations.

- Online component availability facilitates custom builds.

- This segment impacts a small portion of 2024 market sales.

Purple faces significant substitution threats from lower-cost alternatives like air mattresses, which cost under $100 in 2024, and traditional innerspring beds. The growing $64.2 billion global sleep aids market in 2023, expected to grow in 2024, diverts consumer spending from mattresses to holistic wellness solutions. Furthermore, furniture rental services offer flexible alternatives for temporary needs in 2024, impacting direct sales.

| Substitute Type | 2024 Impact | Price Point |

|---|---|---|

| Air Mattresses | Viable low-cost option | Under $100 |

| Sleep Aids/Wellness | Diversion of spending | Variable |

| Furniture Rental | Flexible short-term alternative | Monthly fees |

Entrants Threaten

The barrier to entry for a basic, direct-to-consumer bed-in-a-box brand remains quite low. A new company can efficiently source components, establish a brand, and launch an e-commerce website with a relatively manageable initial investment. This ease of entry is evident in the market, with the number of online mattress companies continuing to grow, reflecting ongoing opportunities for new entrants. By 2024, the online mattress market maintains a competitive landscape, with new players able to quickly emerge and challenge established brands.

New entrants face substantial hurdles when attempting to compete directly with Purple’s proprietary technology. Purple has invested over three decades into comfort technology research and development, culminating in a robust portfolio of over 120 patents as of early 2024. Replicating this deep intellectual property and specialized manufacturing processes demands significant upfront capital investment and extensive time. This formidable combination of established innovation and complex production serves as a high barrier to entry for potential competitors.

Building a recognized brand in the saturated mattress market requires a massive marketing budget. New entrants face significant hurdles, needing to spend heavily on digital advertising to gain visibility against established players like Purple, Casper, and Tempur Sealy. For instance, digital ad spending in the home goods sector continued to climb in 2024, driving up customer acquisition costs. This high cost of customer acquisition, often exceeding hundreds of dollars per customer, makes achieving scale incredibly challenging for new companies.

Economies of Scale and Distribution Access

Established players like Purple benefit significantly from economies of scale in manufacturing and raw material procurement, making it difficult for new entrants to compete on cost. Purple's substantial operational base, evidenced by its 2023 net revenue of over $508 million, allows for efficient production and logistics that smaller companies cannot replicate. Furthermore, securing crucial distribution channels through major partners like Mattress Firm, which operates thousands of stores nationwide, requires a proven brand reputation and extensive track record. This strong existing network creates a formidable barrier for new mattress companies attempting to access the vital wholesale market.

- Purple benefits from scale in manufacturing and logistics.

- New entrants struggle to match established cost efficiencies.

- Access to key retailers like Mattress Firm is a significant hurdle.

- Brand strength and proven track record are essential for wholesale distribution.

Industry Consolidation and Incumbent Strength

The ongoing consolidation within the mattress industry significantly strengthens the position of existing large players, making market entry challenging. These incumbents possess extensive resources, established brand loyalty, and vast distribution networks, effectively deterring new competition. A new entrant not only contends with individual brands but faces a powerful, increasingly integrated industry structure, exemplified by major market shares held by leaders like Tempur Sealy International and Serta Simmons Bedding in 2024.

- Major players command significant market share, making organic growth difficult for new entrants.

- Established brands benefit from decades of consumer trust and recognition.

- Extensive distribution channels, including retail partnerships, are costly for newcomers to replicate.

- High capital investment is required to compete with the production scale of consolidated entities.

While basic online mattress brands face low entry barriers, new entrants struggle to replicate Purple’s patented technology and achieve its economies of scale. High marketing costs, with digital ad spending continuing to rise in 2024, and limited access to established distribution networks like Mattress Firm, deter effective competition. The consolidated mattress market, dominated by major players in 2024, further reduces the threat from newcomers.

| Barrier Type | Purple's Advantage | Impact on New Entrants (2024) |

|---|---|---|

| Proprietary Technology | 120+ Patents, 30+ Years R&D | High R&D/Capital Investment Required |

| Economies of Scale | $508M (2023) Revenue, Efficient Production | Difficult to Match Cost Efficiencies |

| Distribution Channels | Mattress Firm Partnership | Limited Access to Key Retailers |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, competitor financial statements, and government economic indicators.

We also incorporate insights from trade association publications, expert interviews, and publicly available company disclosures to ensure a comprehensive understanding of the competitive landscape.