Promotora de Informaciones SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Promotora de Informaciones Bundle

Promotora de Informaciones boasts a strong brand reputation and a dedicated customer base, key strengths that position it well in a competitive market. However, a reliance on specific technological platforms presents a notable vulnerability. The company also faces opportunities in expanding its service offerings and leveraging emerging digital trends. Ready to dive deeper into these dynamics and uncover actionable strategies?

Strengths

Promotora de Informaciones, or PRISA, boasts a powerful collection of well-known brands, including El País for news, Cadena SER and LOS40 for radio, and Santillana for education. These brands are not just names; they represent significant market presence and deep trust among audiences in Spanish and Portuguese-speaking countries across Europe and the Americas. For instance, El País is a leading newspaper in Spain, and Cadena SER consistently ranks as a top radio station.

Promotora de Informaciones has shown remarkable success in its digital transformation, notably with El País. The newspaper boasts over 400,000 subscribers, a figure that now exceeds its circulation numbers from before the 2008 financial crisis, highlighting a significant digital resurgence.

Santillana, a key division, is also making substantial inroads into the K-12 education sector by digitizing its offerings. The adoption of subscription-based learning models here signals a strategic and successful shift towards recurring digital revenue streams.

This robust digital growth across its platforms is a powerful engine for the company's current financial performance and positions it well for sustained profitability in the evolving media and education markets.

Promotora de Informaciones (PRISA) boasts a strong advantage through its diversified business segments, encompassing news, radio, and education. This multi-pronged approach creates a robust revenue stream, significantly reducing the risk tied to any single market. Such diversification allows PRISA to adapt to varying economic conditions and consumer trends across different industries, enhancing overall business resilience.

The company's strategic presence in both private education and media sectors proved particularly beneficial, contributing positively to its operational performance throughout 2024. This dual strength allows PRISA to capitalize on distinct market opportunities, ensuring a more stable financial footing compared to companies concentrated in a single area.

Improved Financial Health and Debt Reduction

Promotora de Informaciones has achieved remarkable financial deleveraging, reaching its lowest net debt in twenty years by April 2025. This focus on strengthening its balance sheet is a significant advantage.

The company has demonstrated consistent improvement in its cash generation capabilities, which supports ongoing operations and future investments. This financial discipline is a key strength.

Specifically, the improved financial results observed in 2024 were partly attributable to a reduction in interest expenses. This directly contributes to a healthier bottom line.

- Lowest Net Debt in Two Decades: Achieved by April 2025.

- Consistent Cash Generation: Improving operational cash flow.

- Reduced Interest Expenses: A contributing factor to 2024 financial improvements.

- Enhanced Financial Flexibility: Enabling strategic investments and growth.

Commitment to Sustainability and ESG Integration

PRISA's 2022-2025 Strategic Plan places a strong emphasis on sustainability, embedding environmental, social, and governance (ESG) factors directly into its operational framework. This strategic integration is crucial for meeting the growing demands of investors and consumers who prioritize responsible business practices, thereby bolstering PRISA's long-term viability and competitive edge.

By prioritizing ESG, PRISA is actively cultivating a more robust corporate image and improving its access to capital markets, particularly those focused on sustainable investments. This strategic focus is expected to translate into tangible benefits, such as enhanced brand loyalty and a stronger financial position in the evolving market landscape.

Key initiatives under this commitment include:

- Integrating ESG into decision-making processes across all business units.

- Setting measurable targets for environmental impact reduction and social responsibility.

- Enhancing transparency in ESG reporting to build stakeholder trust.

- Exploring opportunities for sustainable innovation within its media and education sectors.

PRISA's portfolio of well-established brands, including El País and Cadena SER, provides a significant competitive advantage. These brands command strong recognition and loyalty across key Spanish and Portuguese-speaking markets. The company's successful digital transformation, particularly evident with El País's over 400,000 digital subscribers, demonstrates an ability to adapt and thrive in the evolving media landscape.

The company's financial health is a notable strength, highlighted by its achievement of the lowest net debt in twenty years by April 2025. This deleveraging, coupled with consistent improvements in cash generation and reduced interest expenses, as seen in 2024 financial results, provides substantial financial flexibility. This enhanced financial position enables PRISA to pursue strategic growth opportunities and weather economic fluctuations more effectively.

| Metric | Value | Period |

|---|---|---|

| Digital Subscribers (El País) | Over 400,000 | As of latest reporting |

| Net Debt | Lowest in 20 years | As of April 2025 |

| Interest Expenses | Reduced | Contributing factor to 2024 performance |

What is included in the product

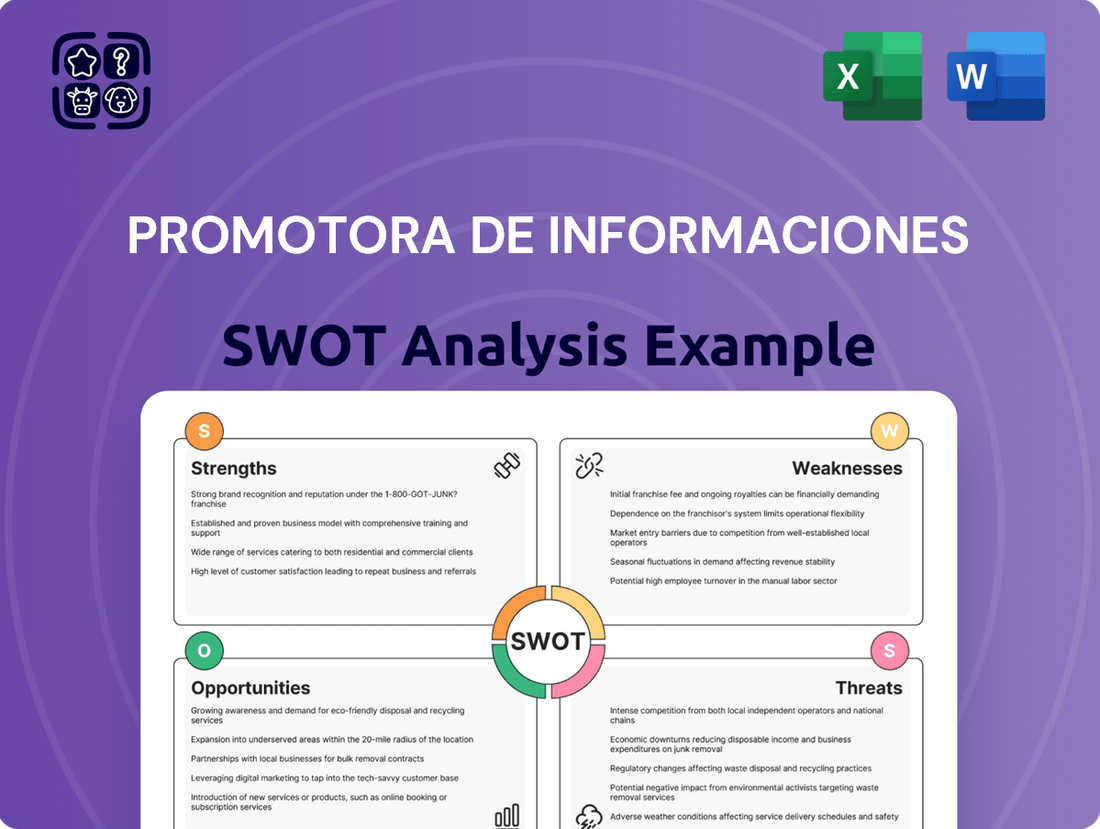

Analyzes Promotora de Informaciones’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a visually clear SWOT analysis that quickly pinpoints opportunities and threats, easing the burden of complex strategic assessment.

Weaknesses

Despite the ongoing shift towards digital platforms, traditional print media, including PRISA's flagship newspaper El País, continues to grapple with a steady erosion of print advertising and circulation revenue. In 2023, the global print advertising market saw a significant contraction, a trend that directly impacts legacy media organizations.

Balancing the substantial operational costs associated with maintaining print publications, such as printing, distribution, and physical infrastructure, against the necessary investments in digital expansion and content innovation creates a considerable financial strain. This necessitates a delicate balancing act to ensure both legacy operations and future digital growth are adequately resourced.

This dual operational model requires significant capital allocation, potentially diverting resources from crucial digital development. For instance, the cost of paper and ink, coupled with declining print sales, means that print operations may not generate sufficient revenue to cover their own expenses, let alone contribute to digital transformation efforts.

PRISA navigates a fiercely contested digital media arena. Global streaming services, burgeoning podcast networks, and AI-driven content aggregators present significant challenges, often providing highly personalized and varied content that can divert audience attention from traditional media formats.

This intense competition necessitates substantial and ongoing investment in both technological innovation and compelling content creation to secure and grow market share. In 2023, the global digital advertising market reached an estimated $603.9 billion, with a significant portion attributed to online video and audio content, highlighting the scale of the competitive landscape PRISA operates within.

PRISA's financial comparisons are often complicated by one-off events. For instance, recent reports show that results from one year to the next can look very different due to things like arbitration payouts or specific asset sales. These can temporarily inflate profits, making it harder for investors to see the real story of how the core business is doing. This lack of clarity in underlying operational performance makes consistent trend analysis a challenge.

Dependency on Specific Regional Education Markets

Santillana's education segment, a core component of Promotora de Informaciones, exhibits a notable dependency on specific regional markets. A substantial portion of its annual sales is generated from the private education sector in Latin America and public sector sales within Brazil. This concentration creates a vulnerability to localized economic downturns, political shifts, or alterations in educational policies in these critical geographies.

The financial performance of the education business is therefore closely tied to the stability and growth prospects within these particular markets. For instance, if Brazil experiences significant budget cuts affecting public education spending, or if a major Latin American country faces an economic recession impacting private school enrollment, Santillana's revenue streams could be disproportionately affected. This reliance means that adverse events in these regions can have a magnified impact on the company's overall financial results.

- Geographic Concentration: High reliance on private education sales in Latin America and public sales in Brazil.

- Economic Sensitivity: Exposure to economic fluctuations within these key Latin American countries.

- Policy Risk: Vulnerability to changes in educational policies and government spending in Brazil and other Latin American nations.

- Revenue Impact: Potential for disproportionate revenue declines due to localized adverse developments.

Pace and Ethical Concerns of AI Integration

While AI offers significant potential, PRISA Media, like many in the news industry, faces hurdles in seamless integration. Concerns about copyright infringement and the ethical use of AI-generated content are paramount. Furthermore, the substantial investment and comprehensive training required for widespread adoption present practical challenges for newsrooms.

The accelerating pace of AI development introduces risks, particularly regarding the potential for sophisticated misinformation campaigns. If not handled with rigorous oversight, this could lead to a significant erosion of public trust in journalistic outlets.

- Copyright Challenges: Navigating the legal landscape of AI-generated content and its implications for news reporting remains complex.

- Ethical Considerations: Ensuring transparency and accountability in AI's role within news production is critical for maintaining credibility.

- Adoption and Training Gaps: Significant resources are needed to equip staff with the necessary skills to effectively and responsibly utilize AI tools.

- Misinformation Risks: The potential for AI to amplify or create false narratives poses a direct threat to journalistic integrity and audience trust.

PRISA's legacy print operations continue to face revenue declines, with global print advertising markets contracting. This erosion impacts profitability and limits funds available for crucial digital investments.

The company must balance high operating costs for print with the necessity of digital expansion, creating a significant financial strain. This dual model can divert resources from innovation, as print may not generate enough revenue to cover its own expenses and contribute to digital transformation.

PRISA operates in a highly competitive digital landscape, challenged by streaming services, podcasts, and AI aggregators. In 2023, the digital advertising market was valued at $603.9 billion, underscoring the intense competition for audience attention and advertising spend.

Santillana's education segment exhibits a significant reliance on specific Latin American markets, particularly private education sales in the region and public sector sales in Brazil. This geographic concentration makes the segment vulnerable to localized economic downturns and policy changes.

Same Document Delivered

Promotora de Informaciones SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

You're previewing the actual analysis document. Buy now to access the full, detailed report.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global EdTech market is experiencing a significant boom, with projections indicating continued strong growth. This expansion is fueled by the increasing desire for tailored educational experiences and the adoption of cutting-edge technologies like artificial intelligence and virtual reality. For instance, the global EdTech market was valued at approximately $121 billion in 2023 and is expected to reach $360 billion by 2028, demonstrating a compound annual growth rate (CAGR) of over 20%.

Promotora de Informaciones, through its subsidiary Santillana, is strategically positioned to benefit from this trend. Santillana's established EdTech platform and its focus on recurring revenue through subscription models align perfectly with market demands. Its commitment to innovation is further bolstered by collaborations, such as its partnership with ISTE+ASCD, which aims to enhance digital learning environments and teacher professional development.

The ongoing growth of El País's digital subscriptions, which saw a notable increase in paid subscribers in early 2024, highlights a robust demand for premium digital journalism. This success provides a clear blueprint for PRISA to replicate across its diverse portfolio, including radio and niche publications.

By leveraging this proven digital subscription strategy, PRISA can cultivate more consistent and reliable revenue streams, moving beyond traditional advertising dependence. This expansion is crucial for adapting to evolving media consumption habits.

Further enhancing the value proposition through strategic partnerships, such as offering bundled access to international publications like The New York Times, can significantly boost subscriber acquisition and retention rates, as seen with similar successful collaborations in the European media landscape.

Artificial intelligence presents a significant opportunity for Promotora de Informaciones (PRISA) to revolutionize its content creation processes and tailor user experiences across its media and education divisions. By integrating AI, PRISA can develop more dynamic paywall strategies and sophisticated content recommendation engines, directly boosting user engagement and attracting a broader audience.

The implementation of AI-powered tools can streamline content production, enabling the creation of more engaging and personalized narratives. This focus on AI-enhanced journalism and storytelling, for instance, could lead to a substantial increase in digital revenue growth, as seen with other media giants who have adopted similar technologies to improve audience retention and attract new subscribers.

Strategic Partnerships and Content Diversification in Media

Strategic partnerships offer a significant avenue for growth, as demonstrated by collaborations like El País's with The New York Times, which enhances subscriber value and broadens market reach. This type of alliance can tap into new audiences and provide access to diverse journalistic resources, a crucial advantage in the competitive media landscape.

Diversifying content into popular formats such as podcasts and short-form video is essential to capture younger demographics. PRISA can leverage these platforms to engage digitally native audiences who increasingly consume information through these channels. For instance, the podcast market saw substantial growth in 2024, with many media companies reporting increased listenership and advertising revenue from audio content.

The Spanish entertainment media market presents a compelling opportunity for the development and promotion of local content. This focus can cater to a growing appetite for culturally relevant programming, potentially driving subscription numbers and advertising engagement within Spain and Spanish-speaking regions. In 2024, regional content production saw a notable uptick in investment and consumer interest.

- Expand reach through international media collaborations: Emulating successful partnerships like El País with The New York Times to access new subscriber bases.

- Diversify content offerings: Invest in podcasts and short-form video to attract younger, digitally engaged audiences.

- Capitalize on local content demand: Focus on developing and promoting Spanish entertainment media to tap into a growing market segment.

- Increase digital engagement: Leverage new formats to boost interaction and build a stronger connection with a broader audience.

Evolution of Radio into Hybrid Digital Platforms

The radio landscape is transforming, merging traditional broadcasts with digital streaming and on-demand services. This evolution presents a significant opportunity for companies like Prisa (Promotora de Informaciones), which owns Cadena SER and LOS40. By embracing this hybrid model, they can ensure they remain relevant to modern audiences.

Leveraging this trend involves building strong digital platforms. This means not just streaming live radio but also offering podcasts, exclusive digital content, and interactive features. For instance, Prisa can enhance its digital offerings by providing hyper-local news and programming tailored to specific regions, a move that could resonate well with listeners seeking community-focused content.

Integration with smart devices is another key aspect of this opportunity. As more people rely on voice assistants and smart speakers for audio content, ensuring that Cadena SER and LOS40 are easily accessible through these platforms is crucial. This seamless integration expands reach beyond traditional radio frequencies, adapting to how people consume media today.

The shift towards digital platforms also allows for new revenue streams, such as targeted digital advertising and premium subscription services for ad-free listening or exclusive content. By Q1 2024, Prisa's digital segment showed continued growth, indicating a positive reception to their online strategies, with digital revenues contributing a growing percentage to the group's overall performance.

- Digital Expansion: Developing comprehensive digital platforms for streaming and on-demand content.

- Hyper-Local Content: Offering localized news and programming to cater to specific community interests.

- Smart Device Integration: Ensuring seamless accessibility across smart speakers and voice assistants.

- Revenue Diversification: Exploring new income streams through digital advertising and premium subscriptions.

Promotora de Informaciones (PRISA) is well-positioned to capitalize on the burgeoning EdTech market, particularly through its subsidiary Santillana, which focuses on digital learning solutions. The global EdTech market is projected for robust growth, with an expected reach of $360 billion by 2028, indicating substantial demand for digital educational content and platforms.

PRISA can leverage the increasing demand for digital journalism by expanding its subscription models across all its media titles, mirroring the success of El País's digital growth. This strategy is supported by early 2024 data showing a rise in El País's paid subscribers, confirming a strong appetite for premium digital news.

The integration of Artificial Intelligence offers a significant opportunity to enhance content creation, personalize user experiences, and optimize revenue generation through dynamic paywalls and recommendation engines. AI's potential to streamline production and create more engaging content is a key driver for digital revenue growth.

Expanding into popular content formats like podcasts and short-form video is crucial for attracting younger demographics, a segment that showed significant engagement with audio content in 2024. Furthermore, developing local Spanish entertainment content caters to a growing market demand, potentially boosting subscription and advertising revenue.

Threats

PRISA grapples with formidable competition from global tech behemoths like Google and Meta, along with a surge of independent content creators, especially among younger audiences who increasingly turn to these platforms for news and entertainment. This shift means traditional media outlets, including PRISA's, face a constant battle for attention and relevance.

These digital platforms often circumvent established media channels, contributing to a noticeable dip in engagement with institutional journalism and potentially eroding public trust in traditional news sources. PRISA must actively address this by understanding and adapting to evolving media consumption habits to maintain its audience share.

Economic downturns present a significant challenge for Promotora de Informaciones, as reduced consumer and business spending often translates directly into lower advertising budgets. This is a critical threat because advertising revenue is a cornerstone for many media companies, including PRISA's news and radio operations.

The advertising market is inherently volatile, and economic uncertainty, such as the projected global GDP slowdown in late 2024, exacerbates this. A shift in advertiser preferences, perhaps towards digital platforms with more measurable ROI, can further impact traditional media revenue streams.

For instance, if economic headwinds persist through 2025, companies might further curtail discretionary spending on advertising, directly affecting PRISA's top line. The ongoing digital transformation also means advertisers can easily shift spend, making PRISA's revenue susceptible to rapid changes.

The ever-shifting regulatory environment, especially around media ownership rules and how online content is managed, presents a significant challenge. For instance, in 2024, the European Union continued to implement and refine directives like the Digital Services Act, which places greater responsibility on platforms for content moderation, potentially impacting how PRISA's content is distributed and monetized across these channels.

Increased government scrutiny or unexpected policy shifts could hinder PRISA's ability to operate freely and generate revenue from partnerships with major tech companies. A tightening of regulations on how news is presented or how user data is handled could necessitate costly adjustments to PRISA's digital strategies and revenue models, impacting its flexibility.

Misinformation, Disinformation, and Erosion of Trust

The increasing prevalence of misinformation and disinformation, amplified by AI-generated content, poses a significant threat by undermining public confidence in established news outlets. For Promotora de Informaciones (PRISA), maintaining its standing as a credible source demands ongoing investment in journalistic rigor and robust fact-checking mechanisms. This endeavor is particularly demanding given the current polarized media landscape.

The financial implications of combating misinformation can be substantial, requiring dedicated resources for verification technologies and expert personnel. PRISA’s commitment to accuracy, while essential for trust, represents a continuous operational cost. For instance, in 2023, media organizations globally saw increased spending on AI detection tools and fact-checking initiatives, with some estimates suggesting a 15-20% rise in operational budgets dedicated to content verification.

- Erosion of Trust: AI-driven fake news can rapidly spread, making it difficult for consumers to distinguish between credible and false information, thereby damaging PRISA's reputation.

- Resource Drain: Combating disinformation requires significant financial and human capital for fact-checking, investigative journalism, and technology development.

- Competitive Disadvantage: Unverified, sensationalized content from less scrupulous sources can gain traction, potentially drawing audiences away from PRISA's meticulously researched reporting.

- Regulatory Scrutiny: Increased focus on content moderation and platform accountability could lead to new compliance costs and operational complexities for PRISA.

Rapidly Changing Consumer Behavior and Attention Spans

The digital landscape is constantly evolving, and consumers, especially younger demographics, are increasingly favoring short-form video and easily digestible content over traditional media. This trend poses a significant threat as it demands continuous adaptation in how Promotora de Informaciones creates and delivers its stories to remain relevant and capture audience attention.

For instance, by late 2024, platforms like TikTok and Instagram Reels have seen user engagement soar, with short-form video content accounting for a substantial portion of total watch time across many demographics. This shift means traditional news websites and apps may struggle to attract and retain audiences accustomed to this faster, more visual format.

- Short-Form Video Dominance: Platforms prioritizing short video content continue to grow, impacting traditional media consumption.

- Attention Span Decline: Consumers, particularly younger ones, exhibit shorter attention spans, necessitating more engaging and concise content strategies.

- Content Innovation Pressure: Media companies must constantly innovate storytelling and delivery methods to cut through the noise and maintain audience engagement.

- Platform Dependency: Reliance on third-party platforms for content distribution can limit direct audience access and control.

PRISA faces intense competition from digital giants and a proliferation of content creators, particularly impacting younger audiences who favor these platforms. This shift necessitates constant adaptation to maintain relevance and audience share in a rapidly evolving media landscape.

Economic downturns directly affect PRISA through reduced advertising budgets, a core revenue source. The volatile advertising market, especially with a projected global GDP slowdown in late 2024, makes revenue streams susceptible to rapid changes as advertisers may prioritize digital platforms with more measurable ROI.

The evolving regulatory environment, including EU directives like the Digital Services Act in 2024, imposes greater responsibility on platforms for content moderation. This could lead to increased compliance costs and operational complexities for PRISA, potentially impacting content distribution and monetization strategies.

The rise of AI-generated misinformation poses a threat to PRISA's credibility, demanding significant investment in journalistic rigor and fact-checking. Global media organizations saw operational budgets for content verification rise by an estimated 15-20% in 2023 to combat this issue.

SWOT Analysis Data Sources

This SWOT analysis for Promotora de Informaciones is constructed from a robust blend of financial statements, comprehensive market research reports, and valuable expert opinions. These diverse sources ensure a well-rounded and accurate assessment of the company's strategic position.