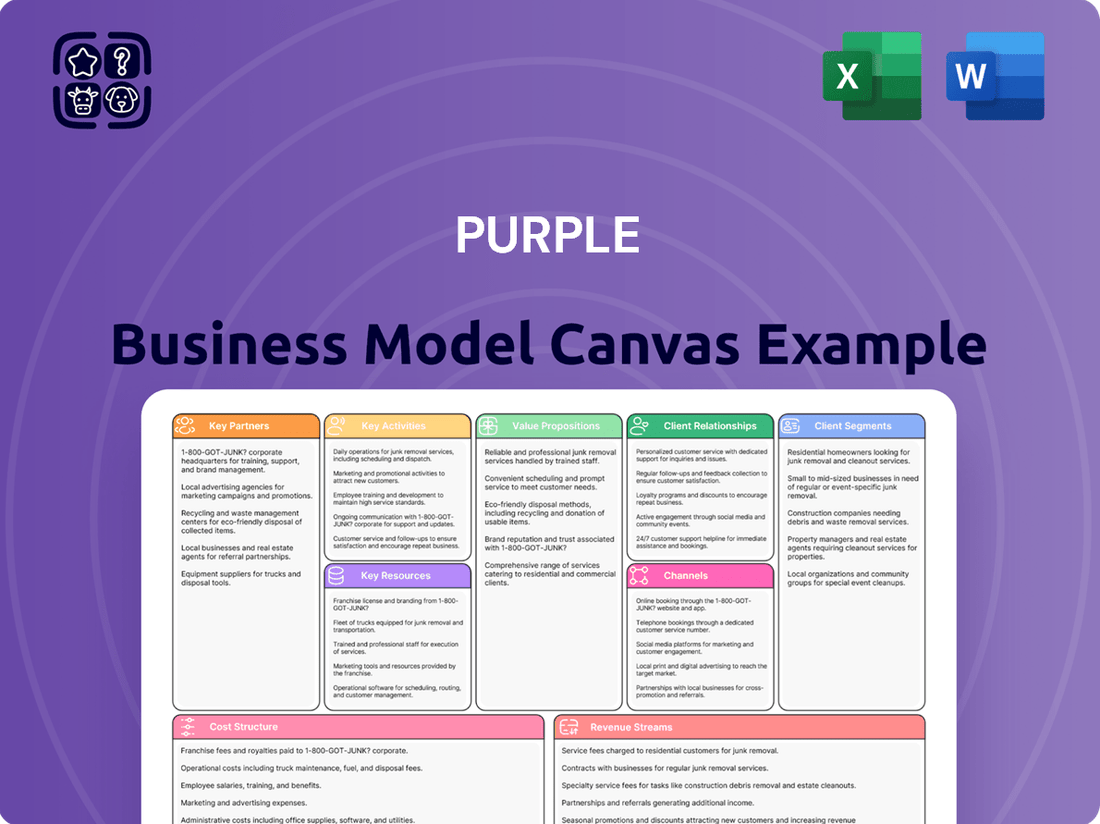

Purple Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Purple Bundle

Unlock the full strategic blueprint behind Purple's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Purple’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Purple operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Purple’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Purple’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Purple partners with a robust network of third-party brick-and-mortar retailers, including Mattress Firm and Raymour & Flanigan, to significantly expand its physical presence. These collaborations are crucial for reaching customers who prefer to experience products firsthand before purchasing, contributing to Purple’s omnichannel strategy. This approach grants Purple access to established distribution channels and expansive sales floors without the substantial capital expenditure required for building new company-owned stores, a key efficiency in its 2024 operational model. As of Q1 2024, Purple continued to emphasize its wholesale channel, which represented a significant portion of its net revenue, highlighting the importance of these retail relationships in capturing a broader market segment and driving sales growth.

Purple's operational backbone rests on specialized raw material suppliers, providing the unique hyper-elastic polymer for its GelFlex Grid and mattress components. Strong relationships with these key partners are crucial for ensuring material quality, especially given the company's focus on proprietary technology. These partnerships directly impact cost control and supply chain resilience, which is vital for maintaining consistent product availability. As of 2024, securing reliable, high-grade material flow remains foundational to Purple's product consistency and protecting its unique manufacturing processes.

For Purple's direct-to-consumer model, partnerships with national and regional logistics providers are essential, including specialized last-mile white glove delivery services. These firms expertly handle warehousing, transportation, and home delivery of bulky items like mattresses. In 2024, efficient logistics are more critical than ever, with consumer expectations for delivery speed increasing and over 70% of customers prioritizing fast shipping. An optimized network directly enhances customer satisfaction, ensuring timely deliveries, and significantly impacts operational costs, with last-mile delivery often constituting over 50% of total shipping expenses.

Technology and E-commerce Platform Providers

Purple strategically partners with technology firms to power its essential e-commerce infrastructure, payment processing, and crucial data analytics. These robust platforms form the backbone of the company's primary direct-to-consumer sales channel, which generated $69.7 million in net revenue in Q1 2024. Such partnerships ensure a seamless online shopping experience, secure transactions for customers, and enable data-driven marketing decisions that optimize digital outreach.

- Critical for Purple's D2C channel, which represented 78.9% of total net revenue in Q1 2024.

- Facilitates secure payment processing, supporting substantial online transaction volumes.

- Enables data analytics crucial for targeted marketing and inventory management.

Marketing and Affiliate Partners

Purple strategically partners with digital marketing agencies, media influencers, and affiliate websites to boost brand awareness and acquire new customers. These collaborations amplify Purple's marketing messages, reaching specific consumer segments in the highly competitive online bedding market. Affiliate marketing, a key component, provides a performance-based channel, driving traffic and sales effectively.

- US digital ad spend projected to exceed $300 billion in 2024.

- Influencer marketing market size estimated at $22.2 billion globally for 2024.

- Affiliate marketing drives over 15% of all digital media revenue.

- Partnerships enhance reach beyond traditional channels.

Purple’s strategic partnerships are foundational, encompassing brick-and-mortar retailers for expanded reach and specialized raw material suppliers for its unique products. Efficient logistics providers ensure seamless direct-to-consumer delivery, while technology firms power its vital e-commerce and data analytics. Digital marketing agencies and influencers amplify brand awareness, collectively driving Purple’s market penetration and operational efficiency in 2024.

| Partnership Type | Strategic Impact | 2024 Data/Trend |

|---|---|---|

| Brick-and-Mortar Retailers | Omnichannel sales expansion | Wholesale significant in Q1 2024 net revenue |

| Logistics Providers | D2C delivery efficiency | 70%+ customers prioritize fast shipping |

| Digital Marketing/Influencers | Brand awareness, customer acquisition | US digital ad spend > $300B; Influencer market $22.2B |

What is included in the product

A detailed, pre-populated business model canvas designed for the unique operational context and strategic objectives of a specific company.

It offers a visual representation of the company's strategy, articulating its value proposition, customer segments, channels, and revenue streams with actionable insights.

The Purple Business Model Canvas streamlines strategic planning by offering a clear, visual representation of how your business creates, delivers, and captures value, alleviating the pain of complex, scattered strategic documents.

Activities

Purple's Research and Development is a core activity, driving continuous innovation in its comfort technology, especially the GelFlex Grid.

This involves extensive materials science research and new product development for mattresses, pillows, and other comfort categories. For example, Purple reported R&D expenses of $7.5 million in fiscal year 2023, underscoring this commitment. These efforts sustain the company's competitive advantage and product differentiation in the market.

Purple vertically integrates the manufacturing of its proprietary GelFlex Grid and the assembly of its mattresses and other products within its own facilities. This gives the company direct control over product quality, production schedules, and intellectual property, which is crucial as Purple continues to innovate its product lines in 2024. Managing these complex manufacturing operations efficiently is vital for maintaining profitability and supply chain resilience. For instance, robust internal production capabilities mitigate reliance on external suppliers, allowing Purple to optimize its cost of goods sold.

A core activity involves managing and scaling Purple's direct-to-consumer channel through extensive digital marketing and e-commerce website management. This includes robust search engine marketing and social media advertising, vital for reaching customers directly. Content creation and continuous conversion rate optimization are also key to enhancing the online shopping experience. This DTC focus is pivotal, driving a substantial portion of the company's revenue; for instance, in Q1 2024, Purple reported net revenue of $105.7 million, with DTC sales being a significant contributor. Maintaining this strong digital presence is crucial for growth and market share.

Omnichannel Operations Management

Purple actively manages a robust omnichannel strategy, integrating its thriving e-commerce platform with company-owned showrooms and extensive wholesale partnerships. This involves meticulous coordination of inventory, pricing, and brand messaging across all channels to ensure a seamless and cohesive customer journey. By harmonizing these diverse sales avenues, Purple ensures that each channel enhances the overall brand experience rather than competing, driving consistent growth and accessibility for customers in 2024. This integrated approach supports broad market penetration and customer engagement.

- In Q1 2024, Purple reported a net revenue of $105.7 million.

- Wholesale net revenue for Purple increased by 19.9% in Q1 2024 compared to Q1 2023.

- Company-owned showrooms expanded to 55 locations by early 2024.

- E-commerce remains a core component, complementing physical retail touchpoints.

Supply Chain and Logistics Coordination

Supply Chain and Logistics Coordination is vital, encompassing the meticulous management of product flow from sourcing raw materials to overseeing inventory and coordinating with logistics partners for final delivery. Efficient supply chain management is critical for ensuring consistent product availability, minimizing operational costs, and meeting evolving customer delivery expectations. This activity serves as the operational backbone, seamlessly connecting manufacturing processes to the end customer. In 2024, global supply chain resilience remains a key focus, with many companies investing in digital transformation to mitigate disruptions and enhance visibility.

- Global supply chain costs are projected to remain elevated in 2024, influencing overall profitability.

- Digitalization in supply chains, including AI and IoT, is expected to increase by 30% in 2024 to optimize logistics.

- On-time delivery performance is a critical metric, with top-tier companies aiming for over 95% in 2024.

- Inventory optimization strategies are crucial in 2024 to balance stock levels against demand volatility.

Purple's key activities center on innovative R&D for its GelFlex Grid, backed by $7.5 million in 2023 R&D spend. They vertically integrate manufacturing for quality control and efficiency. A robust omnichannel strategy, combining DTC channels with 55 showrooms and wholesale partners, drove Q1 2024 net revenue of $105.7 million. Efficient supply chain management is also critical, optimizing product flow and costs.

| Activity | 2023 Data | 2024 Data/Focus |

|---|---|---|

| R&D | $7.5M expenses | Continuous innovation |

| DTC & Omnichannel | Q1 2024 net revenue $105.7M; 55 showrooms; Wholesale up 19.9% | |

| Supply Chain | Elevated costs, digitalization focus |

Full Version Awaits

Business Model Canvas

The Purple Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the final deliverable. When you complete your transaction, you will gain full access to this comprehensive and professionally structured Business Model Canvas, ready for immediate use.

Resources

Purple's core strength lies in its proprietary GelFlex Grid technology, protected by an extensive portfolio of patents and trade secrets related to its unique material and manufacturing processes. This intellectual property establishes a significant competitive barrier, deterring direct replication of their distinctive mattress and pillow products. The GelFlex Grid enables Purple to command premium pricing in the bedding market, underpinning its unique value proposition. As of early 2024, this patented technology remains a primary driver of their market differentiation, contributing to their estimated net revenue of $500-$525 million for fiscal year 2023, reflecting its foundational role.

Purple's vertically integrated manufacturing facilities in Utah are a core physical asset, central to their operations. These advanced plants house proprietary Mattress Max machines, enabling precise, in-house production of the unique GelFlex Grid technology. This direct control is crucial for maintaining the high quality of their products and facilitating rapid innovation in material science. As of 2024, these facilities are vital for Purple's ability to scale production efficiently and meet consumer demand, supporting their market position.

The Purple brand, recognized for its innovative comfort and distinctive marketing, stands as a significant intangible asset. This strong brand equity fosters deep customer trust, allowing Purple to command pricing power in the market. As a crucial resource, it reduces customer acquisition costs, evidenced by Purple's strong direct-to-consumer sales channels. Consistent product performance and unique marketing, such as their 2024 digital campaigns, are pivotal in solidifying this brand strength.

Direct-to-Consumer E-commerce Platform

The company's robust e-commerce platform and digital infrastructure serve as a primary key resource, facilitating direct sales and extensive customer interaction. This crucial platform enables efficient direct-to-consumer transactions, comprehensive data collection, and scalable relationship management. Its performance, intuitive user experience, and inherent scalability are paramount, directly impacting revenue growth and customer retention. In 2024, global e-commerce sales are projected to exceed $6.3 trillion, underscoring the platform's strategic importance.

- The DTC e-commerce channel is projected to grow by 17.5% in 2024.

- A 1-second improvement in site speed can boost mobile conversions by up to 27% in 2024.

- Over 70% of consumers prefer to buy directly from brands in 2024.

- Data collected via the platform informs over 85% of marketing strategies.

Human Capital and Expertise

Purple's core strength lies in its diverse team of engineers, materials scientists, marketers, and manufacturing experts. Their collective expertise, particularly in comfort technology and advanced digital marketing strategies, is a critical resource driving innovation and operational excellence. This talent pool is essential for developing new products, like those contributing to Purple's 2024 product pipeline, and for efficiently scaling production. The company's continued investment in its human capital, reflected in its R&D and marketing expenditures, underscores the strategic value of this workforce.

- Purple's team spans materials science, engineering, marketing, and manufacturing.

- Their expertise drives innovation in comfort technology and digital marketing.

- Human capital is crucial for new product development and operational efficiency.

- Ongoing investment in the workforce underpins strategic execution and growth.

Purple's key resources center on its patented GelFlex Grid technology, establishing market differentiation and premium pricing power. Vertically integrated manufacturing facilities in Utah ensure quality and scale production efficiently. A powerful brand and robust e-commerce platform drive direct sales, with global e-commerce projected to exceed $6.3 trillion in 2024. Finally, its expert human capital fuels innovation and operational excellence.

| Resource | 2024 Impact | Data Point |

|---|---|---|

| GelFlex IP | Market Differentiation | 2023 Net Revenue: $500M-$525M |

| E-commerce | Direct Sales & Growth | DTC growth: 17.5% |

| Human Capital | Innovation & Efficiency | Drives 2024 Product Pipeline |

Value Propositions

Purple delivers unique comfort and support via its GelFlex Grid, expertly designed to cradle pressure points such as hips and shoulders. This technology simultaneously provides firm spinal support, directly addressing a primary pain point in the mattress market. Consumers seeking relief from discomfort find a more restorative sleep experience, a key differentiator in a market estimated to reach $47 billion in 2024. This value proposition has been central to Purple's strategy, with their mattresses consistently highlighting superior pressure relief.

The Purple GelFlex Grid technology, with its open-grid structure, significantly enhances airflow, creating a temperature-neutral sleep environment. This directly addresses a major consumer pain point, as traditional memory foam mattresses are often criticized for trapping heat. This superior breathability helps maintain an optimal sleep temperature throughout the night, a crucial factor for many. This value proposition strongly appeals to customers who tend to sleep hot, a demographic consistently seeking improved thermal comfort in their bedding solutions, with 2024 market data indicating a continued strong demand for cooling mattress technologies.

The Purple Grid's hyper-elastic polymer ensures proven durability and longevity, specifically engineered to resist body impressions and sagging common in traditional mattresses. This robust design is backed by a 10-year warranty, signaling a commitment to long-term performance and customer confidence. For consumers, this translates into a high-quality, enduring investment in sleep health, reinforcing Purple's product quality and delivering significant value for money. This commitment to durability helps justify its market position, with Purple reporting net sales of $90.5 million in Q1 2024, reflecting continued market engagement with its core offerings.

Motion Isolation for Undisturbed Sleep

Purple's Hyper-Elastic Polymer Grid offers superior motion isolation, a crucial value proposition for couples. Its unique structure prevents movement on one side of the bed from disturbing the other, addressing a common issue for shared sleep. This significantly minimizes sleep disruptions caused by a restless partner, enhancing overall sleep quality for two people. In 2024, sleep disruption continues to be a major concern, with many seeking solutions like advanced mattress technologies.

- The Grid's design absorbs and isolates motion.

- Minimizes transfer of movement across the mattress.

- Crucial for couples to ensure undisturbed sleep.

Hypoallergenic and Non-Toxic Materials

Purple products leverage hypoallergenic and non-toxic materials, a key value proposition for health-conscious consumers and those with sensitivities. This commitment provides significant peace of mind, aligning with the growing 2024 consumer trend towards cleaner, safer household goods. The global market for non-toxic products continues to expand, reflecting a strong demand for such assurances, which builds trust and wellness into the Purple brand experience.

- Consumer demand for non-toxic household products is projected to grow, with the global market for non-toxic personal care and cosmetic products alone exceeding $30 billion in 2024.

- Purple’s material choices directly address concerns about indoor air quality and chemical exposure.

- This approach enhances brand credibility among families and individuals prioritizing health.

- It differentiates Purple in a competitive bedding market by emphasizing safety and well-being.

Purple delivers unmatched comfort, support, and temperature regulation with its innovative GelFlex Grid, addressing key consumer pain points like heat retention and pressure. Its durable, hyper-elastic polymer provides long-term value, resisting impressions and isolating motion for undisturbed sleep. The brand also prioritizes health, using hypoallergenic, non-toxic materials, aligning with significant 2024 consumer trends.

| Value Proposition | Key Benefit | 2024 Market Insight |

|---|---|---|

| Comfort & Support | Pressure relief, spinal alignment | Mattress market $47 billion |

| Temperature Neutrality | Enhanced airflow, cooling | High demand for cooling tech |

| Durability & Longevity | Resists impressions, 10-year warranty | Q1 2024 Net Sales $90.5M |

| Motion Isolation | Undisturbed sleep for couples | Sleep disruption major concern |

| Hypoallergenic Materials | Health & safety assurance | Non-toxic market >$30 billion |

Customer Relationships

Purple builds customer relationships primarily through its digital channels, including robust social media engagement, email marketing, and its interactive website. The company uses a friendly, educational, and often humorous tone, reflecting its brand personality to engage customers directly. This approach fosters a strong sense of community and a direct connection with the brand. For instance, Purple's YouTube channel boasts over 200,000 subscribers as of early 2024, utilizing engaging content to educate potential buyers. This digital strategy ensures a continuous, direct dialogue with consumers.

Purple builds strong customer relationships through its 100-night in-home trial period for mattresses, actively offered in 2024. This extended trial significantly reduces purchase anxiety, allowing customers to experience the product without immediate commitment. The company’s confidence in its innovative mattress technology is underscored by this generous policy. Furthermore, Purple ensures a hassle-free return process, which reinforces trust and prioritizes customer satisfaction. This approach minimizes perceived risk, contributing to positive brand perception and sales.

Purple provides dedicated customer support via phone, chat, and email, assisting with inquiries, sales, and issue resolution. Offering responsive and helpful service pre and post-sale is crucial for maintaining customer satisfaction and loyalty. This human touchpoint is vital for handling complex queries, with 68% of customers in 2024 preferring human interaction for intricate issues. Such reliable support builds long-term trust and reinforces customer relationships, ensuring a positive brand perception.

Educational Content and Transparency

Purple fosters strong customer relationships by providing highly transparent and educational content focused on sleep science and its unique GelFlex Grid technology. Through detailed blog posts, informative videos, and comprehensive product pages, the company empowers customers to make informed decisions about their sleep solutions. This strategy positions Purple as a trusted expert in the comfort industry, moving beyond just selling products. For instance, Purple continues to expand its digital content library, aiming to enhance customer understanding and trust, especially important as online sales remain a significant channel.

- Educational content builds trust, differentiating Purple from competitors.

- Transparent information on sleep science empowers customer choices.

- Digital platforms like blogs and videos are key educational tools.

- This approach cultivates brand loyalty and expert perception.

Warranty and Post-Purchase Assurance

The 10-year warranty on Purple mattresses acts as a robust long-term customer relationship tool, assuring buyers of the product's quality and the company's commitment. This post-purchase support reinforces the initial purchase decision, building confidence in the brand's longevity and reliability, especially as the bedding market saw an estimated 2024 value of over $50 billion. It is a tangible promise of a lasting relationship.

- Purple's 10-year warranty fosters trust, a key driver in a market where customer retention is vital.

- This assurance directly supports a high customer lifetime value, critical for sustainable growth.

- It differentiates Purple in a competitive bedding industry, enhancing brand perception.

- Such post-purchase commitment reduces buyer's remorse, leading to positive word-of-mouth.

Purple fosters robust customer relationships through extensive digital engagement and educational content, positioning itself as a trusted expert in sleep solutions. Their 100-night trial and 10-year warranty, both active in 2024, significantly build trust by mitigating purchase risk and assuring long-term product quality. Responsive customer support, with 68% of customers in 2024 preferring human interaction for complex issues, further enhances satisfaction. This comprehensive strategy ensures continuous dialogue and support, vital for customer retention.

| Relationship Aspect | Key Data (2024) | Impact on Customers |

|---|---|---|

| Digital Engagement | 200,000+ YouTube subscribers | Fosters community, educates buyers |

| Trial & Warranty | 100-night trial, 10-year warranty | Reduces risk, builds trust |

| Customer Support | 68% prefer human interaction | Ensures satisfaction, loyalty |

Channels

Purple’s official website, purple.com, stands as its primary sales channel, enabling direct customer engagement from product discovery to purchase. This direct-to-consumer approach yields the highest profit margins, crucial for the company’s financial health, with e-commerce sales consistently contributing significantly to net revenue. For instance, in Q1 2024, direct-to-consumer net revenue was $69.7 million. It offers complete control over branding, pricing, and the entire customer journey, reinforcing Purple’s market position. This channel remains the core of Purple’s business model, driving brand loyalty and maximizing profitability.

Purple operates its own physical showrooms in key metropolitan areas, allowing consumers to experience products firsthand. This channel serves as a powerful marketing tool and a direct sales touchpoint, especially for customers hesitant about online mattress purchases. By the end of 2023, Purple had expanded its retail footprint to 10 company-owned showrooms, a strategic move to complement its online presence and wholesale partnerships. These stores provide a high-touch, brand-controlled environment, enhancing customer trust and brand loyalty. This approach contributed to Purple's net revenue of $120.9 million in Q1 2024, demonstrating the value of a diversified sales strategy.

Purple partners with a national network of third-party retailers, including major mattress chains and furniture stores, to sell its products. This channel significantly expands Purple's market reach and physical availability, capturing customers who prefer shopping at traditional brick-and-mortar locations. As of early 2024, Purple products are available in thousands of retail doors across the US, complementing their direct-to-consumer sales. This extensive wholesale presence is a key pillar of the company's omnichannel growth strategy, aiming to maximize consumer access and brand visibility.

Digital Marketing and Social Media Platforms

Purple leverages digital advertising on platforms like Google, Facebook, and YouTube as a primary channel to reach potential customers and drive significant website traffic. These platforms are integral to the customer journey, from initial awareness to final purchase, serving as critical channels for customer acquisition. In 2024, digital advertising continues its dominance in market reach.

- Google's advertising revenue, a key channel for Purple, is projected to reach approximately 237 billion USD in 2024.

- Meta platforms, including Facebook, are expected to account for a substantial portion of global digital ad spending in 2024.

- YouTube remains a top platform for video advertising, with its ad revenue contributing significantly to Alphabet's overall performance in 2024.

- Purple's focus on these channels aligns with the estimated 700 billion USD global digital advertising market in 2024.

Marketplaces and Ancillary Online Retailers

While not Purple’s primary sales channel, their innovative comfort products are strategically available on select online marketplaces, notably Amazon. This approach allows Purple to tap into Amazon’s vast customer base, which saw North American net sales reach $366.5 billion in 2023, providing an essential supplementary avenue for sales.

This channel effectively captures consumers who prefer the convenience and familiarity of shopping on these established platforms, complementing Purple’s direct-to-consumer and wholesale strategies.

- Marketplace presence expands reach beyond Purple’s DTC sites.

- Access to Amazon’s massive 2024 customer traffic, estimated at over 2.2 billion monthly visits.

- Serves as a crucial supplementary channel, enhancing overall sales volume.

- Offers additional visibility and brand exposure to diverse online shoppers.

Purple employs a robust omnichannel strategy, leveraging its high-margin direct-to-consumer website and growing network of physical showrooms for direct engagement. Extensive wholesale partnerships and strategic online marketplace presence, like Amazon, broaden its market reach. Targeted digital advertising, utilizing platforms such as Google and Meta, drives customer acquisition and brand visibility.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct-to-Consumer (DTC) | High-margin sales, brand control | Significant revenue contributor |

| Wholesale/Retailers | Market expansion, physical availability | Thousands of retail doors |

| Digital Advertising | Customer acquisition, brand awareness | Google ad revenue projected $237B USD |

| Online Marketplaces | Supplementary sales, reach | Amazon over 2.2B monthly visits |

| Company Showrooms | Product experience, direct sales | 10 locations by late 2023 |

Customer Segments

This segment targets individuals and couples, often aged 30-55, who prioritize sleep as a vital component of their overall health and wellness. They are prepared to invest in premium sleep solutions, with average spending on mattresses reaching approximately $1,200 in 2024 for higher-end models. These consumers are highly receptive to the technological advantages of Purple’s GelFlex Grid and its material benefits, often researching products extensively before purchase. Their focus on innovation and long-term health benefits drives their willingness to pay for quality sleep experiences.

Purple specifically targets individuals experiencing chronic pain, such as the estimated 80% of adults who will experience back pain in their lifetime, seeking relief from issues like hip discomfort or pressure-point sensitivity. The unique Purple Grid technology offers a dual value proposition, providing pressure relief while maintaining essential support, which directly addresses the needs of this segment. Their purchasing decisions in 2024 are strongly influenced by a desire to alleviate specific physical ailments and improve sleep quality. This customer group often prioritizes health outcomes, making the mattress an investment in their well-being.

Hot sleepers represent a key customer segment for Purple, comprising individuals who frequently overheat on traditional mattresses, especially memory foam. The unique GelFlex Grid technology offers superior airflow and temperature regulation, making it a primary draw for this group. Purple's marketing efforts heavily emphasize these cooling benefits, directly addressing a common pain point for millions. In 2024, demand for cooling sleep solutions continues to rise, with market research indicating that temperature control is a top priority for approximately 60% of mattress buyers.

Couples Seeking Motion Isolation

Couples seeking motion isolation represent a core segment for Purple, primarily partners whose sleep is disrupted by a bedmate's movements. They highly value the GelFlex Grid's ability to absorb motion, which is a critical differentiator. This group actively seeks advanced technological solutions to enhance their shared sleep quality, aiming for undisturbed rest despite differing sleep patterns.

- In 2024, studies indicate over 30% of couples report sleep disturbances due to partner movement.

- Motion isolation is a top-three desired mattress feature for couples, per recent market surveys.

- Purple's GelFlex Grid is specifically engineered to dissipate motion, addressing this critical need.

- Improved shared sleep can significantly enhance relationship satisfaction for these customers.

Omnichannel Shoppers

Omnichannel Shoppers represent consumers who seamlessly integrate online and offline channels throughout their purchasing journey. These individuals often research products extensively online, comparing features and reviews, but prefer to experience the product firsthand in a physical store before making a final commitment. Purple's strategic hybrid retail approach, which combines a robust direct-to-consumer presence with key wholesale partnerships and dedicated showrooms, is specifically designed to effectively capture this significant and expanding market segment. In 2024, data indicates that approximately 73% of consumers use multiple channels during their shopping process, highlighting the importance of this approach.

- Seamlessly blend online research with in-store product testing.

- Prioritize convenience across all touchpoints for purchasing decisions.

- Higher engagement and lifetime value compared to single-channel shoppers.

- Purple's strategy targets this segment through DTC, wholesale, and showrooms.

Purple targets diverse customer segments, including health-conscious individuals willing to invest in premium sleep solutions and those seeking relief from chronic pain. Hot sleepers benefit from advanced cooling technology, while couples prioritize motion isolation for undisturbed rest. The brand also caters to omnichannel shoppers who blend online research with in-store experiences.

| Segment | Key Need | 2024 Data Point |

|---|---|---|

| Health-Conscious | Premium Sleep | Avg. mattress spend $1,200 |

| Chronic Pain | Pressure Relief | 80% adults experience back pain |

| Hot Sleepers | Temperature Control | 60% buyers prioritize cooling |

Cost Structure

The Cost of Goods Sold (COGS) is a primary cost driver for Purple, directly encompassing expenses for raw materials like hyper-elastic polymer, foams, and fabrics, alongside direct labor for manufacturing and assembly.

As a vertically integrated manufacturer, efficiently managing production and material costs is crucial for maintaining healthy gross margins; for example, raw material costs for furniture and related products saw an average increase of over 5% in 2024 due to supply chain dynamics.

This cost scales directly with sales volume, meaning a 10% increase in sales typically translates to a similar rise in COGS.

Controlling these production efficiencies, especially with labor costs projected to rise by 3-4% in the manufacturing sector in 2024, is vital for profitability.

A significant portion of Purple's cost structure is dedicated to marketing and sales, especially for its direct-to-consumer channel. This includes substantial expenditures on digital advertising, social media campaigns, and influencer partnerships to reach customers directly. For instance, in 2024, these efforts remain a primary driver of customer acquisition, with considerable investment in platforms like Meta and Google. Sales team commissions also contribute to these costs, all aimed at fueling revenue growth and maintaining market presence.

Purple allocates substantial capital to Research and Development, vital for its innovation pipeline and maintaining a technological edge, particularly in mattress and comfort technology. This investment covers salaries for engineers and scientists, rigorous materials testing, and the costs associated with securing new patents. In 2024, Purple Innovation, Inc. continues to prioritize R&D to enhance product performance and unique comfort solutions. These strategic outlays are crucial for driving long-term growth and sustaining competitive differentiation in the market.

Capital Expenditures (CapEx) for Manufacturing

Capital Expenditures for Purple's manufacturing are crucial, reflecting investments in facilities and proprietary machinery, such as the specialized Mattress Max production lines. While not a recurring daily expense, this spending is vital for scaling production and upgrading capabilities, forming a significant part of the company's long-term cost structure. It underscores the capital-intensive nature of Purple's in-house manufacturing operations, ensuring future growth and efficiency. For Q1 2024, Purple reported capital expenditures of approximately $1.5 million.

- CapEx funds proprietary manufacturing technology.

- It is essential for scaling production capacity.

- Reflects the capital-intensive nature of Purple's operations.

- Q1 2024 CapEx was around $1.5 million.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses encompass the essential operational overheads supporting a company's strategic management and daily functions. These include executive and administrative staff salaries, corporate office and showroom rent, and critical IT infrastructure costs. Professional services like legal and accounting fees also fall under G&A. Efficient management of these costs is crucial for achieving operating leverage, especially as businesses navigate fluctuating economic conditions in 2024.

- In 2024, many companies are optimizing G&A by leveraging AI for administrative tasks.

- Corporate office rent, a significant G&A component, saw varied trends globally.

- Professional services fees continue to rise, impacting overall G&A budgets.

- IT infrastructure investments remain a critical, albeit fluctuating, G&A expense.

Purple's cost structure is primarily driven by Cost of Goods Sold, with raw material costs up over 5% in 2024, and significant investment in marketing and sales for direct-to-consumer channels.

Strategic outlays for Research and Development foster innovation, while Capital Expenditures fund proprietary manufacturing, like the $1.5 million spent in Q1 2024.

General and Administrative expenses cover essential operational overheads, including salaries and IT infrastructure, crucial for overall efficiency.

| Cost Category | Key Drivers | 2024 Impact/Data |

|---|---|---|

| COGS | Raw Materials, Direct Labor | Materials +5%, Labor +3-4% |

| Marketing & Sales | Digital Advertising, D2C | Primary Customer Acquisition |

| Capital Expenditures | Manufacturing Technology | Q1 2024 ~$1.5M |

| G&A | Operational Overhead, IT | Efficiency Optimization |

Revenue Streams

The primary revenue for Purple comes from Direct-to-Consumer (DTC) online sales of mattresses, pillows, and other comfort products directly through purple.com. This channel typically yields the highest profit margins by cutting out intermediaries. In 2024, DTC sales continue to be the foundational revenue stream, with Purple reporting net revenues of $110.1 million in Q1 2024, emphasizing its strategic importance. This direct approach allows Purple to control the customer experience and brand messaging effectively.

Purple generates a significant revenue stream by selling its innovative comfort products at wholesale prices to a robust network of third-party retail partners. These partners then distribute and sell the products directly to end consumers through their physical brick-and-mortar stores, enhancing brand accessibility. This wholesale channel is crucial for broad market penetration and driving substantial sales volume, complementing their direct-to-consumer efforts. For instance, Purple has continued to leverage its retail partnerships, which contributed significantly to its overall sales, as reported in its latest financial disclosures for 2024, demonstrating consistent channel performance.

Revenue is generated directly from sales made at Purple's company-owned physical retail showrooms. While this channel is smaller in scale compared to e-commerce and wholesale, it provides high-margin sales contributing to overall profitability. These showrooms play a strategic role in customer acquisition and brand building, allowing customers to experience products firsthand. For instance, Purple continued to expand its retail footprint in 2024, recognizing the value of in-person interactions for converting sales and enhancing brand loyalty.

Sales of Ancillary Comfort Products

Beyond mattresses, Purple generates significant revenue from a growing portfolio of ancillary products, including pillows, seat cushions, pet beds, and bedding. These items, often at a lower price point, serve as an accessible entry point to the brand, fostering opportunities for upselling and repeat purchases. This strategy effectively diversifies revenue streams beyond the high-ticket mattress category, contributing to overall sales. For instance, in Q1 2024, Purple’s net revenue from non-mattress products continued to be a crucial component of their financial performance.

- Ancillary products include pillows, seat cushions, and bedding.

- Lower price points attract new customers and encourage brand engagement.

- These products facilitate upselling and foster repeat purchases.

- Diversifies revenue beyond core mattress sales.

Financing Program Fees

Purple generates value by partnering with buy now, pay later (BNPL) financing companies like Affirm, which facilitates customer purchases of high-ticket items. This financing program enables more customers to afford products, thereby increasing overall sales conversion rates. While not a direct product sale, these partnerships contribute to Purple's revenue by potentially involving fees or, more significantly, boosting the total revenue from product sales. In the first quarter of 2024, Purple reported net revenue of $105.8 million, with financing programs playing a crucial role in enabling a significant portion of these transactions.

- Partnerships with BNPL companies like Affirm facilitate sales.

- Financing programs increase customer affordability for high-ticket items.

- This stream enables larger revenue streams by improving conversion rates.

- Purple reported Q1 2024 net revenue of $105.8 million, supported by these programs.

Purple primarily generates revenue through its robust Direct-to-Consumer (DTC) online sales, which yielded $110.1 million in Q1 2024. Complementing this are significant wholesale sales to third-party retailers, expanding market reach and volume. Additional income stems from company-owned showrooms and a growing portfolio of ancillary products like pillows and bedding. Strategic partnerships with BNPL providers like Affirm further boost sales, contributing to Q1 2024 net revenue of $105.8 million, by increasing affordability for customers.

| Revenue Stream | Q1 2024 Net Revenue (Millions USD) | Contribution |

|---|---|---|

| Direct-to-Consumer (DTC) | $110.1 | Highest profit margins, brand control |

| Wholesale | Significant (not separately reported for Q1 2024) | Broad market penetration, volume sales |

| Ancillary Products | Crucial component of total non-mattress sales | Diversification, entry point, upselling |

| Total Net Revenue (Q1 2024) | $105.8 | Overall performance, inclusive of financing impact |

Business Model Canvas Data Sources

The Purple Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and competitive landscape analysis. These sources ensure a holistic and actionable representation of the business.