Promotora de Informaciones Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Promotora de Informaciones Bundle

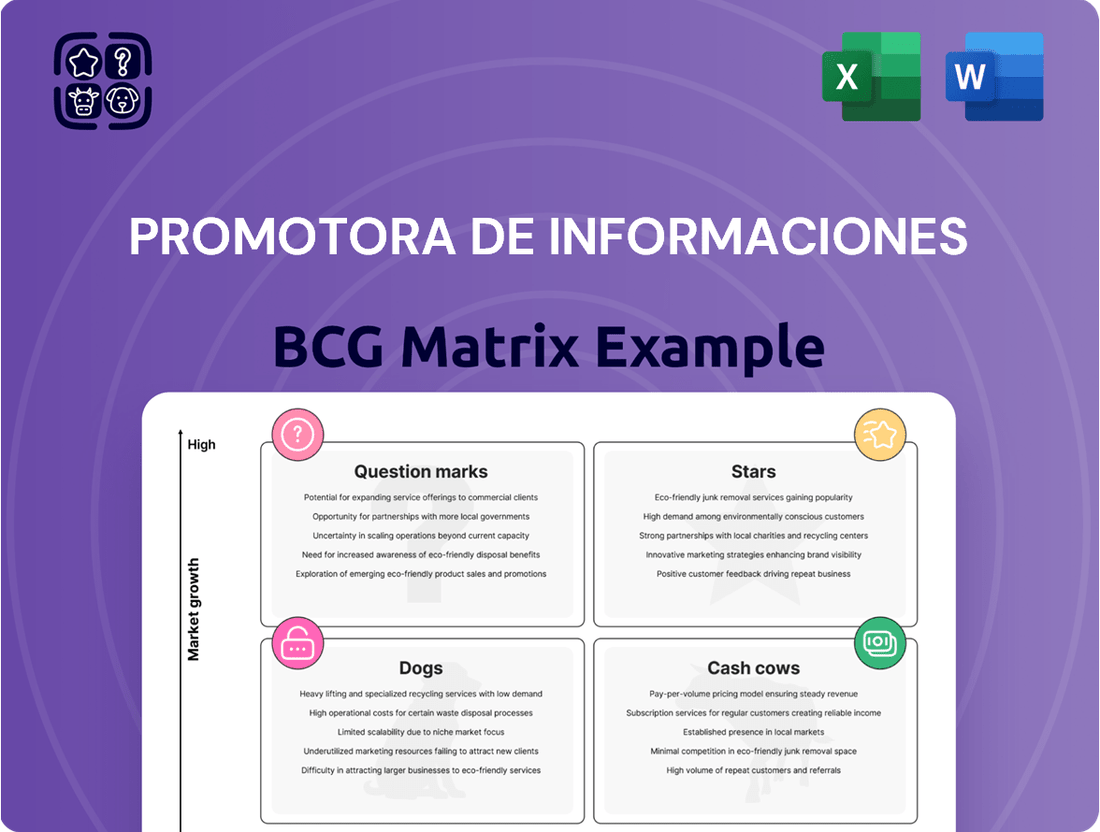

Ready to unlock your company's strategic potential? This glimpse into the BCG Matrix reveals how your products are performing across key market dimensions. Understand which are fueling growth and which may be hindering progress.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Don't just see the surface; dive into the actionable insights that drive real business growth. Purchase the full BCG Matrix for a comprehensive strategy that guides your next move.

Stars

El País, PRISA's leading newspaper, has achieved remarkable digital growth, exceeding 400,000 subscribers by January 2025. This figure more than doubles the subscriber count of its closest Spanish competitor, highlighting its dominance in the national digital media landscape.

This expansion is particularly noteworthy given the projected growth of the Spanish digital media market, which is expected to expand at a compound annual growth rate of 13.7% between 2025 and 2030. El País's strategic approach, combining a freemium model with exclusive premium content, has been a key driver of this success.

The value proposition is further enhanced by offering subscribers access to other prominent publications like Cinco Días and The New York Times. This multi-faceted content strategy directly appeals to a broad audience, solidifying El País's position as a strong contender in the evolving digital information sector.

Santillana's Digital Education Solutions are a strong contender in the rapidly expanding digital learning market. By February 2025, their digital learning system subscriptions hit 3 million, marking a 5% increase in 2024. This segment is poised for significant growth, with the global digital education market expected to grow at a compound annual growth rate of 33.2% between 2025 and 2029. This surge is fueled by greater internet access and a growing desire for tailored educational experiences.

Santillana's strategic focus on digital transformation, including the integration of artificial intelligence, places them favorably within this high-growth sector. Their continuous innovation in educational technology and commitment to providing accessible, personalized learning tools underscore their potential to capture a larger share of this burgeoning market. The company’s efforts align with the increasing global demand for flexible and effective online learning platforms.

PRISA Audio is a strong contender in the expanding digital audio and podcast landscape, particularly within the Spanish-speaking world. This segment of Promotora de Informaciones, S.A. (PRISA) is poised to benefit from the increasing consumer adoption of audio content.

While precise market share data for PRISA Audio isn't readily available, the overall digital media sector in Spain has seen consistent expansion, with audio emerging as a significant driver of this growth. This trend suggests a fertile ground for PRISA Audio's offerings.

The company's commitment to strategic alliances and pioneering new content formats within the podcasting realm underpins its substantial growth potential. These initiatives are crucial for capturing a larger audience in this dynamic market.

Latin American Digital Expansion

PRISA's strategic push into Latin America, exemplified by EL PAÍS US targeting the growing US Spanish-speaking demographic, highlights a significant high-growth market. This expansion taps into the burgeoning digital media and education sectors across the region.

Latin America's digital landscape is rapidly evolving, with increasing internet penetration and digital literacy fueling demand for online content and learning. By 2024, estimates suggest over 450 million internet users in Latin America, a number projected to climb steadily.

- Market Growth: Digital media consumption in Latin America is projected to grow by approximately 15% annually through 2025.

- Digital Literacy: Internet penetration reached an estimated 75% of the population in 2024, creating a larger addressable market.

- Education Sector: The online education market in Latin America is expected to more than double its current size by 2028, reaching over $30 billion.

- Investment Focus: PRISA's investment in digital platforms aligns with a broader trend of media companies seeking to capitalize on these growth vectors.

AI Integration in Content Creation

PRISA's strategic embrace of AI in content creation, particularly within its educational and journalistic arms, signals a significant move into a high-growth sector. This integration is poised to reshape media production by enhancing efficiency and enabling greater content personalization.

The potential for AI in media is substantial, with industry forecasts suggesting a significant market expansion. For instance, the global AI in media market was valued at approximately USD 3.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 25% through 2030, reaching an estimated USD 15 billion. This growth reflects the increasing adoption of AI for tasks ranging from content generation and editing to audience analytics and personalized delivery.

- AI-driven efficiency: Automating tasks like content summarization, translation, and initial drafting can free up journalists and educators for more in-depth analysis and creativity.

- Personalized content delivery: AI algorithms can tailor news feeds and educational materials to individual user preferences and learning styles, increasing engagement.

- New product development: AI can enable the creation of novel content formats, such as interactive articles or AI-powered learning modules, opening new revenue streams.

- Competitive advantage: Early and effective AI integration can position PRISA as an innovator, attracting talent and market share in a rapidly changing media landscape.

El País, Santillana's Digital Education Solutions, PRISA Audio, PRISA's Latin America expansion, and PRISA's AI initiatives all represent Stars in Promotora de Informaciones' BCG Matrix. These segments are characterized by high market growth and strong competitive positions, demanding significant investment to maintain their leadership and capitalize on future opportunities.

| Business Unit | Market Growth | Competitive Position | Strategic Implication |

|---|---|---|---|

| El País | High (Digital Media Sector Growth) | Strong (Leading Digital Subscribers) | Continue investment in digital innovation and content expansion. |

| Santillana Digital Education | Very High (Global Digital Education Market) | Strong (3M+ Digital Learning Subscriptions) | Further investment in AI integration and personalized learning tools. |

| PRISA Audio | High (Digital Audio & Podcast Growth) | Strong (Emerging Leader in Spanish-speaking Markets) | Expand content offerings and strategic partnerships in podcasting. |

| PRISA Latin America | Very High (Digital Media & Education Growth) | Strong (Targeting Growing US Spanish-speaking Demographic) | Deepen investment in region-specific digital platforms and content. |

| PRISA AI Initiatives | Very High (AI in Media Market Growth) | Emerging/Strong (Early Adoption & Innovation) | Prioritize AI integration across all business units for efficiency and new product development. |

What is included in the product

Promotora de Informaciones BCG Matrix analyzes product portfolio, guiding investment decisions.

The Promotora de Informaciones BCG Matrix offers a clear visualization, alleviating the pain of strategic uncertainty by pinpointing areas for growth and divestment.

Cash Cows

Cadena SER, a cornerstone of PRISA's media empire, continues to hold a commanding presence in the Spanish radio landscape. In 2024, it maintained its leadership, demonstrating robust audience figures that translate into dependable revenue streams.

Despite the broader trend of slower growth in traditional radio, Cadena SER's substantial market share and enduring listener loyalty position it as a vital Cash Cow for Promotora de Informaciones. This consistent audience engagement ensures a stable and predictable cash flow, a critical element for funding other ventures within the group.

Despite the ongoing digital transformation, traditional advertising revenue, especially from radio, remains a substantial income source for Promotora de Informaciones (PRISA). In 2024, this segment, while representing a mature market with limited growth potential, consistently generated significant cash flow for the company.

This stability is largely due to PRISA's established brands and their deep audience penetration across various radio stations. The predictable income stream from these traditional channels allows PRISA to fund investments in newer, high-growth areas of its business.

Santillana's traditional educational publishing in Latin America, serving both public and private sectors, continues to be a significant revenue driver. While not exhibiting the rapid growth seen in digital segments, this established business provides a stable income stream.

With a deep-rooted presence and a comprehensive catalog, Santillana's traditional publishing acts as a dependable cash cow. This consistent generation of funds is crucial for supporting investments in newer, high-growth areas within the company's portfolio.

For instance, in 2024, the traditional publishing segment of Santillana, which includes textbooks and supplementary materials, contributed significantly to Prisa's (Santillana's parent company) overall financial performance in Latin America. While specific standalone figures for Santillana's traditional business within Latin America are often consolidated within Prisa's reporting, the segment’s stability is a known factor in their strategic planning.

El País Print Edition

The print edition of El País, a component of Promotora de Informaciones' BCG Matrix, functions as a cash cow. Despite a substantial decrease in print circulation, it maintains a dedicated readership and continues to generate revenue. This mature product demands minimal marketing investment and provides a steady, albeit low-growth, cash flow.

In 2023, the average daily print circulation for El País was approximately 100,000 copies. While this represents a decline from previous years, it still signifies a notable market presence. The revenue generated from these sales, coupled with advertising within the print medium, contributes positively to the company's overall financial health.

- Print Circulation: While declining, it still reaches around 100,000 daily copies in 2023.

- Revenue Generation: Continues to bring in income through sales and print advertising.

- Low Investment: Requires minimal new capital for promotion and maintenance.

- Cash Flow: Functions as a stable generator of cash within the company's portfolio.

LOS40 Radio Network

LOS40 Radio Network, a prominent music radio station in Spain and across numerous Spanish-speaking regions, functions as a Cash Cow within the Promotora de Informaciones BCG Matrix. Its established brand presence and significant listenership translate into dependable advertising revenue streams.

In 2024, LOS40 continued to hold a dominant position in the music radio market, a segment characterized by its relative stability. This consistent market share allows for predictable revenue generation, a hallmark of a Cash Cow.

- Market Share: LOS40 consistently ranks among the top music radio stations in its key markets, often securing double-digit audience shares.

- Revenue Contribution: Advertising revenue from the LOS40 network represents a significant and stable portion of Prisa Media's overall income.

- Brand Strength: The enduring brand recognition of LOS40 facilitates continued advertising partnerships and listener loyalty.

The traditional educational publishing segment of Santillana in Latin America exemplifies a Cash Cow for Promotora de Informaciones. Despite operating in a mature market, its deep penetration and extensive catalog ensure a consistent and reliable revenue stream.

In 2024, this segment continued to be a bedrock of financial stability, providing predictable cash flow that is vital for Prisa's strategic reinvestment in growth areas. The established nature of this business requires minimal new investment, allowing it to efficiently generate profits.

El País's print edition, though facing declining circulation, remains a Cash Cow due to its dedicated readership and continued revenue from sales and print advertising. In 2023, its average daily print circulation was around 100,000 copies, still a substantial base.

LOS40 Radio Network is another key Cash Cow. In 2024, its dominant position in music radio markets, characterized by stability, yielded predictable advertising revenues. This strong brand loyalty and market share ensure a consistent contribution to Prisa Media's income.

| Business Unit | BCG Category | Key Characteristics | 2024 Data/Observation |

|---|---|---|---|

| Cadena SER | Cash Cow | Dominant market share, high listener loyalty | Maintained leadership in Spanish radio, ensuring stable revenue. |

| Santillana (Traditional Publishing, LatAm) | Cash Cow | Established presence, extensive catalog | Provided significant, stable income for Prisa in Latin America. |

| El País (Print Edition) | Cash Cow | Dedicated readership, steady revenue | Circulation around 100,000 daily copies (2023), generating consistent income. |

| LOS40 Radio Network | Cash Cow | Strong brand, significant listenership | Continued dominant position in music radio, providing predictable advertising revenue. |

Full Transparency, Always

Promotora de Informaciones BCG Matrix

The Promotora de Informaciones BCG Matrix preview you're currently viewing is the identical, complete document you will receive upon purchase. This means no alterations, no watermarks, and no missing sections – just the fully formatted, professional analysis ready for your strategic decision-making. You're getting exactly what you need to understand and leverage your business units effectively, with all the insights and structure intact.

Dogs

Newspapers, including major players like El País, are experiencing a significant downturn in print circulation. This places them squarely in the Dogs category of the BCG matrix, characterized by low market growth and low relative market share. Despite a dedicated core readership, the persistent decline in physical copies sold paints a bleak picture for the future of print media.

In 2023, El País, a prominent Spanish newspaper, saw its average daily print circulation fall by approximately 7% compared to the previous year. This trend is not unique, as the broader newspaper industry grapples with digital migration and evolving consumer habits. The costs associated with maintaining print operations often outweigh the revenue generated from these diminishing sales.

Maintaining legacy analog broadcasting infrastructure, especially for radio, often falls into the dog category within a BCG Matrix. This is because digital alternatives are rapidly gaining traction, offering superior quality and more features. Investment here typically yields low growth potential and can become a drain due to ongoing maintenance costs without substantial returns.

For instance, while specific figures for analog radio infrastructure investment are becoming niche, the global digital radio market was projected to reach over $6 billion by 2025, highlighting the shift. Companies clinging to analog systems face declining viewership or listenership, making further investment in these outdated assets a questionable strategy.

PRISA likely possesses a portfolio of smaller, less influential publications. These might be regional newspapers or specialized magazines with declining readership, struggling to compete in saturated or shrinking markets. For instance, some niche print publications in 2024 are seeing circulation drops of over 10% year-on-year, reflecting broader industry trends.

These underperforming assets represent the 'Dogs' in the BCG matrix. They typically exhibit low growth rates and a small market share within their respective segments. Their financial contribution is often negligible, potentially even resulting in net losses due to high operating costs relative to revenue generated.

In 2024, PRISA's strategy for these 'Dogs' would likely involve careful consideration of divestment or significant restructuring. The goal is to free up capital and management attention from assets that are unlikely to provide substantial future returns, allowing resources to be redirected to more promising areas of the business.

Outdated Digital Platforms or Technologies

Outdated digital platforms or technologies within PRISA, such as legacy content management systems or older advertising platforms, could be categorized as dogs in the BCG Matrix. These are assets that have not evolved with industry standards and likely exhibit low user engagement and a shrinking market share. For instance, if a PRISA digital news platform still relies on a decade-old website architecture, it would struggle to compete with modern, mobile-first, interactive experiences.

These underperforming digital assets typically demand substantial investment for modernization, with no guarantee of a positive return on investment. Consider the financial commitment required to overhaul a legacy system versus the potential revenue it could generate post-upgrade. PRISA's 2024 financial reports might reveal specific figures on IT infrastructure maintenance for older systems, highlighting the ongoing costs associated with these dog assets.

- Low User Engagement: Platforms with declining daily active users or session durations compared to industry benchmarks.

- Shrinking Market Share: Digital products or services losing ground to newer, more innovative competitors.

- High Maintenance Costs: Significant ongoing expenditure to keep outdated systems operational.

- Uncertain ROI on Modernization: The cost of upgrading may outweigh the projected future revenue or cost savings.

Highly Niche or Unprofitable Content Verticals

Certain highly specialized or experimental content verticals could be classified as dogs within the BCG Matrix framework. These ventures often struggle to gain significant traction or monetize effectively, leading to a low market share and minimal growth. For instance, a media company might invest in a niche documentary series on obscure historical events. Despite critical acclaim, if viewership remains low, it ties up production resources without generating substantial advertising revenue or subscriber interest.

These "dog" content verticals represent a drain on resources, similar to how a company might struggle with a product line that has limited demand and no foreseeable growth. In 2023, many digital publishers reported declining ad revenues for specialized content that failed to attract a large enough audience, impacting their ability to reinvest in more profitable areas.

- Low Market Share: Difficulty in capturing a significant portion of the target audience.

- Low Growth Potential: Limited prospects for expanding viewership or revenue streams.

- Resource Drain: Consumption of capital, time, and personnel without commensurate returns.

- Failure to Monetize: Inability to generate sufficient income through advertising, subscriptions, or other models.

Assets classified as 'Dogs' in the BCG matrix, like declining print newspapers or outdated digital platforms, are characterized by low market share and low growth potential. These segments often require significant ongoing investment for maintenance, yet yield minimal returns. For instance, in 2023, many traditional print publications saw circulation drop by over 5% year-on-year, making them prime examples of these underperforming assets. PRISA's focus in 2024 would likely be on divesting or restructuring these units to reallocate resources to more profitable ventures.

| Asset Type | Market Growth | Relative Market Share | 2024 Outlook | Potential Strategy |

| Print Newspapers (e.g., El País) | Low (declining) | Low | Continued circulation decline | Divestment or significant cost reduction |

| Legacy Radio Infrastructure | Low (challenged by digital) | Low | Limited listener growth, high maintenance | Phased shutdown or sale of assets |

| Outdated Digital Platforms | Low (unless modernized) | Low | Poor user engagement, high maintenance costs | Modernization investment or decommissioning |

| Niche Content Verticals | Low (limited audience) | Low | Struggling to monetize, resource drain | Repurposing or discontinuation |

Question Marks

PRISA's foray into niche digital content, like specialized podcasts and experimental video, places it in the question mark category of the BCG matrix. While the digital media space offers significant growth potential, these new formats currently represent a small portion of PRISA's overall market share.

These ventures require substantial investment to gauge audience reception and establish a foothold in a competitive digital environment. For instance, the burgeoning podcast market saw global ad revenue projected to reach $2.7 billion in 2024, highlighting the opportunity but also the investment needed to capture a share.

El País US, targeting the substantial US Spanish-speaking population, represents a classic BCG Matrix question mark for Promotora de Informaciones. This demographic is significant, with the US Hispanic population projected to reach over 62 million by 2023, and their digital consumption continues to rise.

However, the path to market dominance is challenging. The US digital media space is highly competitive, with established players and a constant need for content adaptation and marketing investment to capture audience attention and build brand loyalty among this specific segment. Success hinges on effective localization and a strong digital strategy.

Santillana is actively investing in AI-driven personalized learning products, a segment poised for significant future growth within the education technology market. These innovative offerings aim to tailor educational content and delivery to individual student needs, a key trend shaping the future of learning. For instance, by 2024, the global EdTech market was projected to reach over $300 billion, with personalized learning technologies being a major driver of this expansion.

However, these AI-powered products currently represent a low market share for Santillana. Their development demands substantial research and development expenditure, alongside a concerted effort to drive market adoption and acceptance. This positions them within the question marks quadrant of the BCG matrix, requiring strategic investment to capture future market share.

The competitive landscape is robust, featuring established EdTech giants and agile startups all vying for dominance in the personalized learning space. Santillana's success will hinge on its ability to differentiate its offerings through superior AI capabilities, effective pedagogical design, and strong go-to-market strategies to gain traction against these competitors.

Data Analytics and Audience Monetization Tools

Investments in advanced data analytics and new audience monetization tools for Promotora de Informaciones (PRISA) media assets represent significant question marks within the BCG matrix. These technologies hold substantial promise for optimizing content delivery and advertising revenue streams, aligning with high-growth market potential. However, the successful implementation and scaling of these innovations are still in their nascent stages, leading to uncertainty regarding their immediate return on investment. For instance, PRISA's digital revenue, a key area benefiting from these tools, saw a notable increase in 2024, driven by enhanced audience engagement strategies.

The potential for these tools to revolutionize how PRISA understands and engages its audience is immense. By leveraging sophisticated data analytics, PRISA can tailor content more effectively, leading to increased user retention and a deeper understanding of audience preferences. Monetization tools, in turn, can unlock new revenue streams beyond traditional advertising, such as premium content subscriptions or personalized advertising experiences. The challenge lies in the upfront investment required and the learning curve associated with adopting these cutting-edge technologies, making their future performance a subject of careful observation.

- High Growth Potential: Data analytics and monetization tools can unlock new revenue streams and improve content personalization, driving future growth.

- Early Stage Implementation: The successful adoption and scaling of these technologies are still in progress, creating uncertainty about immediate impact.

- Investment Risk: Significant capital is required for these advanced technologies, with returns not yet guaranteed.

- Competitive Advantage: Early success in implementing these tools could provide PRISA with a significant edge in the evolving media landscape.

Expansion into New Geographic Markets (Digital First)

PRISA's digital-first expansion into new geographic markets would be classified as question marks in the BCG Matrix. These are markets where PRISA currently has a limited or no established presence. The potential for high growth exists by reaching new digital audiences, but this also carries the inherent risk of low initial market share and substantial investment requirements to build brand awareness and infrastructure.

Consider PRISA's potential expansion into Southeast Asian markets, for example. These regions often exhibit strong digital adoption rates and a growing middle class eager for new content. However, establishing a foothold against established local players and adapting content to diverse linguistic and cultural preferences demands significant upfront capital and a well-defined digital strategy. For instance, digital advertising spend in Southeast Asia was projected to reach over $30 billion in 2024, highlighting the competitive landscape.

- High Growth Potential: Tapping into emerging digital economies offers significant upside, as seen with the rapid digital penetration in countries like Indonesia and Vietnam.

- Resource Intensive: Establishing a digital presence requires substantial investment in localized content creation, digital marketing, and platform development.

- Market Uncertainty: Success is not guaranteed, as consumer preferences and competitive dynamics in new markets can be difficult to predict.

- Strategic Importance: These ventures are crucial for long-term diversification and capturing future growth opportunities beyond PRISA's core markets.

PRISA's investments in emerging digital content formats, like niche podcasts and experimental video, clearly position them as question marks. These areas hold significant growth potential, evidenced by the global podcast ad revenue projected to hit $2.7 billion in 2024.

However, these ventures currently represent a small fraction of PRISA's market share, demanding substantial investment to gain traction in a crowded digital landscape. El País US, targeting the growing US Hispanic demographic, a group projected to exceed 62 million by 2023, also falls into this category.

Despite the demographic's digital consumption rise, this expansion faces intense competition, requiring dedicated marketing and content localization to succeed.

Santillana's AI-driven personalized learning products are another prime example. While the EdTech market, valued at over $300 billion by 2024, offers immense opportunity, these AI products have a low market share and require significant R&D and market adoption efforts.

The success of these question marks hinges on strategic investment and differentiation against established EdTech players.

| PRISA Business Area | BCG Category | Market Growth | Market Share | Strategic Consideration |

|---|---|---|---|---|

| Niche Digital Content (Podcasts, Video) | Question Mark | High | Low | Requires significant investment for market penetration and audience building. |

| El País US | Question Mark | High | Low | Faces intense competition; success depends on effective localization and digital strategy. |

| Santillana AI Learning Products | Question Mark | High | Low | Demands substantial R&D and marketing to gain traction against established players. |

| Data Analytics & Monetization Tools | Question Mark | High | Early Stage | Potential to optimize revenue, but implementation and scaling are uncertain. |

| Expansion into New Geographic Markets (e.g., SE Asia) | Question Mark | High | Low | Resource-intensive with market uncertainties; crucial for long-term diversification. |

BCG Matrix Data Sources

Our Promotora de Informaciones BCG Matrix is built on comprehensive market data, incorporating financial reports, industry trends, and competitive analyses for strategic insights.